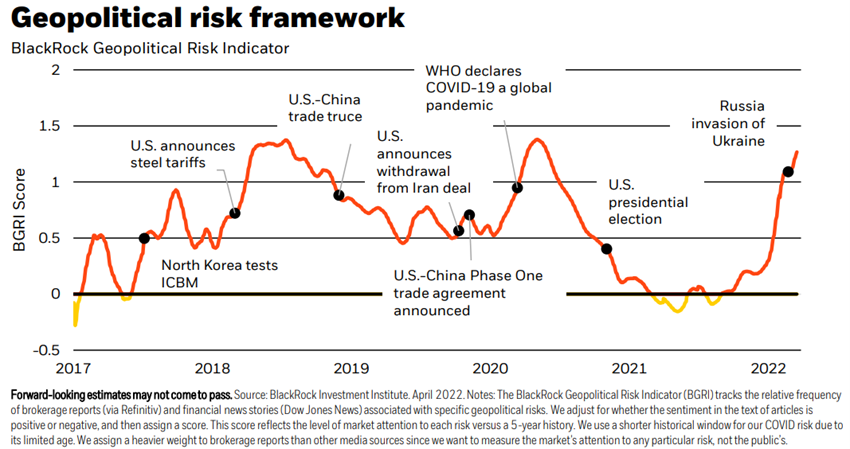

Stock markets and bonds fall 5% in the 1rst quarter and are volatile, with the risks of high inflation, rising interest rates and the war in Ukraine, and with foreshadowings of stagflation and even recession by some economists and investors

Executive summary

1Q22 performance: Stock markets in developed countries fell by more than 5% in the 1rst quarter and are volatile as risks of inflation, rising interest rates and war in Ukraine increase

Status Covid-19: Passage to endemic soon despite some outbreaks of infection in Europe and especially in China, but with significant drop in mortality

Macro Context: Slowing economic growth, but with historically high and still rising inflation rates, aggravated by the war in Ukraine

Micro Context: Key leading economic indicators at good levels, but in decline

Economic policies: The aim of halting rising inflation leads the FED and the Bank of England to increase the pace of interest rates hikes and the rest of the central banks to review their policy

Stock markets: Stock markets enter technical correction with falls of more than 10% in developed countries and larger emerging markets, with increased volatility as a result of economic and geopolitical risks

Bond markets: Fixed yield markets correct more than 10% by long-term interest rate hike

Main opportunities: Rapid end of the war in Ukraine, fall in commodity prices and re-establishment of supply chains, but with low probability

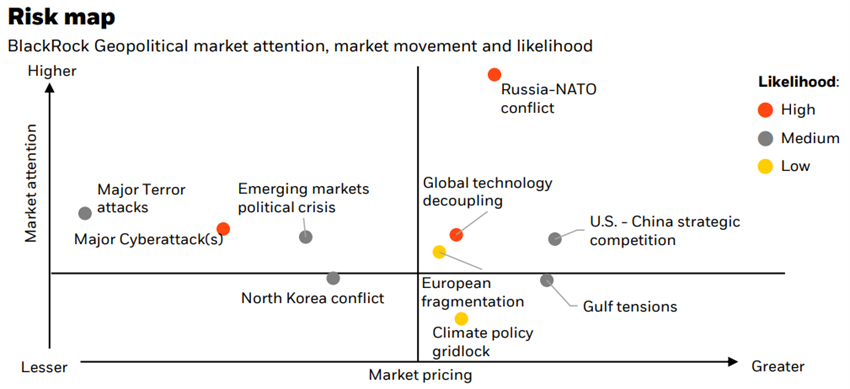

Main risks: Deterioration and increased persistence of inflation, higher interest rate hikes, and prolongation of the war in Ukraine

This phase of cycle transition and growth, with lower levels of economic growth and changing monetary policies, favours equity investments driven by value and quality strategies against growth investments and fixed-rate bonds.

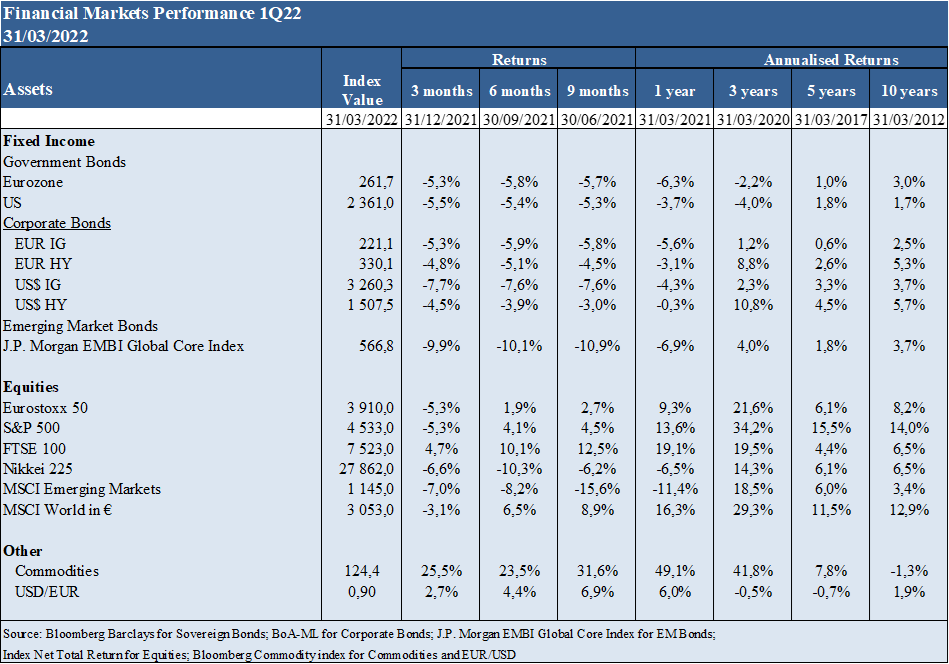

Financial markets performance 1Q22

Stock markets in developed countries fell by more than 5% in the 1rst quarter and are volatile as risks of inflation, rising interest rates and the war in Ukraine increase

Equity markets fell more than 5% in developed countries and have higher falls in emerging markets.

Bond markets also fell more than 5% in the US due to the sharp rise in long-term treasury bond interest rates associated with the monetary policy shift.

The value of cryptocurrencies follows the volatility of markets.

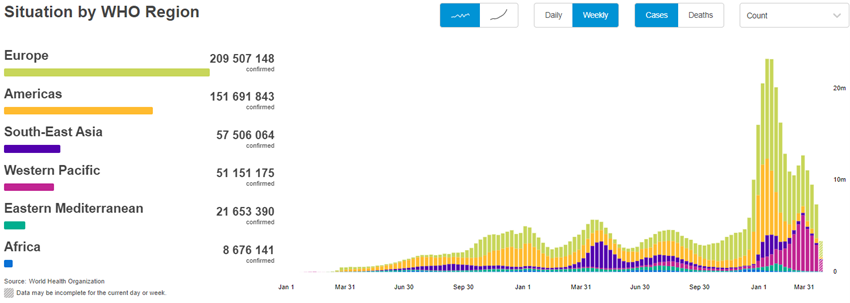

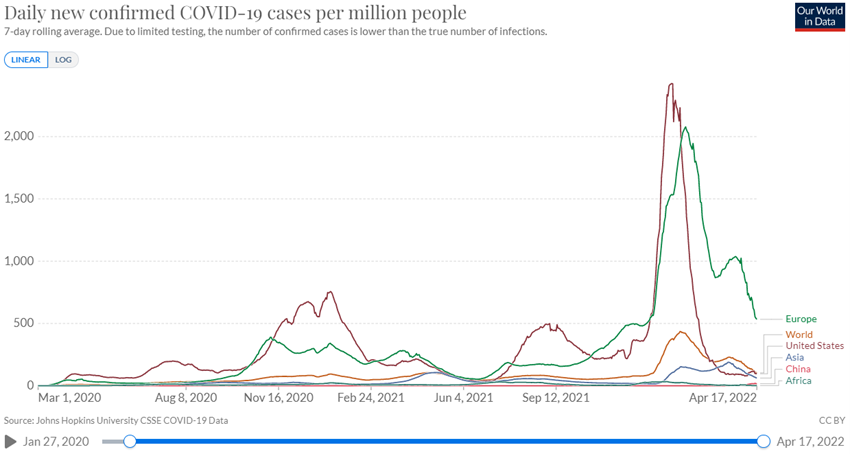

Status Covid-19

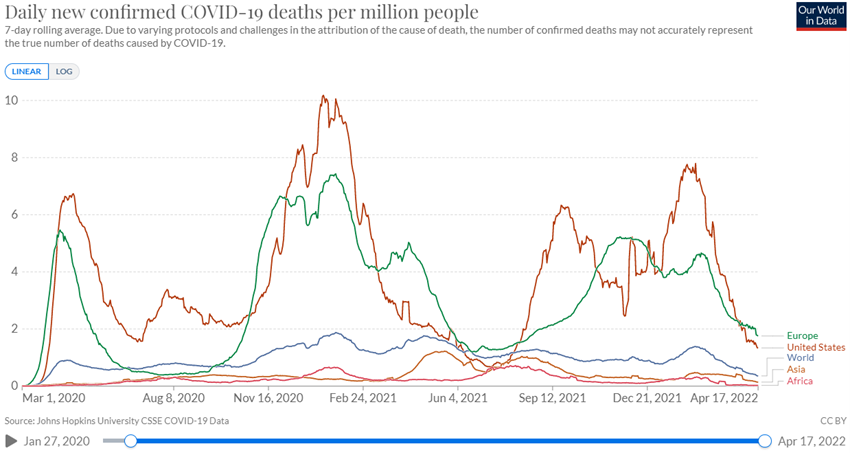

Passage of the endemic is coming soon despite some outbreaks of infection in Europe and especially in China, but with a significant drop in mortality

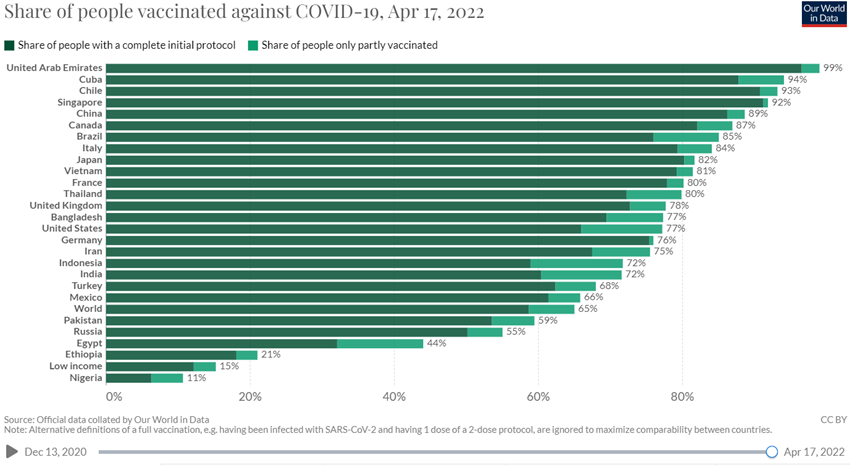

The Covid-19 virus has already surpassed 500 million infected and 6.2 million dead. 65% of people worldwide have already received a dose of the vaccine, but only 15.2% in the lowest income countries.

There are new outbreaks in Europe and especially China, which lead the Chinese government to the isolation of more than 30 million people

Mortality is at low levels and continues to decline due to high vaccination rates and the most effective new treatments, which foretells the passage of the endemic soon.

Source: WHO, Apr, 19, 2022

Macroeconomic context

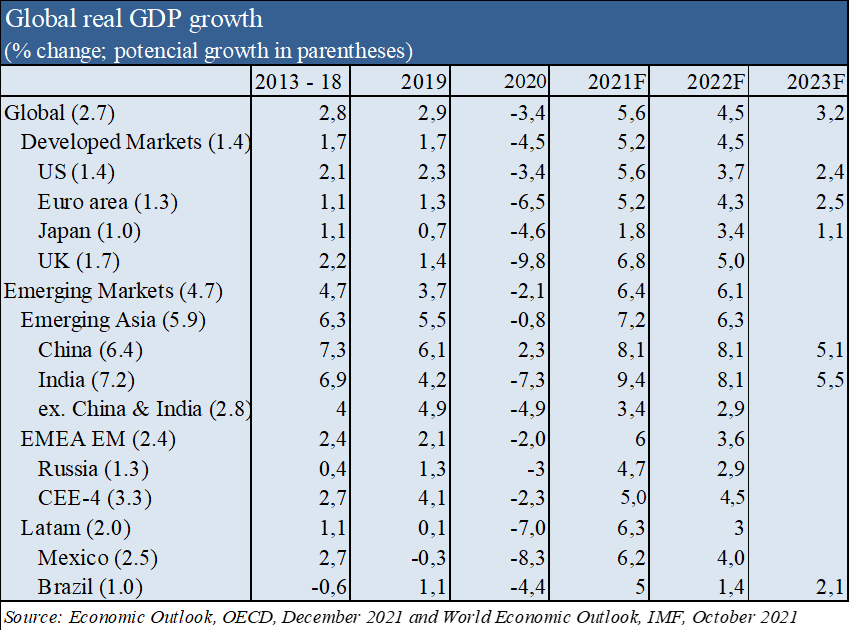

Revision of the IMF’s forecast for lower global economic growth in April to 3.6% in 2022 and 3.6% in 2023 (0.8% and 0.2% less than previous January forecasts, respectively), with 3.3% and 2.4%, respectively, in advanced economies, and 3.8% and +3.4%, respectively, in emerging economies, respectively, due to the persistence of high inflation and the war in Ukraine.

Thus, economic growth is expected to slow down around the world, but at fairly reasonable levels, with less impact on the US and greater impact on Europe and especially emerging economies.

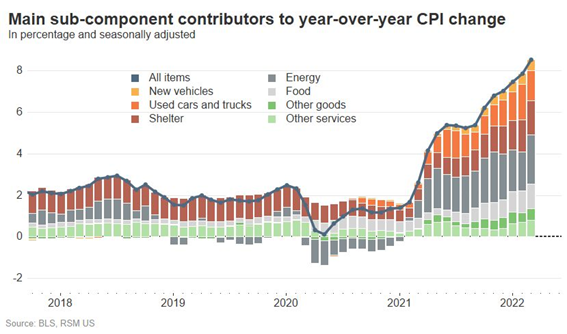

Inflation continues to rise and reach new highs of the last 40 years in developed countries, with 8.5% in the US, 7.5% in the Eurozone, and 6.2% in the UK.

According to the IMF, inflation of 5.7% is expected in developed economies and 8.7% in emerging economies at the end of 2022, an increase of 1.8% and 2.8% compared to previous January forecasts.

Inflation is felt both in consumers and producers, raw materials and goods around the world, and is spreading to wages in the USA.

The household wealth reached maximum values in developed countries as a result of the high savings rates brought by the pandemic and the growth of financial weath in recent years.

Micro-economic context

Key leading economic indicators at good levels, but falling

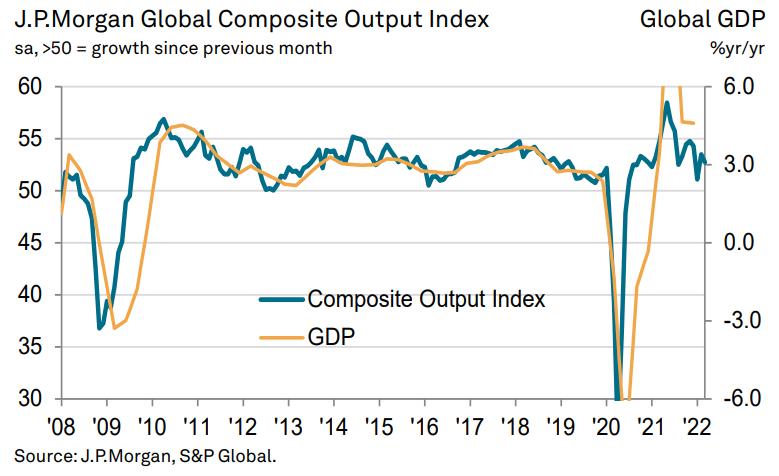

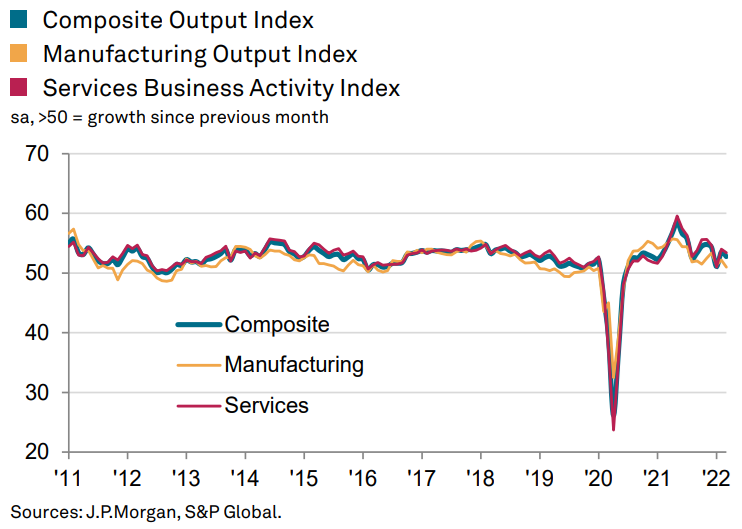

The Global Composite Output reached 52.7 in March, recording a slight slowdown from 53.5 in February, and increasing to 21 consecutive months the period of expansion of economic activity. There was expansion of both sectors, services and manufacturing, with a higher pace by the former.

In March, 11 of the 14 countries with available data expanded, with the best performance in Ireland, the UK and the US. China, Russia and Kazakhstan were the countries with contraction.

Inflationary pressures have intensified by both inputs and outputs.

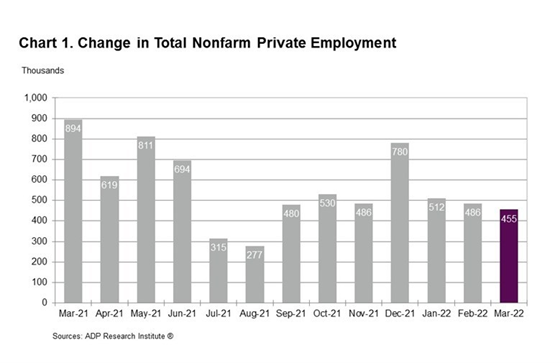

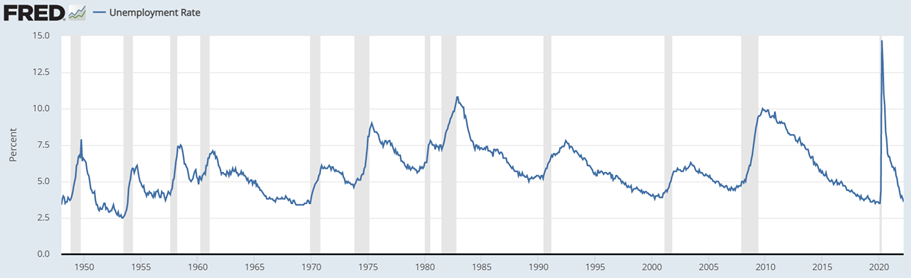

The unemployment rate in the US continues to fall to 3.6%, approaching levels of 3.5% before the pandemic.

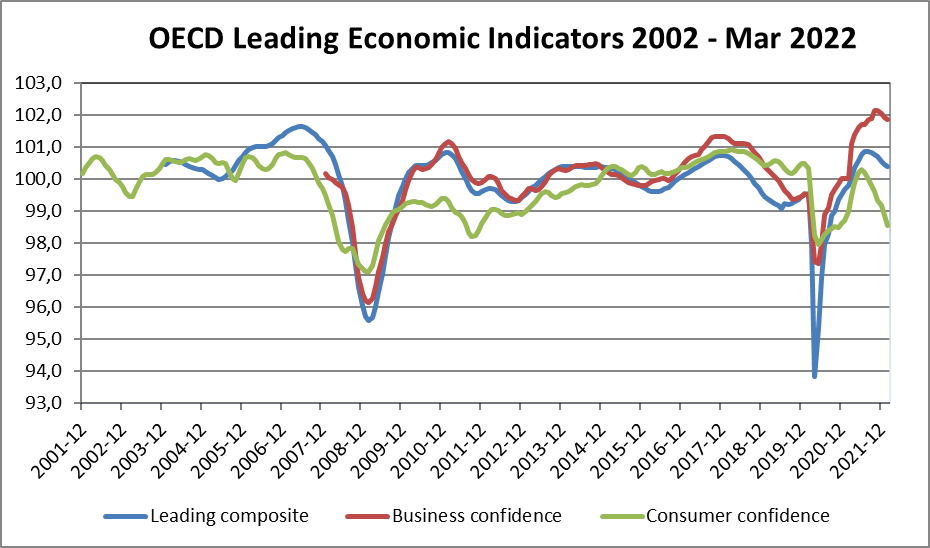

Business and consumer confidence in OECD countries continues to decline, the latter more sharply.

Economic policies

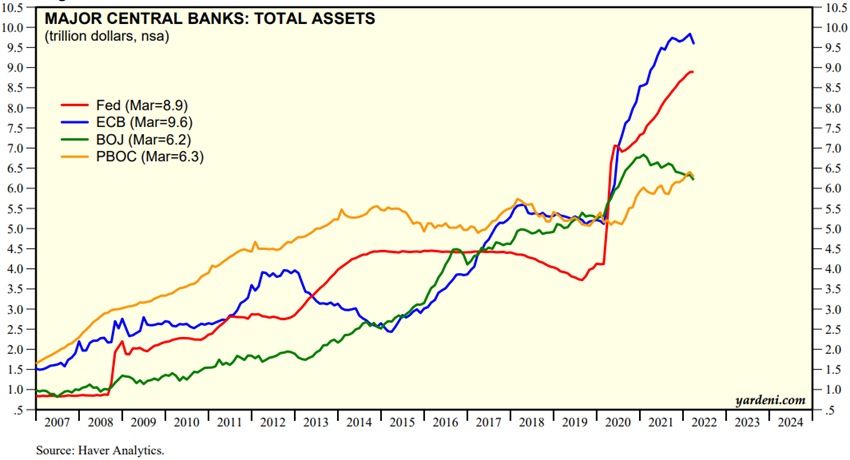

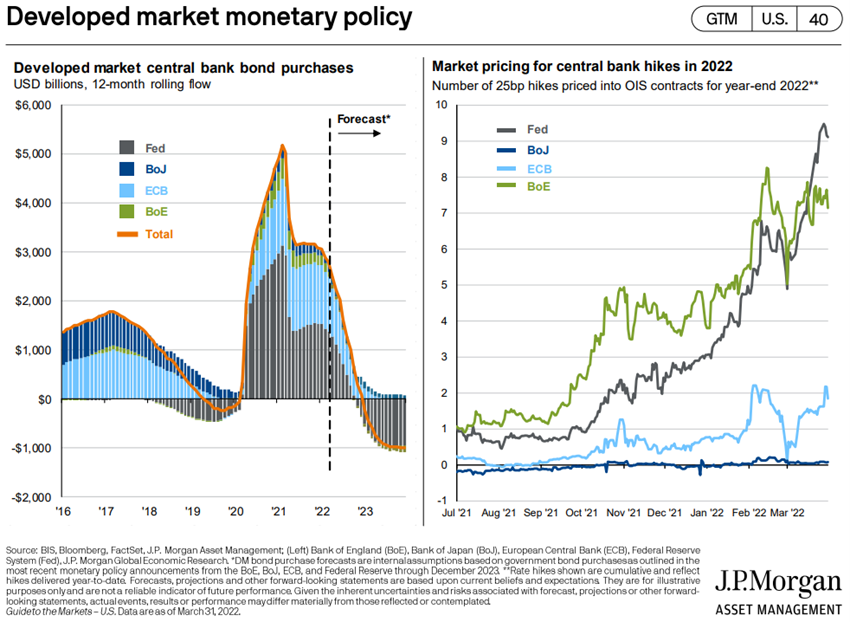

At the March meeting, the FED decided to raise the official interest rate by 0.25% and announce similar increases at the 6 subsequent meetings by the end of the year, admitting that it could go even further. In addition, it decided to accelerate the reversal of the asset purchase program by not renewing maturities at a rate of US$95 billion per month.

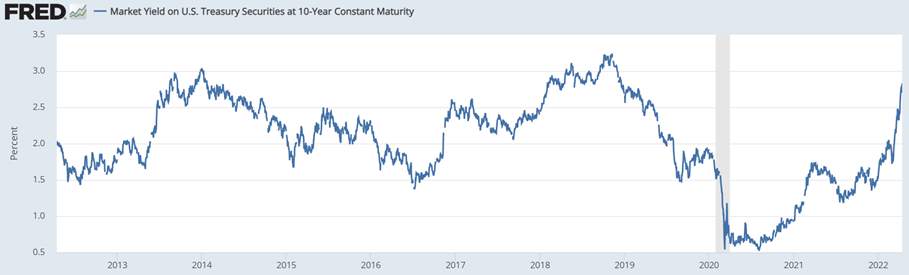

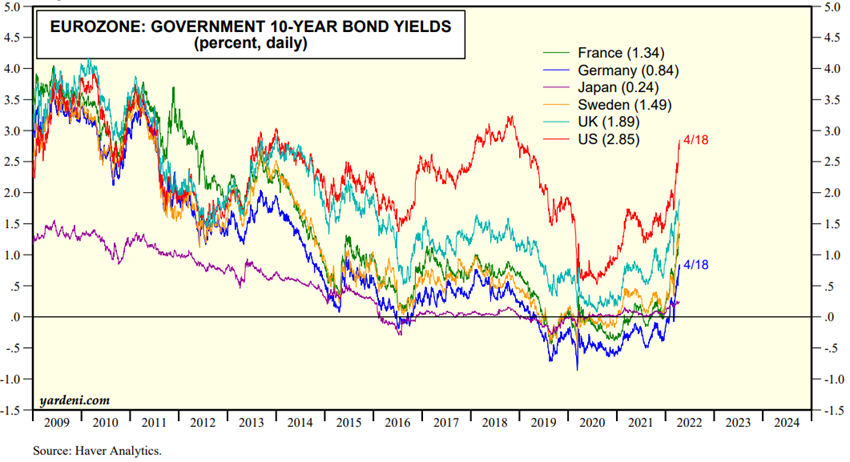

Interest rates on long-term bonds and mortgage loans rose immediately and sharply and are at 2019 levels.

The Bank of England raised official interest rates to 0.75% and the ECB anticipated the end of the asset purchase programme for the third quarter.

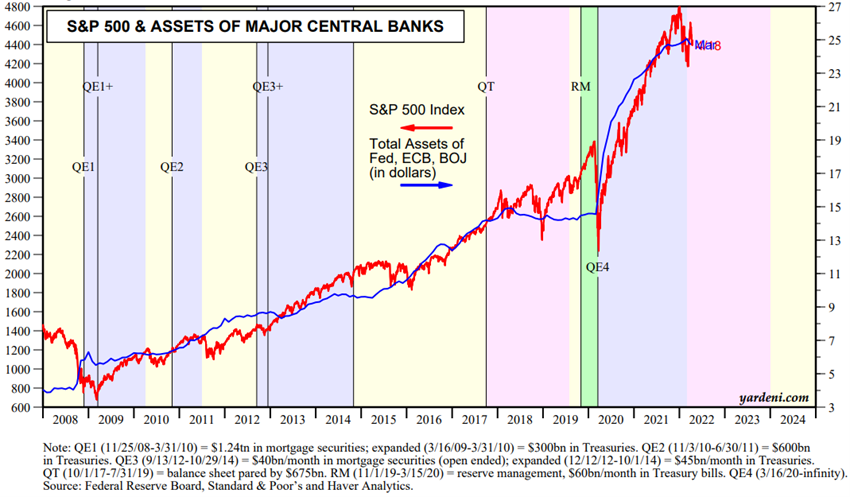

After decades of monetary stimulus, the reversal of monetary policy to halt high inflation in a context of uncertainty aggravated by geopolitical risk has become the determining factor in the evolution of financial markets.

Source: Major Central Bank Total Assets, Yardeni Research, Apr, 19, 2022

Source: World Economic Outlook, IMF, April 2022

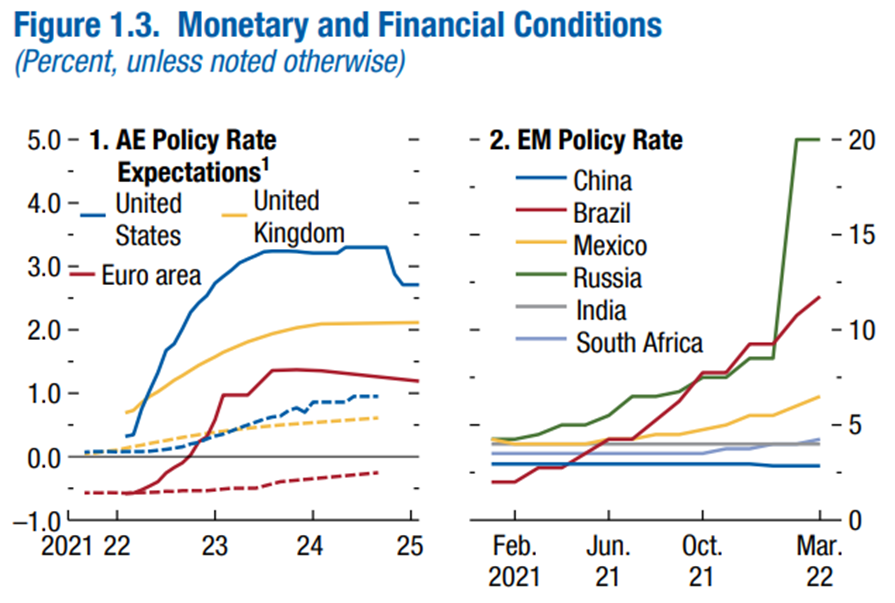

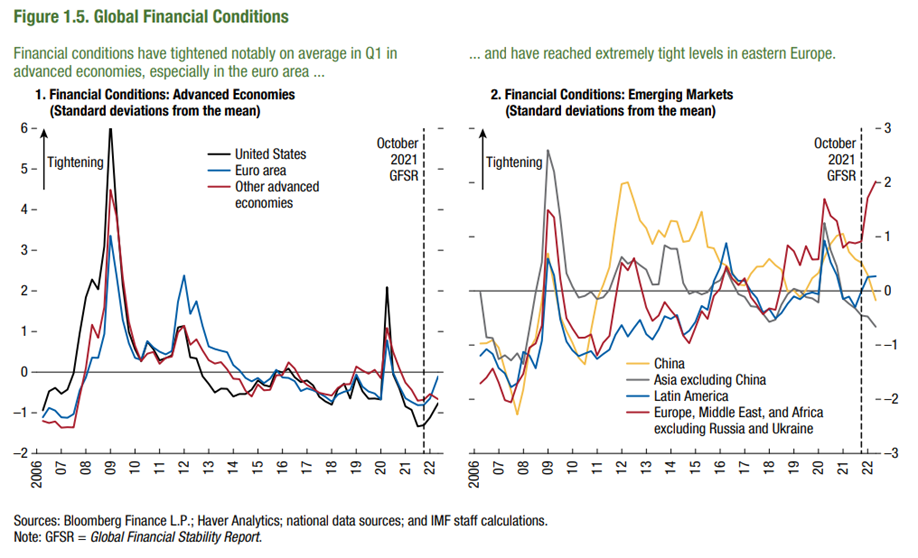

Financial conditions have worsened in developed countries and especially in emerging economies

Financial conditions have worsened in developed countries and especially in the Euro zone.

In emerging countries financial conditions have deteriorated much more in the countries of Eastern Europe and Africa (obviously in addition to Russia and Ukraine).

Source: Global Financial Stability Report, IMF, April, 2022

Equity markets evaluation

The equity markets in developed countries fell more than 10% and went into technical correction, with increased volatility.

Emerging stock markets have fallen sharply, with the Chinese index hitting a five-year low, which prompted the Chinese government to intervene.

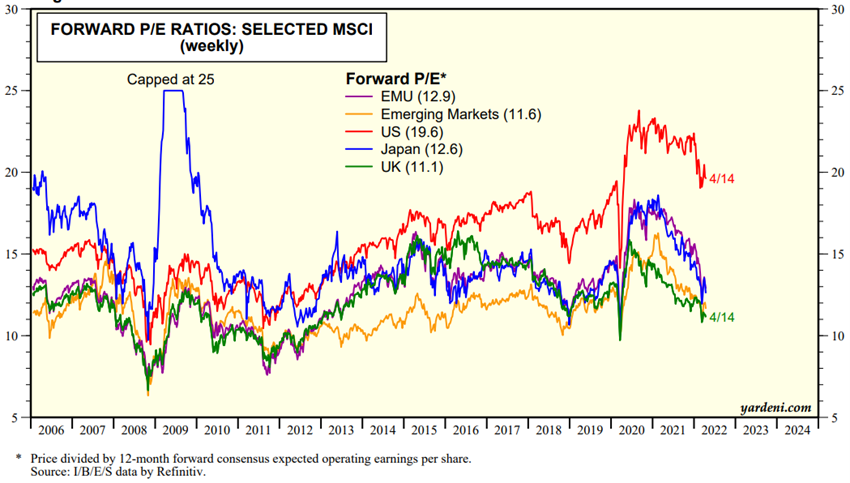

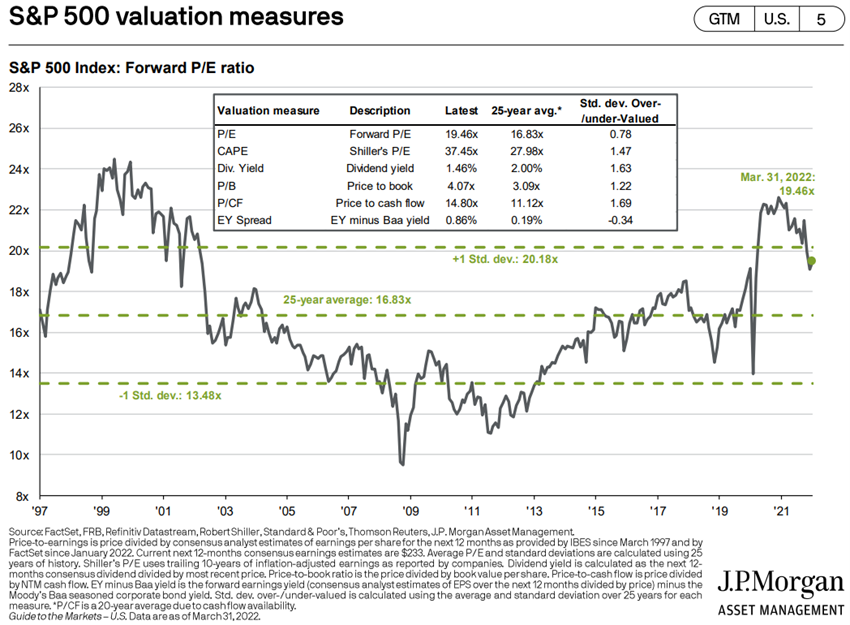

The valuation of the global and global stock market and in the various regions has fallen, but is still above the long-term average. The PER of 19.6x for the U.S. went down, but remains well above average. The PER’s of the remaining regions fell further to 12.9x in the Eurozone, 12.6x in Japan and 11.6x in emerging markets, and are at the end of 2019 levels.

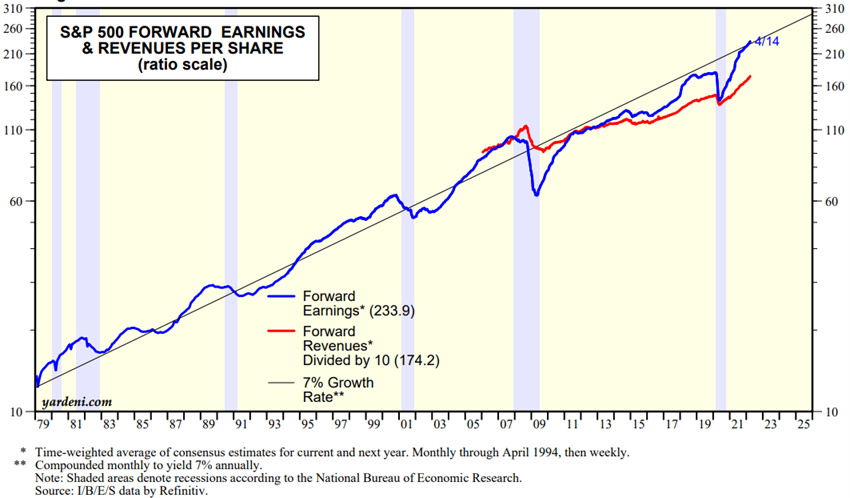

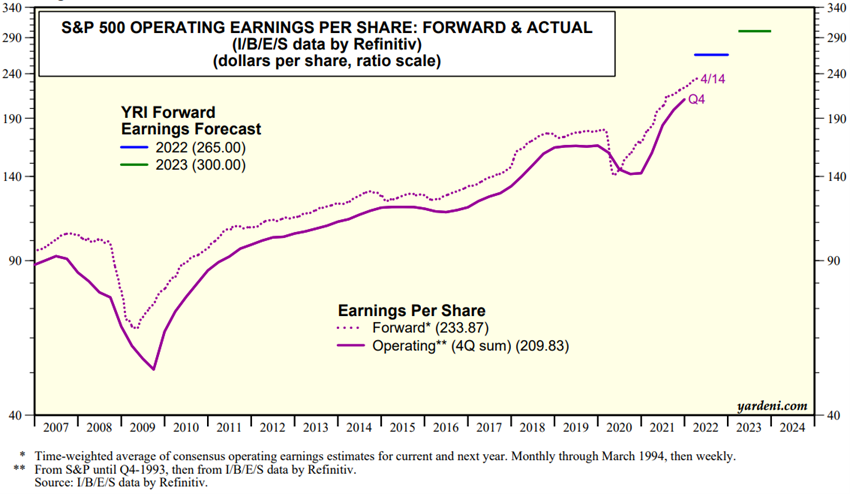

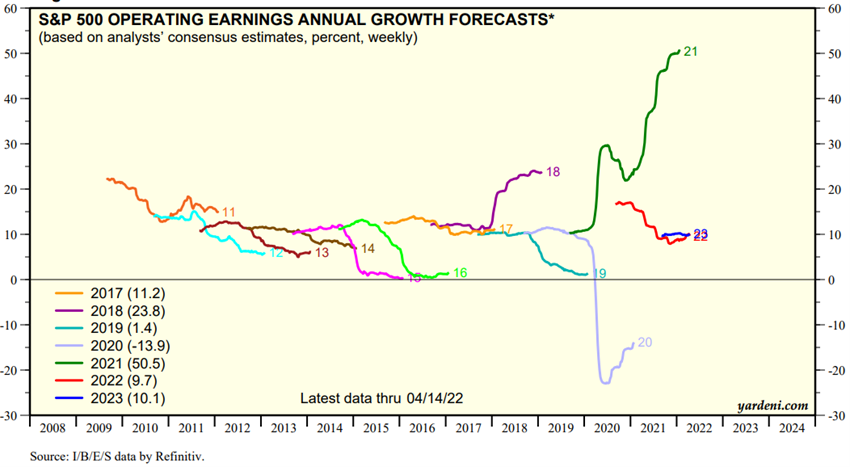

In the last quarter, market analysts moderately raised the earnings outlook for the various S&P 500 stocks for this year.

It is expected that the earnings season that has now begun can give more visibility into the companies situation and prospects.

Despite the correction, the S&P 500’s valuation is excessive in terms of the multiples, but contained in terms of interest rate methods that compared relative attractiveness with bonds, which increases its sensitivity to rising rates.

The war in Ukraine will have a greater impact on emerging economies, including China, with rising energy and cereal prices and declines in international trade.

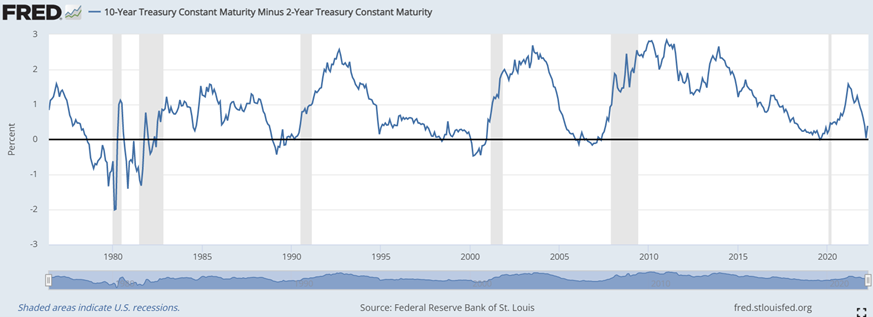

Investors have feared the reversal of the bond yield curve and doubling of the price of oil in less than a year, which in the past have worked as harbingers of recession.

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, Apr, 18, 2022

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, Apr, 19, 2022

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, Apr, 18, 2022

Source: Major Central Bank Total Assets, Yardeni Research, Apr, 19, 2022

Bond markets evaluation

Fixed income markets correct more than 10% by the rise of long-term interest rates

Bonds in developed countries have corrected more than 10% with the sharp rise in long-term interest rates, especially the US treasury bonds, reaching the 2019 levels.

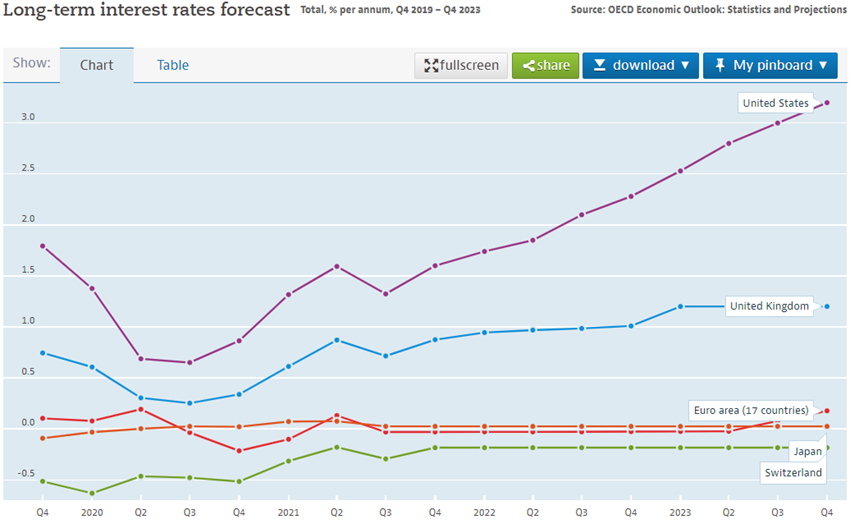

These long rates are expected to continue to rise with the persistence of high inflation and the continued rise in official interest rates.

The bond market is at a crossroads between the losses arising from interest rate increases and their attraction as a refuge value.

Source: Market Briefing:Global Interest Rates, Yardeni Research, Apr, 18, 2022

Main opportunities

The rapid end of the war in Ukraine, the fall in commodity prices and the reactivation of international trade, although with low probability, will reduce inflationary pressures and facilitate the effectiveness of the interest rate hikes.

Main risks

Higher inflation persistence will reduce household consumption and disposable income, lower profits and delay business investment, and push for further interest rates rises, causing further economic slowdown.

Some well-known economists, such as Lawrence Summers, Mohamed El-Erian and Nouriel Roubini, believe that the current too complacent action by the FED will not be able to stify high inflation without a sharp economic slowdown, leading to stagflation or recession.

In our opinion, this more reactive action of the FED to the evolution of economic data will be able to produce a soft transition of cycle and growth, considering the soundness and current financial capacity of households and businesses.

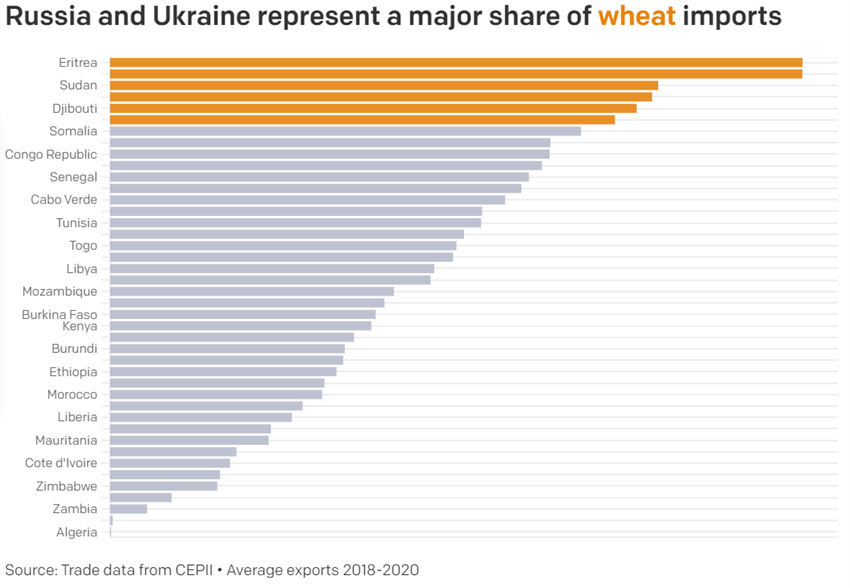

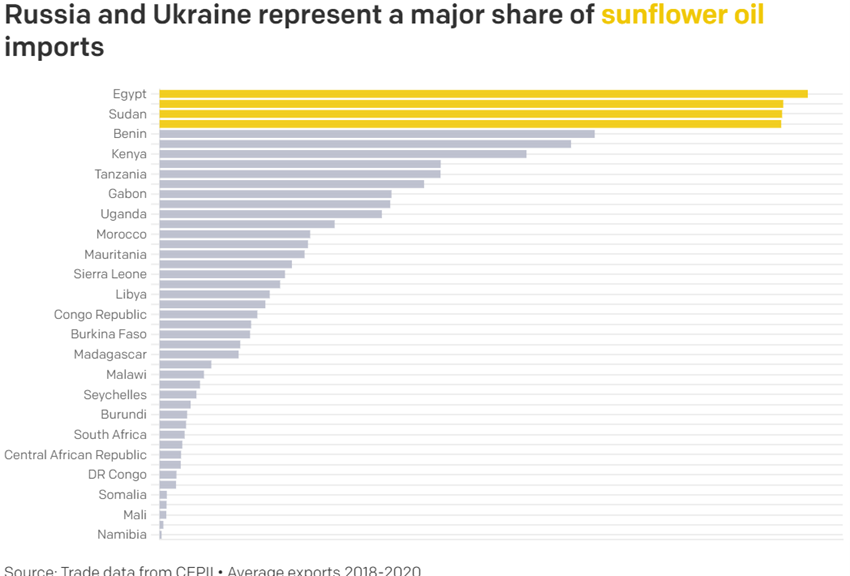

The prolongation of the war in Ukraine will accentuate economic, financial and geopolitical risks, in particular hunger and poverty in African countries.

Russia’s conflict and isolation from Western countries could lead to a new global political and economic order, between Western democracies and eastern autocracies, polarized in the Nato countries and China/Russia, which could lead to greater tensions in international trade and supply chain disruptions.

The risks of more hunger, poverty, uprising and popular uprising in many poor African countries can rise considering that agricultural prices are at their highest in the last 10 years and their dependence on imports of these goods from Russia and Ukraine is very high.

Source: OECD, Long term interest rates forecast, Apr, 19