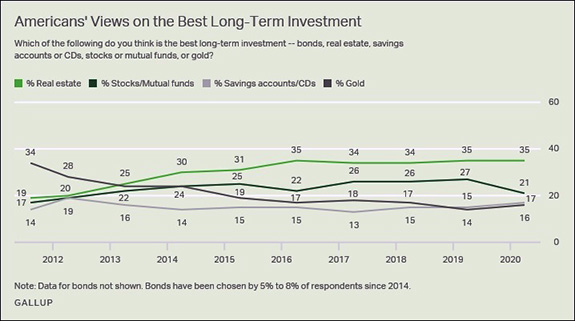

In household surveys, real estate investment is considered one of the best long-term investments

Over a very long period, from 1900 to date, the returns on residential real estate investment were much lower than those of

However, in recent decades the returns of real estate investment funds compared to that of stocks and bonds was much more interesting

In part 1 of this article we saw the types, benefits and weight of real estate investment in household’s wealth.

In this article we will address the returns of real estate investment, comparing them with those of investments in the main classes of assets, stocks and bonds.

In household surveys, real estate investment is considered one of the best long-term investments

Once we’ve seen how househols split their assets in the world’s major countries, it’s worth investigating how they compare it with financial assets.

The few studies that exist are related to the North American market, namely the annual survey conducted by Gallup:

Since 2013, most US households have regarded real estate investment as the best long-term investment, with 1/3.

For about 25% of households the best long-term investment is investment in stocks and investment funds while for 17% are deposits and savings accounts.

About 15% elect gold as their favorite long-term investment.

It is a pity that we do not have an analysis of income or household wealth because it would be very useful.

It is not difficult to intuit that households with lower or even average assets consider that they do not have the money to invest in financial markets and prioritize home buying.

In turn, affluent or wealthier families certainly have a greater allocation to financial investments, namely stocks.

However, in addition there are other more general elements that can influence these results.

Generally speaking, people do not have a correct idea of the returns of the main real estate asset, which is home ownership.

When they think about the returns of this asset, they don’t evaluate it right. They disregard many of the house’s costs. They do not take into account insurance or maintenance and conservation costs.

Since home ownership is generally acquired with a mortgage bank loan, many households do not take into account because they do not realize the effect of interest compounding on debt versus stocks or bonds.

It even happens that many households do not have a correct idea of the accumulated value of the interest paid.

In many cases, they do the accounts at the market value of the housing itself compared to the purchase price, usually many years ago, and correct this difference by a very low estimate of the interest actually paid.

Over a very long period, from 1900 to date, the returns on residential real estate investment were much lower than those of stocks

In this section we discuss the valuation of residential real estate compared to that of financial assets.

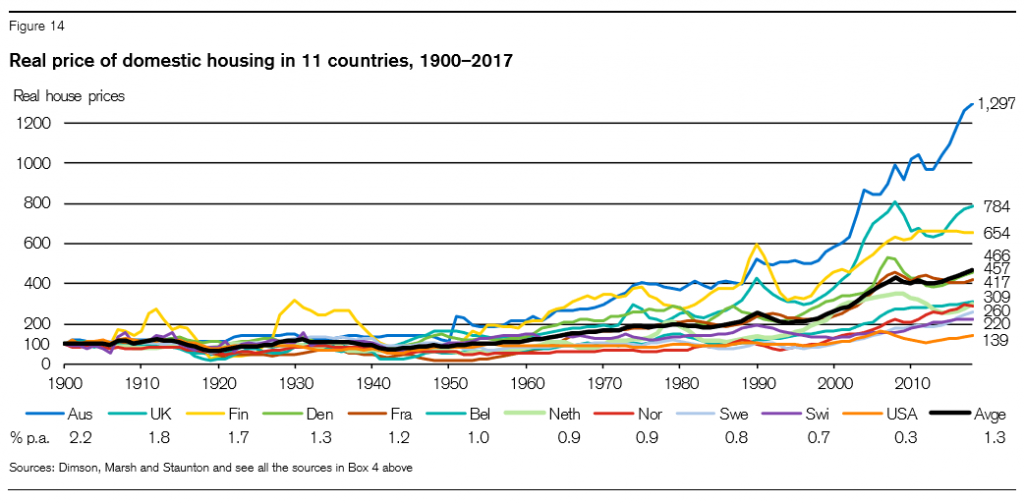

The appreciation of real estate has been very differentiated at the level of countries since 1900 to date:

Australia was the country where housing appreciated the most in real terms, from the base 100 to 1,297 in 2017.

It was followed by the United Kingdom and Belgium with values between 650 and 780.

Switzerland and the US were the countries with the lowest appreciations, to 220 and 139 respectively.

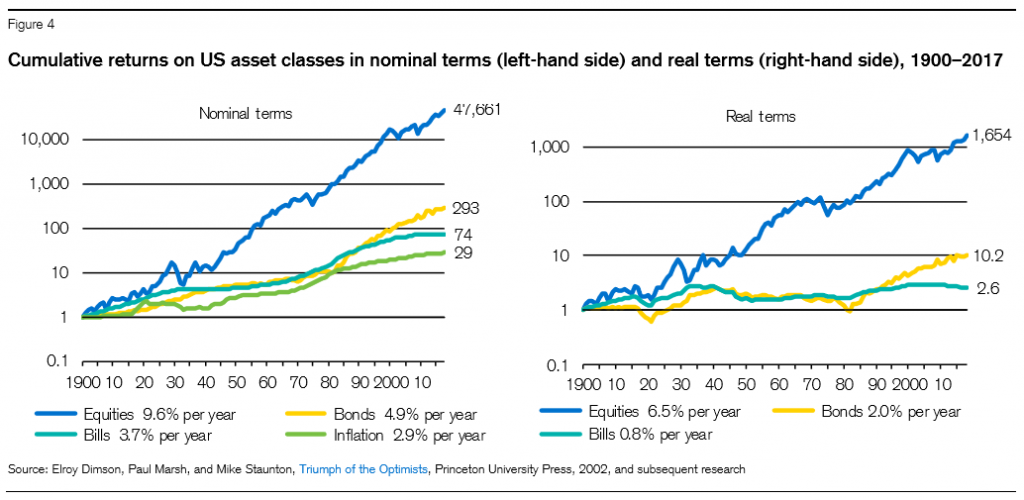

The following graph shows the US stocks and bonds returns in the same period allowing for comparations:

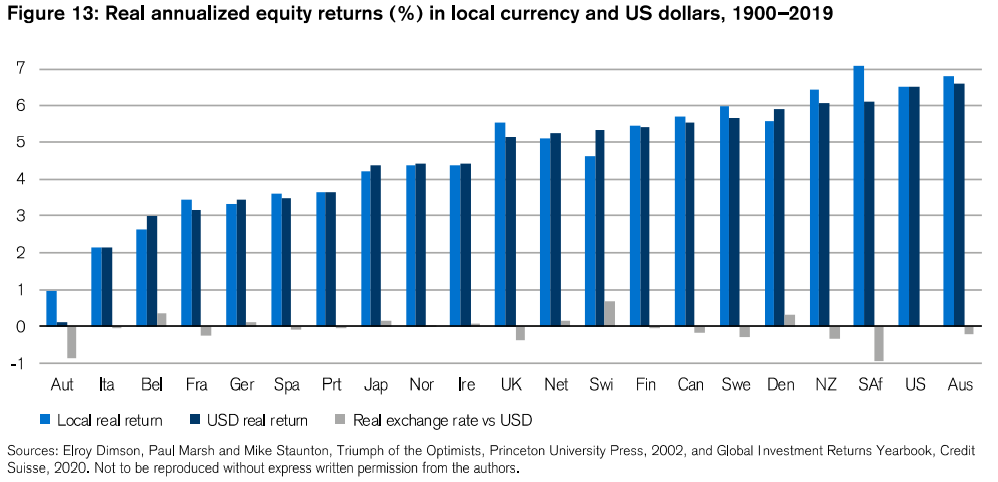

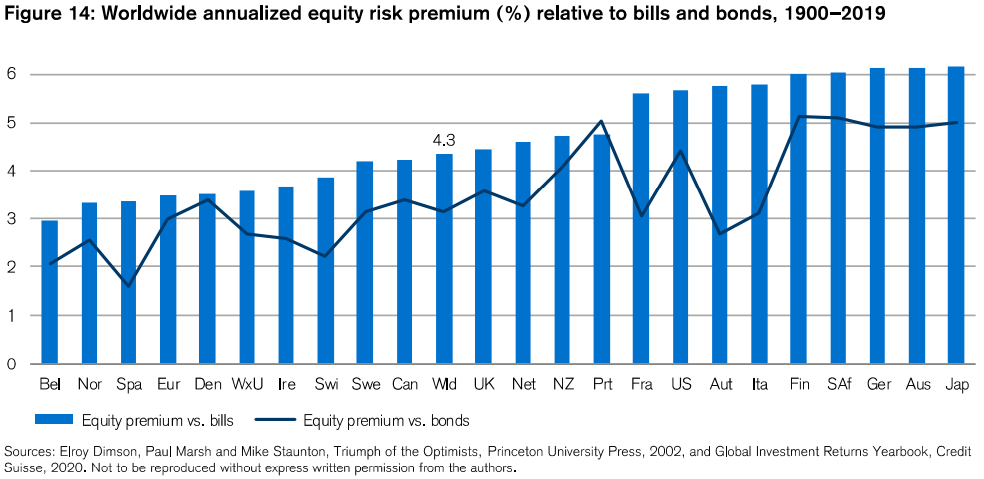

The following two charts show the valuations of these financial assets in other countries, where it is concluded that valuations were not very different from those of the US:

It is obvious that the returns on stocks and bonds were incomparably higher than real estate. Both charts are in real terms being the only difference the starting base of a value of 1 in real estate versus 100 in financial assets. So to compare them directly just multiply or divide by 100.

Real estate was appreciated between 39% in the US and almost 13 times in Australia (in most countries it was between 2 and 5 times). Stocks have appreciated 16.5 times and bonds 10 times in the US, and other countries, the reality is not very different.

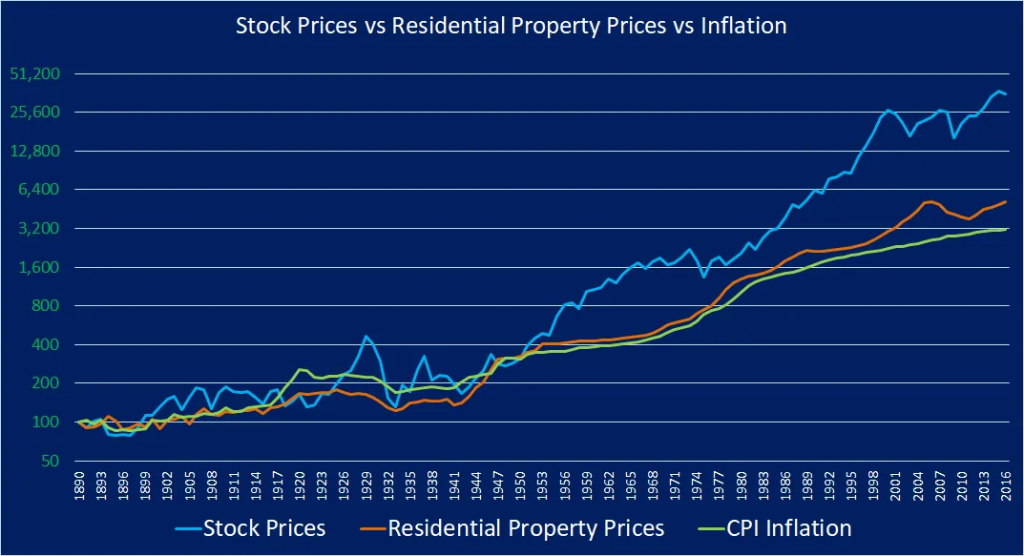

In the following graph we can confirm this reality for the North American case, analyzing the evolution of residential property prices and shares in the US between 1880 and 2016:

In this period of almost 150 years, the wealth index created by the investment in stocks was much higher than that of residential real estate.

$100 invested in stocks would have generated nearly $50,000 in 2016 while only $6,000 in real estate, a difference of almost less than 10 times.

Inflation took half the appreciation of real estate, so in real terms the $100 earned $3,000 in real estate compared to more than 45,000 in the stock.

However, in recent decades the returns of real estate investment funds compared to that of stocks and bonds were much more interesting

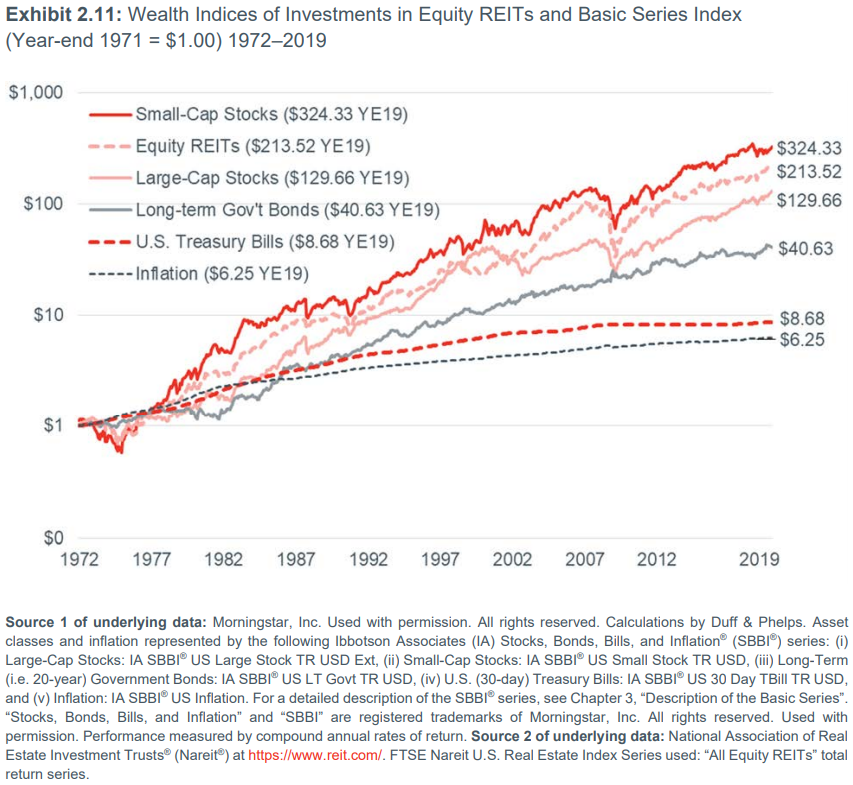

The following graph shows the valuation of a set of assets in the last 40 years, between 1972 and 2019:

During this period, the returns of investment in REIT real estate funds was only surpassed by stocks of small and medium-cap companies, from $213 to $324 dollars respectively.

The large companies stocks appreciation reached $129 and bonds $40.

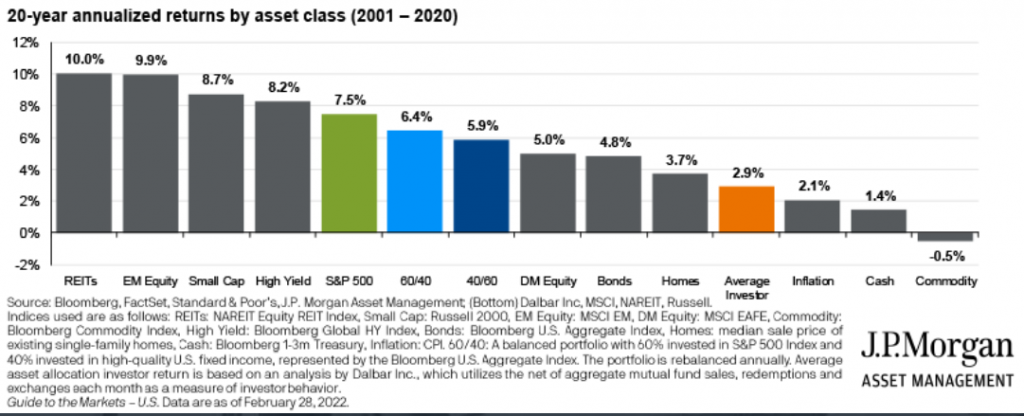

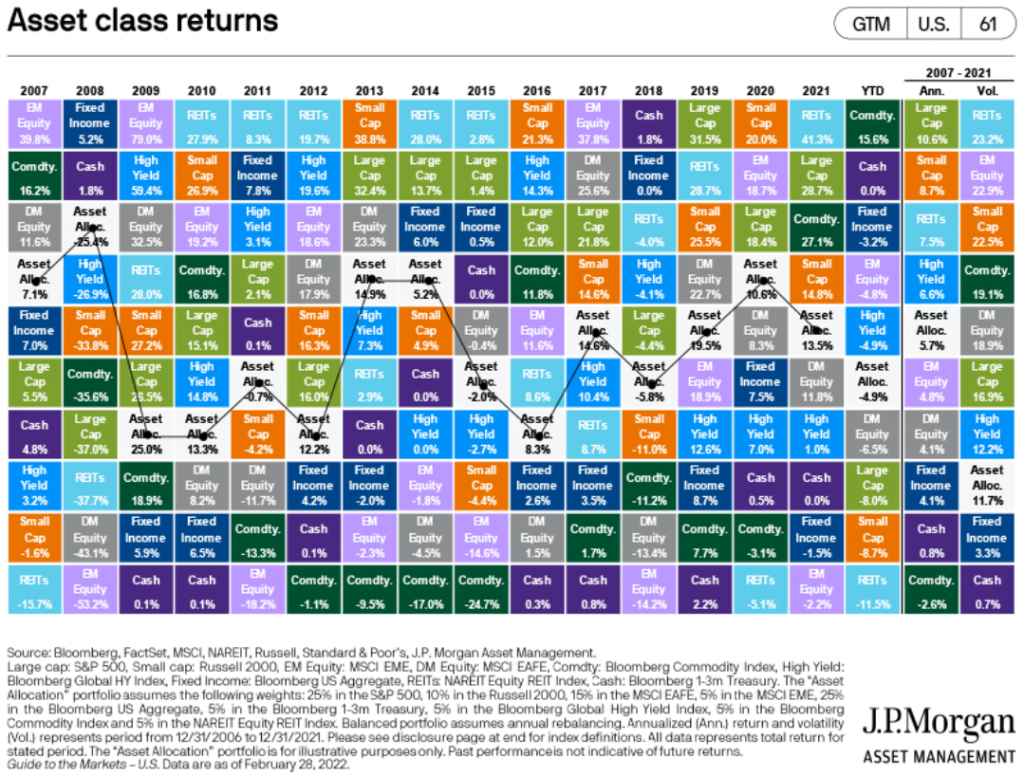

The periodic table of returns of the main assets of the last 20 years is also illustrative:

The returns of real estate funds REITS reached 10%, higher than 7.5% of S&P 500 stocks and 4.8% of treasury bonds.

The following is this table in terms of annual returns between 2007 and 2021:

Also in this period, the appreciation of REIT real estate funds was higher than that of the remaining assets, with an average annual returns of 23%, slightly higher than that of stocks of small and medium capitalizations, above 17% of the largest capitalization stocks, and much higher than the 3.3% of bonds.