What are stock exchanges?

How do stock exchanges work?

The functions of stock exchanges

The regulation and supervision of stock exchanges and capital markets

The size of the global capital market compared to world GDP and wealth

In previous articles we have seen that people invest very little of their savings and usually with results much lower than those of the market.

This has consequences in terms of the appreciation of heritage, growth of wealth and increased quality of life.

A lot of people don’t invest simply because they don’t know.

Many others don’t because they’re afraid. They’re afraid of losing the money that cost them a lot to earn.

Others don’t invest because they’re suspicious. They think the market is a casino, a game of luck and bad luck, in which a small number of agents (the big sharks) win at the expense of many small investors (the small stingray), appropriating and destroying their savings.

So we thought it made sense to include an article on the blog that covered how markets work, including key rules and market surveillance.

There is nothing better than doing so by presenting the stock exchange managers as the cornerstone of the functioning of the markets.

What are stock exchanges?

A stock market is often the most important component of a stock market.

A stock exchange is a market where economic agents can buy and sell securities such as stocks, bonds and other financial instruments.

Exchange-traded securities include shares issued by listed companies, bonds, investment funds, derivatives and other collective investment products.

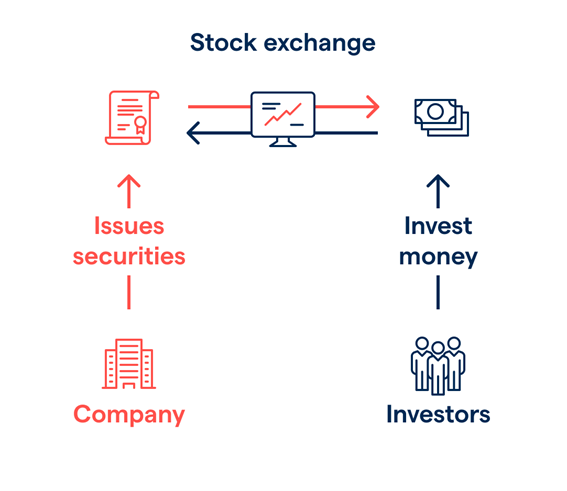

How do stock exchanges work?

Stock exchanges often function as “continuous auction” markets, where buyers and sellers consume transactions through open offers in a trading centre, either in a physical space of the stock exchange building (“floor”) or using an electronic trading platform.

Electronic communication networks are increasingly used because they have advantages of faster and reduced transaction costs.

In order for a security to be traded on a given stock exchange, the security must be previously admitted to the listing on that exchange.

Initial issues or public offerings of stocks and bonds to investors are made in the primary market, and subsequent trading is made on the secondary market.

Listing sums as well as the maintenance of trading on the stock exchange must comply with a set of regulatory requirements.

These requirements are imposed by the financial market supervisors, and in addition, in some cases, by the exchanges themselves.

It is up to both of these entities to verify compliance with the rules in the context of market surveillance.

Supply and demand on stock markets depend on a number of factors that, as in all free goods markets, affect bond prices.

Securities trading may not be done on the stock exchange, and occur off-exchange or over-the-counter.

This is the usual way of trading bonds and derivatives.

Exchanges are increasingly part of a global securities market.

Stock exchanges also provide an economic function by providing liquidity to shareholders by providing an efficient means of divestment of shares, but we will see all of their functions then.

The functions of stock exchanges

Stock exchanges perform several functions:

Mobilisation of savings for investment

In general, when people invest their savings in stocks, a rational allocation of resources is produced because the funds, which could have been consumed or held in low-income deposits, are mobilized and redirected to finance the growth and development of companies.

Capital raising by companies

Stock exchanges allow companies to raise capital or debt for their expansion through the sale of shares and bonds, respectively, to the investor public.

To this extent, the exchanges are an important source of financing for companies, in addition to financing the banking system, in the form of credits or loans.

Facilitate acquisitions by companies

Acquisitions are seen by companies as an opportunity to expand product lines, increase distribution channels, protect against volatility, increase their market share, or acquire other necessary trading assets.

A takeover bid through the stock market is one of the simplest and most common ways for a company to grow through mergers and acquisitions.

Sharing results

The exchanges allow the sharing of company results by individual and professional stock investors, large as institutional investors, or small as a family, through the payment of dividends and stock price increases that can result in capital gains.

Improvement of corporate governance

Listed companies are subject to stricter rules imposed by law and regulatory entities and generally tend to improve management standards and efficiency to meet the requirements of their broad universe of shareholders.

Creating investment opportunities for small investors

Exchange trading allows investment in stocks of both large and small stock investors, since the minimum amounts of investment are minimal.

Therefore, the exchange offers the opportunity for small investors to own shares of the same companies as large investors.

Raising government capital for development projects

Governments finance themselves in the market by issuing bonds to develop public investment projects such as transport infrastructure, water, energy, schools, hospitals, etc.

Economy barometer

On the stock exchange, stock prices rise and fall depending largely on economic forces.

Stock prices tend to rise or remain stable when businesses and the economy in general show signs of stability and growth.

A recession, depression or financial crisis usually leads to a stock market crash.

Thus, the evolution of stock prices and, in general, of stock indexes is an indicator of the general trend of the economy.

The regulation and supervision of stock exchanges and capital markets

Many people fear and distrust stock market investment and capital markets because of some very mediated scandals.

These were the cases of Enron, Worldcom, Lehman Bros (and others of the real estate crisis), Dieselgate, BP Deepwater, Madoff, Wirecard, Archegos, MDB1, etc., many already a few years ago, but others very recent.

The high-hit box office films about greed and corruption in the financial industry, based on some of these real scandals and other fictional ones, help to root this perception.

From the films Wall Street, The Big Short, Wolf of Wall Street, Margin Call, Rogue Trader, Internal Job, Money Monster, the Wizard of Lies, to documentaries, The Smartest Guys in the Room (Enron) and Inside Lehman Brothers.

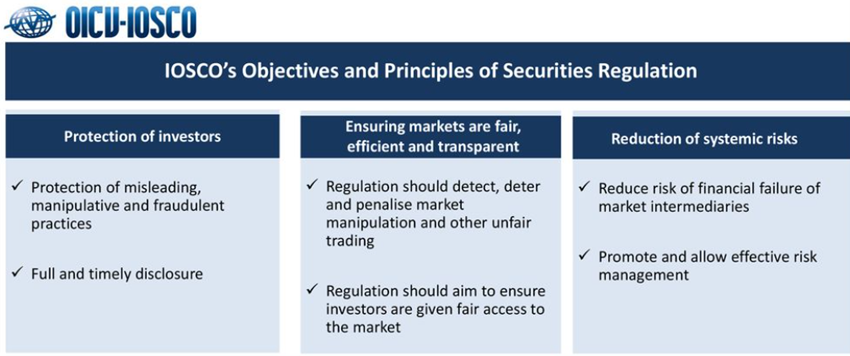

However, many of these people do not know that exchanges and the capital market are one of the most regulated and supervised in our companies.

In a way, capital markets are more regulated and supervised than activities as important to our lives as food, education and health.

The goal of regulation is to prevent and investigate fraud, keep markets efficient and transparent, and ensure that investors are treated fairly and honestly.

In other words, regulation is and aims to protect and defend the interests of investors, in particular the smallest, such as individual investors.

This regulation begins with laws and regulations, including codes of commercial companies, securities codes and complementary regulations.

It also includes the definition of the structures and rules for the organisation and functioning of markets.

In this context, we highlight the appointment and allocation of the responsibilities of the authorities of the supervision and supervision of markets such as central banks, securities market commissions and exchange management companies.

It also covers the definition of the set of duties, obligations and responsibilities to which various market agents are subject, with emphasis on the entities that issue the securities traded on the stock exchange.

Companies with listed shares have obligations of regularity and reliability of provision and disclosure of accounts to the market, communication of other information or relevant facts, etc.

In addition, the work of investment recommendation analysts also involves doing economic and financial information verification analyses.

For all this, the listed entities and the amounts issued by them are subject to permanent and detailed inspection process.

It is clear that, despite this, financial scandals continue to follow, hurting investors in many cases.

However, they are increasingly difficult to occur, and once again, there are many other areas at least as important to our lives, whose regulation is as or more permeable to criminal activities, and perhaps have a less comprehensive and robust regulatory framework.

In a sense, considering the existing regulation and the low expression of cases, the fear is exaggerated and unjustified when it prevents us from investing in the markets.

The loss of the value of the investment is certainly much higher than the costs of the crimes committed.

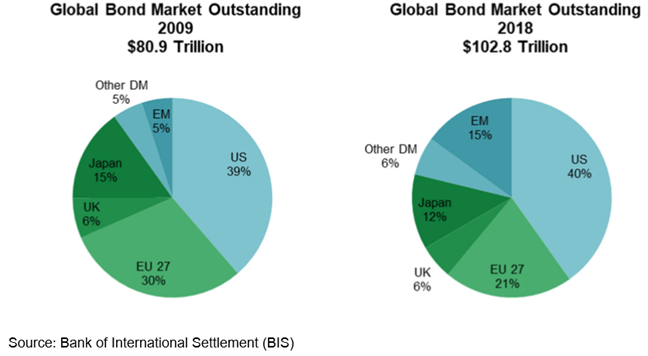

The size of the global capital market compared to world GDP and wealth

We believe that in realising the importance of financial markets in the world, it is enough to present its size and compare it with other relevant economic variables, such as global GDP and wealth.

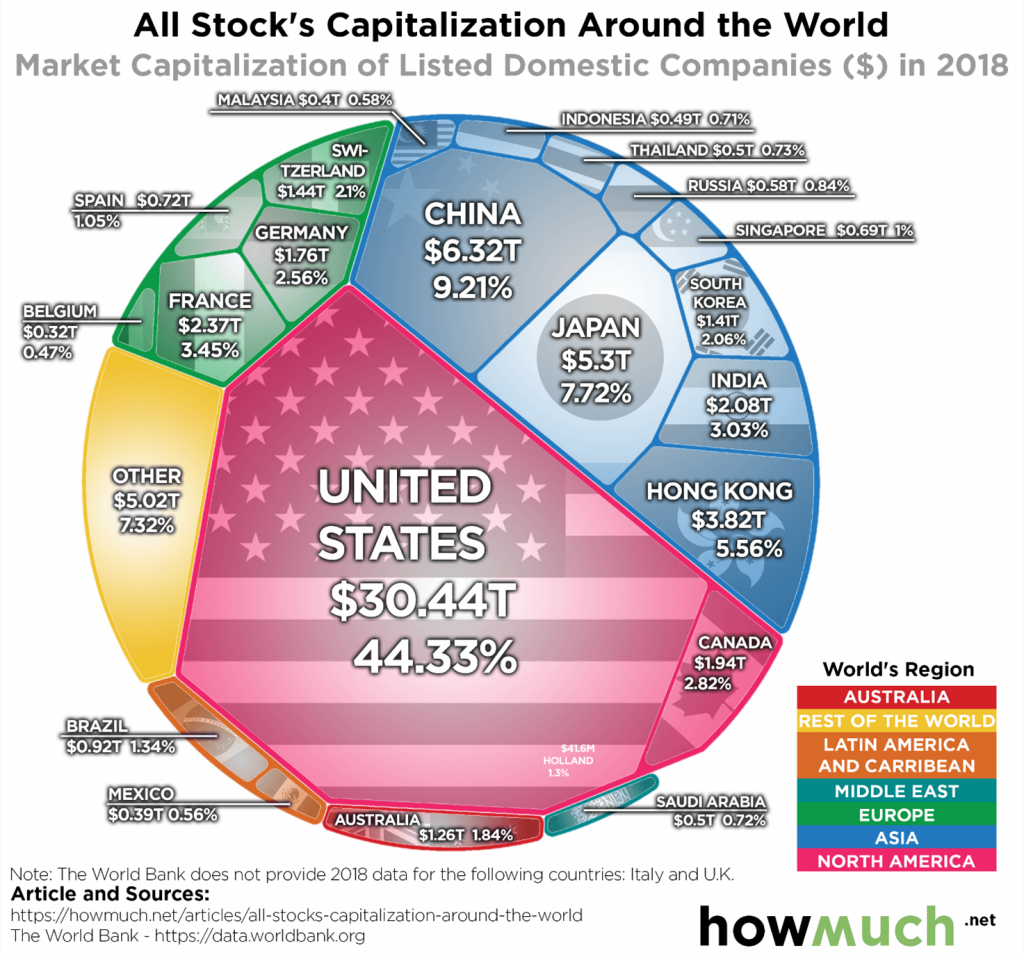

The value of capital markets globally totaled more than US$175 billion in 2018:

The market value of listed bonds exceeded $100 billion and the stock’s $75 billion in 2018.

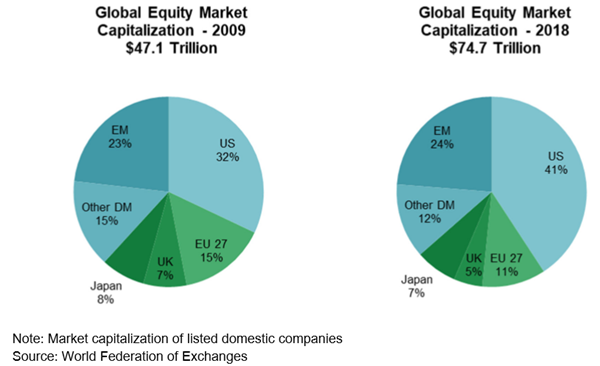

The distribution of the global stock market market capitalization by countries was as follows:

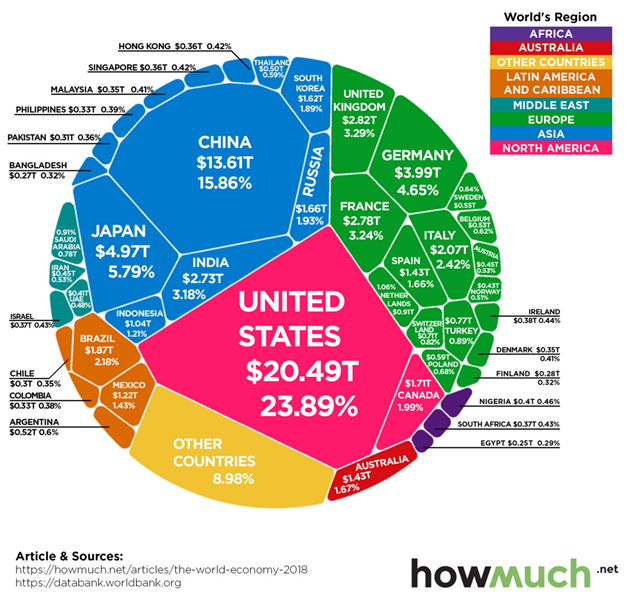

That year, world GDP was $86 billion:

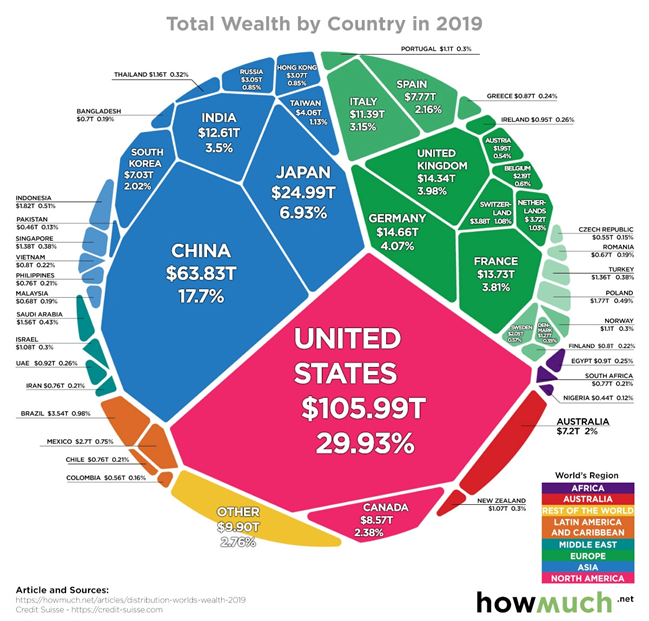

And the estimated world wealth was $360.6 billion that year:

This is why we see the magnitude and importance of the global stock and bond markets, both in absolute and relative terms, compared to product and wealth.

The world’s leading stock exchanges

The top 15 world stock exchanges are as follows:

The two largest are The U.S., the NYSE and nasdaq, with a capitalization of $26 billion and $19 billion, respectively, in 2020.

Then there are three Asians, the Chinese from Shanghai, the Japanese and hong kong.

Then comes Euronext, which is part of the Stock Exchanges of the Netherlands, France, Belgium, Portugal, Ireland and Norway, with a total capitalisation of US$5.4 trillion.

The London stock exchange is in sixth place, with a capitalization of almost $4 billion, while the German stock exchange is in 10th place with a capitalization of $2.2 billion.

In the following link we see the evolution of the main exchanges in the last 20 years.