Warren Buffett and his friend and partner Charlie Munger are two inescapable people in the investment world for their success and for their very useful tips

Berkshire Hattaway remarkable outperformance is 100 times higher than the market in its 53 years of history

One of the main reasons for success is to buy large consumer goods and services companies, which are to stay, today and tomorrow

Invest only in what you known and understand, in a simple way, for the long term, be patient and… most of it in stocks

Having said that, a question remains: should we invest in Berkshire Hattaway or not, and if so, how much?

Warren Buffett and his friend and partner Charlie Munger are two inescapable people in the investment world for their success and for their very useful tips

This is the first article, but surely will not be the only one, about the great investor Warren Buffett and his team in the Berkshire Hattaway Investment Management. The reason is simple: they are an inexhaustible source of excellent ideas that we must transpose into our personal investments.

Warren Buffett is considered the best investment manager of all time (it is also one of the richest men in the world and enormous benefactor). Well, it’s not just Warren, but his entire management team, and his long-time partner of the hugely successful investment firm that both manage Berkshire Hattaway, Charlie Munger.

They are holders of an investment performance record that is absolutely remarkable at two levels: a) the excess of profitability obtained; b) the consistency of the results.

But their contribution to individual investors goes far beyond the results achieved in the management of Berkshire Hattaway. They are an inexhaustible source of wisdom on good investment rules. The secret these rules being so good, comes largely from their simplicity, which makes them accessible to any investor. These rules are part of any summary of the most important and brilliant quotes from personal finances and investments. So the difficult part is not to understand them, but rather to practice them.

Berkshire Hattaway remarkable outperformance is 100 times higher than the market in its 53 years of history

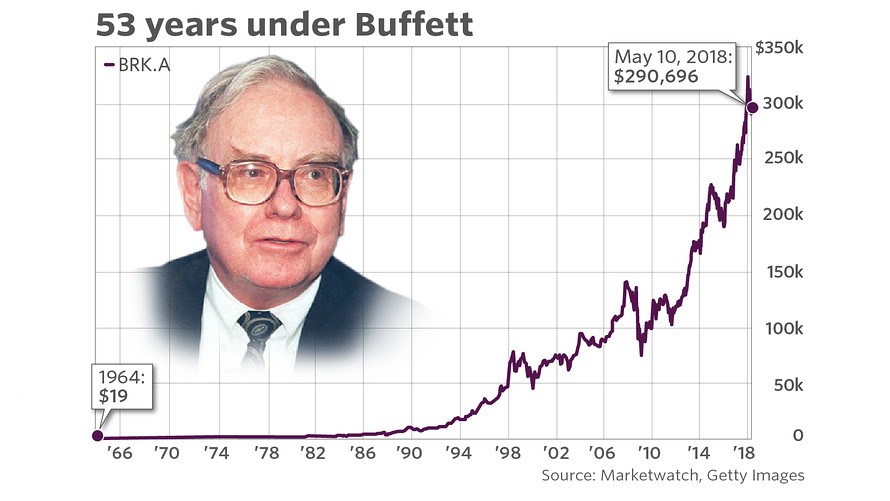

The following chart shows the evolution of the company’s stock managed by both over the last 53 years:

Between 1964 and May 2018 the Berkshire Hattaway stock price increased from $19 to $290.696 per share, i.e. 15,300.8 times.

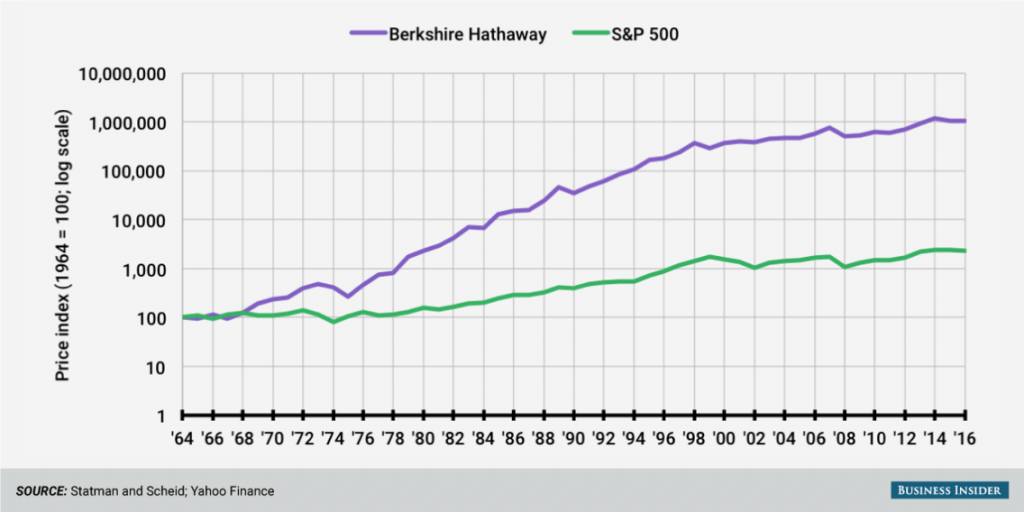

This record is even more impressive when we compare the evolution of Berkshire Hattaway with that of the main market index, the S&P 500:

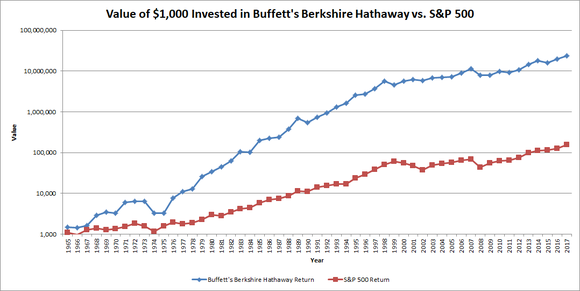

The valuation of 15,300 times more compares with that of 150 times achieved by the market. It’s 100 times more! Even better, an investment of $1.000 in 1965 would have yielded $150,000 if invested in the market in general, but more than $15 million if invested in Berkshire Hattaway.

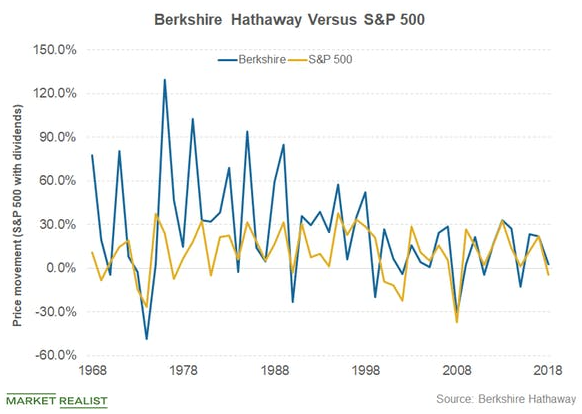

More importantly, the difference in profitability or appreciation has been practically constant, that is, managers have consistently beaten the market.

Between 1965 and 2017, Berkshire recorded an annualised average return of 20.9%, which contrasts with 9.9% of S&P 500 in the same period.

It is quite true that over the years, this difference in performance of Berkshire Hattaway to the S&P 500 index has been less pronounced, which is largely explained by the enormous size already achieved by the company which makes it increasingly difficult to diversify and beat the overall market.

One of the main reasons for success is to invest in large consumer goods and services companies, which will endure for a long time

It is very difficult to pick a single reason for this success, but we risk saying that the main thing is to bet and invest in large-scale consumer goods companies, today and tomorrow.

This is the idea we’ve explored in another article: Why don’t we invest in what we consume?

Sounds easy and common sense, doesn’t it? But it is not because these investments are usually very long-term and most professional investment managers do not have this horizon. They are concerned about this quarter or year results and at most of the following, either because they think they will be assessed for it or because their remuneration, namely bonus, depends on it. That’s why these managers go looking and invest in the fast-growing fashionable companies.

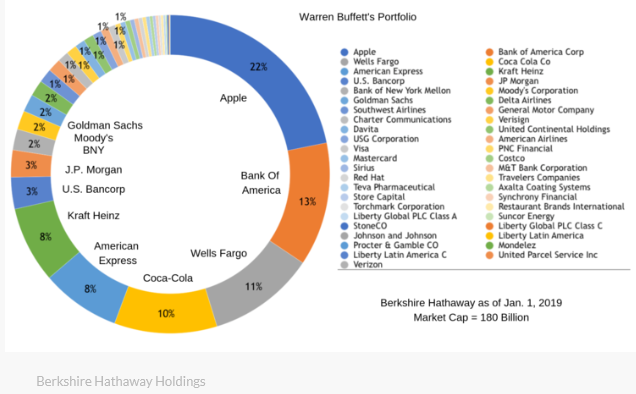

The following chart shows the companies that represent the largest investments of Berkshire Hattaway according to their last annual 2018 report:

The investment portfolio has been much diversified over the years. Apple is its highest position, with 22%. In terms of sectors, consumer goods represent 41%, financial 47%, healthcare 8% and all remaining only 4%.

Some of these companies are not exciting, and we can even classify them as boring: Bank of America, Wells Fargo, American Express, Coca-Cola, etc.

Even, Apple is a relatively recent investment. Moreover, Buffet did not invest in technological stocks before or at the time of the bubble, having been greatly criticized for this even by its shareholders or higher defenders, arguing that he did not know how to evaluate those companies and did not perceive how to invest in companies that are systematically loss makers.

The reason is that these investments are more long-term oriented, unlike the technology companies that can be replaced by new companies a few years ahead. Buffett prefers to invest in business that proved to be able to resist extremely negative financial times.

His obsession with companies that produce goods and services we all consume, and with admired brands, points out in one of the “mottos” of the Berkshire Hattaway website: If you don’t live in a cave, then you’re very likely to be using something that’s ours

Don’t forget that Buffett has the following main rule for successful investments: Rule number 1 – never lose money; Rule Number 2 – don’t forget rules number 1.

Invest only in what you known and can understand, in a simple way, for the long term, be patient and… Especially in stocks

The Warren Buffett and Charlie Munger main quotes can tell us the principles of success of their investments that we should adopt:

#1: Investing in and only in what one knows and understands

This is a wise idea. It seems obvious, but it’s often not followed. Often, people invest in instruments just because others tell them to do so, because they promise them great profits (example Madoff) or even because they gave extraordinary results in the past (example Worldcom or Enron).

Buffett did not invest in the stocks of the technological sector in the years when they had a great performance before the bubble, from 1996 to 2000, and at the time was widely criticized for it.

He stated that he did not invest in what he did not understand and did not realize how expensive it was to pay for companies with losses and without prospects of profits on the horizon, with assessments made solely on the basis of the number of subscribers.

More recently he clarified why he rarely invests in technology: in this sector it is difficult to choose those that will have a lasting competitive advantage and will not be replaced by others; it is also difficult to build a position at reasonable prices because they are bought by too many people (remember Buffett has at Apple its highest position and also participates in IBM and Microsoft).

Warren Buffett: “The most important investment you can make is in yourself.”

Warren Buffett: “Never invest in a business you cannot understand.”

Warren Buffett: “Risk comes from not knowing what you’re doing”

Charlie Munger: “Those who keep learning, will keep rising in life.”

Charlie Munger: “Knowing that you don’t know is more useful than being brilliant.”

#2: In a simple way

Do not invest in business or investments that are complex. Immediately before the sub-prime real estate crisis, mortgage bonds paid a very attractive interest, but their risk was also much higher than it seemed. We must always be suspicious when we are promised a deal too generous to be real, especially when we do not understand it well, because there are no free lunches in finance.

Warren Buffett: “Only invest in ‘simple businesses’ that you understand”

Warren Buffett: “The business schools reward difficult complex behavior more than simple behavior, but simple behavior is more effective.”

Warren Buffett: “It is not necessary to do extraordinary things to get extraordinary results.”

#3: Being patient and having a long-term perspective

Greed is the investor’s greatest enemy. Investment in financial markets is not a casino. It is to participate in the capital of companies that sell products or services or to lend money to companies and governments that invest and generate revenues. There are no immediate profits. Investment in financial markets should only be done with capital we will not need in the next 2 to 3 years.

Warren Buffett: “No matter how great the talent or efforts, some things take time. You can’t produce a baby in one month by getting nine women pregnant.”

Warren Buffett: “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years.”

Warren Buffett: “The stock market is designed to transfer money from the active to the patient.”

Charlie Munger: “You need patience, discipline, and an agility to take losses and adversity without going crazy.”

Charlie Munger: “You don’t have to be brilliant, only a little wiser than the other guys, on average, for a long time.”

#4: Especially in stocks

Investment in the stock markets has produced a higher average return than investment in bonds, in historical terms, not to mention deposits and savings accounts. And it is a long history, of more than 90 years, and rich, with various advances and progress, but also crises and convulsions. And the story repeats itself, for better… and for worse.

Warren Buffett:” Stocks [have] been so much more attractive than bonds for a long time now”

Warren Buffett: “My advice to the trustee couldn’t be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long-term results from this policy will be superior to those attained by most investors — whether pension funds, institutions or individuals — who employ high-fee managers.”

Warren Buffett: “The one thing I will tell you is the worst investment you can have is cash. Everybody is talking about cash being king and all that sort of thing. Most of you don’t look like you are overburdened with cash anyway. Cash is going to become worthless over time. But good businesses are going to become worth more over time.”

Having said that, a question remains: should we invest in Berkshire Hattaway or not, and if so, how much?

No, and Yes!

No, because despite being a diversified investment it’s not as diverse as we need.

First of all, there’s only USA, missing other important geographies.

Secondly, because although Berkshire has an increasing diversification, it still has a high concentration in some stocks and a more defensive profile, primarily those called value investments, such as financials (banks and insurance), household consumer goods and transports (lack of technology and other sectors), as well as a percentage in cash.

Third, in recent years it has been increasingly difficult to beat the S&P 500 index itself not only for those reasons but also for Berkshire own growth. Fourth, Warren Buffett himself recognizes two things: i) Will probably only beat the index in scenarios where it has a flat or low performance; ii) In the recommendation to its heirs, he said that the individual investor should invest most of his assets in the S&P 500 (he said, 90%, and the rest in Treasury bonds) for the long term.

So, where’s the yes? Yes, if the investor wants to complement the main and well diversified investments with some thematic or specific investments (in these cases, more defensive ones), but in total they should not exceed 10% of their total financial assets.