Trump’s recent imposition of abysmal reciprocal tariffs on the entire world brings the threat of recession in the US and some other countries.

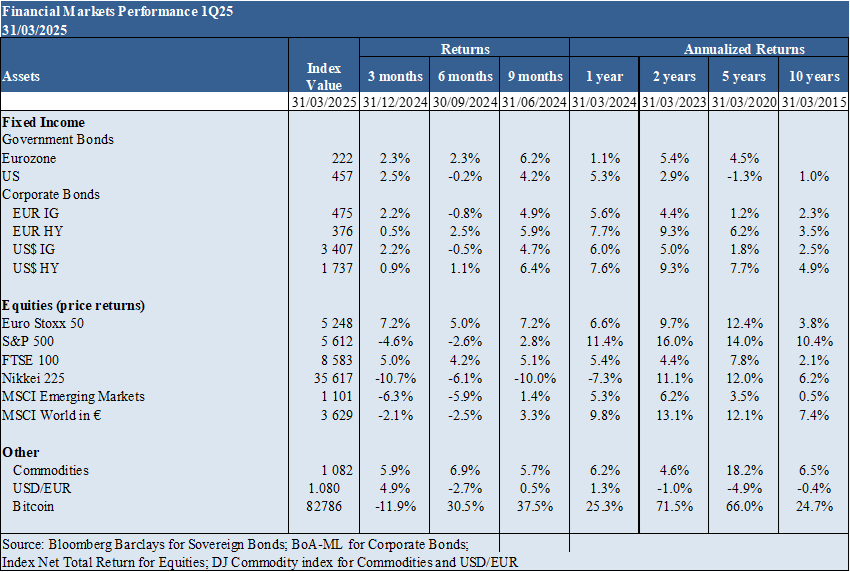

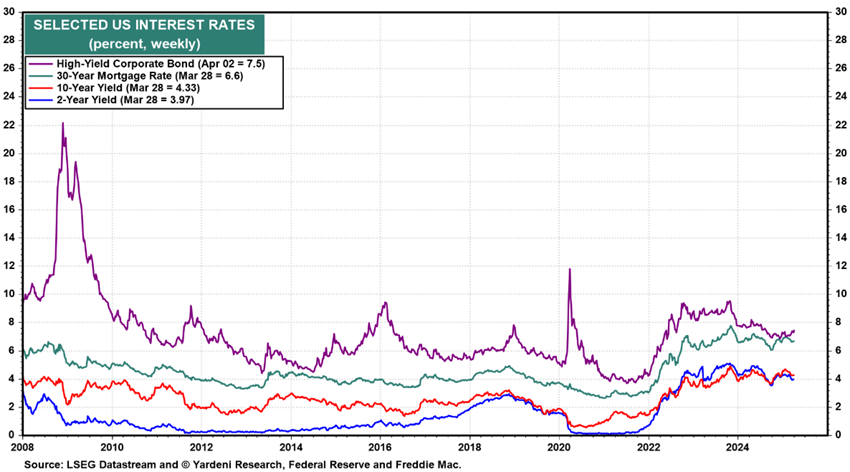

Interest rates fell in all countries in line with inflation in the first quarter.

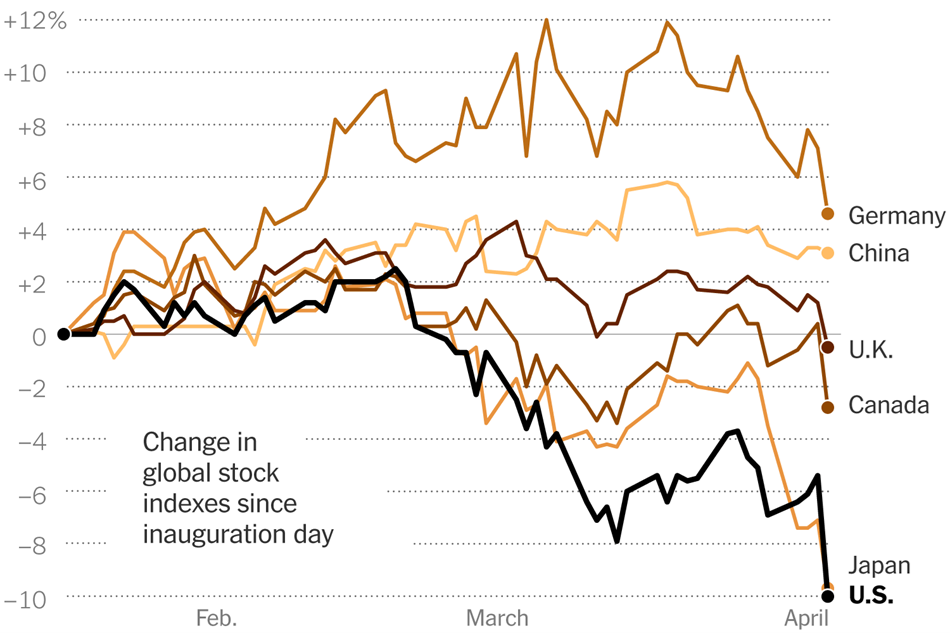

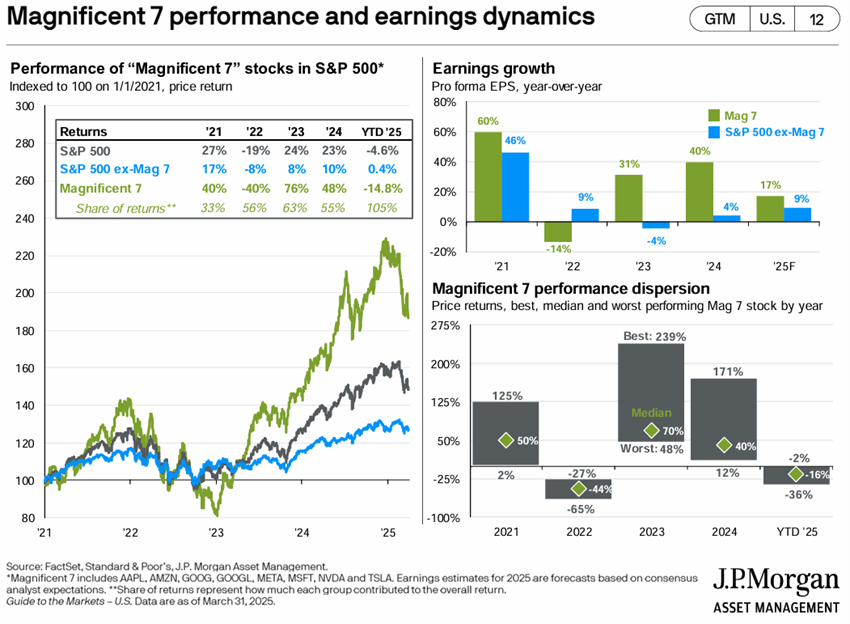

U.S. stock indexes have entered correction levels, with declines of 10% from their previous high, sharper in growth companies.

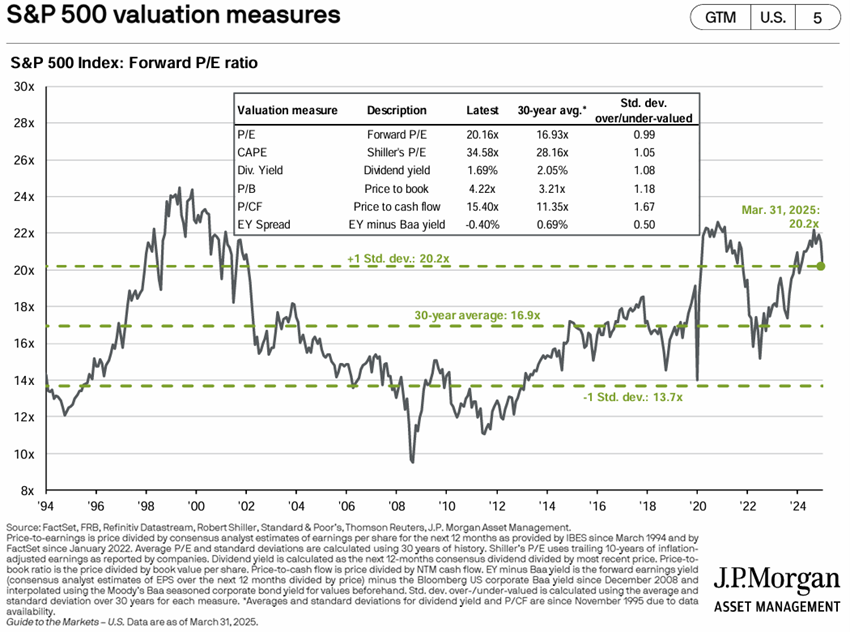

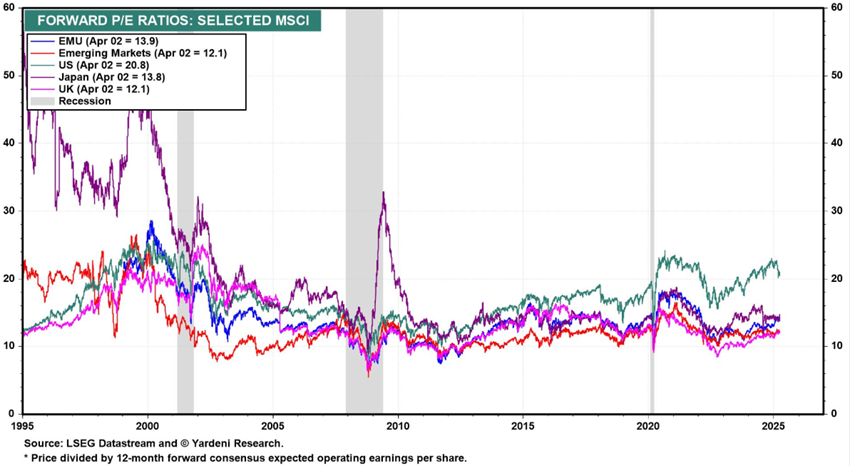

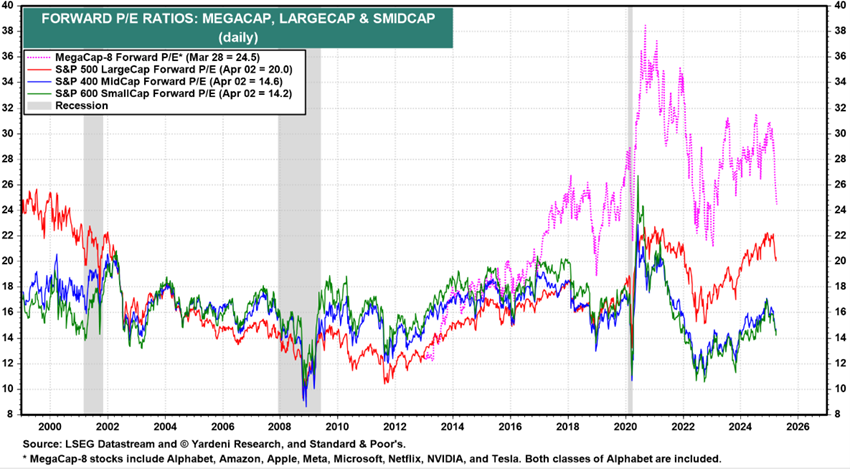

Stock market valuations have improved, but are still above the historical average.

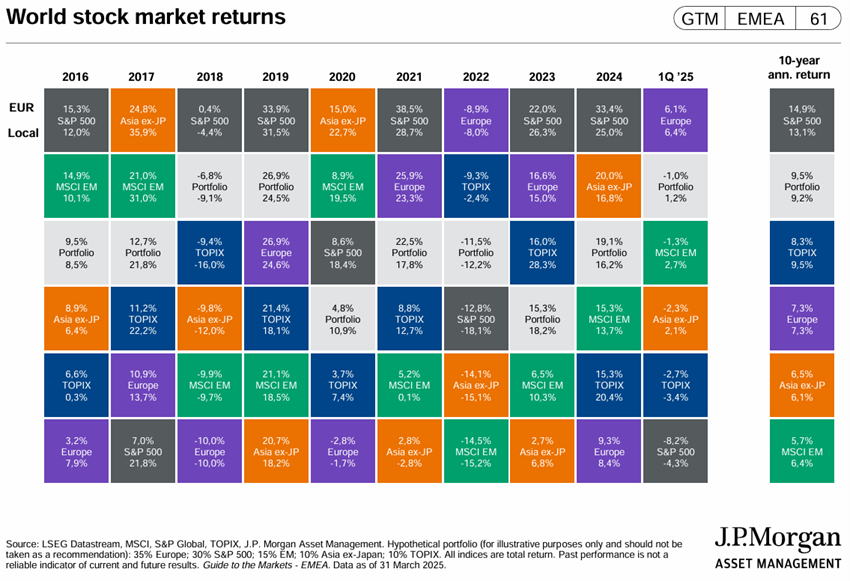

Performance Markets 4Q24: U.S. stocks fall more than 10% from peak levels in a technical correction on a search for safe haven and the increased possibility of recession in the U.S. due to Trump’s tariffs.

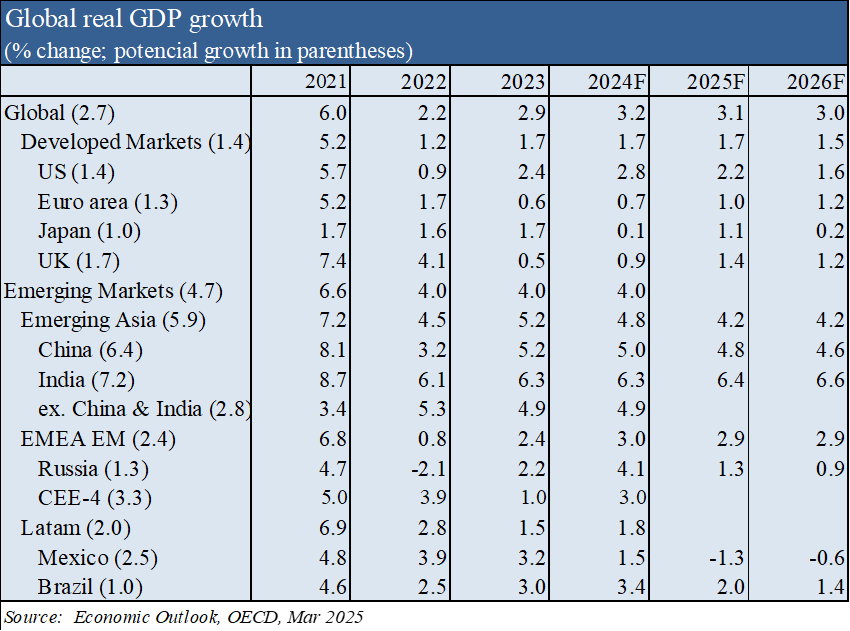

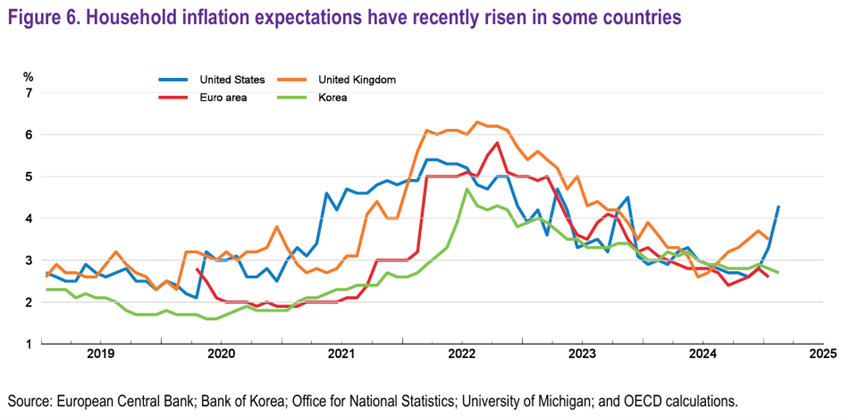

Macro Context: Global economic growth is slowing with greater impact in the US, with economists already talking about stagflation. Inflation in the US and Europe continues to decline, albeit at a more moderate pace.

Micro Context: The main instant and advanced economic indicators show decline almost everywhere in the world.

Economic policies: Central banks continued to reduce official interest rates, in line with the decline in inflation, with fewer cuts expected in the near future.

Equity markets: North American equity markets, in technical correction, penalizing growth companies more, but still with high valuations in historical terms.

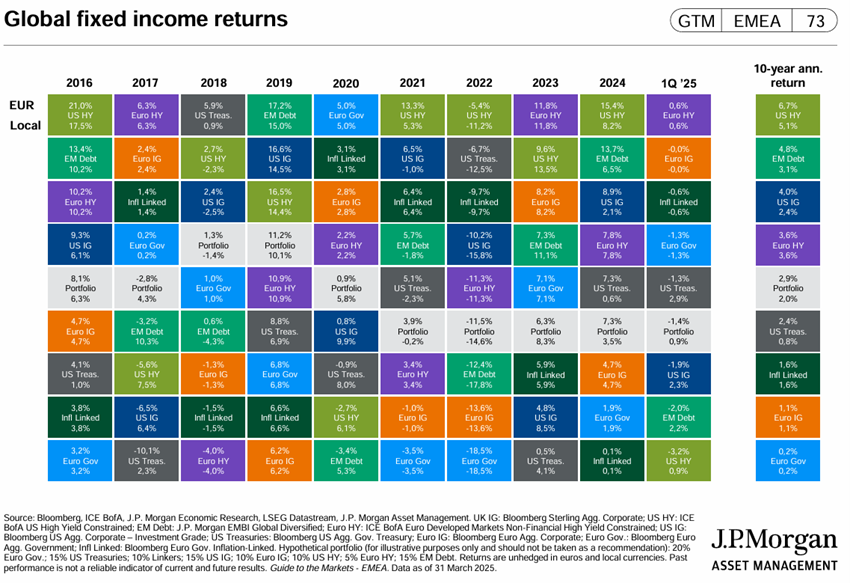

Bond markets: Long interest rates fell in developed economies, valuing bond investments as credit spreads held.

Key opportunities: The possibility of a ceasefire in Ukraine.

Main risks: The tariffs imposed by Trump constitute a very serious and profound risk to the American economy and the rest of the world.

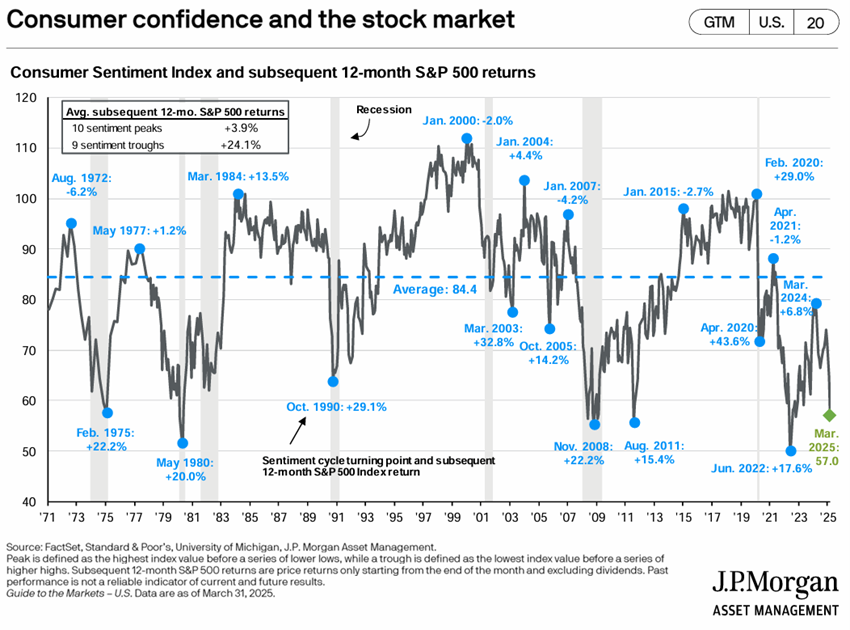

The return of the threat of stagflation in the US has caused a correction in equity investments, and it is important to follow the next advanced macroeconomic indicators.

Financial markets performance 1Q25: U.S. equities fall more than 10% from peak levels, in technical correction, on a search for safe haven and the increased possibility of recession in the U.S. due to Trump’s tariffs

The main US stock indexes are in technical correction, with cooling economic indicators and the instability caused by Trump’s tariffs.

Western bond markets appreciated slightly in the quarter as interest rates declined.

Cryptocurrencies fell from an all-time high of over $108,000 to $83,000, leading the disinterest in momentum investments.

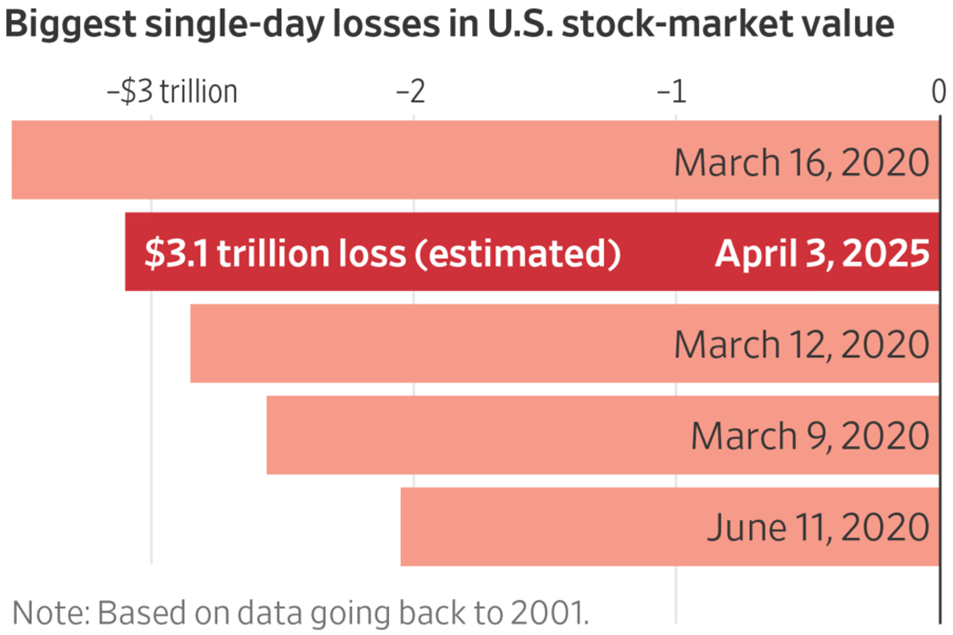

Trump’s announcement of reciprocal tariffs caused the biggest fall in the markets in the last 5 years, with losses of more than $3 trillion in a single day (and $6 trillion in less than a month).

Macroeconomic context: Global economic growth is slowing with greater impact in the US, with economists already talking about stagflation. Inflation in the US and Europe continues to decline, albeit at a more moderate pace.

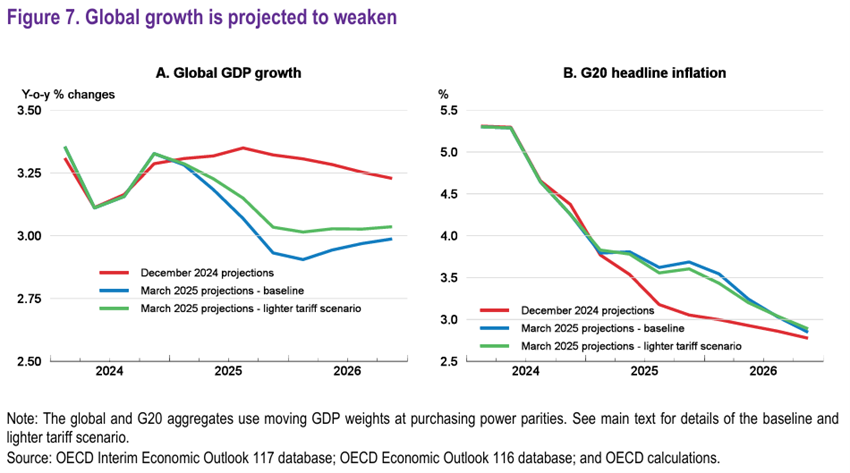

According to the OECD’s end-of-March forecasts, global economic growth will decline from 3.2% in 2024 to 3.1% in 2025, and 3% in 2026, due to the effects of higher trade barriers and geopolitical risks on household consumption and investment.

The OECD also forecasts growth to slow to 2.2% and 1.6% in the US, to 1% and 1.2% in the Eurozone, 4.8% and 4.6% in China, in 2025 and 2026, respectively.

Inflation is expected to decline from 3.8% in 2025 to 3.1% in 2026 in the G20 countries, and is now expected to remain above the central banks’ benchmark level of 2% in many countries, including the US.

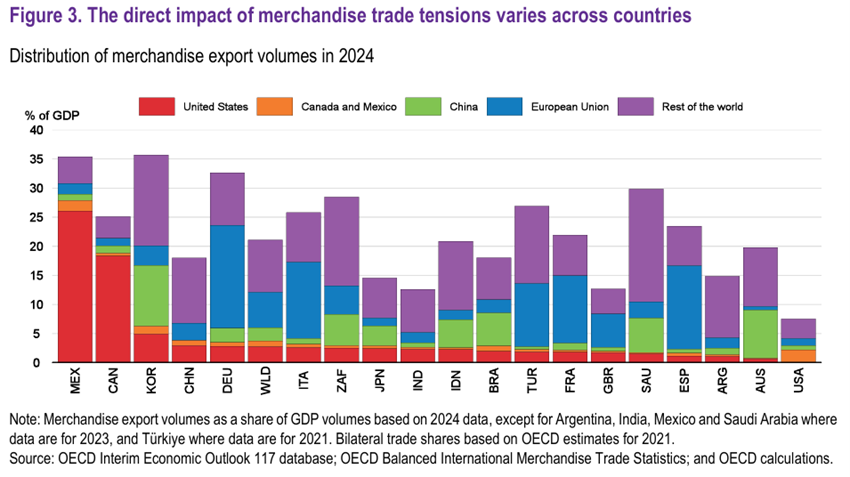

The imposition of tariffs by the US has slowed growth and raised inflation expectations around the world, but with different impacts in different countries.

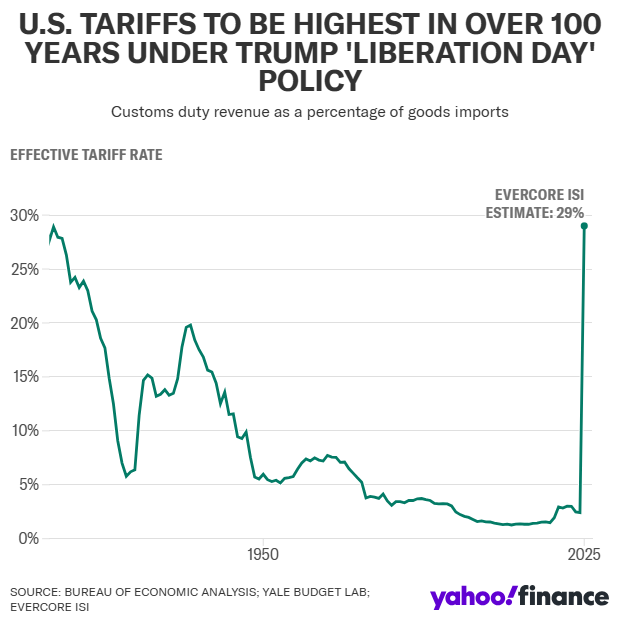

All these forecasts are too conservative and have now been overtaken by the announcement of Trump’s astronomical reciprocal tariffs on all countries, to levels not seen in more than 100 years.

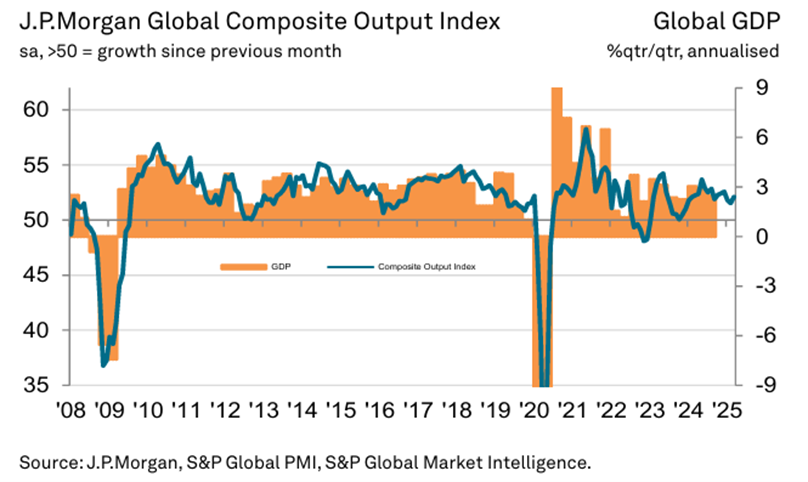

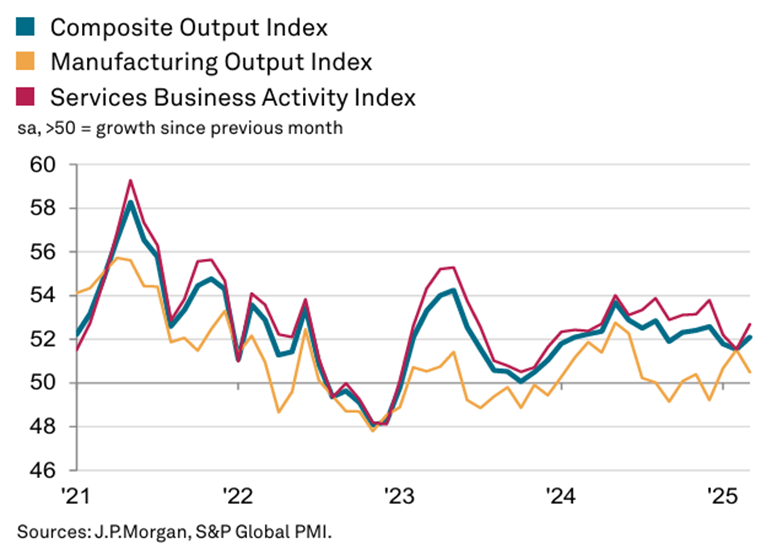

Microeconomic context: The main instant and advanced economic indicators show a slight decline almost everywhere in the world.

J.P. Morgan’s composite manufacturing index PMI stood at 52.1 in March, versus 51.5.

The Output Index for the first quarter (51.8) was still the weakest since the last quarter of 2023 (50.5).

U.S. expansion still outpaced modest gains in the eurozone, the U.K. and Australia.

Economic policies: Central banks continued to reduce official interest rates, in line with the decline in inflation, with fewer cuts expected in the near future.

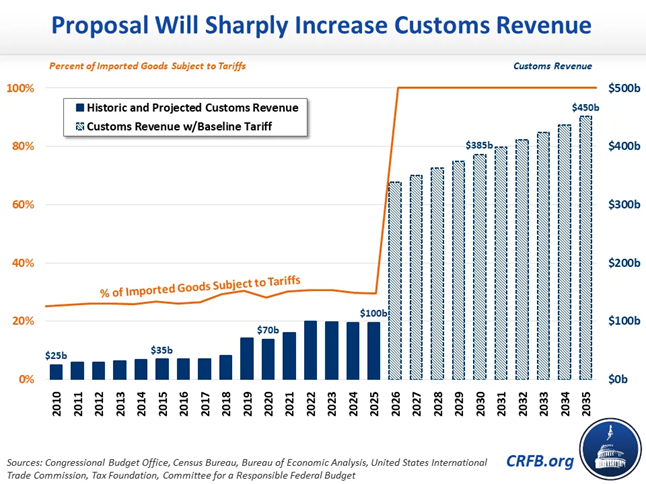

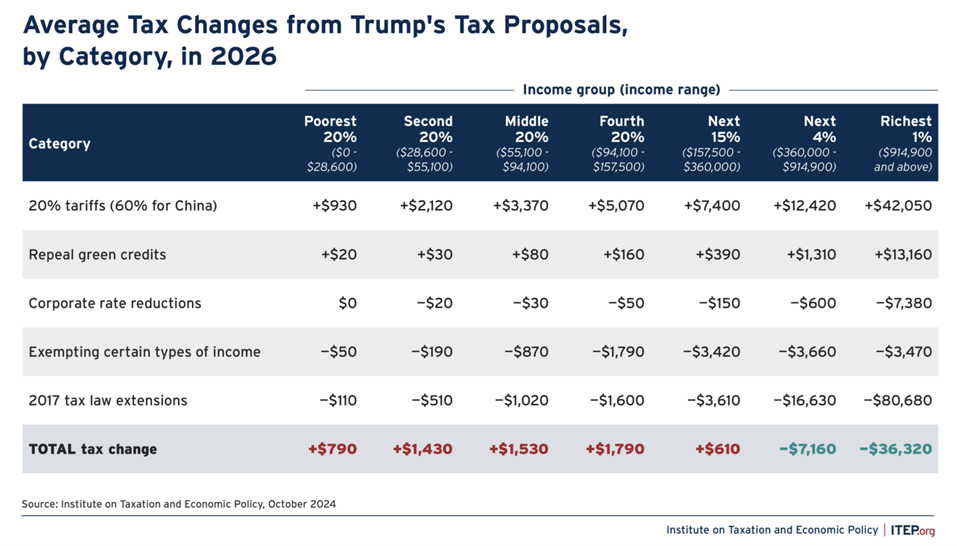

Trump has announced a package of astronomical reciprocal tariffs for all countries because he needs this revenue to finance much of the 2017 tax cut extension that ends this year, a policy that benefits the richest 5 percent exclusively.

In Q1, the Fed kept official interest rates at %-4,5%, projecting 2 cuts (i.e., 0.5%) for this year.

The ECB lowered official rates to %-2.90% in March.

The Bank of England reduced the official interest rate to 4.50% in February.

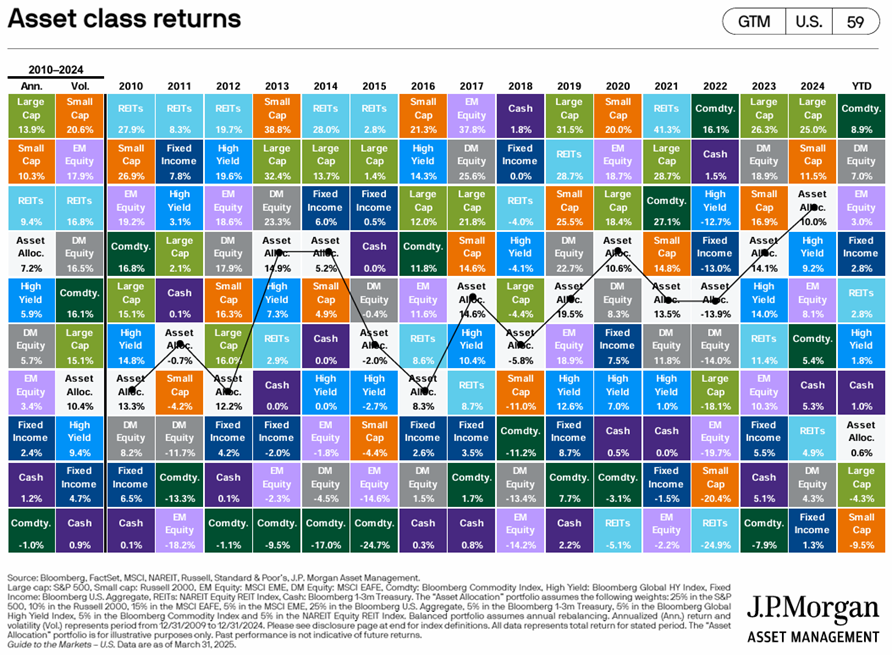

Equity market valuation: North American equity markets, in technical correction, penalizing growth companies more, but still with historically high valuations.

The US stock market entered a technical correction at the end of March, due to the reduction in economic growth and rising inflation resulting from tariffs, combined with the downward revision of corporate results.

The 20x forward PER for the US is still above the long-term average, dropping to 18x without the 10 Mega Caps.

Japan’s PER is at 13.8x, Eurozone’s at 13.9x, 12.1x for the UK and 12.1x in emerging markets.

The PER of mid-cap and small-cap U.S. stocks are both at 14.8x to 14.2x, around the long-term average.

Analysts have been reducing earnings growth for S&P 500 companies, making it difficult to provide a reliable estimate in this context of great uncertainty.

Bond market assessment: Long interest rates have fallen in developed economies, increasing the value of bond investments as credit spreads have held.

Long-term risk-free interest rates fell in developed countries, in the US due to reduced growth forecasts while in Europe due to lower inflation.

Credit spreads in the U.S. and Europe remained stable.

The prospects for further declines are now more moderate.

Main opportunities: The eventuality of a ceasefire in Ukraine.

The possibility of a ceasefire in the war in Ukraine reduces geopolitical risks and market instability.

Main risks: The tariffs imposed by Trump pose a very serious risk to the American economy and the rest of the world.

The tariffs have a minimum base of 10% on imports, reaching 34% for China, 20% for the EU, 24% for Japan, 25% for South Korea and 32% for Taiwan.

Tariffs fragment the global economy, reduce economic growth, increase inflation, prolong tight monetary policy and cause a reassessment of financial markets.

Immediately, economists further lowered their forecasts for economic growth and increased their inflation estimates, accentuating the likelihood of recession in the US.

Americans bought about $3.3 billion in imports in 2024. The tariff rate, of about 2.5%, yielded a tariff tax value of about $83 billion. Investment firm Evercore estimates that all the new tariffs combined will raise that import tax rate to about 29 percent.

German research institute IW estimated that the tariffs would wipe 750 billion euros ($833.63 billion) out of the EU economy.

The economic consequences of this measure are very serious and profound. It is wrong to draw a parallel with Trump’s first term decision. Not only were those measures much more limited (and it was the 1st term), but also their objective is to finance part of the value of the tax reduction promised to the richest.

Thus, although there may be some room for negotiation in lowering these tariffs, it is small, and the disruption in the various economies and in the financial markets is very violent.