This is the fourth article in this series dedicated to thematic investing, i.e. the investment strategy that aims to identify major transformations and megatrends that are likely to shape the global economy in the coming decades, and the underlying investments that can benefit from the materialisation of these trends.

In the first article, we made an introduction and overview of the topic of thematic investment including its definition, scope, and the three main areas: disruptive technology or innovation, megatrends, and sustainability.

In the second and third articles, we addressed the first of the 3 major areas, technology or disruptive innovation.

We started by presenting the speed of innovation adoption over time, the definition of disruptive technology and innovation, and the various waves of this innovation and economic growth.

In this article, we will develop the second of the 3 major areas of thematic investments, the megatrends. Sustainability, the third of these areas, we have already delved into throughout the series of articles on ESG investing.

What are megatrends?

Identify and rank key megatrends

The Top Investor-Relevant Megatrends: A Rating by Blackrock

What are megatrends?

Megatrends are trends that have an effect on a global scale.

Megatrends strongly influence different spheres of life in many countries and at different levels, covering political, economic, environmental, social and cultural dimensions.

Megatrends are made up of many correlated and mutually dependent trends.

A megatrend is both the sum of trends and a guiding force, since it influences the trends that compose it.

Trends are hard to predict, and megatrends are hard to recognize.

The evolution in terms of the trend is easier to observe because it is more dynamic with more immediate results. However, the impact of megatrends is increasing.

John Naisbitt was a pioneer of future studies, with his book “Megatrends: Ten New Directions Transforming Our Lives” first published in 1982.

It focused mainly on the United States, but also tried to present a global perspective, and accurately predicted the shift from industrialized societies to information societies.

Identify and rank key megatrends

The selection of the main megatrends is subjective, depending on the importance and impact attributed to the different scopes, the factors and the consequences of transformational movements.

Therefore, this selection is intrinsically linked to the nature of those who select them.

If it is a government institution, it is possible that it values political factors more. If you are an academic or a university, in general, you are likely to give more weight to science. In the case of an economist or financier, the most prominent aspects are those of investment.

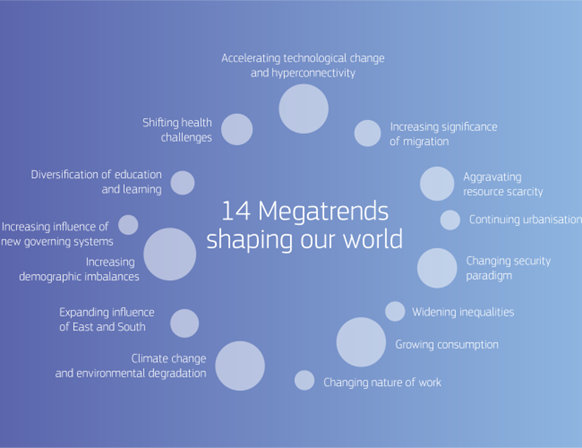

For example, the Joint Research Center, a European Union policy research center, selects the following 14 megatrends:

In this set, there are megatrends with a deep economic and social scope, such as technological change, resource scarcity, and climate change.

Similarly, there are other megatrends in which the scope is more political, such as widening inequalities, the growing significance of migration, or the influence of new systems of government.

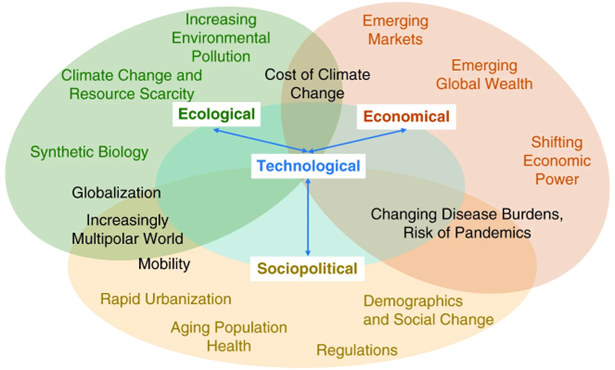

The following study identifies a similar set of megatrends, classifying them by their dominant nature or scope, into technological, economic, sociopolitical and environmental:

There are 15 megatrends, including: emerging markets, emerging global wealth, transformations in economic power, climate change, changing disease severity and pandemic risk, demography and social change, regulations, population ageing and health, rapid urbanisation, mobility, increasing environmental pollution, climate change and resource scarcity, synthesized biology, globalization and the growing multipolar world.

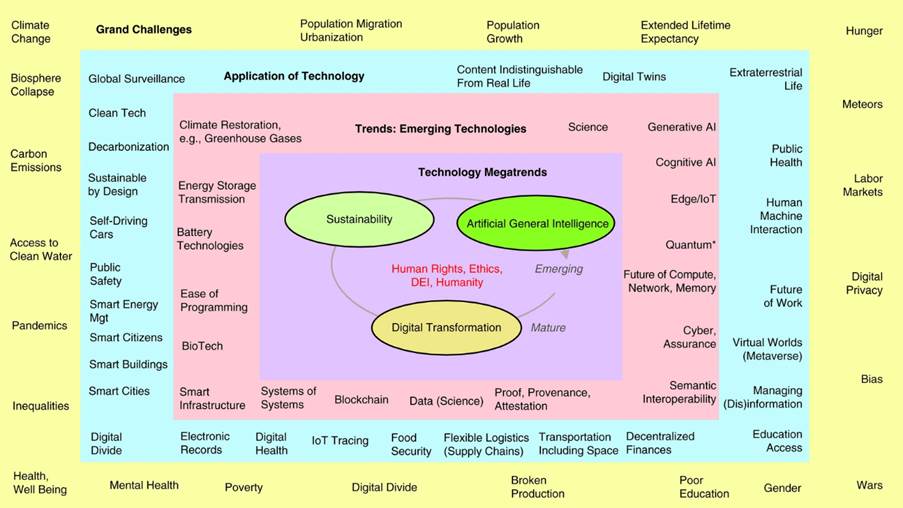

These megatrends unfold into subsets of multiple trends:

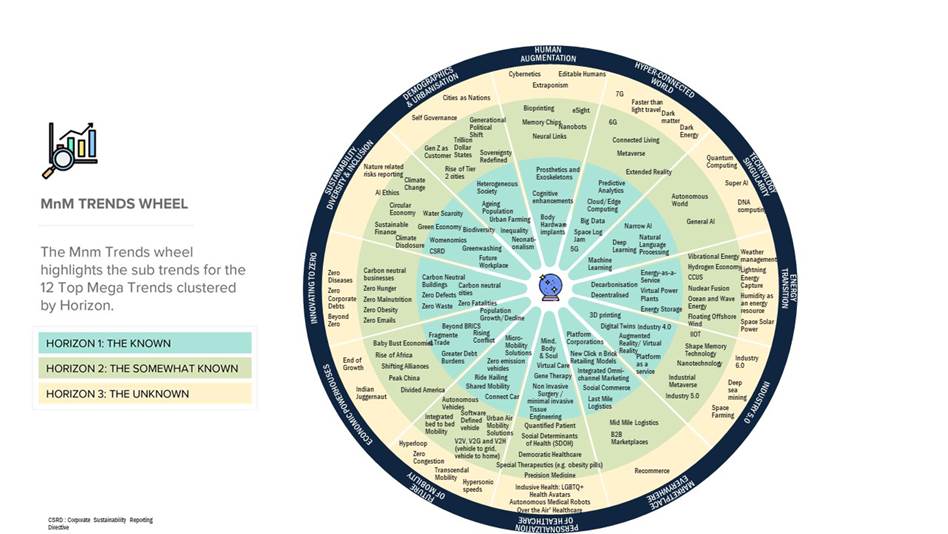

Another study listed 12 megatrends, with different ramifications in trends:

Megatrends include the connected world, technological singularity, energy transition, industry 5.0, the global trade market, healthcare personalization, the future of mobility, economic powerhouses, innovation to zero, sustainability, diversity and inclusion, demography and urbanization, and augmented humanization.

The Top Investor-Relevant Megatrends: A Rating by Blackrock

Of the set of possible megatrends, there are some that can be the object of investment while others do not, and only the first are of interest to the investor.

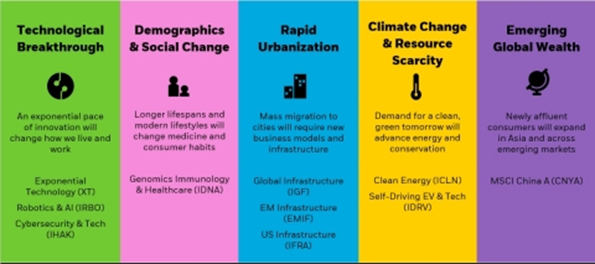

Blackrock, the largest global asset manager, identifies a narrow set of 5 major megatrends that are quite consensual and has organized them into practical and real cases of investment possibilities:

This grouping follows a logic of arranging into subsets of potential related investments with a relevant size.

Firstly, the technological revolution, also called technology or disruptive innovation, classified as one of the 3 major areas of thematic investment and already addressed in a previous article. This includes the technological explosion, robotics and artificial intelligence, and cybersecurity and technology.

Second, demographic and social change, ranging from longevity and ageing, genetic decoding, the treatment of chronic diseases, pharmacology, and the development of health care, nutrition and well-being.

Third, rapid urbanization that puts pressure on infrastructure improvements globally, in the large emerging economies (China, India, etc.), but also in developed countries such as the USA.

Fourthly, climate change and resource scarcity, classified as one of the 3 major areas of thematic investment such as sustainability, covering clean energy, and autonomous vehicles.

Finally, the growth of wealth in emerging countries, in general, and that of the middle class in particular, mainly in China and India.

In a subsequent article we will address some of these thematic investments.