Stock markets in China: Shanghai, Shenzhen, and Hong Kong

The investors in China’s stock markets

Price differences in the A-shares and H-shares segments

The historical performance of the Chinese stock markets

The ongoing process of opening the Chinese domestic capital market opportunity

Given that China is the second largest country in the world in terms of GDP, the country that contributes the most to global economic growth, which has underway major structural transformations in its capital markets, and that major indexes of the its stock markets, the CSI 300 and Shanghai SE Composite Index, rose 25.5% and 12.6% in the year ending , respectively, and are at 2008 highs, it is important for investors to know their markets.

In another post we looked at China from the internal perspective: how their people live financially, what their incomes are, how much they save and how they invest.

In this post we will see the external financial perspective, knowing about their capital markets, especially the stock market.

China is currently experiencing a phase of great growth and openness to the outside of its financial markets, in the stock and bond segments, with the entry of new international agents, whether intermediaries or investors.

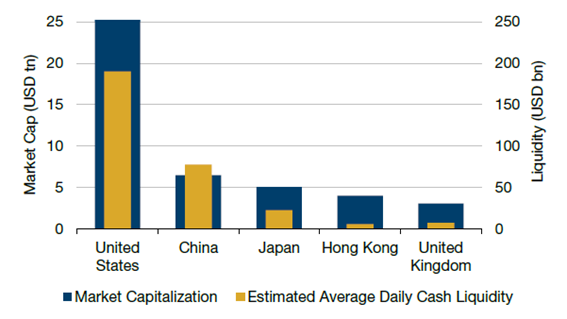

China has the world’s second largest stock market, a strong weight in emerging markets and a unique growth outlook

Although China’s market capitalization is the world’s second, only behind that of the US, the risks and complexities of investing are very different from those of other major stock market countries:

The $9 trillion Chinese stock market represents 14% of the global market. This includes the vast $6 billion domestic market, and the remaining $3 billion traded offshore in the US, Hong Kong, and Singapore.

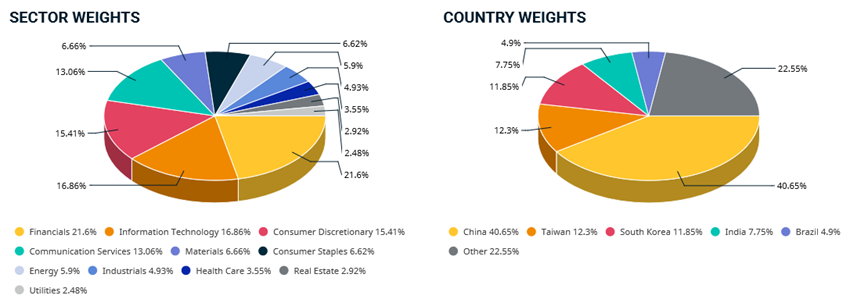

That is why China has a dominant weight in emerging markets:

A huge growth in the Chinese stock market is estimated in the coming years:

The Chinese stock market is expected to grow from the current 12.3 trillion to more than 27.3 trillion in 2027, i.e. more than double.

Stock markets in China: Shanghai, Shenzhen, and Hong Kong

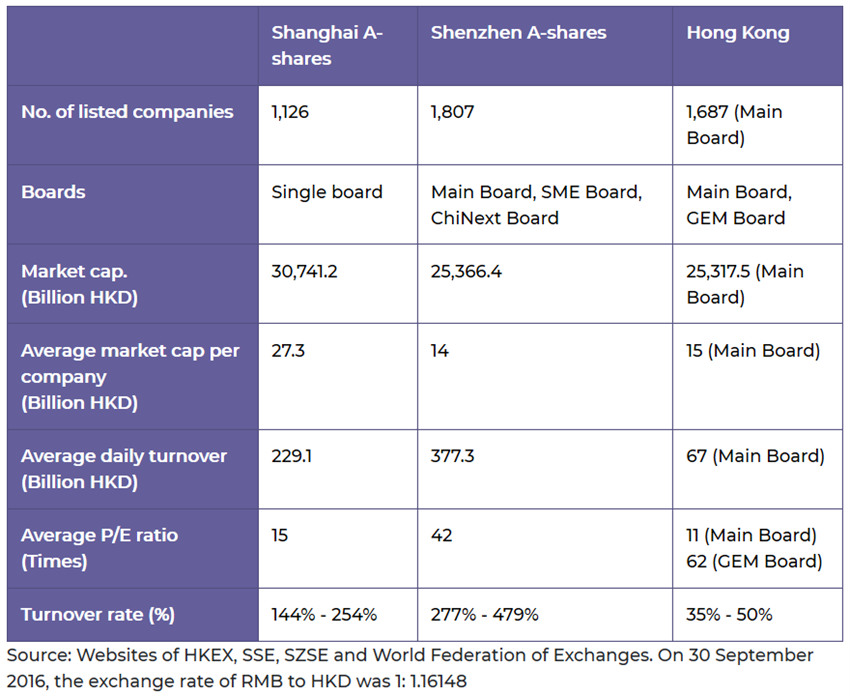

The Chinese stock market has particularities that distinguish it from others, including emerging ones, unfolding in three markets – Shanghai, Shenzhen and Hong Kong – which have to do with the location of companies, denomination of currency and investors access:

One of the distinct characteristics of China’s stock markets is that listed companies can issue different classes of shares, depending on the location in which they are listed and the type of investor who is allowed to own them. The most common of these classes are A-Shares and B-Shares.

Class A shares represent securities of incorporated Chinese companies trading on the Shanghai or Shenzhen Stock Exchanges. They are listed in renminbi and can only be traded by Chinese residents or foreign investors eligible for the Qualified Foreign Institutional Investor (QFII), Renminbi Qualified Foreign Institutional Investor (RQFII) and/or Stock Connect programs. The latter is listed in US dollars on the Shanghai Stock Exchange and Hong Kong dollars on the Shenzhen Stock Exchange.

Class B shares are traded by residents and non-residents of China.

And then there is the least known class that’s perhaps the most intriguing of all for investors: H-Shares. Class H shares are shares of mainland Chinese companies listed on the Hong Kong Stock Exchange. Although these shares are regulated by Chinese law, they trade in the same way as all other shares on the Hong Kong Stock Exchange. They are expressed in Hong Kong dollars as opposed to the renminbi, and like other securities trading on the Hong Kong Stock Exchange, there are no restrictions on who can trade H. In many respects, H-Shares is reminiscent of the American Depositary Receipts (ADR), which are shares of non-U.S. companies that are traded on the New York Stock Exchange, just like US-based companies. The companies listed on the Hong Kong and mainland exchanges are therefore classified as having H-Shares and A-Shares respectively, and there are currently about 250 of those companies.

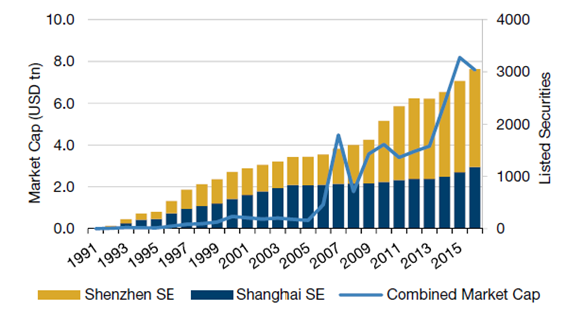

The Shanghai Stock Exchange (SSE) and the Shenzhen Stock Exchange (SZSE) are the two exchanges of Mainland China, which have about 3,000 listed companies.

Most are class A stocks, which are listed on Chinese exchanges in local currency. They represent about 65% of the national stock exchange.

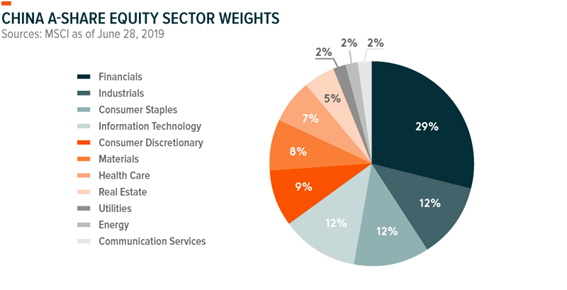

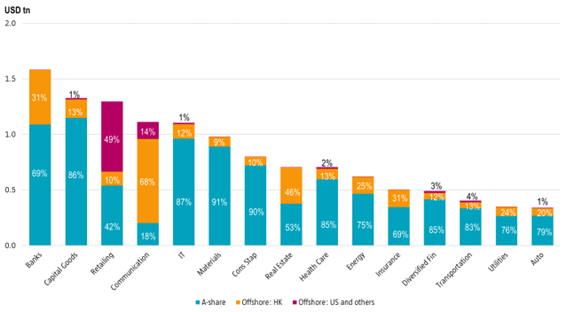

The sectoral composition of the Chinese Class A stock market is as follows:

With a market share of almost 30%, the financial sector is China’s largest sector. This includes several state-owned banks and insurance companies. Industrial companies and manufacturers of discretionary consumer products also have a large weight. Unlike the US, where information technologies account for about a quarter of the S&P 500 index®, information technologies account for only about 9% of the A stock market because most Chinese technology companies are listed in the US and Hong Kong.

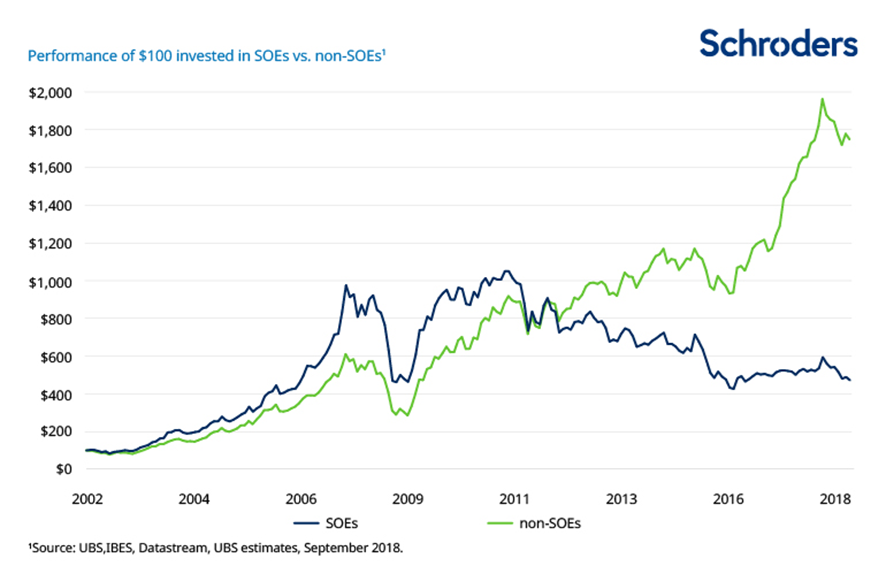

More than half of Chinese A-stock companies are state-owned enterprises (State Owned Enterprises or SOEs) whose executives are appointed by the government. As such, public policy objectives can outplay the profitability of these companies, especially in sectors where the government wants more oversight. Consequently, the high level of exposure to underperforming SOEs in an index can make a purely passive approach to investing in China less efficient.

There are studies that show that SOEs are generally less efficient, less profitable, more expensive and more leveraged than their peers, a reality that is not exclusive to China, but also in other economies including developed ones (e.g. in France).

Shanghai-listed companies on SSE are generally large companies, many of which are state-owned. Financial services, real estate, natural resources, and energy, as well as infrastructure are Shanghai main stock industries.

On the other hand, Shenzhen or SZSE consists of a majority of small and medium-sized enterprises and private enterprises, many of which are from the high-tech industry.

Companies listed outside mainland China also offer access to this growing economy. Examples include the BAT – Baidu, Alibaba and Tencent – which are listed in the US and Hong Kong exchanges. They are regarded by some investors as the Chinese equivalent of US FANG —Facebook, Amazon, Netflix and Google.

Hong Kong tends to host most China’s older-economy sectors, such as real estate, financials, materials, and heavy industry. And China’s large IT companies are well represented in New York via ADRs.

The Shanghai and Shenzhen stock exchanges represent 90% of the investible market cap in capital goods, 90% in consumer staples, 89% in healthcare, 85% in autos, and 78% in retail, all of them high-growth sectors in China.

Shanghai is the traditional market and Shenzhen is the one that has grown the most:

The investors in China’s stock markets

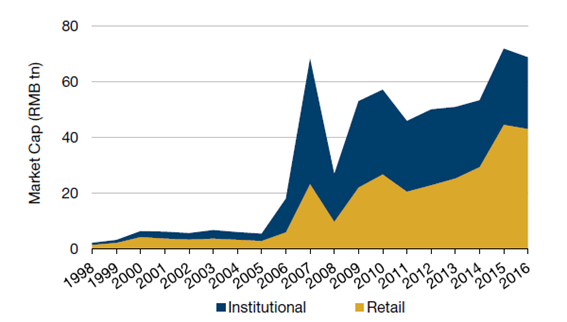

Unlike the Hong Kong Stock Exchange, the Shanghai Stock Exchange is not yet fully open to foreign investors and often line up several times by central government decisions. This is due to tight controls on capital accounts exercised by the authorities of mainland China.

Mainland China exchanges are dominated mainly by individual investors, while the Hong Kong stock exchange is dominated by institutional investors:

Unlike the US stock market, which is dominated by institutions, China’s A-share market is dominated by individual investors who hold more than 75% of the market – excluding shares held by insiders.

Individual investors can often be irrational, making buying and selling decisions based on emotion and speculation rather than fundamentals. In addition to creating increased volatility, irrational behaviour can cause individual stocks to become misquoted, creating opportunities for qualified active managers.

Price differences in the A-shares and H-shares segments

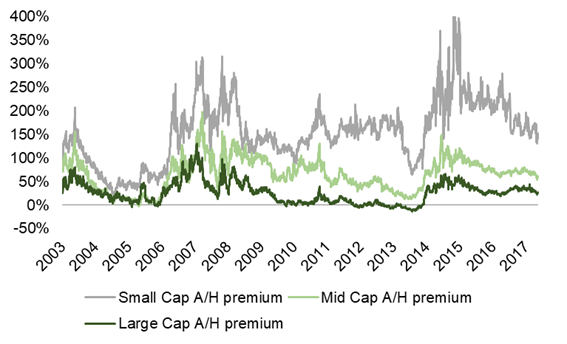

Investor access and capital control schemes result in differences in the prices of companies as they transact in the A-shares and H-shares segments:

The most appealing characteristics of H-Shares companies are that they invariably trade at prices lower than their equivalent quotes on the mainland stock exchanges. In fact, class A shares currently trade at a premium of around 30% over their Hong Kong-listed peers.

This is clearly a bonus for investors, who can thus take advantage of the lower prices of the Hong Kong Stock Exchange against the Shanghai or Shenzhen stock exchanges. This trend is also not a recent phenomenon. On the contrary, in recent years the A-Shares quotes of companies have consistently traded at considerable premiums compared to their H-Shares quotes.

This happens despite the introduction of programs such as Shanghai-Hong Kong Stock Connect and Shenzhen-Hong Kong Stock Connect in 2014 and 2016, respectively, that allow foreign investors to buy A-Shares and gain exposure to mainland China — which in turn means they don’t simply have to buy H-Shares to gain exposure.

Thus, the main reason for this premium is that domestic investors can only invest in the mainland China market in A-Shares.

The historical performance of the Chinese stock market

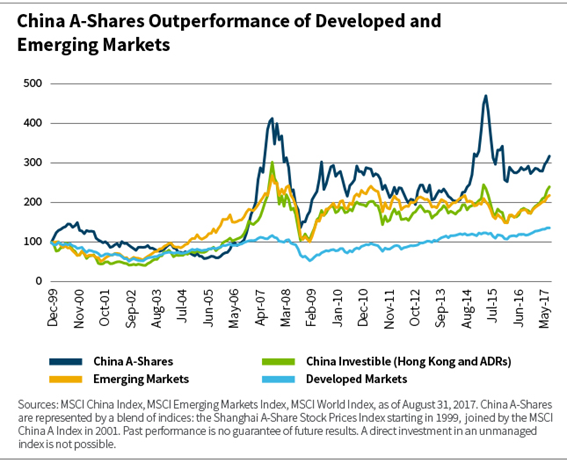

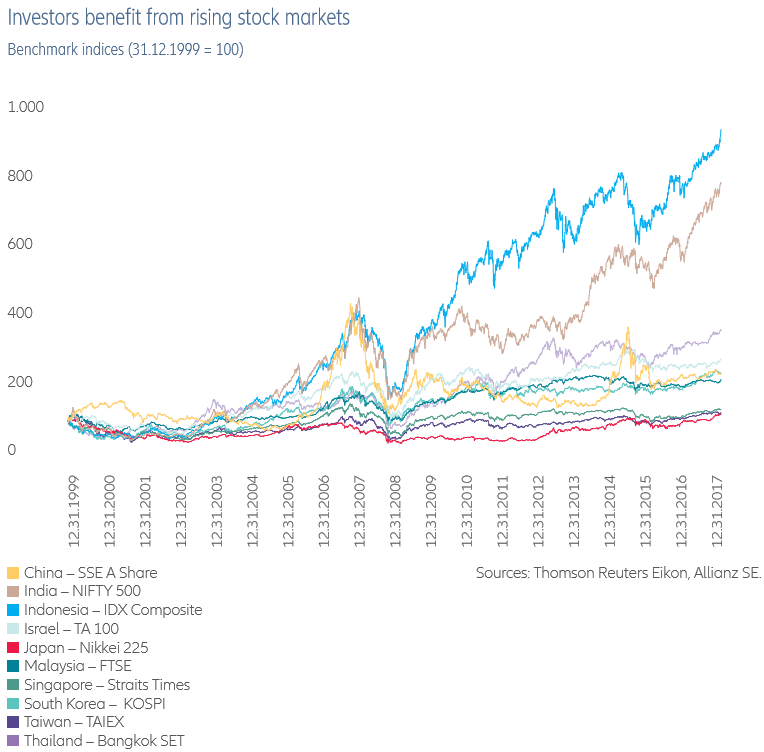

The following graph shows the evolution of the Chinese stock market compared to other relevant ones between 1999 and 2017:

The Chinese A-share market performed better, increasing more than 200%, followed by Chinese markets opened to foreigners investors (Hong Kong and ADR) with 140%, well above 40% of developed markets.

The following chart shows the performance of the Chinese stock market of A-shares compared to other emerging markets:

The appreciation of the Chinese market was largely surpassed by that of the Indonesian, Indian and Thai markets, keeping abreast of Malaysia and South Korea, and well ahead of the Japanese and Singapore.

The ongoing process of opening the Chinese domestic capital market opportunity

The Chinese government has taken serious steps to liberalize its stock market for foreign capital, with reforms such as updating accounting and financial reporting standards and strengthening investor protection, starting with the issuance of B and H shares, then launching the regimes of qualified foreign institutional investors (QFII) and RMB, and finally implementing measures linking the B and Shanghai markets to Shenzhen to the Hong Kong stock market.

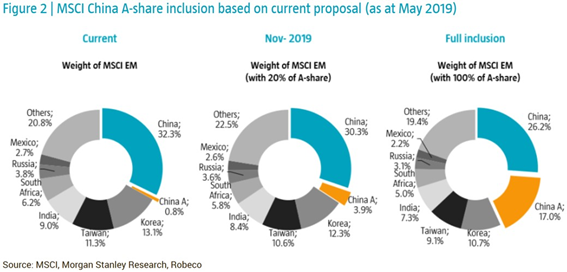

As a result of these initiatives, in June 2018 Chinese stocks were included in the MSCI Emerging Markets Index and the MSCI ACWI Index, which has been gradually and phased up:

The weight of mainland China’s shares in major indexes has increased significantly. In 2019, the weight of A-shares in the MSCI Emerging Markets Index rose from almost nothing to 4%. Over time, this can increase to 17%. For the sake of completeness, this is above the weight of 30% of Chinese shares listed in Hong Kong.

Foreign investors can now access parts of China’s fast-growing economy that were not previously accessible, and these opportunities span sectors —capital goods, distribution, healthcare and consumer goods, among others.

Looking at the investable market capital of A-Shares by stock exchange – Shanghai Stock Exchange, Shenzhen Stock Exchange, Hong Kong Stock Exchange, and U.S. depositary receipts (ADRs) – China’s A-Shares shares listed in Shanghai and Shenzhen represent most of the investment opportunity established in China’s domestic growth sectors.

The opportunity is immense. China’s capital markets have many high-quality companies that experience dynamic growth, making them ideal for quality growth investors.

As the chart below shows, 70% of China’s A-Shares are growing faster than the average emerging stock markets of about 12% per year —and that 70% represents 2,392 companies listed on the Shanghai and Shenzhen stock exchanges (up from less than 550 for each of the other emerging markets shown, and less than 100 for several).

China’s bond markets

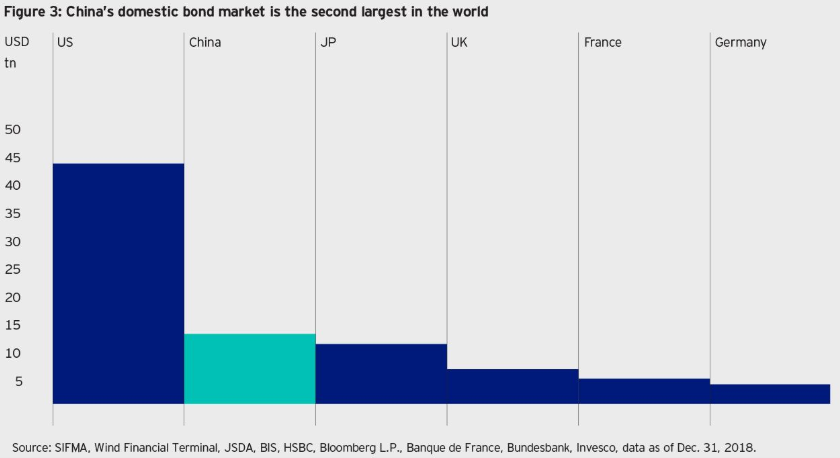

The Chinese bond market is the second in the world, but only very recently has it begun to be represented in benchmarks with little expression:

China’s “onshore” bond market totaled RMB 89 billion ($13 billion) in outstanding bonds in April 2019.

It is the second largest bond market in the world, behind the US, but ahead of Japan, the UK, and other European countries. In the last five years, it has grown at an annual rate of more than 20% per year.

Chinese bonds were included in the main market benchmark for global bonds – the Bloomberg Barclays Global Aggregate Index – for the first time in April 2019.

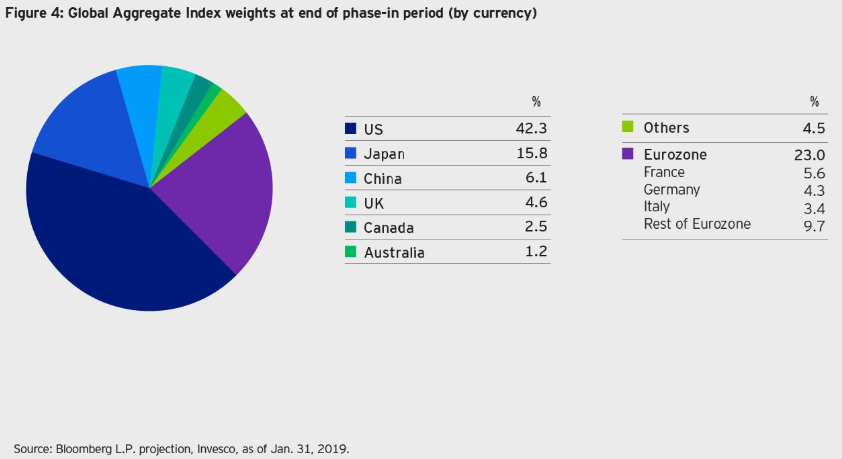

Over a 20-month period, more than 360 Chinese names will be added, giving China a significant weight in the index:

China’s final weight in the index could be higher than that of France, the United Kingdom, Germany, and several other developed markets, except for the US and Japan. After the transition period (“phase-in”), Chinese bonds may become the fourth largest category of bonds per currency and the third largest by country in the Global Aggregate Index.

china-capital-markets-final-english-version.pdf (asifma.org)