Insurance is a key and priority element of our personal finance plan that defines our needs and financial objectives, as they give us risk protection and guarantee us a safety net in the face of unforeseen adversity

The most important insurance we need is protection from housing and car claims, health, life and personal accidents

Insurance investment products (financial insurance), pension plans and annuities

Although this blog focuses primarily on wealth management and financial investments, we believe that we should address, albeit in a simplified way, the universe of personal insurance, given its central importance for financial security in particular, and for the personal financial plan in general.

Thus, this is the first article in this series dedicated to personal insurance.

Insurance is an important and a key and priority element of the personal finance plan that defines financial needs and objectives because they provide risk protection that guarantees us a network and cushion in the face of unforeseen events

Personal finance covers the entire management of our money, including how to save and invest. It includes budgeting, banking, insurance, mortgages, investments, reform planning and tax and real estate planning.

Financial planning is the process of properly managing our finances in order to achieve our objectives. It includes elements of protection, wealth creation, contingency planning and emergencies, as well as the planning of specific milestones in life.

Insurance is a financial component of financial security, placed at the bottom of our pyramid of our financial needs, right after meeting the basic needs of food, shelter, etc., and before we even think about the accumulation of wealth:

Insurance is an important part of financial planning because it protect us from the costs or losses associated with accidents, disability, illness and death.

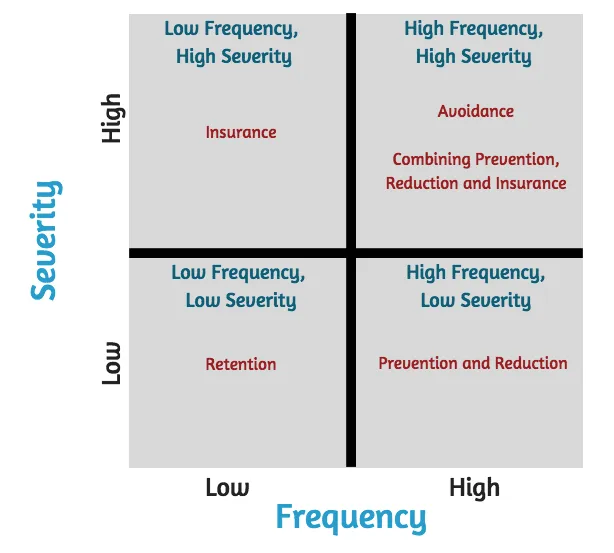

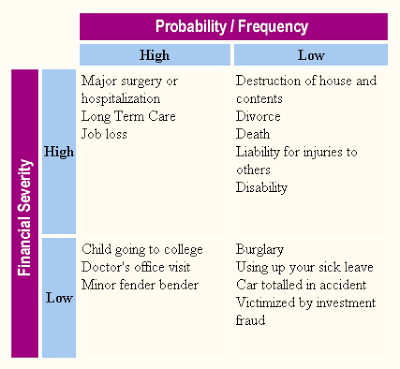

We must buy protection insurance for low-probability and high cost or loss of financial shocks

Fundamental insurance is what protects us against low-probability, high-impact financial shocks. For example, the payment of a long stay in the hospital. Most people just don’t have that much money in an emergency fund. It is impractical and is not an efficient use of money.

On the other hand, it usually makes no sense to have insurance for high probability and low-impact events, because cost often outweighs the potential benefit. For example, it is often more expensive to buy a warranty than to replace a relatively inexpensive appliance.

The most important insurance we need is protection from housing and car claims, health, life and personal accidents

The four types of insurance recommended by most financial experts are life, health, home and car, and long-term disability.

Life insurance helps protect our family if we die prematurely. It can also be used for business needs or more complex real estate planning strategies.

Health insurance can help reduce the costs of medical bills if we get sick. We all need this insurance, regardless of our age or our current health.

Disability insurance helps protect us from lost income if we can’t work. Most workers, especially those who are at the peak of their income years, should consider this important coverage.

Housing and car insurance protects these assets from damage or loss.

It is not a luxury, but a necessity, not least because all mortgage companies require borrowers to have insurance coverage for the full or fair value of a property (usually the purchase price).

Owners’ insurance policies generally cover destruction and damage to the interior and exterior of a residence, loss or theft of property, and personal liability for damage to others.

The penetration and density of insurance in the world vary depending on many factors, such as economic development, the productive fabric, social protection systems, the development of the insurance sector itself

There is no reliable data on the use of personal insurance in the various countries of the world. The best we have is global insurance data, which comprises personal and business.

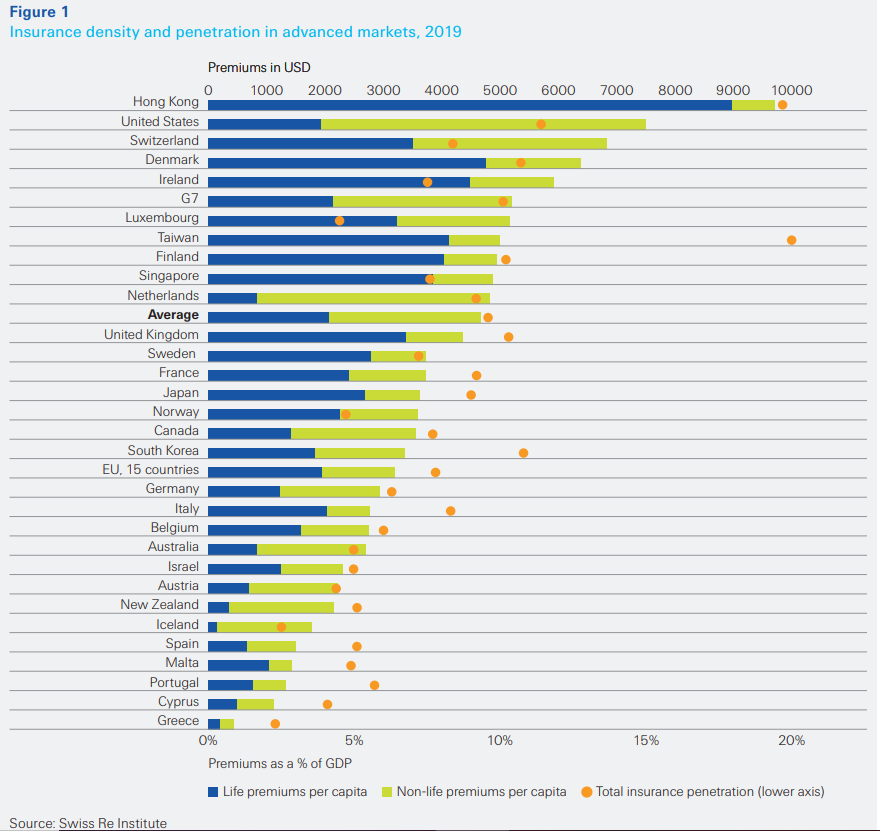

Swis Re publishes insurance penetration and density annually in developed countries worldwide, presenting the values of per capita premiums decomposed in terms of life and non-life insurance.

The life component provides a good indication of the expense of personal insurance in each country to the extent that it is exclusively personal, as opposed to the non-life or risk that includes, property insurance and other commercial assets.

As we know, the data of country-to-country comparations are influenced by the degree of economic development, development of the insurance sector itself, the characteristics of the productive and business fabric, public social security systems, the insurance tax regime itself, etc.

In its most recent edition, the density (per capita premiums) and penetration (ratio between total premiums and GDP) of life and non-life insurance in developed economies is as follows:

The average per capita expenditure on total insurance (density) in developed countries was $4,664 in 2019 and insurance penetration (premiums/GDP) was 9.6%.

The average density was $2,000 in life insurance and nearly $3,000 in non-life insurance. In the wealthiest countries, the density in life insurance is between $2,000 and $4,000 (non-life insurance has a much longer range).

In southern European countries and with the exception of Italy, the average total insurance density is very low, below $2,000.

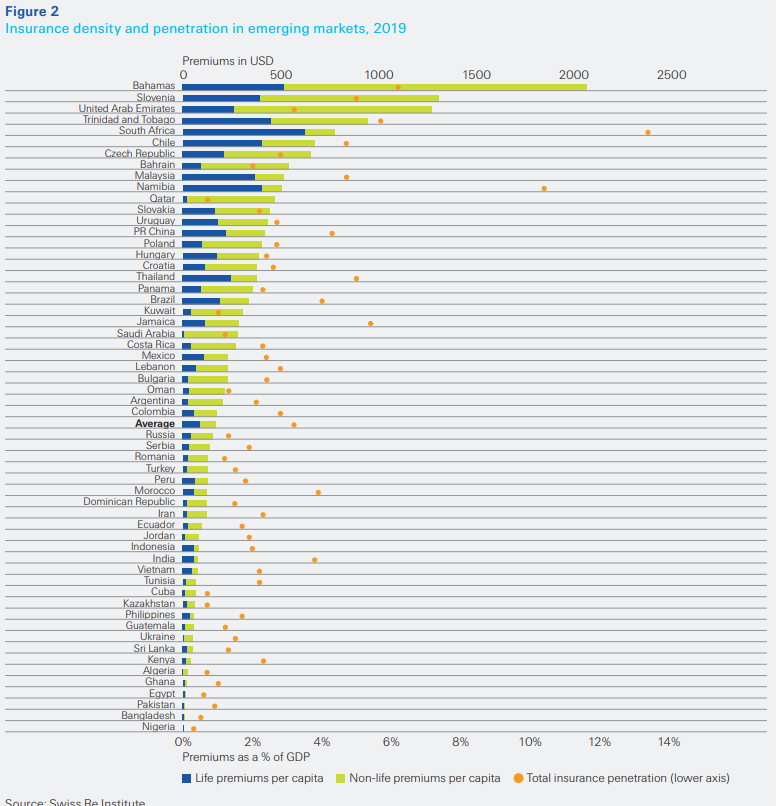

The density and penetration of insurance in emerging economies is as follows:

Average per capita insurance expenditure (density) in emerging markets was $175 in 2019, and insurance penetration of 0% (premiums/GDP) was 3.3%.

As you would expect, density and penetration vary much more in emerging countries than in developed ones.

These are negligible in most African countries, India and Indonesia, and have more relevance in the thriving emerging economies of Southeast Asia.

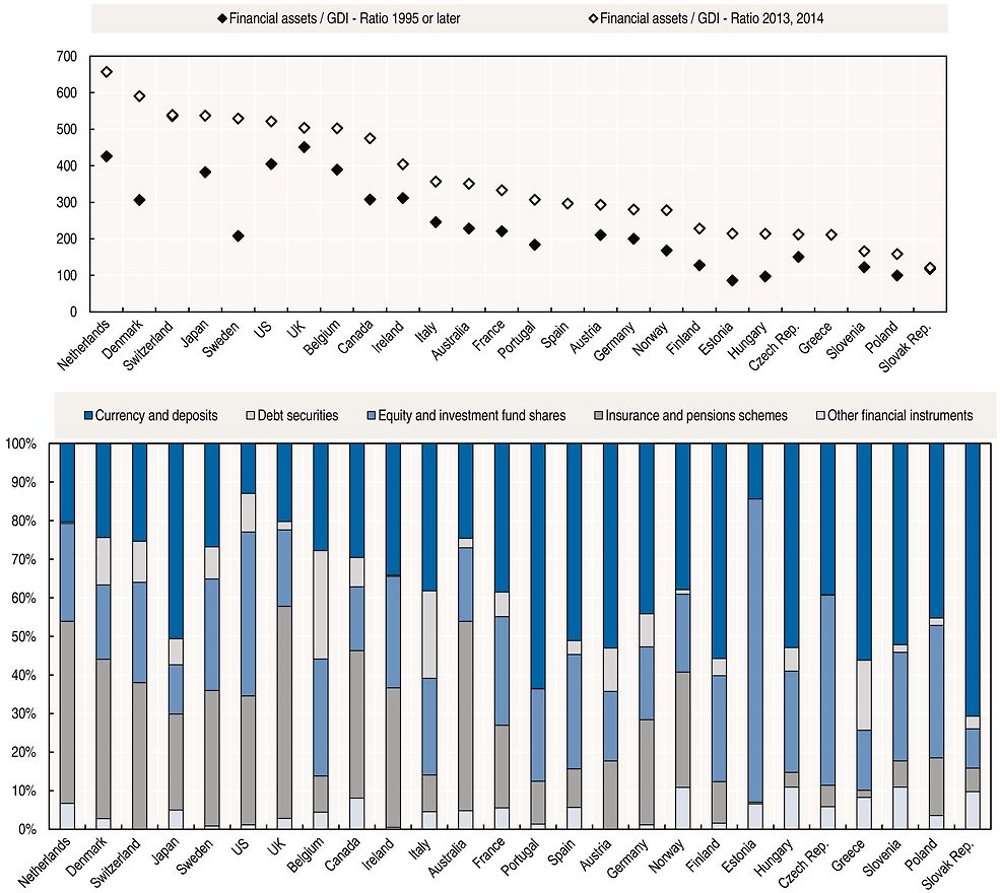

The OECD also publishes another annual indicator on the weight of the use of insurance and pension schemes in total financial assets per member country:

There is a great variation of this weight by the various member countries.

These schemes are less significant in less wealthy countries, such as Estonia, Greece, Slovakia, the Czech Republic, Hungary and Slovenia, and have an important weight in the wealthiest countries, with less public social protection and where the insurance system is highly evolved, such as the Netherlands, Denmark, Switzerland, Sweden, the United Kingdom, Canada, Ireland, Australia and Norway. They have a moderate weight in Japan, France, Austria and Finland.

In the next articles in this series we will address some of the most important insurance, especially life and financial insurance, but also some of risks, namely:

- Insurance investment products, such as capitalisation insurance, unit-linked and annuities

- Insurance pension plans

- Life insurance

- Health insurance

- Accident or disability insurance

- Housing and car insurance