This is the second post on the financial behaviours of different generations, the first having focused on the theme of goals. This focuses on savings and investment attitudes.

Again, most studies originate in the USA, which is not intended. It is a pity that there is no more information of this nature in other parts of the world.

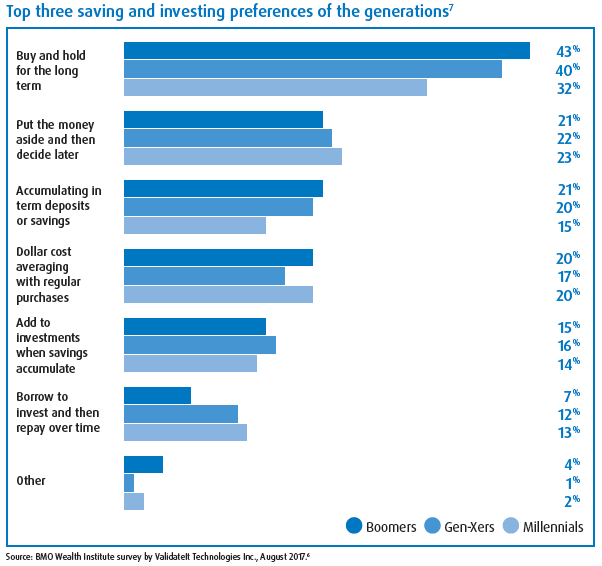

All generations have a stable and long-term investment perspective, with virtually no differences between them

There are virtually no differences between generational savings and investment preferences.

In general, the investment prospect is stable and for the long-term, although less for Millennials, constant savings accumulate in deposits until they are transformed into investments, these being realized over time in order to smooth the moments of purchase.

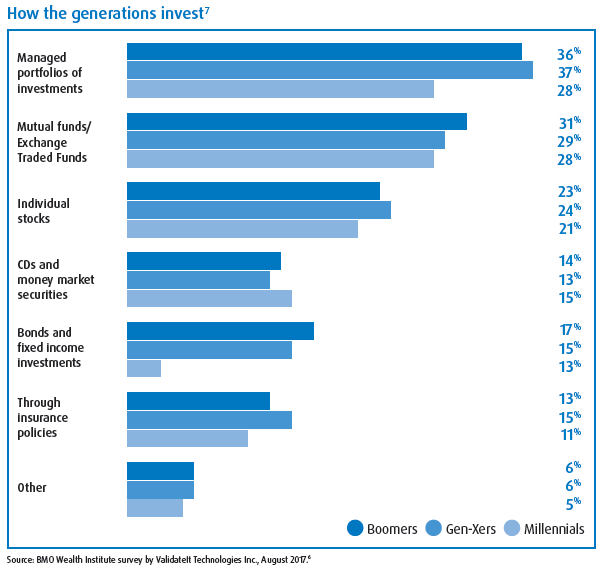

All generations invest mainly in financial markets, with low investments in deposits and other money market instruments

Nor are there much difference stemming from the investments made.

All the generations also prefer investing in managed portfolios (between 28% and 37%) although to a lesser extent for Millennials, in mutual funds are or are not traded on the stock exchange (between 28% and 31%) and direct investment in stocks (21% to 24%).

Only then, and with a much lower expression, do deposits, money market securities, direct bond investment and insurance policies appear.

Millennials generally invest less, which may be associated with lower savings capacity.

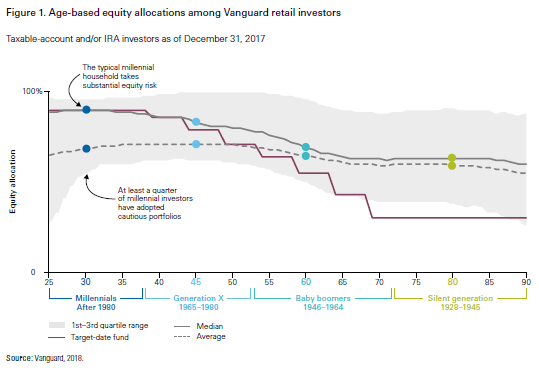

The different generations allocate investments to equities in line with what is expected until the age of 60, but thereafter maintain a higher than expected allocation

The following chart shows the equity allocations of Vanguard’s individual investors (the world’s largest asset manager with more than 4 trillion dollars or millions of dollars under management), comparing them with the standard allocations of targeted dated funds:

As you would expect, younger generations, such as Millennials and Generation X, typically have a high allocation to equities, respectively, from 90% to 70%, in line with the benchmark.

Baby Boomers reduce equities allocations between the ages of 55 and 65 to levels of about 60%, with retirement age approaching, and Silent Generation keeps that level of equities allocation virtually stabilized. This means that these generations maintain a higher allocation to equities than is the standard allocation of retirement funds (60% versus the 35% standard).

This mismatch from the pattern can be caused by the positive situation of the markets, by the low rates of remuneration of deposits in recent years, or simply by the good situation and financial capacity of these families who may have resolved the issue of retirement favourably and, to that extent, they think above all of the very long-term objective of the transfer of assets (inheritance).

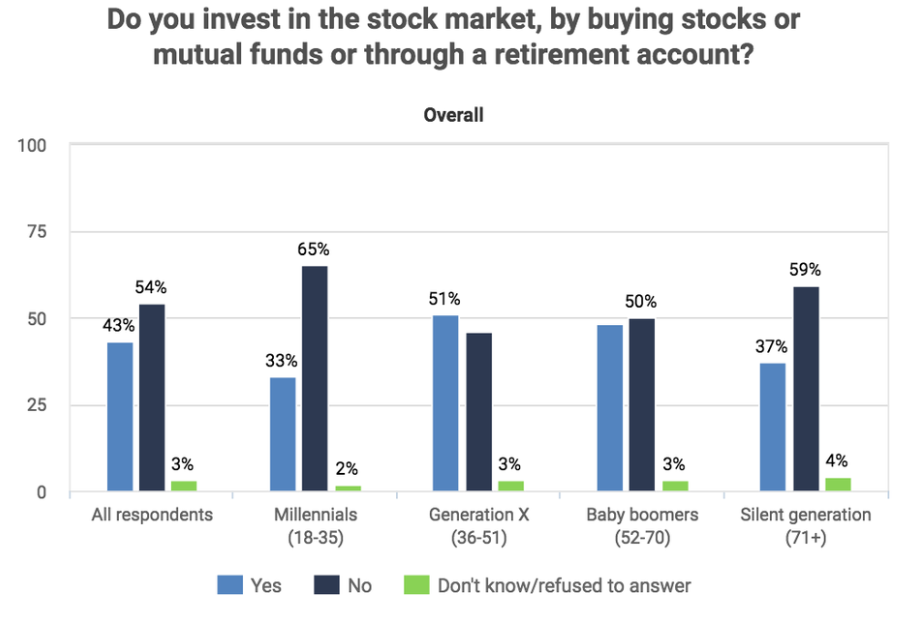

Most people of all generations invest in the equities and have it as their preferred investment, except Millennials who invest more and prefer cash

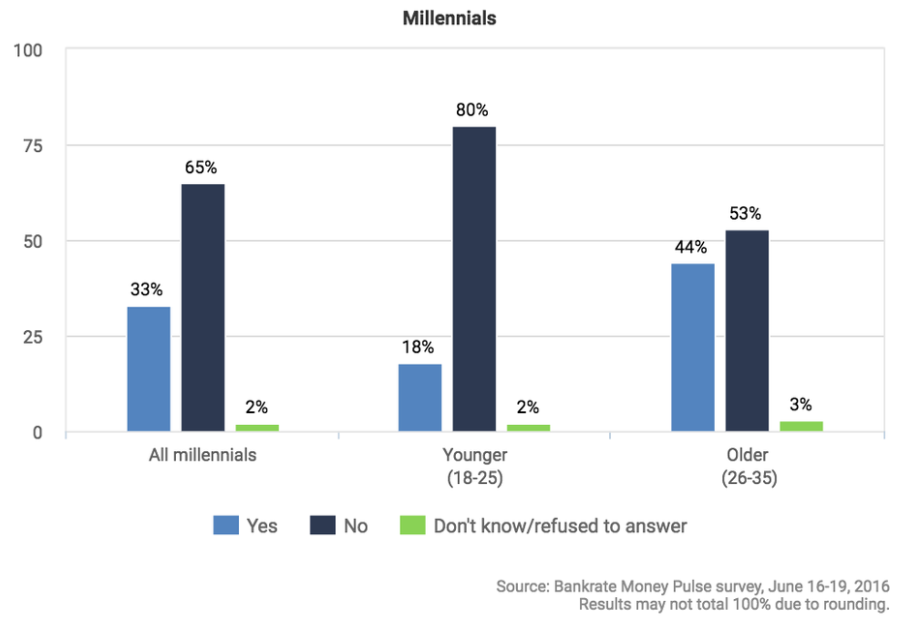

Millennials invest less in stocks than the rest of generations:

Only 33% of Millennials invest in stocks, compared to 51% of Generation X and 50% of Baby Boomers. Only the Silent generation with 37% approaches the Millennials levels.

It is mainly younger Millennials who invest less in stocks, only 18% of those aged 18 to 25, compared to 44% of older people aged 26 to 35.

It is mainly younger Millennials who invest less in stocks, only 18% of those aged 18 to 25, compared to 44% of older people aged 26 to 35.

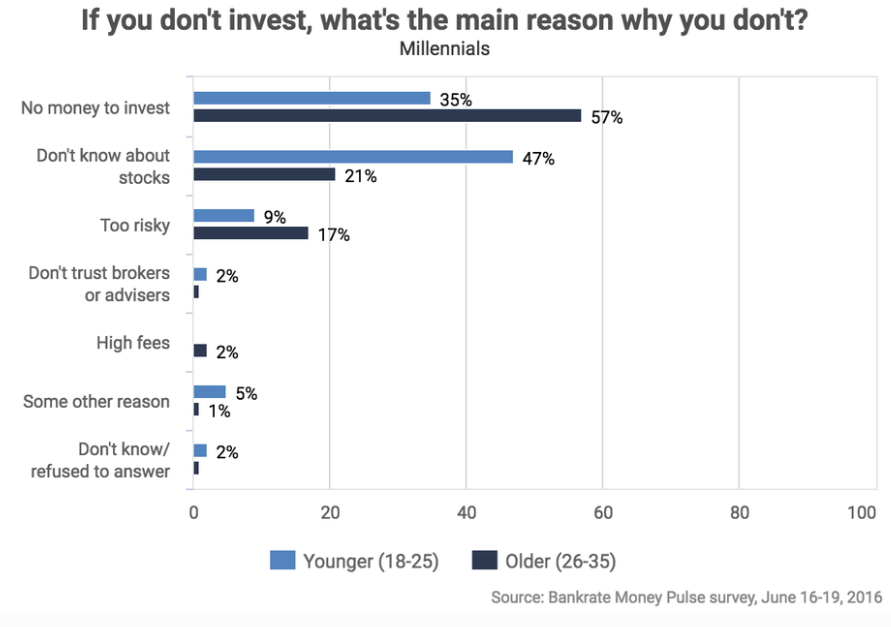

The main reason for not to invest in stocks is simply the lack of money, in 47% and 35% of the cases of younger and older Millennials respectively.

However, it is very important that 47% of the youngest and 21% of the older ones do not invest because they feel they do not know how to do it.

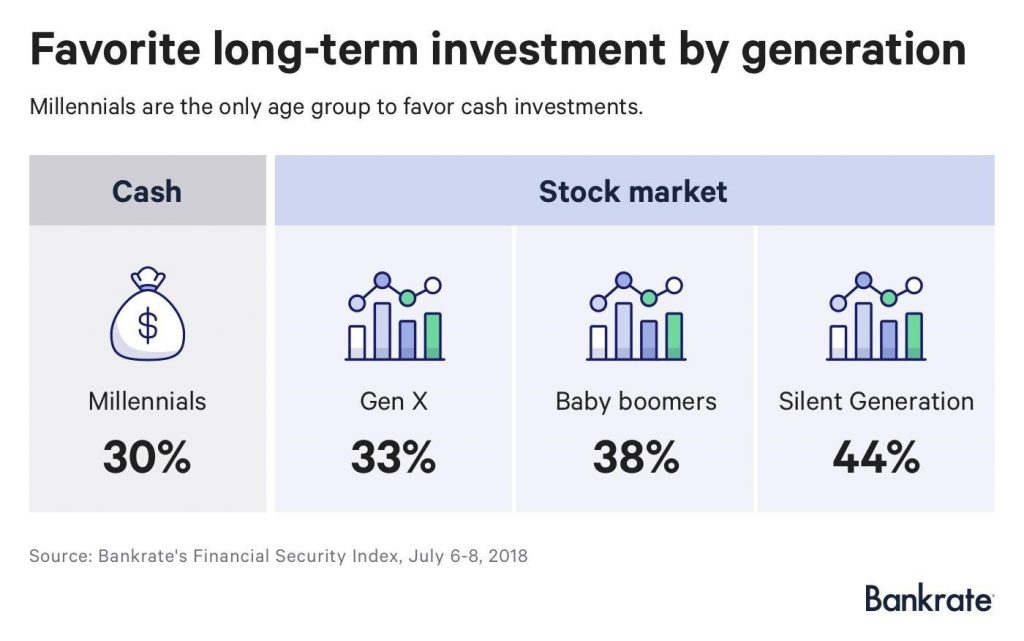

Thus, it is understood that the favorite investments of the various generations are as follows:

For all generations except Millennials the preferred investment is stocks, getting between 33% and 44% of responses, while for Millennials it is cash with 30%.

Generations have the same financial goals, but different priorities – Investorpolis

https://www.am-switzerland.ch/assets/content/images/schroders_globalinvestorstudy_en.pdf

The financial objectives are common across generations, but there are some meaningful differences in their investment process and choices.

Wealth size matters and markets experiences influence generations investment patterns and preferences.

The great wealth transfer is on course from the Silent Generation and Baby Boomers to the Gen X and Millennials.

Will this wealth transfer have an effect on long-term market dynamics and returns?