The stocks that were most valued

The most popular stocks

Analysts’ favorite stocks

The stocks owned by the billionaires

The Gurus stocks

Sometimes we need to identify a set of stocks to have on our investment radar.

We typically look for global stocks with good valuation potential in the medium and long term.

The possibilities to build this list are many, including the stocks indicated to us by family, friends and our financial managers and advisors.

In addition to these indications, we can obtain other market information, such as television channels and market news sites CNBC and Bloomberg, Yahoo, Kiplinger, Marketwatch, SeekingAlpha, Morningstar, among others.

A very interesting source of information to constitute this universe of stocks to be held under surveillance are the various lists compiled periodically by market professionals according to objective criteria.

It is these lists that include the stocks that valued the most, the most popular, the favorite of analysts, the stocks owned by billionaires, the stocks of the gurus, which we developed in this article.

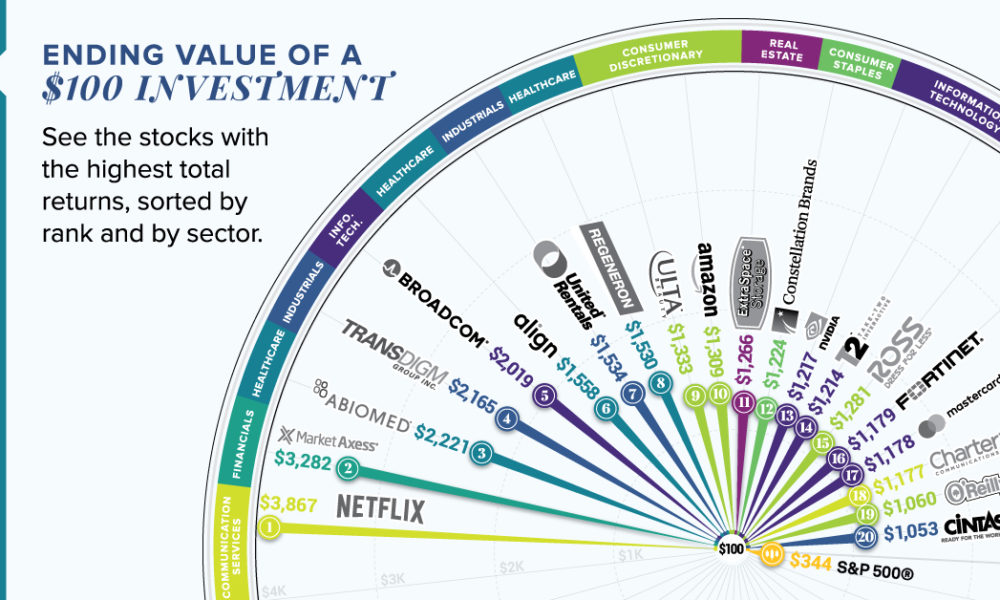

There are several lists of stocks that have appreciated the most in view of the market index and the period we are talking about.

The most frequent and most useful lists correspond to the S&P 500 index, the market’s main index. As for the period can cover since the last quarter, the last year, the last 3, 5, 10, 20, or 30 years, … to the all-time or ever.

The ones that seem most useful to us are the lists of the stocks that gained more value in long periods, equal to or greater than 10 years.

The S&P 500 shares that rose the most in the 10 years between 2009 and 2019 were as follows:

In these 20 companies an investment of just $100 would have generated a capital of $1,053 in Cintas at $3,867 on Netflix, while an investment in the S&P 500 index would only have generated $344.

This list includes some consumer companies, such as Netflix’s video streaming, e-commerce giant Amazon in 10th and Constellation Brands, the maker of Corona. MarketAxess, the second bond trading platform, and biotechnology company Abiomed third.

In another article we will account for stock lists for several periods and try to see if we can detect some patterns among the winners.

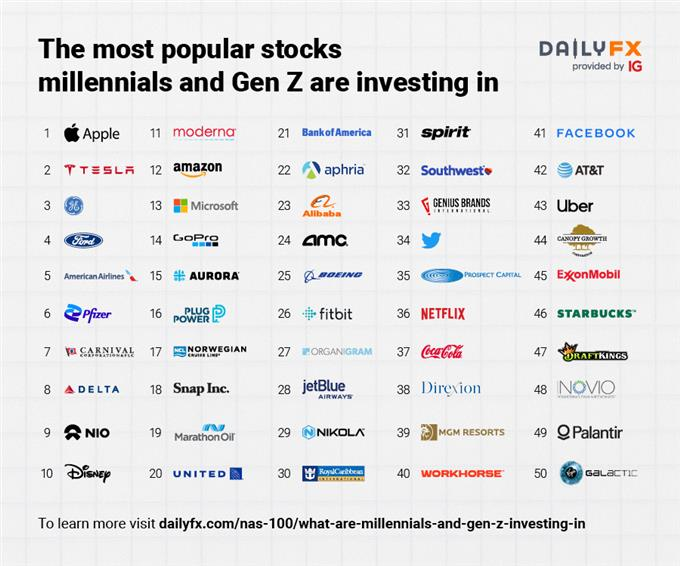

Other interesting lists are the most popular stocks, i.e. the shares of companies that are more owned or more traded by individual investors or institutional investors.

Typically these lists are also compiled for the stocks that make up the S&P 500 index.

Overall, the most popular stocks with individual investors are the largest companies that make up the S&P 500 index, especially those of consumer goods or globally recognized brands from various sectors of activity.

Apple, Microsoft, Alphabet, Amazon, Tesla, Facebook, Netflix, Visa, JP Morgan, Disney, AT&T, Ford, United Health, Johnson & Johnson, Pfizer, Exxon Mobil, among others.

These stocks usually capture the cross-interest of the various generations. Despite this, it is obvious that the various generations have different interests.

Older generations such as Baby Boomers favor the shares of higher-capitalization companies and the banking, energy and retail sectors, while new generations favor technology stocks, for example by giving greater weight to Tesla or China’s NIO electric cars.

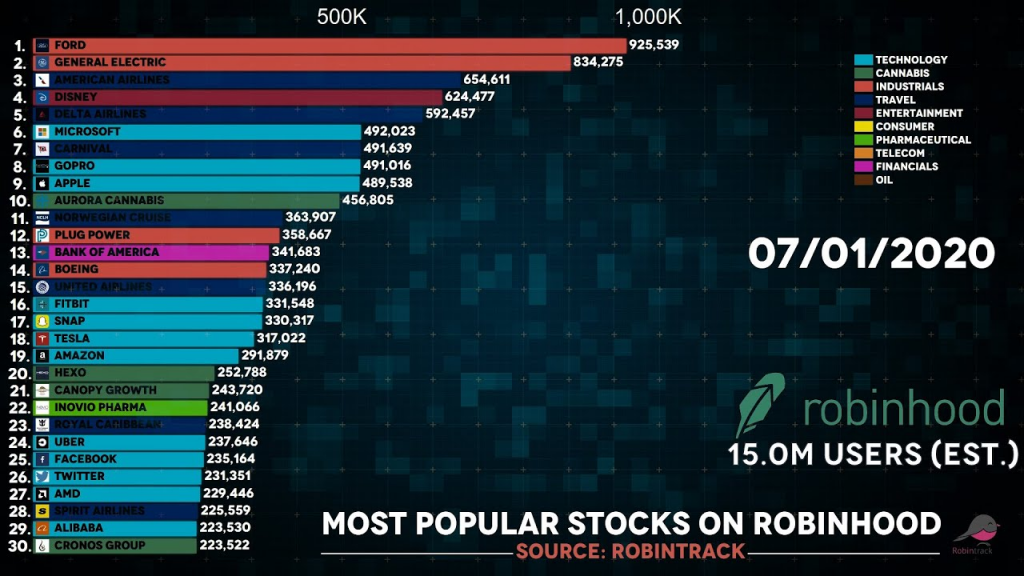

Then we have the stocks that attract investors in a certain time frame, the so-called stocks of the moment.

In September last year Robinhood had as the most compared shares on its platform many of the largest companies, but also some stocks at the moment such as GoPro, Plug & Power, etc.

In some cases or for short periods, these actions at the moment may include very speculative stocks such as meme stocks, for example Gamestop, AMC, etc.

Analysts’ favorite stocks

Market analysts’ favorite stocks vary from time to time depending on the cycle and market conditions, in addition to the personal preferences of the analysts themselves.

The best way to know at every moment what these stocks are is to browse the news sites mentioned above.

In early 2022, U.S. stocks with the highest valuation potential for the analyst consensus target price as reported at Tipranks included Charles Schwab, Applied Materials, Coca-Cola, Lowe’s, Johnson & Johnson, Altria, Chevron, Alphabet, Dupont, General Motors, Salesforce, etc.

Morningstar recently had the following favorite actions:

https://www.morningstar.com/articles/1075106/best-innovative-companies-to-own-2022-edition

Hedge Funds shares

Periodically, lists of hedge funds are also published.

According to one of the most recent publications made by Kiplinguer this list of 25 shares included in late 2021 Microsoft, Amazon, Facebook, Alphabet, Apple, Visa, JP Morgan, Johnson & Johnson, Berskshire, Mastercard, Disney, PayPal, Pfizer, UnidedHealth, Nvidia, Procter & Gamble, Merck, AbbVie, Salesforce, Home Depot, Adobe, Cisco, Bank of America, Intel and ExxonMobil.

The stocks owned by the billionaires

Kiplinguer also regularly publishes the favorite shares of US billionaires, identifying the highest-staked stocks held by each.

In one of its most recent articles it indicated as the top 10, Lowe’s, Gingko Biowoks, Alphabet, Tesla, Paypal, Moody’s, CSX, Baush Health Companies, Berkshire Hathaway and Taiwan Manufacturing Semiconductor.

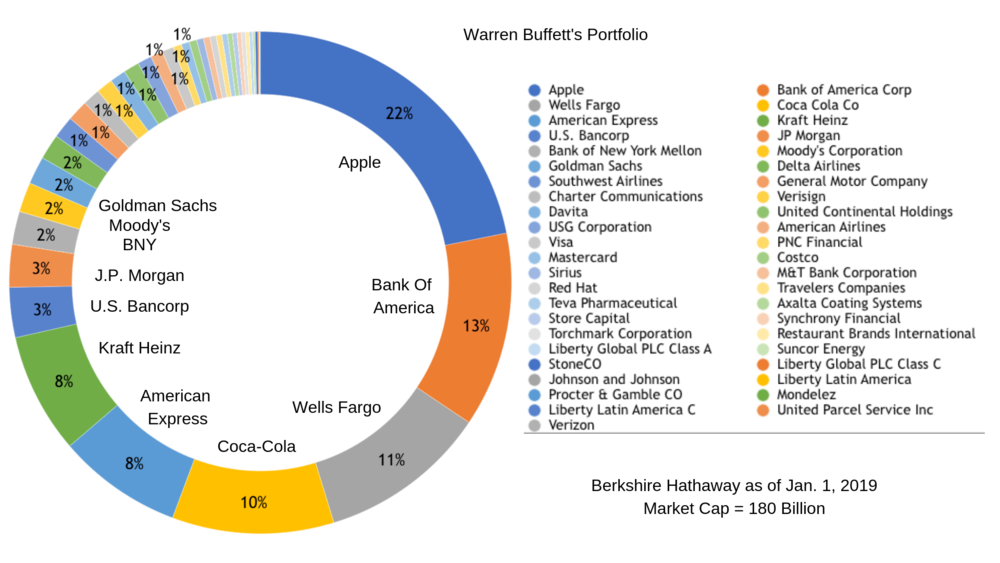

The stocks of the largest wealth managers

The preferred stocks of the largest wealth managers are very diverse.

Warren Buffett, the largest manager of all, has at Berkshire Hathaway main stakes in Apple, Bank of America, Wells Fargo, Coca-Cola, American Express, Kraft Heinz, JP Morgan, US Bancorp, BNY, Moody’s and General Motors, with a clear inclination to the financial sector.

Jim Simmons of Renaissance Technology preferred at the end of the third quarter of 2021 technology and medicine companies, including in the top 5 positions Novo Nordisk, Atlassian Corp, Verisign, Zoom and Microsft.

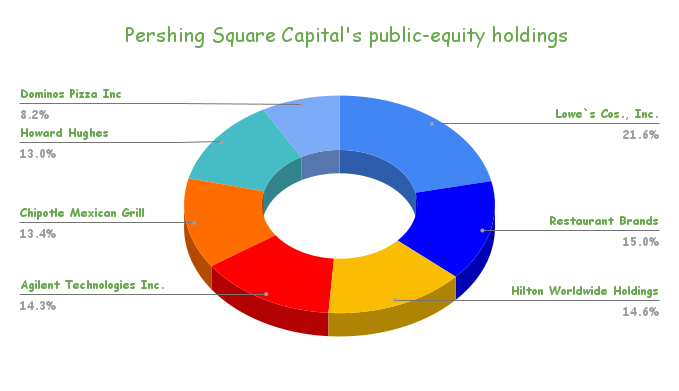

Bill Ackman of Pershing prefers the stocks of Lowe’s, Restaurant Brands, Hilton, Agilent, Chipotle, Howard Hughes and Domino’s, favoring the catering industry.

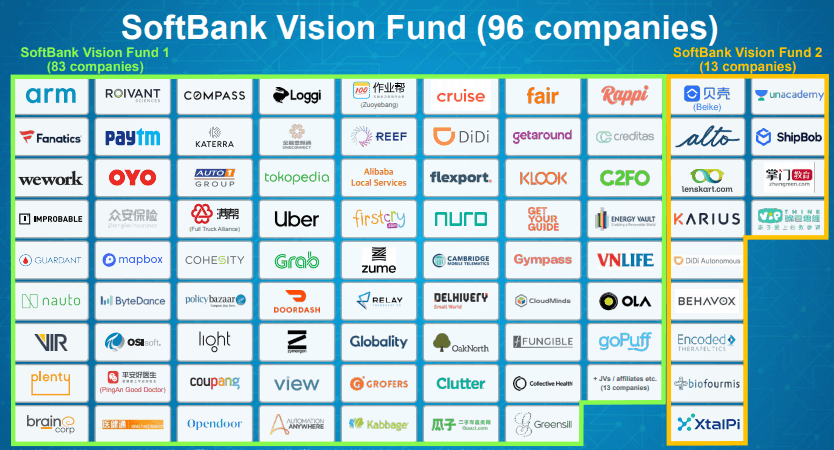

Masayoshi Son’s Softbank fund has as main positions technology and Asian companies including Alibaba listed, Didi, among many private companies.

Cathie Wood, in her main fund Ark Innovation, prefers Tesla, Square , Teladoc, Roku, Zillow, Spotify, Crispr, Shopify, Zoom and Baidu.

It may be worth knowing the latest stock listings of all these types of investors, but each investor will have to choose their own!