This report provides an overview of concepts, assessments, and conducts quantitative analysis to clarify the progress and challenges of the current state of ESG investments.

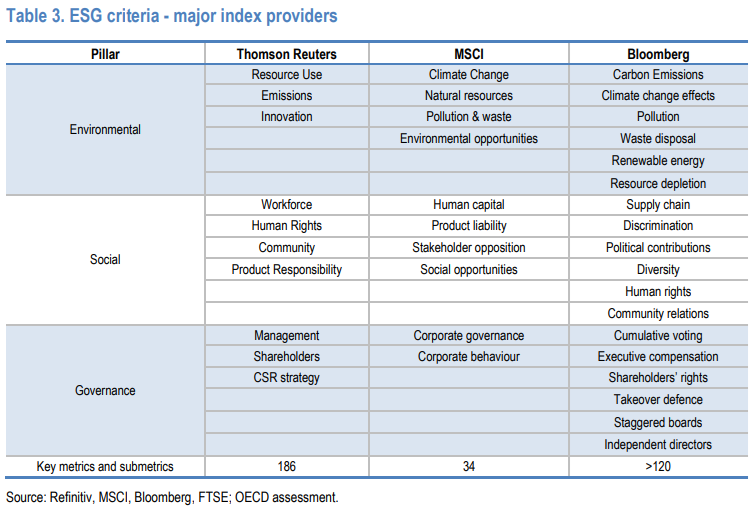

It highlights the wide variety of metrics, methodologies and approaches that, while valid, contribute to disparate outcomes.

These metrics result in a range of ESG investment practices that together reach an industry consensus on what high-quality ESG portfolios are performing, and which can be discussed.

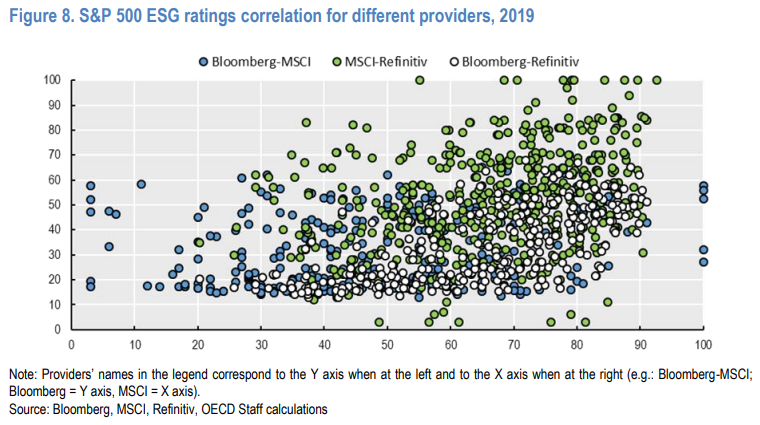

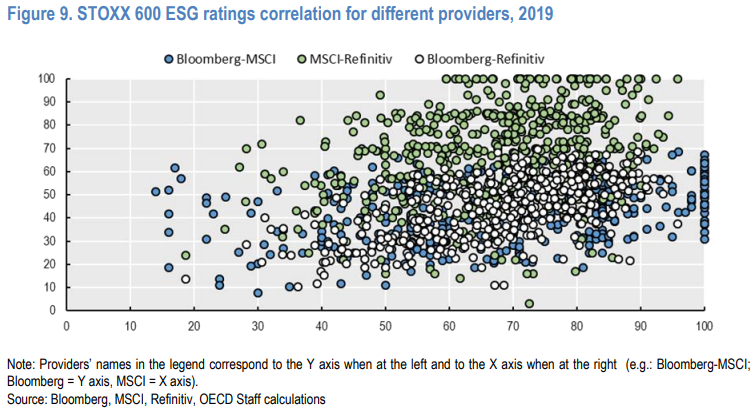

The key findings of this analysis show that ESG ratings vary strongly depending on the rating agency chosen.

This occurs for a number of reasons, such as different frameworks, measures, key indicators and metrics, data use, qualitative judgement and weighting of subcategories.

In addition, returns have shown mixed results over the past decade, raising questions about the true extent to which ESG is aligned with investment performance.

This lack of comparability of ESG investment metrics, ratings and approaches makes it difficult for investors to make a judicious decision between managing ESG risks within their investment mandates and achieving ESG outcomes that can pay off in terms of financial performance.

Despite these shortcomings, ESG scoring and reporting has the potential to unlock a significant amount of information about companies’ management and resilience in pursuing long-term value creation.

The expected developments could represent an important market mechanism to help investors better align their portfolios with environmental and social criteria aligned with sustainable development.

However, the progress made to strengthen the significance of ESG investing requires further efforts towards transparency, consistency of metrics, comparability of rating methodologies and alignment with financial materiality.

Finally, despite the efforts of regulators, standard-setters and private sector participants in different jurisdictions and regions, comprehensive guidance may be needed to ensure market efficiency, resilience and integrity.

Access here:

https://www.oecd.org/finance/ESG-Investing-Practices-Progress-Challenges.pdf