The second quarter ends on a slight note, with a lot of volatility, to the sound of Trump’s tariffs and the preparation of his “big, beautiful tax and spending bill”.

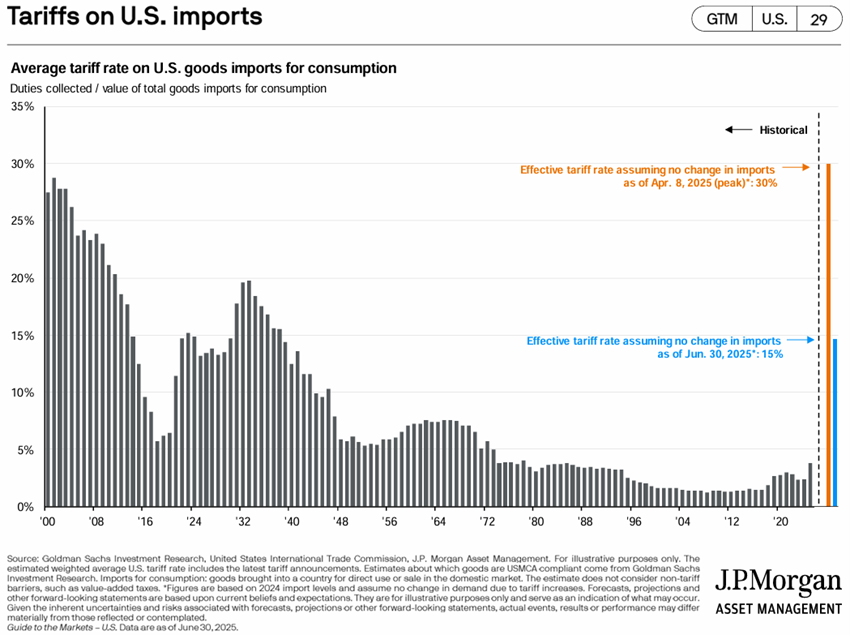

Equity markets retreated to correction levels shortly after the astronomical tariffs announced on the “liberation day” in early April, and recovered with the decrease in the base tariff and the passage of time for negotiating trade agreements that ends on July 9.

This quarter is decisive for Trump’s second term, in economic terms, as the “tax and spending bill”, which defines his economic options, is expected to be approved in this period.

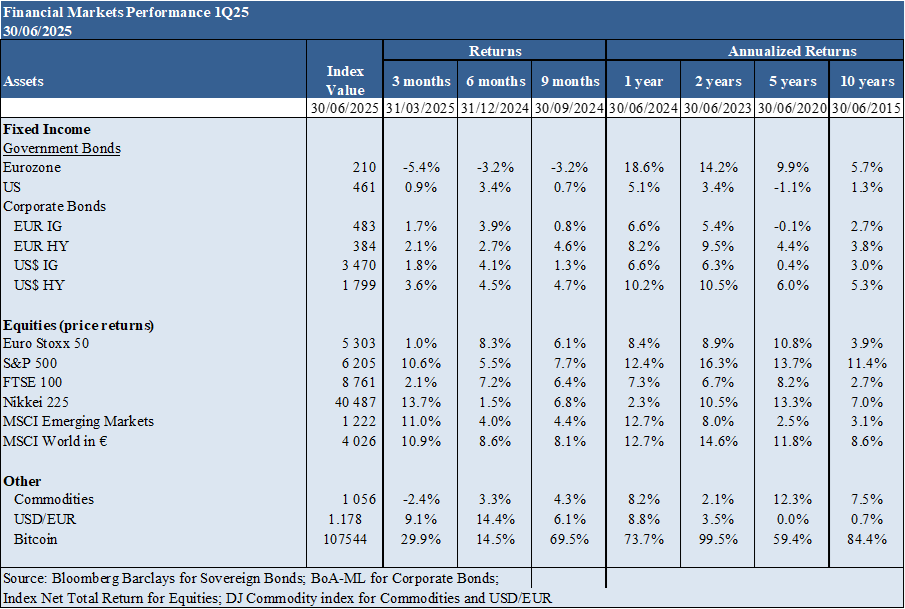

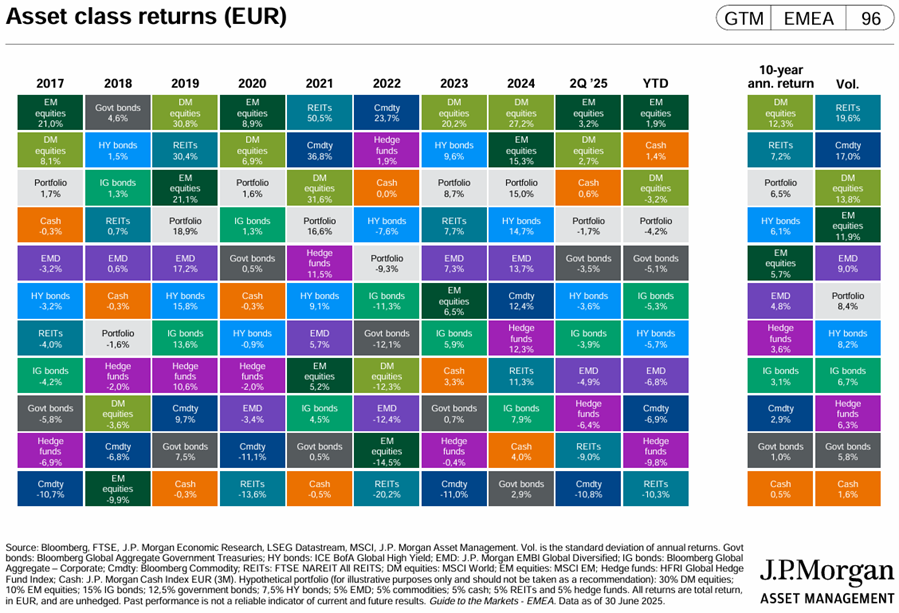

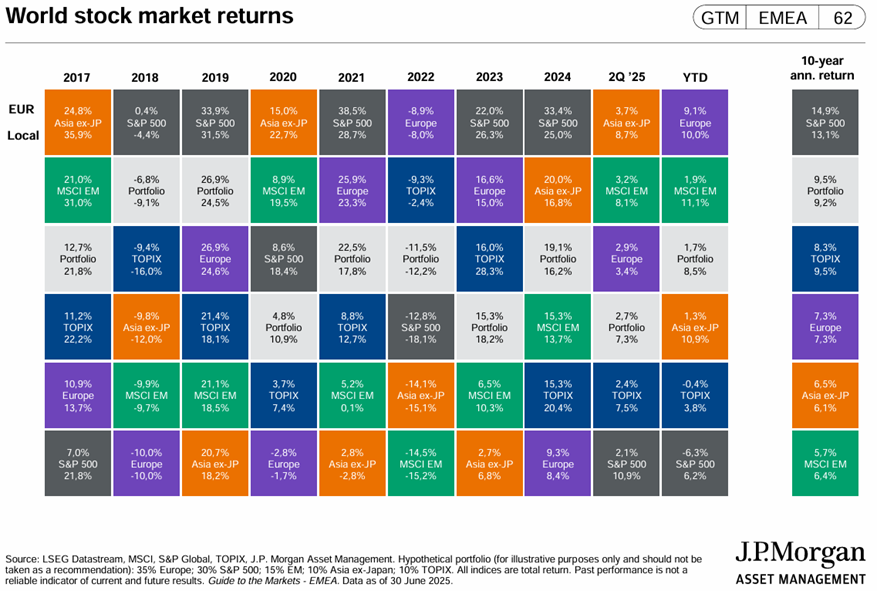

Performance 2Q25 Markets: Developed countries’ actions are close to peak levels. U.S. stocks appreciated 10% in the quarter, with great volatility due to the tariffs imposed by Trump.

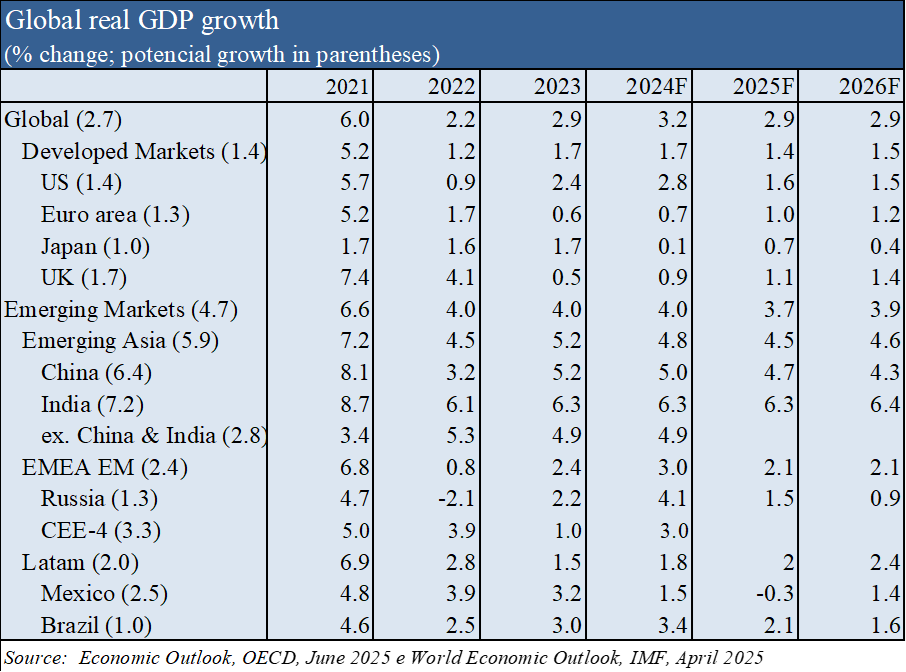

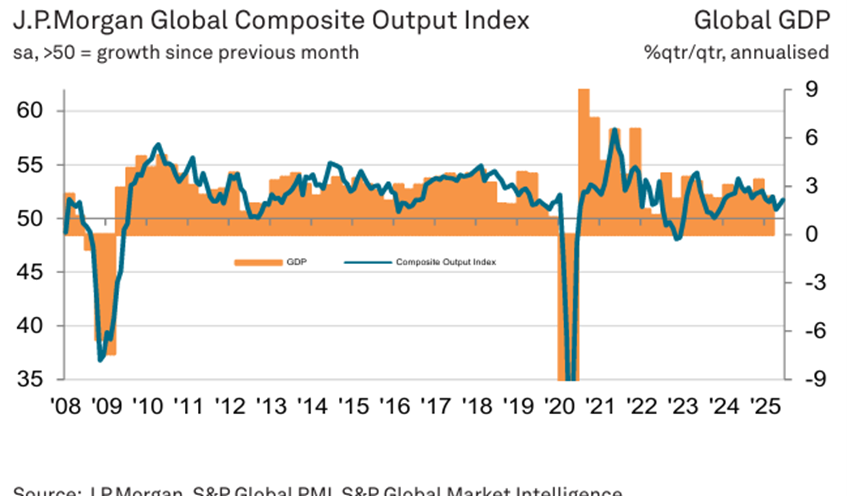

Macro Context: Global economic growth remains at a moderate pace, with inflation rates around 2% in the Eurozone, and 2.4% in the US, under the influence of new trade tariffs.

Micro Context: Leading instantaneous and advanced economic indicators are stable almost everywhere in the world.

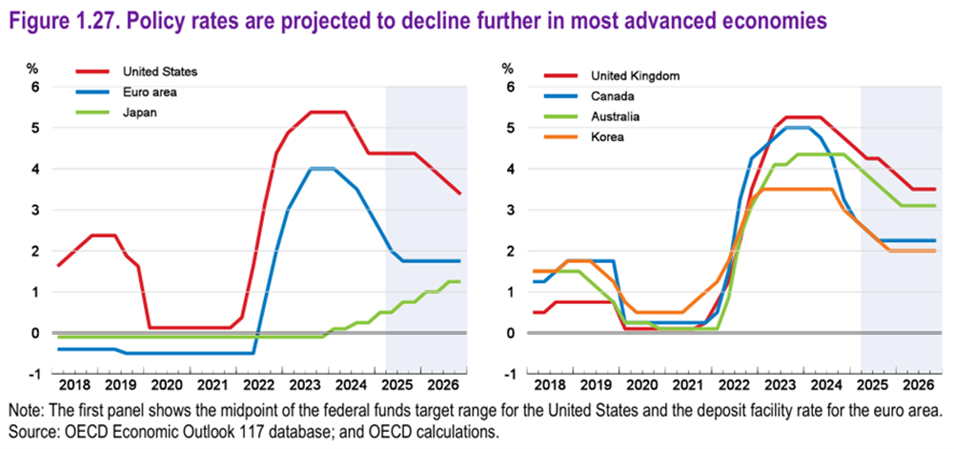

Economic policies: The Fed maintained official interest rates, while the ECB and BoE continued their reductions. The focus of attention this quarter will be on the fiscal policy of this Trump term, centered on the “tax and spending bill” and trade tariff agreements.

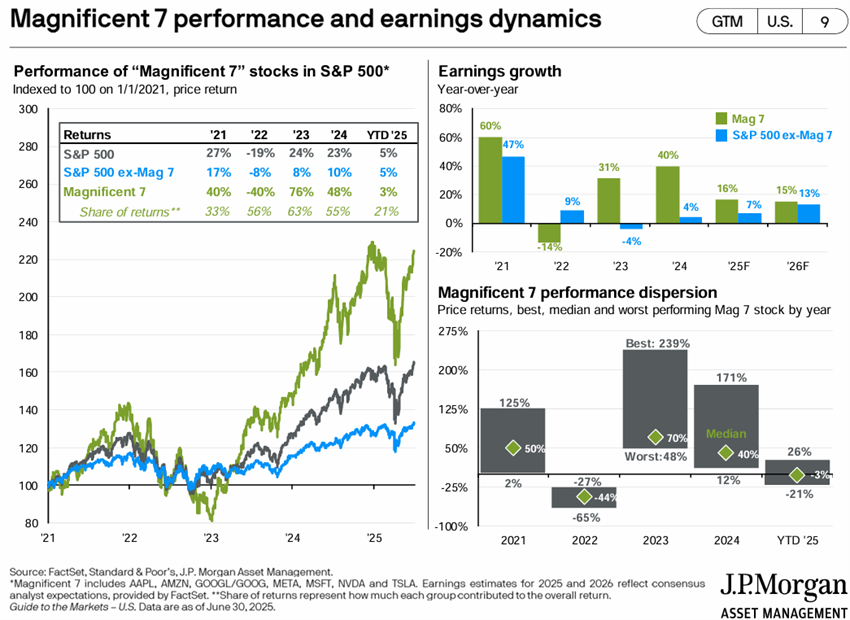

Equity markets: Equity markets at all-time highs, with a lot of volatility in the US, associated with Trump’s tariff policy.

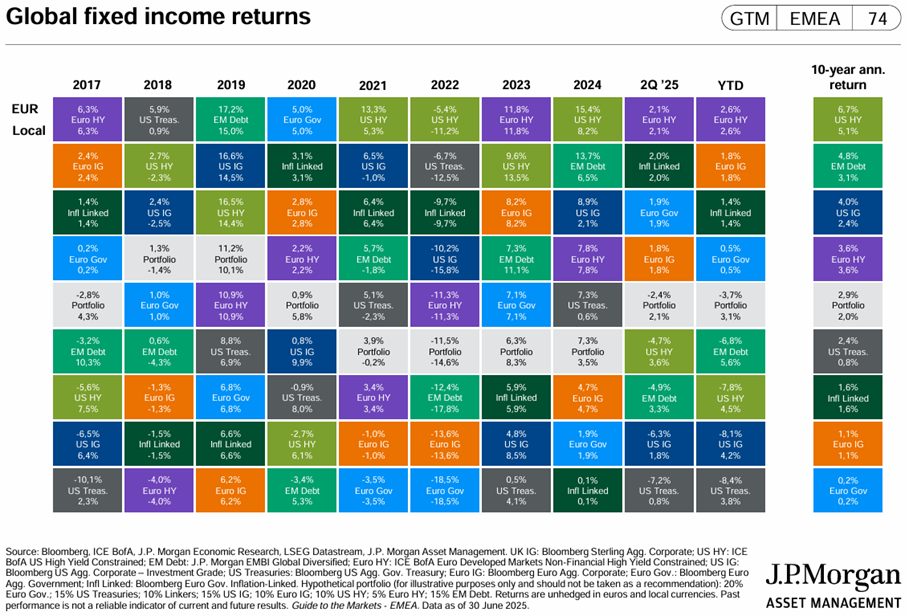

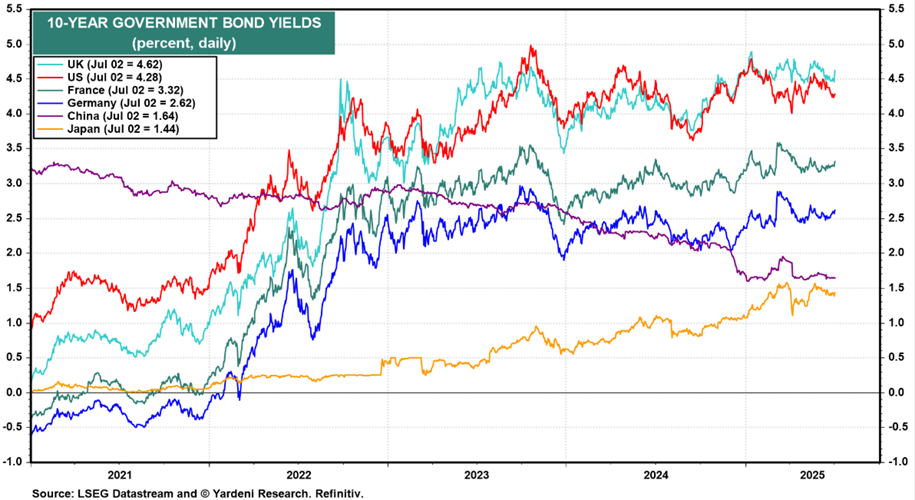

Bond markets: Long interest rates fell in developed economies, valuing bond investments as credit spreads held.

Key opportunities: The possibility of a resumption of the decline in official interest rates in the US.

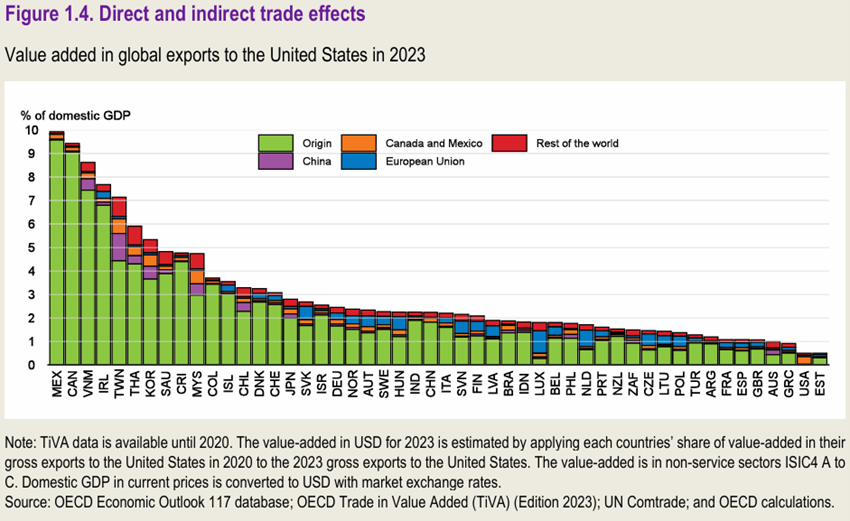

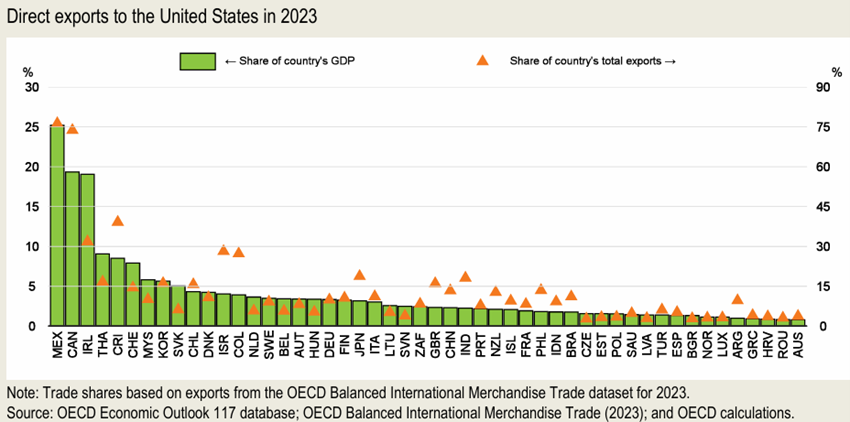

Main risks: The effects of a poor outcome of Trump’s tariff negotiations with key partners, namely China, the eurozone and Japan.

Financial markets in a positive macro context, and under the influence of the impacts of Trump’s fiscal policy, on tariffs and inflation.

Financial markets performance in 2Q25: Developed country equities are close to peak levels. U.S. stocks appreciated 10% in the quarter, with great volatility due to the tariffs imposed by Trump.

The main stock indices of developed markets are close to peak levels. This year, the performance of US stocks is lower than that of European stocks, bucking the trend of the last 12 years (and local currency, that is, without considering the 14% devaluation of the dollar).

Western bond markets appreciated slightly in the quarter as interest rates declined.

Cryptocurrencies have risen to an all-time high of $108,000.

Macroeconomic context: Global economic growth remains at a moderate pace, with inflation rates around 2% in the Eurozone, and 2.4% in the US, under the influence of new trade tariffs.

According to the OECD’s June forecasts, global economic growth will be 2.9% in 2025 and 2026, with a reduction in the US and an increase in the Eurozone.

Inflation is estimated to fall from 3.6% in 2025 to 3.2% in 2026 in the G20 countries, but with the possibility of an increase in the US due to the increase in tariffs.

.

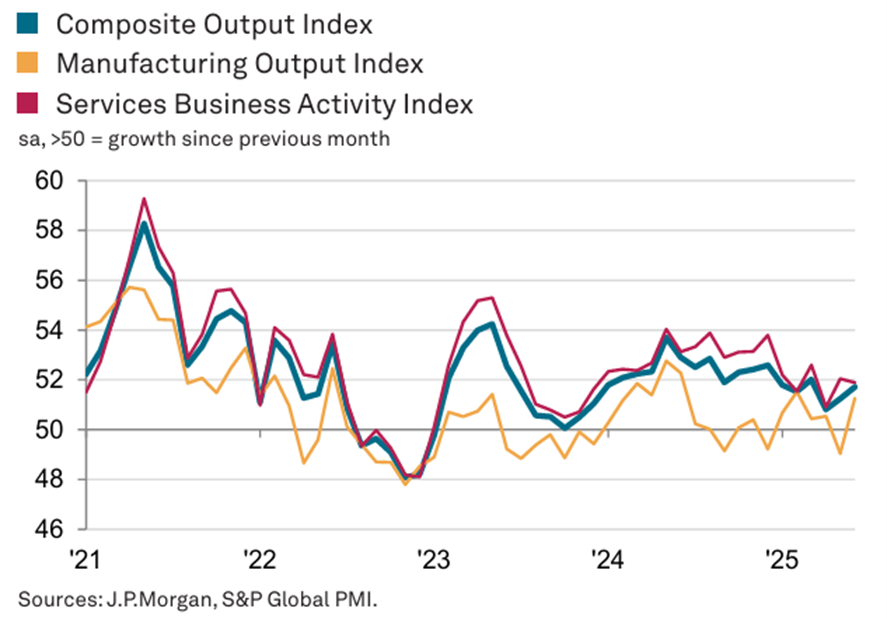

Microeconomic context: Leading instantaneous and advanced economic indicators are stable almost everywhere in the world.

The overall services activity index registered 51.9 in June, slightly above the 51.3 of its industrial equivalent.

Economic policies: The Fed maintained official interest rates, while the ECB and the BoE continued the reductions. The focus of attention this quarter will be on the fiscal policy of this Trump term, centered on the “tax and spending bill” and trade tariff agreements.

Trump’s tax and spending bill is expected to be approved this quarter.

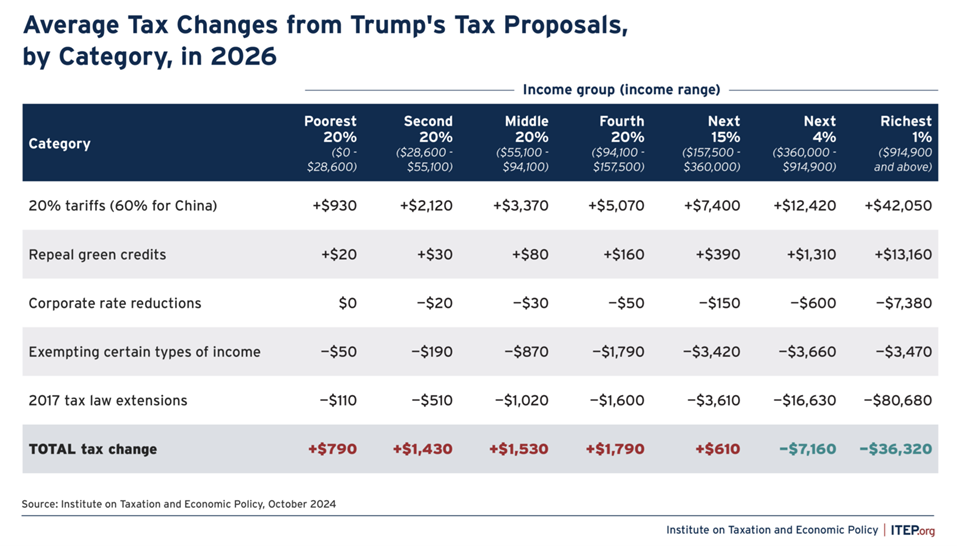

This law constitutes the economic program of Trump’s second term, establishing the extension of the tax cuts instituted in 2017 and that would end in 2025, at the expense of cuts in incentives for renewable energy, health and social spending.

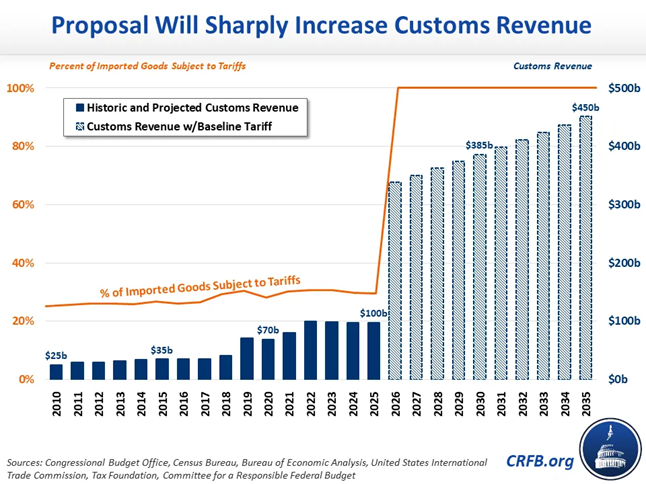

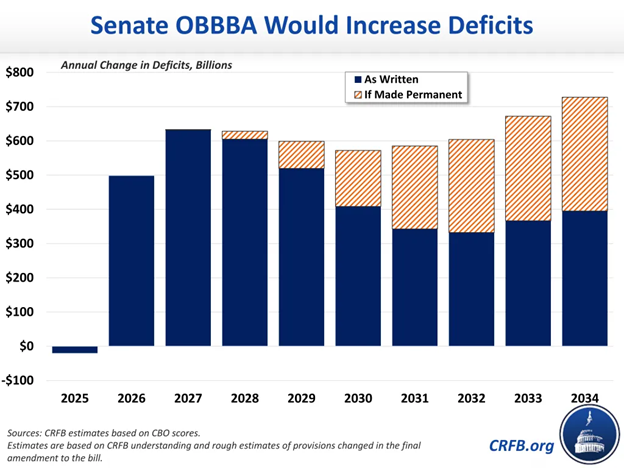

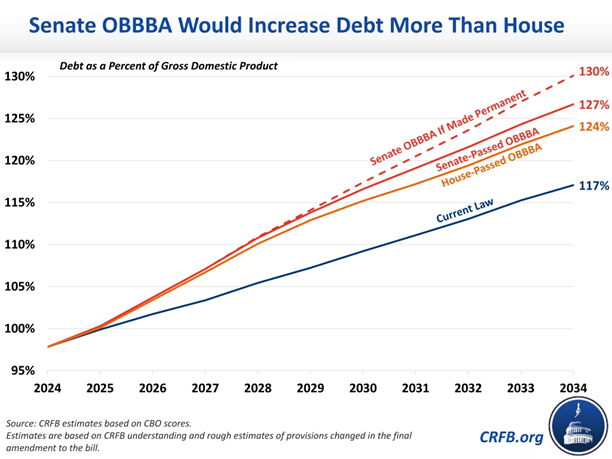

As a result of this law, which is being approved by the Senate, independent analysts predict an increase in public debt by $3.4 trillion by 2034, and the corresponding ratio to GDP to 127%.

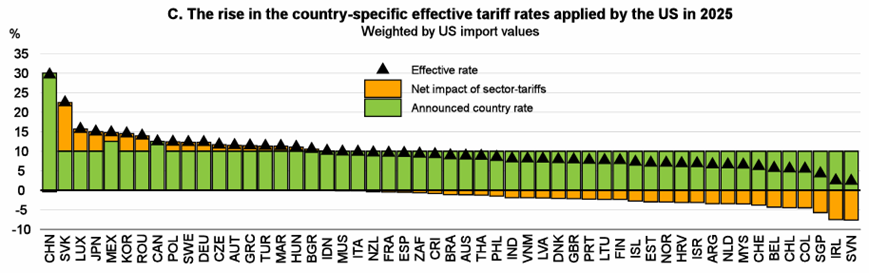

Trump has argued that tariff revenues resulting from the increase in customs duties will reduce these values, which conditions the ongoing negotiations with trading partners.

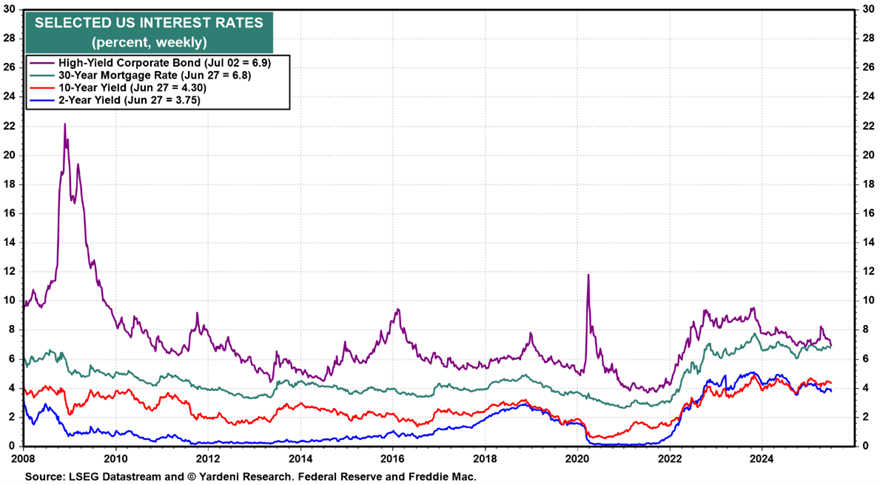

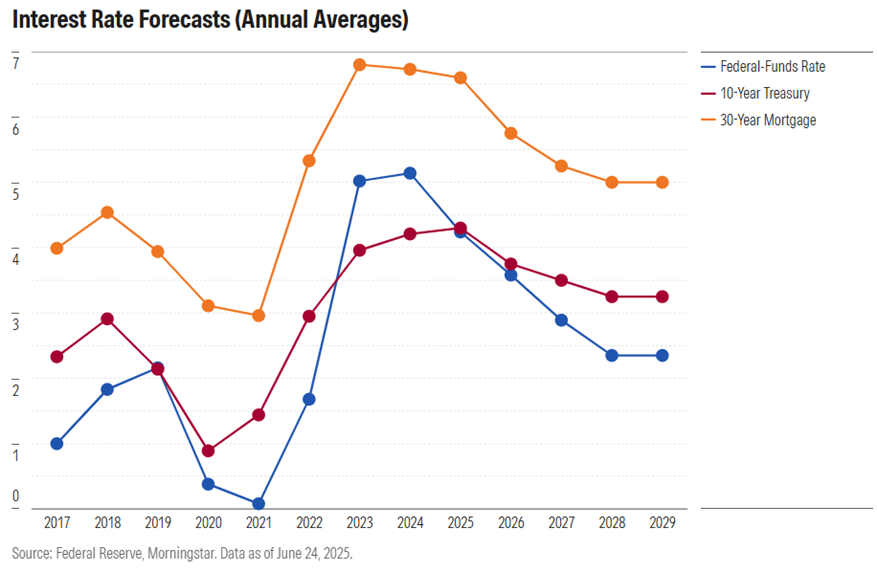

In Q1, the Fed kept official interest rates at %-4,5%, projecting 2 cuts (i.e., 0.5%) for this year, justifying prudence by the inflationary effects of the increase in tariffs.

The ECB lowered official rates to %-2.40% in June.

The Bank of England kept the official interest rate at 4.25% in June.

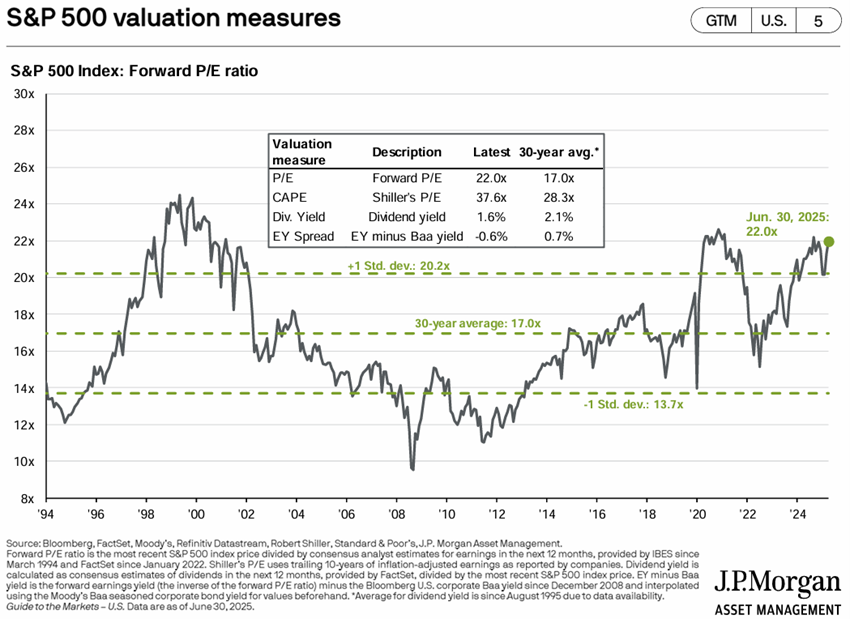

Equity market assessment: Equity markets at all-time highs, with a lot of volatility in the U.S., coupled with Trump’s tariff policy.

The US stock market has recovered losses since the pre-announcement of Trump’s tariffs in late February.

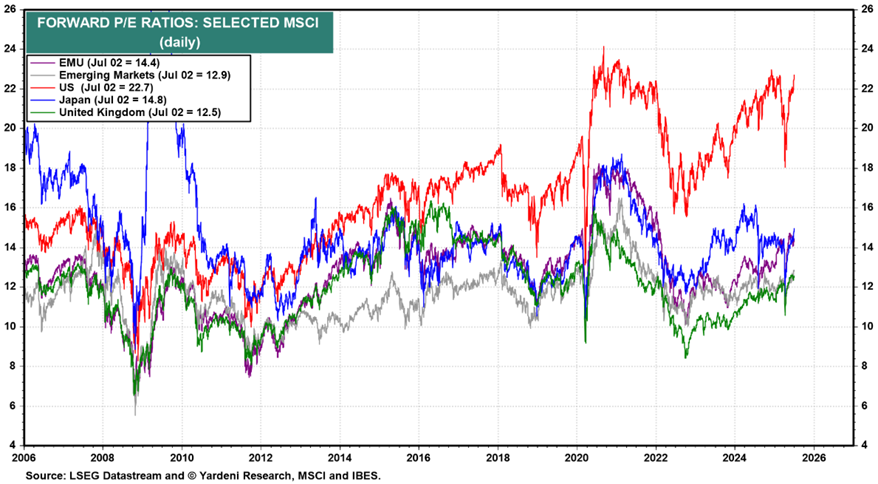

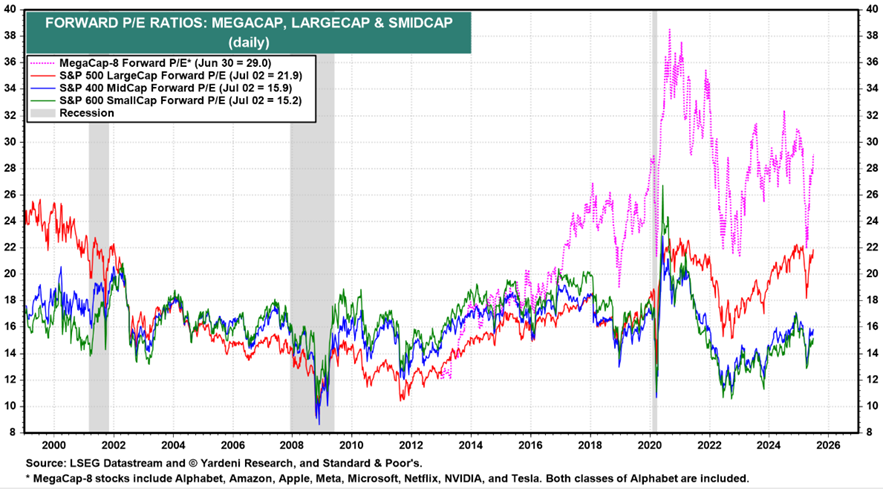

The 22x forward PER for the U.S. is still above the long-term average, dropping to 19x without the 10 Mega Caps.

Japan’s PER is at 14.8x, Eurozone’s at 14.4x, 12.5x for the UK and 12.9x in emerging markets.

The PER of mid-cap and small-cap U.S. stocks are both at 15.9x to 15.2x, slightly above the long-term average.

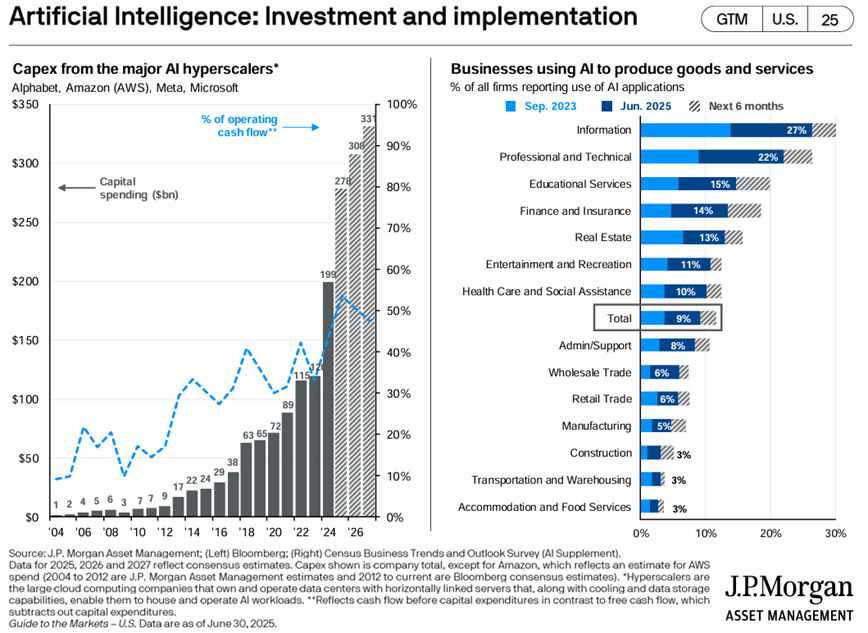

Annual investments in AI by hyperscalers continue to increase at a good pace, reaching an average value of $300 billion over the next 3 years.

Bond market assessment: Long interest rates have fallen in developed economies, increasing the value of bond investments as credit spreads have held.

Long-term risk-free interest rates have fallen in developed countries.

Credit spreads in the US and Europe rose slightly due to economic and geopolitical uncertainties.

The Fed is at a crossroads for the resumption of rate reductions. The proximity of 2% inflation and signs of slowing economic growth could justify the decline, but the increase in tariffs has increased inflationary expectations.

Main opportunities: The possibility of a resumption of the decline in official interest rates in the US.

The Fed may announce the resumption of tariff reductions in September, with positive effects on the stock markets, as has been happening in the Eurozone.

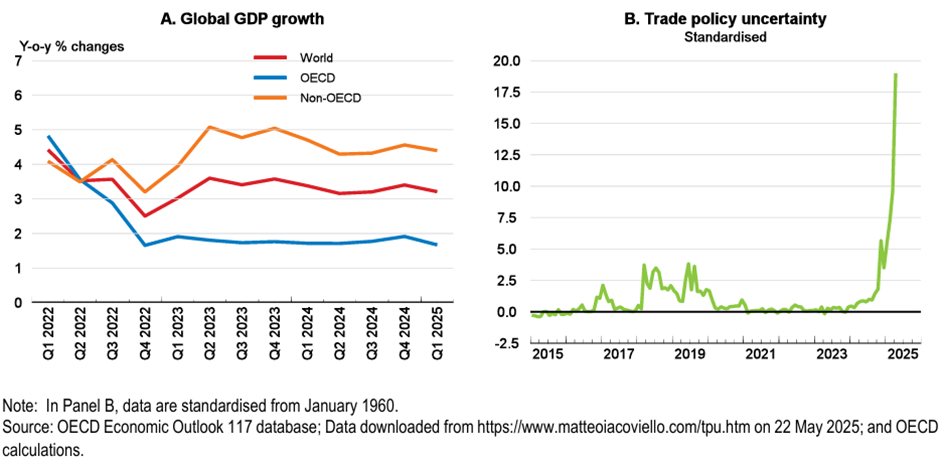

Main risks: The effects of a poor outcome of Trump’s tariff negotiations with key partners, notably China, the eurozone and Japan, and the long-term impacts of worsening US debt.

Trump needs a significant amount of tariff revenue to mitigate the worsening of his domestic fiscal policy, which makes negotiations difficult and increases inflationary risks.

On July 9, the period defined by Trump for the establishment of new trade agreements with more than 50 partners ends, with new tariffs imposed by Trump being announced to be in force until August 1 (to date there are only two agreements concluded, with the United Kingdom and Vietnam).

There are risks for the markets if the development of negotiations with relevant partners such as China, the Eurozone and Japan is unsuccessful.

Tariffs fragment the global economy, reduce economic growth, increase inflation, prolong tight monetary policy and cause a reassessment of financial markets.

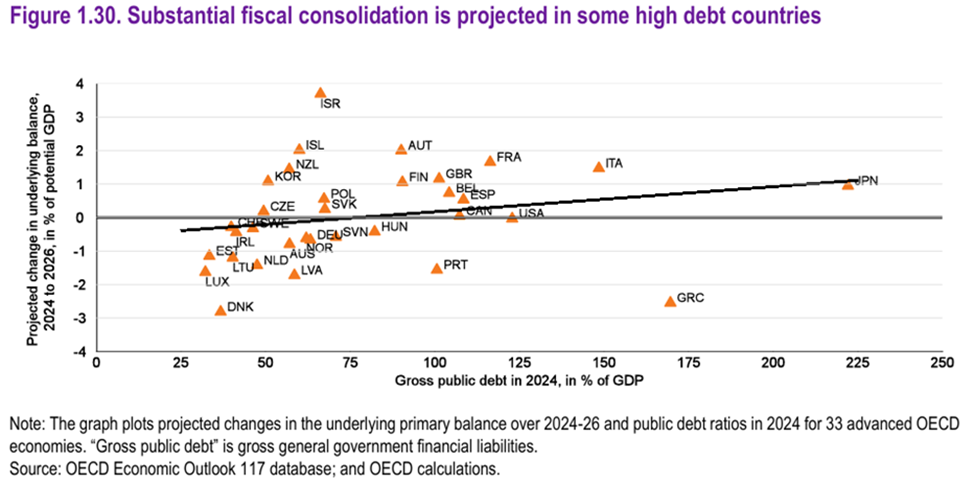

On the other hand, many Western countries face serious problems of public debt containment, namely Italy, France, the United Kingdom and the USA.

The US tax and spending bill will considerably aggravate an already difficult starting fiscal situation, with a deficit of 6.7% and a debt of 100% of GDP this year, which led to the loss of the AAA rating by the last of the 3 major agencies (Moody’s).

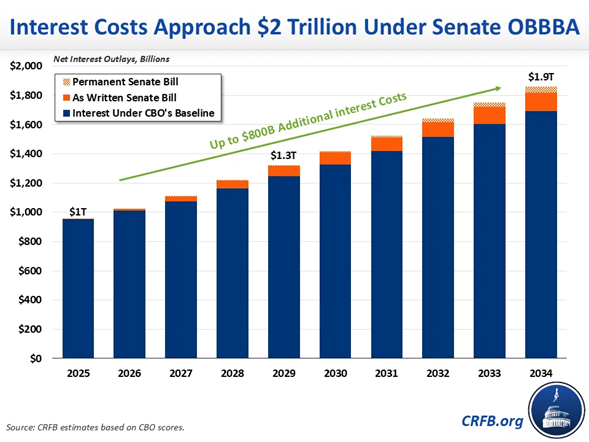

The law under approval provides for an increase in public debt by more than US$3.4 trillion, its ratio to GDP to 127%, and an annual interest bill of US$2 trillion by 2034, considered unsustainable by many experts.