This report quantifies the long-term performance of the U.S. stock market in terms of increases or decreases in shareholder wealth (relative to the Treasury Bill investment benchmark), by considering the full history of net fund distributions and capital appreciation.

The study includes all 26,168 companies with publicly traded U.S. common stock from 1926 to 2019.

The main conclusions are as follows.

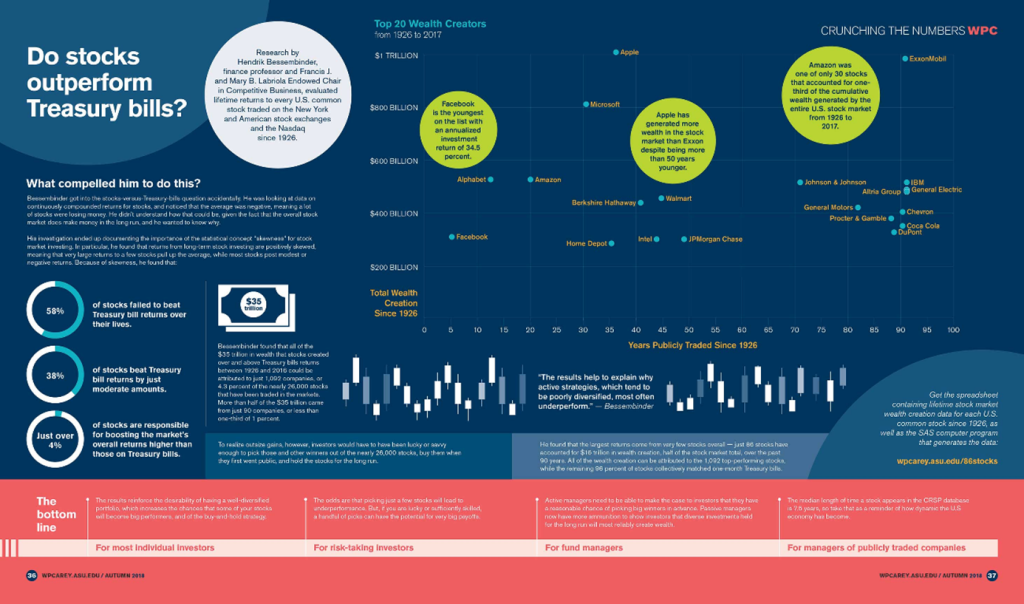

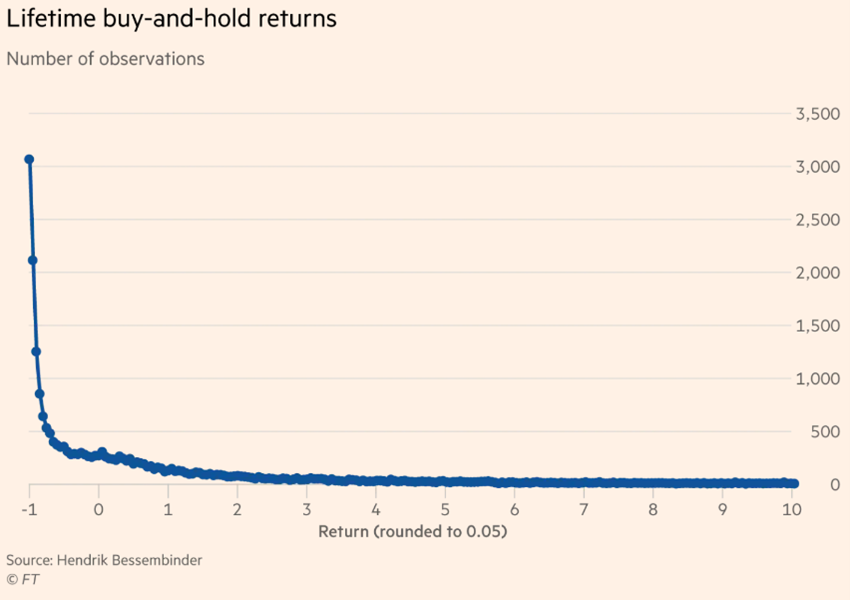

However, most U.S. stocks (about 4 out of 7) have negative long-term returns. The majority of actions (57.8%) resulted in a reduction in shareholder wealth, rather than an increase.

Of the companies in the sample, 11,036 companies (42.17% of the total) created positive wealth for their shareholders over their lifetime, while 15,132 companies (57.83% of the total) reduced shareholder wealth, compared to the benchmark of Treasury bills.

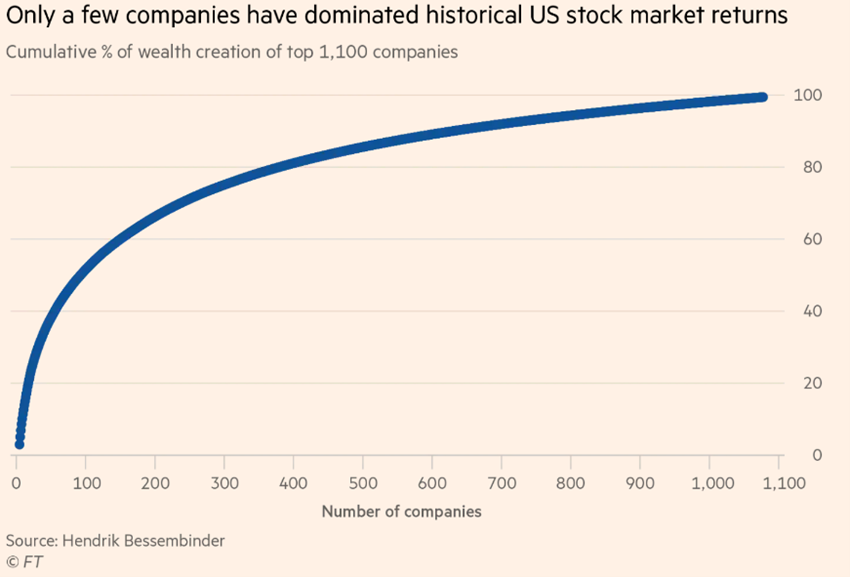

About 1,100 companies, or 4% of all listed companies in the period, were responsible for all value creation in the U.S. market.

In other words, 96% of listed companies over the 90-year period did not add any more value to the investment in treasury bills, in aggregate terms.

Some stocks have very large long-term capitalized returns.

The aggregate wealth creation of shareholders is concentrated in a relatively small number of high-performing stocks.

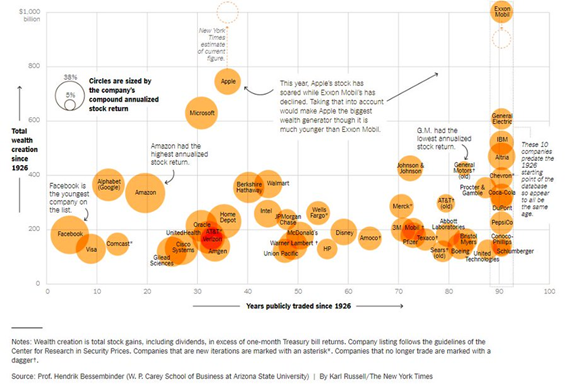

There were 5 companies that accounted for 10% of the total value creation – ExxonMobil, Apple, Microsoft, General Electric and IBM – and half of the aggregate wealth creation of $35 billion came from just 90 companies.

Thus, the positive market risk premium is attributable to relatively few stocks.

The degree to which wealth creation in stock markets is concentrated in a small number of best-performing firms has increased over time and has been particularly strong over the past three years, when five firms accounted for 22% of net wealth creation.

A subsequent analysis, Gene Hochachka, in “The Distribution of US Stock Returns, 1963-2020”; Frontier Financial, Inc., June 2022, found that the median large-cap stocks comfortably outperformed the return on treasury bills in the period from 1963 to 2020.

That is, when the universe is limited to the 500 largest companies, comprising about three-quarters of the US market capitalization, 59% of companies outperformed treasury bills with an average return of 8.5% versus a return of 4.5% for treasury bills.

The conclusion that the highest returns come from very few stocks overall — just 86 stocks accounted for $16 billion in wealth creation, half of the total stock market, over the past 90 years — led Bessembinder to point out that “the results also help explain why active hedge fund management strategies, which tend to be poorly diversified, most of the time they perform below expectations”.

Access here: