The competitive advantages of the Porter’s 5-force model

The dissemination of information has reduced today’s competitive advantages to a narrower range than Porter’s

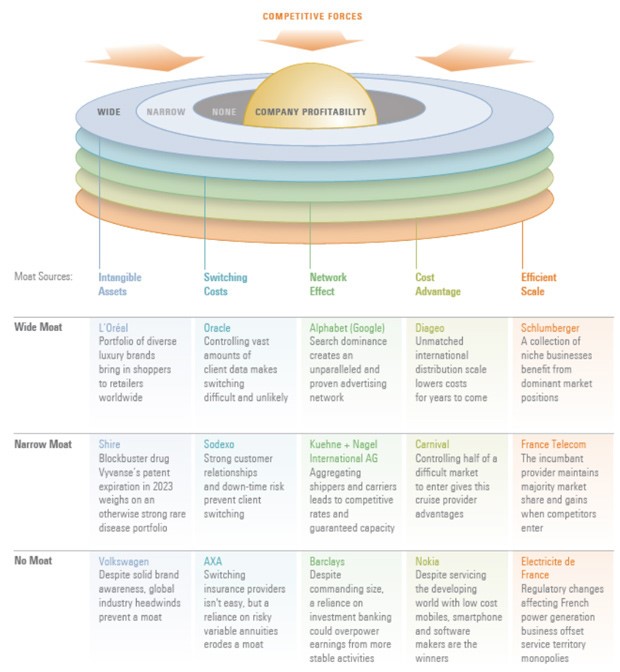

There are several models of evaluation of the stocks available that incorporate the analysis of competitive advantages. The Morningstar’s 5 areas example

The performance of stocks with competitive advantages

Invest in companies you believe in: It’s much better to buy a wonderful company at a fair price than a fair company at a wonderful price.

Price and value are not always the same. Don’t pay too much: “The price is what you pay. Value is what you get.”

Long-term invest: “[O nosso] favorite detention period is forever. We are precisely the opposite of those who rush to sell and make profits when companies perform well, but who hold on tenaciously to the companies that disappoint. [O investidor americano] Peter Lynch likets this behavior to cutting flowers and watering weeds.

To increase the likelihood of being successful in long-term investments, the investor’s goal should be to buy companies with sustainable competitive advantages and at a fair price.

In this article we will see how we can analyze the existence of sustainable competitive advantages.

In a next article we will address the issues of fair price, or value.

It is impossible to treat any of these two subjects seriously without entering the academic field of theories and models. It is inevitable to do so.

However, the aim is not to thicken these matters, but only to alert to the aspects that the investor should pay more attention to.

It doesn’t matter either the details, nor the formulas or the calculations, let alone to take these articles as an academic lesson.

What matters is instigating the investor’s reasoning and intuition in the right direction.

Sustainable competitive advantages allow a company to defend its competitive position in the market or outperform its competitors on a continuous and lasting basis.

The competitive advantages of the Porter’s 5-force model

Michael Porter is a Nobel Prize-winning economist precisely for having developed the most robust competitive advantage model in 1989, known as Porter’s five-force model:

According to this model, there are 5 major forces that determine the existence of sustainable competitive advantages:

The threat of new competitors, the power of suppliers, the power of consumers, the threats of replacement products and competitive rivalry.

The value of each of these 5 forces is measured by the most relevant specific elements that impose on each of the 5 forces, which are about 25 in total.

For example, for barriers to entry the most relevant aspects are the time and cost of entry of new competitors, specific knowledge, economies of scale, cost advantages and technological protection.

The dissemination of information has reduced today’s competitive advantages to a narrower range than Porter’s

Since then, the revolution of the information society has brought the dissemination of information and knowledge, mitigating or even eliminating many aspects of Porter’s competitive advantages, significantly reducing them:

Currently the main aspects of competitive advantages are:

Proprietary information, economies of scale, intellectual property, location (or proximity to supply and consumer markets), closed supply chain, network effect, innovation and brand loyalty.

There are several models of valuation of listed stocks that incorporate the analysis of competitive advantages. The Morningstar’s 5 areas example

Morningstar created a business valuation model in 2007 that benchmarks the basic principles of value investing by Warren Buffett and Benjamin Graham.

Its evaluation recommendations are based on 5 sustainable competitive advantages to which it calls MOAT (or gap) and the reasonableness or fairness of the stock price.

Morningstar’s rationale is:

“Invest in companies with strong and growing competitive advantages (MOATs), trading at reasonable prices”.

This model is part of the understanding that capital flows to the areas of greatest potential return, so all companies face competition that seeks to force the decline of high capital returns.

But some companies generate high returns for a long time.

How do they do it?

Creating economic moats or sustainable competitive advantages in your business.

An economic gap is a structural feature of the business that allows a company to generate surplus economic returns for an extended period.

Companies with economic divides have the ability to invest incremental capital at high rates of return = providing faster growth in earnings and/or higher free cash flows for distribution to shareholders.

These companies have more predictable cash flows, which limits the risk.

In quantitative terms, the key measure for assessing the economic gap is return on invested capital (ROIC).

Morningstar subdivides its universe of analysis of more than 1,500 companies into three dimensions of economic divide: none, narrow and wide.

Large-pit companies are those that have a competitive advantage for more than 20 years, while narrow-pit companies have advantages for a term of between 10 and 20 years.

Morningstar’s universe leans towards companies with an economic divide, although in the global economy, most companies don’t.

Economic moats are also not evenly spread across sectors. Highly standardized or highly competitive industries will naturally have fewer companies with moats.

Morningstar considers that there are 5 sources of economic moats or competitive advantages:

Intangible assets, moving costs, network effects, cost advantages and economies of scale.

Each of these 5 fonts has some defining elements that we present below.

Intangible Assets: includes trademarks, patents and regulatory licenses. The brand increases the customer’s willingness to pay. Patents protect the power of pricing legally preventing competition. Government regulations prevent competitors from the market. Examples: Coca-Cola, Unilever, Johnson and Johnson, Sanofi.

Change costs: time is money and vice versa. The value of the change exceeds the expected value of the benefit. Shaver models and their blades create a repeatable shopping circle of consumables. Price is not the only determinant. Examples: Oracle, Intuitive Surgical and ADP.

Network effect: The value of a particular good or service increases for both new and existing users as more customers use that good or service. The number of potential bindings grows exponentially with each additional node. Examples: Facebook, Mastercard, Ebay, Chicago Mercantile Exchange Group.

Cost advantages: Costs that are long below than competitors. Irreplaceable procedural advantages. Top location. Scale difficult to accumulate. Access to a single asset. Examples: Amazon, Novo Nordisk, AB inBev, Morningstar, Shell.

Efficient scale: Dynamics in which a market of limited size is effectively served by few companies. Established operators generate economic profits. Newcomers are discouraged from entering because returns in the market fall below the cost of capital. Examples: UPS, National Grid, Carnival.

In the following links we have more information about the methodology used by Morningstar in the attribution of the Moat rating and how its analysts evaluate the actions in general:

Morningstar publishes assigns Moat rating to several individual shares.

In addition, it builds and manages several proprietary Moat stock indices, the best known being the Morningstar US Wide Moat Focus Index composed of at least 40 US stocks.

There are also Moat indices on other geographies, for example global market or developed countries, as well as at sectoral level.

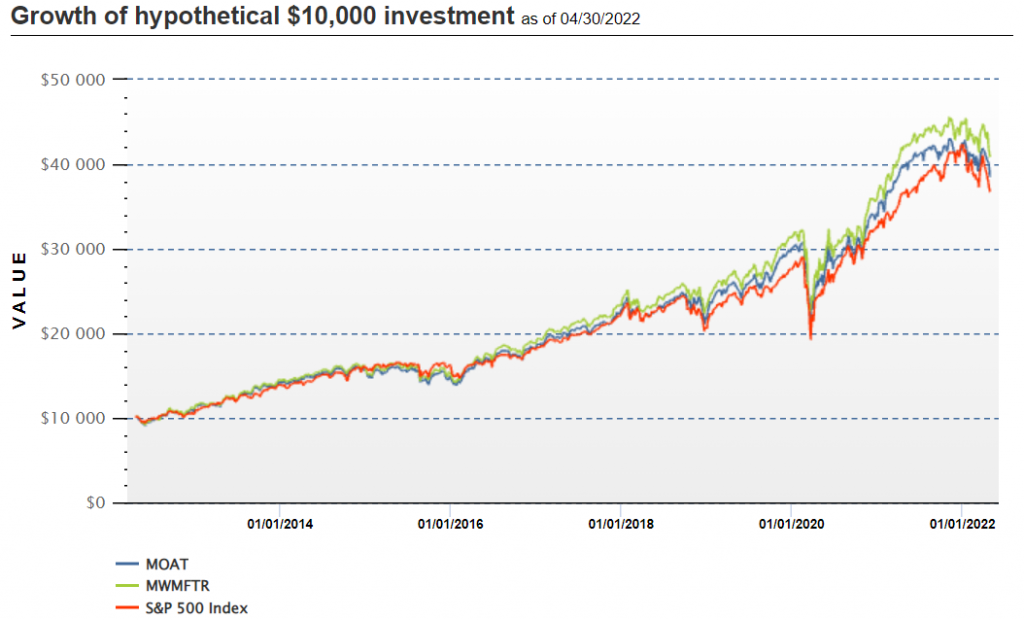

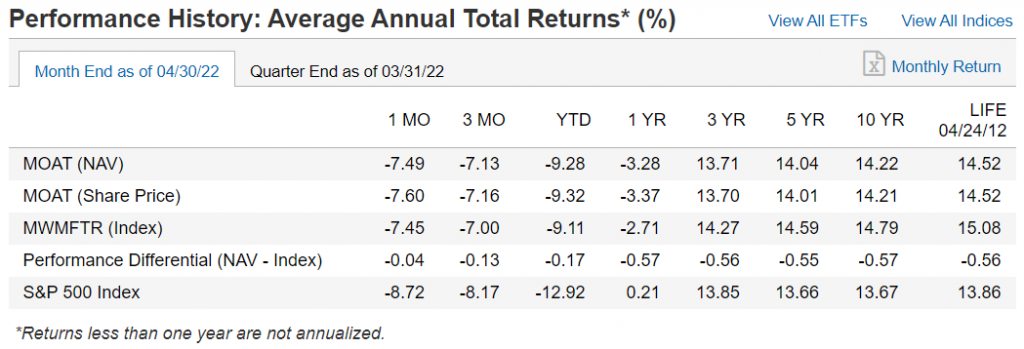

The performance of stocks with competitive advantages

The following chart shows the performance of Morningstar’s MOAT index compared to the S&P 500 index and the fund under the MOAT index managed by Van Eck between 2012 and 2021:

Source: VanEck, 30/04/22

Since its inception in 2012, the Moat index (MWMFTR) has had an average annual profitability of 15.08%, more than 1% per year above the 13.86% of the S&P 500 index:

Part of this performance stems from the dynamic nature of the index. For example, throughout 2020, Morningstar has moved from expensive growth companies to more defensive sectors such as aerospace and finance.

This rotation has benefited the recent performance of value stocks in relation to growth.

Van Eck manages a fund under Morningstar’s Moat index, the conditions of which can be accessed at the following link:

https://www.vaneck.com/us/en/investments/morningstar-wide-moat-etf-moat/

Morningstar published an article in 2021 that looks in more detail at the performance of its Moat index: