Who are the Silent Generation, Baby Boomers, Generation X and Millennials (and Generation Z)?

Do financial goals change with age or do generations have different goals?

Who are the Silent Generation, Baby Boomers, Generation X and Millennials (and Generation Z)?

This is the first of a series of posts that seek to analyse the behaviours of different generations in terms of personal finances, savings, and investments.

We would like to do this with a global perspective, or at least cover the world main regions, because we admit that there can be differences between countries.

However, since most studies on the assessment of behaviors of different generations, notably among Baby Boomers, Generation X, Millennials (and in some cases even, more recently, Generation Z), are done in the US, we will focus primarily on the North American case.

We admit that given the growing globalisation, the differences may not be very significant when it comes to western and advanced countries. In other situations, the situation will be different.

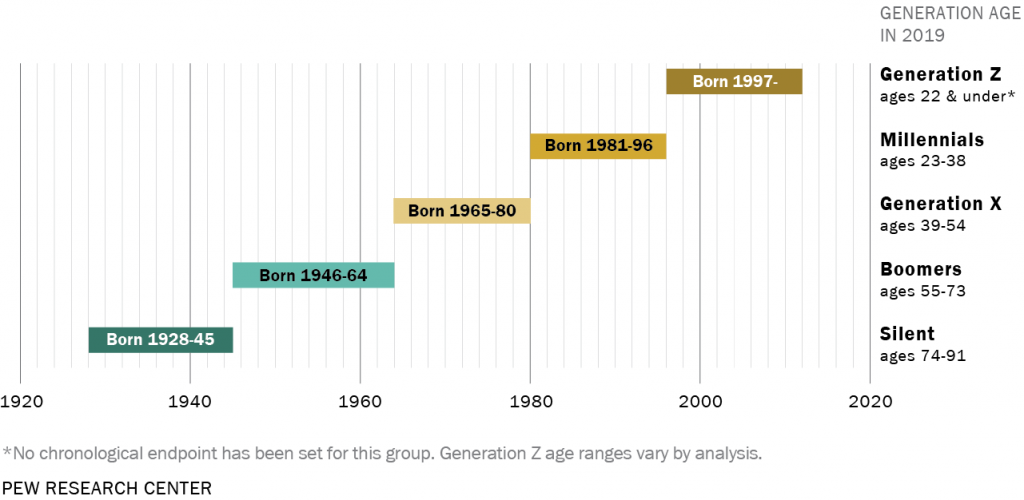

By the way, it is worth remembering the age groups we are talking about in 2019 – Silent Generation (ages 74-91); Baby Boomers (55-73); Generation X (39-54); Millennials (23-38); Generation Z (less than 22).

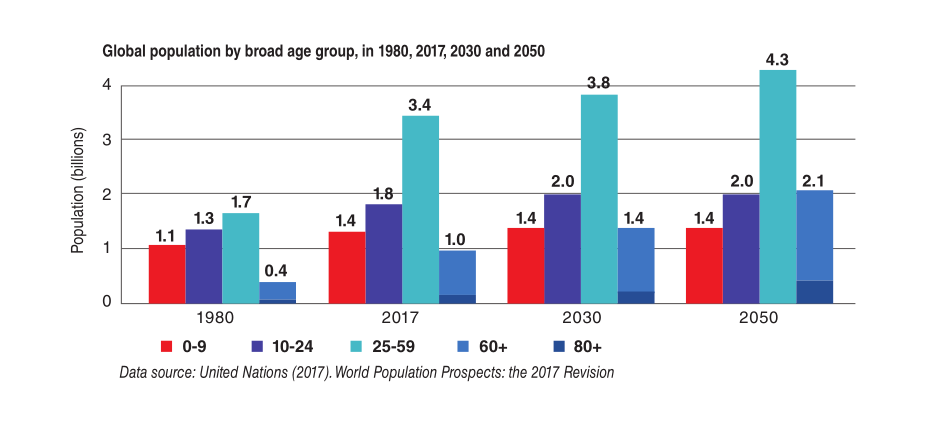

The following graph shows the current size of populations in the world by age structure:

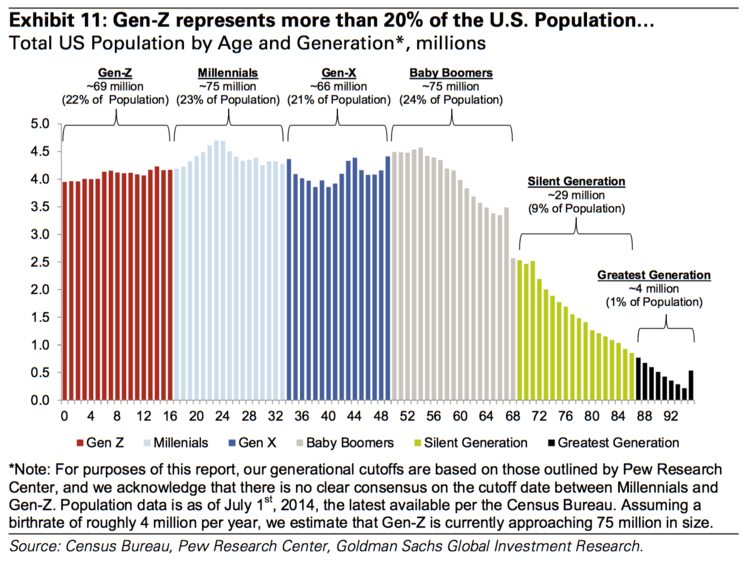

In the USA the current dimension of the different generations is as follows:

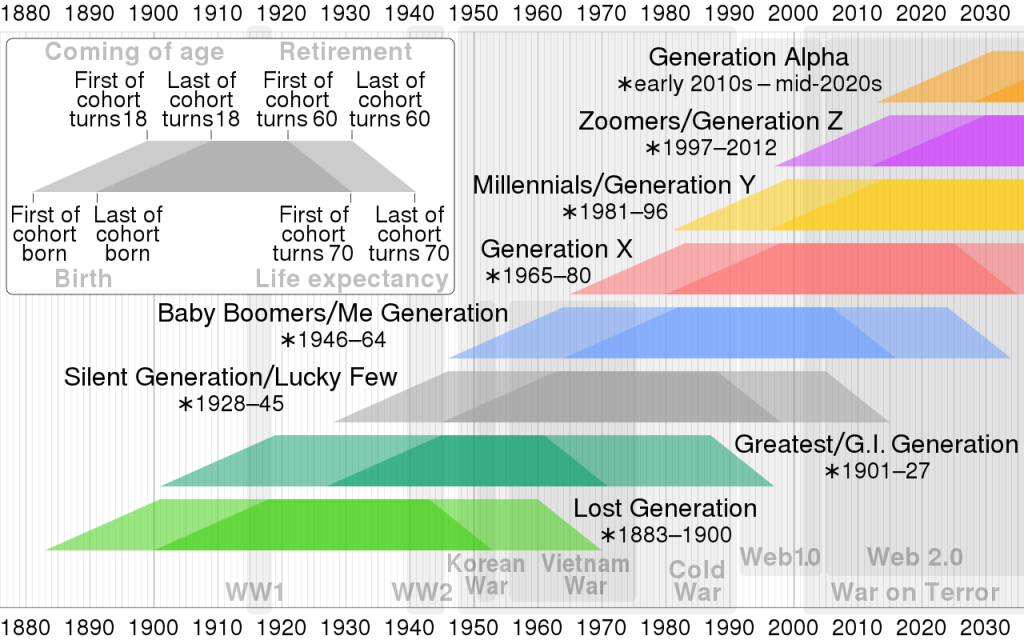

It is worth having an idea of the historical landmarks that these generations have lived and that influenced their experiences:

The Silent Generation was born in the Great Depression, lived through World War II, and the US fought the Korean and Vietnam wars, while the Baby Boomers lived through the post-war and Cold War times, with some in the US fighting in the Vietnam War.

Generation X was born in Web 1.0 times and was caught up in the two financial crises at the time they started investing, the 2000 tech bubble and the Great Financial Crisis of 2007-08 (GCF), with Millennials having the same financial markets experience at the GCF.

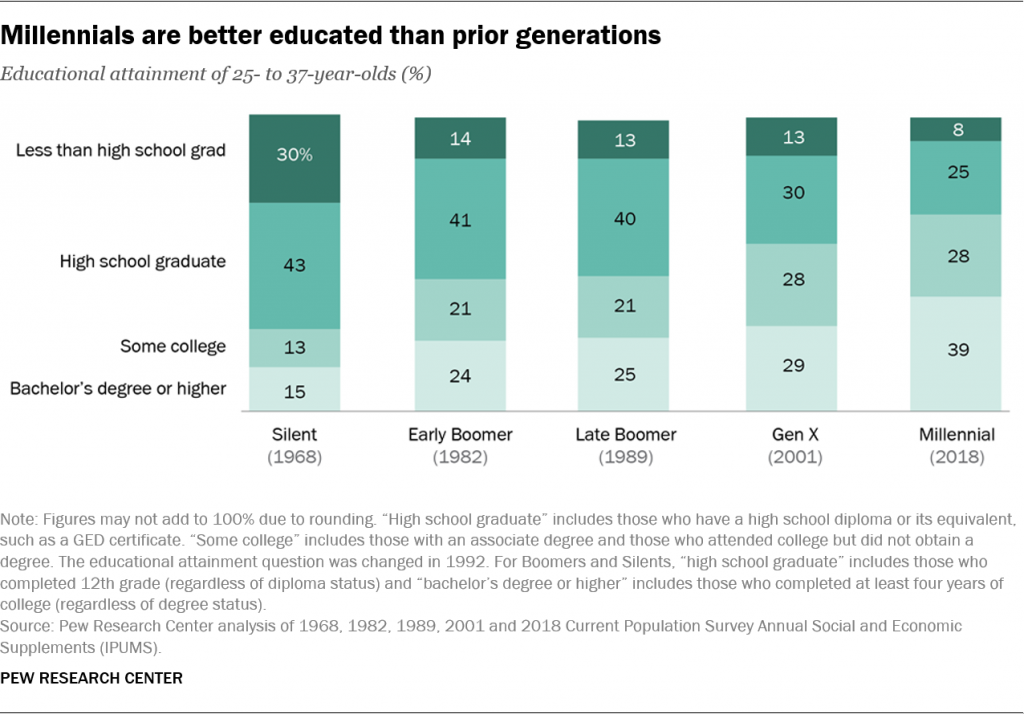

It is important to be aware that, in general, new generations have a better level of qualifications than previous ones around the world and in the case of the US.

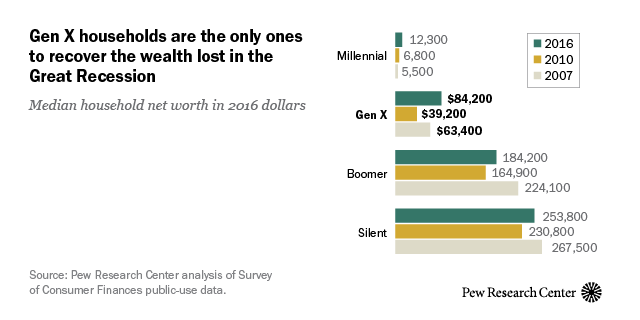

And that their financial situation and investment experience is also different:

Obviously, older generations have a larger accumulated wealth.

It should be stressed that generation X had the greatest negative experience with the crisis of 2007 and 2008, suffering a greater loss, in relative terms.

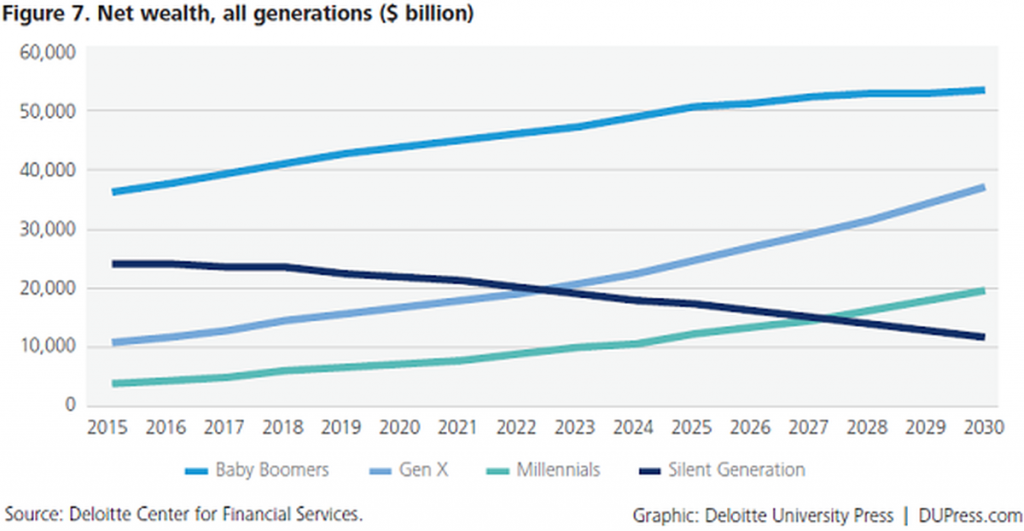

In aggregate terms, net wealth is distributed as follows by generations in the US:

The Baby Boomers concentrate most of the wealth and it is growing at a moderate pace, followed by the gradually declining Silent Generation and the rapidly growing Generation X, with the Millenials having the same pace but lower size.

Do financial goals change with age or do generations have different goals?

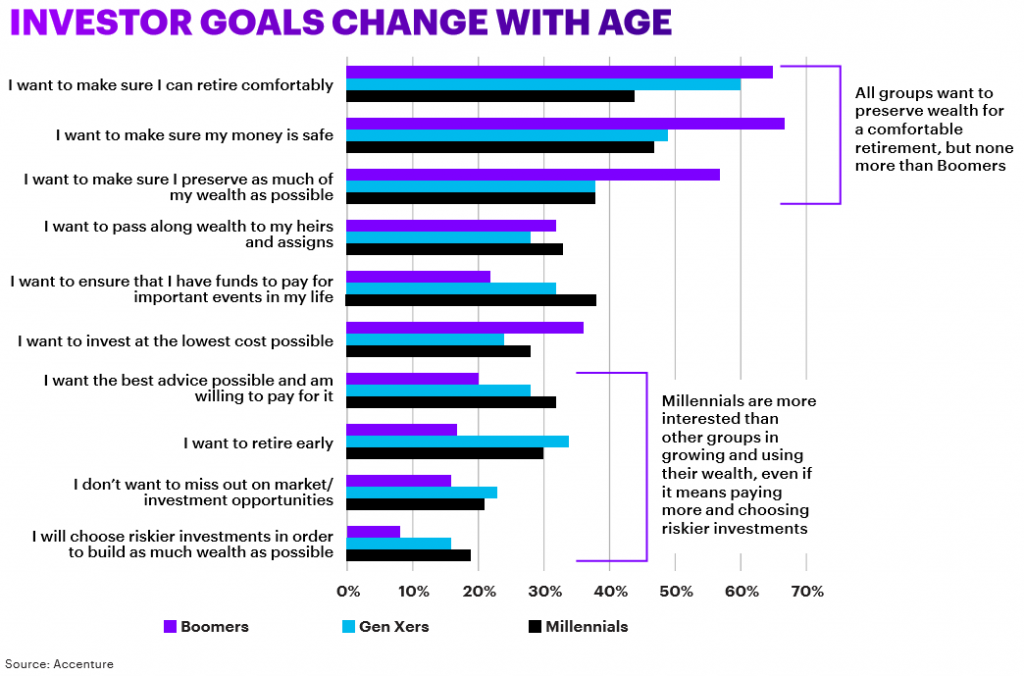

When asked about the reasons why people invest, the financial goals of the 3 generations analysed in the US by Accenture in 2017 made through a survey of 1,300 individuals seem to be different:

Many of these differences are not the result of a change in behaviour, but rather from the fact that the stage of the financial life cycle in which they are is different. However, other differences must have other explanations.

The Baby Boomers generation was expected to have a greater concern than the rest about the issues of retirement, money security, and the preservation of wealth or less willingness to risk.

Most of the Baby Boomers are already retired or about to retire, worrying more about preserving wealth and security, because their sources of income are pretty much defined.

The younger generations not only have the theme of the most distant retirement but are also in a phase of accumulation and building of wealth, and may see further changes in their sources of income and wealth growth in the future.

Different generations have very small differences in their willingness to pass on the assets to their heirs, in the choice of the lowest cost investments and in the interest of having the best possible investment advice, but the results are significant because of the importance they attach to these matters.

Where there are greater divergences, at first less evident, it is that younger generations give more importance to have money for the main events of their life, want to retire earlier and be more willing to pay for financial advice. That is, younger generations want to enjoy life more, value leisure more and apparently recognize that they need more help to make their investments.

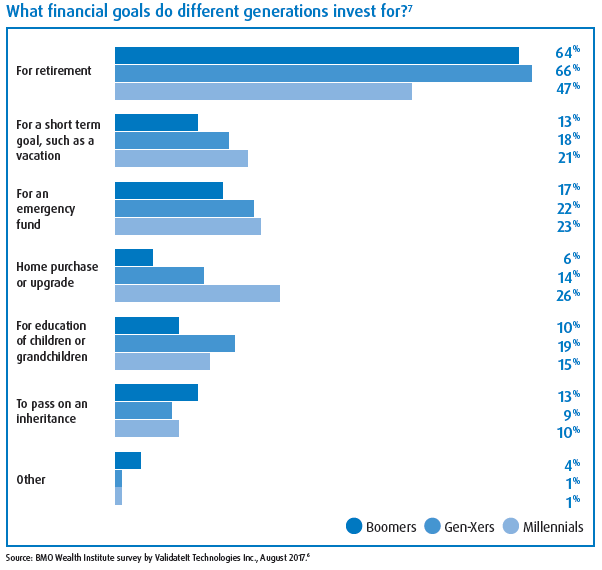

As for the priorities in terms of investment objectives, the BMO survey in 2017 (sample of 1,006 Americans aged 18 to 71) concluded in the following:

The priority financial objective common to all generations is retirement, and by a very wide margin (between 47% and 66%). Next comes practically on par, the safety or emergency fund with between 17% and 23%, and a very short-term goal, which includes holidays as an example, with between 13% and 21%.

For younger generations, the purchase of the house and the education of children or grandchildren acquires greater relevance with between 14% and 26% of the answers.

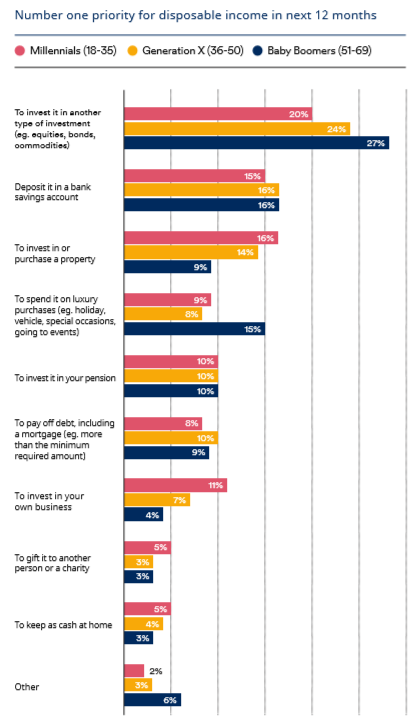

A recent Schroders study conducted in 2017 through a survey of 22,000 individuals worldwide indicated the following priorities for using disposable income for the various generations:

The priorities for placing disposable income are common to several generations with small differences in importance.

The priority is to invest in the financial markets, followed by making savings and buying a home for the two younger generations, with the house being replaced by small luxuries as a trip for the Baby Boomers generation.

Then, and practically on par, there is the strengthening of the pension and the payment of debts. Launching a business is equally important for the younger 2 generations.

Generations have similar investment rules, but different allocations to stocks – Investorpolis

https://nesbittburns.bmo.com/getimage.asp?content_id=79344

https://www.am-switzerland.ch/assets/content/images/schroders_globalinvestorstudy_en.pdf