The outlook for 2023 of the major investment banks

U.S. recession with high probability, S&P 500 at 4,000 points (the current level), with fluctuations throughout the year, and interest rate on U.S. treasuries bonds coming down slightly

JP Morgan: 80% probability of recession between the first quarters of 2023 and 2024

Goldman Sachs: S&P 500 at 4,000, with lows of 3,600, or 3,150 in the event of a deep recession

Morgan Stanley: S&P 500 at 3,900, with lows of 3,600 in the first quarter, or 3,000-3,200 if support broken

Bank of America: S&P 500 at 4,000, pessimistic at 3,000, and optimistic at 4,600

The outlook for 2023 of the major investment banks

This week began to be published and released by the press reports on the financial market outlook for 2023 of the major U.S. banks: JP Morgan, Goldman Sachs, Morgan Stanley and Bank of America.

Each year, individual investors must make an assessment of the positioning of their investments and this is the right time to do so, based on a balance sheet for the current year and the outlook for the next.

In this article, we begin by presenting the main conclusions of a joint analysis of the various opinions, then moving on to some further development on the position of each, and concluding the ideas with our recommendations on investments.

Last year, by this time, the target prices for the S&P 500 at the end of 2022 were as follows: JP Morgan (4,400); Goldman Sachs (5,100); Morgan Stanley (4,400); and Bank of America (4,600).

It is recalled that these levels were set before the war in Ukraine, and with an inflation of 7% still taken by some as temporary and not justifying large interest rate hikes.

Since they are, these banks have been reviewing these levels down, the most negative being Morgan Stanley and Bank of America.

As usual, these exercises do not consider any changes in exogenous factors, current or potential, including changes in the geopolitical context, in particular the War of Ukraine.

In our opinion, it is interesting and important to consider and monitor the opinion of the big banks regarding the economy and financial markets in general.

On the contrary, we are very critical of the value of your recommendations for individual securities.

U.S. recession with high probability, S&P 500 at 4,000 points (the current level), with fluctuations throughout the year, and interest rate on U.S. treasuries bonds at a slight low

The conclusions common to the various perspectives of banks are:

The dominant economic theme will be the fight against inflation by restrictive monetary policy, with the likely consequence of an economic downturn

The probability of recession is between 50% and 80%, and may occur between q2 2023 or the first quarter of 2024

The recession will be different from the usual, softer and shorter than the previous ones, due to the good economic and financial situation of households and businesses

Annual economic growth will be very low, about 1%, but there is great doubt and dispersion about inflation at the end of 2023

The S&P 500 will end 2023 around 4,000 points, the current level, but with plenty of swings, which could fall to 3,600 points (200-day moving average), and reach 3,000 to 3,300 in an extreme case, in the first or second quarter

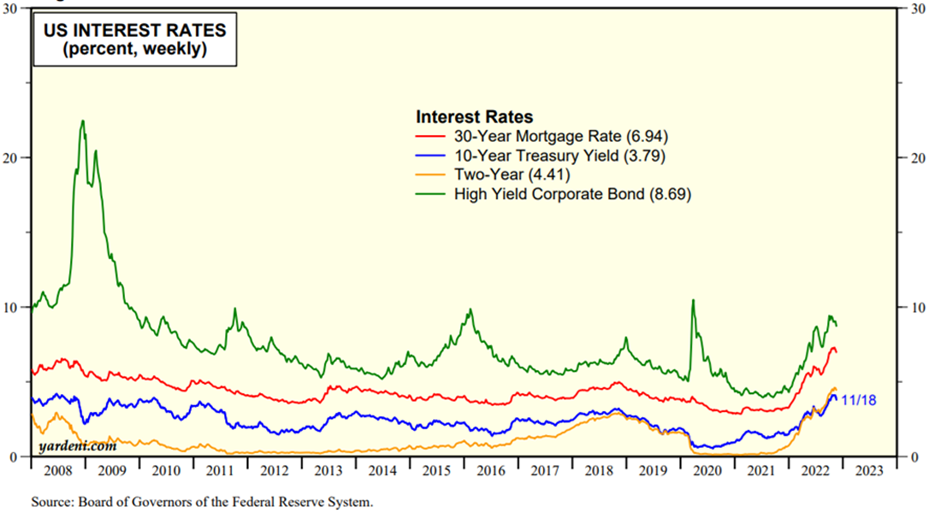

Interest rates on 10-year treasury bonds will be around 3.5% at the end of 2023, lower than the current 3.7%

The dollar reached its highest value in 2022 and will fall in 2023

JP Morgan: 80% probability of recession between the first quarters of 2023 and 2024

Jp Morgan’s team of economists led by Bruce Kaufman considers that the U.S. economy faces four likely scenarios, with none very favorable, establishing the probability of avoiding a recession at 20%.

Scenarios vary depending on how long the recession occurs, the path of FED policy and the repercussions on the world economy.

In the most likely scenario, with 32%, the economy has a contraction in the second half of 2023.

In the scenario with the second highest probability, of 28%, the recession arises at the end of 2023 or early 2024.

In the worst case scenario, with a 20% probability, the economy goes into recession in the first half of 2023.

The most positive scenario, with 20%, is a soft landing, in which the FED can bring inflation down without major damage to the economy.

Goldman Sachs: S&P 500 at 4,000, with lows of 3,600, or 3,150 in the event of a deep recession

Strategist David Kostin and his team see a soft landing as the baseline scenario, with below-potential growth and a 0.5% increase in the unemployment rate.

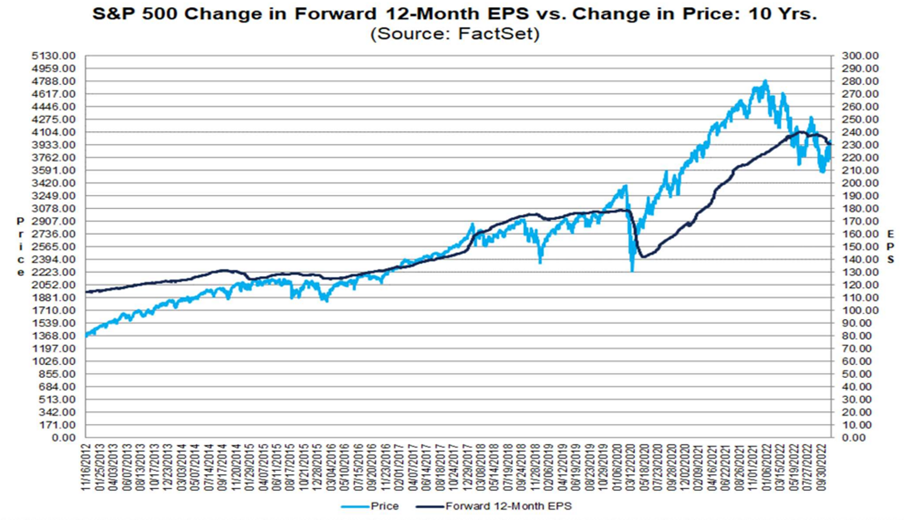

In this scenario, the S&P 500 is expected to end 2023 at 4,000 at the current level, with results growth close to zero.

The S&P 500 earnings will be $224 and the PER multiple of 17x.

The S&P 500 is expected to start falling to 3,600 points in the first quarter, a 10 percent devaluation from current levels, with the EDF ending the interest rate hike cycle in May, starting with a market hike by the end of the year.

If there is a recessionary scenario, the S&P 500 could fall to 3,150.

Morgan Stanley: S&P 500 at 3,900, with lows of 3,600 in the first quarter, or 3,000-3,200 if support broken

Morgan Stanley strategist Mike Wilson and his team see the S&P 500 at 3,900 between June and the end of the year, falling to 3,600, the moving average of the last 200 days in the first quarter of 2023, coincident with the end of the bear market.

However, they consider that if this support level of 3,600 is broken, the S&P 500 could fall to 3,000-3,200.

Bank of America: S&P 500 at 4,000, pessimistic at 3,000, and optimistic at 4,600

Savita Subramanian, head of U.S. quantitative stock strategy at Bank of America, and his team, predict the S&P 500 to close 2023 at 4,000 points, the current level.

In the pessimistic scenario they see the S&P 500 at 3,000, and in the optimistic scenario at 4,600.

They admit that the market will experience some turbulence throughout the year as the economy goes into recession, albeit different and softer than the previous ones.

They estimate the S&P 500’s earnings to be at $200, down 9%, less sharply than the 20% of the average recession.

Conclusions and recommendations

These forecasts recommend that investors be cautious about the stock market, and favor the most defensive.

At this final stage of the cycle change, investors should be aware of economic developments, legislative and regulatory policies, company results and market valuation.

Considering these forecasts, the recommendations are as follows:

Maintenance of allocations of investments in pension plans

Maintaining high cash levels, waiting for the stock market to reach and show support at the predicted minimum levels of 3,600 in the S&P 500 to increase stock exposure, phased out from then on

Increased exposure to U.S. treasury bonds to 10 years for U.S. investors, and wait 3-6 months for European treasury bond increases by European investors, while the ECB is more advanced in raising official interest rates and long-term ones show stability

Reduction of exposure to investments in more volatile stocks, less mature and solid companies, growth, with negative or low results, and higher indebtedness, which still transact to high multiples

Decreased exposure to the technology sector, and increased exposure to the consumer goods, health, public goods, energy and financial sectors.