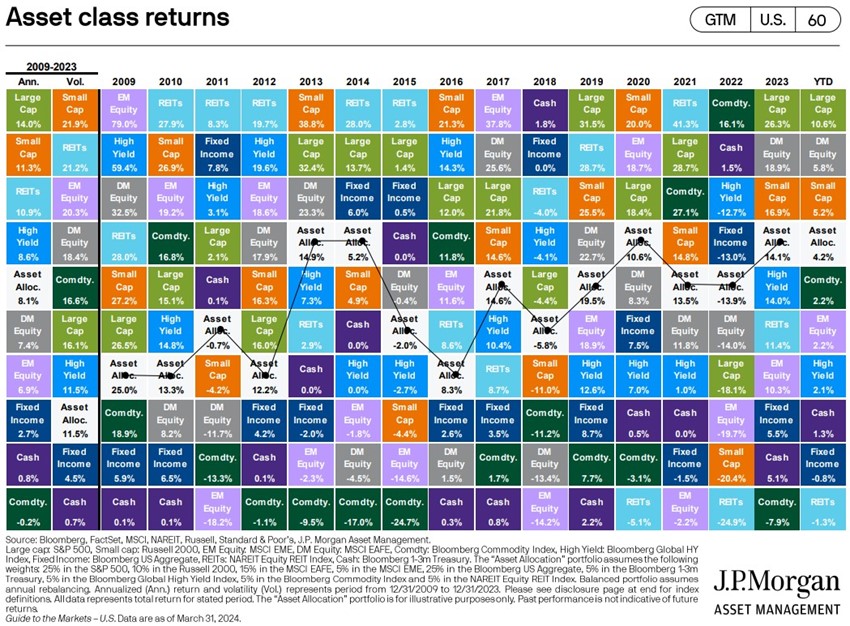

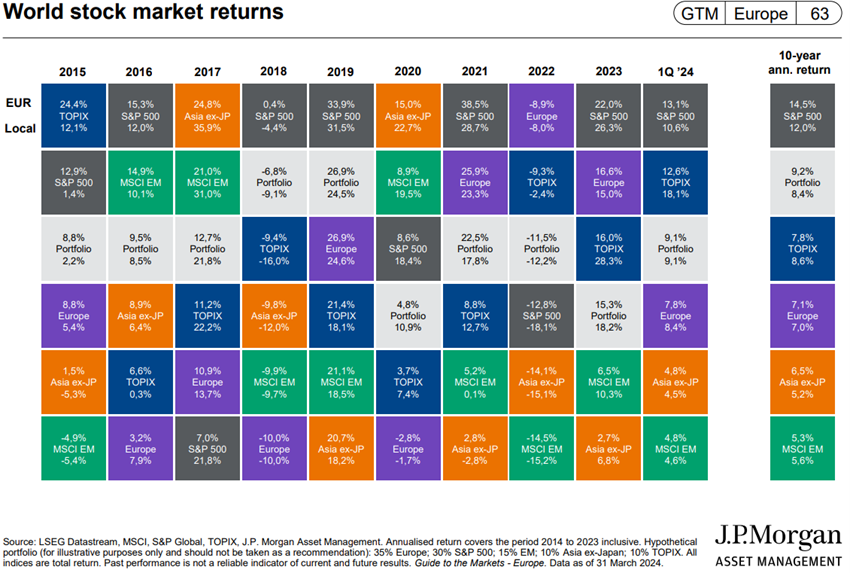

After an exceptional 2023 for equity markets, especially the North Americans, Q1 continued the bullish trend, putting the market at new highs.

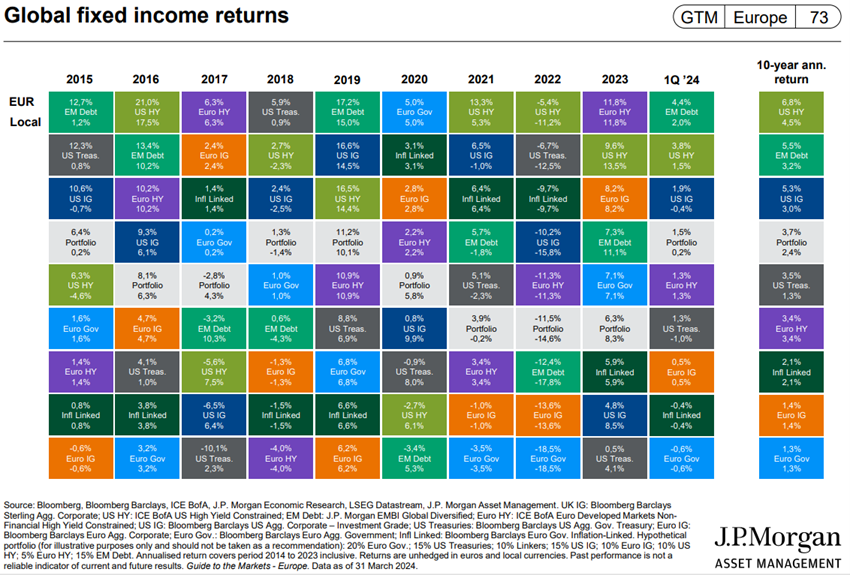

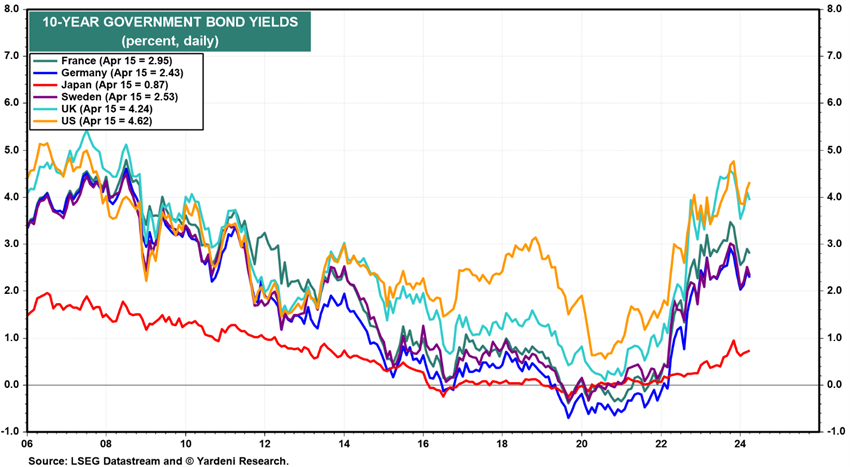

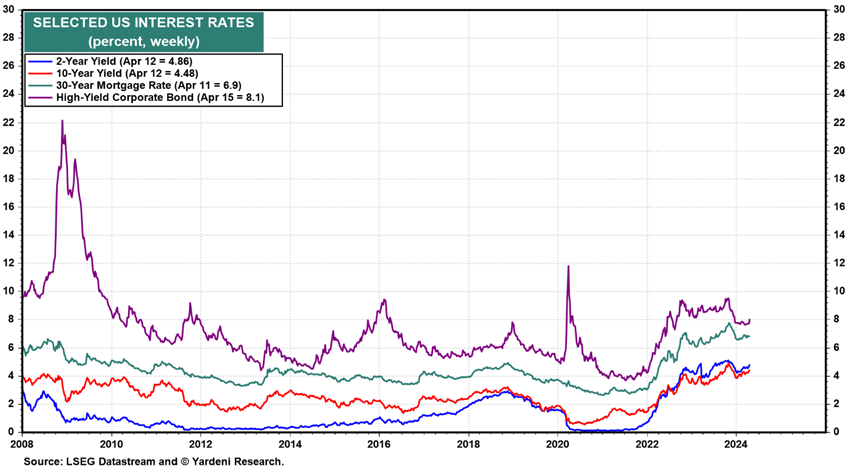

Bonds in the U.S. and Europe, which also did well in 2023, performed worse in the last quarter due to rising interest rates.

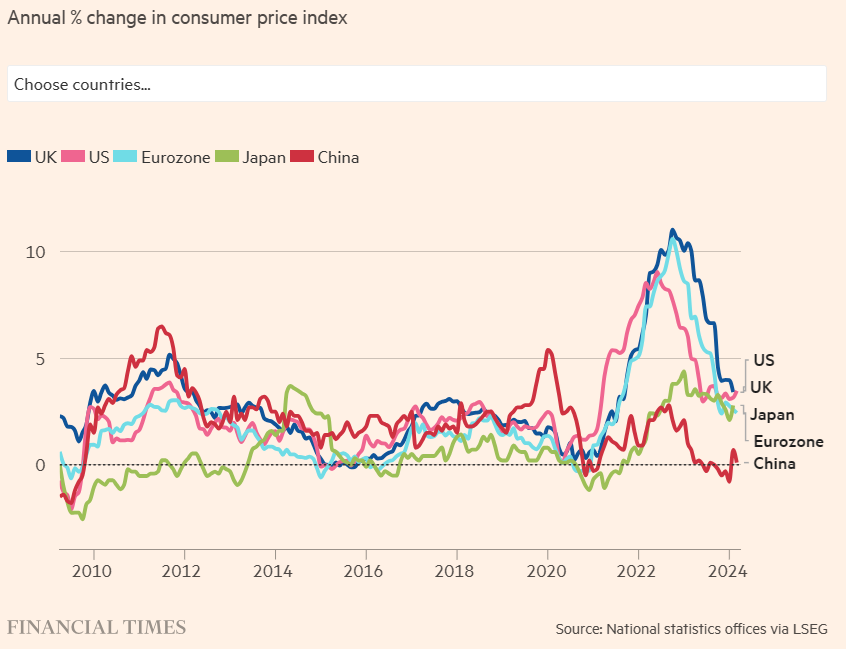

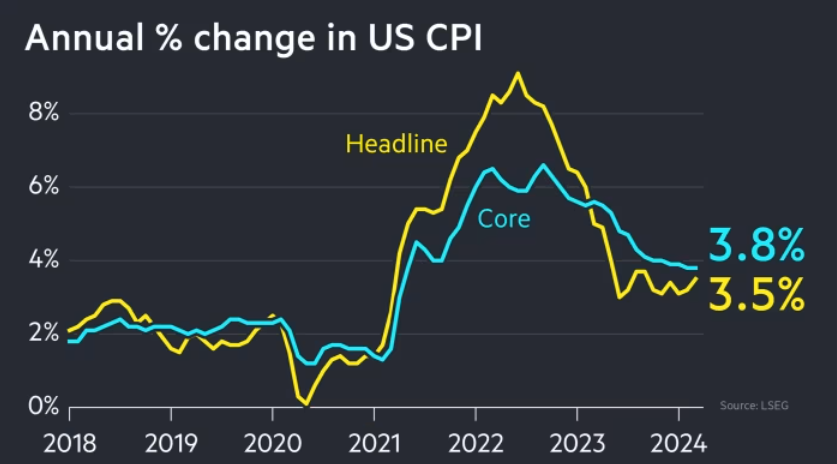

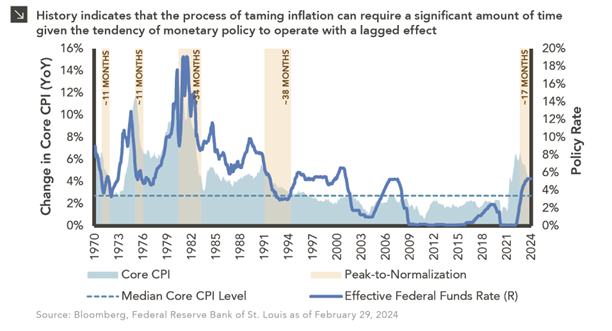

The attention of analysts and investors is increasingly focused on the trajectories of declines in inflation and official interest rates, especially in the US, which shows greater rigidity.

The biggest uncertainties continue to focus on developments in China, the US elections and the two major ongoing wars.

1Q24 Markets Performance: Stock markets continue to trend bullish and reach new highs after having had one of the best years ever. Interest rates on long-term government bonds in the US and Europe in the 1st quarter reversed course and rose again in line with the evolution of inflation, impacting bond performance.

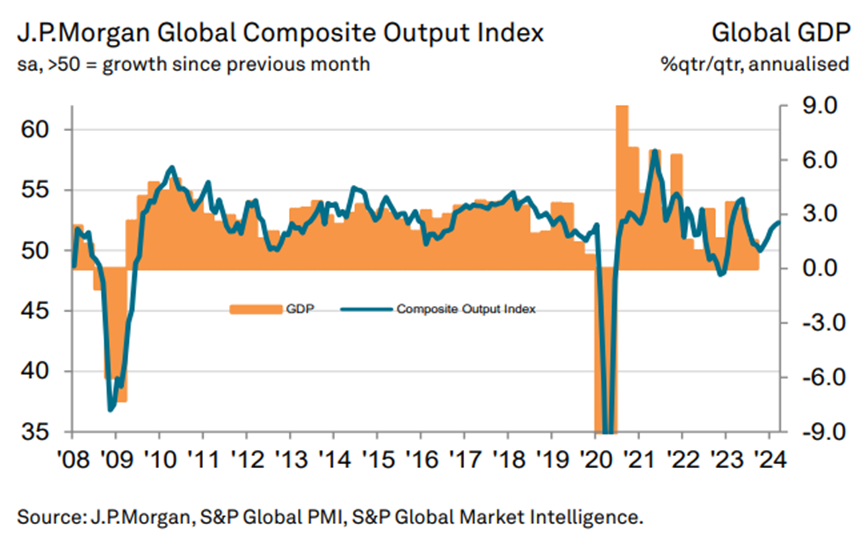

Macro Context: Global economic growth levels remain low and declining. The U.S. continues to exceed expectations and Europe is stagnating. Inflation stubbornly falls in the U.S. due to the services component. Problems remain in China, with low economic growth, high youth unemployment, and bankruptcies in the real estate sector.

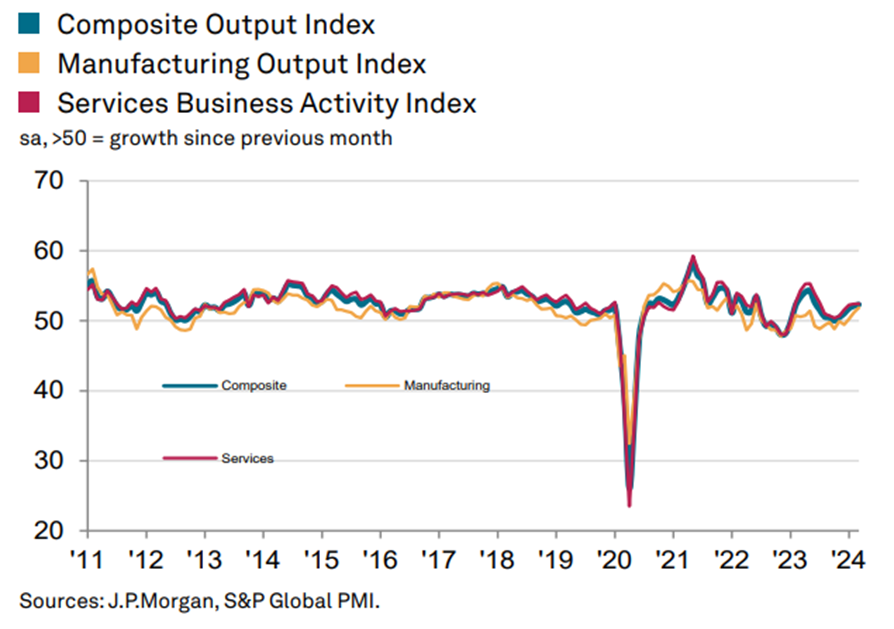

Micro Context: Leading snapshot and leading economic indicators have improved around the world.

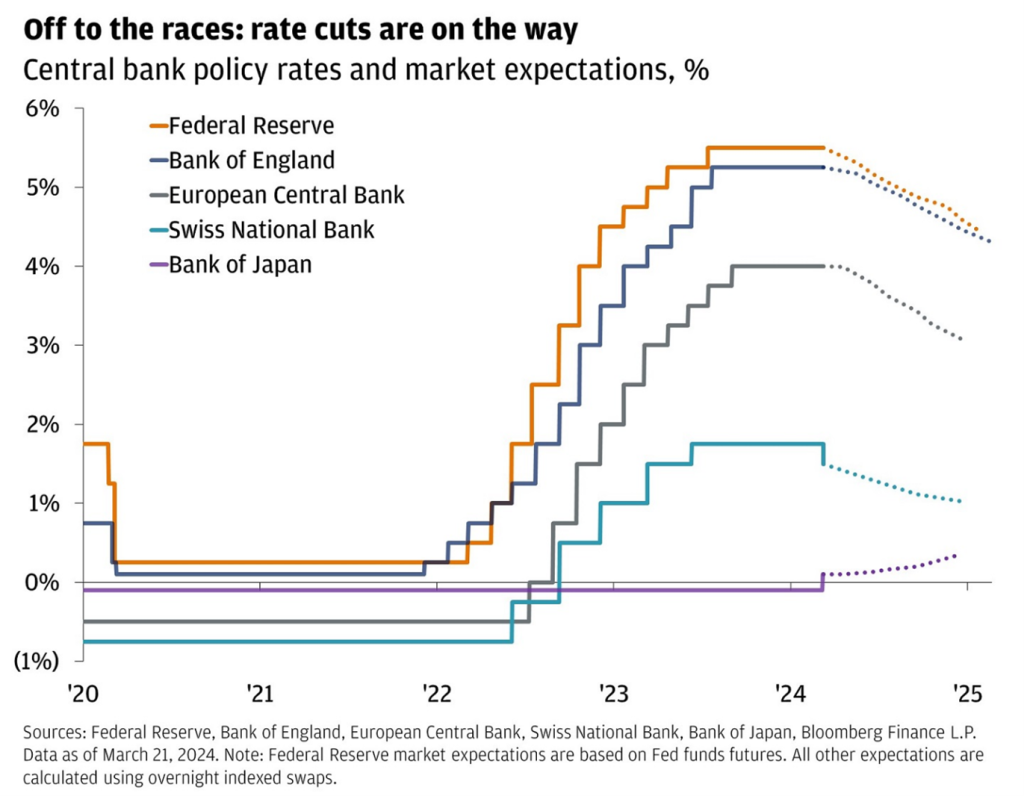

Economic policies:Central banks in the U.S. and Europe may start cutting official interest rates in June if inflation continues to decline.

Equity markets: North American and European equity markets at peak levels, associated with a stable macro environment and good earnings growth prospects. Broadening of the range of sectors and companies with good performance.

Bond markets: The performance of bond markets will benefit from the start of the reduction in official interest rates scheduled for June, and subsequent declines until the end of the year in line with inflation. Credit spreads remain at historically low levels.

Key opportunities: Confirmation of the start of the decline in official interest rates by the Fed and ECB in June, and the expectation of subsequent rate reductions by the market during this year.

Main risks: Postponement of interest rate reductions and consequent impact on household income and economic growth due to a tighter inflation rate. Deepening economic recession in Europe due to high energy costs and high interest rates. Spread of the Israeli-Palestinian conflict to Iran and the Middle East region. Deadlock in the U.S. government leading up to the elections.

The continued decline in inflation and long-term interest rates in Western countries favors investments in equities as well as bonds, especially in the US, where growth has been less affected.

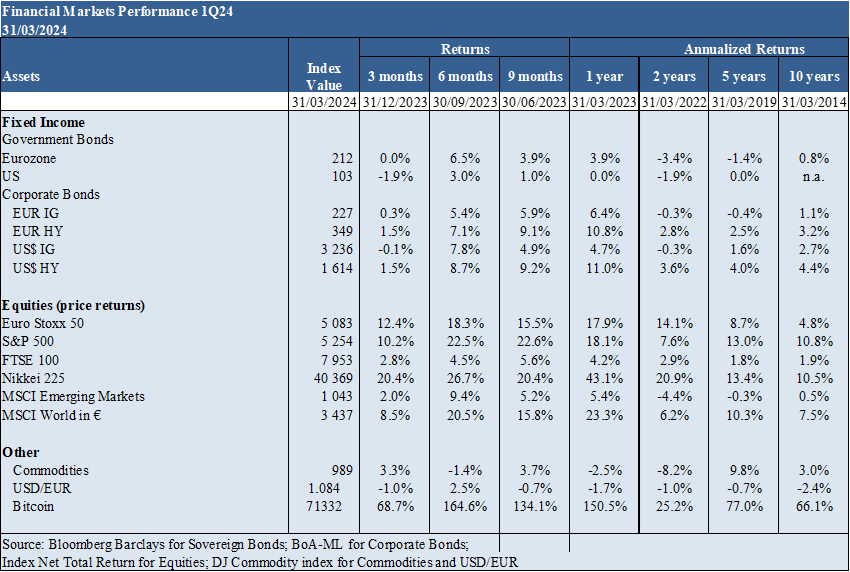

Financial market performance 1Q24

Stock markets continue to trend bullish and reach new highs after having had one of the best years ever. Bond markets have stabilised as a result of rising long interest rates.

Western stock markets maintained an upward trajectory in the first quarter, with gains of (10%), taking the main indexes to all-time highs.

Bond markets in Western countries are moving sideways due to rising long-term interest rates.

Bitcoin also maintained the bullish trend with a 69% appreciation in the quarter, especially in the 2nd half, associated with the regulatory authorization of the launch of the first ETF investment funds in the US.

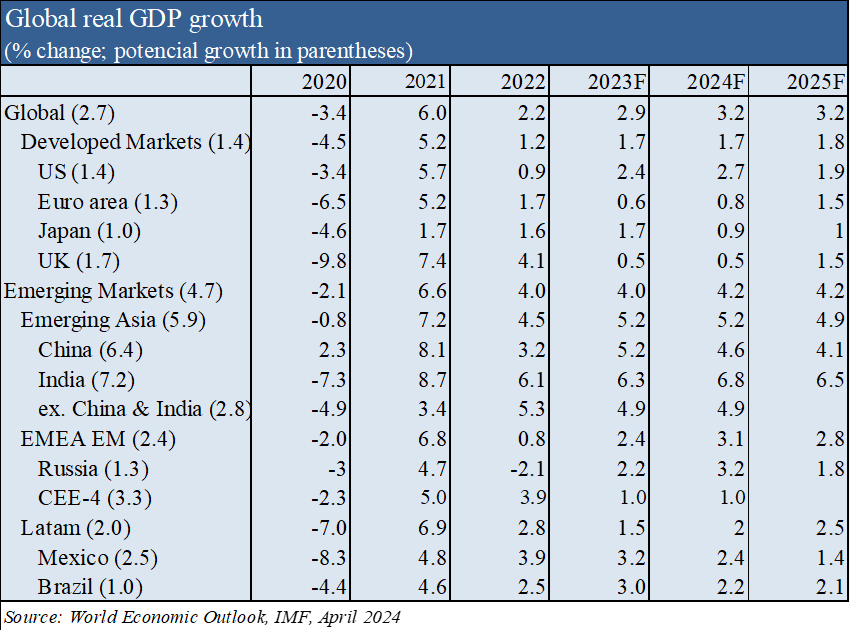

Macroeconomic context

Global economic growth levels remain low and declining. The U.S. continues to exceed expectations and Europe is stagnating. Inflation stubbornly falls in the U.S. due to the services component. Problems remain in China, with low economic growth, high youth unemployment, and bankruptcies in the real estate sector.

IMF global economic growth forecasts improve to 3.2% in 2024 and 2025, with 2.7% and 1.9% in the US, 0.8% and 1.5% in the Eurozone, 4.6% and 4.1% in China, respectively, but below the long-term average.

The U.S. continues to beat economic growth estimates, while Europe is stagnant.

Inflation in the U.S. rose from 3.2% in February to 3.5% in March due to the services component, staying above the Fed’s 2% target, which pushed up long-term interest rates and tempered market expectations of rate cuts for this year (from 5 or 6 at the beginning of the year, for 3 in March and now only 2).

Inflation in the 20-nation eurozone eased to 2.4% in March from 2.6% in the previous month.

China continues to struggle to increase levels of economic growth and employment, and to resolve the crisis in the property sector.

Micro-economic context

Leading snapshot and leading economic indicators are at low levels around the world

The main index has expanded for five months in a row, accelerating over that period.

In March, expansion rates increased in the industrial and service sectors.

Industrial production had the best record in the last 21 months, while services grew at the fastest pace since last July.

Of the 15 countries with manufacturing and services PMI data available, 12 expanded in March, up from 11 in February and 10 in January.

Developed markets were boosted by a faster recovery in Japan, ongoing expansion in the US and UK, and a return to growth in the euro area (on average).

The economic expansion across the currency bloc was the first since May 2023 and was driven by solid growth in Italy and Spain (offsetting continued recessions in France and Germany).

The emerging markets aggregate benefited from faster expansions in economic activity in China, India and Russia. Brazil also had solid growth.

The unemployment rate in the U.S. is at 3.8%, levels close to the lows.

Economic policies

Central banks in the U.S. and Europe are expected to start cutting official interest rates in June if inflation continues to decline

The Fed and the ECB have already indicated that they will lower interest rates this year, probably as late as June, in line with the path of inflation falling from current levels to the 2% target.

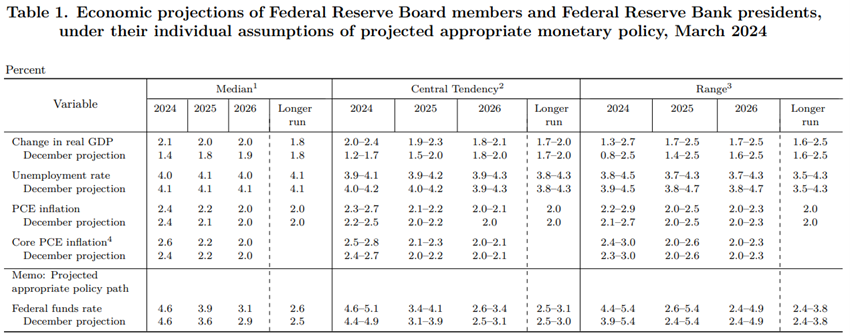

The Fed’s projections point to the decision of this rate from the current 5.25% to 4.6% in 2024, 3.5% in 2025, and 2.5% in 2026. The Fed lowered its projections for its preferred measure of inflation – the private consumption price index (PCE) – to 2.4% in 2024, 2.2% in 2025 and 2% in 2026.

The Fed maintained its outlook for three interest rate cuts this year and a slowdown in the pace of tapering of holdings, despite rising inflation in the first quarter.

The ECB kept the refinancing rate at 4.5%, and could make the first reduction in June. It forecasts inflation of 5.4% in 2023, 2.7% in 2024 and 2.1% in 2025.

The Bank of England has kept the official interest rate at 5.25% and is likely to keep interest rates at a 16-year high until inflationary pressures are further reduced.

Equity markets valuation

U.S. and European stock markets at peak levels, coupled with a stable macro environment. Broadening of the range of sectors and companies with good performance.

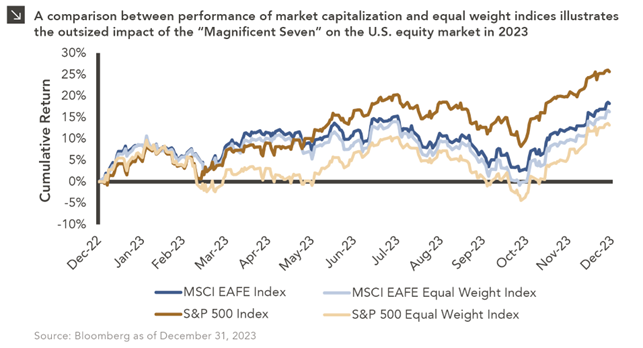

The stock markets of Western countries are at maximum levels, maintaining the bullish trend that began in October 2023.

The S&P 500 ended the first quarter of 2024 with a 10.2% gain, marking its strongest first-quarter performance in five years.

In addition, all three major U.S. indices posted significant quarterly advances.

This rally has been fueled by optimism around artificial intelligence (AI) stocks and speculation about potential interest rate cuts by the US Federal Reserve in the coming months.

But first-quarter gains were broad-based, with four sectors posting double-digit gains. The only sector that lost in the first quarter was real estate.

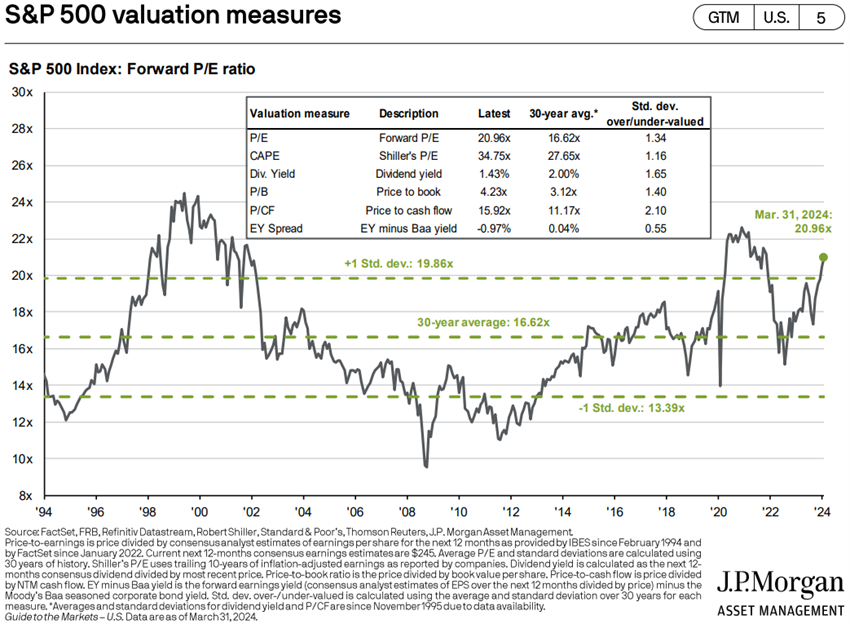

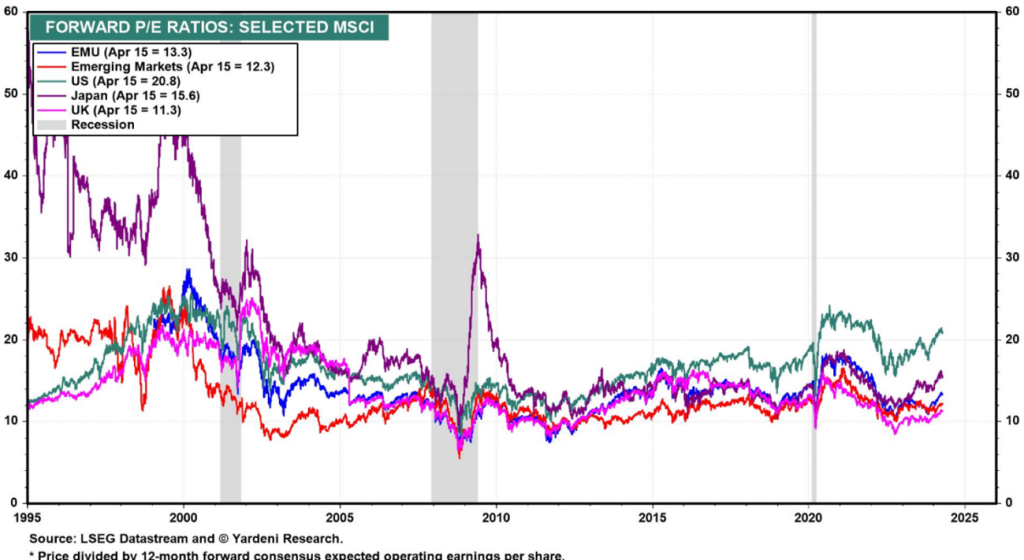

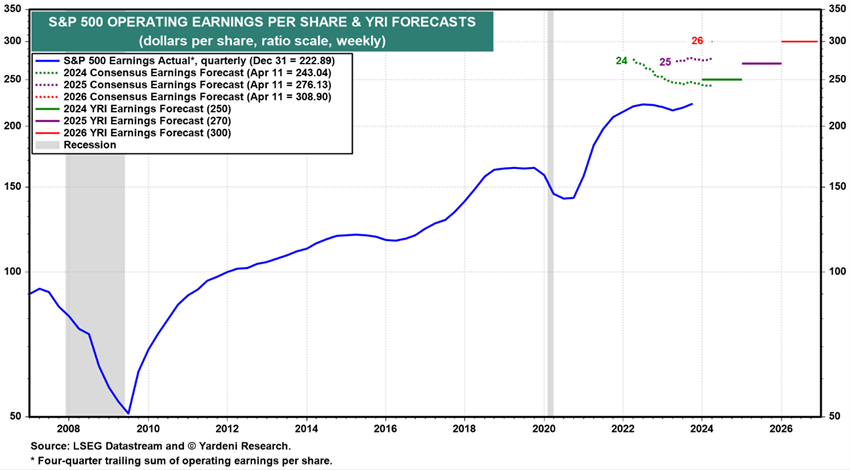

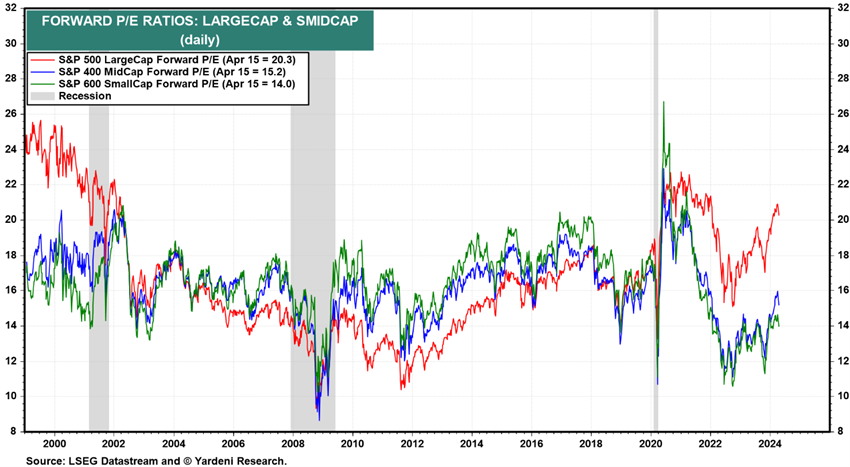

The 21x forward PER for the U.S. is above the long-term average, falling to 18.6x without the 8 MegaCaps.

The PER of the remaining regions fell slightly to 13.3x in the Eurozone, 15.6x in Japan, 11.3x in the UK and 12.3x in emerging markets, all of which are below the historical average.

The PER of mid- and small-cap U.S. stocks are both at 15.2x to 14x, below the long-term average.

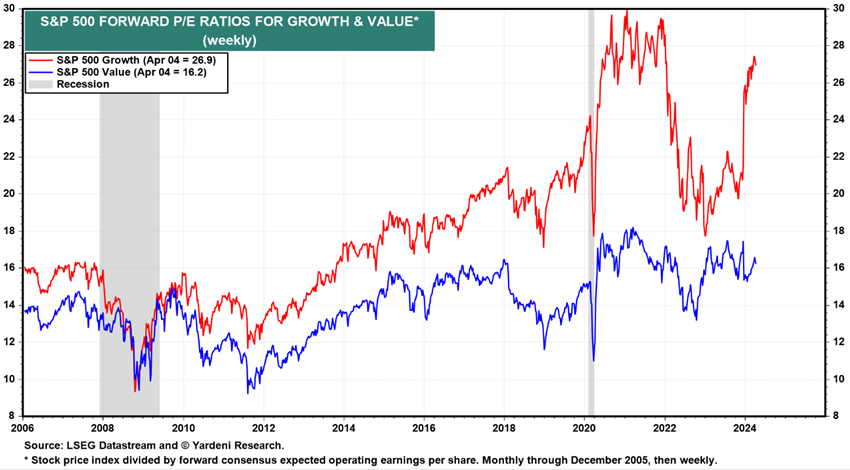

The PER of U.S. growth stocks is at 26.9x and that of value stocks at 16.2x.

The North American market continues to be attractive (alongside Japan) despite higher valuation multiples, with annual earnings growth expected of 11%.

Europe is threatened with recession, or at least stagnation, while China is struggling with the exhaustion and fracturing of the development model, which could benefit India as one of the main bets of emerging markets.

Bond markets valuation

The performance of bond markets will benefit from the start of the reduction in official interest rates scheduled for June, and the subsequent declines until the end of the year in line with inflation. Credit spreads remain at historically low levels

Long-term risk-free interest rates have risen 0.5% in the United States and 0.4% in the Eurozone since November, impacting bond performance.

Credit spreads in the U.S. and Europe remained stable.

The start of the reduction of official interest rates by the Fed (June or September) and the ECB (June), and the subsequent reductions in line with inflation, will have a positive impact on bonds.

With long interest rates well above the average of the last 15 years, and the downward trend in these rates, investment quality bonds trade at interesting levels in the medium and long term, especially in the US.

Main opportunities

Confirmation of the start of the rate hike by the Fed and ECB in June, and the expectation of subsequent rate cuts by the market.

Historically, the monetary policy lag (for inflation to move from peak to minimum) is about 2 years, with the last two cases requiring about three years, and the peak of the current cycle occurred 17 months ago.

Main risks

Postponement of interest rate reductions and consequent impact on household income and economic growth due to a tighter inflation rate. Deepening economic recession in Europe due to high energy costs and high interest rates. Spread of the Israeli-Palestinian conflict to Iran and the Middle East region. Deadlock in the U.S. government leading up to the elections.

The postponement of official interest rate cuts in Western countries will have a negative impact on economic growth.

Worsening of the recession in Europe, starting in Germany, France and the United Kingdom and extending to the rest of the countries, due to high inflation, high interest rates, and the prolongation of the war in Ukraine.

The medium-term trajectory remains fraught with risks, given the enormous challenges in finding a path of relief. Thus, the main transmission channels exposed to the conflict that could affect credit conditions should be monitored, including energy prices, supply chain disruptions, financial market volatility and the resumption of inflationary pressures, which could worsen if the conflict reaches a turning point.

The blockade of some U.S. policies in Congress could extend into the November elections.

The following link shows the status of the most recent polls for the US elections:

https://projects.fivethirtyeight.com/polls/president-general/2024/national/