In the recent past, emerging markets have been viewed as a bloc, more or less homogeneous of the main countries that make up them, associating their absolute and relative performance with 4 key factors: the price of commodities, world trade growth, the evolution of the dollar and global financial conditions.

There are 4 major reasons that influence emerging stock markets in general and explain the lower economic growth and performance of emerging countries’ stock markets at the turn of the millennium: commodity prices, world trade growth, the evolution of the dollar and global financial conditions

#1 Prices of commodities

#2 World trade growth

#3 Dollar evolution

#4 Global financial conditions and capital flows

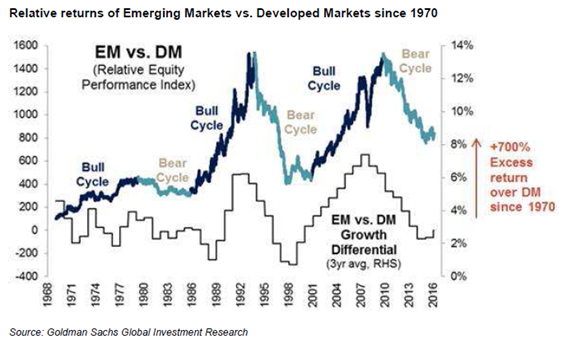

The worse relative performance of emerging markets versus developed markets since 2000 is associated with the loss of pace of higher economic growth and productivity

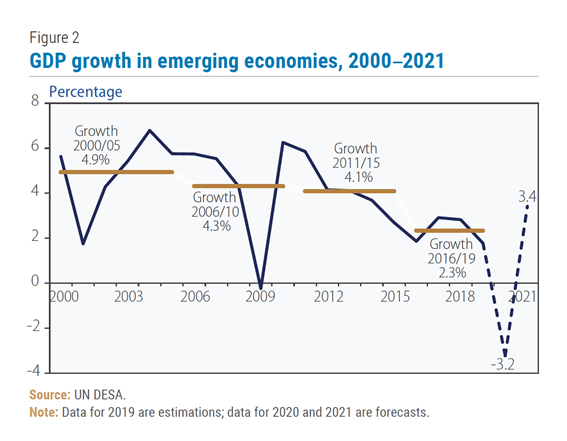

The lower relative performance of emerging markets especially since 2000 has been reflecting the strong economic cooling in most countries in recent years as we can see in this chart:

The slowdown in economic growth is quite noticeable. Starting at an average annual GDP growth of 4.9% between 2000 and 2005, it fell to 4.3% between 2006 and 2010, followed by 4.1% between 2011 and 2015, and subsequently recorded the highest cooling to levels of 2.3% between 2016 and 2019.

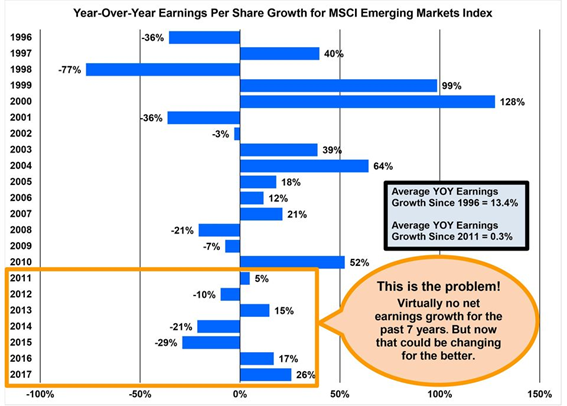

There are 4 major reasons for the lowest economic growth and performance of emerging countries’ equity markets at the turn of the millennium: commodity prices, world trade growth, the evolution of the dollar and the global financial conditions.

#1 Prices of commodities

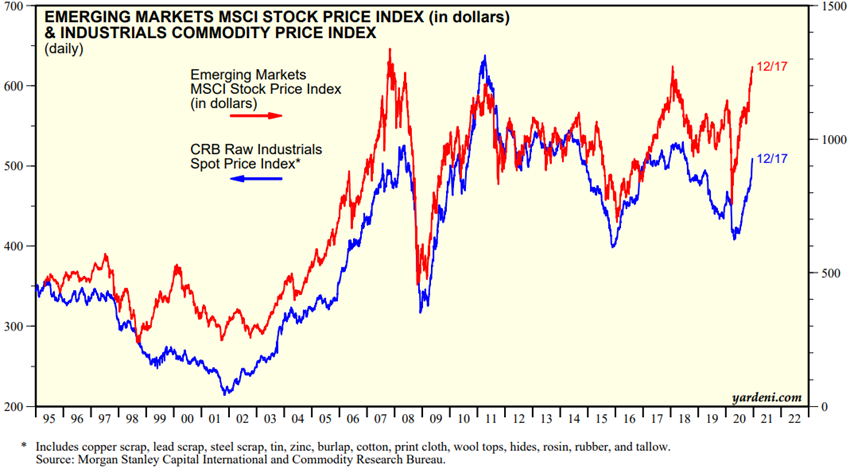

Most emerging countries are abundant in commodities or commodities, which they export to the rest of the world.

The following graph shows that there is a high correlation between commodity price developments (copper, lead, steel, tin, zinc, litter, cotton, wool, leather, stamped, rubber, resin, and tallow) and emerging stock markets:

There is a great synchrony of evolution, more marked in the two steep rises cycles from 2000 to 2007 and from 2009 to 2011. The stabilisation and falls in commodity prices since 2011 have weighed on the performance of equity markets since then.

#2 World trade growth

It is not just the commodities that are exported. There are industrial goods in which emerging countries are also the world’s major exporters, although they are mainly low-processing and consequently low added value, based on the competitive advantage of cheap labour.

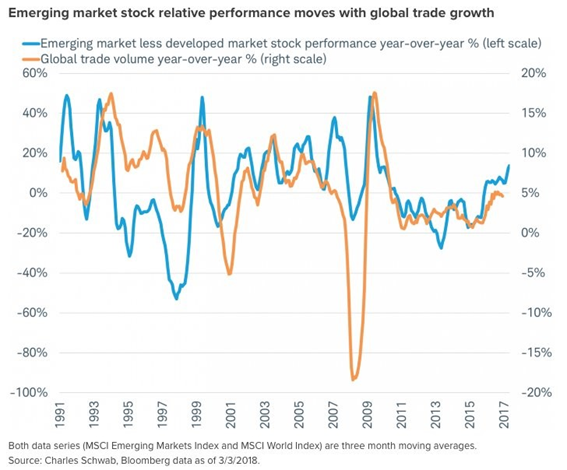

The following chart shows the high correlation between global trade growth rates and the relative performance of emerging equity markets:

We see that the higher the growth rate of global trade, the better the performance of emerging versus developed markets.

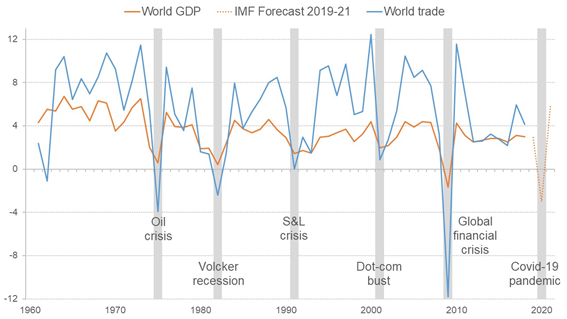

Since 2011, the growth rates of world trade have been around 4%, much more modest than the averages since 1960 and especially those in the golden period of emerging equity markets between 1990 and 2010.

The growth between 1960 and 2010 was mainly due to the elimination of tariffs and quotas that have recently been at minimum levels.

#3 Dollar evolution

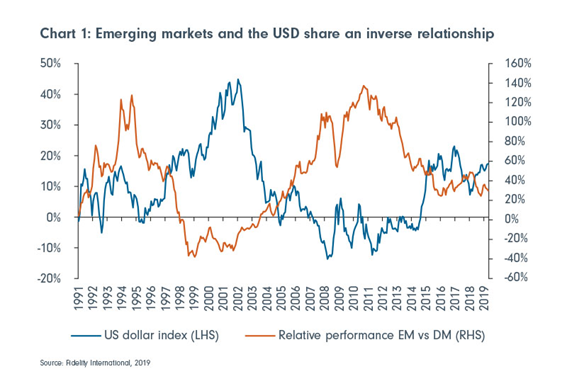

The following chart shows that emerging markets evolve inversely to the dollar:

Emerging markets perform worse than developed markets when the dollar appreciates, as was the case between 1995 and 2001 and between 2015 and 2019, and perform better when the dollar depreciates, a situation between 2003 and 2002 and 2008.

When the dollar strengthens, emerging market economies typically feel pressured to raise interest rates to defend their currencies, which often proves negative for equity market performance.

There are three factors that explain that a strong dollar has a negative effect on emerging markets: debt costs, capital flows and exports.

During periods of low US interest rates, many governments and companies in emerging markets seek to take advantage of a weaker dollar to borrow money to finance growth and fiscal needs. However, when the dollar is strong, these countries come under pressure as the repayment of their debts becomes more expensive.

Most emerging markets rely heavily on foreign capital flows to finance budget or current account deficits. Higher interest rates in the US, typically associated with a stronger dollar, cause capital to move away from emerging economies and return to the US in search of higher investment returns.

In addition, many emerging market economies also rely on exports to boost their economic growth. Given that most commodities are priced in dollars, emerging market exporters lose money in real terms if their currency depreciates against the dollar.

#4 Global financial conditions and capital flows

We have seen that emerging markets are very exposed to global financial conditions and many of their economies rely on external capital flows to finance their public and external imbalances.

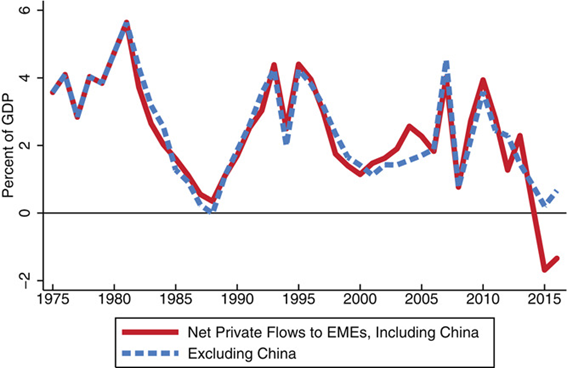

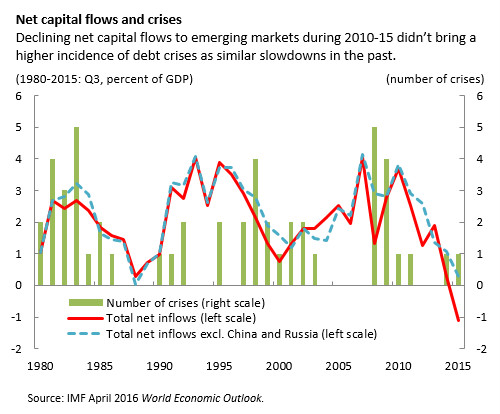

The following graph shows the evolution of capital movements as a percentage of GDP for emerging economies between 1975 and 2015:

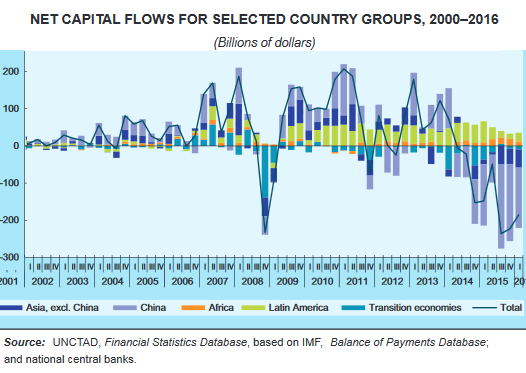

These flows have been very relevant in the past but have been falling sharply since 2012.

Since 2012, there has been a widespread decrease in capital flows to all emerging economies, but the hardest hit countries have been China and the other Asian countries.

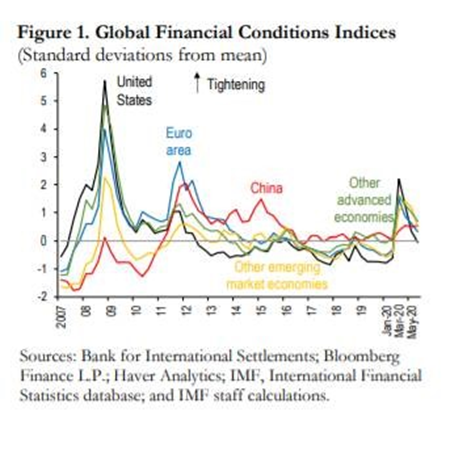

Since 2011, financial conditions have also not been particularly favourable in emerging economies:

These economies, and especially China, have faced more restrictive financial conditions than developed economies.