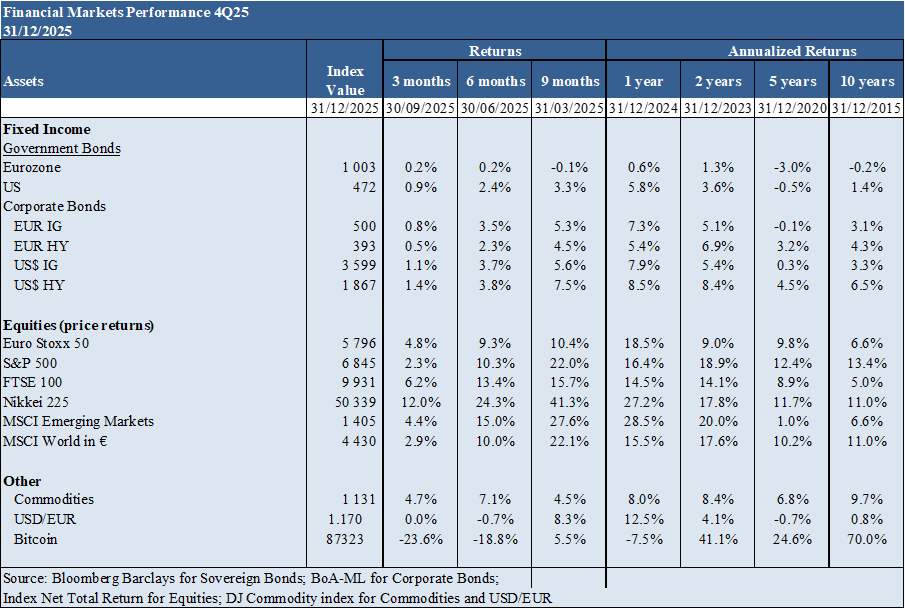

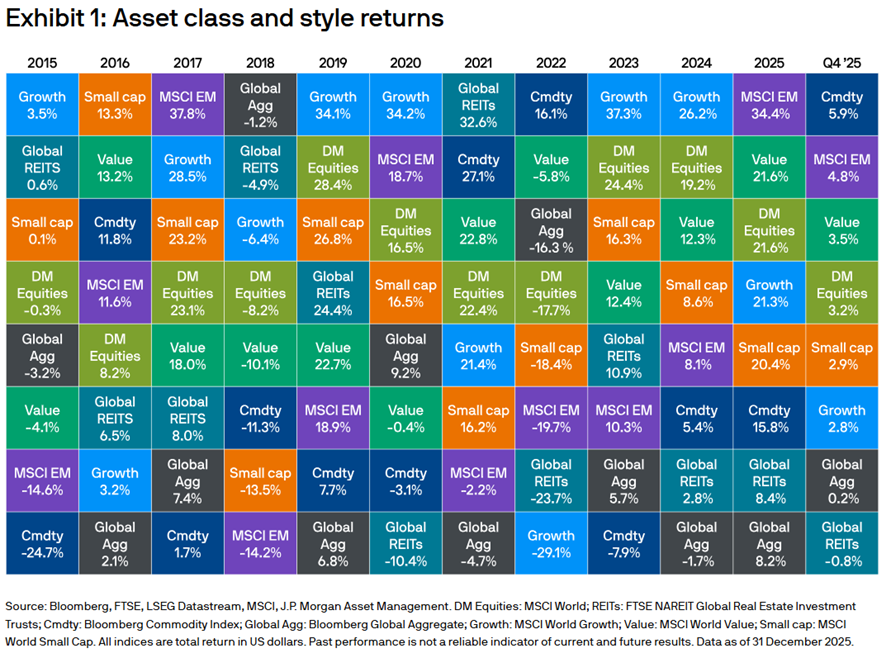

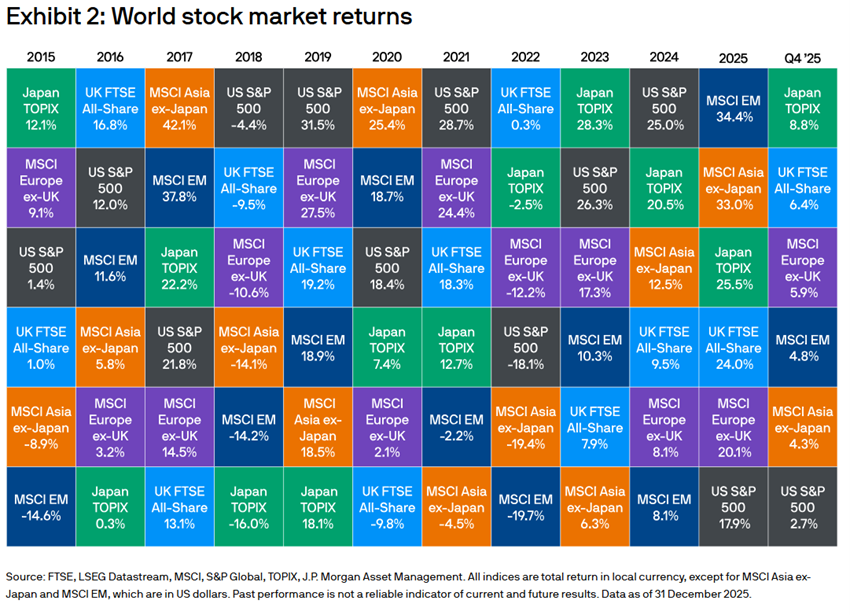

The year ended stock markets near peak levels almost everywhere in the world, driven by big US tech companies, the positive AI cycle, and the partial outcome of Trump’s tariff “drama”.

Performance 4Q25 Markets: Developed countries’ stocks close to peak levels. U.S. stocks have appreciated 17% in 2026, having been outperformed by valuations in Japanese emerging market stocks and also the European ones, a situation that, in the latter case, was unusual in the last decade. The dollar had a sharp devaluation.

Macro Context: Global economic growth remains at an average pace, close to 3.0%, and inflation rates are between 2% in the Eurozone and 2.7% in the US.

Micro Context: The main instant and advanced economic indicators are expanding slightly around the world, with some cooling in recent months.

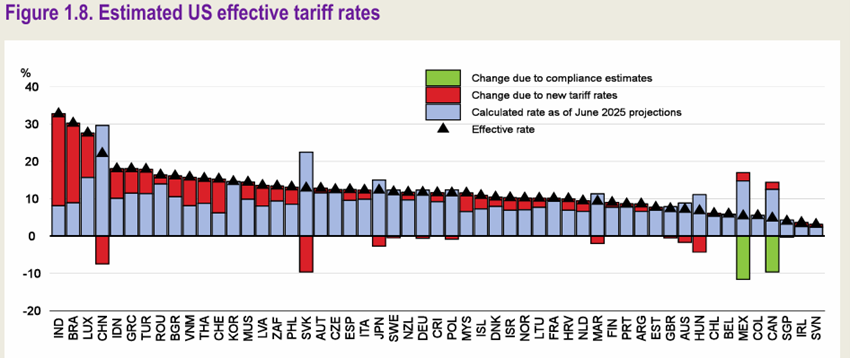

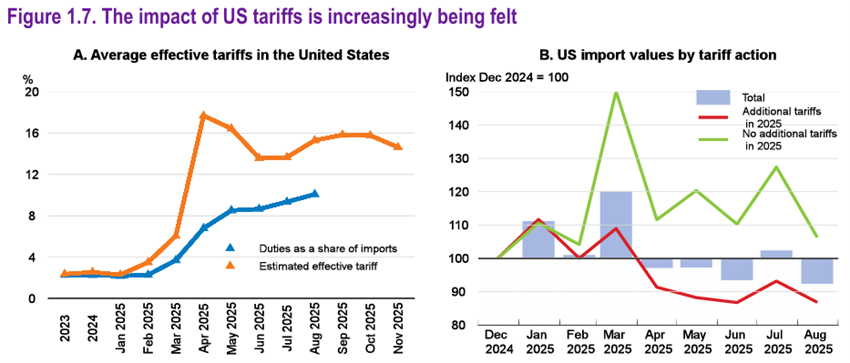

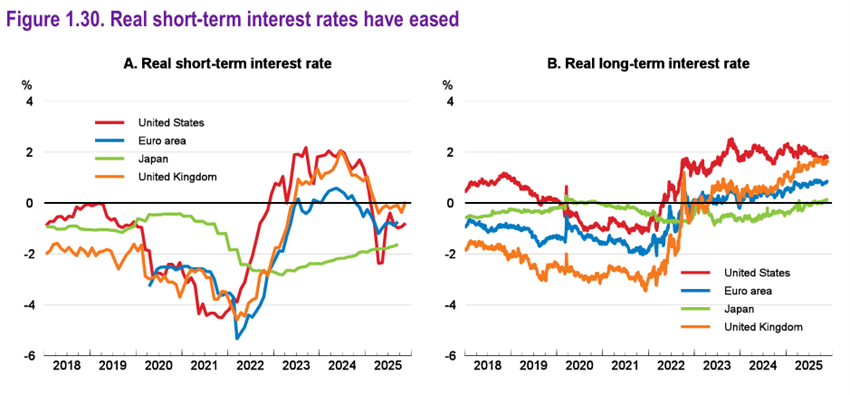

Economic policies: The Fed resumed lowering official interest rates in response to a deterioration in the labour market, while the ECB and BoI maintained their levels. Fiscal policy will be virtually neutral at the global level. Despite the conclusion of most trade agreements, uncertainty remains regarding the use of new tariffs.

Equity markets: Equity markets at all-time highs in almost all countries, with broad participation at the sectoral and capitalization levels, driven by big AI technologies.

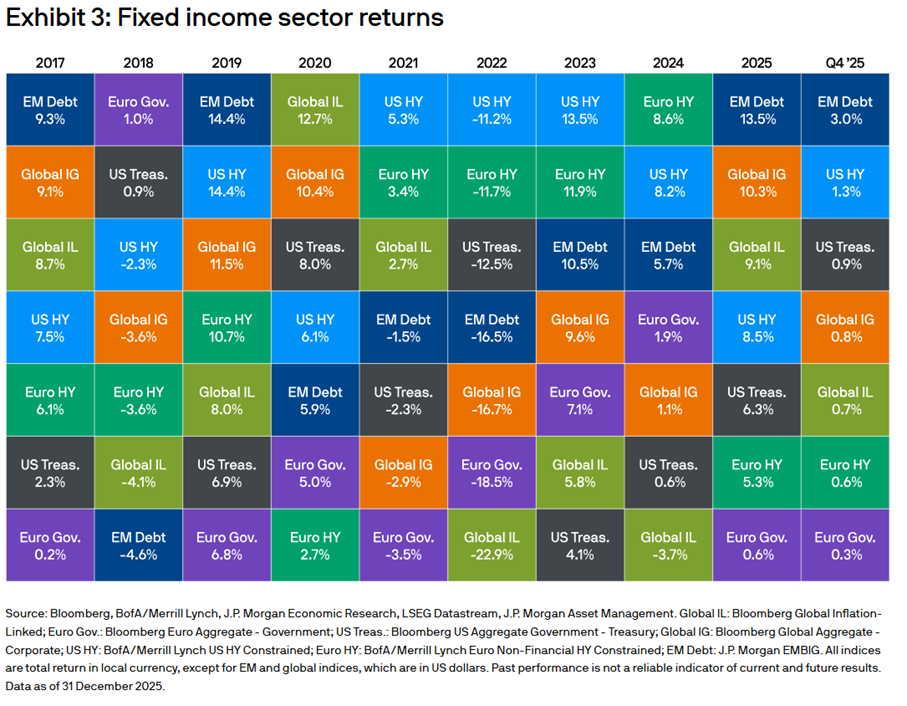

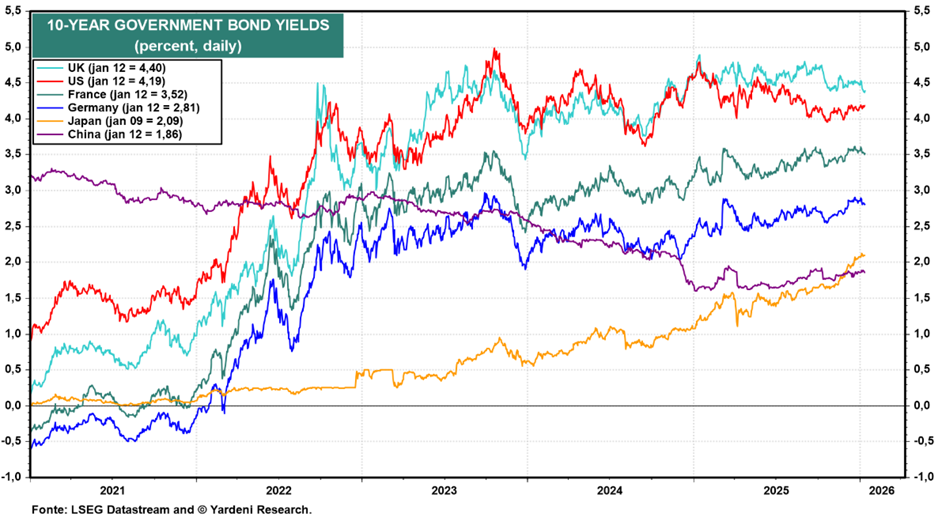

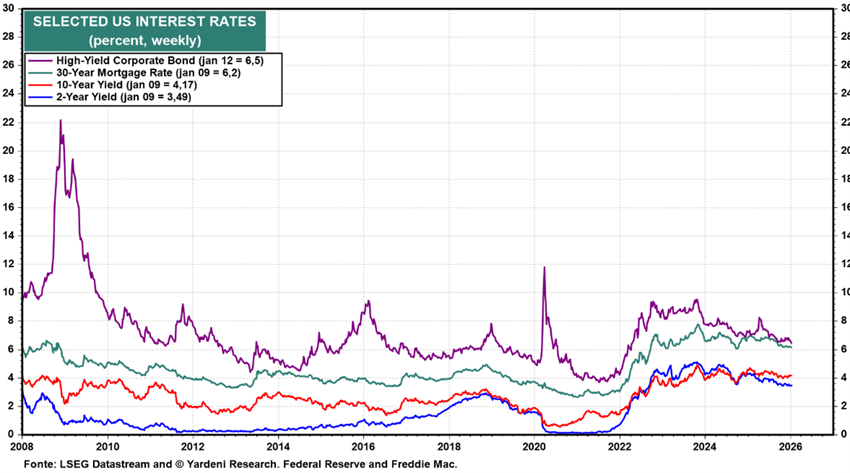

Bond markets: Long interest rates fell in developed economies, valuing bond investments as credit spreads held.

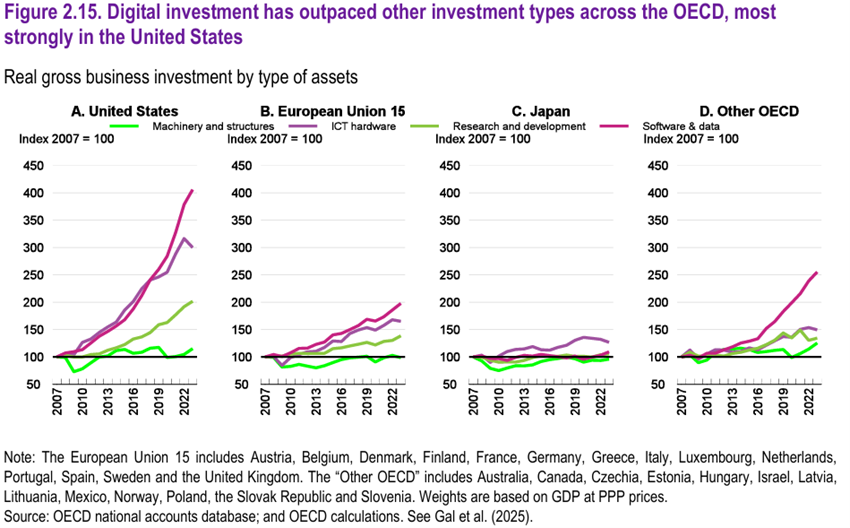

Key opportunities: The greatest impact of Artificial Intelligence on increasing productivity and profits.

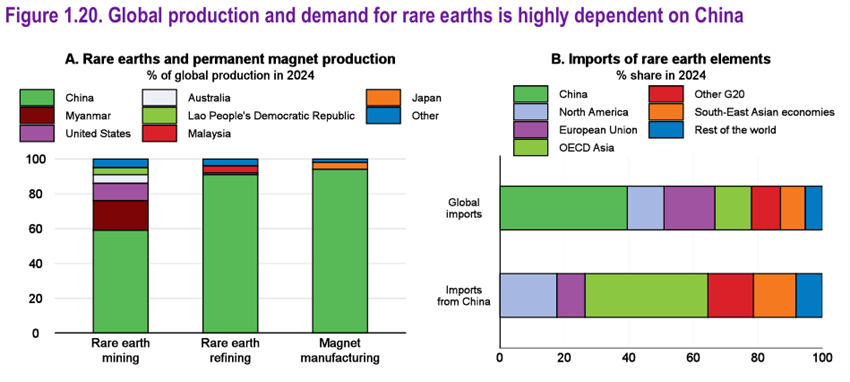

Main risks: A bad outcome of Trump’s tariff negotiations with the most important trading partner, China.

Financial markets in a positive macro environment, growth and interest rates, in a context of geopolitical uncertainty.

4Q25 financial market performance: Developed country equities near peak levels. US stocks have appreciated 17% in 2026, having been surpassed by the valuations of Japanese, emerging market and European stocks, a situation that, in the latter case, has been unusual in the last decade. The dollar had a sharp devaluation.

Major developed-market stock indexes are near peak levels, with double-digit valuations in 2026.

Western bond markets have appreciated between 5% and 7% in the year, as a result of the fall in interest rates.

Bitcoin has retreated to $87,000, losing 7% in 2026.

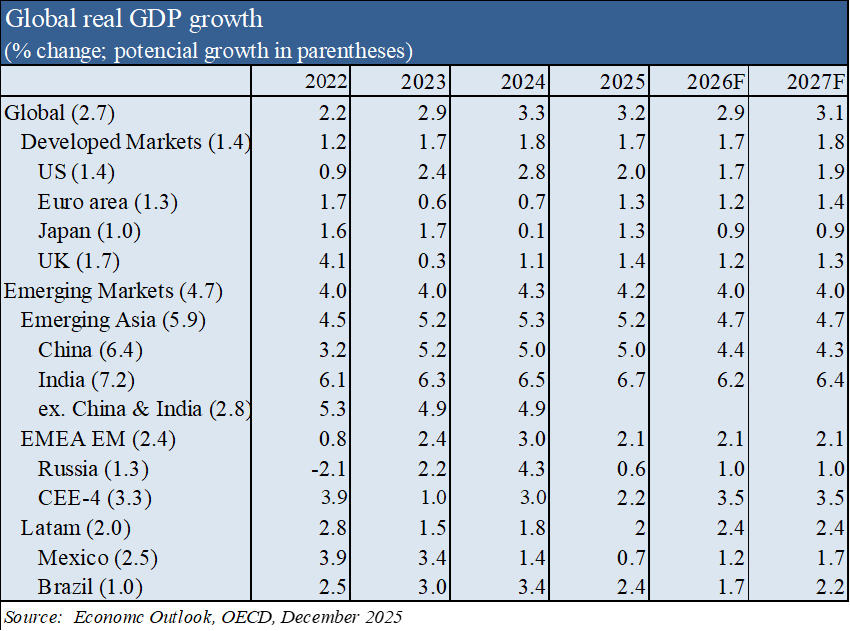

Macroeconomic context: Global economic growth remains at an average pace of close to 3.0%, and inflation rates range from 2% in the Eurozone to 2.7% in the US.

Global GDP growth is forecast to slow from 3.2% in 2025 to 2.9% in 2026, due to the impact of tariffs, before rising to 3.1% in 2027.

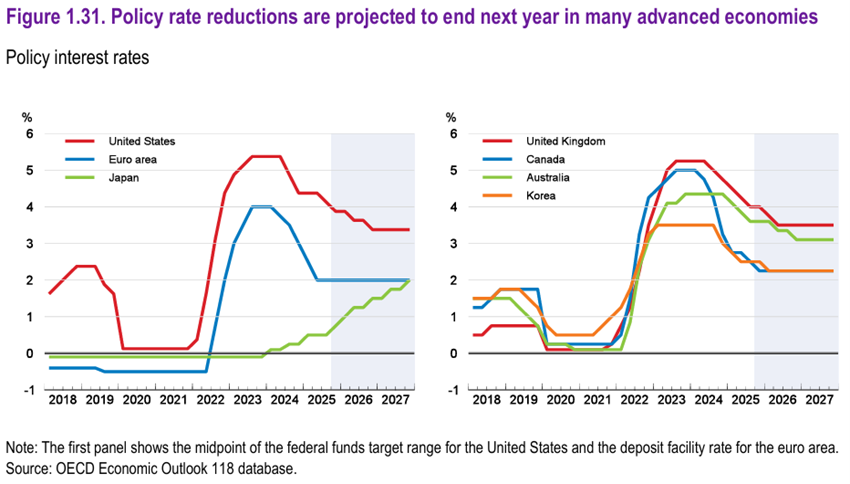

Further reductions in monetary policy interest rates are expected, and little fiscal tightening is expected in many countries, despite the need to respond to increased fiscal pressures.

Labour markets are expected to continue to ease, putting downward pressure on labour cost growth and inflation.

Annual consumer price inflation in G20 countries is expected to moderate to 2.8% and 2.5% in 2026 and 2027, respectively, from 3.4% this year. Thus, by mid-2027, inflation is forecast to return to target in almost all major economies.

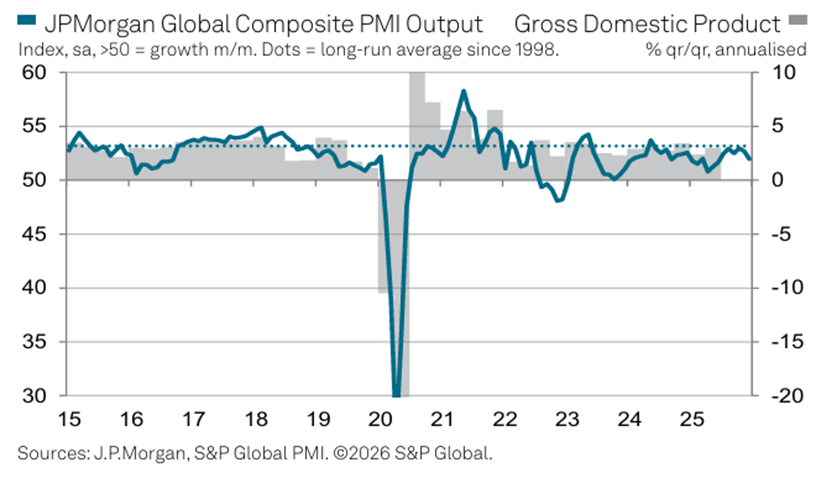

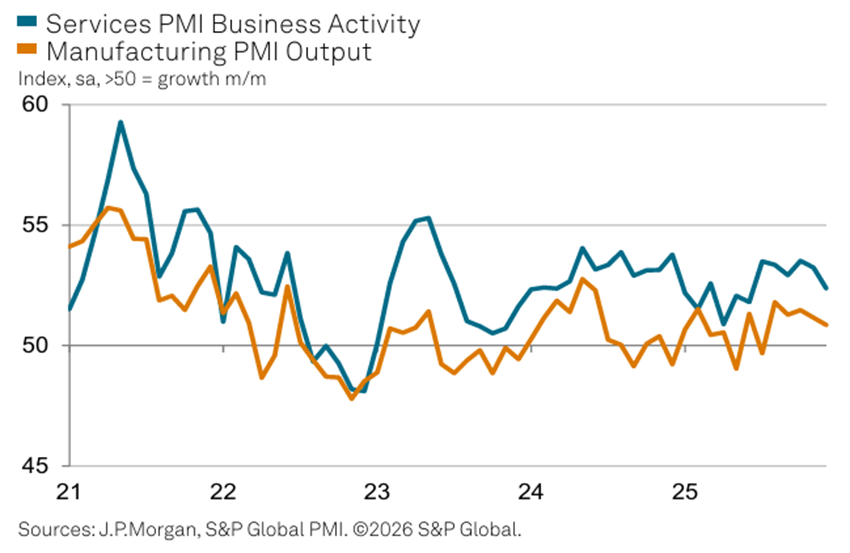

Microeconomic context: Key instant and forward economic indicators are expanding slightly around the world, with some cooling in recent months.

The core Output Index has remained above the neutral mark of 50.0, which separates expansion from contraction, for 35 consecutive months.

Growth remained stronger in the services sector compared to manufacturing, although expansion rates slowed in both cases. The Services PMI’s Global Business Activity Index fell to a six-month low of 52.4, while the Manufacturing PMI’s Global Index registered 50.9, its weakest reading in the current five-month expansion streak.

December saw output expansions in 11 of the 14 nations for which PMI Composite Output Index data was available. India, Spain and Ireland led the growth rankings, while the US and Brazil also recorded expansion rates above the global average. China, the euro area, Japan and the United Kingdom recorded lower-than-expected growth rates.

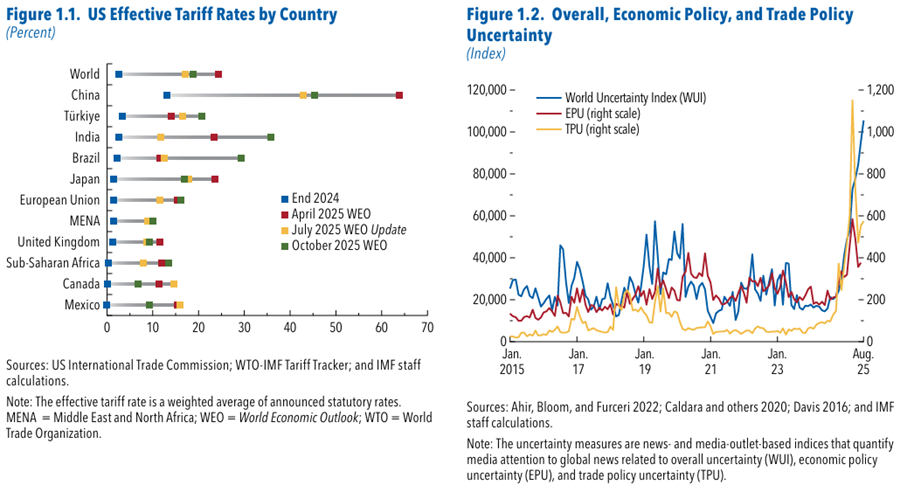

Economic policies: The Fed resumed lowering official interest rates in response to a deterioration in the labour market, while the ECB and BoE maintained their levels. Fiscal policy will be virtually neutral at the global level. Despite the conclusion of most trade agreements, uncertainty remains regarding the use of new tariffs.

In the United States, the official interest rate is expected to gradually decline from 3.75%-4% percent currently to 3.25%-3.5% percent by the end of 2026, remaining unchanged thereafter.

In the euro area, interest rates are expected to remain unchanged until the end of 2027, around 2%, with inflation remaining close to the same target.

In Japan, the monetary policy rate is expected to gradually rise from 0.5% currently to 2% by the end of 2027 as core inflation stabilizes at around 2%.

Fiscal policy is forecast to ease slightly in many advanced economies in 2025 and 2026, before tightening in most countries in 2027. The government’s gross debt-to-GDP ratio is expected to increase by 2.6 percentage points in the OECD between 2025 and 2027.

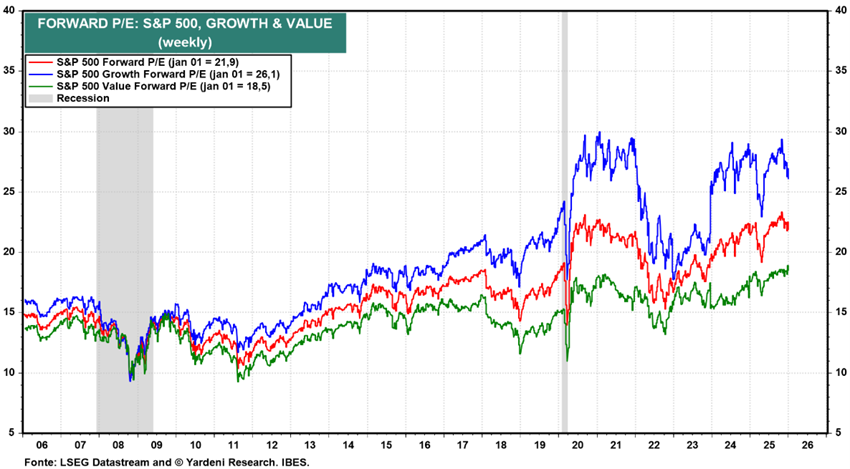

Equity market valuation: Equity markets at all-time highs in almost all countries, with broad participation at the sectoral and capitalization level, driven by large AI technologies.

Equity markets in almost all countries are near peak levels, driven by falling interest rates and the AI cycle.

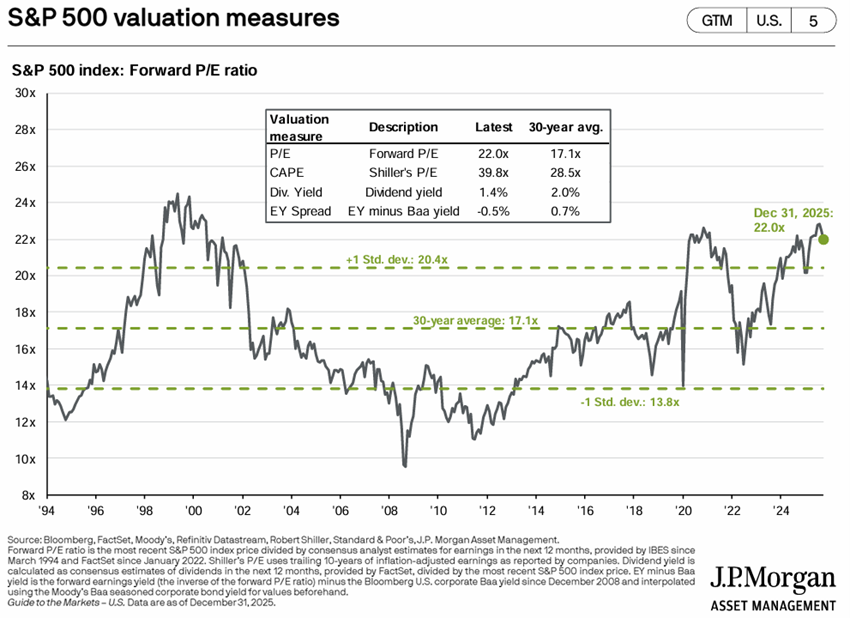

The 22.0x forward PER for the U.S. is still above the long-term average.

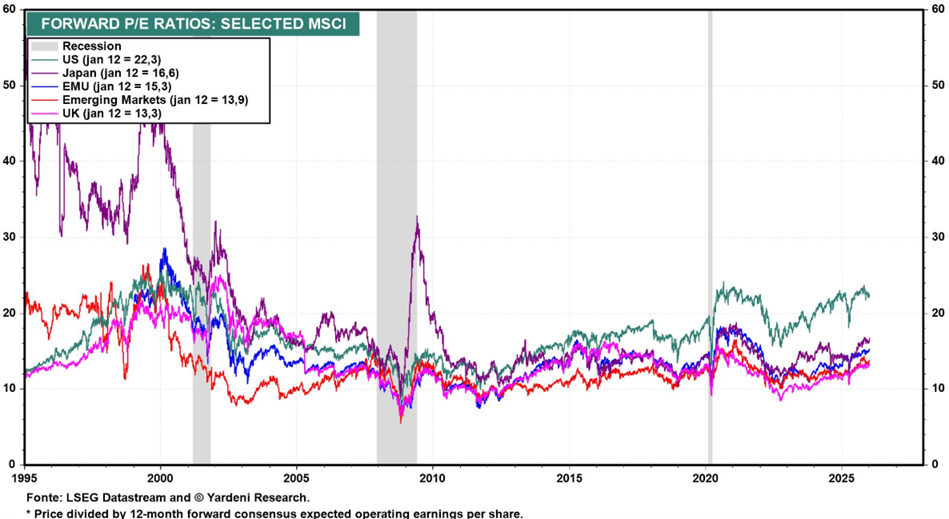

Japan’s PER is at 16.6x, Eurozone’s at 15.3x, 13.3x for the UK and 13.9x in emerging markets.

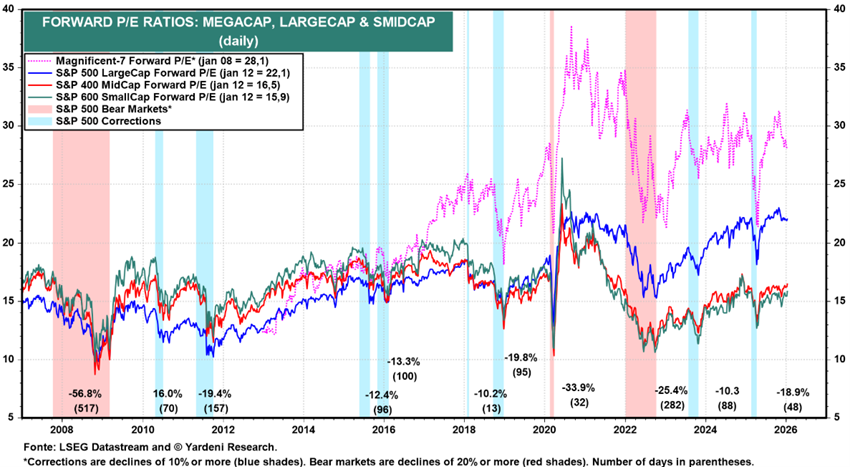

The PER of mid-cap and small-cap US stocks are at 16.5x to 15.9x, respectively, slightly above the long-term average.

Bond market assessment: Long interest rates have fallen in developed economies, increasing the value of bond investments as credit spreads have held.

Bond investments in developed countries appreciated slightly in line with the decline in long-term risk-free interest rates, while credit spreads were maintained.

Main opportunities: The greatest impact of Artificial Intelligence on increasing productivity and profits.

The future productivity benefits of new technologies could also emerge more quickly and more broadly than anticipated, giving an additional boost to the global growth outlook.

Main risks: A bad outcome of Trump’s tariff negotiations with the most important trading partner, China.

Trump has ended tariff negotiations with most of the partners, but the most important is still missing, China. The base scenario is that negotiations with China conclude without impact on the markets, although there is always the possibility of a negative outcome.

The elevated asset valuations, based on optimistic expectations of AI-driven corporate earnings, pose a risk of potential abrupt price corrections.

Fiscal vulnerabilities can boost sovereign yields in the long run, tightening financial conditions and hampering growth.