Markets close to the maximums with a small correction in September, in a context of the emergence of the second wave, the multiplication of economic and political risks, and hoping of a vaccine sooner

Index

Executive summary

In this scenario where markets trade close to highs, expectations are at high levels, and risks overweight opportunities, more defensive action should be favoured than the central allocation of each investor to the different asset subclasses of financial markets.

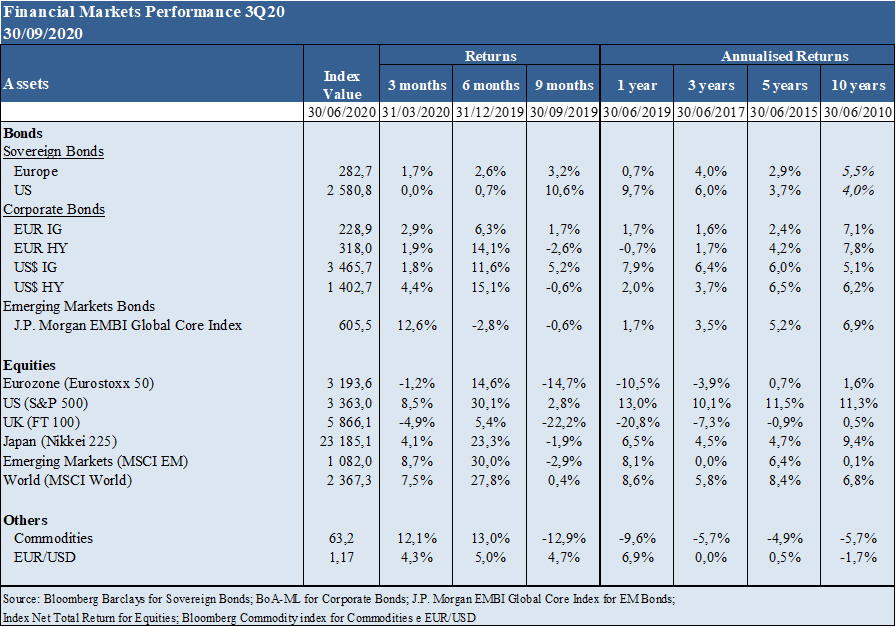

Financial markets performance 3Q20: Surprising recovery in equities and fixed income markets after March’s sharp decline, coupled with the reopening of economies, resumption of activity and implementation of unprecedented economic policies, and with indices such as the S&P 500 and especially the Nasdaq 100 positive for the year.

Abrupt falls of between 10% and 40% in the main stock and bond markets with the emergence of the pandemic and the closure of activity in the 1st quarter, followed by rapid recovery with reopening of economies from May, with the exception of a small correction in September.

Worsening the situation, the imbalance in the oil market caused a 50% price drop in the year, even after the OECD+ production cut-off agreement in mid-April.

Markets react to unprecedented action on economic policies – monetary and fiscal – and anticipate the evolution of indicators of economic activity and the pandemic.

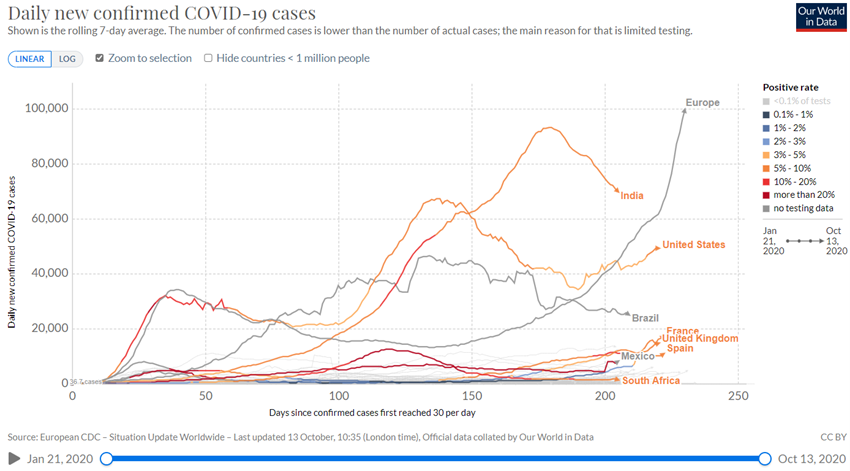

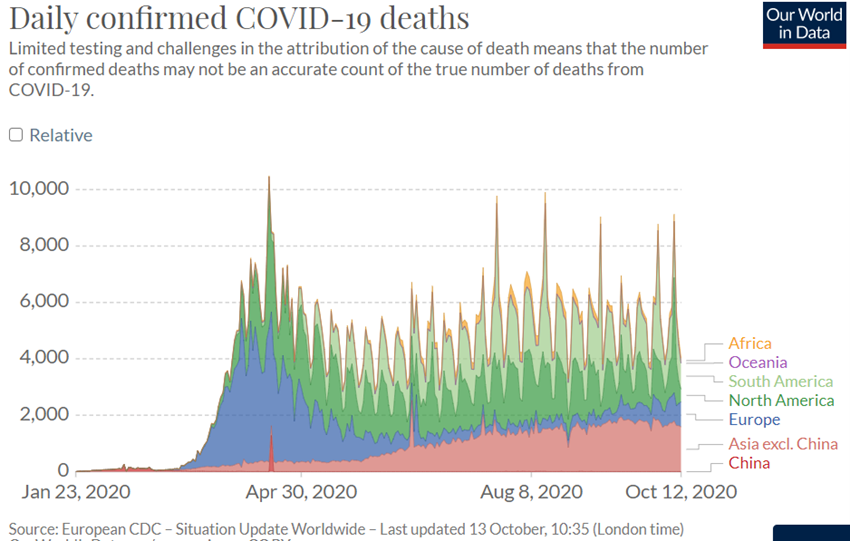

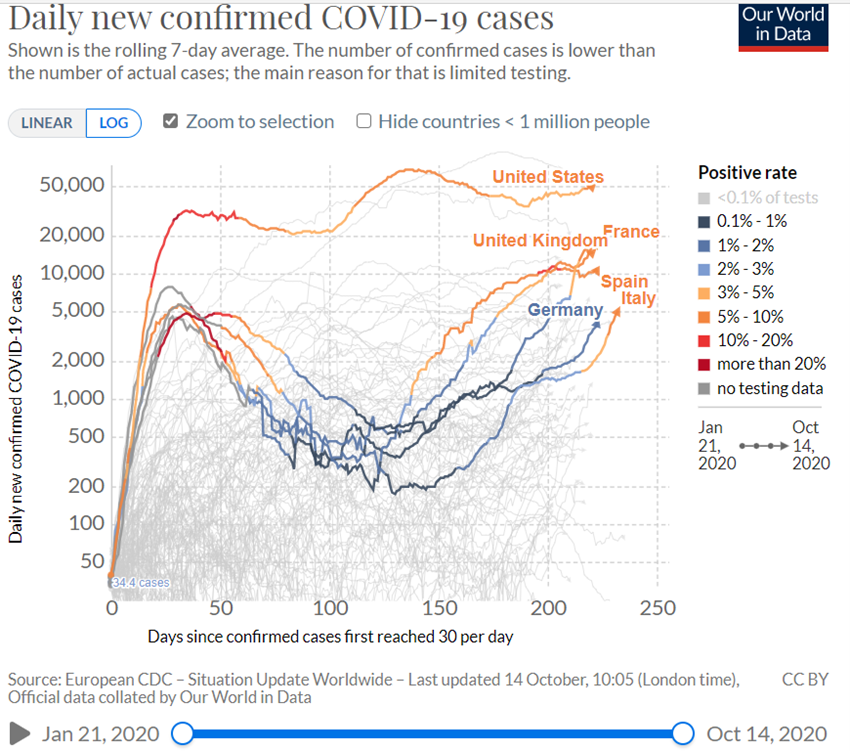

Covid-19: Pandemic worsens in underdeveloped countries such as India and Brazil and is under control and on close surveillance in the more developed countries, with recent indications of a second wave (associated with greater circulation of people), more worrying in Spain, France and the United Kingdom, while there is a decrease in mortality/lethality resulting from better response capacity, and a vaccine is eagerly awaited.

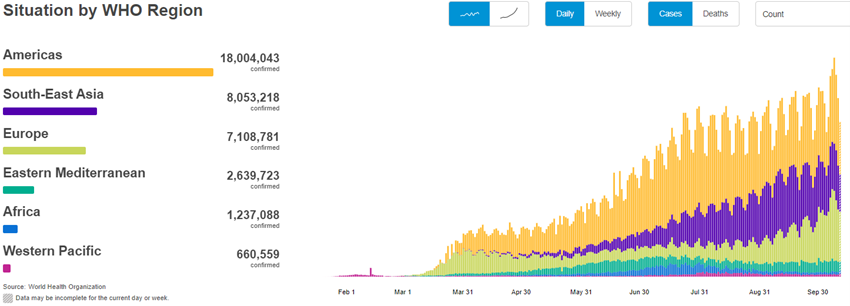

The Covid-19 virus started in February has already surpassed 38 million infected and 1 million deaths.

The strong impact in some countries in Europe and the US in the second quarter followed a growth of cases in India, Latin America and Russia in the third quarter, albeit more recently and with the recovery of economic life, the infection rate is again spiking around the world and more intensely again in some European countries such as France, Spain and the United Kingdom.

It has high rates of transmission, contagion and lethality and there is still no effective treatment or vaccine available, being fought with masks of individual protection, social distancing, prompt discovery (tests), hospitalization of critical cases and with the improvement of the responsiveness of public health authorities.

There are some treatments that are being used around the world and have been shown to be increasingly useful to reduce the lethality of critically ill cases with limited efficacy.

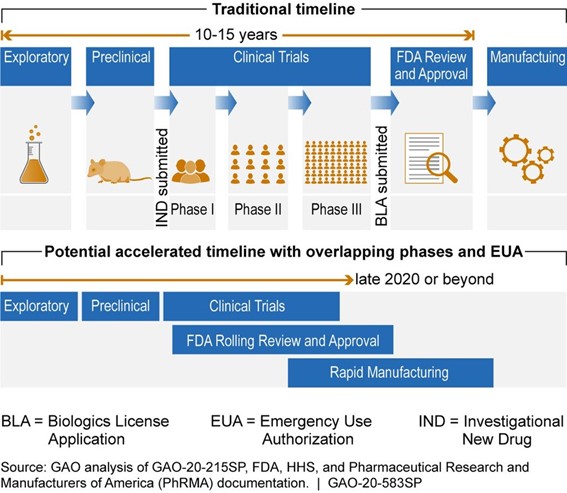

There are 42 vaccines in the clinical phase (human trials), of which 8 in stage 3, and 151 more vaccines in pre-clinical study phases, and public health experts believe that the availability of vaccines can happen by the first half of 2021 (only up to 18 months after the onset of the pandemic which compares with the average 10-year term of the previous vaccines).

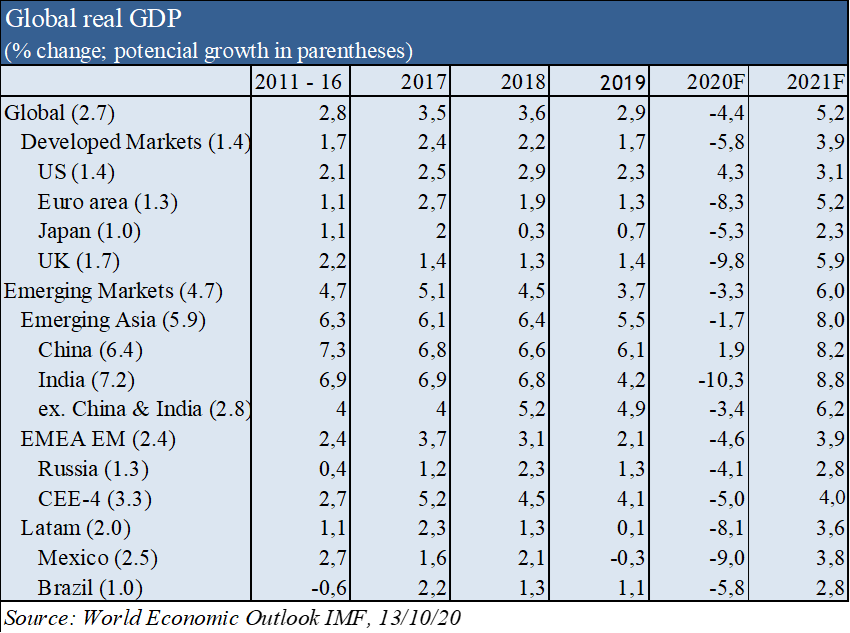

Macroeconomic context: It is expected a global real GDP contraction of -4.4% in 2020 and growth of +5.2% in 2021, -5.8% and +3.9% in advanced economies, and -3.3% and +6.0% in emerging economies, respectively, according to the latest IMF forecasts of 13 October, in a scenario where pandemic containment will be kept.

According to the IMF’s latest forecasts, the global economy is expected to contract sharply at -4.4% in 2020 as a result of the shutdown of much of economic activity to contain the pandemic fundamentally concentrated in the second quarter, and also recover significantly by +5.2% in 2021.

The stoppage of activity had a differentiated impact in sectoral terms, strongly affecting the tourism, leisure, consumer discretionary and banking sectors, and to a small degree consumer staples, utilities, telecommunications and technology.

This crisis is different from the others because it was not caused or caused a destruction of productive capacity, but rather the partial suspension of activity.

Inflation is controlled all over the world.

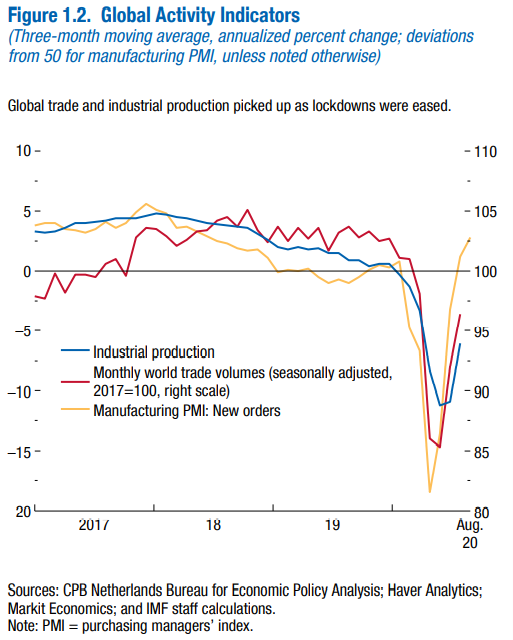

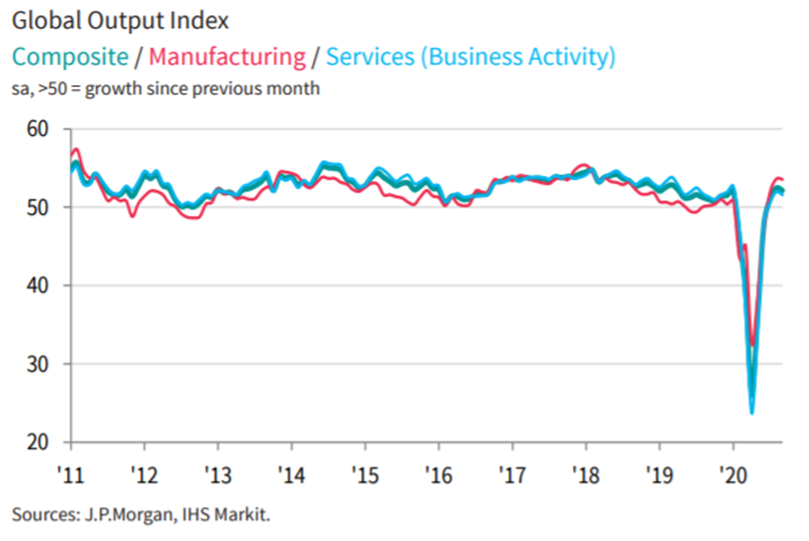

Micro-economic context: The instantaneous and advanced economic indicators released in the first week of October indicate accelerated activity and good recovery in employment levels in major economies, except for some European countries most hit by the pandemic.

The sharp contraction of the leading economic indicators from March to May associated with the shutdown of activity, followed an equally strong generalized improvement of them with its opening.

The Global Composite PMI has been improving from the lows of 36.3 reached in May to 52.1 September, accelerating in the U.S., China, and Germany, and still contracting in Spain, France and Ireland.

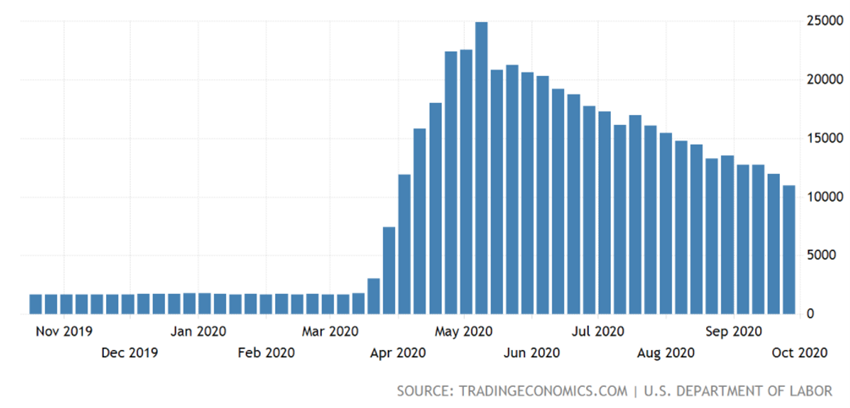

Unemployment indicators, notably the U.S. Continuing Jobless Claims in the US have improved from 25 million unemployed in May to 13 million at the end of September, but job creation has declined recently.

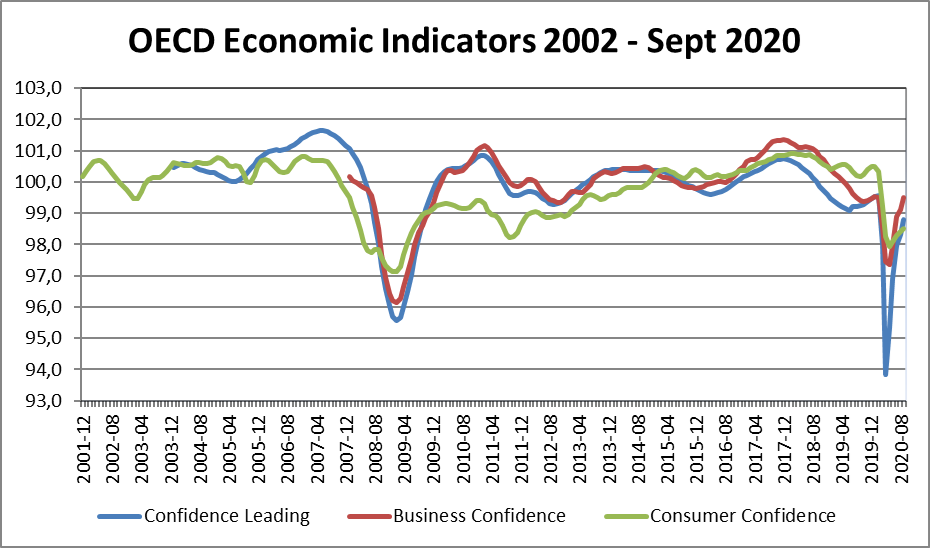

The latest business and consumer OECD confidence indicators are also reflecting the abrupt fluctuations in the shutdown and resumption of activity.

Source: US Continuing Jobless Claims 1Y, US Department of Labor, 08/10/20

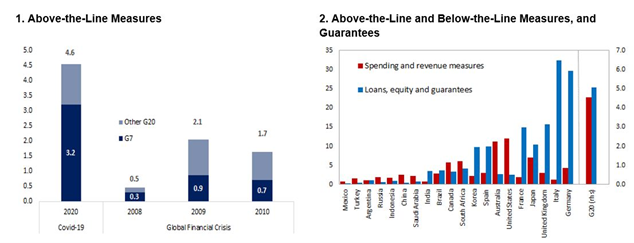

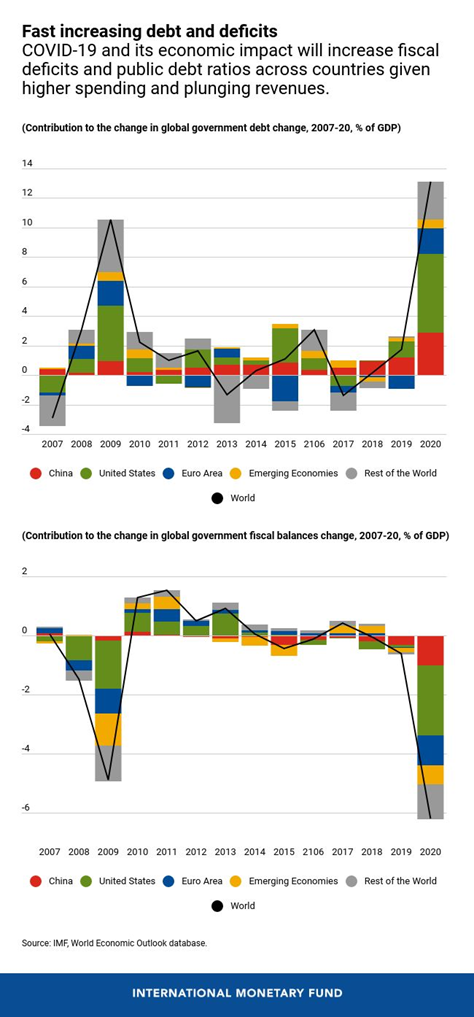

Economic policies: Governments and monetary authorities in the various countries support the bridge of the gap between present and future by pursuing unprecedented expansionary economic policies in support of affected families and businesses, with worsening balances in the medium term, and trying to avoid the costs of further shutdown.

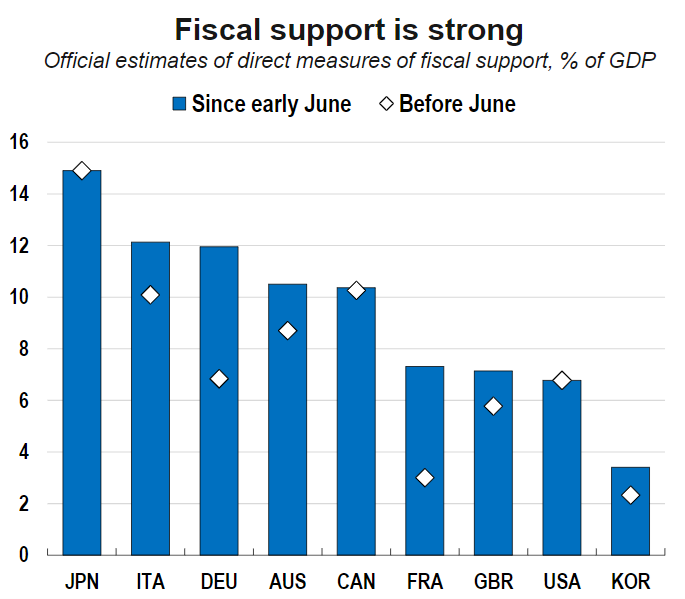

Around the world, economic policy makers have implemented strong, substantial fiscal and monetary and financial measures to support affected households and businesses until activity is normalised:

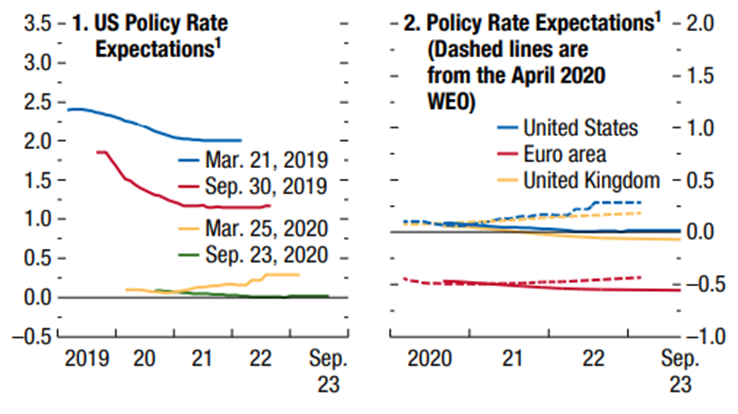

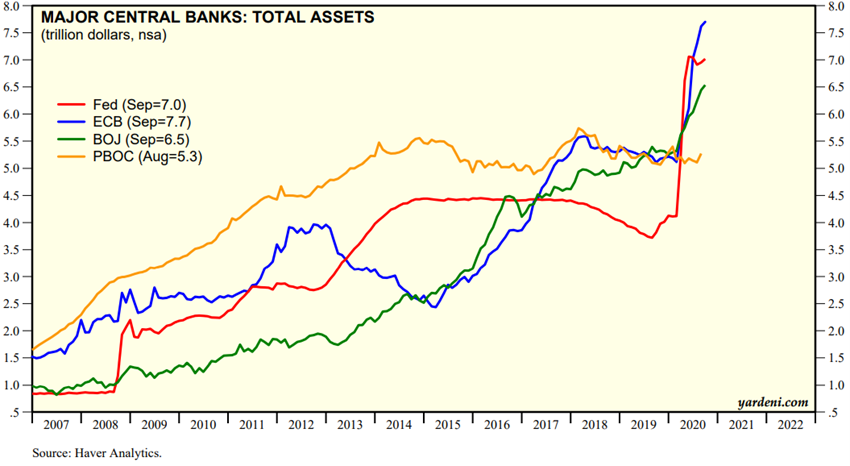

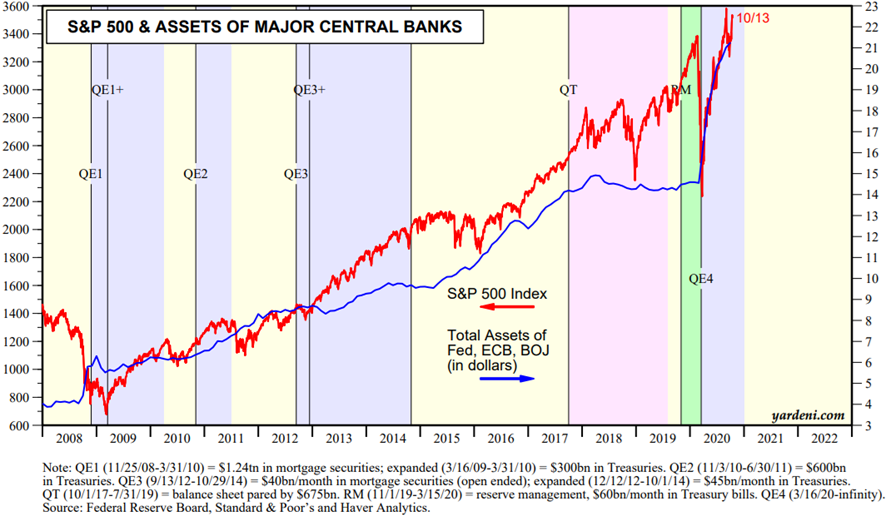

– Reduction of key interest rates to levels close to zero and even negative and strong strengthening of asset purchase programs by central banks worldwide.

– Programmes aimed at maintaining income and employment, with the improvement of unemployment benefits, financial support granted to companies for the maintenance of employment for access to the layoff scheme in Europe and the USA, and moratorium concessions on the payment of loans and rents;

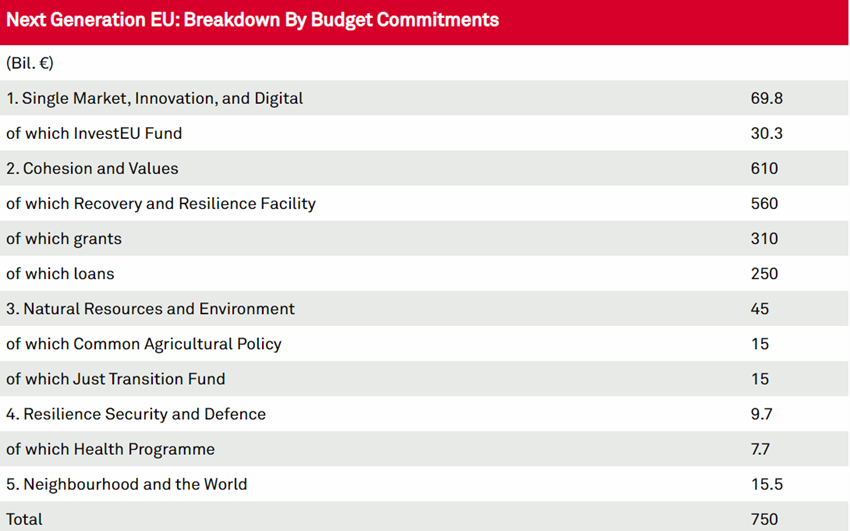

– Economic recovery programmes based on strong public investment in the medium term, such as NextGen EU 2021/2027 totalling €750 billion (of which €560 billion is earmarked for recovery and resilience), mostly grants and partial loans granted by the European Union to its most affected member countries.

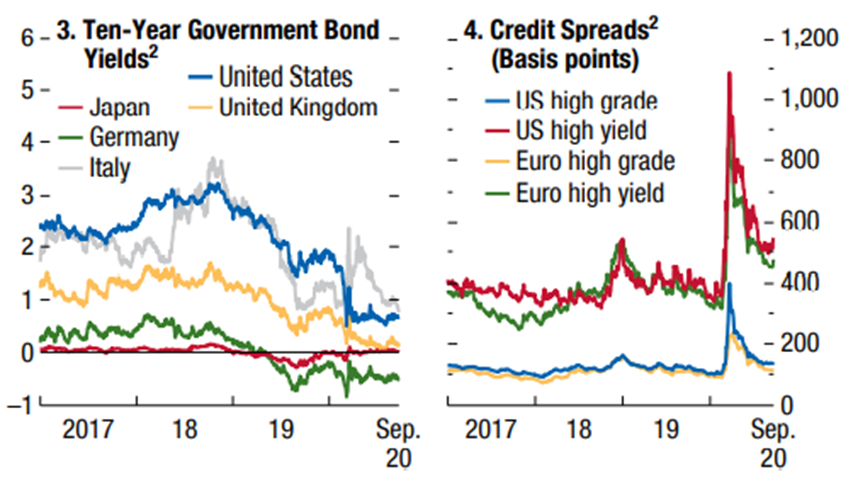

Short-term interest rates are negative in the Eurozone, Japan, and Switzerland, and have fallen sharply in the US. Interest rates on 10-year treasuries are close to zero in the Eurozone, Japan, and Switzerland, and at historic lows in the US and UK. Central bank reference interest rates are expected to remain very low in the Eurozone and the US in the medium term.

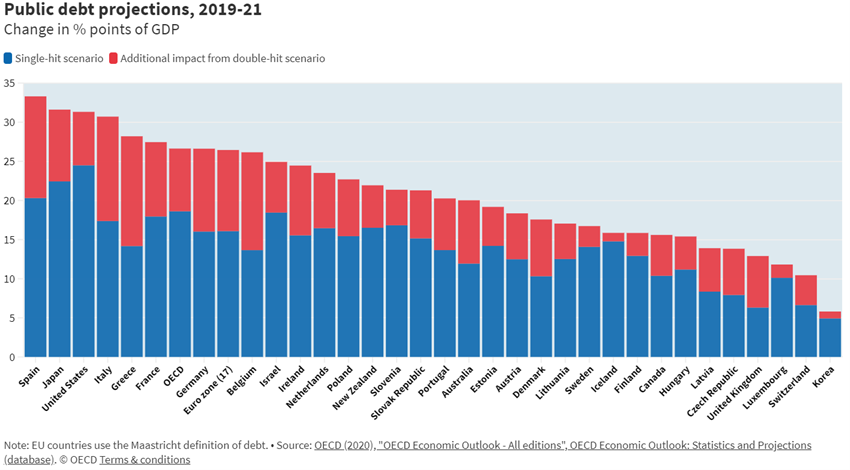

Thus, there has been a huge transfer of public funds to the private sector, financed largely by monetary creation, greatly aggravating fiscal and monetary imbalances.

Source: World Economic Outlook Update, IMF, October, 13

Source: Major Central Bank Total Assets, Yardeni Research, October 13

Source: OECD Economic Outlook, June 2020

Source: OECD Economic Outlook, September 2020

Source: OECD Economic Outlook, June 2020

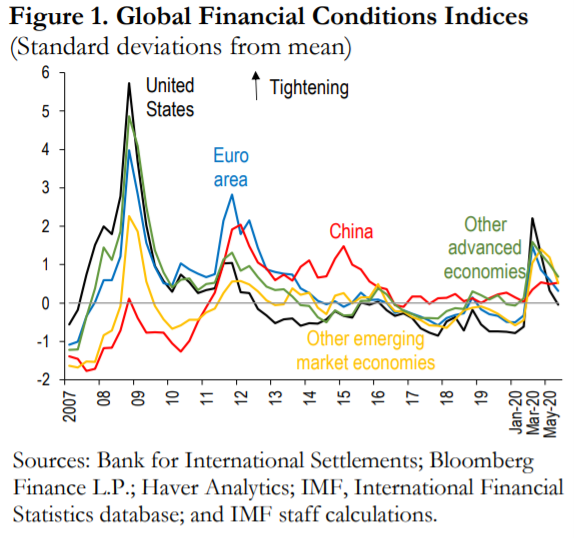

Financial conditions have improved with the recovery of markets and the strong and bold action of governments and central banks around the world.

The prompt and bold response of governments and central banks around the world has improved financial conditions, with some countries such as the US, including increasing disposable income and household savings.

The recovery in risk asset prices and the fall in benchmark interest rates also led to an overall improvement in financial conditions.

Source: Global Financial Stability Update, IMF, June 2020

Source: Central Banks:Monthly Balance Sheets, Yardeni Research, October, 13, 2020

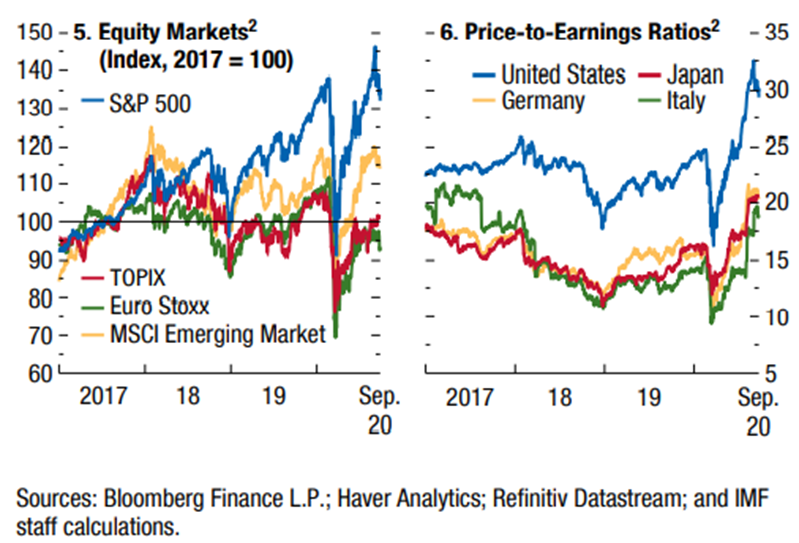

Markets valuation: Equities markets had a rapid and good recovery after the initial violent fall, in response to economic policy actions and in anticipation of improved economic data.

Equities markets have fallen sharply by 30% in two months and have already recovered this drop in the US and Europe in reaction to strong economic policies and in anticipation of improved economic data.

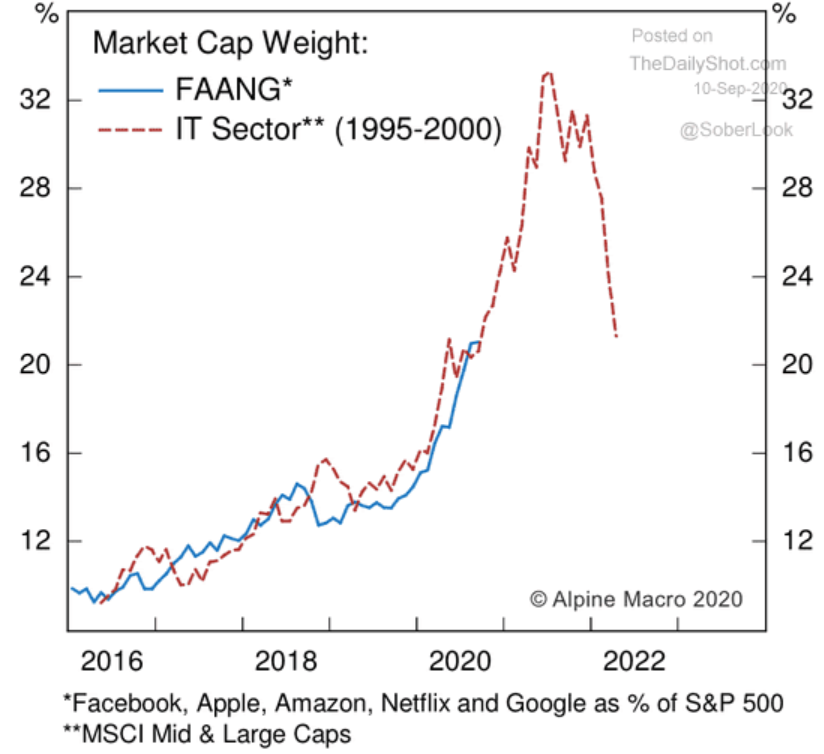

This movement is propitiated by the rotation of assets associated with low interest rates (“there is no alternative”), resumption of activity, support of economic policies for families and companies, and the strong appreciation of companies in the technology sector or working at home (WFM or Work From Home) and especially the FAMG/FANG.

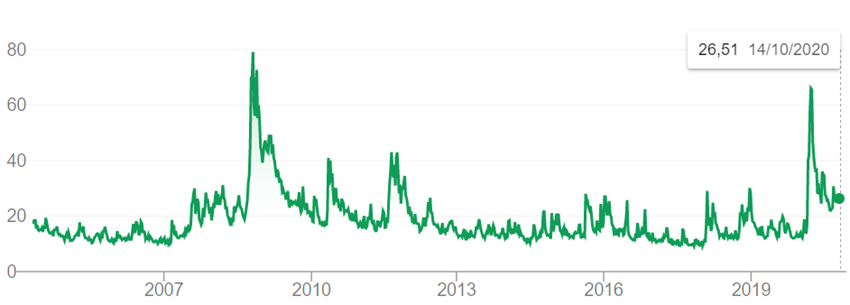

Volatility indicators such as the VIX in the US have been stabilizing near 30 points after reaching 80 points at the height of the crisis.

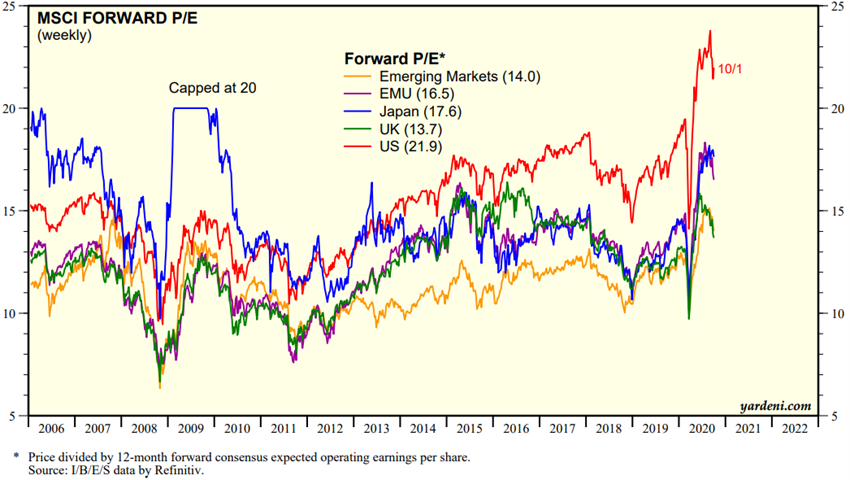

The equities markets valuation in the various regions are above their long-term average. The PER of 21.9x for the US is well above average and close to highs. The PER’s of 16.5x in the Eurozone, 17.6x in Japan and 14.0x in emerging markets are also above average.

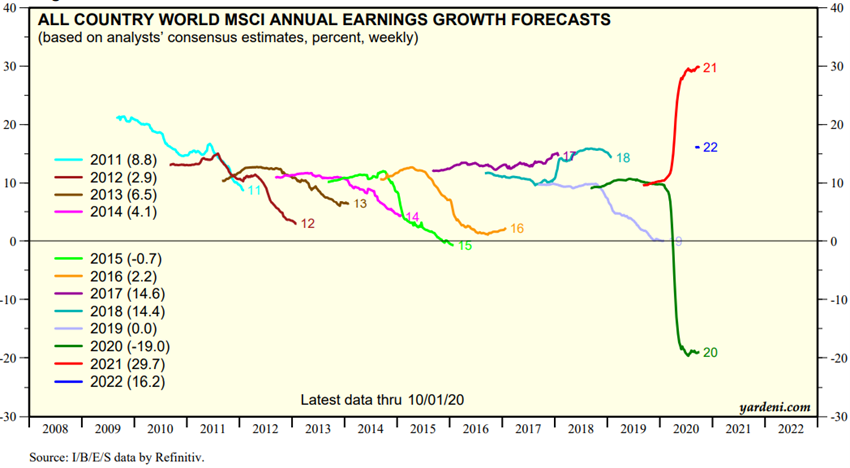

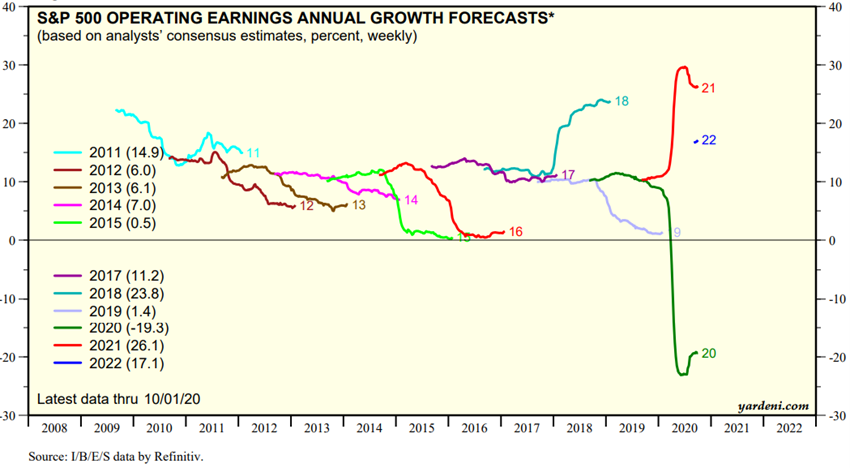

The consensus forecasts negative earnings growth of -20% for the global equities market in 2020, and a positive +21% for 2021, based on a rapid recovery from the second half of this year.

Most companies abandoned their results guidance due to the environment of great uncertainty. The third quarter results season in the US that now begins will last for the next 3 weeks (in Europe starts at the end of the month) and could bring important indications.

Source: World Economic Outlook, IMF, October, 13, 2020.

Source: VIX, Trading Economics, October, 14, 2020

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, October, 1, 2020

Source: Global Index Briefing: All Country World MSCI, Yardeni Research, October, 10, 2020

Source: Corporate Finance Briefing: S&P 500 Revenues and Earnings Growth Rate, Yardeni Research, October, 10, 2020

Markets valuation: Credit markets had the same movement and for the same reasons, with a significant reduction in risk spreads especially in investment grade ratings after the initial sharp worsening; treasury interest rates in the largest economies continue at historic lows due to demand for refuge assets (as well as gold).

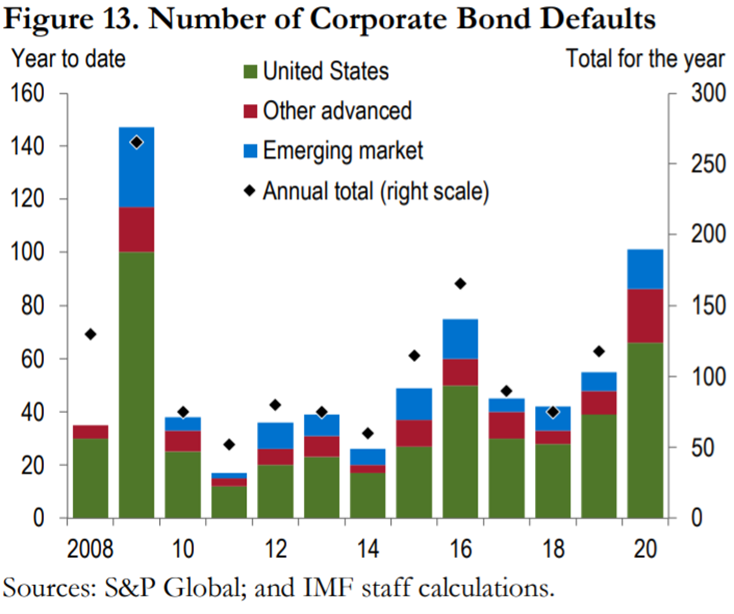

The pandemic initially had a huge impact on credit markets with risk spreads implicit to more than double to values never seen after GCF in the investment grade segment and with greater preponderance in the speculative grade segment, and then improved with the intervention of the authorities, in particular the FED.

Medium- and long-term interest rates on US and European treasury bonds are at historic lows due to demand for refuge assets (such as gold).

There has been a deterioration in credit ratings by the various agencies at country and corporate levels, with particular focus on the most unbalanced, more dependent on oil and tourism. Fitch downgraded 33 countries (including Canada, the UK and Hong Kong) in the first half (a number that had never been reached in a full year) and put 40 in a negative outlook.

Source: World Economic Outlook, IMF, October, 13, 2020.

Source: Global Financial Stability Report Update, IMF, June 2020

Main opportunities: Anticipation of definitive, effective and reliable medical solutions (treatments and vaccination) to combat the pandemic that allow for a fast normalisation of the activity around the world, and the intensification of economic policies especially in the West (new Cares Act in the USA and Next Gen in the EU).

Anticipation of medical solutions (effective treatments and/or vaccine) compared to the spring 2021 forecast, enabling a faster normalization of economic activity.

Efficient implementation of the Next Gen EU 2021/2027 programme in the European Union and rapid approval of the Heroes Act or Cares Act 2 in the USA.

Source: U.S. Government Accountability Office from Washington, DC, United States

Source: Economic Research: The EU’s Recovery Plan Is The Next Generation Of Fiscal Solidarity, S&P Global Ratings

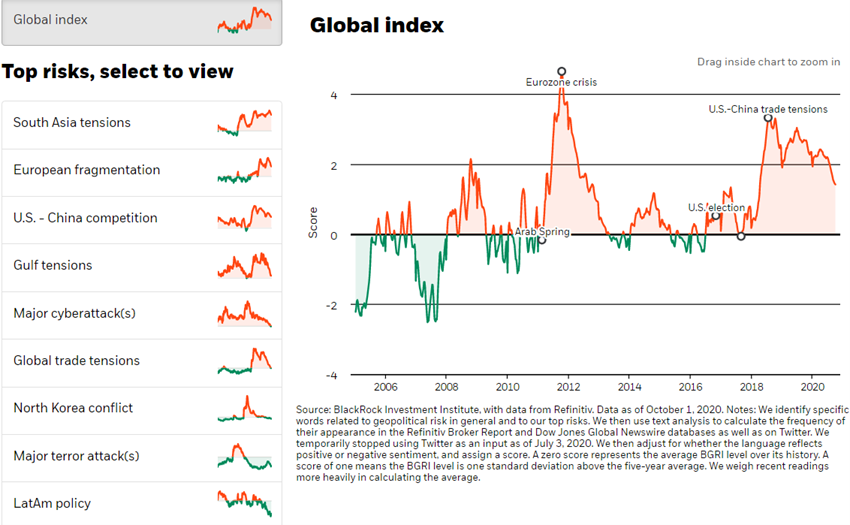

Main risks: Deterioration of market sentiment caused by the worsening and/or prolongation of the pandemic that require measures to reduce activity in developed countries, troubled outcome of the US elections, uncontrolled exit of the UK from the EU, deterioration of public accounts, multiplication of bankruptcies of companies hit by the pandemic, fragility of the oil market and its impact on vulnerable emerging countries.

Inability to control the second wave of the pandemic without aggressive new measures to halt and stop activity in some European countries and the US.

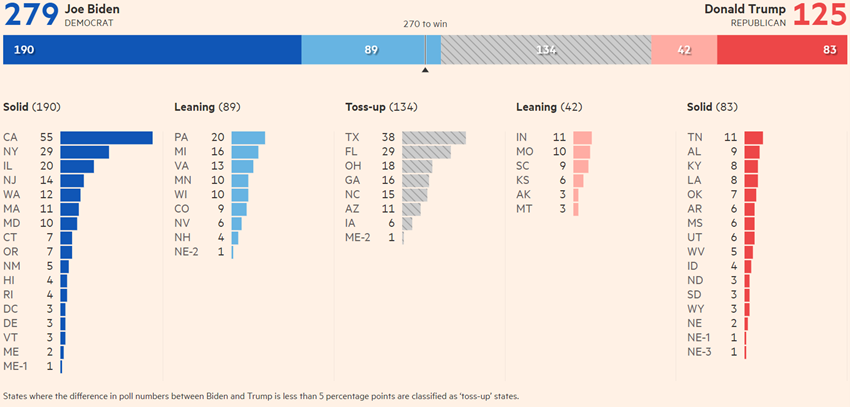

Tumultuous outcome of the November 3 US presidential election, in a context of advantage in democratic candidate Joe Biden’s polls and likely political and judicial challenge to election results based on arguments of mail-in voting fraud by current President Donald Trump.

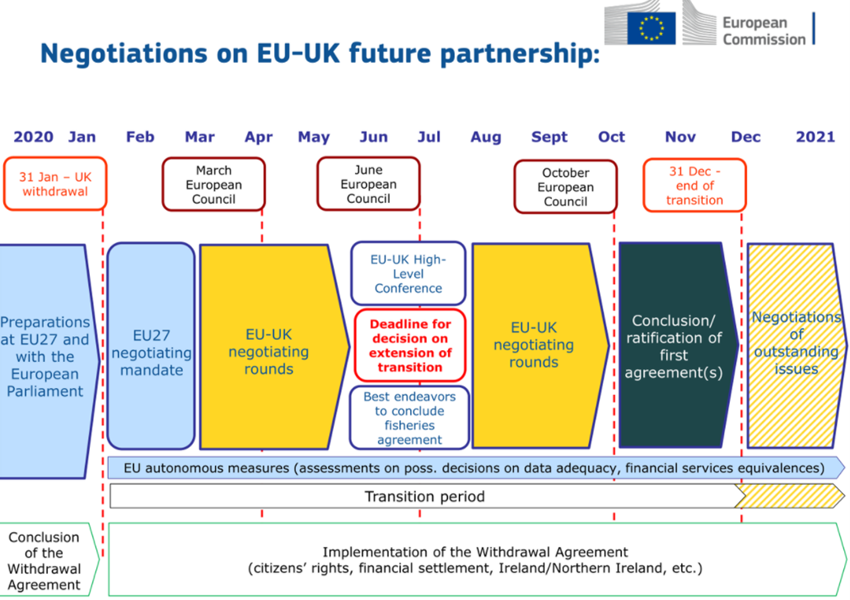

Uncontrolled and non-extended withdrawal from the UK’s EU deadline set for 1 January 2021 following the negation of the international exit agreement on 8 September by the UK, in an attempt to gain advantages from the trade agreements under negotiation.

Worsening external imbalances and public accounts in large developed and mostly emerging economies such as India, Brazil, Mexico and South Africa, doubly dependent on oil and other natural resources and international trade (increased protectionism).

Increased hoarding effect by households and businesses with the consequent brake on the normalization of economic activity.

Source: US presidential election 2020, Financial Times, October, 13, 2020

Source: World Economic Outlook Update, IMF, June, 24

Source: Main Geopolitical Risks, Blackrock Institute, October,6, 2020