The rise in interest rates on treasury bonds (without risk) in the medium and long term increases the absolute and relative attractiveness of these bonds in relation to liquidity and investment in shares

This increase also raises the bar and pressure on stock valuation, by the combined effects of the discount rate of future cash-flows and asset rotation (risk premium)

Interest rates on long-term treasury bonds have been rising, and are at 4% a year, above the very long-term average

Inflation has not yet given a respite, the risk of investing in bonds is that rates rise higher, but the “great is the enemy of the good”

The levels of medium and long-term interest rates in the U.S. already make it interesting to invest in these bonds for investors in these countries

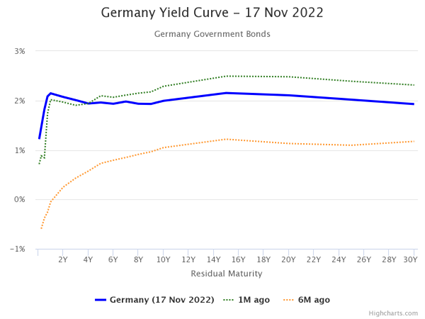

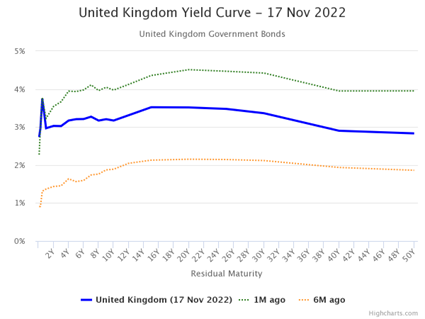

European investors will have to wait a little longer for ECB interest rate hikes

Rising risk-free interest rates increase the relative attractiveness of bond investment in liquidity and stocks, putting greater pressure on their valuation

In the latest article on the Quarterly Financial Markets Outlook , we said that U.S. treasury bonds in the medium and long term, by allowing an implied return rate of 4% per year, have become an interesting investment for individual U.S. investors.

The investment in these bonds gains attractiveness compared to other assets, liquidity or shares.

To that extent, it will be worth investing in these bonds rather than maintaining liquidity or cash availability in deposits or savings accounts in banks.

And it will also be worth increasing exposure to these bonds by reducing investment in stocks, making a small rotation between assets, especially in exchange for the most volatile stocks.

This rotation should be small, because it is difficult to predict changing market conditions.

In this article we will look in more detail at the current attractiveness – in terms of profitability and risks – of interest rates on treasury bonds with a good rating or risk-free level.

In this analysis, we will consider some aspects related to the financial investments that have been presented in previous articles, such as profitability of the main assets – stocks and bonds – the risks of these assets, the efficient diversification, the allocation of assets by investors, and the importance of their alignment with the risk profile and the objectives of the investor.

Interest rates on long-term treasury bonds have been rising at 4% a year, above the very long-term average

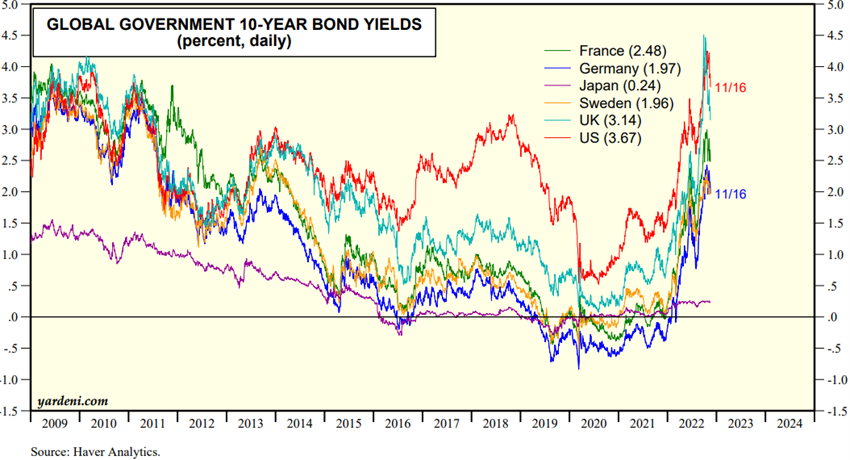

Interest rates on long-term treasury bonds have been rising.

In the US and UK they are already above the average for the last 15 to 20 years, but in Europe they have not yet:

In the current context of combating monetary policy against inflation, it is very difficult to predict the future evolution of these rates.

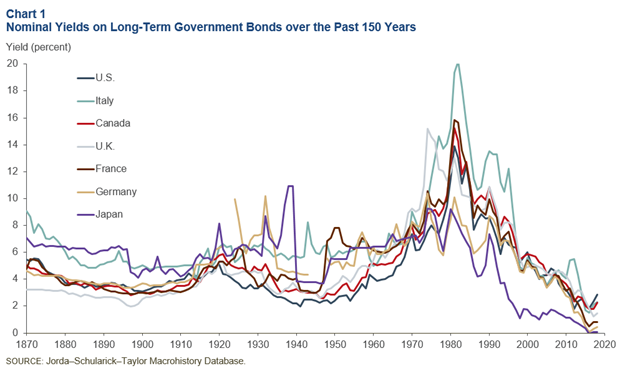

To put this issue in a longer perspective, the following graph shows the evolution of interest rates on 10-year treasury bonds in developed countries over the past 150 years:

Interest rates in the U.S. between the 2 and 10 years are already close to historical average levels, and have largely prevailed until the mid-1960s.

However, in the 1970s, with inflation even higher than the current one, interest rates far exceeded these levels, remaining above 4% until the GCF.

From 1980 to 2021, the trend was downward, until it reversed in 2022, due to the adoption of restrictive monetary policy to combat high inflation.

Inflation has not yet given a respite, the risk of investing in bonds is that rates rise higher, but the “great is the enemy of the good”

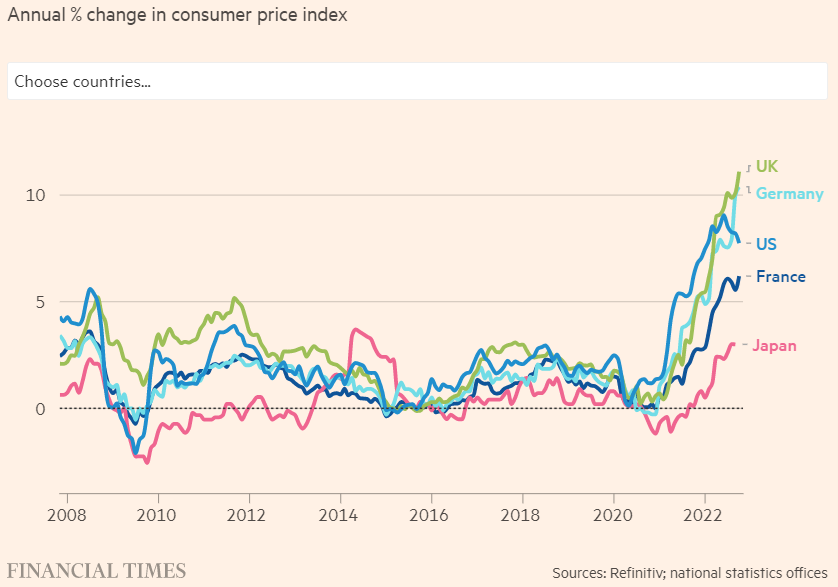

Inflation is beginning to show slight signs of stabilisation or even a slight decline, but it is still not relenting.

The consumer price index has evolved as follows:

Inflation has proved very rigid and cross-cutting, as we have developed and deepened in two recent articles on the costs and measures of inflation, as well as their components and dynamics.

It is not only the prices of energy, or agricultural products, but it has already expanded to other components with an important weight such as housing and services, for example health.

Wages also show increases, especially in the U.S.

European leaders try to avoid significant wage increases, but they cannot avoid some increases.

This situation can cause the greatest risk that must be avoided, that of entering an inflationary spiral of goods and wages.

However, with regard to the US, we believe that the recent stabilisation of some prices of goods and services and wage moderation, and the time lag of the effects of the interest rate hike, could result in the start of the fall in inflation.

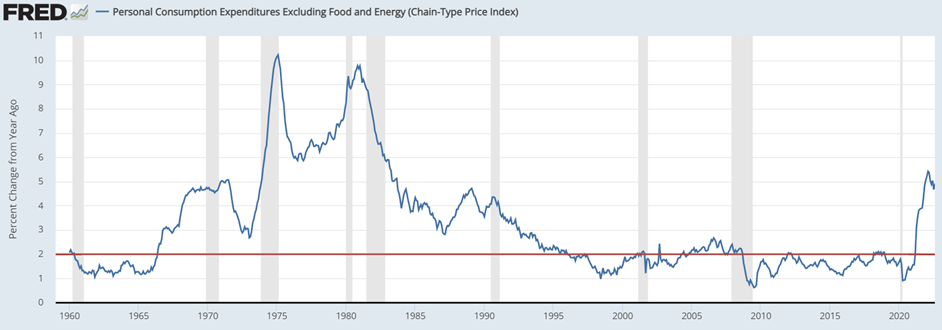

More importantly, the measure of inflation that the EDF and other central banks aim at is not the simple consumer price index, but that excludes the most volatile components such as energy and power (in the case of the FED the core PCE).

This is the indicator that seek to stabilize around 2% in the medium and long term.

In the case of the USA, this indicator has had the following evolution from 1960 to date:

The U.S. core PCE price index was at 4.91% in August, up from 4.67% the previous month and 3.88% last year. This is higher than the long-term average of 3.22%.

The average annual change in the PCE Price Index in the United States was 1.82% between 2004 and 2022.

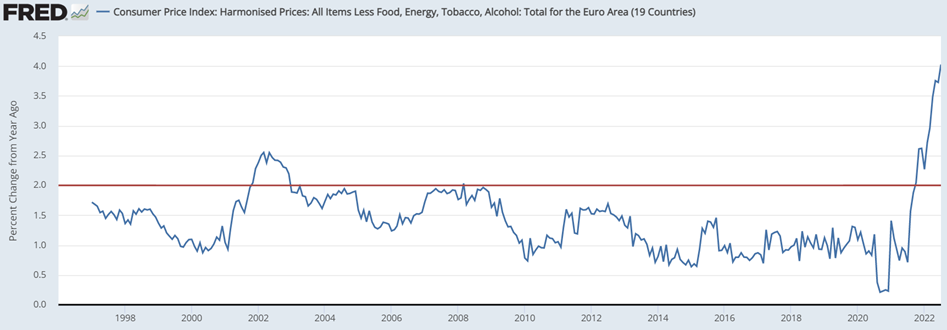

In the Eurozone the price index without energy and power had the following evolution:

The core inflation rate in the Eurozone reached a maximum of 4.80% in September 2022. The average was 1.43% between 1997 and 2022, and had a minimum of 0.20% in September 2020.

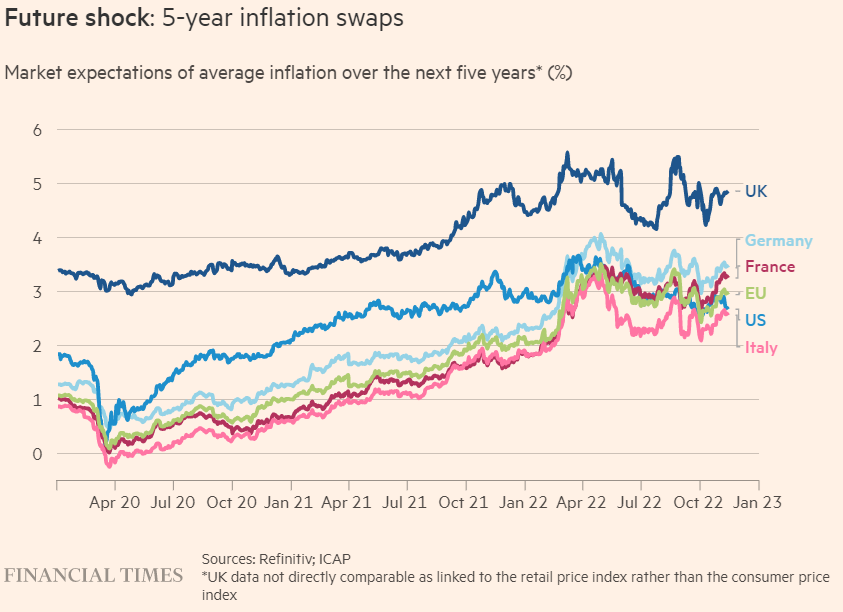

Medium-term inflation expectations in the U.S. and Europe are also moderate and show signs of stabilisation, or decline:

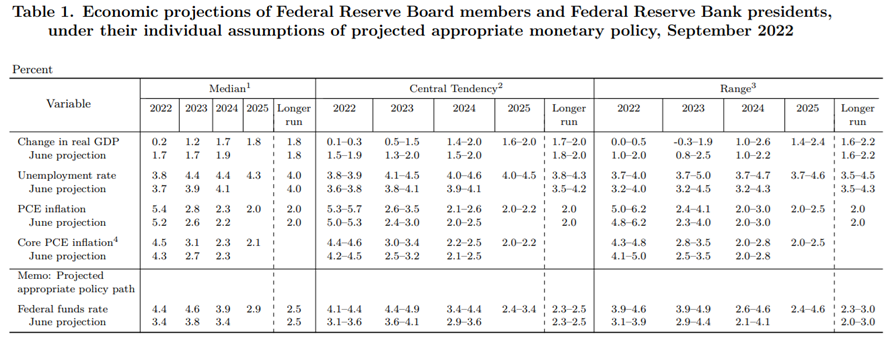

To this extent, interest rates should no longer rise much further than predicted in the EDF projections:

For Europe, the risks are greater due to the greater impact of the war in Ukraine, the delay in restrictive monetary policy and the fact that inflation in Europe is at a higher and still rising level.

The levels of medium and long-term interest rates in the U.S. already make it interesting to invest in these bonds for investors in these countries

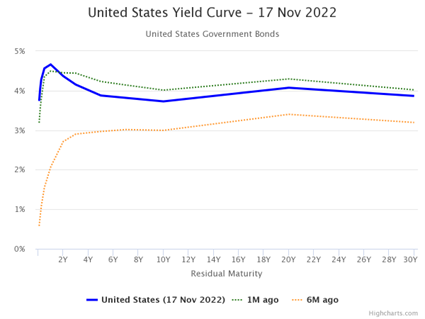

In the following chart we show the yield curves, or the implied yield returns of investment in treasury bonds at each timeframe, for U.S. treasury bonds:

In the current context, we consider that at current rates, investment in U.S. treasury bonds for maturities between 2 and 10 years is attractive to dollar currency investors.

It should be refound that we consider that investments in bonds should be made without foreign exchange risk.

Investment in 2-year U.S. treasury bonds at current rates of 4.2% per year is very interesting for U.S. or dollar currency investors.

The deadline is short enough to disregard future interest rate movements.

In addition, we consider that investments in 10-year U.S. treasury bonds at current interest rates of about 4% per year are already attractive to these same investors.

The risk of this investment is that interest rates rise largely and that they remain at these levels for a few years.

This would result in a devaluation of investments and an increase in the cost of opportunity.

However, in our opinion, these interest rates may even rise slightly in the next 1 to 2 years, but from 2025, i.e. in the next 8 years, they will be below current levels.

This idea is based on two factors.

First, long-term average inflation is expected to resume the historic 2.5% from 2025.

Second, by absurd or paradoxical as it may seem in the current context, we consider that there is a long-term deflationary trend associated with ageing, technological development, low productivity, and indebtedness, which will reemerge after inflation returns to the level of the 2% desired by central banks.

We will address this theme in a next article, which, although it seems inappropriate and controversial under the current conditions, we understand it as important to project investments in the medium and long term.

European investors will have to wait a little longer for ECB interest rate hikes

From what we have already said, we believe that the medium and long-term interest rates on British and eurozone government debt will still rise in the next 3 to 6 months, so we will have to wait for their attractiveness to improve.

Rising risk-free interest rates increase the relative attractiveness of bond investment in liquidity and stocks, putting greater pressure on their valuation

Rising interest rates improve the return on investment in high-credit-rated or risk-free treasury bonds, and by this way, its attractiveness in absolute terms.

This increase also increases the opportunity cost of investing in other assets, i.e., favors investment in those bonds against liquidity and stocks.

The same rise raises the bar and puts more pressure on the valuation of stocks by increasing the discount of cash-flows” futures at the risk-free interest rate.

In this way, it reduces the risk premium between the shares and these bonds, increasing the relative attractive-ups of the latter.

These variations cause asset rotations, whose supply and demand dynamics accentuate relative interest in bonds.