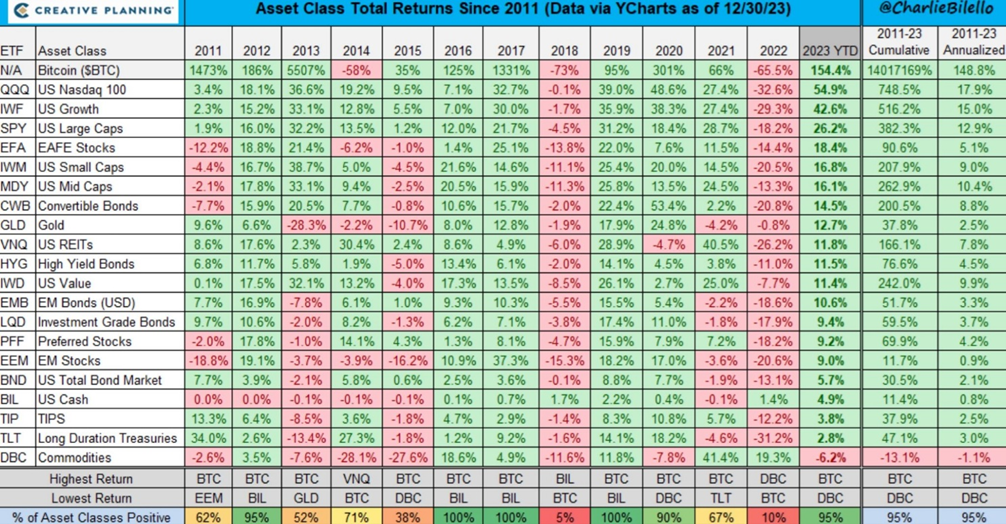

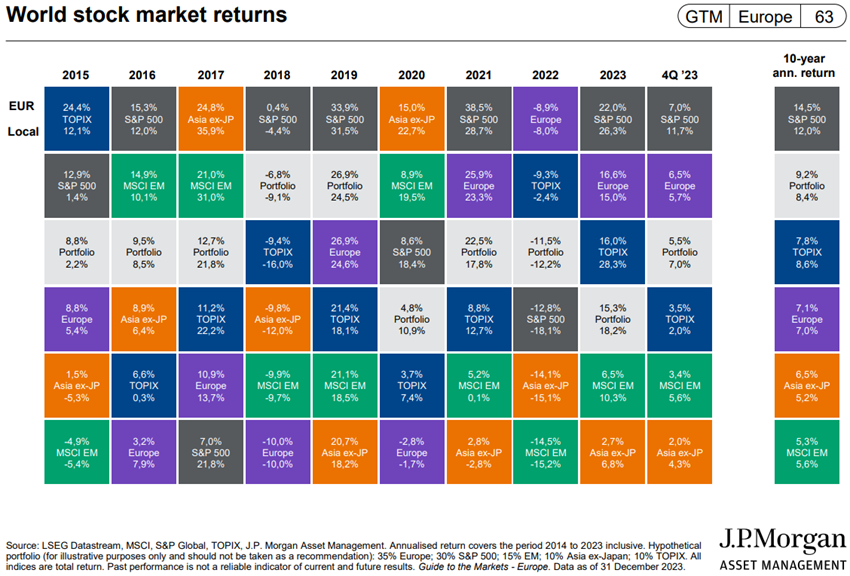

2023 was an exceptional year for equity markets, especially the US. The S&P 500 rose 24%, erasing losses from 2022. The Nasdaq 100 gained 54%, its best since 1999.

But U.S. and European bonds have also done well, especially in the last quarter as interest rates fell sharply.

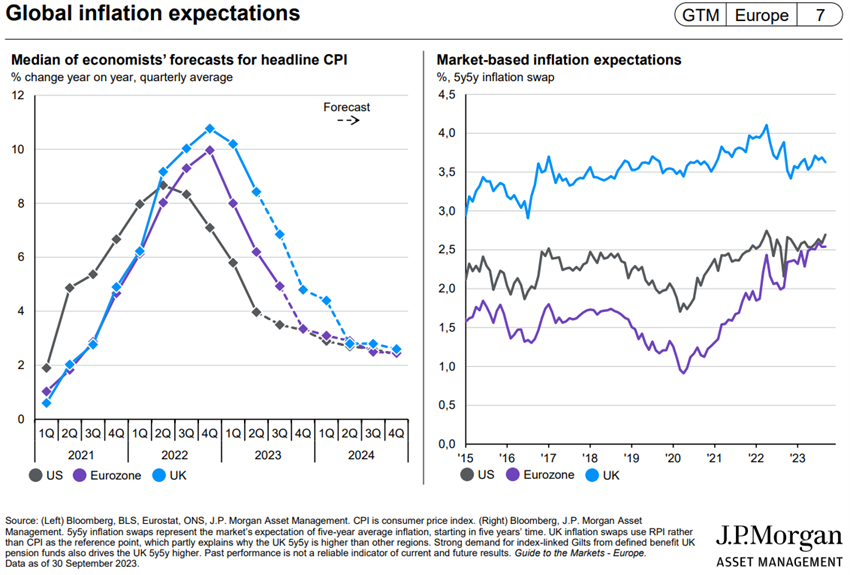

The attention of analysts and investors is focused on the trajectories of the declines in inflation and official interest rates, especially in the US.

Equity and bond markets trade at fair levels.

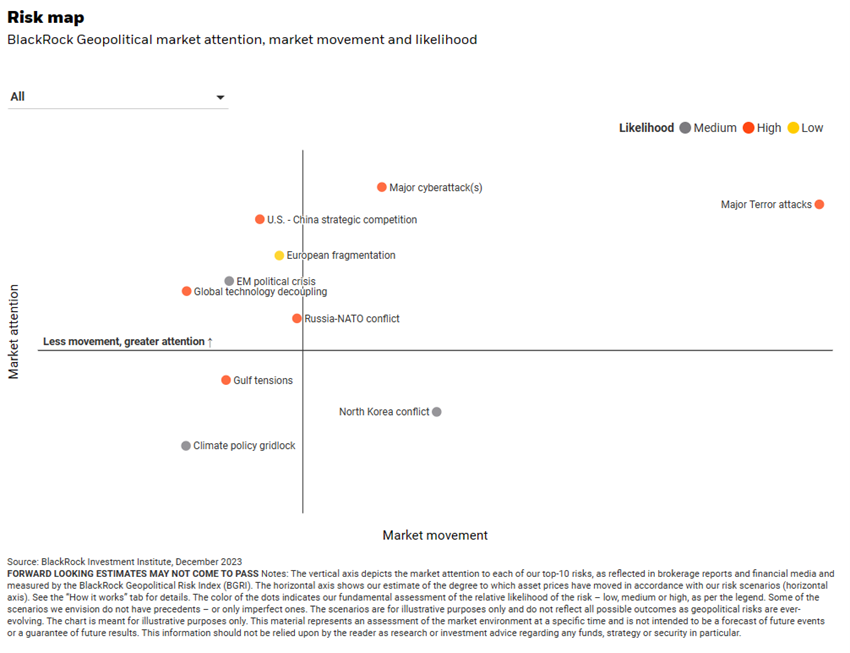

The biggest uncertainties center on developments in China, the U.S. elections, and the two major ongoing wars.

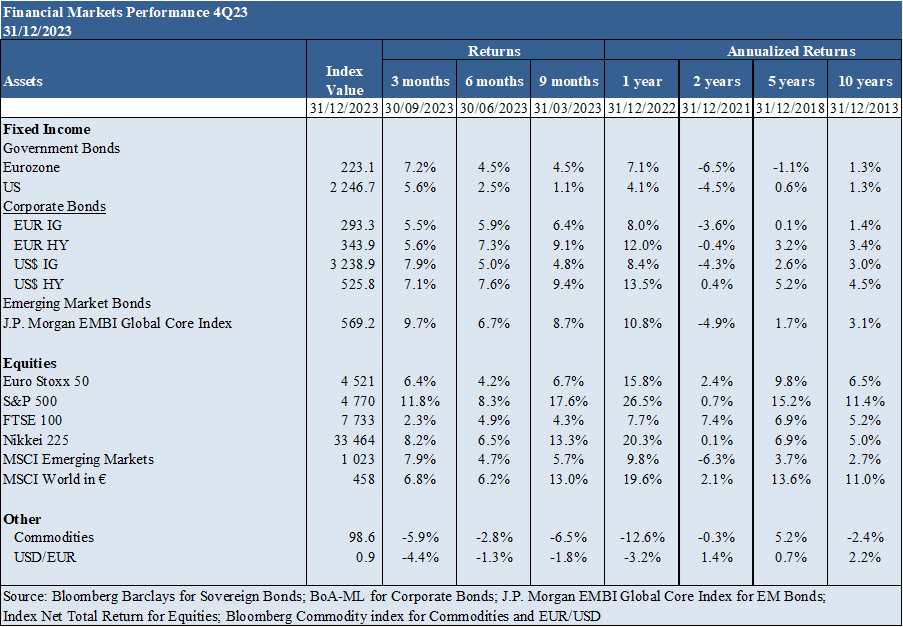

4Q23 Markets Performance: Equity markets have one of their best years ever, while bond markets are performing well, especially in the last quarter, as a result of falling long interest rates.

Macro Context: Global economic growth levels remain low and declining. Inflation continues to fall, but at an uncertain pace. Economic growth in China remains much lower than expected, with high youth unemployment, problems in the real estate sector and in enveloped savings products.

Micro Context : Leading snapshot and leading economic indicators are at low levels around the world.

Economic policies: Central banks in the U.S. and Europe will start lowering official interest rates, after the fastest hike in decades.

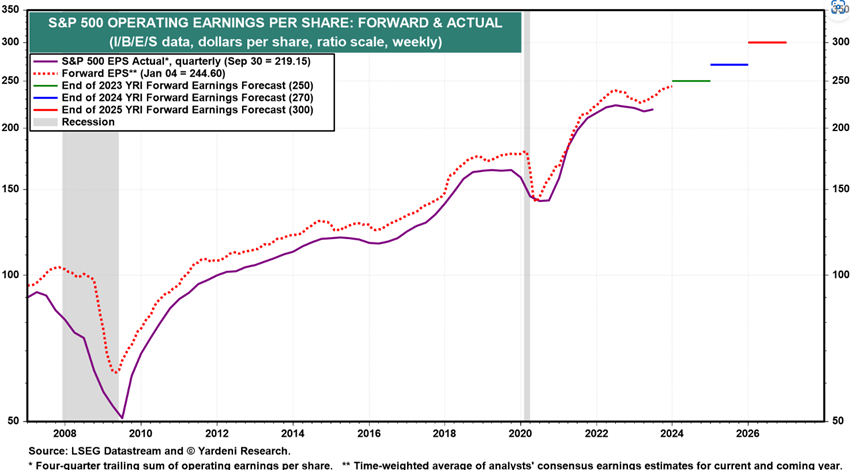

Equity markets : The U.S. stock market is close to peak levels, trading at fair prices in anticipation of earnings growth of 11% for this year, which the earnings season that is now beginning may help to clarify.

Bond markets : Long-term treasury bond yields in the U.S. and Europe fall nearly 1% after hitting 15-year highs in early October, with credit spreads remaining at historically low levels.

Key opportunities : Higher than expected economic growth in China as a result of corrections to existing imbalances and changes in its development model, and a negotiated end to the war in Ukraine, albeit with a very low probability.

Main risks : A worsening economic downturn in Europe stemming from high energy costs and high interest rates, aggravated by increased global economic fragmentation. Spread of the Israeli-Palestinian conflict beyond the Gaza Strip.

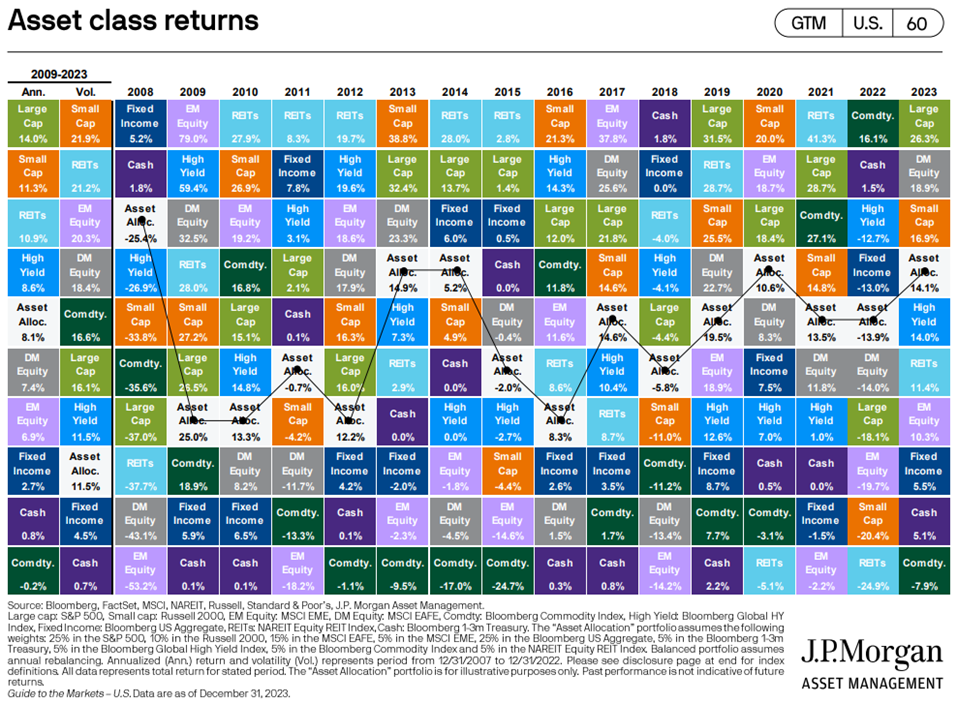

The downward trajectory of inflation and long-term interest rates to high levels in Western countries favor investments in U.S. and Japanese equities, as well as bonds, especially in the U.S.

At the end of November, we published the Outlook for the year 2024. After 1.5 months, we updated and then developed the quarterly outlook.

4Q23 Financial Markets Performance:

Equity markets are having one of their best years ever, while bond markets are performing well, especially in the last quarter, as a result of falling long interest rates

U.S. stock markets with one of the best years ever. The S&P 500 rose 24%, erasing losses from 2022. The Nasdaq 100 gained 54%, its best since 1999. Eurozone and UK markets gained more than 15%.

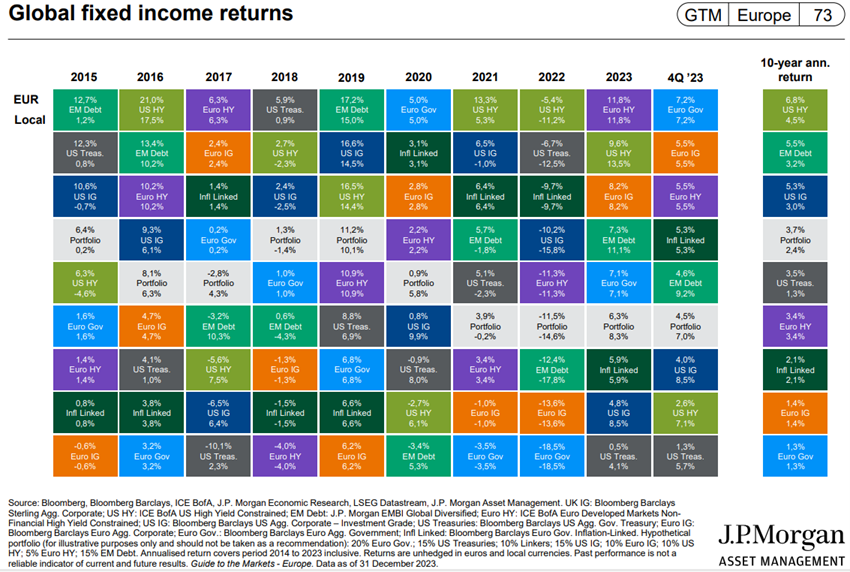

Bond markets in Western countries appreciated between 5% and 7%, mainly due to the fall in long-term interest rates last quarter.

As a result, the traditional 60/40 portfolio in the U.S. performed excellently at around 15%.

Bitcoin has appreciated by more than 150% in the year, especially in the 2nd half of the year, associated with the expectation of regulatory authorization for the launch of the first ETF investment funds in the US.

Macroeconomic context:

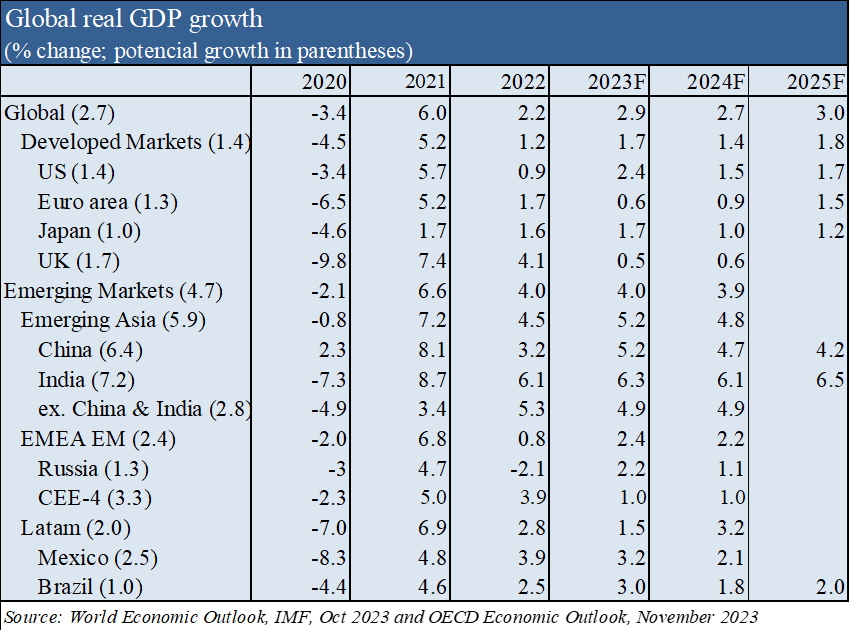

Global economic growth levels remain low and declining. Inflation continues to fall, but at an uncertain pace. Economic growth in China remains much lower than expected, with high youth unemployment, problems in the real estate sector and in enveloped savings products.

Global economic growth forecasts are maintained to 2.9% in 2023 and 2.7% in 2024, with 2.4% and 1.5% in the US, 0.6% and 0.9% in the Eurozone, 5.2% and 4.7% in China, respectively, below the long-term average.

The Eurozone is virtually stagnant and close to recession.

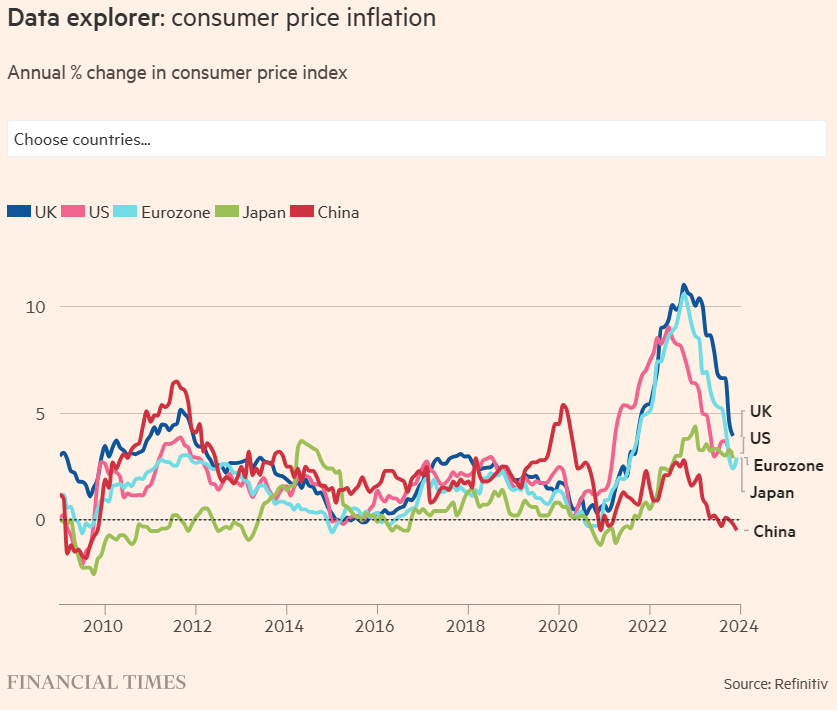

Core inflation in the U.S. and Europe resumed its decline in the last quarter due to lower energy and services prices.

China is at a crossroads, with growth of 5% and lower than predicted by the authorities, and far from the average of 9% per year of the last 4 decades.

Microeconomic context:

Leading instantaneous and advanced economic indicators stabilize at low levels around the world

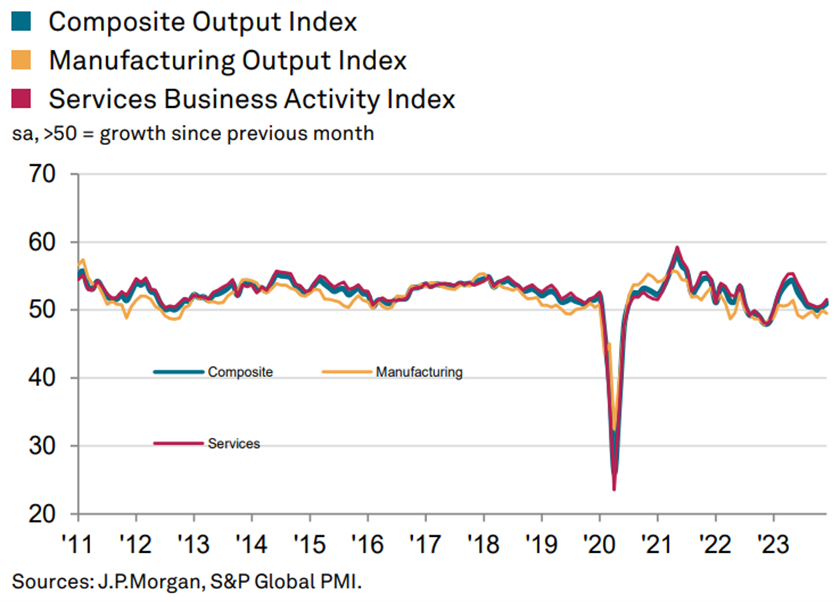

Business activity in the services sector rose for the eleventh consecutive month in December, with the growth rate reaching a five-month high. The industry slowdown extended for the seventh consecutive month in December.

National PMI data signalled that the Eurozone, Canada and Australia were the main headwinds to global economic activity in December, with output falling. Japan expanded slightly, following a slight contraction in November. Growth accelerated in the US, China, the UK and Russia.

The unemployment rate in the U.S. is at 3.8%, levels close to the lows.

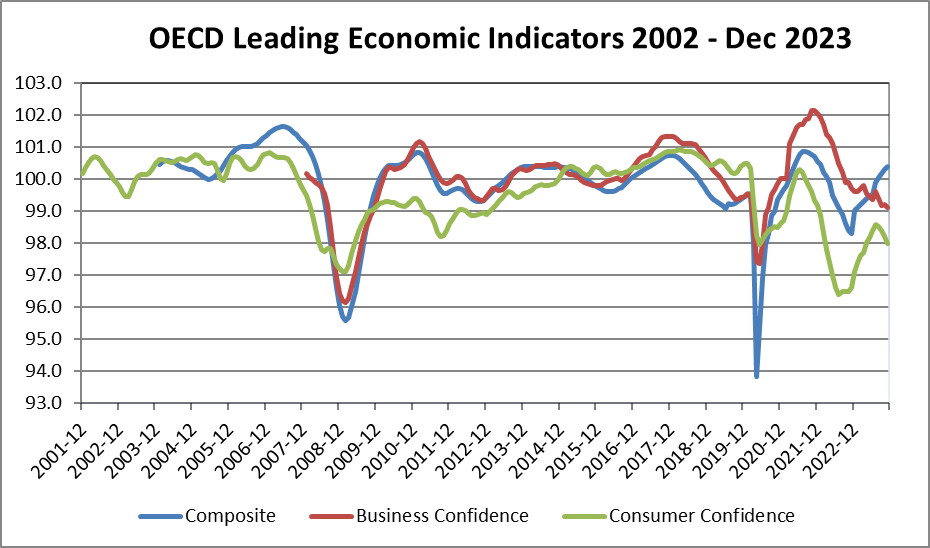

Business and consumer confidence in OECD countries has improved.

U.S. businesses and households continue to show financial strength and resilience.

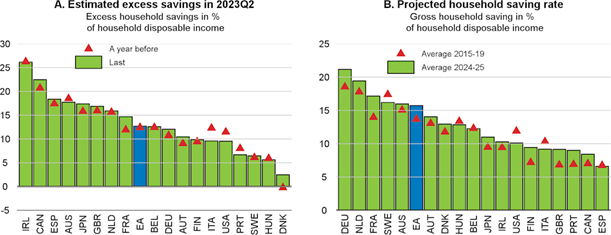

Projected savings rates for 2024-25 are significantly above their 2015-19 average for the euro area as a whole, implying further additions to the stock of excess savings.

This contrasts with the continuation of projected low savings rates in the United States, where excess savings continue to decline throughout 2024 and 2025.

Economic policies:

Central banks in the U.S. and Europe will start lowering official interest rates after the fastest rise in decades

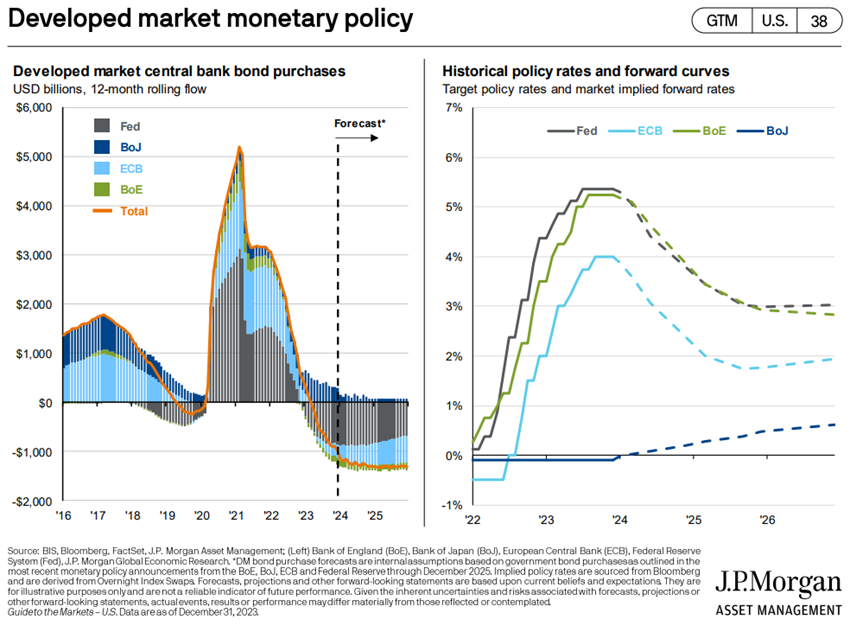

The U.S. central bank has already indicated that it will lower interest rates this year, in line with the path of inflation falling from current levels to the 2% target.

The Fed’s projections point to the decision of this rate from the current 5.25% to 4.6% in 2024, 3.5% in 2025, and 2.5% in 2026. The Fed lowered its projections for its preferred measure of inflation – the private consumption price index (PCE) – to 2.4% in 2024, 2.2% in 2025 and 2% in 2026.

The minutes of the last Fed meeting are at the following link:

https://www.federalreserve.gov/monetarypolicy/fomcminutes20231213.htm

The ECB kept the refinancing rate at 4.5%. It forecasts inflation of 5.4% in 2023, 2.7% in 2024 and 2.1% in 2025.

The Bank of England kept the official interest rate at 5.25%.

Assessment of the stock markets:

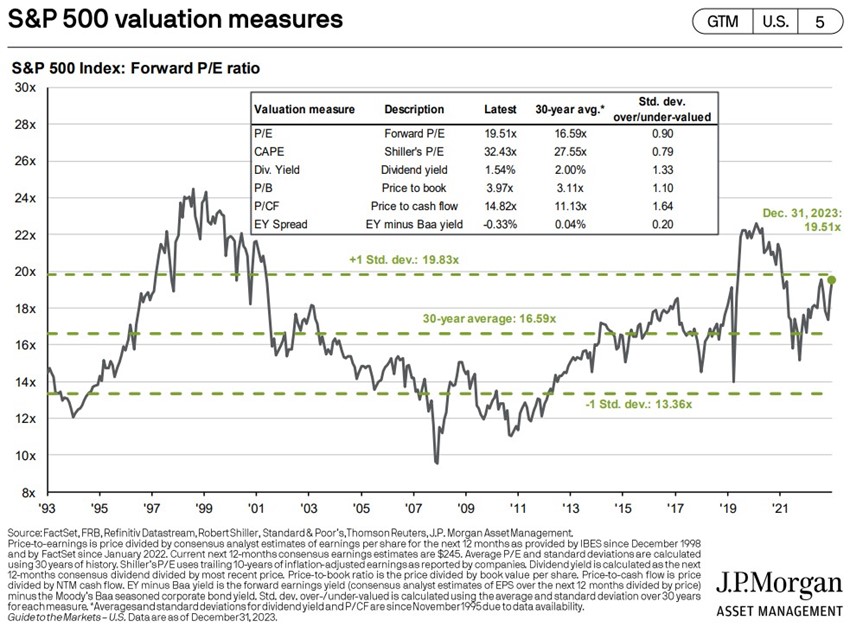

The U.S. stock market is close to peak levels, trading at fair prices in anticipation of earnings growth of 11% for this year, which the earnings season that is now beginning may help to clarify

The U.S. stock market is nearing peak levels, with gains of 24% for the S&P 500 and 40% for the Nasdaq 100, and a broad-based appreciation of various stocks in the last quarter, driven by lower interest rates.

The Japanese market is also at an all-time high, while Europe and the UK have seen gains of around 10%.

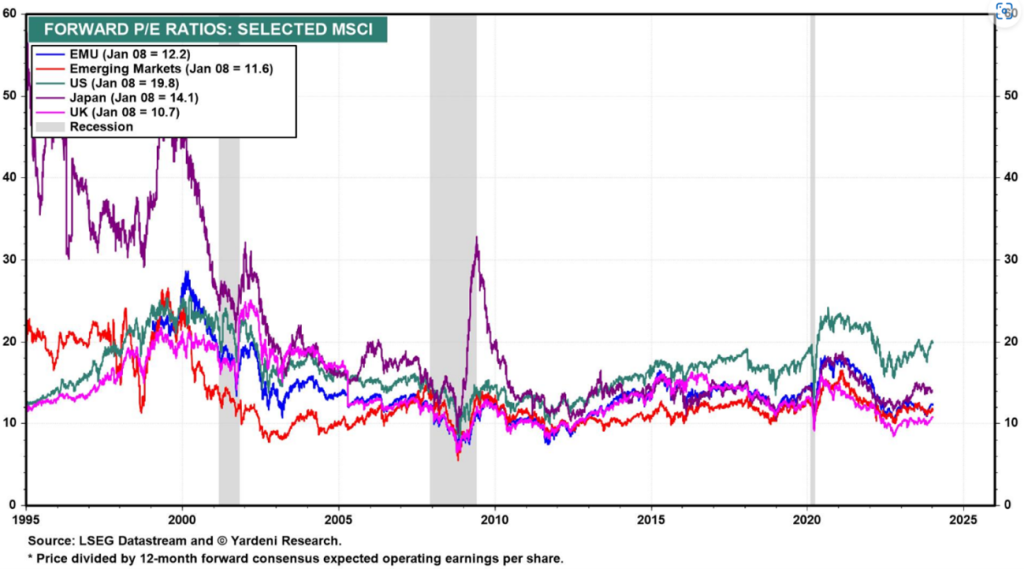

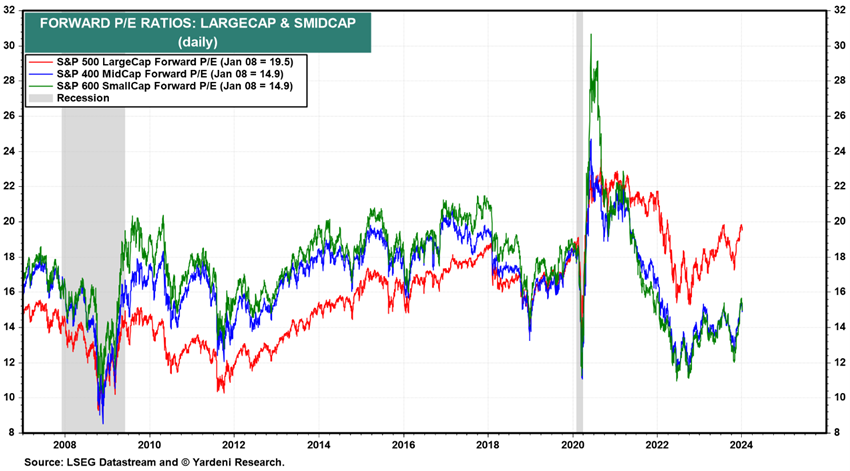

The 19.5x forward PER for the U.S. is above the long-term average, falling to 17.7x without the 8 MegaCaps.

The PER of the remaining regions declined slightly to 12.2x in the Eurozone, 14.1x in Japan, 10.7x in the UK and 11.6x in emerging markets, all of which are below the historical average.

The PER of mid- and small-cap U.S. stocks are both at 14.9x to 12.1x, below the long-term average.

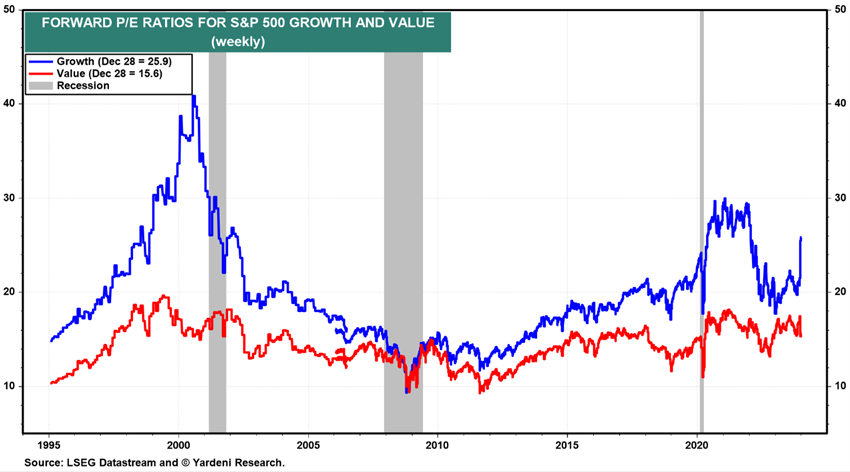

The PER of U.S. growth stocks is at 25.9x and that of value stocks at 15.6x.

The North American market continues to be more attractive (alongside Japan) despite higher valuation multiples, with annual earnings growth expected to be 11%.

Europe is threatened with recession, or at least stagnation, while China is struggling with the exhaustion and fracturing of the development model, which could benefit India as one of the main bets of emerging markets.

Valuation of bond markets:

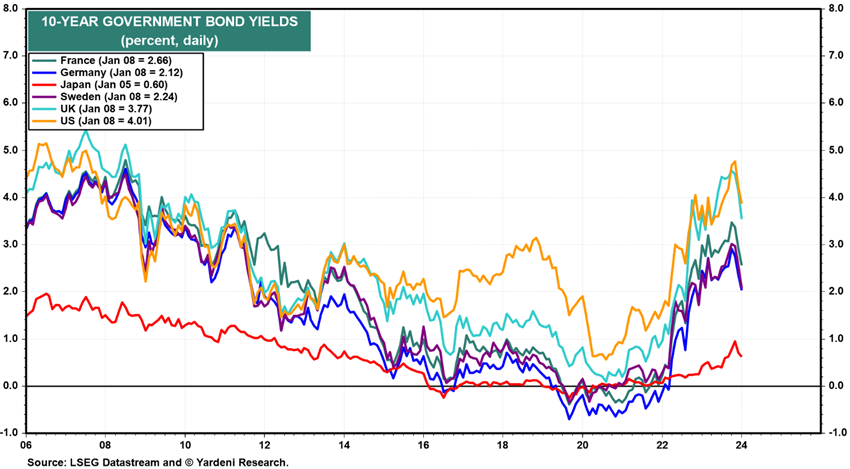

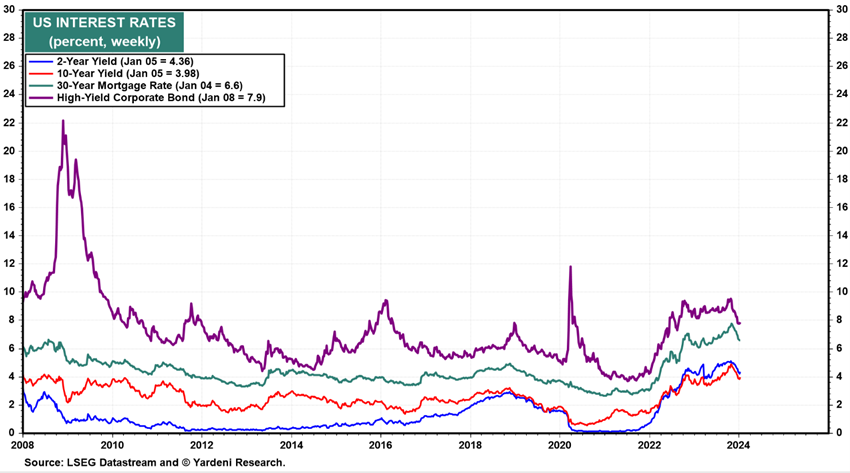

Interest rates on long-term government bonds in the U.S. and Europe fall nearly 1% after hitting 15-year highs in early October, with credit spreads remaining at historically low levels.

Long-term risk-free interest rates fell 1% in the United States and the eurozone last quarter, following 15-year highs reached in October, triggering significant gains in bond investments in the last quarter.

Interest rates on 10-year US Treasury bonds have fallen from almost 5% in October to 4% today (and 2-year yields from 5.2% to 4.3%), and have also decreased in the largest European countries (to 2.2% in Germany, 2.7% in France and 3.8% in the UK).

Interest rates on 30-year U.S. government debt are at 4.1%, down from 5.1% last October.

Credit spreads in the U.S. and Europe remained stable.

With long interest rates well above the average of the last 15 years, US and European investment quality bonds are trading at interesting levels in the medium and long term.

Key opportunities:

Higher than expected economic growth in China, as a result of the corrections of existing imbalances and changes in its development model, and a negotiated end to the war in Ukraine, albeit with a very low probability.

The result is bankruptcies in the largest construction companies (which weigh 25% of GDP), which spill over into losses in state-owned banks and with a doubly negative effect on household wealth, through falling real estate prices and losses in high-paying packaged savings products (savings accounts channeled into construction loans).

China is trying to shift to a development model based on private consumption, which could lead to more dynamic growth.

The eventuality of a negotiated term in the war in Ukraine, with a very low probability due to the elections in Russia, would obviously be a very positive surprise factor for the markets.

Main risks:

Worsening economic recession in Europe due to high energy costs and high interest rates, aggravated by increasing global economic fragmentation. Spread of the Israeli-Palestinian conflict beyond the Gaza Strip.

Stagnation or even recession in Europe in the short term, starting in Germany, France and the United Kingdom and extending to the rest of the countries, due to high inflation, high interest rates, and the prolongation of the war in Ukraine.

U.S. government instability associated with the November elections, with Republican candidate Donald Trump, who is still ahead in the polls, mobilizing his congressmen to block domestic and foreign policies.

Israel’s conflict in the Gaza Strip risks spreading to the entire Middle East region and triggering terrorist actions around the world.

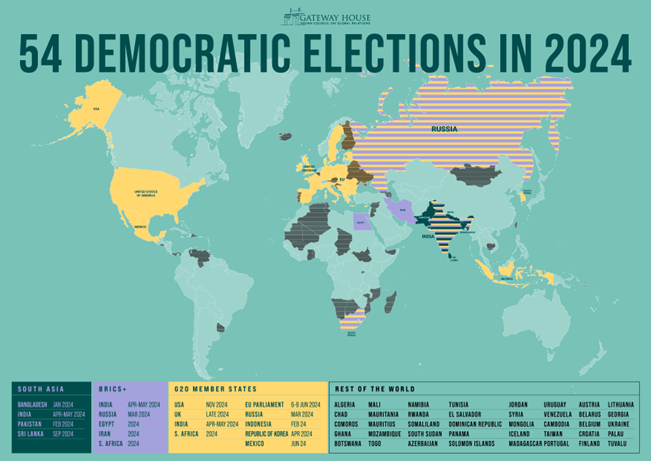

2024 will have 57 elections around the world, with the most relevant being those in the US, UK, India (and many of the adjacent countries), Taiwan, Mexico and Russia.