What is real estate investment?

Is our house an investment?

In most countries real estate is the most important part of households wealth

What is real estate investment?

Real estate is a class of assets or properties that includes land, houses, factories, farms, etc., that is, a whole set of properties linked to land, whether natural or man-made.

There are five main categories of real estate: housing, commercial, industrial, land and special use as agricultural or forestry land.

We can invest in real estate directly, buying a house or any other property to rent.

And we can invest indirectly through real estate investment funds, whether more specific as real estate investment trust or REIT), more general as traditional investment funds or ETFs or private equity funds.

Real estate is a very heterogeneous asset, even belonging to the same category, such as residential.

The main component of determining its value is location and use.

In this article we will address the importance of real estate in the assets of households and analyze its returns, including comparison with the stocks and bonds returns.

Is our house an investment?

This is a rather controversial issue.

Most academics and investment and asset management experts think that our home is not an investment, but an asset.

They only consider it as an asset because it is not liquid enough to be taken as an investment, putting it more on top of works of art and other collectibles or even our car.

It should be noted that some more purist experts even consider that our home is not even an asset, but rather a good that we consume and that provides us with shelter.

Your understanding is that the house we live in can be from a good to an investment.

It is a good that we use, that we do not have the prospect of trading or selling within a reasonable time, with which we develop a more affective or sentimental relationship than rational and emotional.

In our opinion our house is certainly an asset.

In fact, several financial entities classify it as a real asset, and not a financial one, an integral part of household assets, being for many their largest asset.

We also consider that it can be seen as an investment as long as we are available to sell it when we want or need it.

In addition, in assessing its appreciation, all costs and charges with it, including mortgage loan costs (if any), insurance and all conservation and maintenance charges, and the opportunity cost of an equivalent income may be deducted.

In most countries real estate is the most important part of the households weatlh

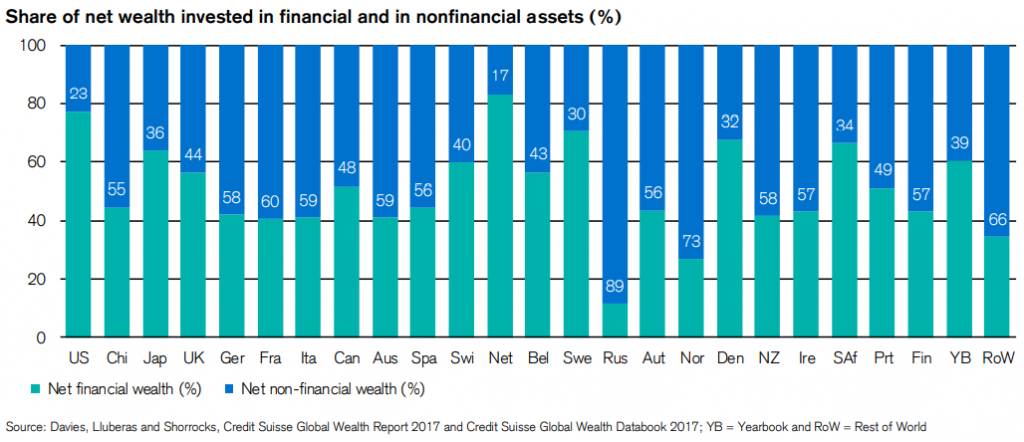

In most countries, non-financial assets, where real estate is the main component, have a greater weight than financial assets in households’ net worth, as we can see in this Credit Suisse study conducted in 2017

The exceptions are the most developed countries such as the US, many Nordic countries, Switzerland, Japan and the UK, where financial assets have the most weight.

It should be stressed that in these data, the own housing asset is included in these values of wealth or personal assets.

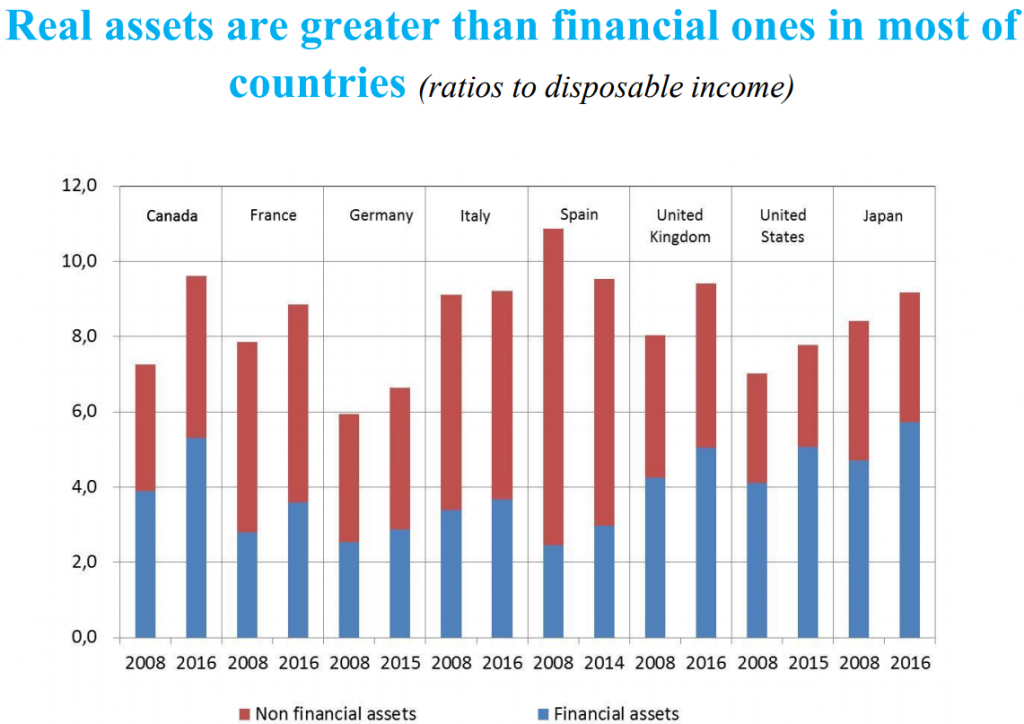

Real assets are also more relevant than financial assets when measured as a percentage of household disposable income, especially in European countries:

The factors that distinguish the allocation between countries are usually six, some specific to real estate and others to investments in general.

In relation to real estate-specific, the first factor is affordability that can be assessed by the relationship between house price and wages, income or wealth.

Second, the relative value of the asset, usually measured between the value of the house purchase compared to that of the lease.

Third, labour mobility, in so far as the greater the mobility, the lower the willingness to buy due to transaction costs.

Additionally, there are 4 other non-specific factors, but linked to investments in general.

First, the higher average wealth level of households, which typically leads to greater allocation to financial assets.

Second, a more evolved capital market results in greater financial investment.

Third, a lower social protection system than other countries with the same degree of development makes it necessary to provide additional financial investments in retirement.

Fourth, a less rooted culture of house ownership and a lower geographical mobility.

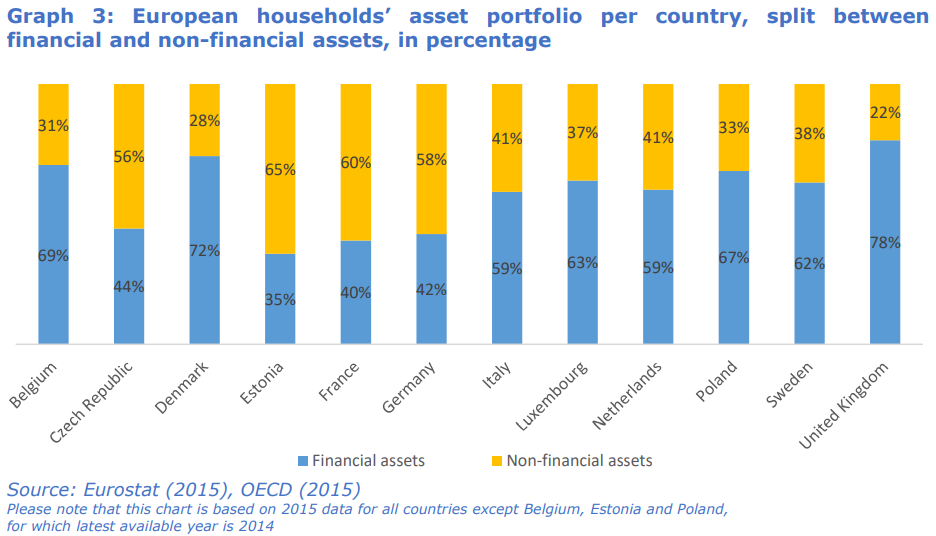

The following graph focuses on the European reality:

All the above factors explain why real estate is particularly important in southern European countries.

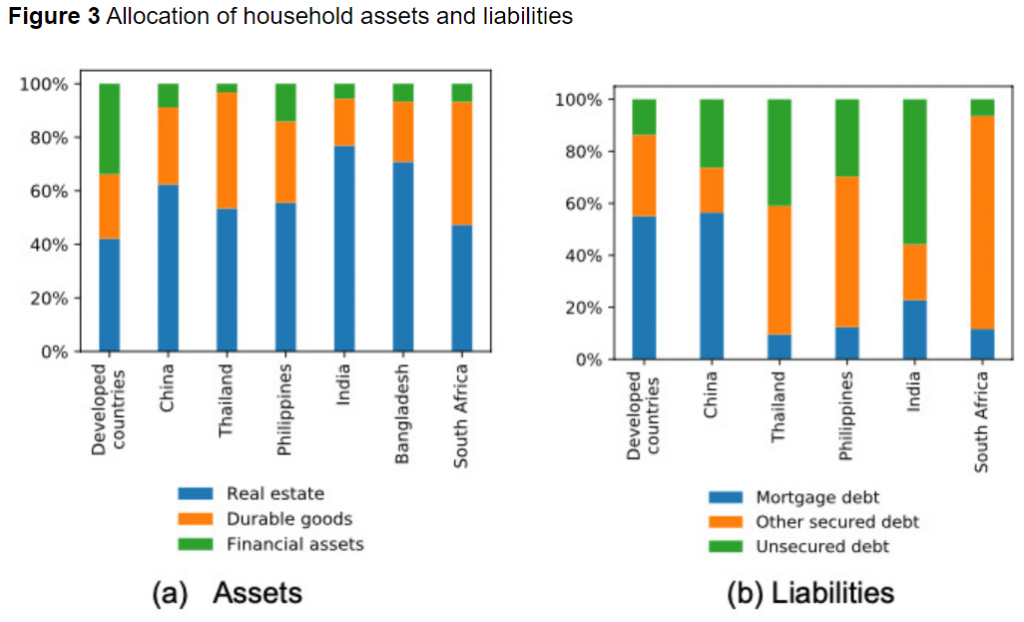

In emerging countries the weight of non-financial assets, in particular real estate, is even greater:

In major emerging economies such as China, India and South Africa, real estate accounts for between 50% and almost 80% of total wealth. The reasons are the same, in many cases the absence of investment alternatives available.