Financial markets were performing excellently until late February, when Trump began talking about his tariff plans

Global economic growth forecasts were also good

On April 2, Trump’s reciprocal tariffs came, putting the effective rate at the highest level in the last 100 years

These unreasonable and absurd fees have brought down financial markets globally

With repercussions on long interest rates and the dollar, signs of distrust and loss of credibility in the American economy

The immediate negative reactions of the debt and currency markets caused the Trump administration on April 9 to lower tariffs to the 10% level for all countries except China, the only country that had reciprocated the tariff increases

The economic effects of these tariffs soon began to be felt in the US, China and other countries around the world

Now, the news of the first trade agreements is awaited to know the general model followed, and the most impactful will be the (later) Chinese

The tariffs imposed by President Trump in April have rattled financial markets and altered global trade patterns. Now, they are also affecting economic growth and inflation.

Given this situation of tariffs, how should we act in the management of our investment portfolio?

This is the question we will answer in this series of articles.

To do so, we begin by making a review of the events in this first article, that is, the framing of the situation.

In the following articles we will develop what is behind the tariff plan, that is, its objectives, integrating it into the tripartite economic agenda of this Trump term: tariffs, taxes and deregulation.

We will then examine the conditions necessary for the implementation of this policy, which are based on the approval of the multiannual budget that will be made by the summer, in the context of its effects on the deficit and public debt.

Then we will evaluate the possible scenarios for the development of the tariff negotiations.

Finally, we will combine the 3 major economic policy actions to project the investment scenarios in the short and medium term.

Financial markets were performing excellently until late February, when Trump began talking about his tariff plans

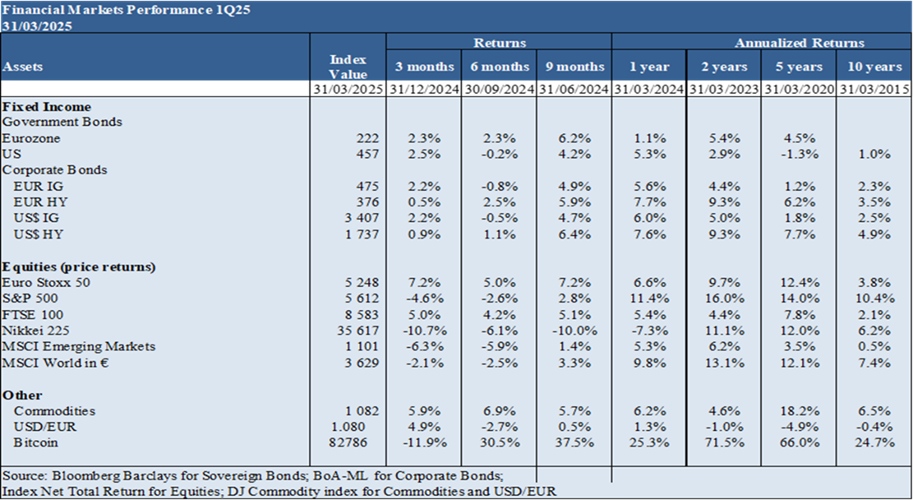

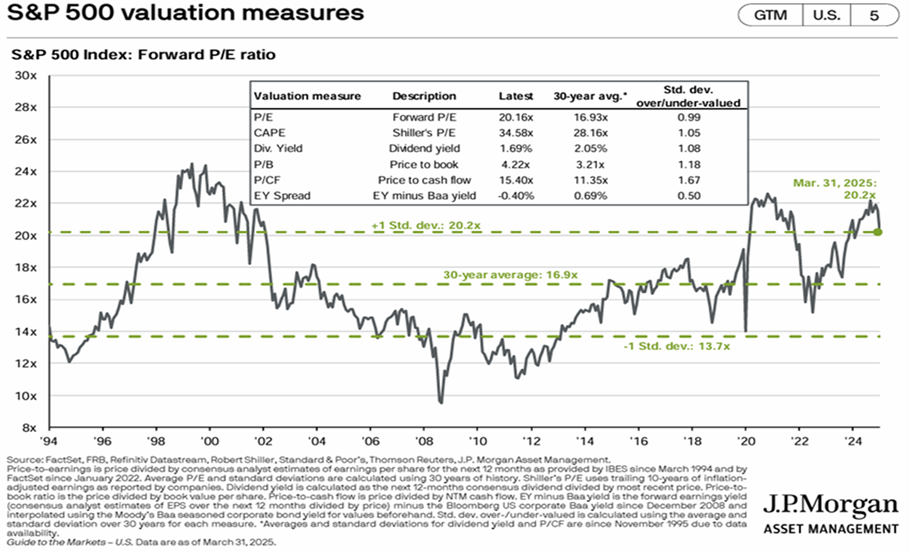

In the first months of this year, the financial markets were performing excellently.

In mid-February, Trump began announcing the tariff plan and the markets corrected slightly.

The S&P 500 index, the main index of the American stock market, started the year at the … points, reached a high of 6,200 points in mid-February, and settled on the … at the end of March.

Global economic growth forecasts were also good

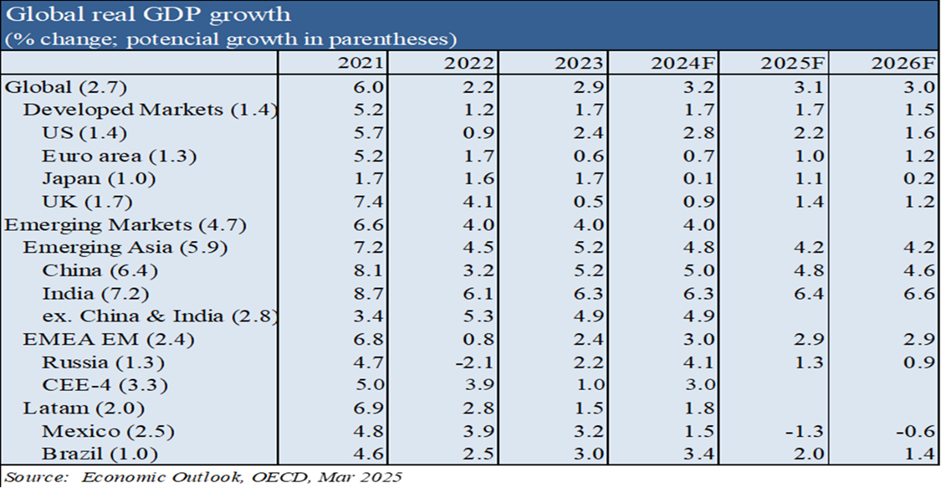

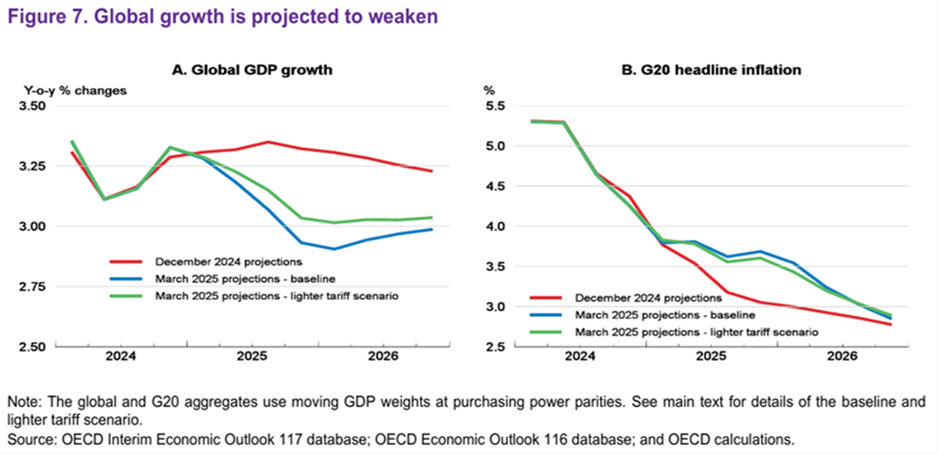

At the end of March, growth forecasts for the global economy were also positive, even assuming a moderate tariff plan

In March, the OECD’s global economic growth forecasts were at a good level, above 3%, similar to the last 2 years.

Growth in Western countries was expected to be more in line, with robust levels decreasing by the US and Europe rising.

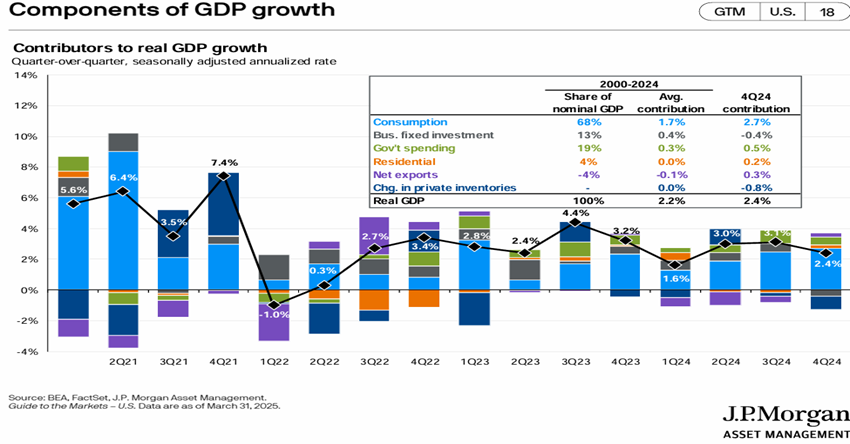

In particular, US economic growth has been quite solid over the past 2 years, very much driven by consumption:

Assuming a scenario of light tariffs, the OECD forecast in March a reduction in growth and an increase in inflation, in both cases mild, for the US.

On April 2, Trump’s reciprocal tariffs came, putting the effective rate at the highest level in the last 100 years

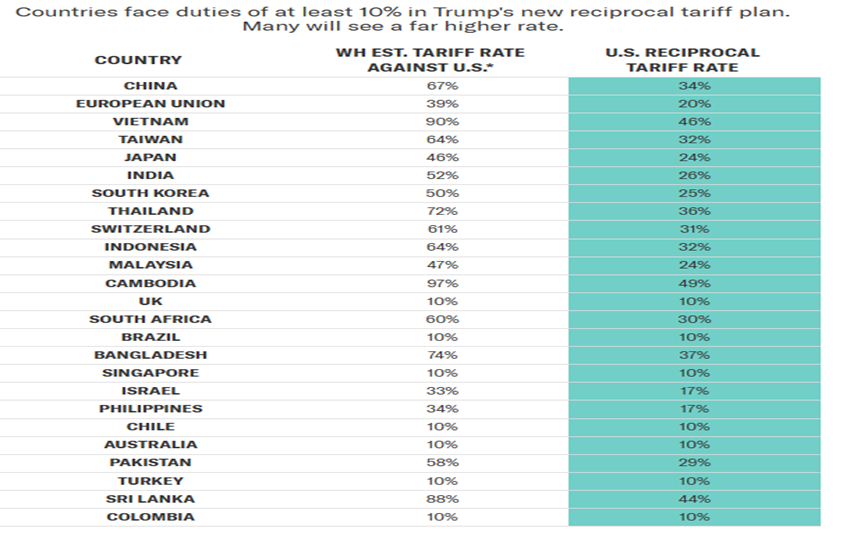

On April 2, Trump announced his plan for reciprocal tariffs for the various countries:

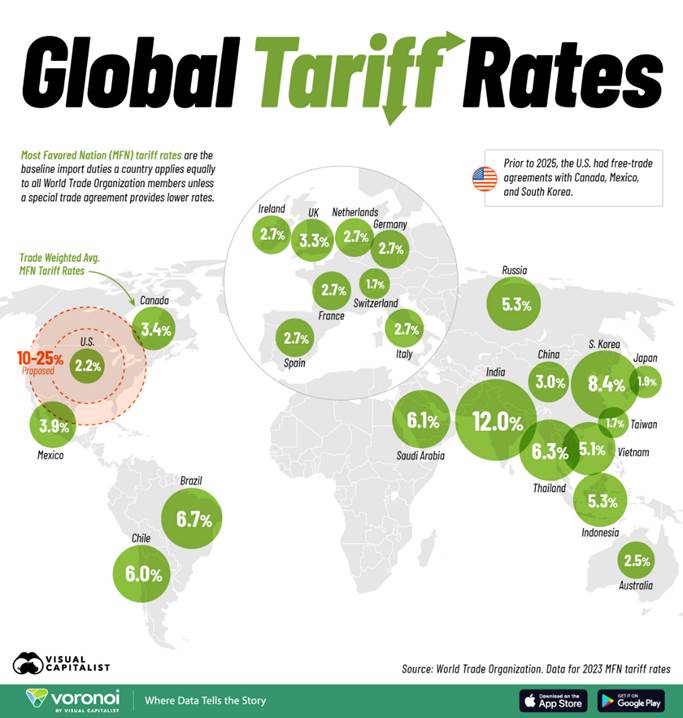

The Trump administration applied these reciprocal tariffs, since it assumed that they were the actual tariffs imposed by different countries on the U.S. in any form, including tariffs, taxes, export subsidies, and currency devaluation.

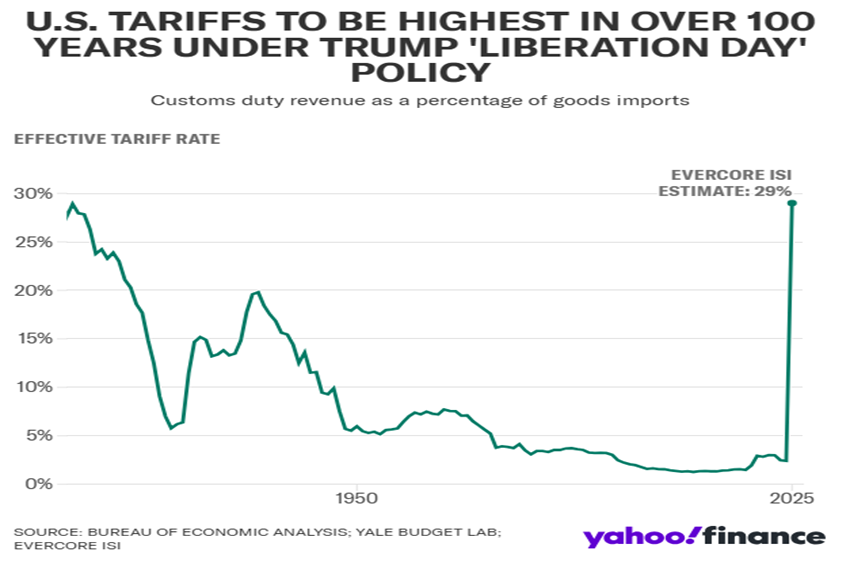

This increase means an increase in the effective rate of US tariffs to a level only seen more than 100 years ago, when the size and density of world trade was much lower.

The formula used to establish these tariffs is totally unreasonable and has no adherence to the tariffs determined by international organizations such as the WTO:

The April tariffs were calculated as the ratio between the deficit and the value of imports.

What the application of this figure results in is a zero trade deficit, without any assessment of the rational situation and the advantages of trade.

These unreasonable and absurd fees have brought down financial markets globally

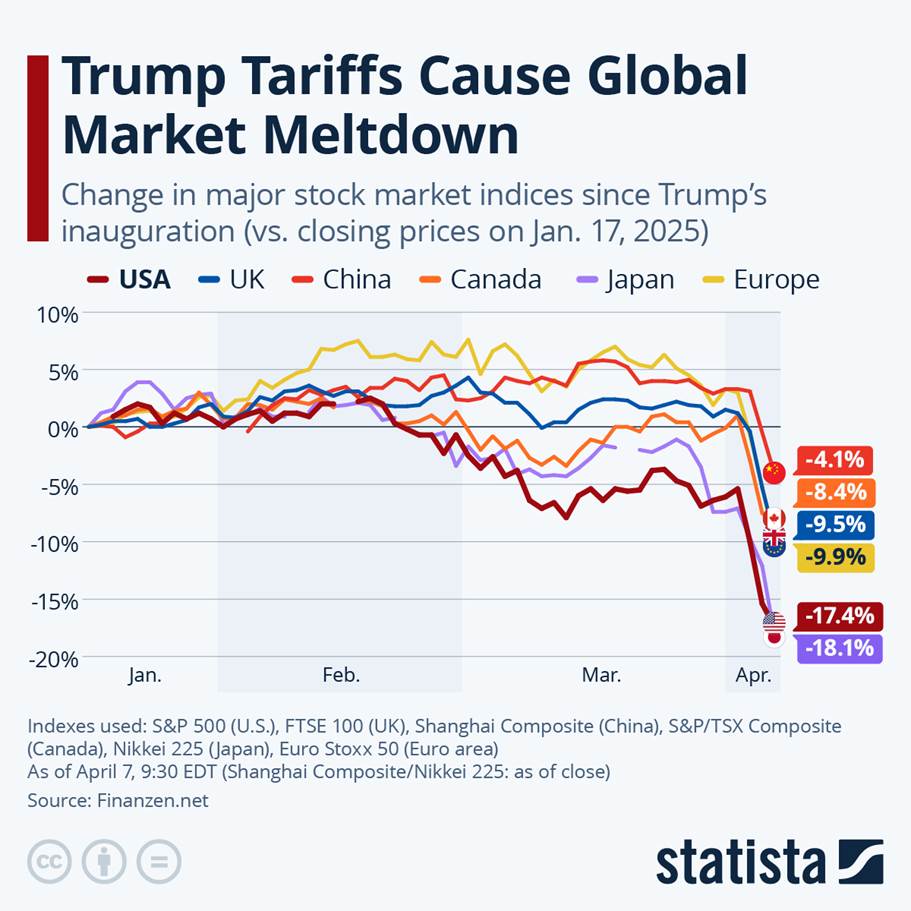

Naturally, the imposition of these tariffs caused a strong shock in the global financial markets.

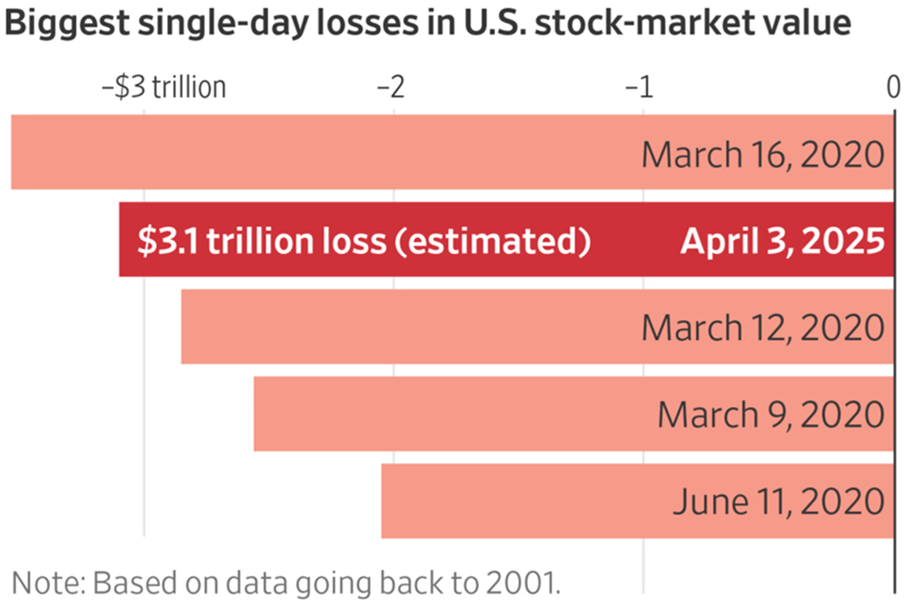

On the first day of trading alone, the world’s major stock indices lost 10% and more than $3 trillion in the US alone:

Since Trump began talking about tariffs in the second half of February, US stock markets have lost $9 trillion, and more than 20% of peak levels, entering a bear market.

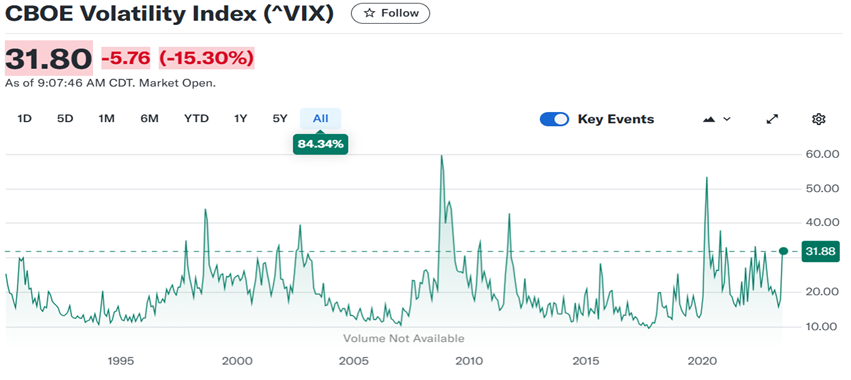

The VIX index, which measures the volatility of the markets, soared to more than 40, considered abnormally high:

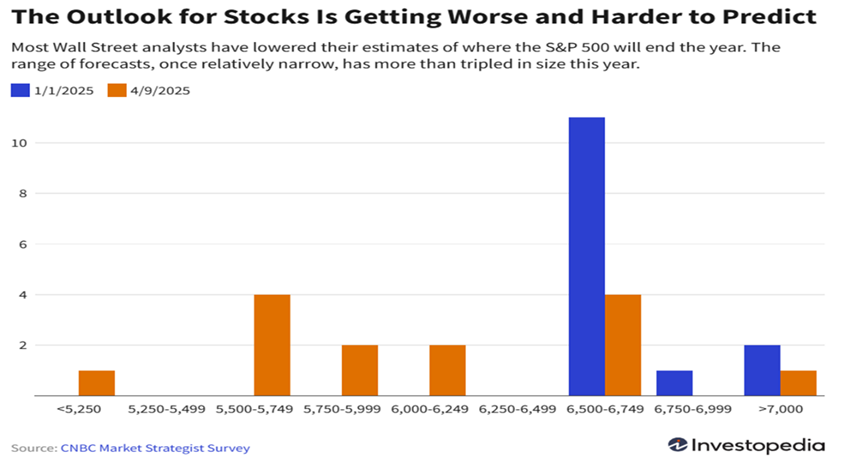

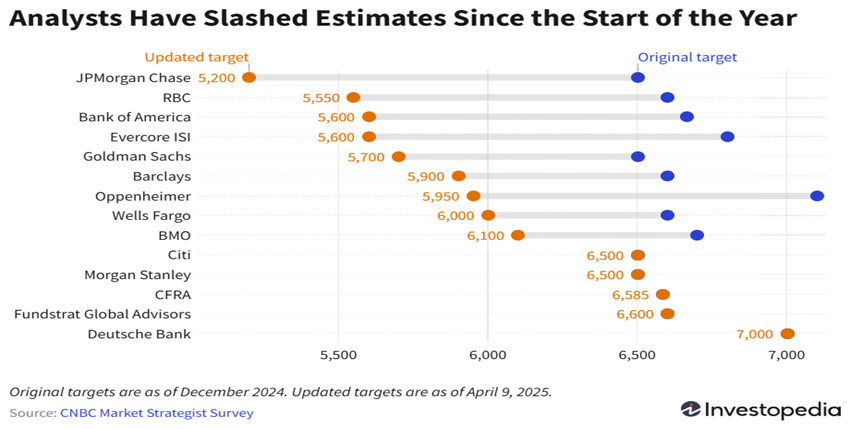

The world’s leading investment banks have revised down their forecasts for market valuations, lowering the target prices of the S&P 500 index for the end of the year from more than 6,500 points to 6,000 points, on average:

Today, after successive revisions, these forecasts are even lower, close to 5,600 points.

With repercussions on long interest rates and the dollar, signs of distrust and loss of credibility in the American economy

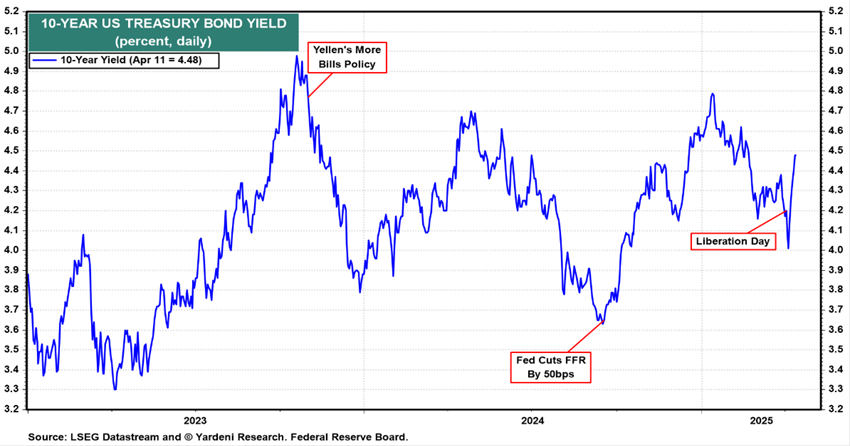

The April 2 tariffs also had a considerable impact on the prices of safe-haven financial assets, in particular the interest rates on long government bonds and the dollar.

In a few days, interest rates on 10-year US treasury bonds passed the 4.5% barrier

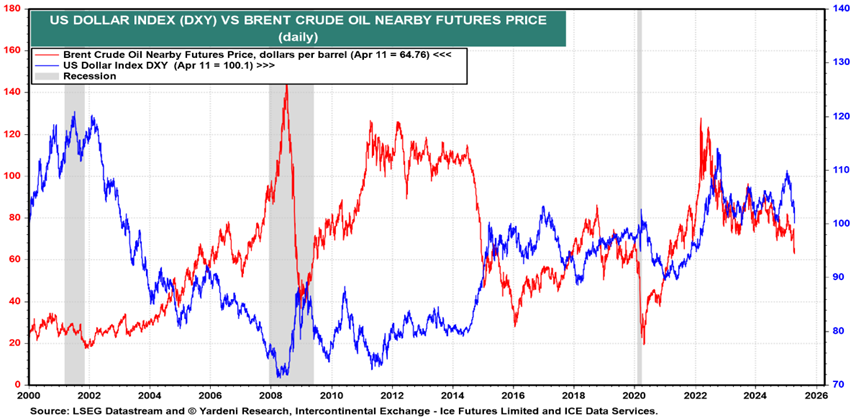

And the dollar accentuated its devaluation trajectory:

These movements signal not only a worsening of the growth prospects for the economy, but also a loss of confidence in the US by investors.

The only asset that appreciated significantly was gold.

The immediate negative reactions of the debt and currency markets caused the Trump administration on April 9 to lower tariffs to the 10% level for all countries except China, the only country that had reciprocated the tariff increases

This negative spiral in the debt and foreign exchange markets caused changes to the initial tariffs.

On April 9, Trump replaced the plan of variable tariffs per country with a common tariff of 10% for all countries except China, which he maintained at the initial level of 145%.

It was announced that these new tariffs will be in force for 90 days, until July 9, during which time negotiations on new trade agreements will take place.

Of course, the tariffs on trade between the US and China, at 145% and 125% respectively, are absurdly high, and are basically equivalent to an embargo.

The economic effects of these tariffs soon began to be felt in the US, China and other countries around the world

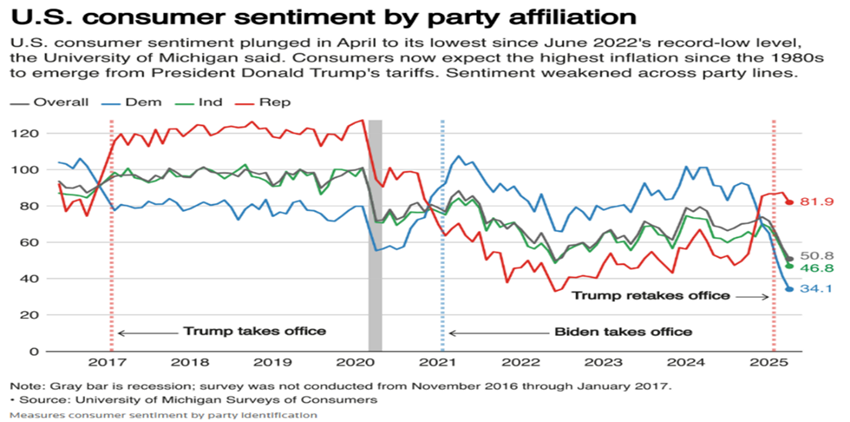

Economic data have begun to show the effects of these tariffs, all over the world.

In the US, consumer confidence has deteriorated considerably, as “Michigan Consumer Sentiment” showed on April 11. Consumers raised inflation expectations to 6.7% at 12 months from the level of 5% in March, and to an average of 4% over the next 5 years when the central bank’s FED target is 2%.

The vast majority of economists lowered growth forecasts and increased inflation projections.

The Fed chairman himself has stated the increase in economic uncertainty and risks to US growth and inflation.

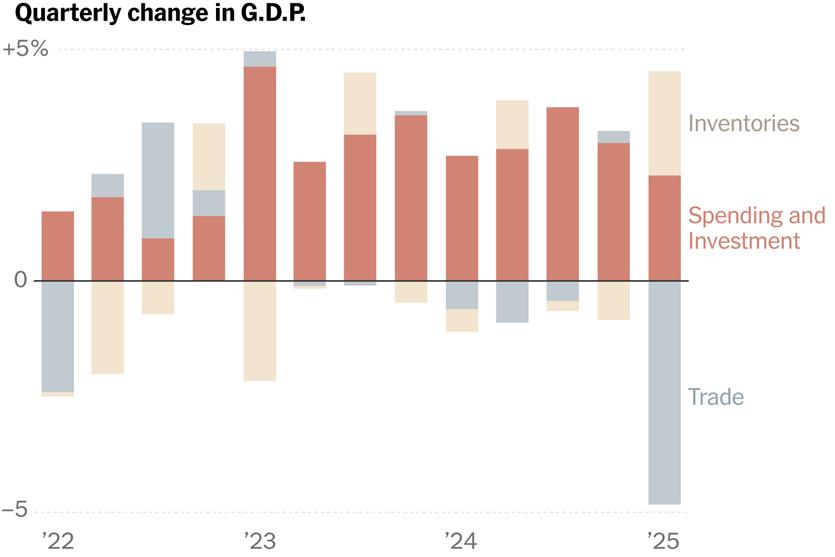

More recently, first-quarter GDP data for the U.S. shows a contraction of 0.3%, due to the substantial increase in imports in anticipation of tariffs.

The latest economic data from the Chinese economy also show a cooling of activity, admitting that the authorities will have to launch a style plan to compensate for the situation.

In other countries, signs of slowing down are also noticeable, especially in Mexico and Canada, but also in Europe, Japan and Latin America.

Now, the news of the first trade agreements is awaited to know the general model followed, and the most impactful will be the (later) Chinese

The Trump administration says that almost all countries have approached the US to negotiate new trade agreements.

It points out that negotiations are underway with 17 of the 18 main trading partners, i.e. all except China.

It is admitted that the first agreements may be announced in the coming days, possibly with India, South Korea, Japan, or the United Kingdom.

Given their size and importance, the agreements with Mexico and Canada will come later, and the agreement with China will certainly have the broadest horizon.

The first agreements will be important to understand the general model and the base tariff rule followed by the US.

The longest deal with China will be the most impactful given its one-third share of the total U.S. trade deficit, as well as the density of integration into some critical supply chains (e.g., rare minerals, consumer electronics, small and large U.S. retailers, etc.).