This is the fourth article on investing in money market funds.

In this article we will see how these investments can be used and how to make the selection of money market investment funds.

Who Money Market Funds Are Intended For

The main purpose of a money market fund is to provide investors with a secure and very liquid asset, cash equivalent and debt securities-based, using small investment amounts.

Money market investment funds are characterized as low-risk, low-return investments.

Money market funds are attractive to investors because they typically have no commissions, entry or exit fees.

Many investors invest substantial amounts in these funds for the short term.

Money market funds are used to preserve capital and generate certain yield, and they offer an attractive option for storing money during periods of increased market volatility.

To this extent, money market investment funds are usually a good alternative to investing cash in deposits or savings accounts in banks, i.e. very short-term investments, whether for active or retired investors.

The fact that they usually have a very low yield and much lower than inflation makes them uninteresting for medium and long-term portfolios.

Money market funds are not suitable for long-term investment goals, such as retirement planning, as they do not offer much capital appreciation.

For investors with a balanced risk profile, these funds are used to park money in times of greater uncertainty or market volatility.

These funds are also useful for integrating very conservative investor portfolios.

Money Market Funds in the Current Context of Markets

In the low-rate environment that has persisted in recent years, money market funds have offered negligible returns.

Now that interest rates are higher, yields have risen, and in some cases, especially in the US, they are already outpacing inflation.

Rising interest rates are allowing savers to protect the purchasing power of their wealth and income.

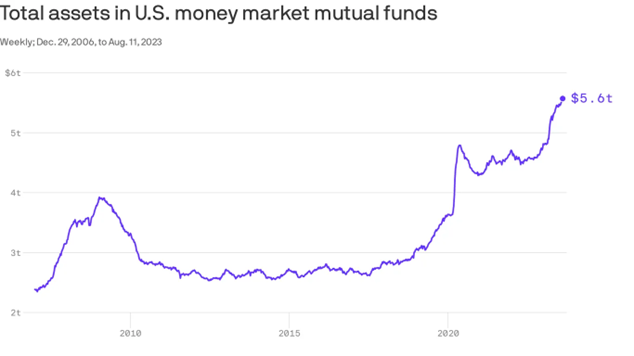

And investors are investing more and more in these funds.

At the moment, the total amount invested in these funds already reaches more than $5.8 trillion in the US, a growth of 17.8% in the last year, and an increase of 13.1% this year alone.

This growth is due to rising interest rates and the crisis in US regional banks.

The Eurozone has seen the same growth, although short interest rates are still below inflation, and the money market funds market is not as developed as in the US.

How to Invest in Money Market Funds

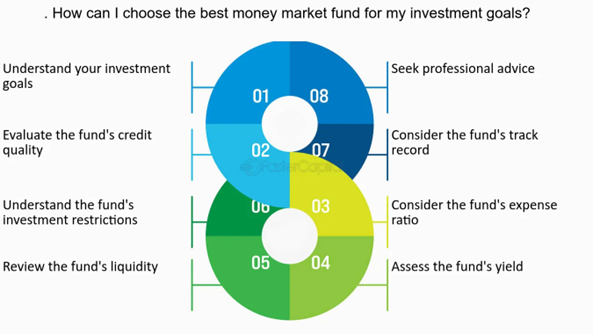

The selection of money market funds to invest in must comply with several fundamental criteria:

Denomination Currency

The currency of denomination is important since the purpose of the fund is to preserve capital, we should not incur foreign exchange risk. That is, in principle, investors should invest in funds denominated in their own currency.

Wide availability

The first condition is that the funds are available, that is, they must be traded in the country and be distributed by the banks or brokers in which we have an account.

Similarly, we have tried to avoid funds that charge liquidity fees or impose limits on redemptions.

Minimum amounts and low fees

The funds chosen should be those that accept small minimum amounts, for example, 3 to 5 thousand euros or dollars. On the other hand, commission and fee costs should be as low as possible, never exceeding 0.5%.

Consistently higher yields

We should select the funds with the highest consistent returns.

The industry standard for making comparisons between funds is 7-day yields, which are the net valuations (minus fees) of funds over the last 7 days projected for the next 12 months.

Large volume of assets under management

Funds should be the largest in terms of assets for three reasons.

The first is that the fact that they have large amounts under management signals that they have the quality to attract a lot of investors and capital.

The second is that the funds that have the best chance of preserving capital are the largest funds, as they are best able to withstand spikes in liquidity stress in the markets.

The third is that the larger the fund, the better the level of service to clients.

Money market investment funds are not rated, but there are databases that contain the most important information on the largest funds

Money market funds are not subject to ratings, unlike equity and bond funds (the closest funds that exist with a rating are the so-called ultra-short bond funds, with an investment maturity of up to 3 years).

However, the specialized financial information agency Morningstar contains a good database on the main characteristics of the largest investment funds in the US money market.

The largest money market investment funds in the US are those managed by the largest investment fund managers in general, namely Vanguard, Blackrock, Fidelity, State Street, Charles Schwab, T Rowe Price, Invesco, JP Morgan and Morgan Stanley.

The eurozone’s largest money market investment funds are a mix of global and European asset managers, including Vanguard, Blackrok, Fidelity, Amundi, DWS, UBS, Natixis and Morgan Stanley.

In the Tools folder, we will develop in more detail the largest funds available to US and Eurozone investors.