Stocks and bond in bear market. The risks are on the downside. S&P 500 can reach 3,300 in the next 3 to 6 months. US risk-free interest rates at 2 and 10 years at attractive levels for US dollar investors.

This will be the first Outlook in which we do not address the situation of the pandemic, as we have been doing since March 2020.

Although the pandemic has not disappeared, economic and financial concerns have changed.

Today the issues that impact on investments are inflation, restrictive monetary policy – rising interest rates and quantitative tightening – the energy crisis, and the war in Ukraine.

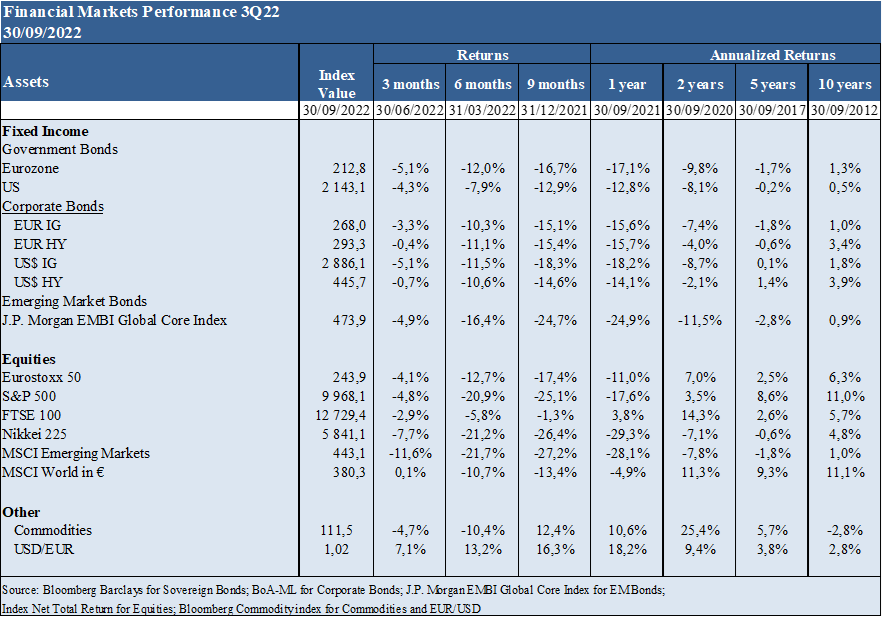

Markets Performance 3Q22: Bear market stock markets with corrections of more than 20%. Bond markets entered an unusual bear market in September. Increased volatility. Consequently, the classic and very popular 60/40 portfolio and the general ity of investors show sharp losses.

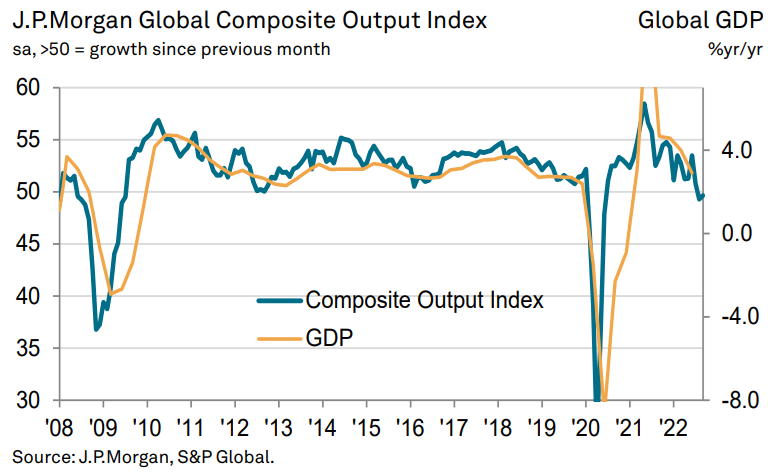

Macro Context: Continued sharp slowdown in economic growth around the world due to the fight against inflation, the prolongation of the war in Ukraine, and lockdowns in China, and the increased likelihood of recession

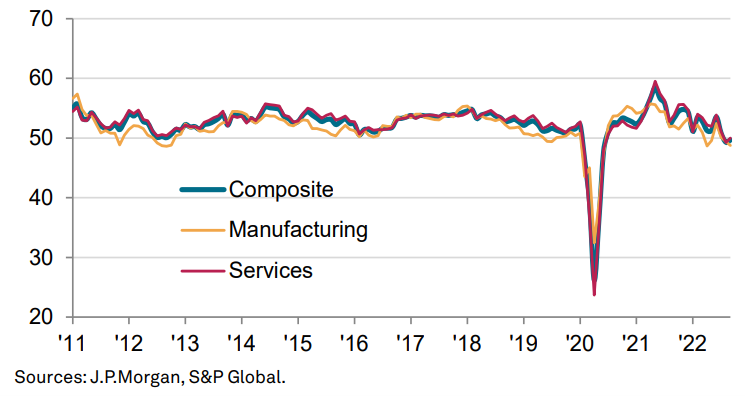

Micro Context: Key instantaneous and advanced economic indicators in decline and at contraction levels in Europe

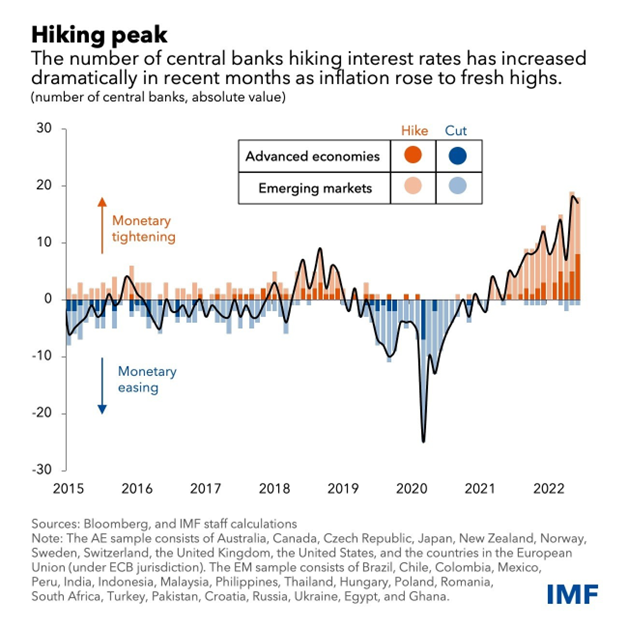

Economic policies: Central banks with restrictive policies lead to interest rate hikes

Stock markets: Bear market stock markets continue to fall, with significant increase in volatility as a result of increased economic and geopolitical risks

Bond markets: The end of the long 40-year bull market of bonds culminated in an unprecedented bear market. Increased risk-free rates and some widening of spreads.

Key opportunities: Negotiated term of Ukraine war, with low probability

Main risks: Economic downturn in Europe and the US, consequent increase in risk premiums, and increased vulnerability to low-probability and high-impact risks (“tailrisks” or even “black swans”)

This phase of economic cycle change, of monetary policy change, favors defensive investments, in value stocks or dividends, and for U.S. investors, in medium and long-term treasury bonds. Exposure to low-quality rating debt should be avoided.

Performance of financial markets 3Q22

Bear market stock markets with corrections of more than 20%. Bond markets entered an unusual bear market in September. Increased volatility. Consequently, the classic and very popular 60/40 portfolio and the general ity of investors show sharp losses.

Stock markets in bear market, or fall above 20%, in developed countries, and higher in emerging markets.

Bond markets entered an unusual bear market in September.

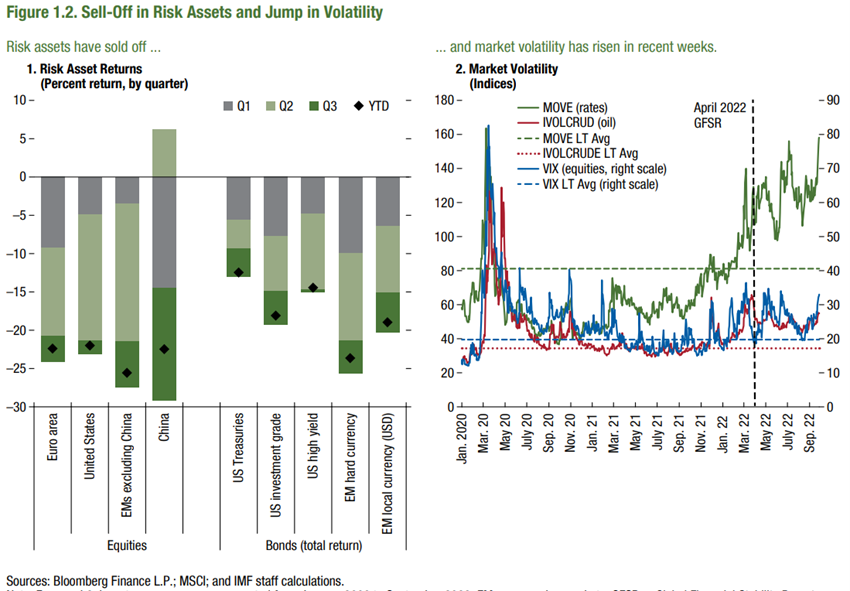

Increased volatility, with VIX levels above 30%, predicts larger falls.

Maintaining bitcoin’s $20,000 price and global cryptocurrency market capitalization more resilient than shareholder market volatility.

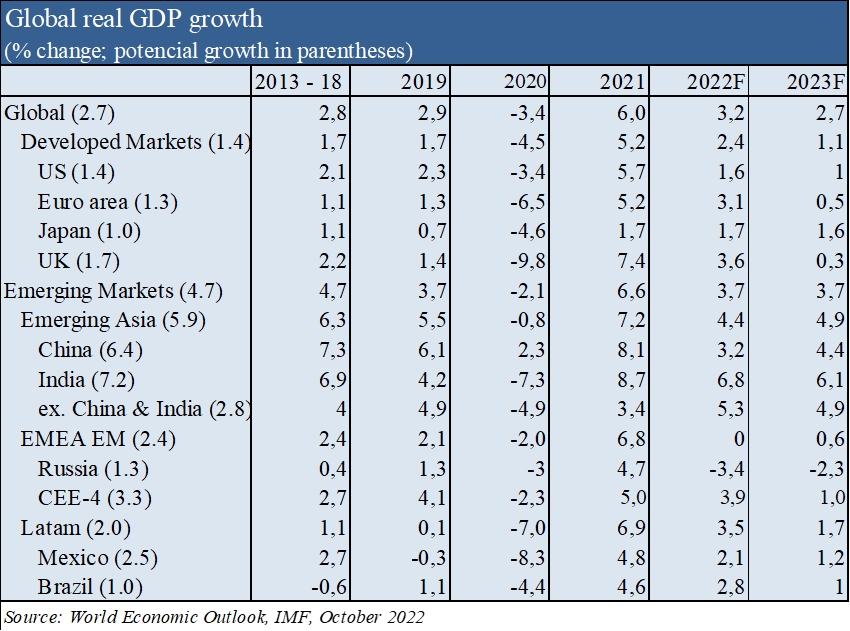

Source: World Economic Outlook, IMF, October 2022

Macroeconomic context

Review of global economic growth forecasts down slightly to 3.2% in 2022 and 2.7% in 2023, and with 1.6% and 1.0% in the USA, 3.1% and 0.5% in the Eurozone, and 3.2% and 4.4% in China in 2022 and 2023 respectively, due to the persistence of high inflation, rising interest rates, oil prices and war in Ukraine (between April and October, IMF).

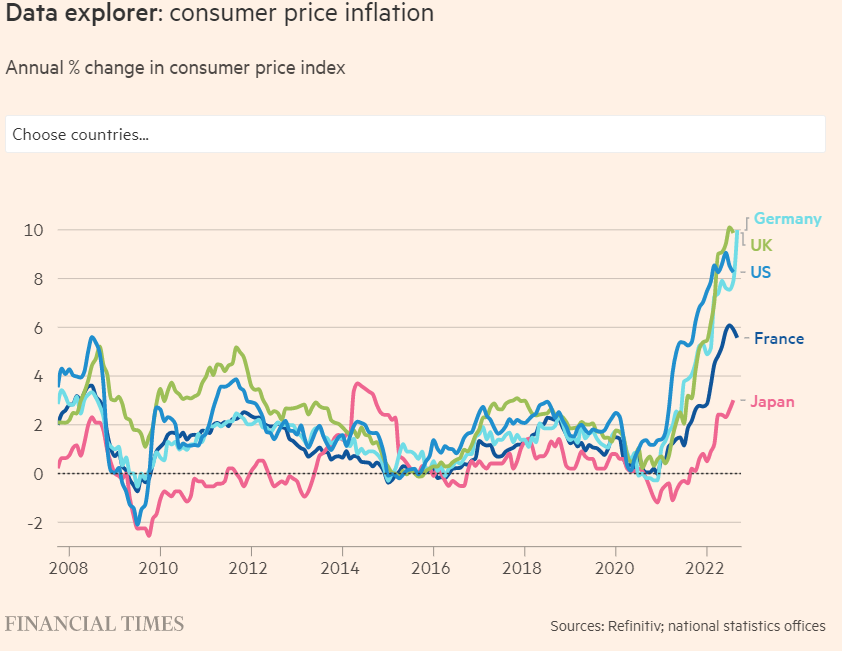

Inflation persists at highs over the past 40 years in developed countries, with figures of 8.1% in the US, 10.0% in the Eurozone, and 8.6% in the UK.

According to the IMF, inflation of 7.2% and 4.4% is expected in 2022 and 2023, respectively, in developed economies, and 9.9% and 8.1% in emerging economies.

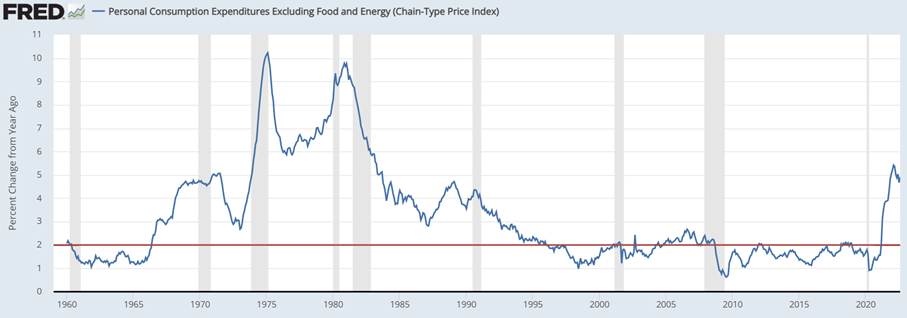

Central banks are determined to drive their preferred inflation metric, the core PCE, from the current almost 5% to the 2% level in the medium term, with a restrictive monetary policy.

The main question is what cost to pay in terms of economic growth and jobs, with threat of recession in Europe and the US.

The good levels of wealth, income, employment and household savings in most developed countries generated in recent years are a buffer, but also prolong, the arm wrestling between inflation and restrictive monetary policy.

Most analysts attribute a probability of recession in the U.S. between 65% and 80% for 2023 (second half).

There is a large dispersion in these probabilities, between 96% to 98% of Ned Davis Research and the Conference Board, respectively, and less than 2% of the St. Louis FED.

Micro-economic context

Global economic contraction, with slowdown in the US, Eurozone and UK

Slowdown in the US, the Eurozone (with only France among the big four EA economies watching the expansion) and the UK.

Production increased in Japan, Brazil, Russia and Australia.

Inflation in production costs is the lowest in the last year.

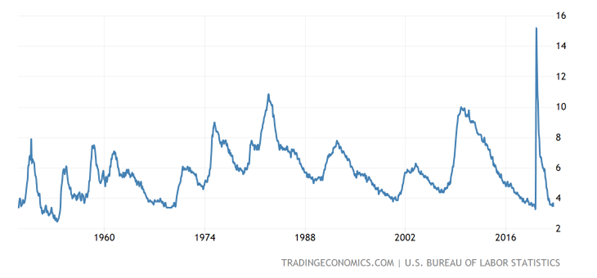

The unemployment rate in the U.S. is at 3.5 %, minimum levels.

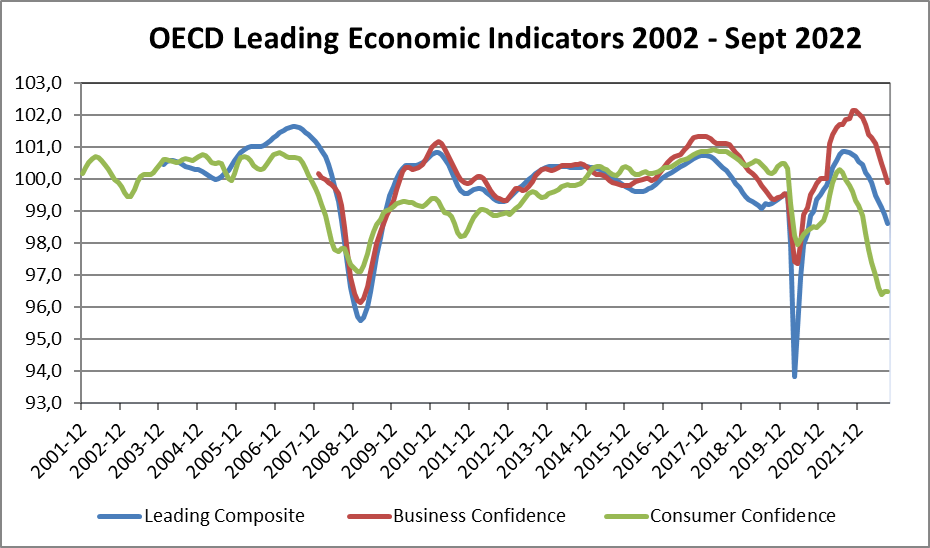

Business and consumer confidence in OECD countries continues to decline sharply.

Economic policies

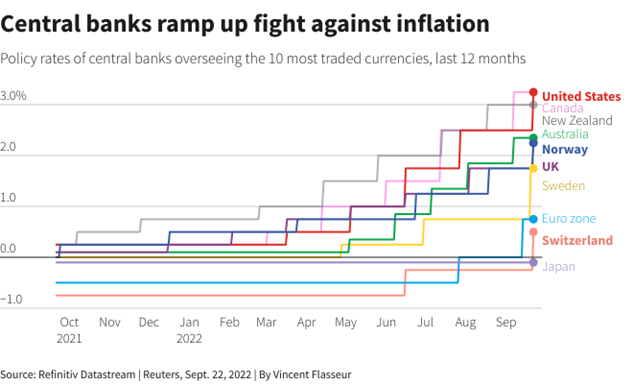

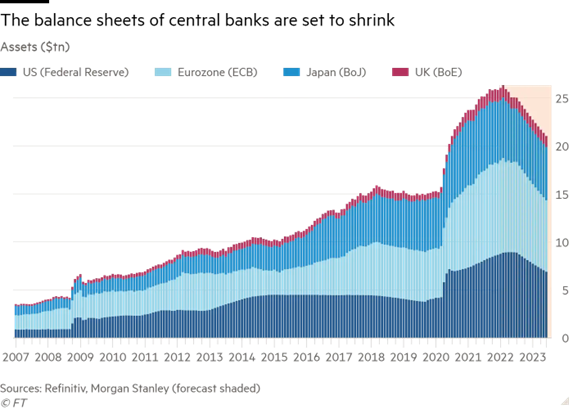

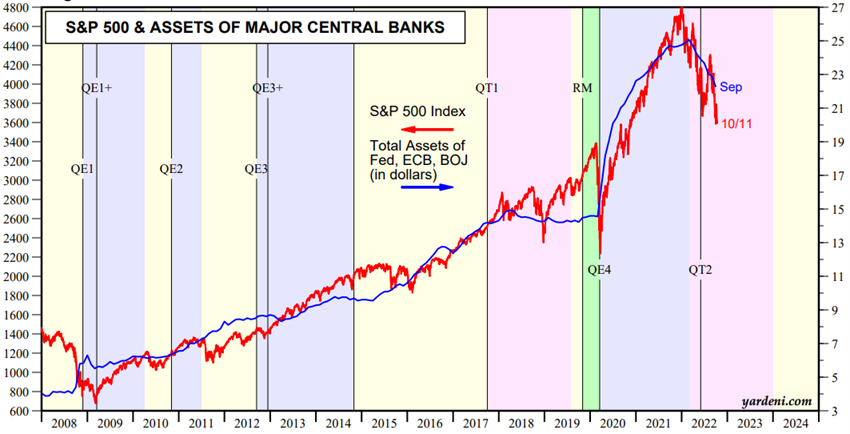

Central banks raise interest rates and remove excessive liquidity from the system

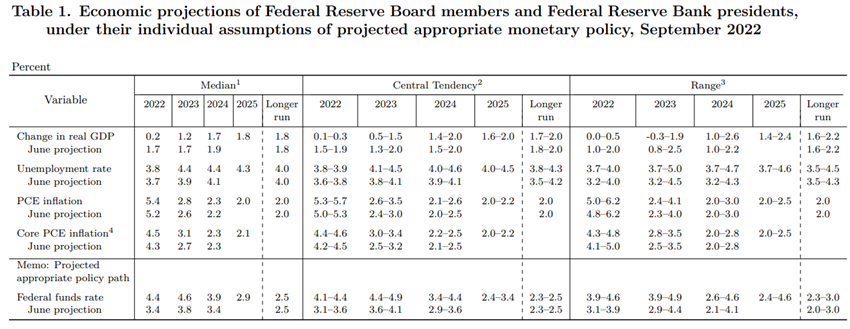

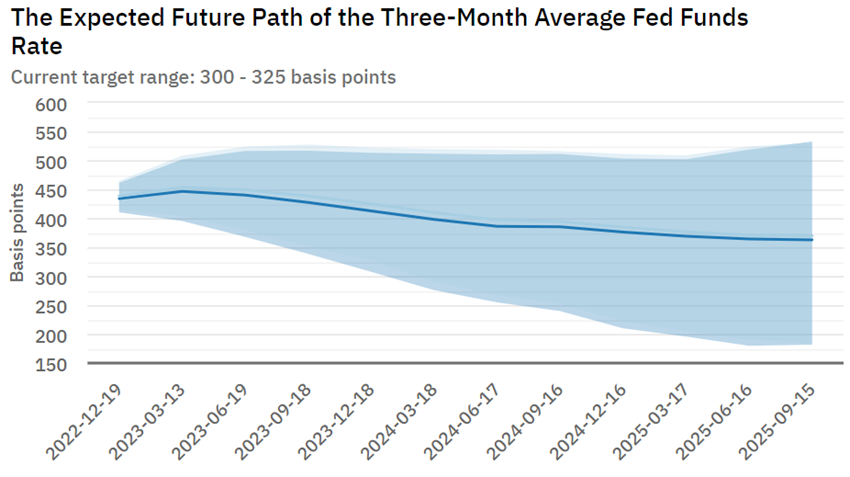

The FED is determined to fight inflation, having risen the official interest rate by 0.75% in September, setting it at %-3,25%.

Its projections point to the increase of this rate to 4% at the end of the year, 4.6% in 2023, 3.9% in 2024, and 2.9% in 2025, and 2.5% in the longer term.

It admits that unemployment could reach 4.4%.

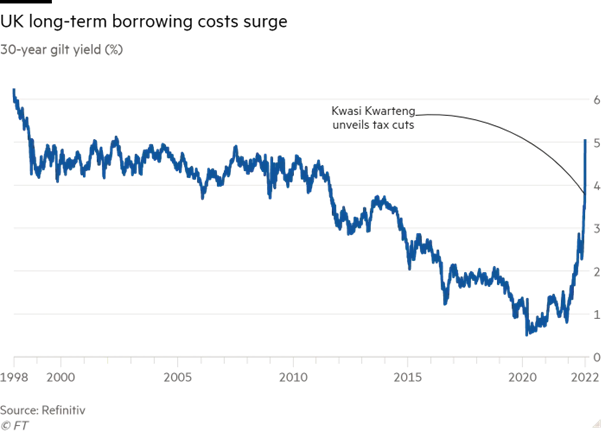

The Bank of England raised the official interest rate to 2.25%.

More importantly, at the end of September, it made an emergency decision to buy up to £65 billion of long-term treasury bonds, reinsing the announced start of asset sales.

The aim was to defend the exposure of Liability Driven Investments to the devaluation of 30-year treasury bonds, which lost 15% within days of the announcement of the new government’s mini-budget plan.

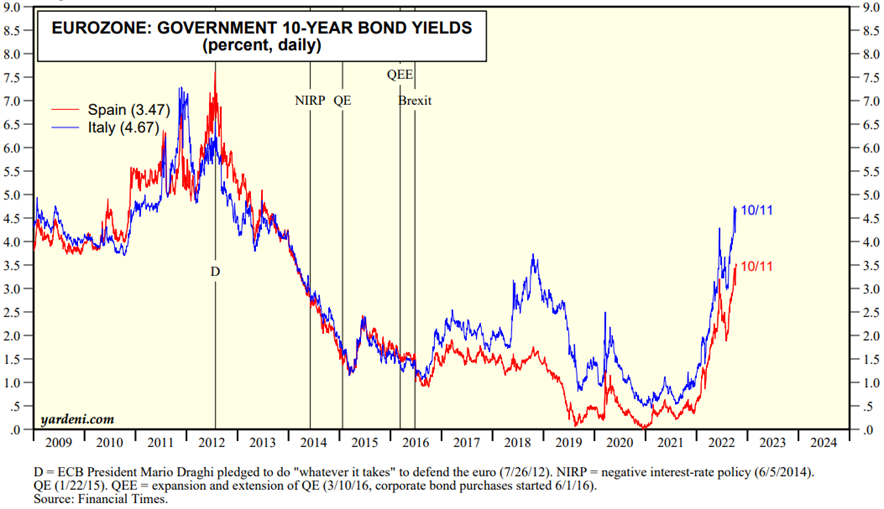

The ECB has raised the official rate to 0.75% and expects to start selling assets in the first quarter of 2023.

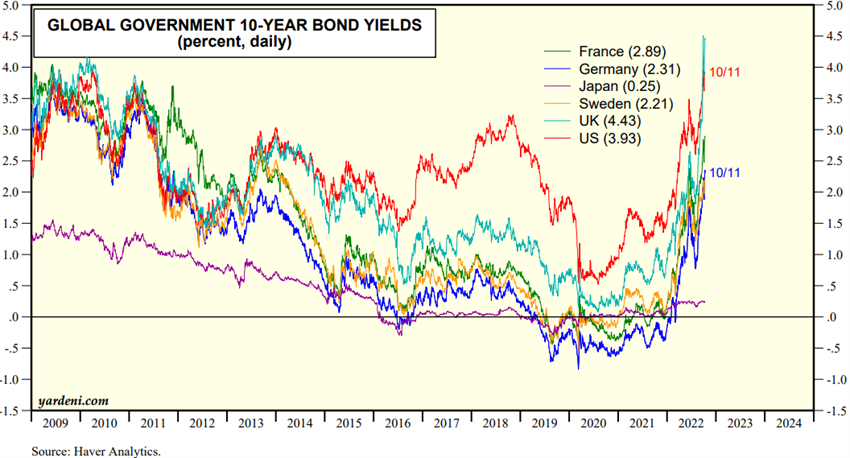

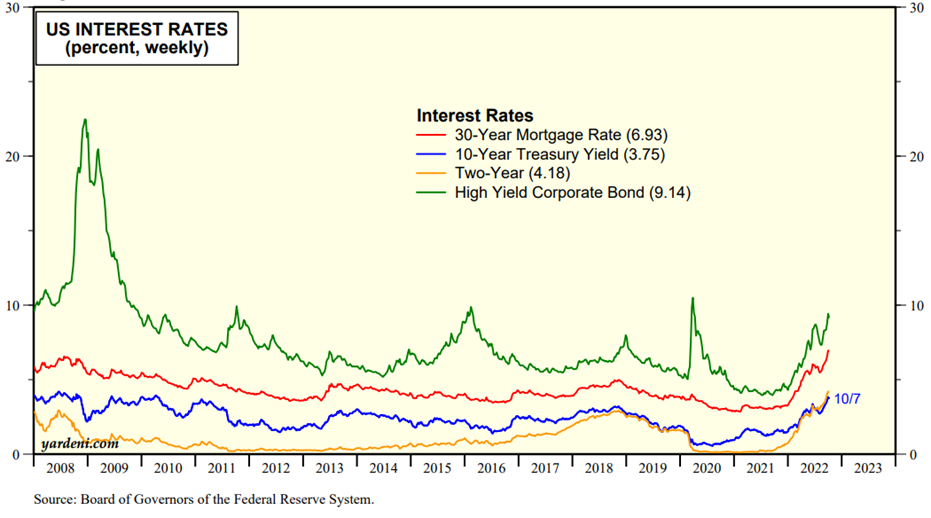

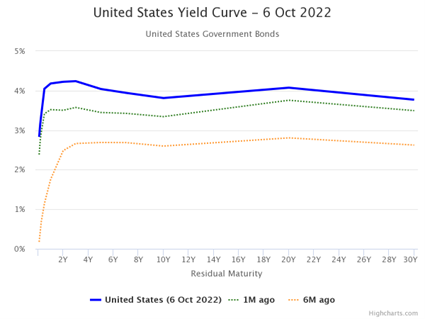

All countries’ 10-year treasury bonds continue to rise sharply.

The implied annual returns of 2-year U.S. treasury bonds are 4.2% and of 10-year close to 4%.

The dollar continues to rise against the other currencies and is already worth more than the euro.

The effectiveness of restrictive monetary policy in fighting inflation is faced with the obstacle of the supply-side component of inflation (energy and global trade).

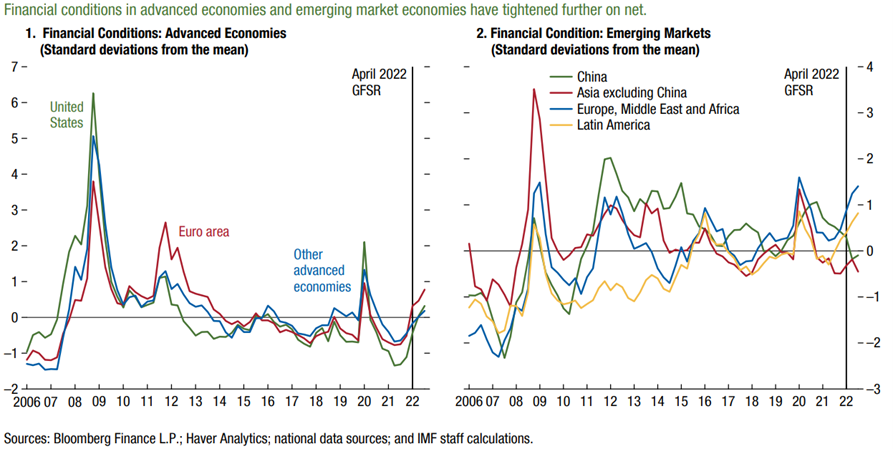

Financial conditions continue to worsen in developed countries and especially in emerging economies

Financial conditions continue to worsen around the world, with some signs of worrying “stress.”

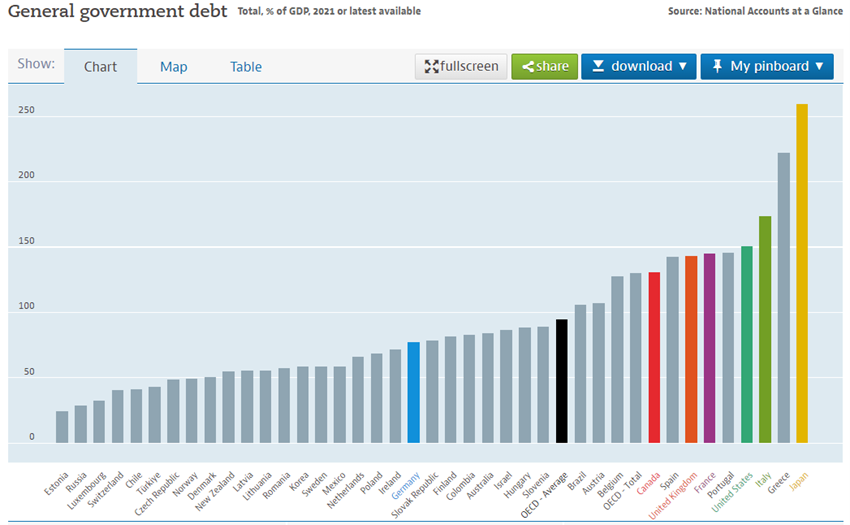

Countries are facing major financial difficulties due to high indebtedness and trade deficits, compounded by a strong dollar.

Risk spreads are widening in European sovereign debt and speculative bonds.

Corporate bankruptcies are expected to increase, with the notion that many companies, so-called “zombie”, do not bear financial costs above 5% per year for a long time.

Source: World Economic Outlook, IMF, October 2022

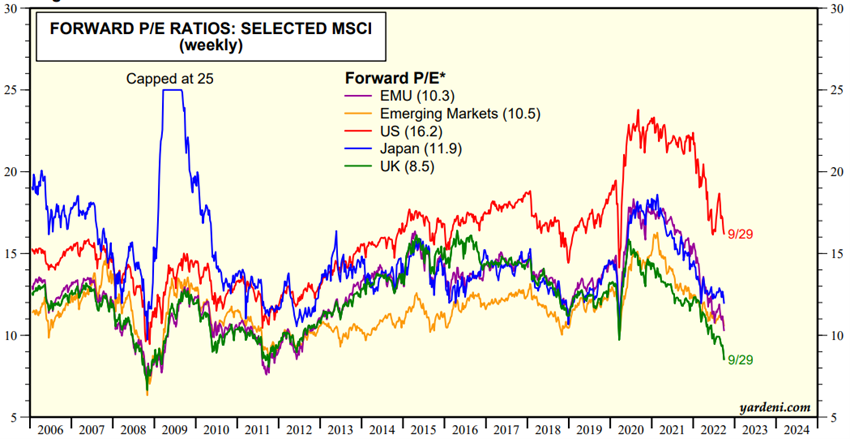

Equity markets valuation

Stock markets are in bear market and continue to fall, with significant increase in volatility due to the increased likelihood of recession.

Emerging stock markets have fallen more sharply.

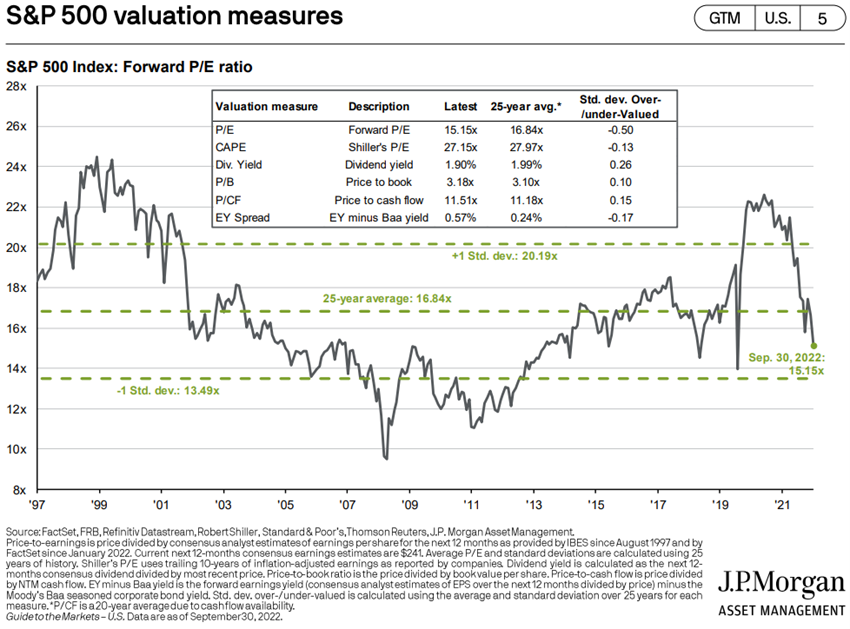

The valuation of the global stock market and the various regions has fallen and is on the long-term average.

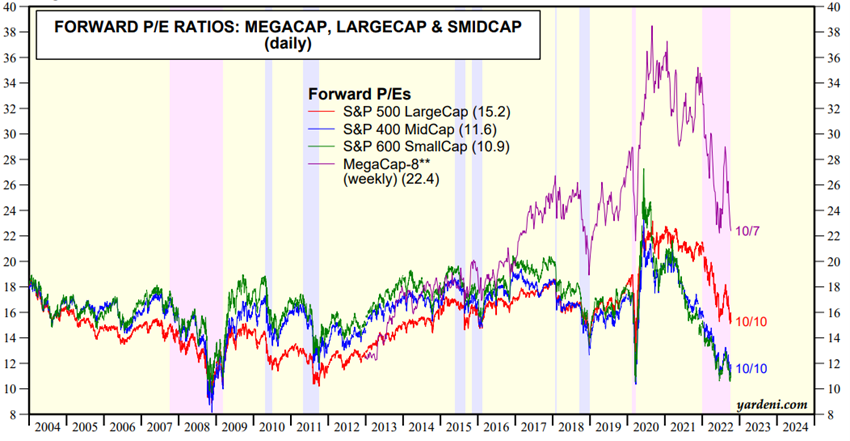

The 16.2x forward PE ratio to the U.S. remains close to the long-term average.

The PE ratio of the remaining regions fell to 10.3x in the Eurozone, 11.9x in Japan, 8.5x in the UK and 10.5x in emerging markets, below the historical average.

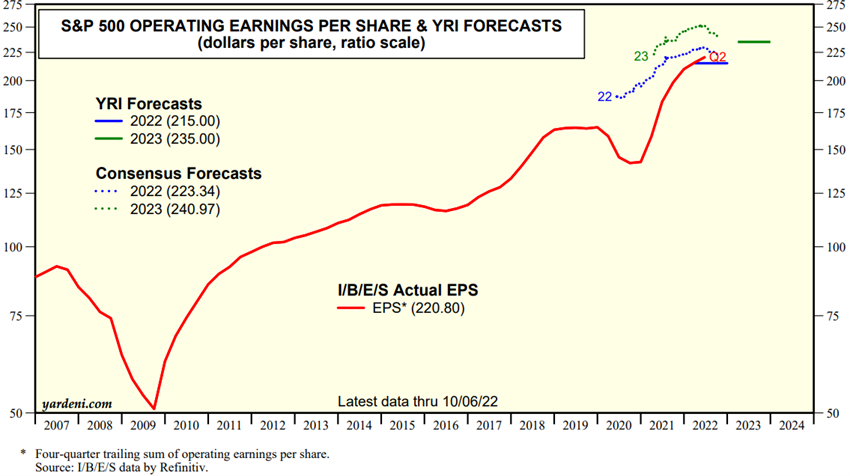

Companies and analysts began to revise its forecasts for low results, but still with little impact.

The PE ratio of small and medium-cap U.S. stocks is about 11x to 12x, below the long-term average, while the mega-caps at 24x are well above the same.

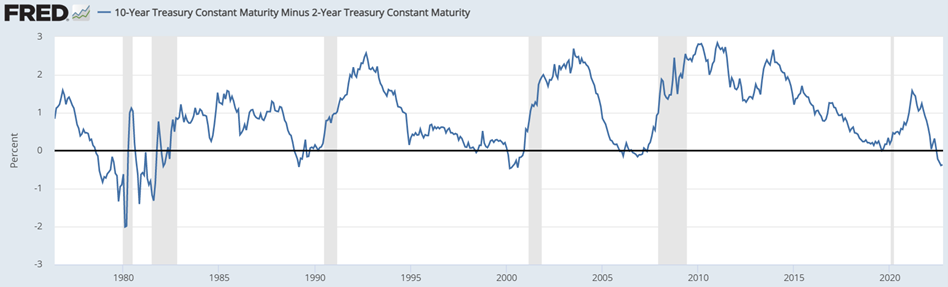

The gap between 10- and 2-year U.S. treasury bond rates is negative, which has been a predictor of a 6-9-month recession.

The key question is what cost to pay in terms of economic growth and employment, measured in terms of duration and depth, that economies will bear, so that restrictive monetary policies return the core PCE index (the inflation metric followed by the FED) to 2% levels.

The risks are on the downside.

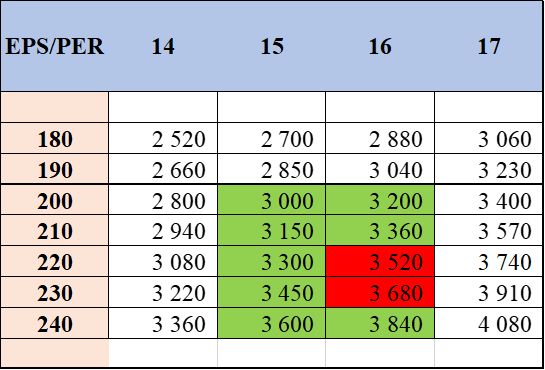

The S&P 500 is expected to fall to 3,300 points in the next 3 to 6 months, with multiples falling and eps down.

Value, or quality, or dividend companies with good cash-flow generating capacity are favored in the face of growth and with low or negative results.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, October, 8, 2022

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, October, 10, 2022

Source: Major Central Bank Total Assets, Yardeni Research, October 11, 2022

Source: Style Guide: LargeCaps vs SMidCaps, Yardeni Research, October,10th, 2022

Bond markets valuation

The end of the long 40-year bull market of bonds culminated in an unprecedented bear market. Increased risk-free rates and spreads widening. Tensions in the most liquid credit markets

Global treasury bonds corrected more than 20% and entered an unprecedented bear market in September.

The U.S. treasury bond market is starting to trade at interesting levels.

Credit spreads continue to rise, especially Europe’s sovereign debts and speculative-grade debts.

The sovereign debt market has been the first to react, anticipating the movements of the remaining segments of the financial markets.

The credit market, especially in the most liquid segments, has shown signs of some worrying instability, forcing emergency reactions by the authorities, particularly in the face of abrupt movements in European sovereign debt at the end of June and those of the United Kingdom at the end of September.

Source: Federal Reserve Bank of Atlanta, September, 15, 2020

Source: Market Briefing:Global Interest Rates, Yardeni Research, October, 11, 2022

Source: Market Briefing: US Bond Yields, Yardeni Research, October, 11, 2022

Main opportunities

Negotiated term of war in Ukraine, with low probability

Main risks

The threat of recession in the US has been increasing in probability, being almost certain in Europe.

It is admitted that if it happens in the USA, it will be mild, due to the good financial situation of families and corporations.

Europe might be already in recession, which will be aggravated if Russia cuts gas supplies in the winter.

If the war in Ukraine continues, there will be a worsening of economic and financial imbalances in the most vulnerable emerging countries.

With the devaluation of assets and the contraction of liquidity, some risks of low probability and strong impact (“tailrisks” or even “black swans” are beginning to arise, especially in the less liquid financial markets segments.

Examples range from UK debt movements, Eurozone debt fragmentation, to daily falls of 10% to 20% in the stocksof the S&P 500 and major cryptocurrencies.

The political risks are accentuated by the expansionary tax programmes of the United Kingdom and Italy, whose new government will take office at the end of October and could collide with the European Union.

Moodys admits that business default rates in the U.S. and EMEA could triple in a year, increasing from the current 2% to 7.8% and 6.5%, respectively, due to liquidity contraction and deteriorating trading conditions.

In this context, financial difficulties in some emerging countries are expected to worsen, low-quality credit spreads to widen, credit derivatives risk to increase, and the risk of contagion or systemic risk to arise

Source: Market Briefing: European Interest Rates, Yardeni Researh, October, 11, 2022