The problems of confirmation bias in personal finances and investments

The Bad Blood of Elizabeth Holmes’ Theranos

Madoff and the biggest Ponzi scheme in history

How to overcome confirmation bias?

The confirmation bias consists in privileging the ideas, convictions and opinions that agree with ours and ignore the contrary

Confirmation bias is the tendency to search, interpret, favor and recall information that confirms or supports previous personal beliefs or values.

People exhibit this prejudice when they collect or remember information selectively, or when they interpret it in a biased way.

For example, a person can choose empirical data that supports their belief, ignoring the remaining data that does not support them.

People also tend to interpret ambiguous evidence as supporting their existing position.

The effect is stronger for the desired results, for emotionally charged issues, and for deeply entrenched beliefs.

This bias manifest itself in many ways in various aspects of our lives. We only read and hear those who are ours, those who have our experience, convictions, beliefs, or opinions. We consider that everyone else knows nothing and is wrong. Nothing can be worse. It takes an open mind, in many cases to change our minds. The most valuable are the contrary ones. They are the ones who demand the most from us. Contesting an opposite or different idea is an excellent validation exercise.

A good example is what happens in our media choices. In terms of media it is more likely that: The Republicans will see Fox News and the Democrats the CNN or NY Times in the USA; the Conservatives read the Daily Mail and Labour and Liberals the Daily Mirror or the Guardian in the UK; the Socialists follow Le Monde or Liberation and the Republicans Le Figaro or L’Expansion in France; the Popular read El País and the Socialists the … in Spain, etc.

Em termos de media é mais provável que: os Republicanos vejam a Fox News e os Democratas a CNN ou NY Times, nos EUA; os Conservadores leiam o Daily Mail e os Trabalhistas e Liberais o Daily Mirror ou o Guardian no Reino Unido; os Socialistas sigam o Le Monde ou o Liberation e os Republicanos o Le Figaro ou o L’Expansion em França; os Populares vejam o El Mundo e os Socialistas o El País em Espanha, etc.

The problems of confirmation bias in personal finances and investments

Confirmation bias can create problems for investors.

When researching an investment, the investor may inadvertently look for information that supports their beliefs about the investment and does not show information that presents different ideas. The result is a one-sided view of the situation.

Confirmation bias can thus cause investors to make bad decisions, whether in their choice of investments or in their buying and selling timing.

Confirmation bias affects perceptions and decision-making in all aspects of life and can cause investors to make very different choices from ideal ones.

Searching for people and posts with alternative opinions can help overcome the confirmation bias and help you make better informed decisions.

This phenomenon is a source of investor overconfidence and helps explain why optimists or bulls tend to stay bullish or long, and pessimists or bears tend to stay bearish or short regardless of what is happening in the market.

The confirmation bias helps explain why investors don’t always behave rationally and perhaps support the arguments that the market behaves inefficiently.

Confirmation bias can lead investors to be overconfident, ignoring evidence that with their strategies they can lose money.

Confirmation biases contribute to overconfidence in personal beliefs and can maintain or strengthen beliefs in the face of contrary evidence.

Suppose an investor hears a rumour that a company is about to declare bankruptcy. Based on this information, the investor considers selling the shares. When this investor does an online survey to read the latest news about the company, he only reads the stories that confirm the likely bankruptcy scenario and loses a story about a new product that the company has just launched that is expected to perform well and increase sales. Instead of detaining the shares, the investor sells it at a substantial loss just before turning around and rising to an all-time high. A good example was Tesla in May 2019 and NIO in March 2020.

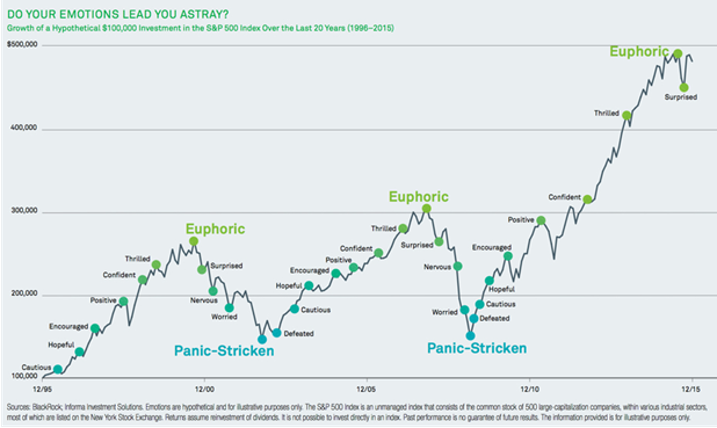

Market bubbles are the best examples of optimists (in rises and falls) but also of pessimists (in recoveries)

Market bubbles are one of the best examples of confirmation bias. The bubbles are created and fed by the inveterate optimists, who usually sell close to the moment of inflection of the fall, when they panic and despair. After these scares and high losses, many of these optimists become pessimistic and only invest when the positive cycle is already long, or even and what is much worse, never return to invest, losing the market return.

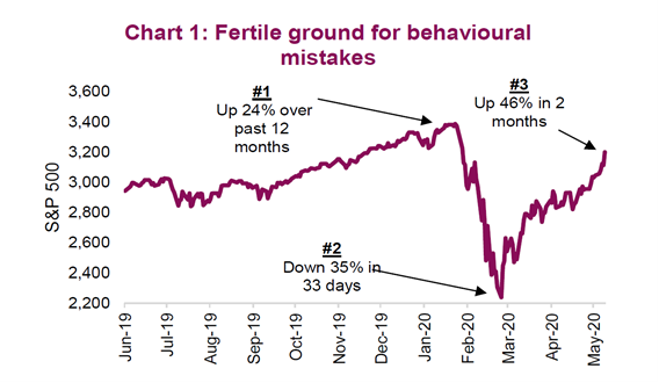

The moment we currently live in is associated with a crisis that is totally new and unpredictable, is fertile to make behavioural confirmation mistakes, given the strong oscillations in a short period:

But the bias is not only manifested in market bubbles. It arises every day, with greater or lesser intensity, in the fluctuations of the market in general or in the price variations of some assets, mainly in stocks. Next, we will see some emblematic examples of what can happen in individual stock investments by the effect of the skew of confirmation.

Become overly Optimistic or Aggressive: the extreme cases of biggest bankruptcies, like that of Enron, and others …

Being overly optimistic is equally very dangerous, and it is more common.

It happens when we are stubborn and refuse to see the evidence.

The paradigmatic and extreme cases of investments in individual shares are the bankruptcies. Every year in the US thousands of listed companies go bankrupt. But the biggest bankruptcies follow with a bang, causing many investors to lose fortunes, and in some cases, destroying their financial life.

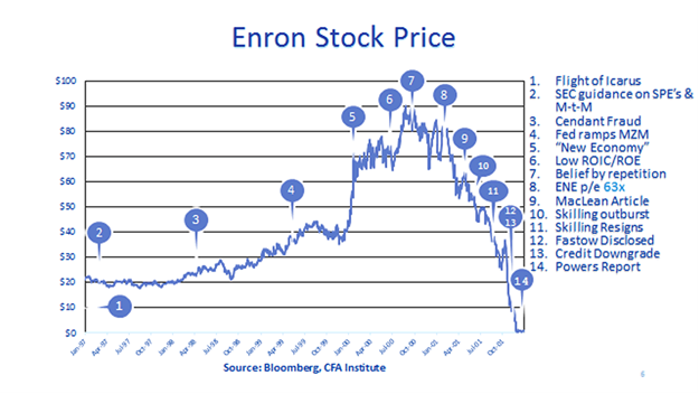

Enron’s is one of the study cases of academia and industry:

There were many investors who were attracted by the company’s success story that quintupled the value of the stock in just 4 years between 1996 and 2000.

This appreciation occurred despite the various news and accusations of fraud, made by the press, auditors and even the regulator, the SEC. Many investors ignored all this and Enron went bankrupt in October 2011, dropping from the maximum unit price of $90 reached in 2000 to zero.

It is not just in bankruptcies that investors lose a lot of money. We saw in the post about anchoring the cases of Nokia and BlackBerry, companies that flew very high and lost immense value.

Becoming Overly Pessimistic or Conservative: Apple and Amazon’s success stories have also had occasional failures, which have generated setbacks in quotes and the abandonment of many of their early investors

It is true that both Apple and Amazon have always had many resilient investors or irreducible believers. But also, some of them have been lost throughout the history of companies and especially their quotes.

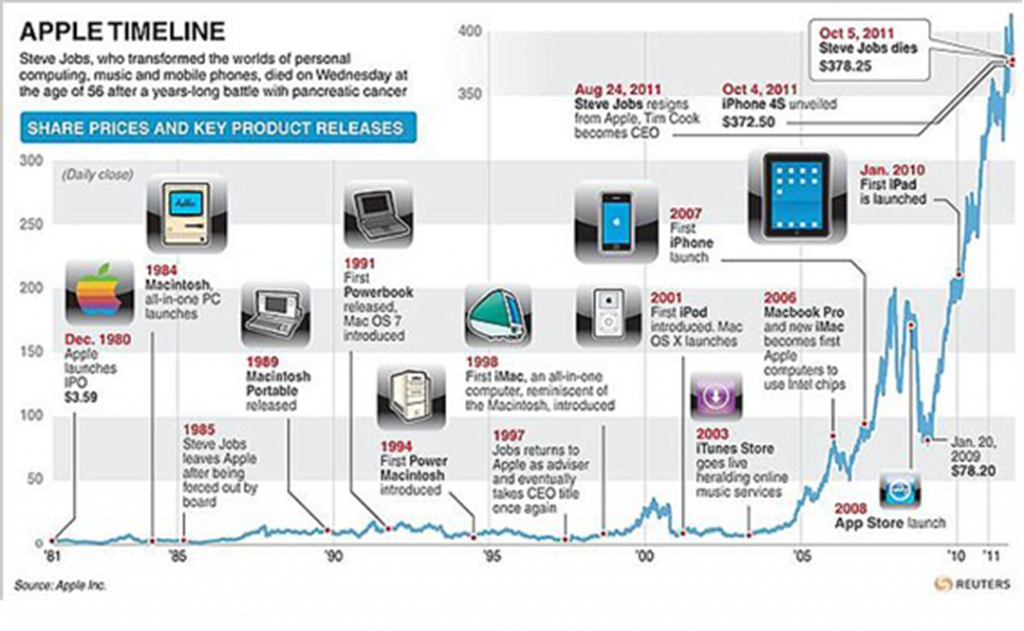

Let us start by looking at a little bit of Apple’s history.

The following chart shows the evolution of its stock prices from its IPO on December 12, 1980 to the end of 2017:

Apple is a hugely successful story, the first company to reach the trillion-dollar stock market cap in 2018. But evolution was not continuous, a straight, constant, or permanent line. As we see, it was many years before the quotation had a very positive evolution, more precisely between 1980 and 2005 the progression of the stock does not impress.

The following chart shows some of Apple’s top milestones with Steve Jobs and the evolution of its stock price:

Apple went on the stock exchange in 1980 and released the first versions of the revolutionary Macintosh PC fixed in 1984 and the laptop in 1989. However, Steve Jobs was removed from the company in 1985 and did not return until 1997. In this return Jobs launches the first iMac in 2998, Ipod in 2001 and the Iphone in 2007. The company suffers the impact of the technological bubble and only in 2005 begins an unstoppable upward spiral to this day.

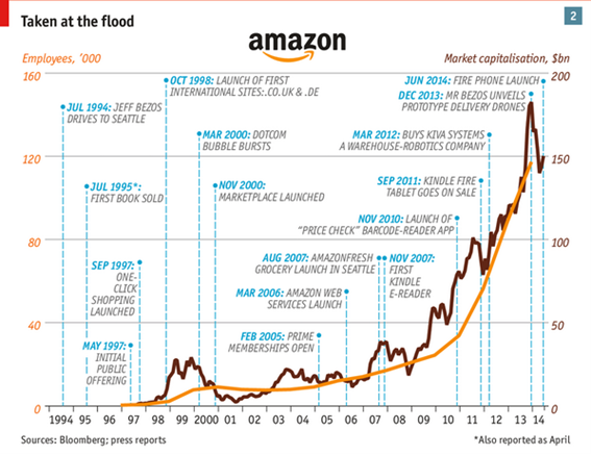

Amazon’s chart history is also not much different:

Amazon started operations in 1994 and went public in May 1997. It suffered the crises of the technological bubble and that of the subprime, which certainly caused many investors to give up the investment.

Starting in 2009, it began an impressive escalation that led to its stock market capitalization exceeding a trillion dollars in 2019. Today it is the second largest company in the world, behind Apple.

It is easy to intuit that throughout this story there have been many investors who have sold and stopped believing in these two successful giants.

Instead, many of its staunch supporters took these companies to the national and restricted club of the 2 trillion stock market capitalization and profited well from it!

It is harder to find a good new investment than to keep a good one. One way to avoid these mistakes is to revisit the reasons that led us to make a given investment the first time and think about how many alternative and better investments we can identify before we sell.

It is not only in the fluctuations of market quotes that the skew of confirmation manifests itself. In ideas, or rather, in preconceived prejudices or ideas, gullible are caught up in the tees of forgeries or fraud, as we will see some examples below.

The Bad Blood of Elizabeth Holmes’ Theranos

An example of the disastrous effects of confirmation bias is evident to investors in the infamous blood-test start-up, Theranos of charismatic Elizabeth Holmes.

Among the company’s very prominent investors was George Schultz, former secretary of state.

Not only was Schultz an investor, but he was also a personal friend of the Holmes family, whose daughter founded the company at a young age.

As such, when Schultz’s grandson Tyler presented him with evidence based on facts that Theranos was a complete scheme, Schultz refused to believe it. Tyler presented him with contradictory information to his pre-existing beliefs. Essentially, the perception of non-do-harm that had of the start-up clouded Shultz’s judgment. As a result, it cost him millions of dollars.

Madoff and the biggest Ponzi scheme in history

Ponzi schemes that occur almost all over the world with more or less variants are an example of confirmation bias, in which people believe what they want to believe.

This old scheme attracts investors with the promise of high profitability. These new funds do nothing more than pay older investors. This is a wagon or a circle that only ends when not enough money comes in to maintain it and the scheme is discovered. It can take a few years or even decades. If people were rational, they would quickly conclude that it is not possible to give above-normal profitability over a long period, but how they are gaining they let themselves go on the wave.

The best-known case worldwide is that of Bernard Madoff.

Bernard Lawrence Madoff is a former US market trader, investment advisor, financier and convicted felon who is currently serving a federal prison sentence for offenses related to a massive Ponzi scheme, the largest in world history, and the largest financial fraud in U.S. history. Prosecutors estimated that the fraud would be worth about $64.8 billion based on the accounts of Madoff’s 4,800 clients as of November 30, 2008.

Madoff said he started the Ponzi scheme in the early 1990s, but federal investigators believe the fraud began as early as the mid-1980s and may have started since the 1970s. Those responsible for recovering the missing money believe that the investment operation may never have been legitimate. The missing amount in customer accounts was nearly $65 billion, including invented earnings. The administrator of the Securities Investor Protection Corporation (SIPC) estimated real losses for investors of $18 billion. On June 29, 2009, Madoff was sentenced to 150 years in prison, the maximum allowed.

How to overcome confirmation bias?

Let us see below two tips on how to look for contrary advice.

The first step to overcoming confirmation bias is to be aware that it exists. Once an investor has collected information that supports their opinions and beliefs about a particular investment, they should look for alternative ideas that challenge their point of view. It is a good practice to make a list of the pros and cons of investing and re-evaluate it with an open mind.

Second, avoid confirmation questions. Investors should not ask questions to confirm their findings about an investment. For example, an investor who wants to buy a share because it has a ratio of low multiples of price results (P/E) would be confirming its conclusions if it only asked its financial advisor about the company’s valuation. A better approach would be to ask the broker for more information about the shares, which can be gathered to form an impartial conclusion.