Morningstar is the leading global mutual funds analysis and rating agency, which is widely used by institutional investors.

Morningstar covers 4,000 mutual funds, including 1,150 funds and 300 ETFs in the US, and 91% of funds traded in Europe.

This study is very interesting because funds are the investment vehicle par excellence for individual investors.

Therefore, we have dedicated a series of articles on this blog to the topic of investment fund selection, ranging from their description and characteristics, investment types and policies, to returns, and costs.

We have also published several articles on the choice between active and passive (or indexed) investment funds, including their differences and their advantages and disadvantages.

In the Tools portfolio, we have been presenting some of the largest equity and bond, asset and liability investment funds traded in the US and Europe.

In 2009, Morningstar launched the Global Investor Experience (GIE) study to encourage a dialogue on global best practices for investment funds from the perspective of investors in the funds.

The study is produced every two years, and 2021 was the seventh edition.

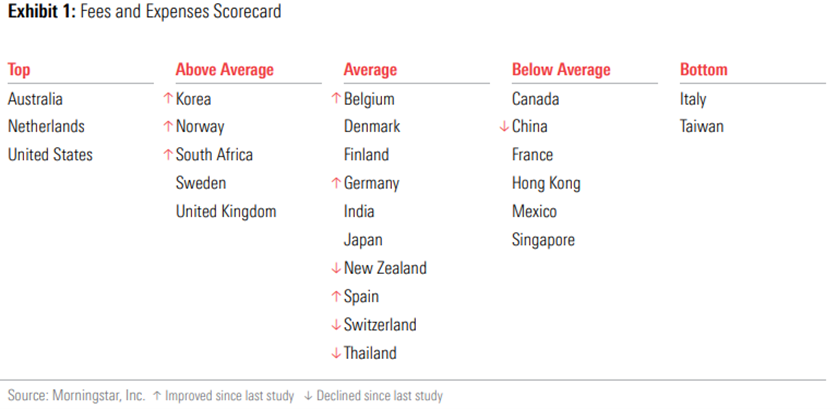

It is structured around three chapters: Commissions and Expenses, Disclosures, and Regulation and Taxation.

Morningstar publishes each chapter of the study independently, beginning with the Fees and Expenses chapter.

The total number of markets analyzed in this study is 26 countries: Netherlands, United States, Sweden, Switzerland, United Kingdom, Norway, Australia, Denmark, New Zealand, South Africa, Germany, Hong Kong, Finland, Korea, Japan, Singapore, France, Belgium, Thailand, China, Spain, Mexico, India, Canada, Italy, Taiwan.

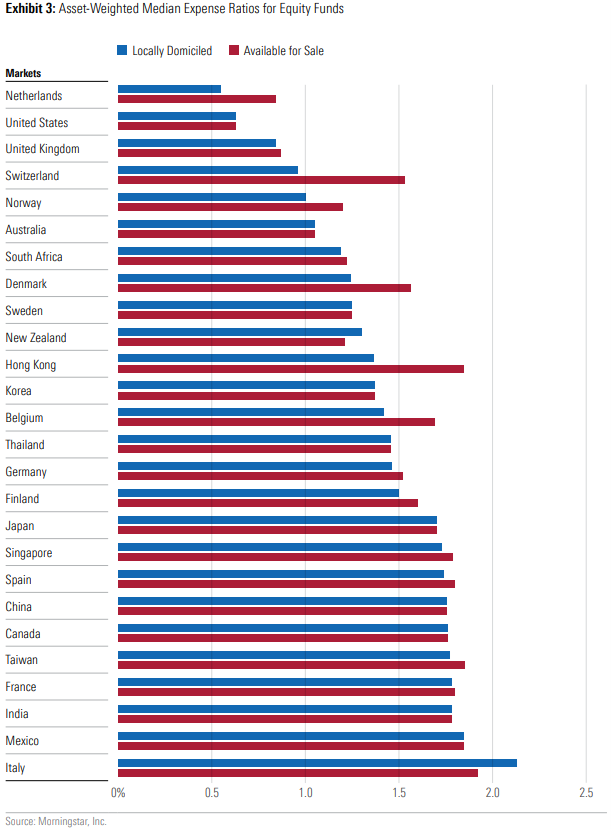

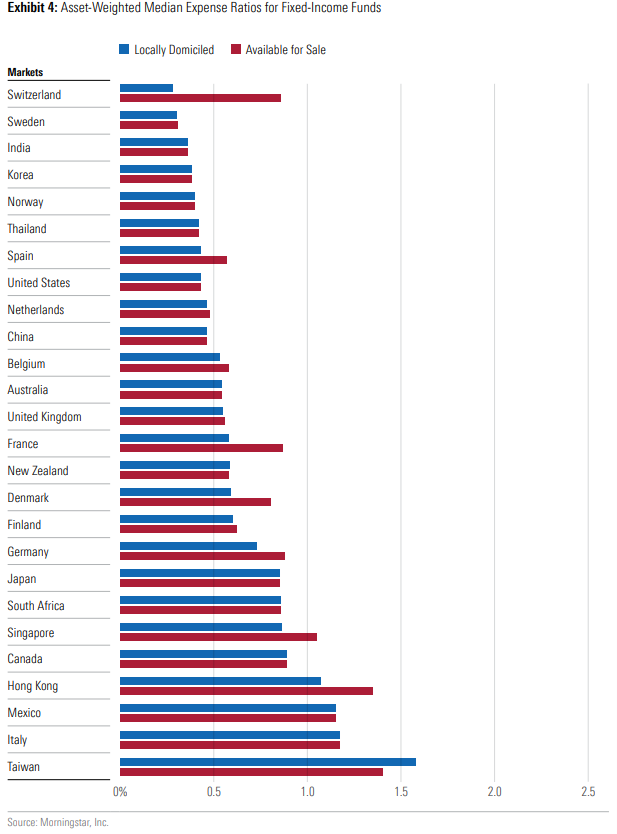

This study highlights the asset-weighted median expense ratio, which provides the best objective measure for comparing the costs of funds in global markets.

Reliable data on financial advice and distribution platform fees are not available in the 26 markets that are considered in this global study. Therefore, this study does not assess the total potential cost of investing in a fund, or receiving financial advice.

This study primarily considers publicly available open-end funds that typically issue or redeem shares or units on a daily basis.

This edition’s survey includes some questions about exchange-traded funds to assess the breadth and level of use of ETFs in each market.

ETF markets are growing strongly and have been putting pressure on all publicly traded funds.

ETFs are considered an industry best practice and are particularly suitable for use in independent advisory programs, due to the exclusion of initial charges and low management fees.

In addition, ETF expenditure data was not included in the asset-weighted median calculations, as it is not possible to accurately measure ETF ownership at individual market level in all markets represented in this study.

Access here:

https://www.morningstar.com/lp/global-fund-investor-experience