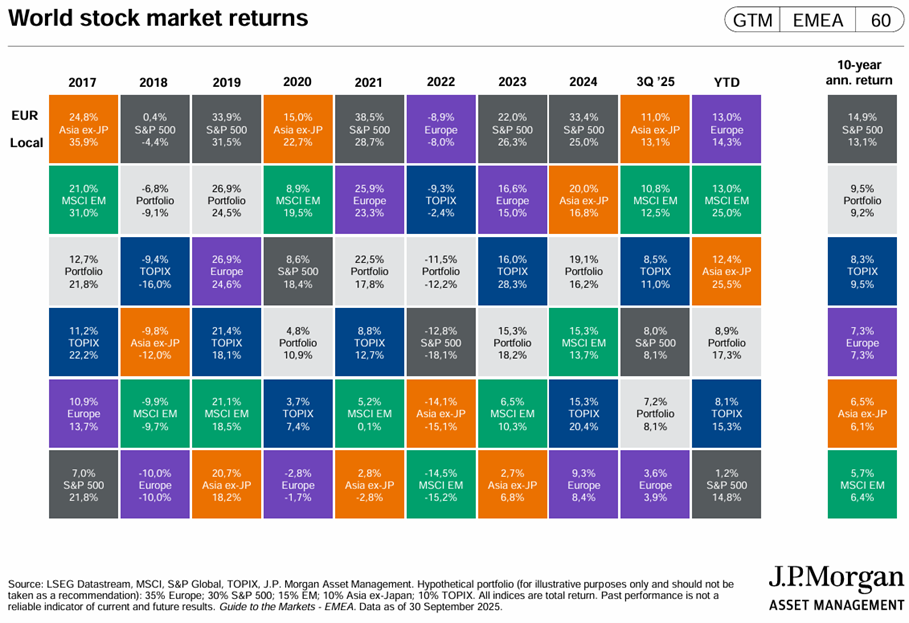

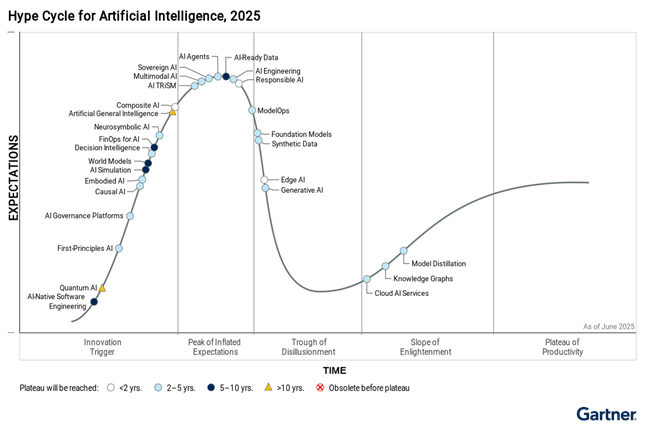

The third quarter ended at peak levels almost everywhere in the world, driven by big US technology, the positive AI cycle, the approval of the “tax and spending bill” and the partial outcome of the “drama” of Trump’s tariffs.

Performance 3Q25 Markets: Developed countries’ stocks close to peak levels. U.S. stocks gained 8% in the quarter, above the 5% in the Eurozone .

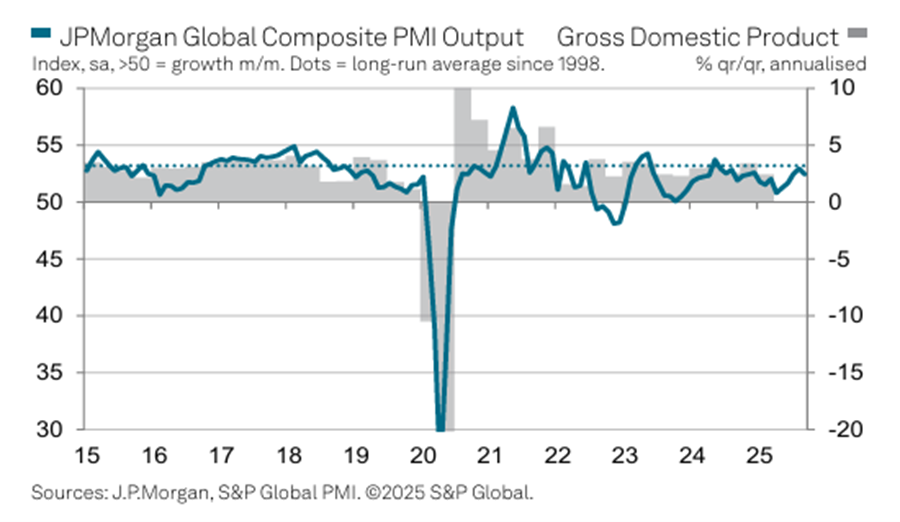

Macro Context: Global economic growth remains at a medium pace, with signs of some slowdown, and inflation rates are between 2% in the Eurozone and 2.7% in the US.

Micro Context: Leading instant and leading economic indicators are expanding slightly around the world.

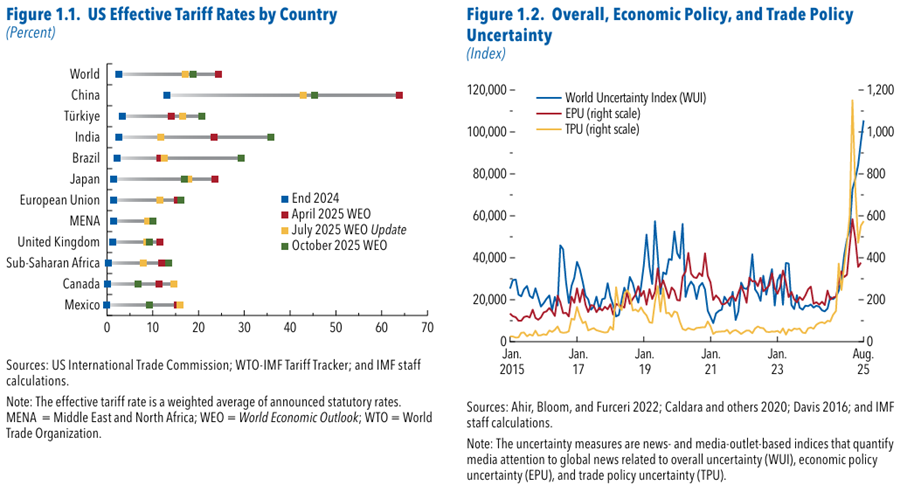

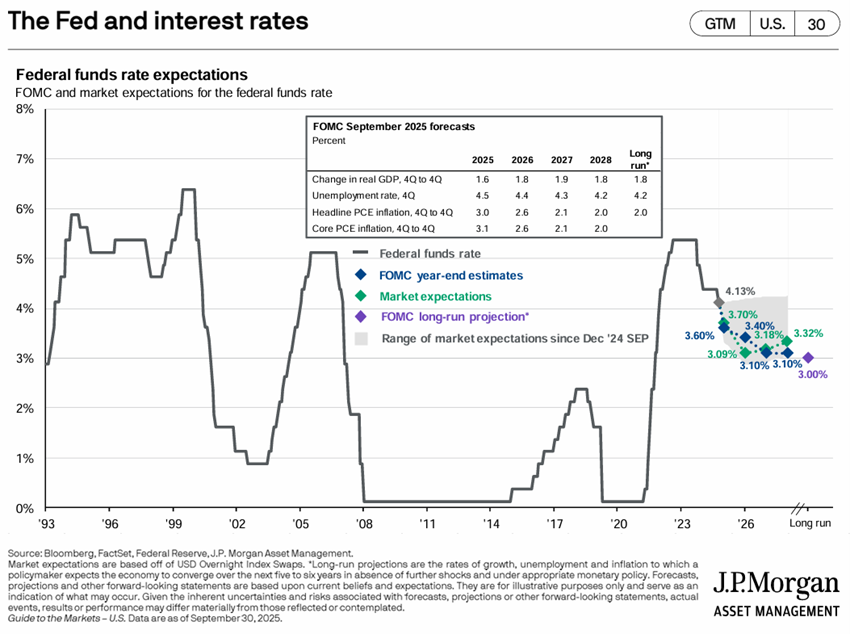

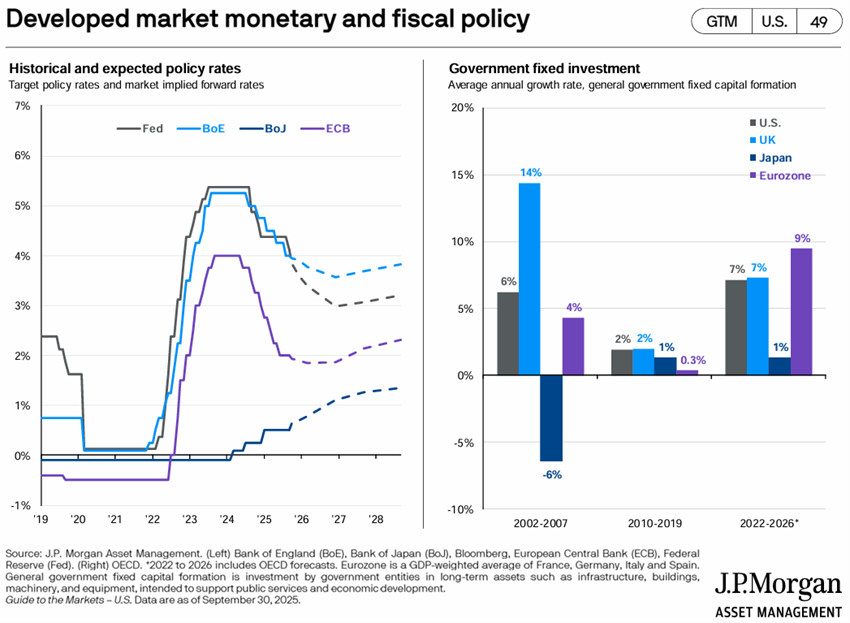

Economic policies: The Fed resumed lowering official interest rates in response to a deterioration in the labour market, while the ECB and BoE maintained their levels. Trump pushed through his “One, big and beautiful bill”, and closed trade agreements with most countries around the world, except with some of his largest partners, especially China, but also Mexico and Canada.

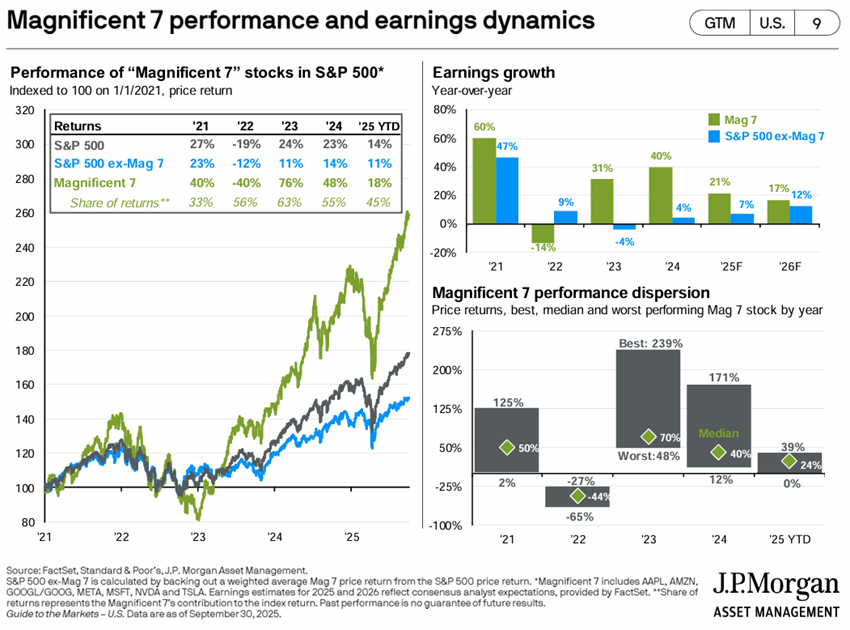

Equity markets: Equity markets at all-time highs in almost all countries, with broad participation at the sectoral and capitalization levels, driven by big AI technologies.

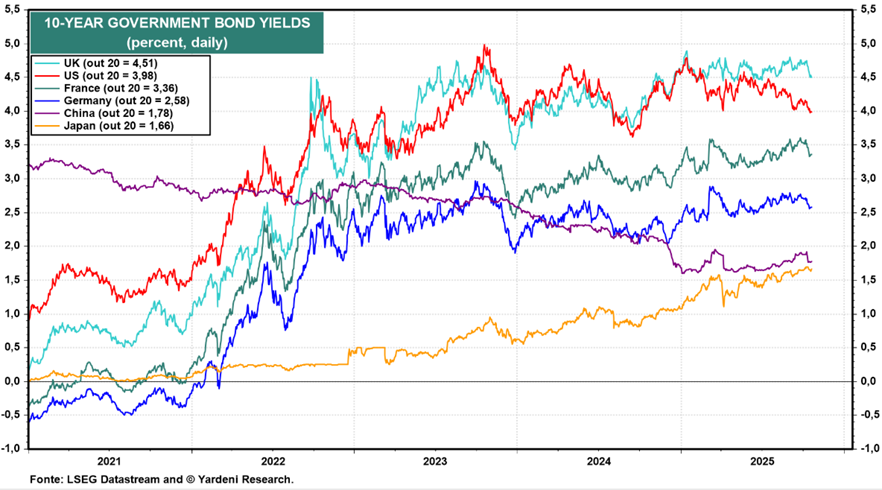

Bond markets: Long interest rates fell in developed economies, valuing bond investments as credit spreads held.

Key opportunities: The prolongation of the Artificial Intelligence cycle and the continued decline in official interest rates in the US.

Main risks: A bad outcome of Trump’s tariff negotiations with the most important trading partner, China.

Financial markets in a positive macro context, of growth and interest rates, dependent on Trump’s negotiations with China.

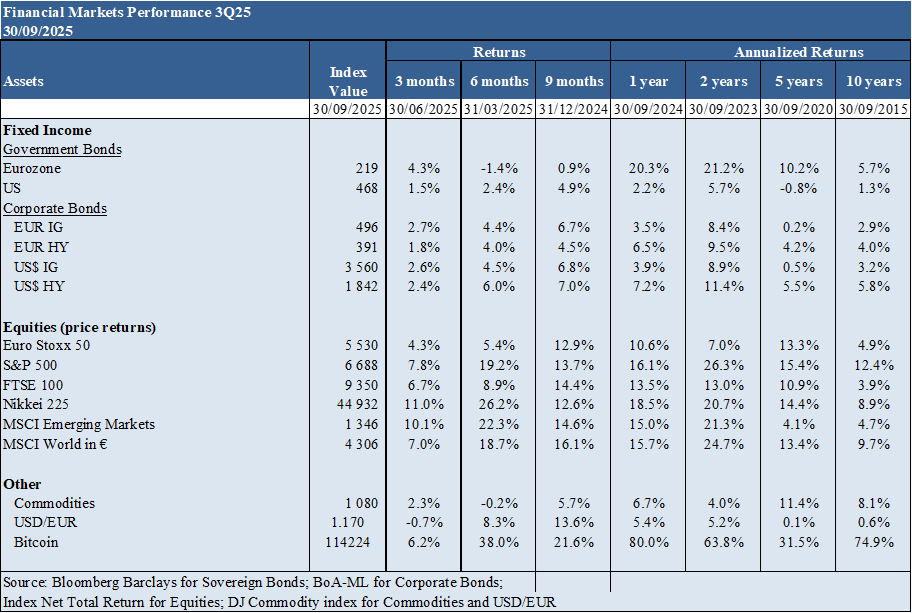

Performance of financial markets 3Q25: Stocks in developed countries are close to peak levels. US stocks appreciated 8% in the quarter, above the 5% in the Eurozone.

The main stock indices of developed markets are close to peak levels.

Western bond markets appreciated between 2% and 4% in the quarter, as a result of lower interest rates.

Bitcoin reached an all-time high of $114,000.

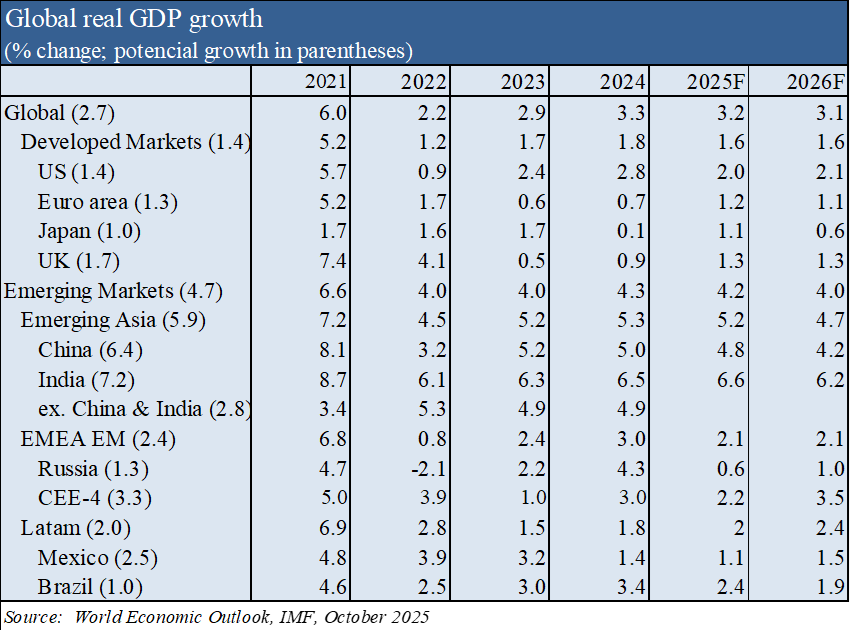

Macroeconomic context: Global economic growth remains at an average pace, with signs of some slowdown, and inflation rates range from 2% in the euro area to 2.7% in the US.

Global growth is forecast to slow from 3.3% in 2024 to 3.2% in 2025 and to 3.1% in 2026.

Inflation is estimated to decline from 3.6% in 2025 to 3.2% in 2026 in the G20 countries, but with the possibility of an increase in the US due to the increase in tariffs.

To date, the impact of the new tariffs has been low. However, its effect can only be assessed in the longer term and negotiations with China have yet to be concluded

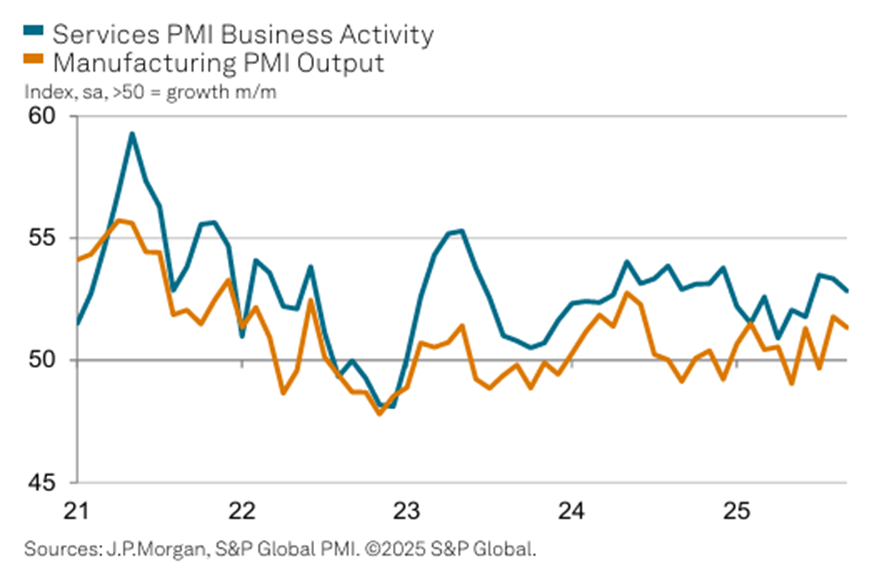

Microeconomic context: Leading instantaneous and advanced economic indicators are stable almost everywhere in the world.

The overall services activity index at 52.8 remained above its industrial equivalent at 51.3.

The vast majority of countries recorded expansion, with the best results being obtained by India, followed by the USA and Spain.

Economic policies: The Fed resumed lowering official interest rates in response to a deterioration in the labour market, while the ECB and BoE maintained their levels. Trump pushed through his “One, big and beautiful bill”, and closed trade agreements with most countries around the world, except with some of his largest partners, especially China, but also Mexico and Canada.

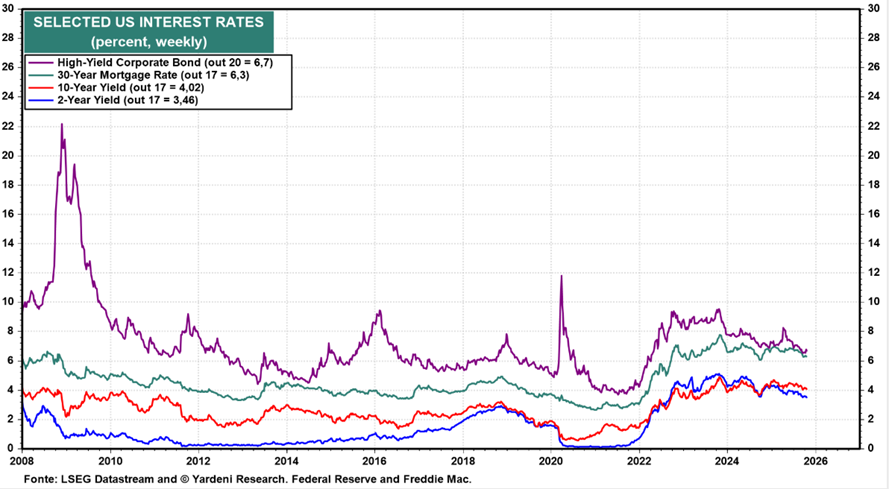

In the 1st quarter, the Fed resumed the reduction of official interest rates to 4.0%-4.25%, projecting 2 cuts (i.e. 0.5%) for this year, stressing that the main motivation was the risks in the labor market.

The ECB kept official rates unchanged to 2.0%-2.40% in September.

The Bank of England kept the official interest rate at 4.0% in September.

Trump won the passage of his “one and big, beautiful bill”, the fiscal budget for his legislature.

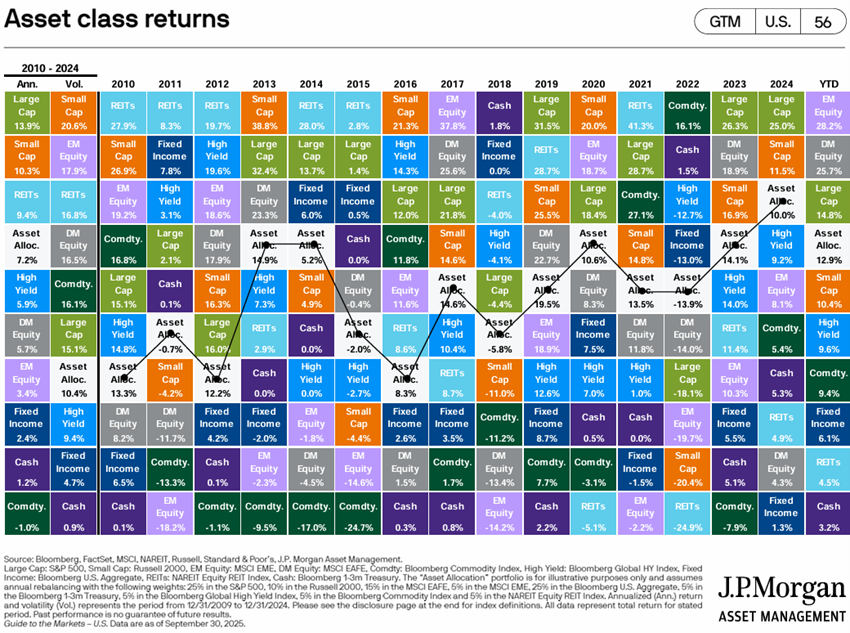

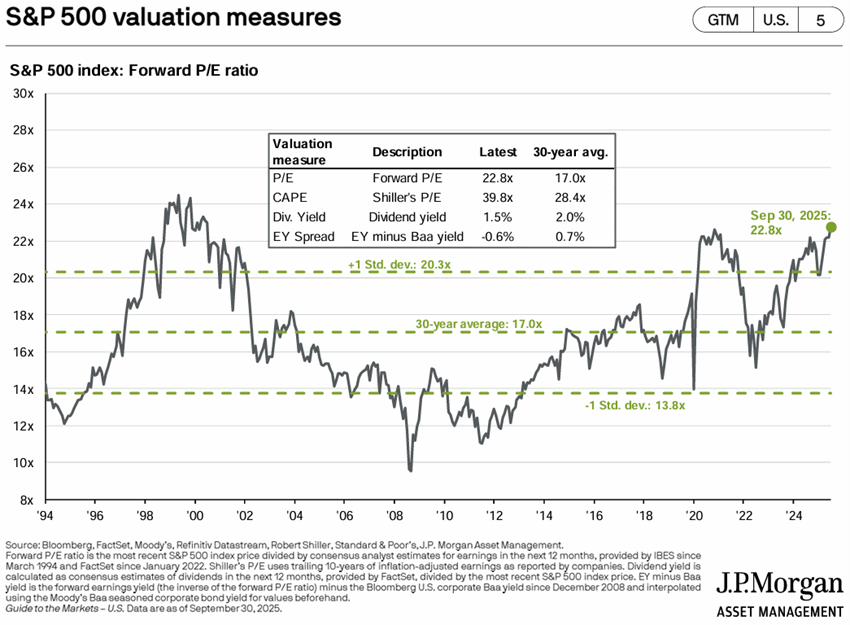

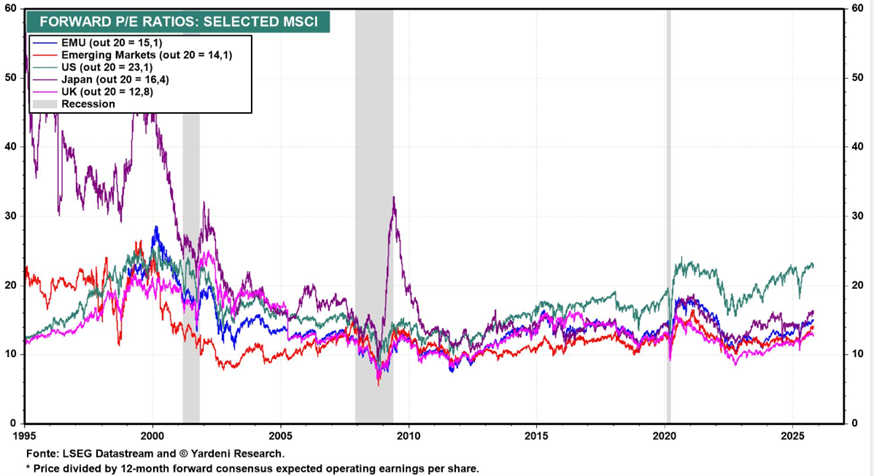

Equity market valuation: Equity markets at all-time highs in almost all countries, with broad participation at the sectoral and capitalization level, driven by large AI technologies.

Equity markets in almost all countries are near peak levels, driven by falling interest rates and the AI cycle.

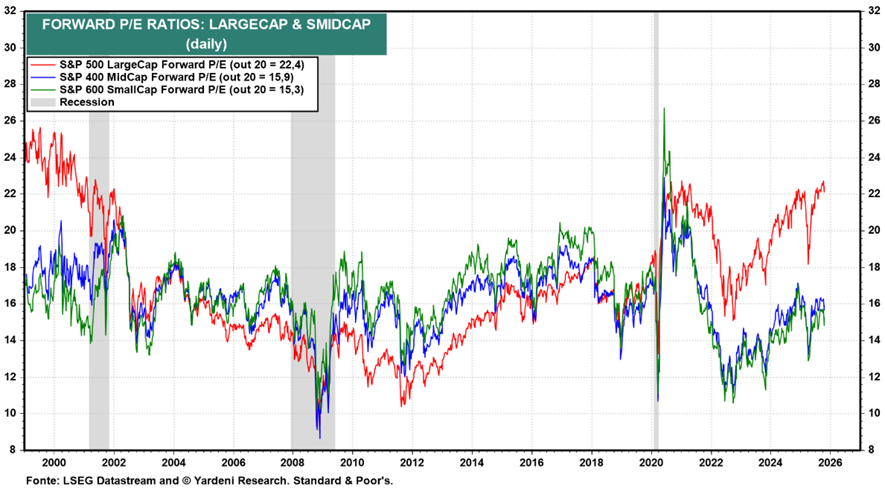

The 22.8x forward PER for the US is still above the long-term average, dropping to 19x without the 10 Mega Caps.

Japan’s PER is at 16.4x, Eurozone’s at 15.1x, 12.8x for the UK and 14.1x in emerging markets.

The PER of mid-cap and small-cap U.S. stocks are both at 15.9x to 15.3x, slightly above the long-term average.

Bond market assessment: Long interest rates have fallen in developed economies, increasing the value of bond investments as credit spreads have held.

Bond investments in developed countries appreciated as a result of lower long-term risk-free interest rates and the maintenance of credit spreads.

Main opportunities: The prolongation of the Artificial Intelligence cycle and the continued decline in official interest rates in the US.

The appreciation can be accentuated if we observe the productivity gains in various industries and companies resulting from the use of AI, with an impact on profit margins.

The Fed is expected to announce two more interest rate cuts by the end of the year, reducing companies’ borrowing costs and increasing the relative attractiveness of equities vis-à-vis bonds.

Main risks: A bad outcome of Trump’s tariff negotiations with the most important trading partner, China.

The base scenario is that negotiations with China conclude without impact on the markets, although there is always the possibility of a negative outcome.