This article is part of the Series “How they invest” that presents how the major private and individual investors act and manage investments.

In particular, this article focuses primarily on the case of public pension funds (Social Security and others).

It also includes an approach to all retirement investments worldwide, including all pension funds and other pension vehicles, both public and private, such as individual accounts or retirement plans in the various countries.

Public pension funds receive contributions from employees and employers, as well as government appropriations.

They invest and monetize this capital, with the aim of ensuring the payment of public old-age pensions and others, for example, disability.

In some cases, such as social security systems, they go further and have to ensure other social protection measures, such as unemployment benefits and other social support.

In essence, what these investors do is ensure the best transfer of assets in time.

In some ways, they are promoting investments accumulation and de-accumullation, in aggregate for the whole pensionable population, as each of us would do at the individual level for their lifetime retirement supplement, having to manage investments in one phase of accumulation and in another of accumulation.

It should be noted that the allocation of assets from our public pension funds cannot be taken for the assessment of our allocation of global equity investments.

The public pension, normally of defined benefit, should be considered as a value of a certain and defined income (to the exact extent of sustainability and revisions made to the systems).

In this sense, if the public pension were seen as active, the most similar would be a treasury obligation indexed to inflation.

Pension systems in major world economies

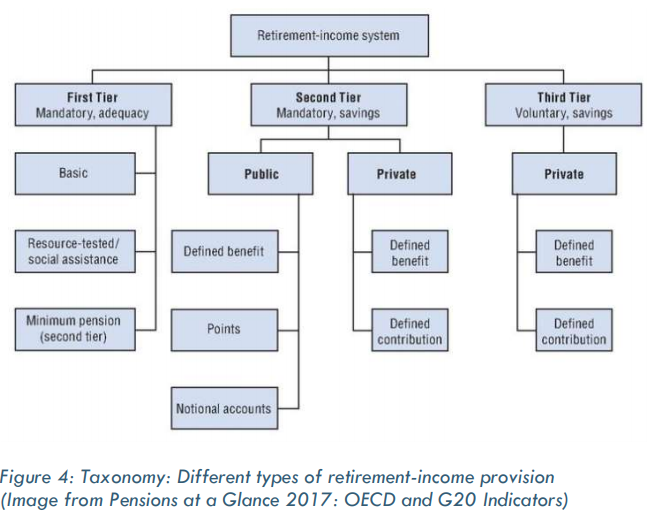

According to the OECD, pension systems are diverse, but common elements can be found in their design in terms of their three pillars, mandatory and voluntary:

The first pillar includes programmes to provide pensioners with a minimum standard of living.

The second pillar may be a mandatory and contributory public system, typically related to income or earnings and/or a madatory and fully funded private system.

The additional classification can be based on how benefits are determined (defined contribution (DC) or defined benefit (DB)).

The third pillar in most systems is voluntary private savings. Most pension systems have to have a second and/or third pillars considerable.

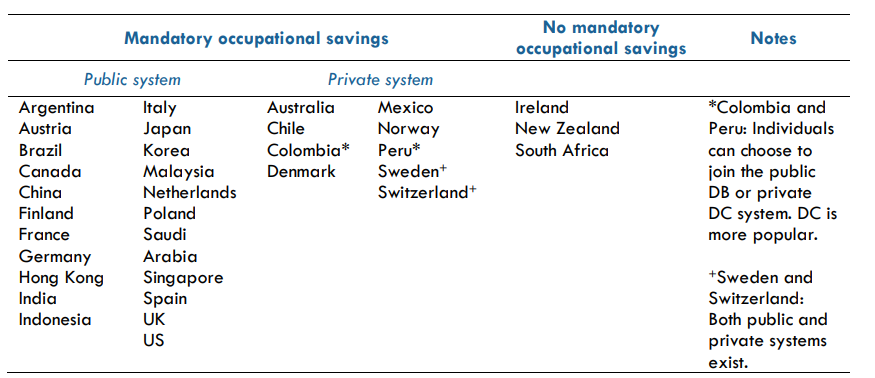

Countries such as Australia and Denmark have a strong private system for the second pillar while other mature pension markets, such as the United States, the Netherlands and the United Kingdom, have a public system supported by large voluntary savings in the third pillar.

The OECD produces annually information on the pensions of the world’s major economies, adding compulsory and voluntary public and private pension funds:

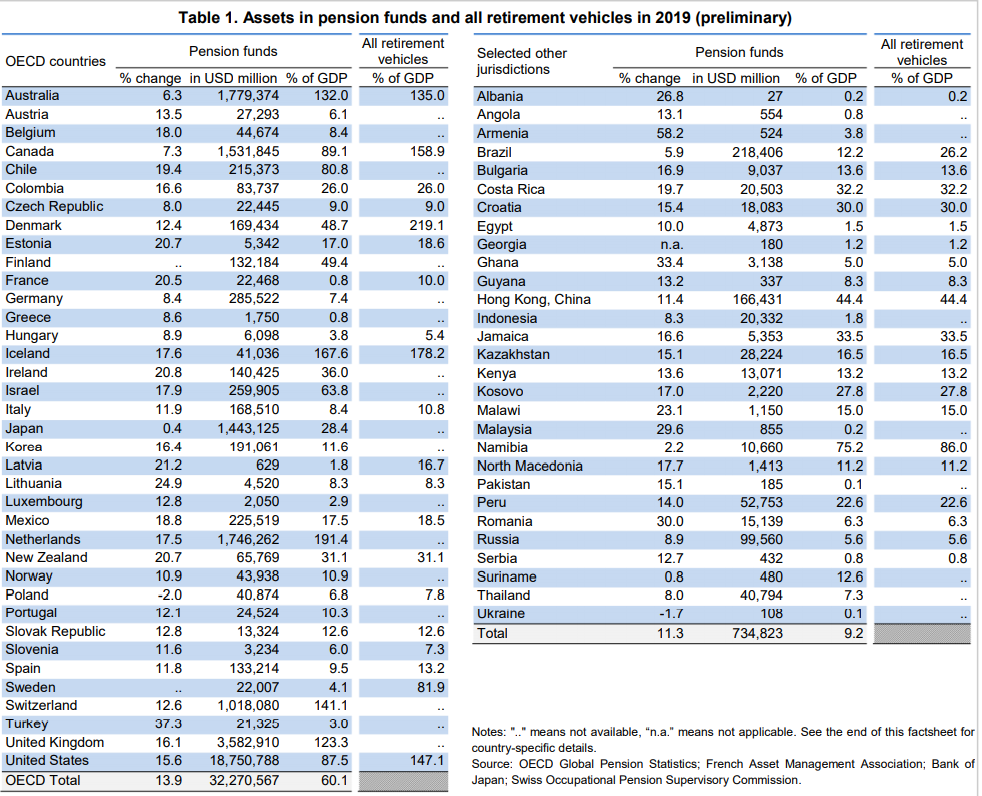

Pension funds held $32.3 trillion in the OECD area and $0.7 trillion in 29 other countries reported.

The United States has the largest amount of pension fund assets at the end of 2019 ($18.8 trillion), followed by the United Kingdom ($3.6 billion), Australia ($1.8 billion), the Netherlands ($1.7 billion), Canada ($1.5 billion), Japan ($1.4 billion) and Switzerland ($1.0 billion).

These seven countries held more than 90% of all pension fund assets in the OECD area.

The allocation of pension fund investments in the OECD

The allocation of investments to all pension funds in OECD countries, both public and private, including corporate and occupational, in 2019 is as follows:

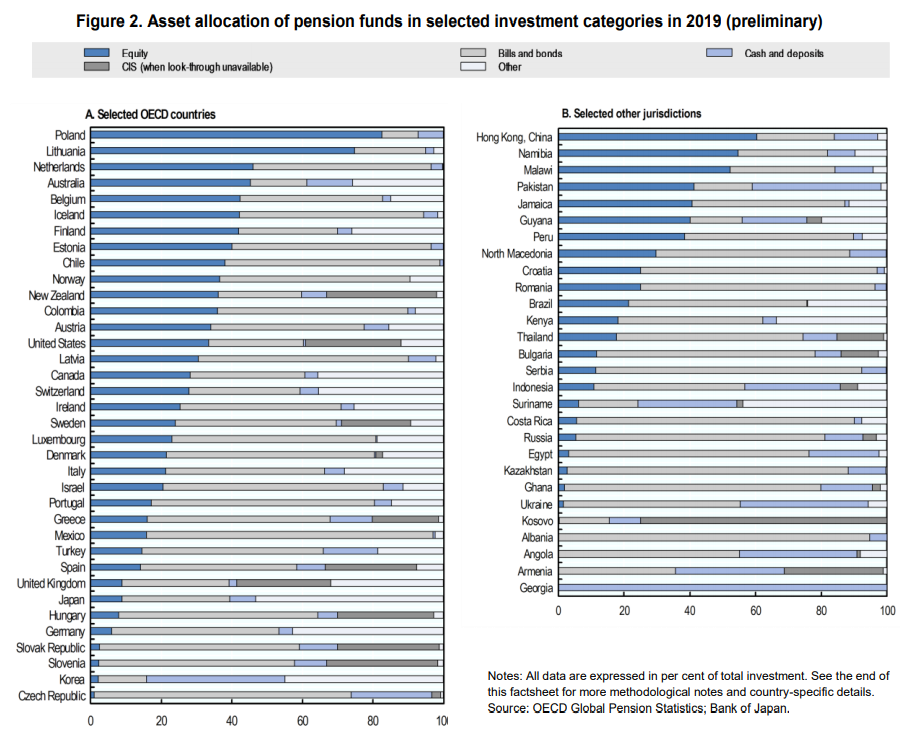

Pension funds invest mostly in equities and bonds.

Pension funds held an additional 75% of their portfolios in equities and bonds in 16 of the 36 OECD countries reporting and in 17 of the 28 reporting jurisdictions.

Pension funds invest in these instruments directly or indirectly through collective investment vehicles (CIS).

In most countries, bonds and equities are the two main asset classes in which pension funds invest, accounting for more than half of investments in 32 of the 36 OECD countries, and in the five non-OECD jurisdictions of the G20.

The proportion of equities and bonds varies considerably between countries.

In general, although there is a greater preference for bonds, the reverse is true in some countries, namely six countries where equities have exceeded obligations (e.g. in Australia from 43.7% to 14.6%) and in South Africa (37.2% to 16.2%).

Treasury or government debt bonds account for the largest share of direct bonds (i.e. excluding investment through collective investment schemes) in several countries.

For example, government bonds accounted for 96.9% of bond investments in Hungary and 87.6% in the Czech Republic, but only 24.8% in Norway and 10.5% in New Zealand.

Cash and deposits also account for a significant proportion of pension assets in some OECD countries.

For example, the percentage held in cash and deposits was very high in the Czech Republic (19.7%), Indonesia (27.5%) and France (34.5%, PERCO plans).

In most countries, loans, real estate (land and buildings), unallocated insurance contracts and private investment funds (presented as “other” in the table) represent only relatively small parts of pension asset investments, despite some exceptions.

Real estate, for example, was a significant component of pension providers’ portfolios (directly or indirectly through collective investment schemes) in Australia, Canada and Finland (between 10% and 15% of total assets).

The allocation of investments from public pension funds

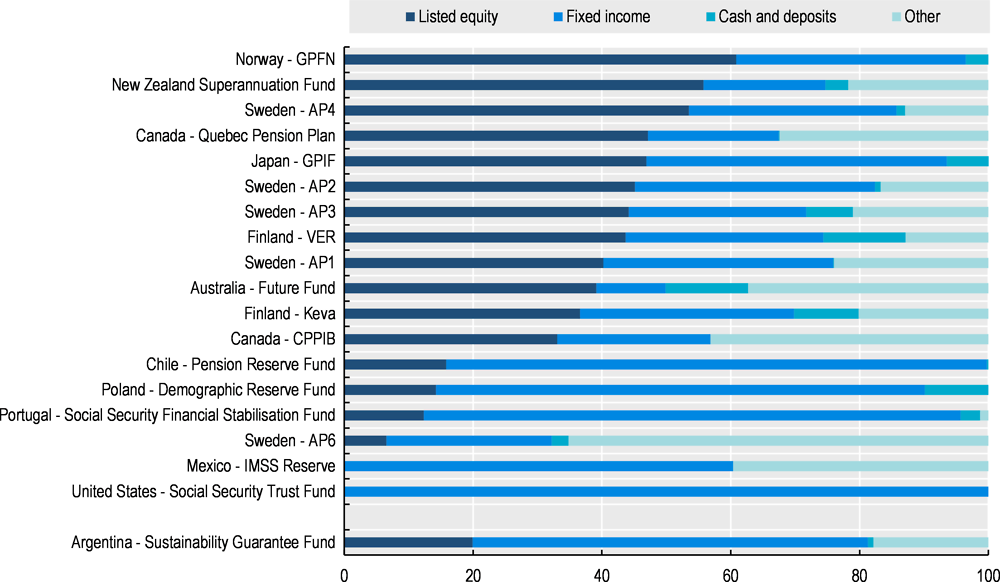

Looking exclusively at public pension reserve funds (PPRF), the allocation of investments is as follows:

Bonds and equities are also the predominant asset classes in PPRF portfolios at the end of 2017.

There is also a strong bias for equities in some reserve funds, reflecting their long-term investment prospects and, in general, greater investment autonomy.

For example, the Norwegian Government Pension Fund invested 60.9% of its assets in equities and 35.6% in bonds, Swedish AP pension funds are on average around 46% for shares and 33% for bonds, and Canada’s Quebec pension plan 47.2% in equities and 20.3% for bonds.

Japan’s GPIF has recently been investing more in equities than in fixed income, attributing 46.9% of assets to listed shares (versus 46.6% in bonds).

On the contrary, reserve funds in Chile, Portugal and Poland, for example, have invested much more in bonds than in equities.

The extreme case is that of the US PPRF, which is by law fully invested in treasury securities.

Some PPRFs have also invested in real estate and non-traditional classes such as private equity and hedge funds.

For example, some of the funds with the highest allocation for private equity and hedge funds included those from Mexico (39.7% in total) and Australia (23.6%)

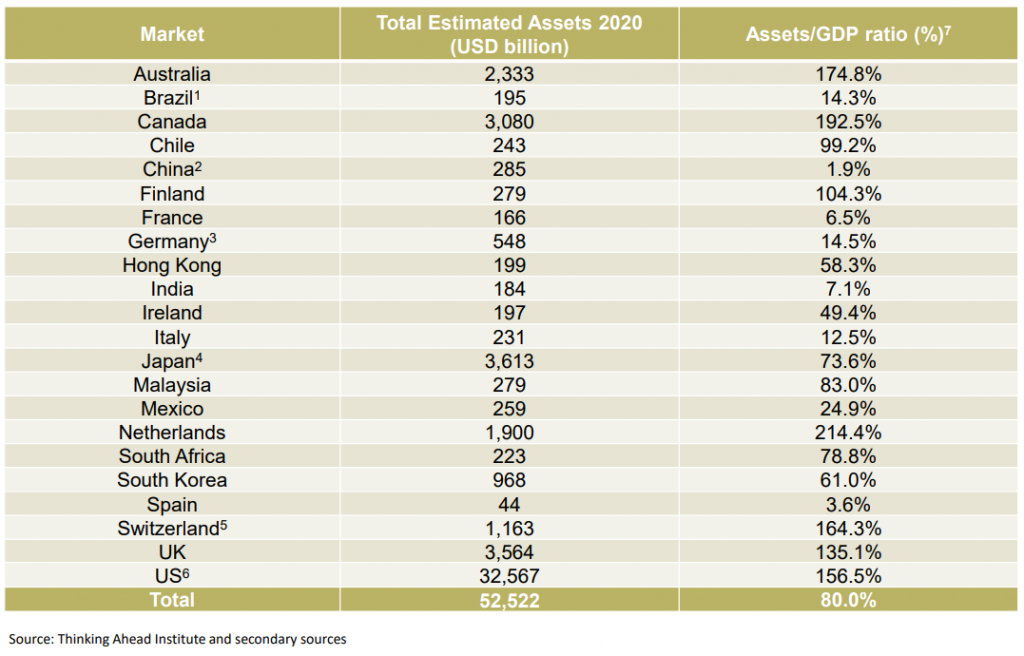

The situation of all pension markets in the world

The Thinking Ahead Institute annually conducts another study covering 22 pension markets worldwide, in which it extends the analysis to include all retirement investments beyond pensions, for example, individual retirement accounts (Individual Retirement Accounts or IRA) in the US.

The goal is to better capture retirement assets around the world and expand the analysis into the 3rd pillar universe (individual savings), which is being used primarily for pension purposes in many markets.

The study covers the largest 22 pension markets in the world: Australia, Brazil, Canada, Chile, China, Finland, France, Germany, Hong Kong, India, Ireland, Japan, Malaysia, Mexico, The Netherlands, South Africa, South Korea, Spain, Switzerland and the United Kingdom.

The total pension assets of these 22 countries are $52.5 trillion.

It is estimated that outside these 22 countries there will be an additional USD 3-5 billion of pension assets for a total of 195 countries.

The US is the largest market in these 22 countries, with a share of 62.0% of assets, followed by Japan and the UK with 6.9% and 6.8%, respectively. About 92% of the assets of the 22 countries are in the seven largest markets, Australia, Canada, Japan, the Netherlands, Switzerland and the United Kingdom.

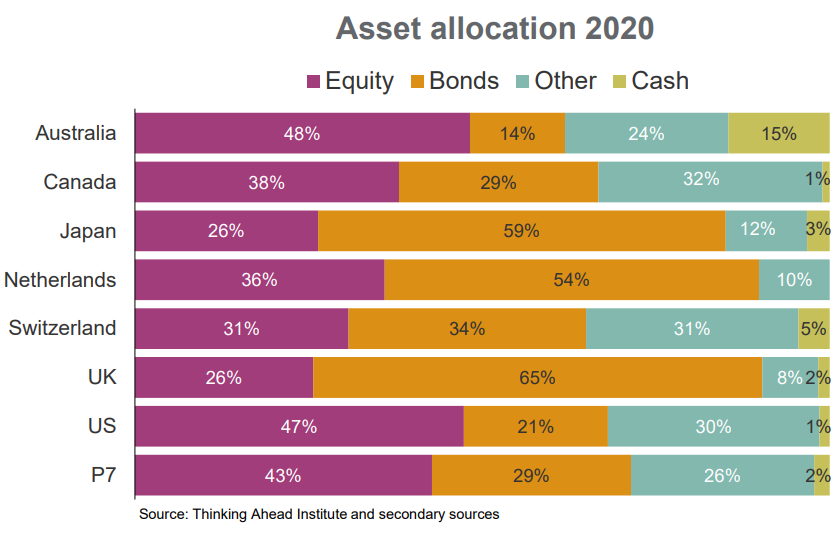

The US and Australia are the countries with the highest stock appropriations among the 7 largest countries.

Japan, the Netherlands and the United Kingdom have a higher endowment for bonds.

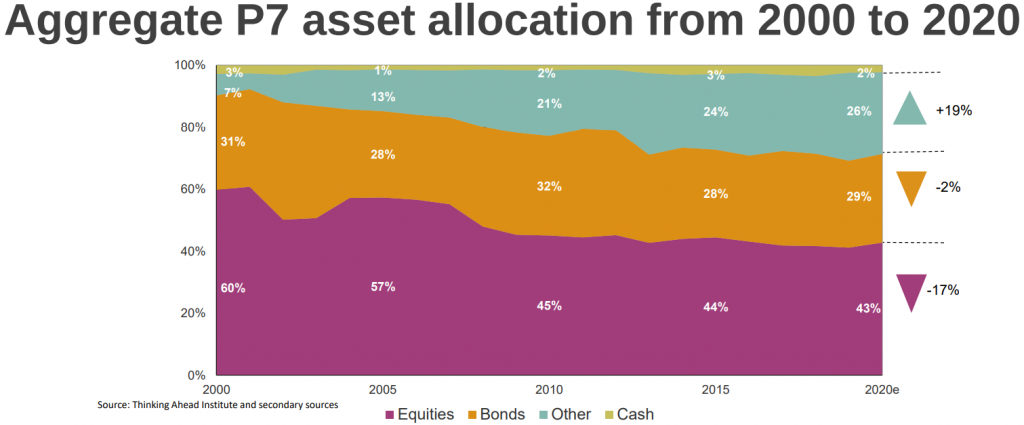

The pattern of asset allocation has changed since 2000. Stock allocation decreased, while investments in other assets grew during the same period.