Types of money market funds

Advantages and disadvantages of money market funds

This is the second article on investing in money market funds.

In this article, we will look at the various types of money market funds and the advantages and disadvantages of investing in these funds.

What types of funds are the money market

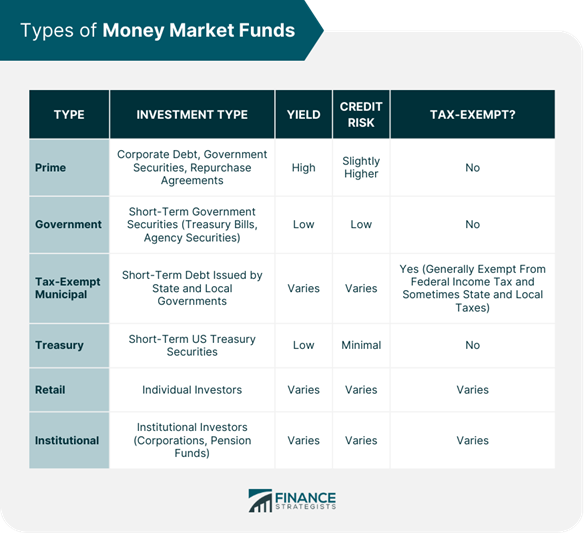

In the U.S., the various segments of money market investment funds are defined by their type of investments, usually referred to as government (or public), premium, and municipal funds.

Public funds must invest 95.5% of their assets in government-issued bonds, and consequently they are extremely safe.

Premium money market funds invest in corporate commercial paper, central bank repurchase agreements, certificates of deposit, and other bank debt securities.

Municipal money market funds invest in bonds issued by municipalities and municipal agencies, which pay interest exempt from federal tax.

Premium and municipal funds are further classified as retail or institutional, depending on the type of investors in the fund.

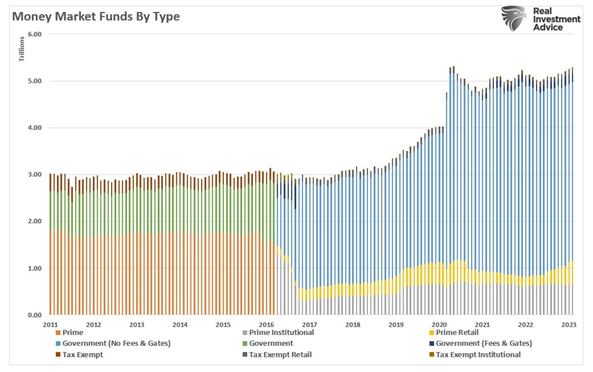

The distribution of money market funds by type of funds is as follows:

The largest funds are government or public debt (80%), followed by municipal funds (15%), and finally prime (5%), totaling $5 trillion (of which $1.6 trillion are retail funds).

In Europe, 90% of money market funds are prime funds, with a total value of €1.5 trillion.

U.S. individual investors invest more in these funds than their European peers.

Institutional investors, who manage mutual funds, pension funds or other asset portfolios (e.g. discretionary accounts), invest in money market funds to park money during times of greater uncertainty in the stock and bond markets, in essence, the same reason as institutional investors.

Advantages of Money Market Funds

Low Risk and Short Duration

When the stock market is extremely volatile and investors are unsure about where to invest their money, the money market can be a safe haven, in that money market funds carry less risk than their stock and bond counterparts.

That’s because these types of funds typically invest in low-risk vehicles, such as certificates of deposits, treasury bills, and short-term commercial paper.

In addition, the short maturity of these securities limits the sensitivity of a money market fund to interest rate risk.

So, even though the money market often generates a low single-digit return for investors in a volatile or bear market, investing can be quite attractive.

Diversification

As with most investment funds, a money market fund offers instant diversification among a range of securities, which is an important safeguard for all investment portfolios.

Investors do not have to select and invest in several money market securities individually.

Stability and Security

A money market fund is one of the least volatile types of investment available.

This feature can be useful to offset the higher volatility of investments in stocks and bonds in the investment portfolio.

In addition, these funds offer a safe, short-term investment option when none else is viable.

High Liquidity

Money market funds generally do not invest in securities that trade low volumes or have little monitoring from analysts and investors.

Instead, they invest mostly in entities and/or securities with a fairly high demand (such as treasury bills and short-term treasury bonds), which means they tend to be very liquid.

This way, investors can buy and sell them with relative ease.

Potential Tax Efficiency

In the U.S., interest payments on some money market funds are exempt from federal and, potentially, state income taxes.

Disadvantages of Money Market Funds

Inflation risk

If the money market fund’s return is lower than inflation, the investor is essentially losing purchasing power each year.

Over time, money market investment can devalue wealth, in the sense that the income earned may not keep up with the rising cost of living.

Commission and fee expenses can be an unreasonable burden

When investors are earning only 2% or 3% of a money market fund, even small annual fees or commissions can eat up a substantial portion of the yield.

This situation can make it even more difficult for money market investors to keep up with the pace of inflation.

No insurance protection from the deposit guarantee scheme and bank savings accounts

Deposits and savings accounts in banks are guaranteed up to a certain limit by the respective guarantee scheme.

This is not the case with money market funds.

As a financial investment, money market funds can be considered a comparatively safe place to invest money, but as with any investment, there is still an element of risk that all investors should be aware of.

Risk of higher yields

While money market funds generally invest in treasury bills and bonds and other vehicles that are considered safe relative to investments such as stocks and bonds, fund managers may decide to take some larger risks in order to earn higher returns for their investors.

For example, the fund may invest in bonds or commercial paper that have more risk. Depending on your investment goals and time horizon, investing in the highest-yielding money market fund may not be the most appropriate move, given this additional risk.

In this sense, it is important to know the investment policy of the funds, which establishes the scope and limits of allocation by types of securities (and in terms of risk).

Low returns have an opportunity cost (lost)

In the long term, stocks have annual returns of 8% to 10% on average (including periods of recessions and crises).

By investing in a money market fund, which can often yield as little as 2% or 3% due to the fixed-income and low-risk nature of your investments, you may be missing out on an opportunity for a better rate of return. This effect can have a huge impact on one’s ability to build wealth over time.