2025 Overview

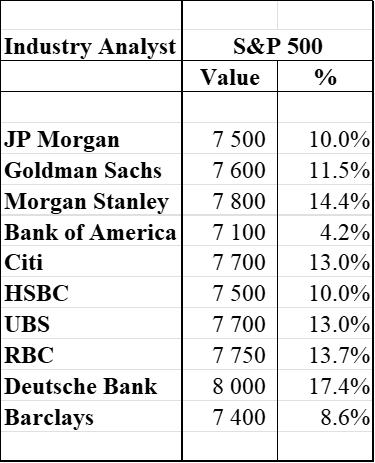

Predictions for the S&P 500

JP Morgan: S&P 500 at 7.800 points, and stabilization of official US interest rates around 3.5%.

Goldman Sachs: S&P 500 at 7,600 points, based on economic growth of 2-2.5 and business-friendly economic policies in the US

Morgan Stanley: S&P 500 at 7,800 points, with economic growth of 1.8% in the US and S&P 500 EPS growth of 14%

Bank of America: S&P 500 at 7,100 points, with the growth of the US economy outpacing that of other developed economies.

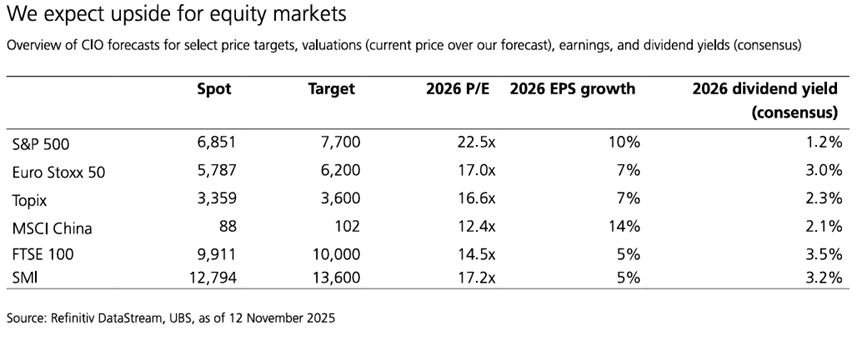

UBS: S&P 500 at 7,700 points at the end of 2026, driven by solid economic growth, lower interest rates and advances in AI.

Great harmony in the outlook for global and regional economic growth, the preference for investment in the US stock market, as well as the forecasts for the positive performance of the S&P 500 and the lowering of official rates by the Fed.

Conclusions and recommendations: investment portfolios balanced between stocks and bonds; shares of high-quality companies, with a preference for the US; American and European investment-grade bonds.

In the past three weeks, reports on the outlook for the financial markets for 2026 from the main US banks: JP Morgan, Goldman Sachs, Morgan Stanley, Bank of America and UBS, began to be published and released by the press.

In this article, we develop the opinion of these banks.

Every year, individual investors must make an assessment of the positioning of their investments and this is the opportune time to do so, based on an assessment of the current year and the prospects for the next one.

As usual, these exercises do not consider any changes in exogenous, current or potential factors, including changes in the geopolitical context, in particular, the war in Ukraine and the conflict in Gaza.

In our opinion, it is interesting and important to consider and monitor the opinion of the big banks regarding the economy and financial markets in general.

On the contrary, we are very critical of the value of your recommendations for individual securities.

A year ago we presented the Outlook of the world’s leading investment banks for 2025 which, on average, pointed to the S&P 500 between 6,400 and 7,100 points and interest rates on US 10-year bonds below 4.0%.

2025 Overview

The performance of the various segments of the financial markets in 2025 was very positive:

The leadership fell to the stocks of emerging markets and developed countries ex-US, which, by outperforming their American counterparts, reversed a reality of more than a decade.

Still, the S&P 500 rose 17 percent, the third straight year of double-digit gains for U.S. stocks.

Predictions for the S&P 500

Investment banks predict that the S&P 500 will be between 7,100 and 8,000 points by the end of 2026:

JP Morgan: S&P 500 at 7,800 points, and stabilization of official US interest rates around 3.5%.

Economic growth and inflation are expected to pick up in the first part of 2026 due to fiscal policy, then slow down due to the effects of tariffs and curbing immigration.

Forecasts real GDP growth slowing to around 1% in the fourth quarter of 2025, rising to more than 3% in the first half of 2026, and then decelerating again to between 1% and 2% growth.

Estimates that inflation will remain below 4% year-on-year, due to the fall in oil prices and the fall in housing inflation, falling to 2% by the end of 2026.

Expects interest rates on 2-year Treasuries to remain between 3.50% and 3.75%, while long rates (10-year Treasuries) will settle between 4.00% and 4.50%.

Believes that the valuations of the US stock market are undoubtedly high, but there are some compelling justifications, such as impressive double-digit earnings growth for four consecutive quarters.

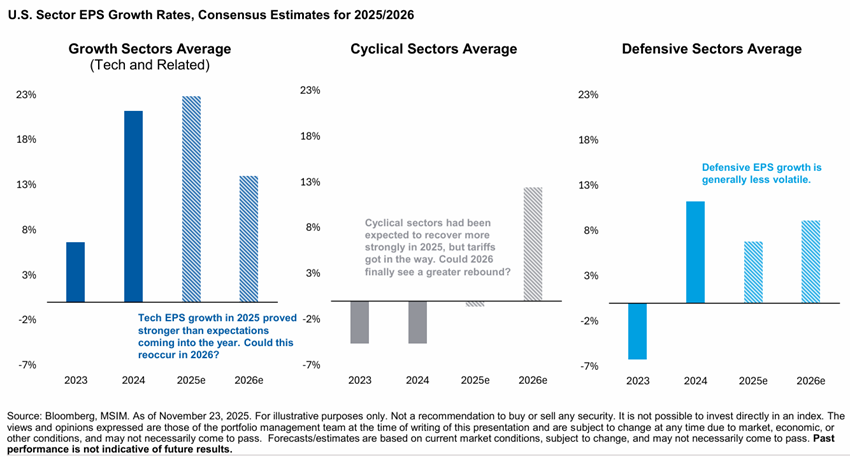

Expects S&P 500 earnings to grow 11% in 2025 and a further 13% in 2026, with earnings growth for the Magnificent 7 expected to slow slightly to 20%, while the rest of the index is expected to grow 11%, contributing 64% of global earnings growth.

Considers that the difference in earnings growth between the US and the rest of the world has narrowed, as a result of structural changes, such as positive nominal growth, AI, fiscal stimulus and more shareholder-friendly policies.

Access here:

https://www.jpmorgan.com/content/dam/jpmorgan/documents/wealth-management/outlook-2026.pdf

Goldman Sachs: S&P 500 at 7,600 points, based on economic growth of 2-2.5 and business-friendly economic policies in the US

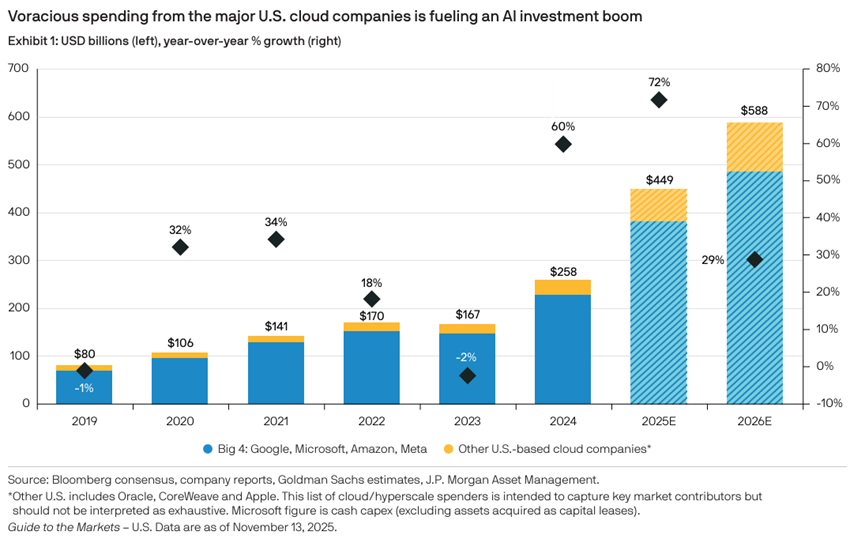

GS understands that central bank actions, a new international trade order, fiscal risks, geopolitical shifts and AI are creating a complex but dynamic investment backdrop.

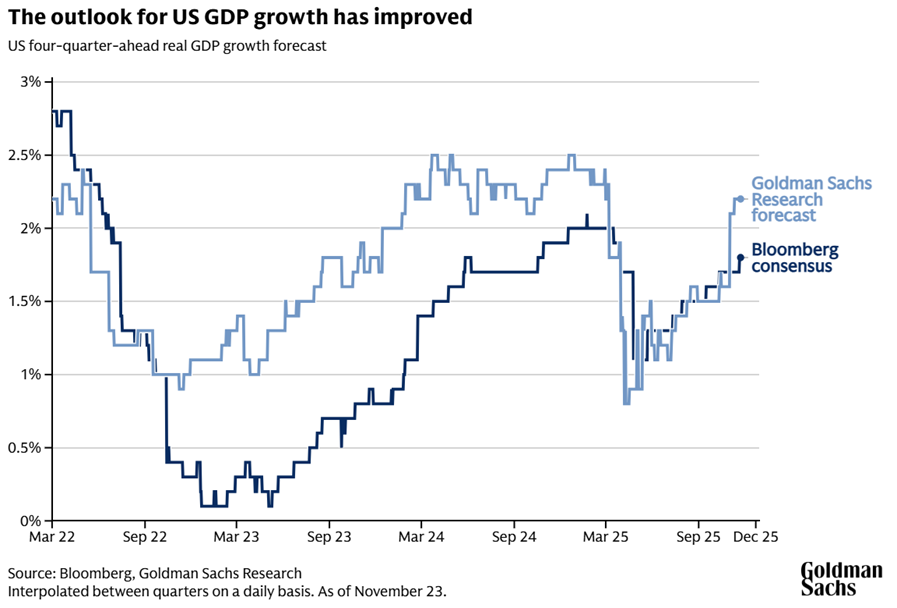

Goldman Sachs Research forecasts U.S. economic growth to accelerate to 2-2.5% in 2026 due to less impact from tariffs, tax cuts, and more favorable financial conditions.

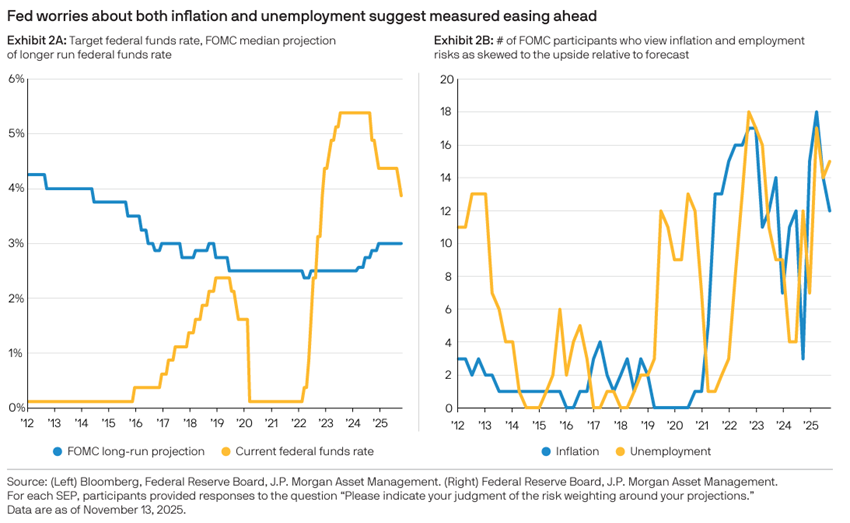

Considers that the outlook for monetary policy in 2026 is more difficult to predict due to the divergent views of FED members on the priority of the dual mandate, employment and inflation.

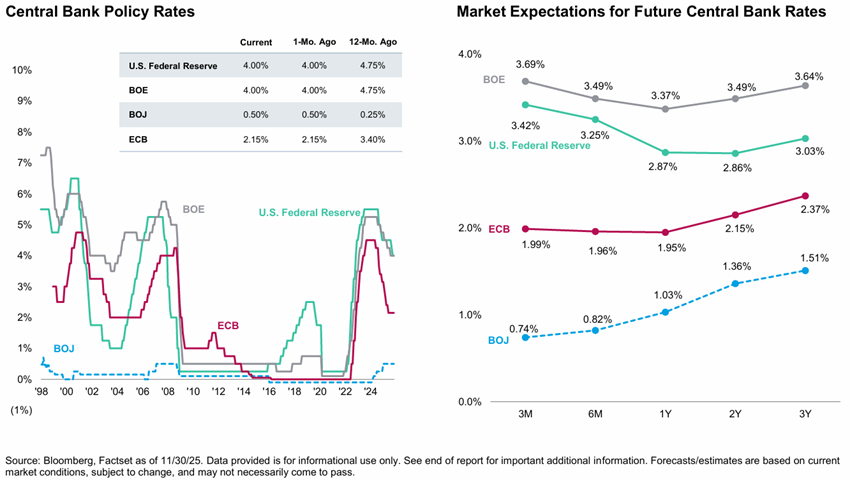

Thus, it expects the FED to suspend its cutting cycle in January before applying cuts in March and June, causing official interest rates to fall to a level of 3-3.25% by the end of the year (compared to 3.75%-4% today).

Predicts that the S&P 500 will reach 7,600 points by the end of 2026, a little more than 10% of current levels, assuming that artificial intelligence will boost productivity next year, and in this way, boost corporate profits of the S&P 500.

Expects S&P 500 earnings per share to rise 12% in 2026 to $305, with most of that growth coming from just the big six tech companies.

Access here:

Morgan Stanley: S&P 500 at 7,800 points, with economic growth of 1.8% in the US and S&P 500 EPS growth of 14%

According to MS, the US economy will slow in the first two quarters of 2026, but accelerate in the second half, helped by the boost in consumer and business spending, along with more favorable monetary and fiscal policy.

Estimates real GDP growth of 1.8% in 2026 and 2.0% in 2027, assuming that growth potential increases as the adoption of AI drives productivity growth.

Forecasts inflation to be 2.6% at the end of 2026 and 2.3% at the end of 2027.

Admits that the FED is likely to reduce interest rates until April, to stimulate job growth, in a context of containing inflation.

Expects the 10-year U.S. Treasury yield to fall by the middle of the year as the Fed lowers rates, before recovering slightly above 4% by the end of the year.

U.S. equities are expected to outperform their global peers in 2026, with the S&P 500 rising to 7,800 over the next 12 months, up 14% from the current level, as a result of expected earnings and cash flow growth.

The main drivers for this appreciation of the US stock market are a combination of market-friendly policies, interest rate cuts by the Federal Reserve, a $129 billion reduction in corporate taxes during 2026 and 2027 due to the One Big Beautiful Act, positive operating leverage, pricing and margin capability, and AI-driven efficiency gains.

It forecasts China’s real GDP to grow by 5% in 2026, helped by government policy support, followed by 4.5% in 2027 as the effect of fiscal stimulus wanes.

Growth in the euro area is expected to remain subdued, at 1.1% in 2026 and 1.3% in 2027, as German fiscal support is partially offset by consolidation in France and Italy.

In the eurozone, inflation is forecast to fall below the European Central Bank’s target of 2%, reaching 1.7% at the end of 2026 and in 2027. with the economy operating below its potential.

With inflation continuing to moderate in most major economies, monetary policymakers in the UK and the eurozone will have room to cut rates.

Yield curves in the euro area and the UK will tend to widen, although less dramatically than in the US.

MS anticipates expected gains of 7% for Japan’s TOPIX and 4% for MSCI Europe.

https://www.morganstanley.com/insights/articles/stock-market-investment-outlook-2026

https://www.morganstanley.com/insights/articles/global-economic-outlook-2026

https://www.morganstanley.com/im/publication/insights/articles/43274.pdf

Bank of America: S&P 500 at 7,100 points, with the growth of the US economy outpacing that of other developed economies.

The bank expects the Fed to cut rates twice in 2026 (June and July), and 10-year government bond yields to be between 4-4.50% by the end of 2026, remaining close to current levels.

BofA economists expect S&P 500 EPS growth of 14%, but only 4-5% S&P price appreciation, with a year-end target of 7100 for the index.

Access here:

https://www.ml.com/articles/economic-market-outlook-2026.html

UBS: S&P 500 at 7,700 points at the end of 2026, driven by solid economic growth, lower interest rates and advances in AI.

Forecasts real U.S. GDP growth close to 2% in 2026, similar to that of 2025, with an acceleration throughout the year.

Estimates that inflation will peak in the second quarter, at just over 3%.

Expects the Federal Reserve to implement two additional rate cuts by the end of the first quarter, then move towards a neutral policy stance.

Considers that the US will continue to be the central driver of global equities, with strong earnings growth, high profitability and the accelerating impact of AI, energy, resources and longevity, all of which will drive performance in 2026.

It expects S&P 500 earnings per share to reach $305 in 2026, up 10% from a year earlier, and the index to rise to 7,700 points by the end of the year, as a result of monetary and fiscal policy support.

The main risks include possible AI-related setbacks, inflation, trade tensions, and debt concerns.

Access here:

https://www.ubs.com/global/en/wealthmanagement/insights/marketnews/article.2856943.html

Strong alignment in the outlook for global and regional economic growth, the preference for investment in the US stock market, as well as the forecasts for the positive performance of the S&P 500 and the reduction of official rates by the Fed

The conclusions common to the various perspectives of banks are:

Maintenance of global economic growth and in all economies, advanced and emerging, to good levels in the US, lower, but rising in Europe.

Continued decline in inflation in advanced economies towards the 2% target.

Interest rates on 10-year US government bonds will continue to fall and are expected to fall below 3.5% by the end of 2026.

The dominant economic theme will be the effect of AI on corporate productivity and profits.

All banks are positive on investment in equities and government bonds in developed economies, which will benefit from economic growth, lower inflation and interest rates, as well as growth in corporate earnings and increased productivity.

Conclusions and recommendations: investment portfolios balanced between stocks and bonds; shares of high-quality companies, with a preference for the US; American and European investment-grade bonds.

These forecasts recommend that investors maintain balanced portfolios by combining investments with stocks of quality and solid companies with investments in investment grade bonds.

Considering these forecasts, the recommendations are as follows:

– Maintaining moderate exposure to longer-term US and European government bonds than average, respectively for US and European investors, benefiting from lower interest rates.

– Preference for investments in US equities, combining widespread investments in the main indices with the selection of thematic investment funds and individual securities associated with the ongoing economic transformations.