2023 in review: Major strides in the battle against inflation in advanced economies, with a controlled impact on growth. Concentration of US stock returns on the magnificent 7 and Artificial Intelligence, after a 2022 in which the losses of technology spooked investors.

Macroeconomic outlook for 2024: Inflation, interest rates and economic growth

Financial market outlook for 2024: high single digit gains in US and European bonds, and in US stocks and Japanese stocks (in the various capitalization segments)

Key findings and recommendations: overweight of U.S. and European bonds, U.S. and Japanese equities, and the attractiveness of balanced portfolios and of the traditional 60/40 portfolio

In the previous article, we published the outlook for the financial markets in 2024 of the main global investment banks, in line with what we started in 2023.

In this article we will present our opinions and recommendations.

2023 in review: Major strides in the battle against inflation in advanced economies, with a controlled impact on growth. Concentration of US stock returns on the magnificent 7 and Artificial Intelligence, after a 2022 in which the losses of technology spooked investors.

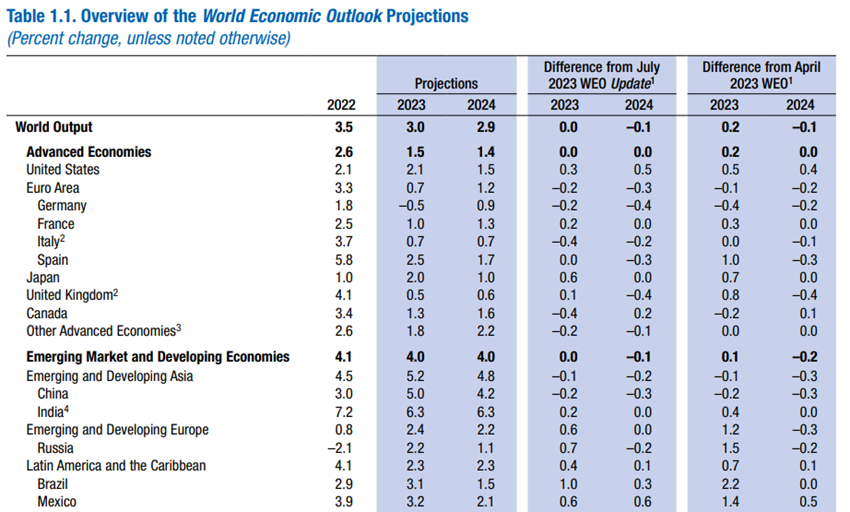

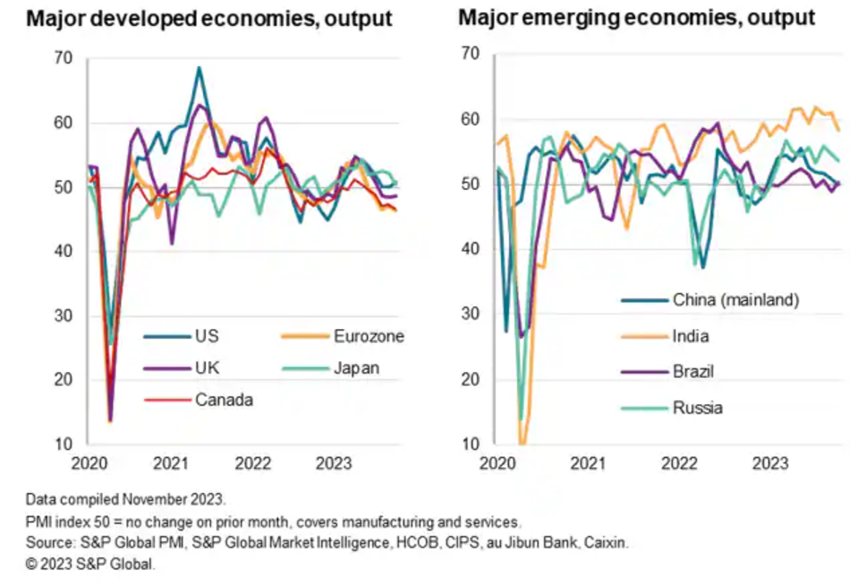

Global economic growth has been asynchronous. In the U.S., growth was much better than expected, Europe stagnated, and China slowed significantly.

2003 was an even more difficult year than usual for investment managers and individual investors.

The S&P 500’s 18% return was largely due to the Magnificent Seven – Apple, Microsoft, Alphabet, Meta, Amazon, Nvidia and Tesla – with a weight of 25% and average returns of more than 90%, especially from the second half of the year onwards (note: its weight in the Nasdaq 100 exceeds 50%).

In the first half of the year, there was still some breadth in the American stock market, but in the second half the concentration was accentuated in the Magnificent Seven.

The Japanese stock market had good returns, while the European ones were moderate and the Chinese one was negative.

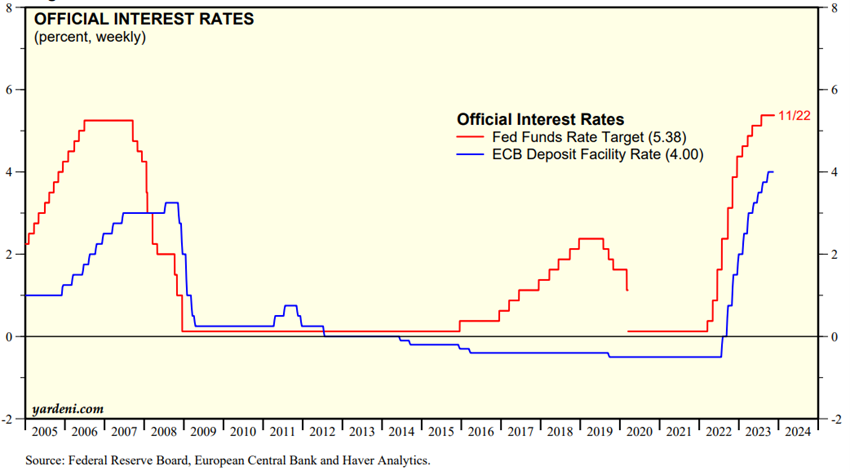

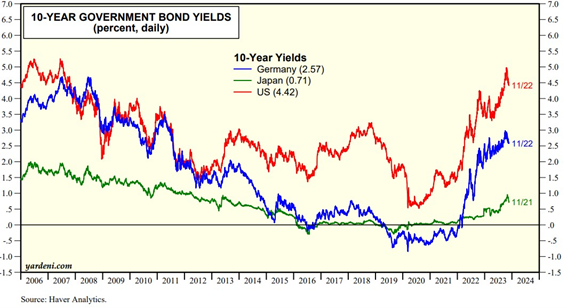

Long-term interest rates have risen for most of the year in the U.S. and Europe, starting to decline in November, in line with the downward path of inflation and the consistent action of central banks.

As a result, bond investment has been losing for most of the year.

Fund flows to equities were negative, positive for bonds, and very strong for short-term investments such as money market funds.

Macroeconomic outlook for 2024: Inflation, interest rates and economic growth

In 2024, growth is expected to slow down globally and in all economies, both advanced and emerging.

Developed countries will feel the effects of the current monetary policy of high interest rates for longer, while emerging economies will be affected by the backlash of globalization and a strong dollar.

With Europe stagnant or in recession, China in economic cooling and with unresolved problems in the construction sector that represents 25% of GDP, the big question for 2024 is to know how resilient the American consumer will be to the effects of high interest rates, as consumption is the great engine of economic growth in the US.

The starting point of the U.S. economy is favorable, as households and businesses are in good economic and financial capacity, inflation and market interest rates are falling, and the labor market is robust.

Leading economic indicators remain generally positive.

Accordingly, the evolution of consumption in the US will depend on the lagged effects of high interest rates and the path of inflation rates and their direct implications on interest rate movements, disposable income and household employment.

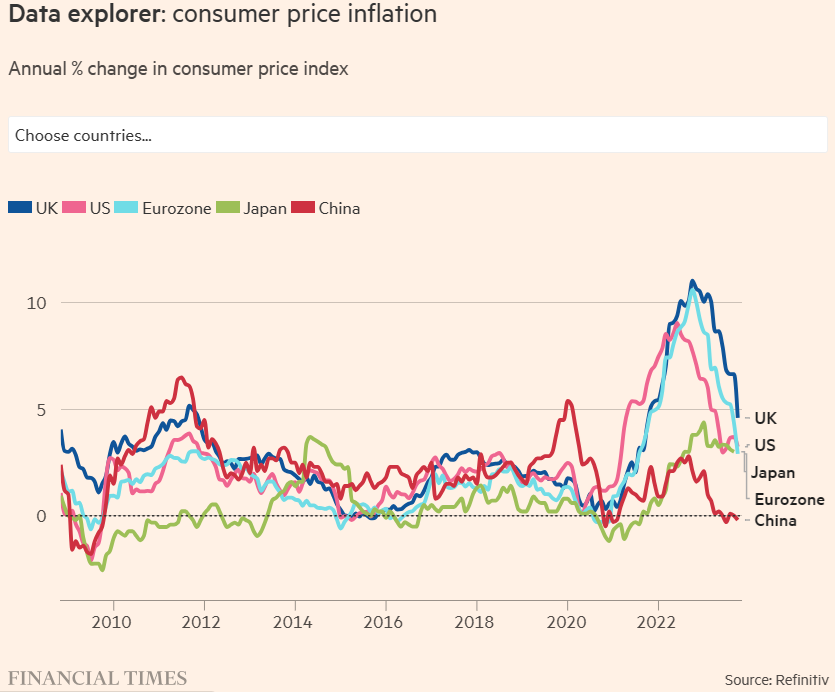

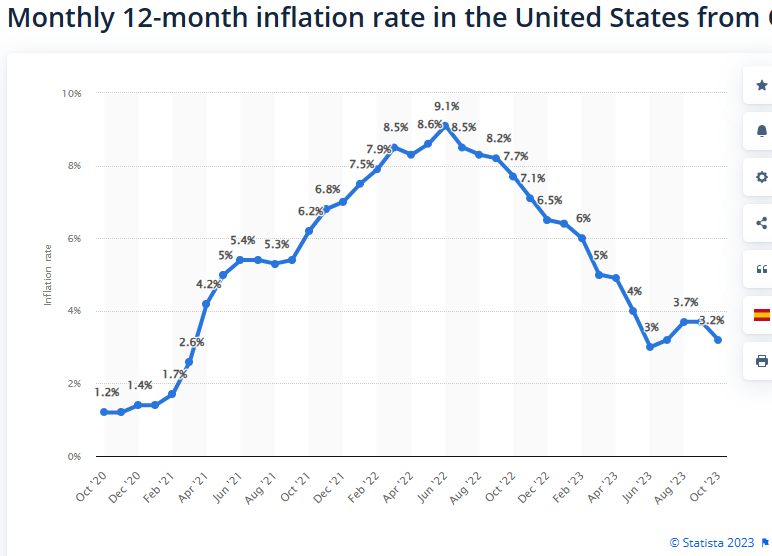

As we mentioned in another article, it is very difficult to predict the development of inflation, given its multiple components, its dynamics. and the surprises that the future always brings.

However, we are of the opinion that inflation in the US will continue to decline gradually and it is estimated that it could fall from the current 3.2% to close to 2.5% by the end of 2024.

This development is due to the effect of a change in base, the fall in the prices of goods and services – in particular, in the cost of housing, which being the most important component had been shown to be more rigid – and the stability of energy prices.

We believe that in this scenario, the Fed will start quoting policy rates in June, at a pace of 0.25% per quarter.

In Europe, the reduction in inflation will be more gradual, which will cause the rate cut to be delayed.

Long-term interest rates will adjust accordingly, assuming 10-year U.S. bond yields fall below 4% from the current 4.5%.

We believe that this framework of a virtuous circle of decreasing inflation and short- to long-term interest rates will offset the lagged effects of past high interest rates, leading to an increase in disposable income and household consumption.

The dollar will remain strong against other currencies.

Financial market outlook for 2024: gains in US and European bonds, and in US and Japanese stocks (in the various capitalization segments)

Against this backdrop of falling interest rates, a very positive performance is expected for US long-term government bonds and, to a lesser extent, for European ones.

Good-rated and high-yield bonds are also expected to benefit, as a widening of their spreads is not anticipated through an increase in default rates.

The assessment of equity markets should be done with more granularity given the variety of situations.

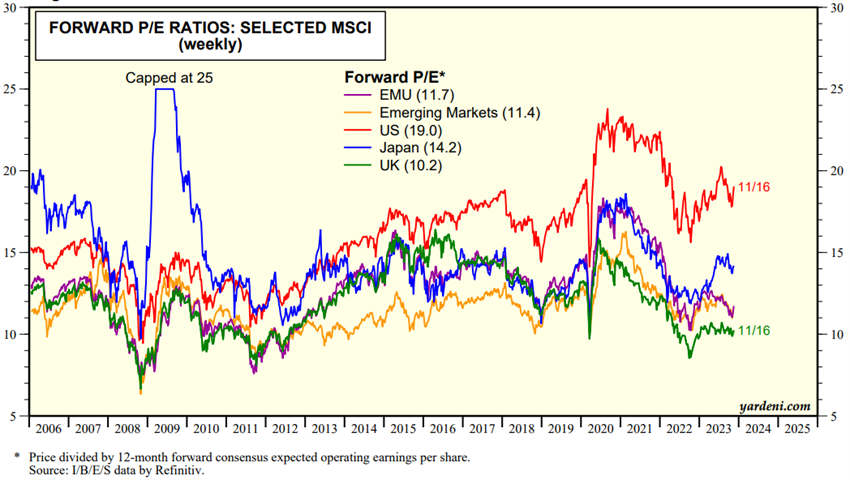

The U.S. market has multiples above the historical average, while the rest are below, namely the European, Japanese and emerging economies markets.

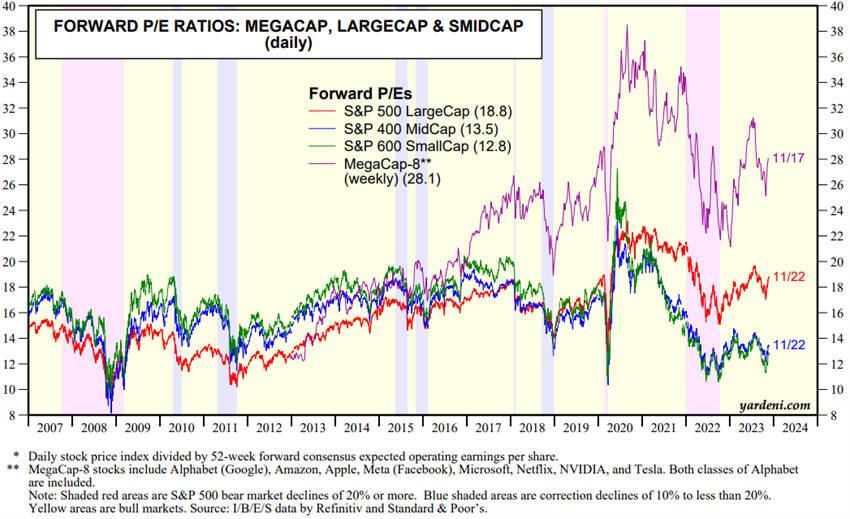

However, if we exclude the Magnificent Seven from the S&P 500 index, the remaining 493 companies are quoted at PER multiples at the level of the average of the last 20 years.

This phenomenon is even more significant for US small and mid caps, which are at multiples below the long-term average.

This disparity results from the preference for investing in quality companies (global, stable, robust balance sheets, and strong cash-flow generation) and the different EPS growth estimates of the various geographies and capitalization segments in the US.

Earnings per share growth is not expected for European and emerging market companies due to difficulties in domestic markets and the reversal of globalization.

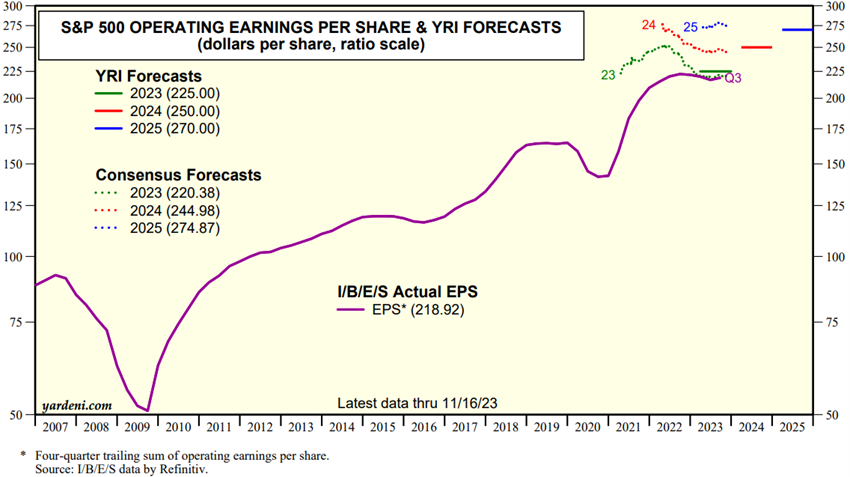

For the U.S., the situation will be different, as after a year of contraction in earnings per share in 2023, we expect S&P 500 EPS to increase by between 5% and 10% in 2024, with a broader number of companies contributing.

This does not mean that we do not consider that the Magnificent Seven will continue to maintain revenue, margin and profit growth well above the rest of the companies, due to its global footprint and pricing power.

Against this backdrop, we expect U.S. equities to perform well in general, not only the S&P 500, but also the small and mid caps, which are more exposed to the domestic economy.

We believe that the U.S. stock market will have less concentration and more width than in 2023, although there will still be a dispersion higher than the historical average, both at the sectoral and individual levels.

Cash will continue to be a competing investment for stocks and bonds with rates ranging from 5.5% to 4% in the US, and between 2.5% and 3% in the Eurozone.

Key findings and recommendations: overweight U.S. and European bonds, U.S. and Japanese equities, and the attractiveness of balanced portfolios and of the traditional 60/40 portfolio

Maintaining balanced portfolios in terms of asset allocation across equities and bonds, aligned with financial objectives and risk profile

Good prospects for the appreciation of long-term bonds of North Americans, and to a lesser extent of European ones, which will benefit from the fall in interest rates at high levels, as well as the maintenance of credit spreads.

Attractive upside expectations for investments in US and Japanese equities as a result of better-than-expected economic growth.

Attractiveness of investment in small and medium-sized North American companies, anticipating the improvement of earnings per share and above all the expansion of market multiples that are at a very low level in historical terms.

Combination of investment in the main generalist indices in individual securities of the most favored asset subclasses.

Cash will continue to be an investment alternative, especially in the first quarter, before the process of cutting central bank rates, scheduled for the second half of the year, begins.

The dollar will remain strong, reflecting a relatively better pace of growth in the U.S. economy than the rest of the world.