In a previous study of the US stock market, conducted on more than 26 thousand companies between 1926 and 2019, Bessembinder concluded that the concentration of wealth creation was very high.

This study refers to the global stock market, covering 64,000 shares of global companies, between 1990 and 2018.

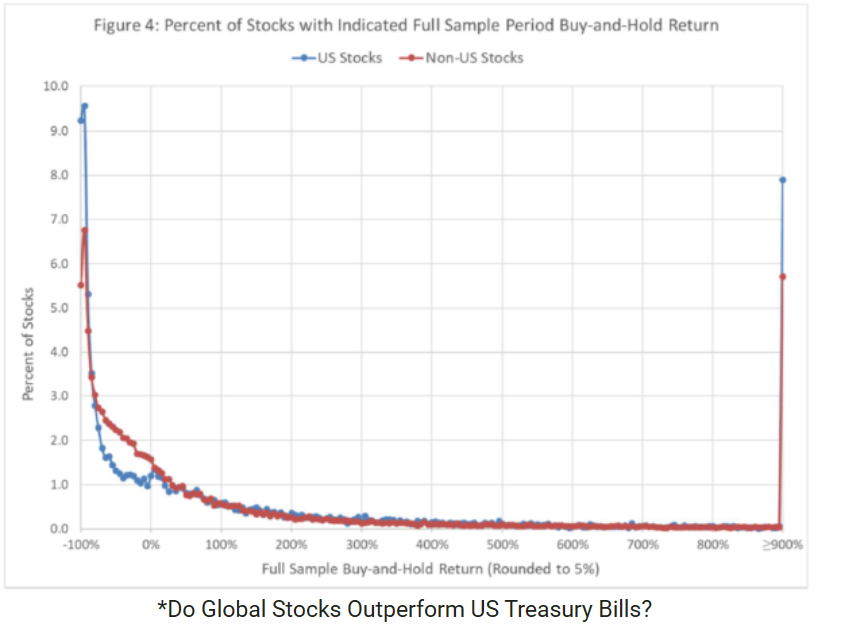

This study shows that Bessembinder’s previous results are not unique to the U.S. and are actually stronger outside the U.S.

The present sample includes 44,476 shares of non-U.S. companies.

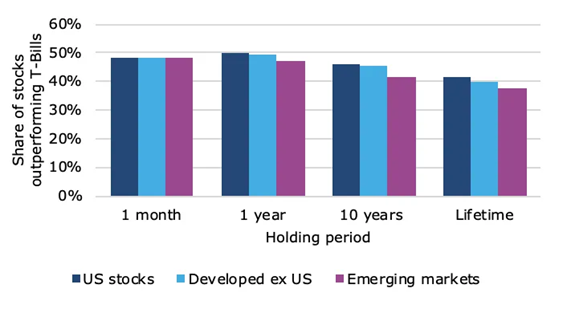

The key takeaway is that while the average cross-sectional return on equities is indeed positive across the 42 countries analyzed, returns for most global equities lag behind returns for U.S. treasury bills at one month over corresponding time horizons.

Only 40.5% of global equities, including 43.7% of U.S. equities and 39.3% of non-U.S. equities, have a return that exceeded the cumulative return for one-month U.S. treasury bills over corresponding time horizons.

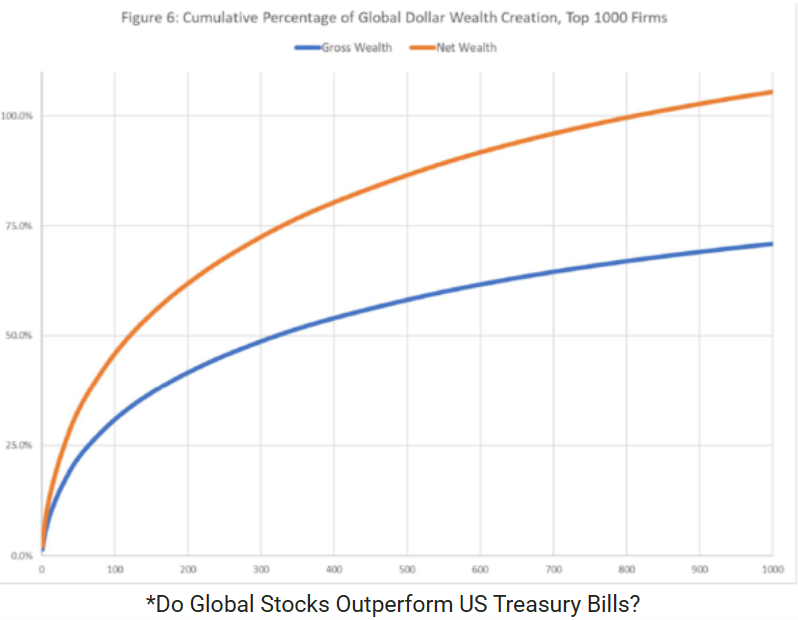

A large part of the overall wealth creation in the stock market comes from just a few companies.

Of the $79.87 trillion (gross) or $56.24 trillion (net) of shareholder wealth created by 64,000 shares from 1990 to mid-2020, the top 20 companies accounted for 15% of gross wealth creation and 22% of net. And the 50 largest companies accounted for 24% of gross wealth creation and 34% of net wealth.

The five companies (0.008% of the total) with the highest wealth creation during the period from January 1990 to December 2018 – Apple, Microsoft, Amazon, Alphabet and Exxon Mobile – accounted for 8.27% of global net wealth creation and 5.56% of global gross wealth creation.

The 306 best-performing companies (0.5% of the total) accounted for 73.03% of global net wealth creation and 49.08% of global gross wealth creation.

The 811 best-performing companies (1.33% of the total) accounted for all global net wealth creation and 67.20% of global gross wealth creation.

Outside the U.S., the 111 companies (0.25% of the total) with the best performance accounted for 34.18% of gross wealth creation and more than two-thirds (69.20%) of net wealth creation.

The 221 best-performing non-U.S. firms (0.50% of the total) accounted for 46.32% of gross non-U.S. wealth creation and more than nine-tenths (93.79%) of net non-U.S. wealth creation.

The 441 best-performing non-U.S. firms (1% of the total) accounted for 59.94% of gross creation and 121.37% of net wealth by non-U.S. firms.

That is, less than one percent of the non-U.S. companies in the sample accounted for all net wealth creation in the non-U.S. stock market during the sampling period from January 1990 to December 2018.

Returns on developed market equities outside the U.S. (40.0%) more often outperform U.S. Treasuries compared to emerging market equities (37.6%).

The share of stocks with returns above US one-month Treasury bills is above 50% in only 7 of the 42 countries in the sample.

The results are also relevant to the debate over active stock selection versus passive holding of broadly diversified stock indices.

The results show that the wealth created by investing in the stock market is largely attributable to the positive outcomes of relatively few stocks.

For those investors without a comparative advantage in identifying the few stocks that will create the most wealth (or in selecting a manager with the ability to do so), and without a substantial preference for positive asymmetry, the results reinforce the desirability of investing in a broad passive ratio.

On the other hand, for the (presumably few) investors with the proper comparative advantage, the results highlight the degree to which a successful stock selection can increase wealth.

Less than half of the stocks in any market outperform investing in treasury bills and the longer the holding period, the fewer stocks can outperform.

This is a reflection of the increase in the asymmetry of returns due to the effect of capitalization.

As the investment horizon grows, more and more stocks will suffer severe declines, and many will eventually go to zero.

Thus, performance focuses on fewer and fewer winners over time.

Access here:

https://klementoninvesting.substack.com/p/let-your-winners-run