Cats having 7 to 9 lives is a myth; we managed to earn these same lives, but without myths

8% per year (or up to 10% per year) is not even too much in medium and long-term investments!

Cats having 7 to 9 lives is a myth; we managed to earn these same lives, but without myths

Without knowledge of the origin of the phrase, this expression appeared by the ability of cats to escape situations of extreme difficulty. As they fell from great heights and hit the ground on the four legs, they created a magical image around them.

About 5,000 years ago, in ancient Egypt, in the times of the pharaohs, these felines were worshipped as deities. The Egyptian goddess Bastet, a symbol of maternal love, tenderness and fecundity, was depicted with a woman’s body and cathead. The Egyptians believed in Eneade, a group formed by 9 deities. It was from there that the legend that cats were protected by the 9 Egyptian gods and that, with every lost life, reincarnated another of the 9 gods of Eneade.

There are also those who attribute to the Chinese the origin of the 9 lives of cats. Number 9 is considered a lucky number in China.

Muhammad had a great worship for felines and for that reason he quoted them several times in his proverbs, as well as their seven lives.

In the middle ages, cats had seven lives and were directly linked to witches and their power of evil and black magic, to the point that they were the object of persecution by the Inquisition.

The numbers, 7 or 9, change depending on the cultures, as their meanings also vary. But luck, success, fertility and longevity are usually linked to these numbers.

What do cat lives have to do with our financial life. Much because we too can live 7, 9 or even more better lives. How can we do that?

Making investments at 8% per year instead of investments in deposits, savings or money market accounts at 1% per year in the long term

We can live 7, 9 or even 18 times better if we better decide the fates of our money. How?

Investing our savings in financial assets instead of placing them in deposits, savings accounts or the money market, on the medium and long-term.

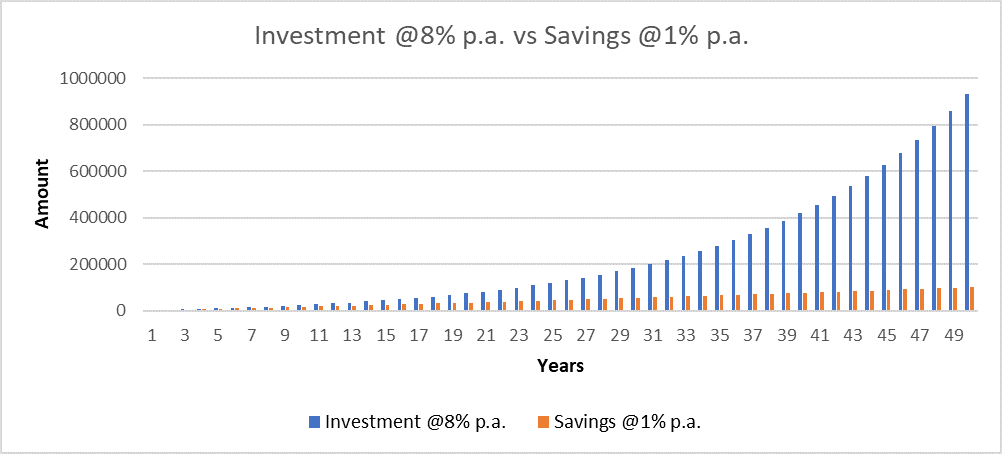

The following graph shows how this is possible by investing in financial assets €30 euros per week at an average annual rate of 8% compared to the placement of the same €30 euros per week in time deposits, savings account or money market funds:

We have taken as an example the placement of €30 euros per week simply because it seems to us a perfectly achievable value within many, but the conclusion is the same for whatever amount used.

The following table details the amounts accumulated by the various types of placements, highlighting the situations of monetary application at 1% per year versus an investment of 8% per year:

Savings of €30 per week are €15,600 per decade and €78,000 over 50 years.

The placement in time deposits, savings or money market accounts at an average rate of 1% per year would provide an appreciation of capital from €78,000 to €101,064 for 50 years. We can also see what would happen on other time periods. For example, the application for 30 years would result in an increase in accumulated savings from €46,800 to €54,535.

Investment at an average annual rate of return of 8% would result in capital growth from €78,000 to €930,196 in 50 years. For the 30-year period, savings of €46,800 would have become a capital of €183,655.

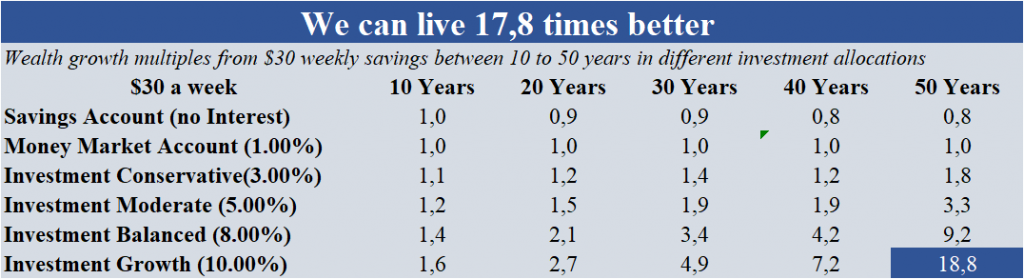

In the following table we split the capital accumulated by the various types of investments and those resulting from the placing in money market accounts at 1% per year:

This ratio shows the multiples of net worth creation or wealth building provided by each of the investments versus the scenario taken as the basis, of the placement at 1% per year.

Thus, it is concluded that if we invest with an average annual rate of return of 8% per year, we accumulate 9.2 times the capital we obtain in the placement at 1% per year. We can say we live 8.2 times better. If we manage to get a rate of return of 10% per year, the multiple would be 18.8, so we would live 17.8 times better.

We can achieve this money by making savings between the age of 20 and 70. This allows us to enjoy a much quieter and richer retirement live and provide our children, grandchildren, great-grandchildren or other family, friends or those who we wish, a better life.

8% per year (or up to 10% per year) is not even too much long-term investments!

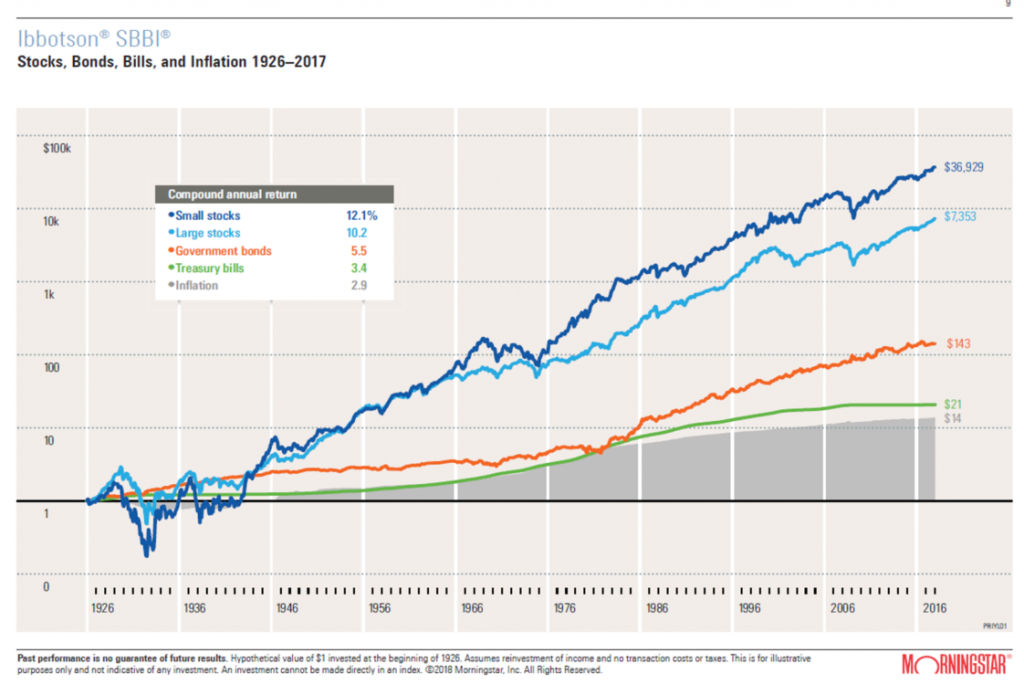

But isn’t 8% a year too much? Isn’t it an unattainable average annual rate of return?

No, not at all. As we can see in the following chart the average annual rate of return of investment in shares of large U.S. companies was 10.2% per year and investment in small and medium-sized companies was up to a much higher, 12.1% per year, in the period 1926 to date.

And isn’t investing everything in stocks too risky? Shouldn’t we diversify and make also investments in bonds? Not once again, no, at all. In a long-term investment, as the present case, the advisable allocation is 100% in shares.

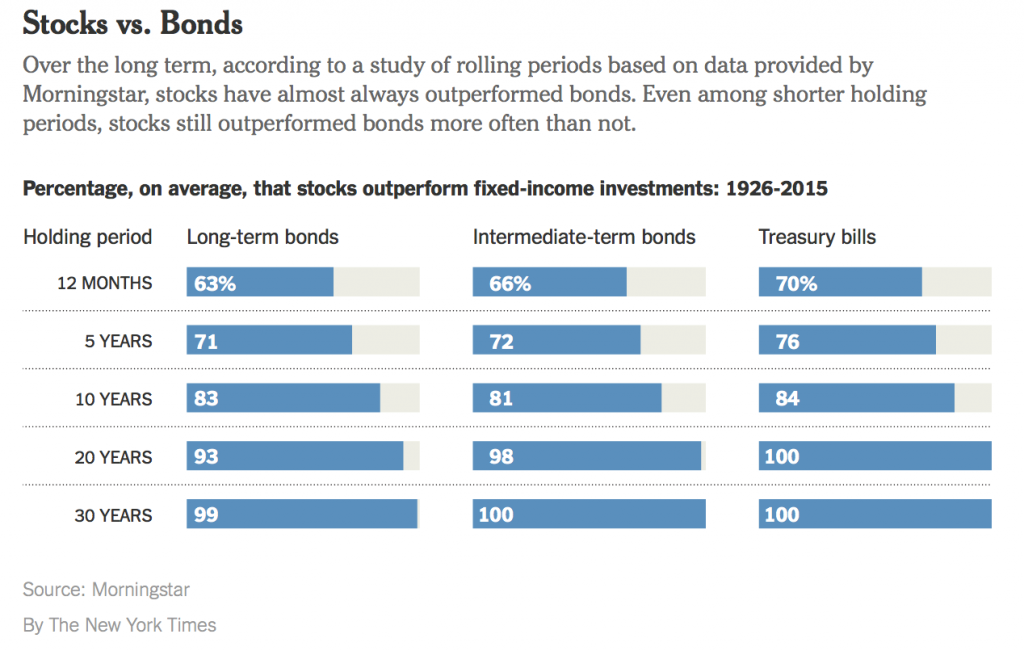

The following chart shows the distribution of the rates of return of investment in shares and bonds as a percentage, from 1926 to 2015 in the US.

For investment periods equal to or longer than 30 years, in 99% of cases the profitability of investment in shares was higher than that of bonds. 99%!

So, it’s not worth investing a penny that’s in bonds. What we should do is invest 100% of the capital in stocks, but in a diversified way. For example, investing in investment products indexed to markets, the S&P 500 (of the 500 largest US companies) or the Russell 2000 (of the 2000 largest small and medium-sized companies). We can also invest in products indexed to MSCI World (about 1,600 largest companies in the world) or Eurostoxx 50 (50 largest European companies).