The Returns and Risks of Cash Investing: In the Long Term, Savings Accounts Do Not Yield

Money market funds are one of the cash investment options, usually the most interesting for investors

What Are Money Market Funds

Comparison of bank deposits and money market investment funds

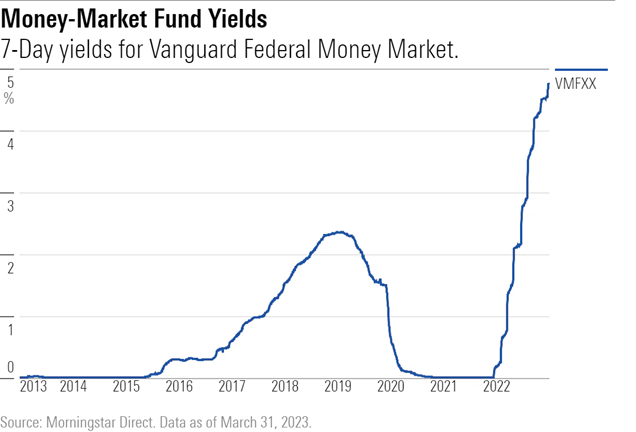

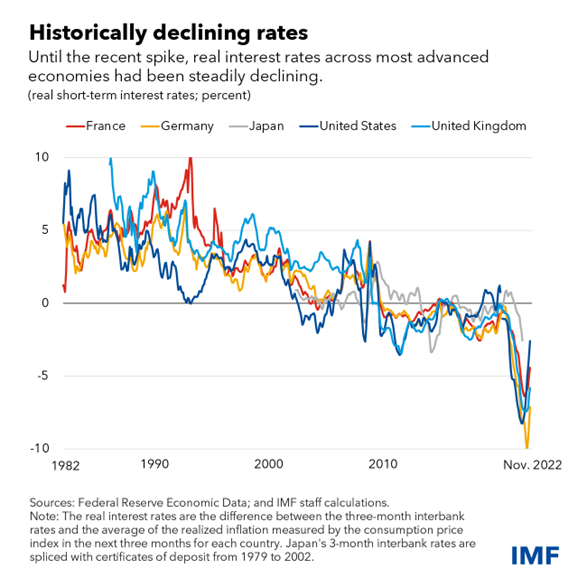

In recent years, for a long time, money market funds have had very low and very unattractive returns, due to the low interest rates associated with Quantitative Easing programs.

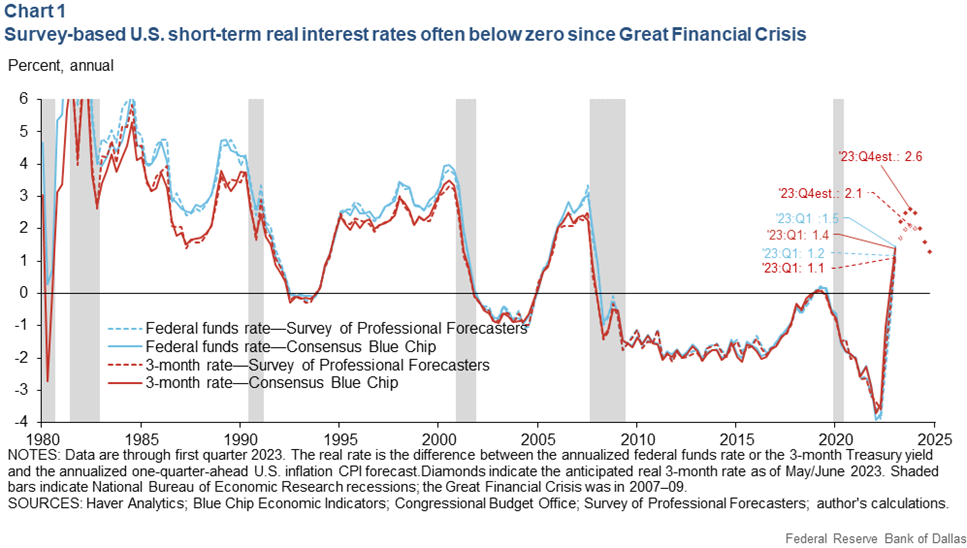

Interest rates were almost nil, which meant that real interest rates were negative, despite inflation being very low.

Annual short-term interest rates have gone from almost 0% to 5% in the US and from negative to over 3% in Europe.

With inflation at 3.7% % in the US, and gradually declining, short-term interest rates are already positive (and with medium- and long-term interest rates at 4.5%, they are also positive in real terms).

In the Eurozone, despite the rate hikes already seen in 2023, short-term (and long-term) real interest rates are still negative, but it is assumed that they may return to positive in the short term:

In this context of positive real short-term interest rates, cash investing becomes more attractive.

One of the main options for this investment is money market funds, which we will cover in this article.

Cash is one of the top three assets, but it’s usually not an interesting investment, as we saw earlier.

In a previous article we showed the main characteristics of cash investing, comparing them with the other 2 assets, bonds and stocks.

In other subsequent articles, we also presented a comparison of the profitability and risk of the three assets.

However, there are situations in which cash investing makes sense and is even very interesting, such as the one currently experienced in the USA where interest rates paid for short-term investments reach 5%.

We will see that cash is a useful and temporary investment, when there is a lot of uncertainty about the context of the markets, or in situations of transition of economic cycles, and/or when, for these reasons or others, its remuneration is attractive.

That is what is happening in the USA today.

After decades of virtually non-existent profitability, cash rates are attractive.

So, at this point, it may make sense to diversify investments beyond stocks and bonds and have a small cash allocation, even for less conservative investment portfolios.

In this article we will delve into money market investment funds, the best alternative to bank deposits and savings accounts, the other cash investment options.

According to the U.S. Crane Data (https://cranedata.com/) database, the 100 largest money market funds provide an average annual return rate of 5.17%, well above the estimated average annual yield of 0.43% on bank deposits and savings accounts.

This means that if we invest $100,000 in U.S. money market funds, we will get more than $4,740 than by investing that capital in the banks.

The Returns and Risks of Cash Investing: In the Long Term, Savings Accounts Do Not Yield

Even in the US, there is not much information on the long-term rate of return on deposits.

The closest information on the rate of return is that of 6-month treasury bills, which are usually one of the main components of money market or treasury investment funds.

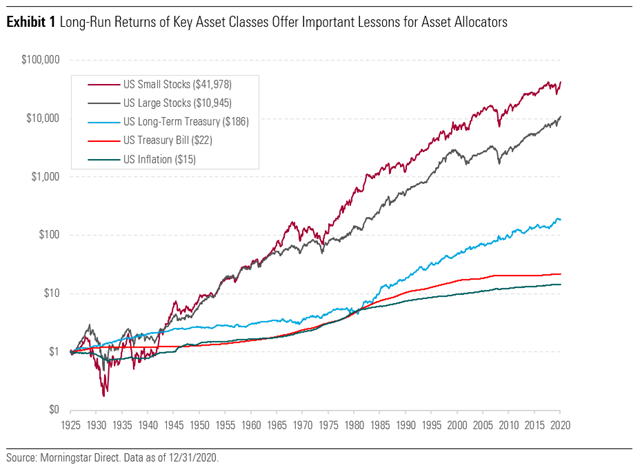

The following chart shows the investment performance of these treasury bills compared to stocks (S&P 500 index) and 10-year treasury bonds since 1925:

Over this very long period, the average annual rate of return on investment in 6-month treasury bills was 3.2%, compared with 5.2% for bonds, 10.1% for large corporate stocks and 11.8% for small company stocks.

If the percentage differences may seem small, they are no longer so when we compare the valuation of invested capital.

$1 invested in 1925 generated $22 in Treasury bills, compared with $186 in bonds, nearly $11,000 in large company stocks, and $42,000 in small business stocks.

It should also be noted that of the $22 generated, $15 would have been consumed by inflation, which means that deducting transaction costs and considering taxes, this investment did not even beat inflation.

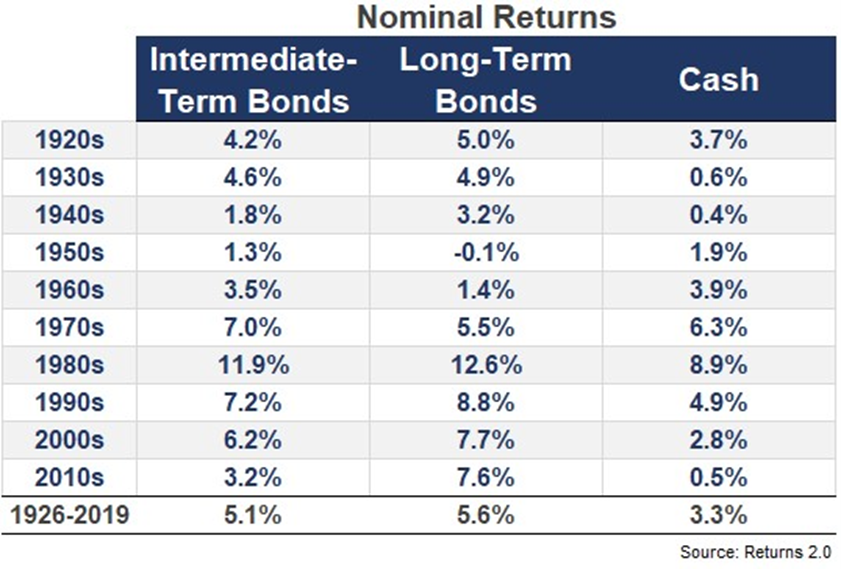

The following table shows the average rate of return on cash (considering the treasury bill rate as its closest reference) for several decades, compared to that of medium and long-term bonds since 1920:

This rate of return has varied greatly over the decades.

In the last 20 years it has been very low, as it had been between 1930 and 1960.

Between 1960 and 1990, this rate was high, in a period of high inflation, and which preceded the change to an expansionary active monetary policy regime.

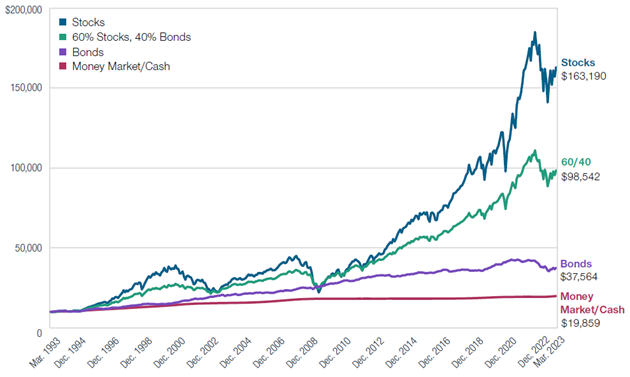

The following chart gives us the same information for a more recent period, showing the appreciation of an invested capital of $10,000 in the various assets over the last 30 years:

The accumulated capital of investing in cash or money market funds would be $20,000, about half the $38,000 for bonds and 8 times less than that of stocks.

Money market funds are one of the cash investment options, usually the most interesting for investors

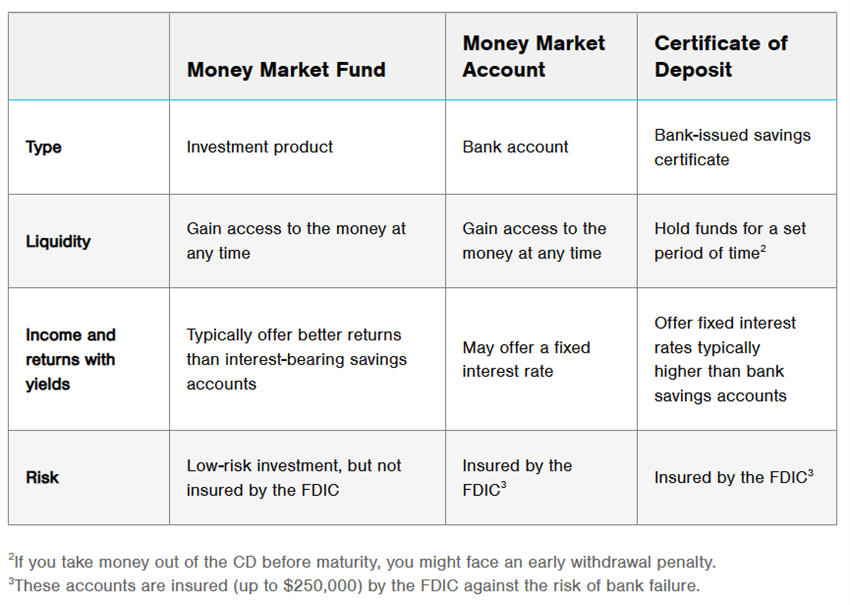

The most popular cash investment options are deposits, savings accounts, and money market funds.

These investments are highly liquid for putting money in, which means that you can easily access funds whenever you need them.

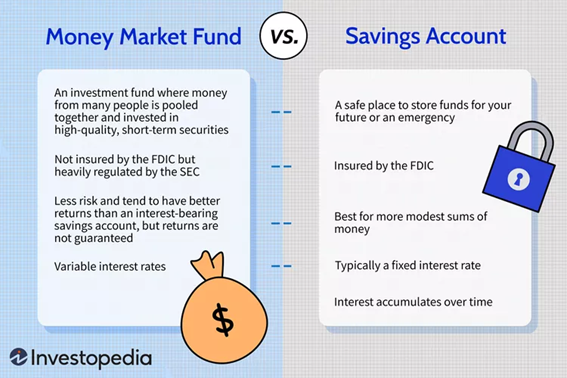

But there are some key differences between them.

Deposits and savings accounts are banking products, bear interest, and can be demobilized with or without penalty before the end of the term, being guaranteed up to a certain limit amount per holder by a deposit guarantee scheme.

Money market funds are collective investment trusts that pool money from multiple investors into different investment vehicles.

Although money market funds are not guaranteed by the deposit system, they are low risk.

Money market funds tend to offer higher yields than other money market products.

What Are Money Market Funds

Money market funds are investment funds (see series on these funds in other articles for more information) that invest in debt securities with short maturities and very low credit risk.

They have very low volatility and very high liquidity.

Money market funds are open-ended (or variable capital) funds, which can grow without limitations, and can attract additional capital at any time.

The funds sell and redeem investors’ units at a price equivalent to the net asset value (NAV), which is calculated daily according to the value of the assets that comprise it.

Comparison of bank deposits and money market investment funds

A deposit or savings account at a financial institution is a safe and liquid option to store our money.

That’s because they benefit from the deposit guarantee system up to a limit amount, and the funds are instantly available.

Beyond this threshold, there is a risk of non-repayment associated with the bank’s failure (see the recent example of Silicon Valley Bank in the US).

Money market investment funds are investment securities, not bank accounts, and as such, are not covered by deposit guarantee insurance.

However, money market funds are also very low-risk, as they invest in cash and government-backed securities such as treasury bills, Treasury bonds, and repurchase agreements collateralized by government-backed bonds.

In turn, these money market funds pay a much higher rate of return than bank deposits and savings accounts, as we saw earlier.

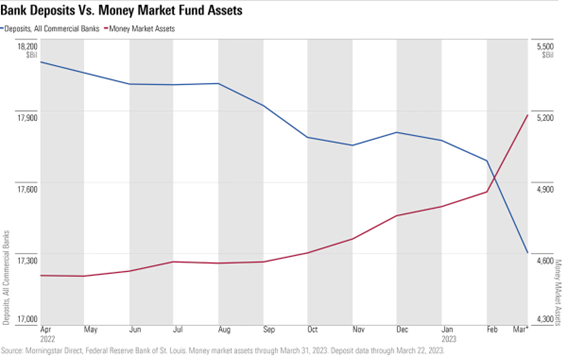

The following chart shows that the recent rise in short-term rates in the US has increased investments in money market funds and reduced deposits in banks.