Race between vaccination and virus to return to normality, despite many things not being as before

Vaccination at full speed to fight third wave, economy at one of the strongest paces in history in a path to the new normal, more digital, more sustainable, but also more unequal world, with much uncertainty regarding adjustments, changes, and transformations in the lives of many families and businesses.

Index

Executive summary

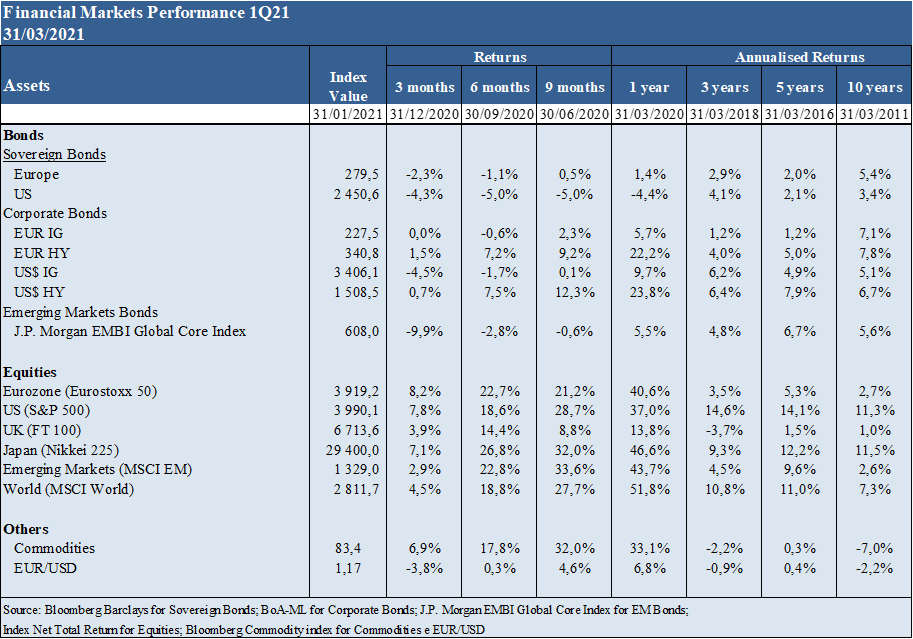

1Q21 performance: After an unbelievable 2020, the first quarter of this year remained positive for equity markets, but negative for fixed income markets, with some volatility brought about by the rise in long-term interest rates.

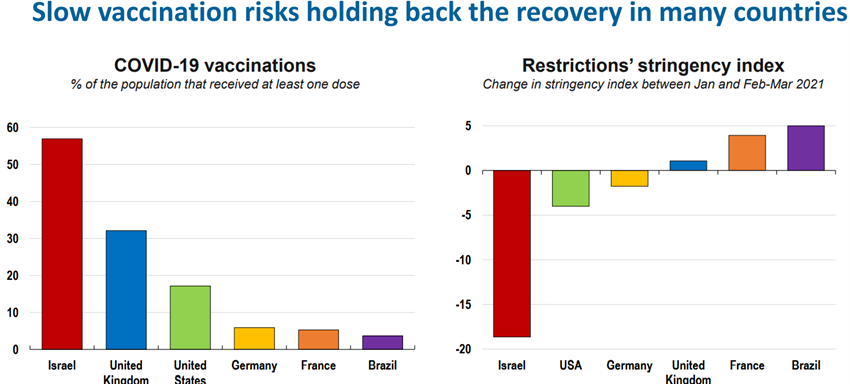

Status Covid-19: Vaccination continues at full speed with Israel, the US and the UK at an excellent pace, and delays in continental Europe, with the ghost of a third wave in some European countries.

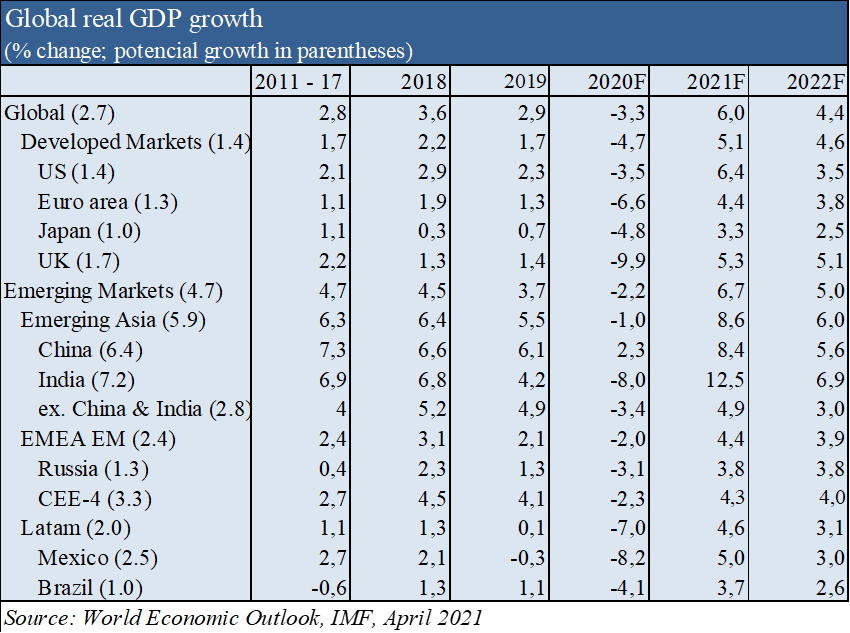

Macroeconomic Context: After an economic contraction in world GDP of -3.3% in 2020, it is expected a growth of +6.0% and 4.4% in 2021 and 2022, respectively, recovering from -4.7% to 5.1% and 4.6% in advanced economies, and from -2.2% to 6.7% and +5.0% in emerging economies, respectively, according to the IMF’s latest April forecasts.

Microeconomic Context: Just over a year after the start of the pandemic and 4 months after the discovery and implementation of the sanitary solution, the first negative historical records of 2020 are now followed by positive historical records of most instantaneous and leading economic indicators.

Economic policies: Governments are boosting stimulus programs, with a focus on the $1.9Tr ARP (8% of GDP) in the US and the €750Bn NextGen in the European Union, while central banks keep official interest rates low and strong asset purchase programmes.

Equity markets: Stock markets continued to record historic highs in the US and years highs in other geographies, also continuing the movements of more universal gains and a rotation of growth stocks to value stocks in line with the normalization of economic activity and the rise in long-term interest rates.

Fixed income markets: Fixed income markets performed slightly negatively due to the rise in long-term sovereign interest rates.

Main opportunities: Achievement of group immunity earlier than anticipated in major economies to allow for a faster return to the new normal.

Main risks: Rising inflation and interest rates in the US, new and less controllable virus strains, vulnerabilities of indebt companies and countries, and market excesses behaviours.

In this scenario of less uncertainty with progress on ongoing vaccination and robust economic indicators, strong and persistent support of economic policies continues to favour equity markets over fixed income markets.

Financial markets performance 1Q21

2020 was an unforgettable year in health, social, economic, and financial fronts … and 2021 will not be behind it.

The most serious pandemic of the last 100 years has caused a sudden and deep halt to economic activity, but the prompt and effective action of the authorities, as well as the rapid discovery and production of vaccines, have enabled an unprecedented recovery.

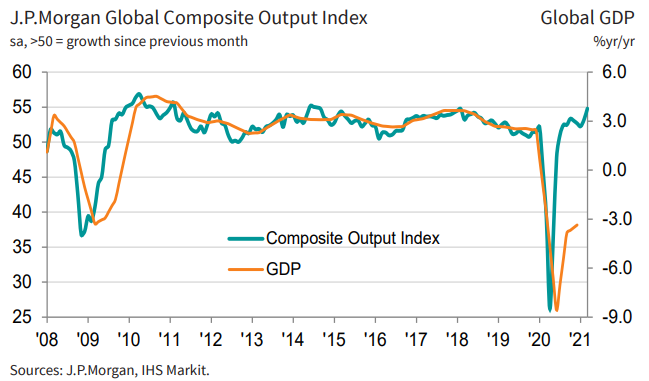

Deep contraction in annual world GDP centred in the 2nd and 3rd quarter, followed by a very pronounced recovery since the beginning of the 4th quarter.

2020 and 2019 were two successive years in which the main assets had positive performances as can be seen in Callan’s periodic table of returns.

Contrary to what happened in the past when both markets, fixed income and equity performed excellently, the first quarter brought asymmetric behaviour, favourable to the stock markets and unfavourable to those of the bonds associated with the rise in US interest rates.

Status Covid-19

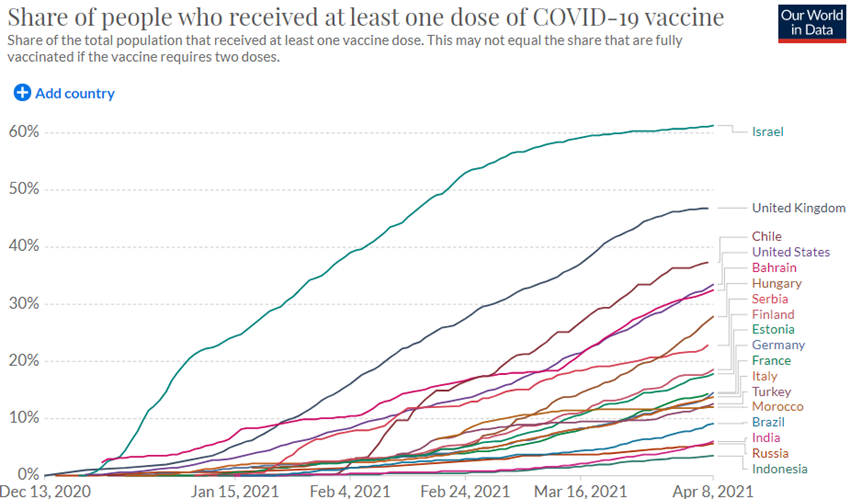

Vaccination continues at full speed with Israel, the US and the UK at an excellent pace, and delays in continental Europe, with the ghost of a third wave in some European countries.

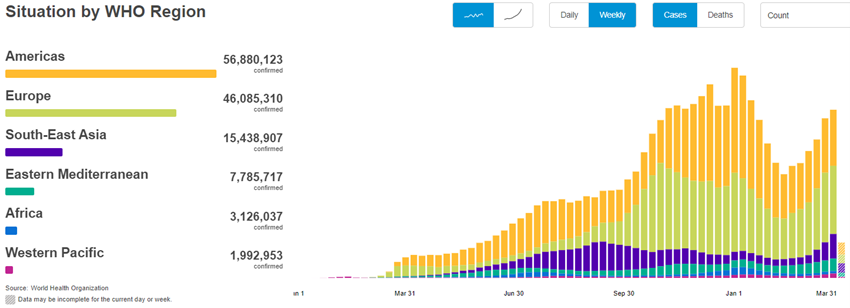

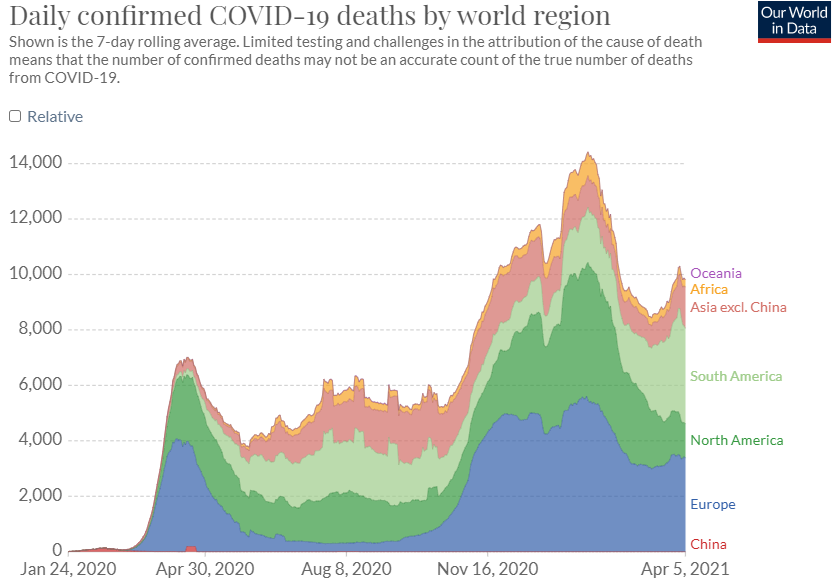

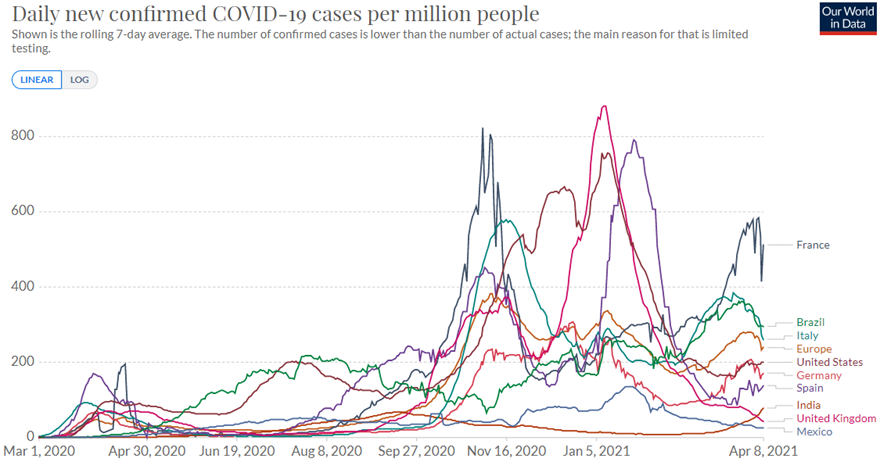

The Covid-19 virus has already surpassed 133 million infected and 2.9 million dead.

Since its emergence in early 2020 there have been several waves, with different intensities around the world, and the most affected regions have been the USA, Europe, Latin America, and India.

Soon after the discovery of the first vaccines in the last quarter of 2020, a rapid process of approval, production and distribution began, and currently we are now in the vaccination phase at full speed.

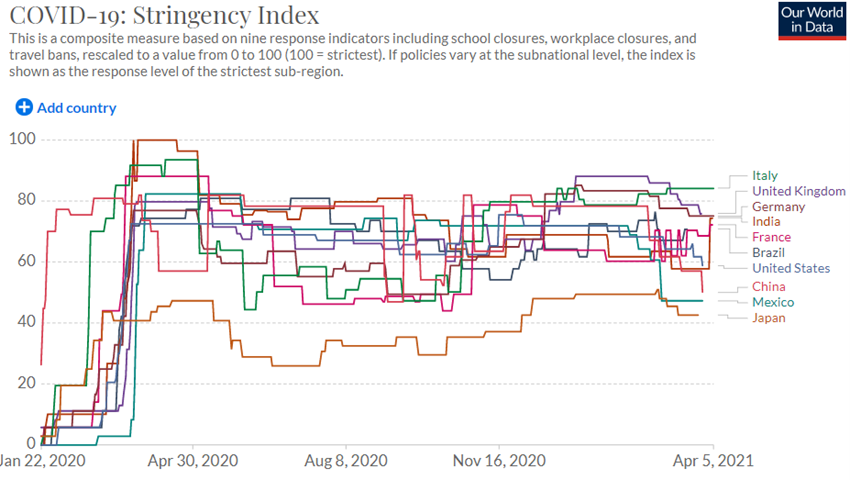

Currently, there is a race between accelerated vaccination to rapidly achieve group immunity and the emergence of a third wave of the virus in some countries, with more infectious and lethal strains.

There have also been several significant advances in the management of public health systems and in the recovery and treatment of patients.

Most countries around the world still put-up limitations to economic activity to manage the containment of the pandemic, which is higher in European countries where the infection rate is higher, and vaccination is slower.

Macroeconomic Context

According to the IMF latest April forecast, the global economy will have contracted -3.3% in 2020 as a result of the various outages in economic activity to contain the pandemic, and will resume +6.0% and +4.4% in 2021 and 2022 respectively as a result of the strong recovery of economic activity with sanitary normalization.

Most developed countries are expected to achieve group immunity until the beginning or during the summer, enabling the return of normalisation of economic activity.

Economic policy authorities in the US and Europe have maintained the purpose of doing whatever it takes to meet existing restrictions and reinforced the idea that they will only withdraw support when the recovery is sustainable.

Inflation is controlled almost all over the world, but in clear rise in the US.

Microeconomic Context

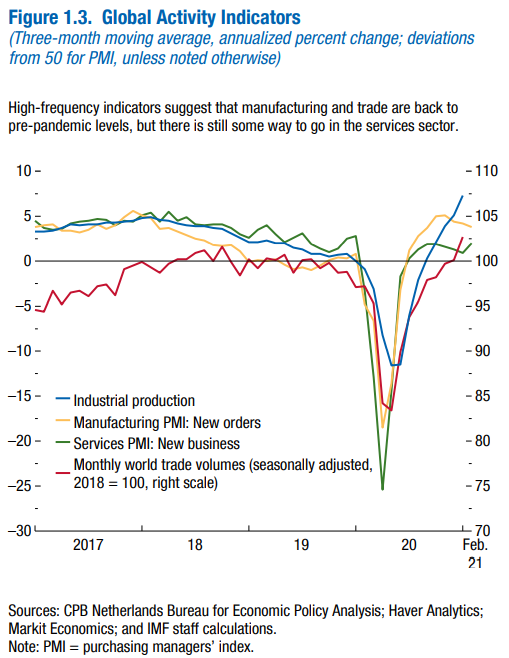

Just over a year after the start of the pandemic and 4 months after the discovery and implementation of the sanitary solution, the first negative historical records of 2020 are now followed by positive historical records of most instantaneous and leading economic indicators.

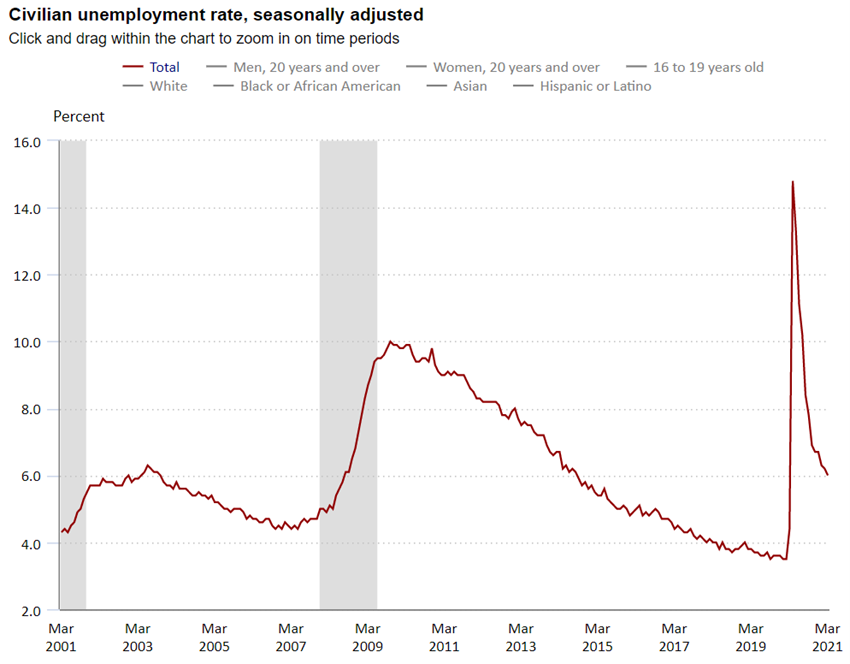

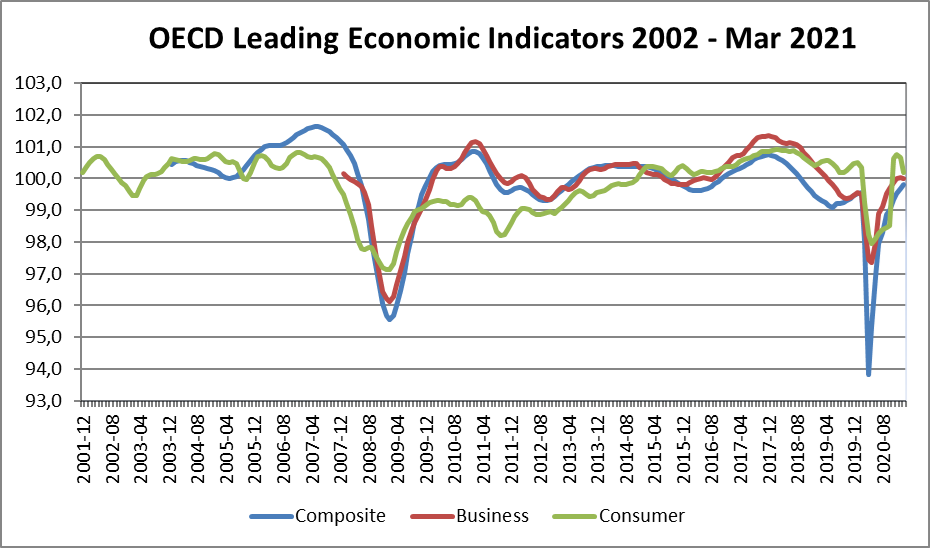

Since the fourth quarter of last year, the positive historical records of the various instant and leading economic indicators have been multiplied, whether in terms of economic activity, employment and consumer and business confidence.

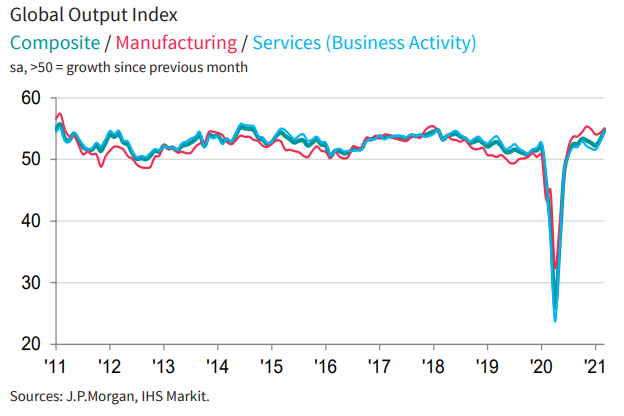

The Global Composite Output reached 55.8 in March, rising for 9 consecutive months, and recording one of the best records of the last decade. Industry growth remained solid, and the services sector continued to recover. The US led this growth, with good records also from Germany, the UK, India, and Australia, with Brazil at the bottom of the table.

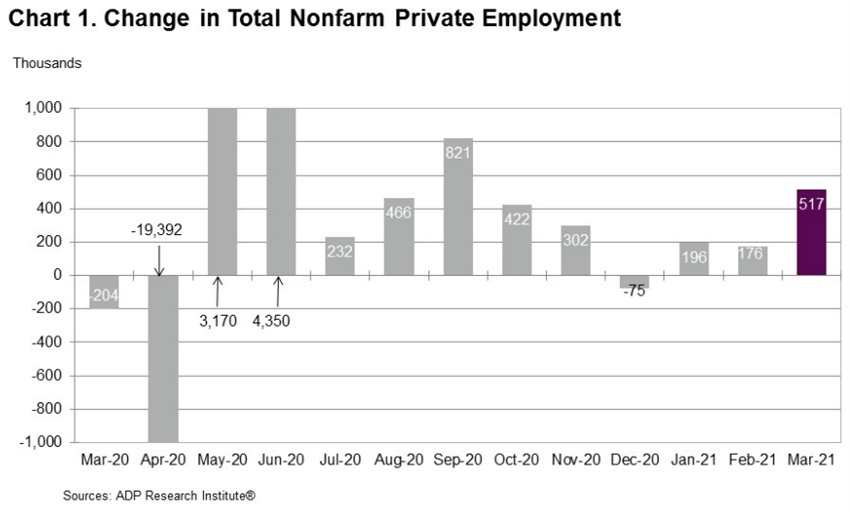

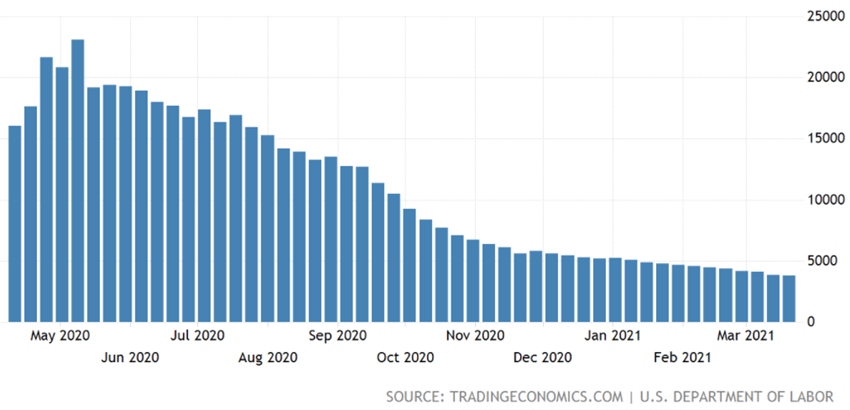

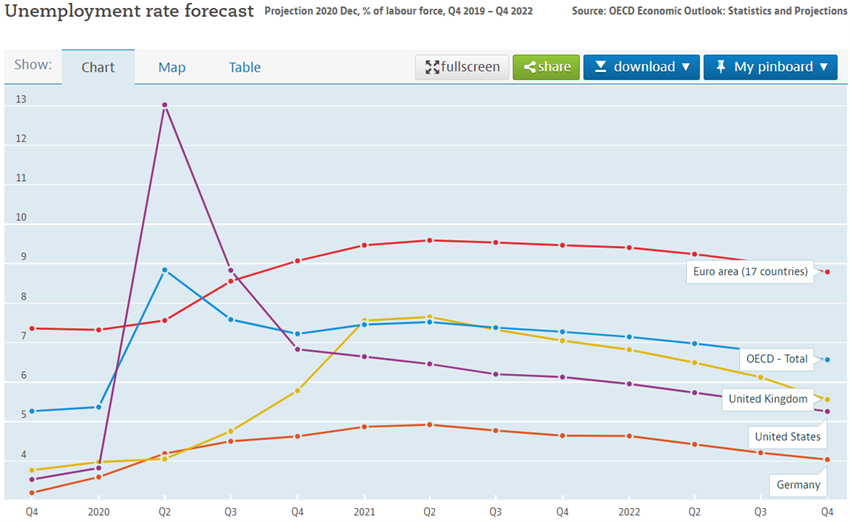

Job creation continued to rise in all countries, with 916,000 new jobs in March in the US, putting the unemployment rate at 6 percent, still 2.5 percentage points above pre-pandemic levels.

The latest OECD business and consumer confidence indicators have also improved.

Source: US Continuing Jobless Claims 1Y, US Department of Labor, 08/04/21

Economic policies

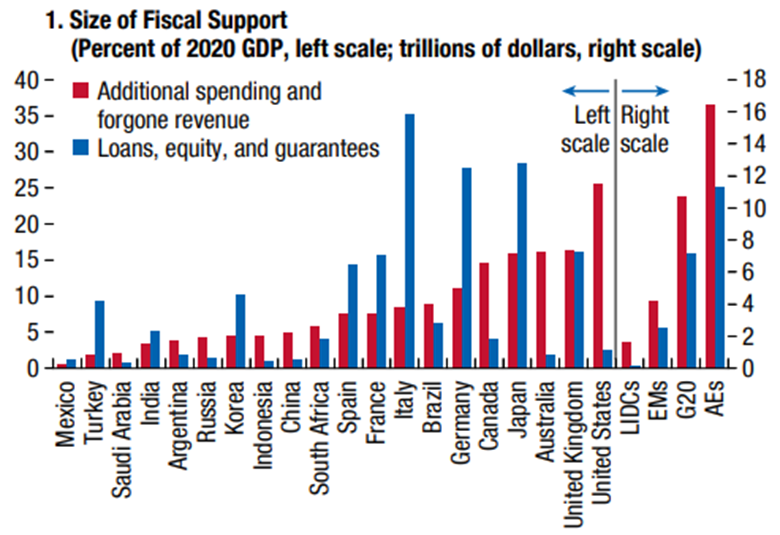

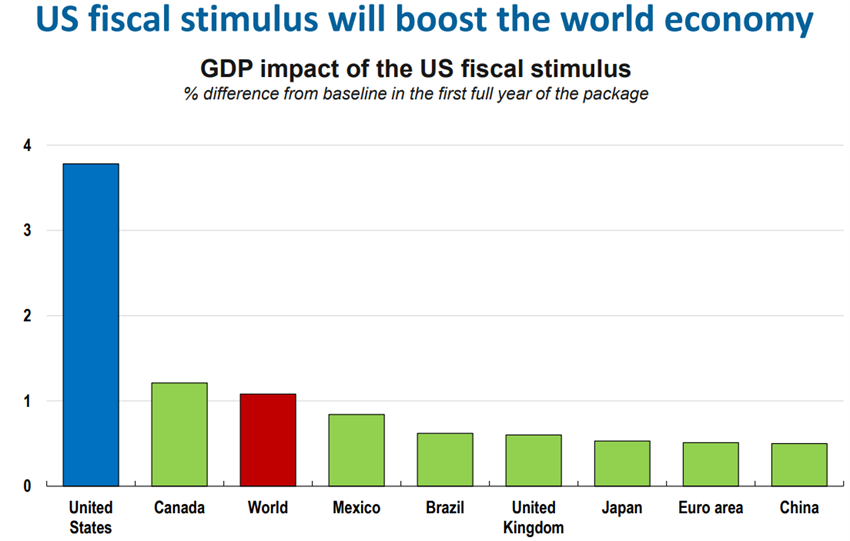

Governments are boosting stimulus programs, with a focus on the $1.9Tr ARP (8% of GDP) in the US and the €750Bn NextGen in the European Union, while central banks keep official interest rates low and strong asset purchase programmes.

The efforts of economic policy makers to support affected households and businesses continue until the activity is normalised:

– Subsidy programs and transfers to the most affected sectors, especially those of developed countries, the $1.9Tr of the ARP in the USA (8% of GDP) approved in December, which followed the $2.2Tr of CARES in March.

– Medium-term investment programmes also in these developed countries, highlighting the NextGen of the European Union in the amount of €750Bn and the $2Tr to $3Tr project advocated by Biden for the USA, aimed at modernizing infrastructure, digitisation, education, and health.

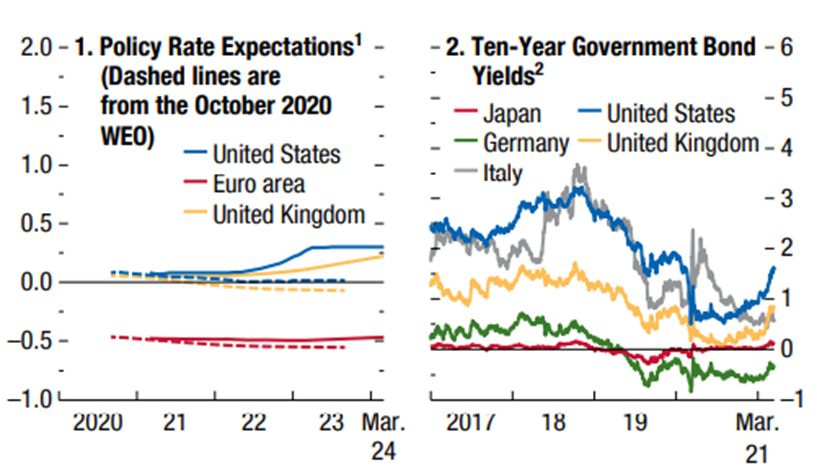

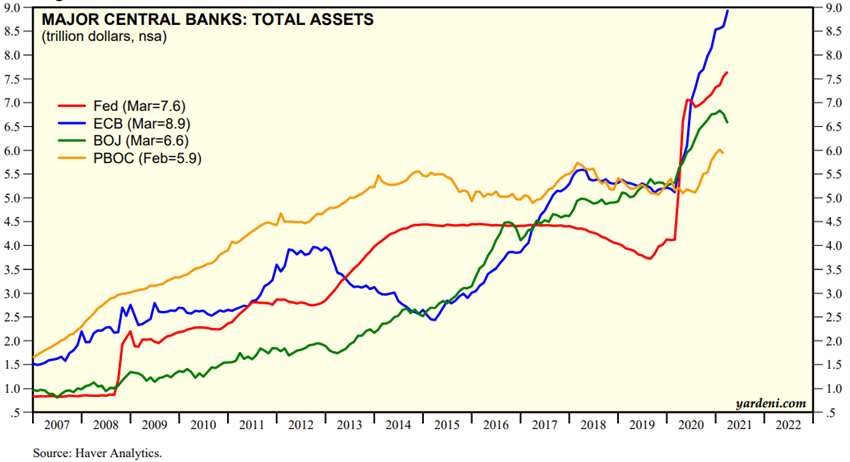

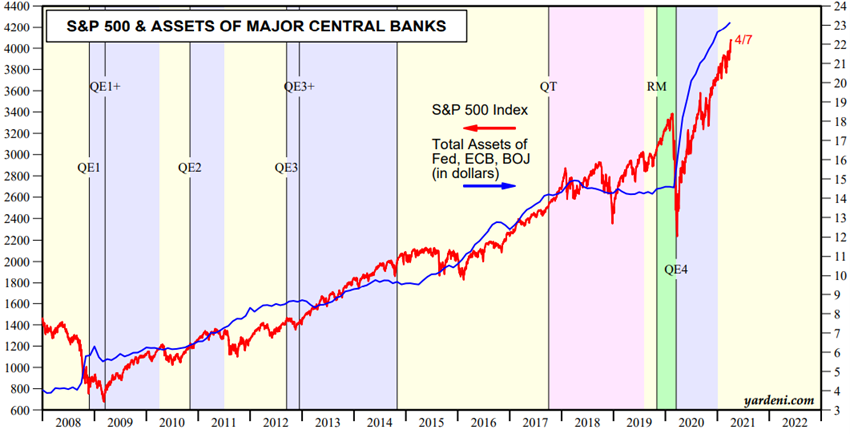

– Maintenance of official interest rates to levels close to zero and even negative and strong strengthening of asset purchase programs by central banks worldwide.

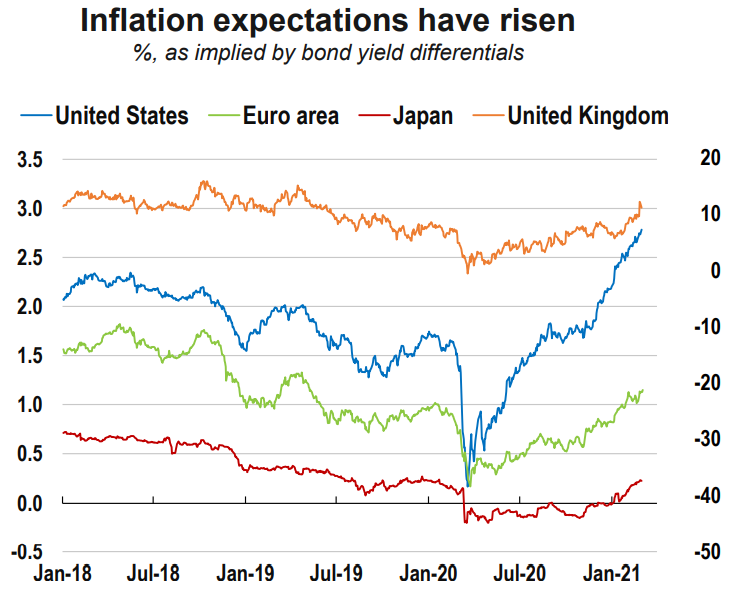

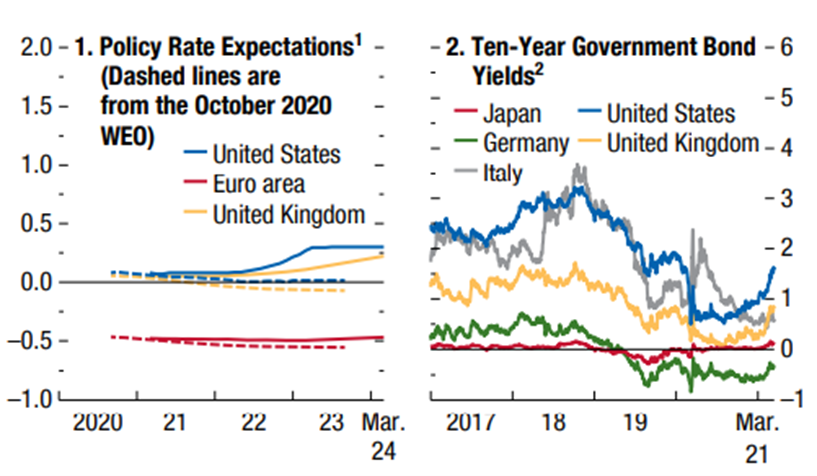

Short-term interest rates are negative in the Eurozone, Japan, and Switzerland. Interest rates on 10-year treasuries are close to zero in the Eurozone, Japan, and Switzerland, but are rising in the US following increases in inflation.

Central bank reference interest rates are expected to remain very low in the Eurozone and the US in the medium term.

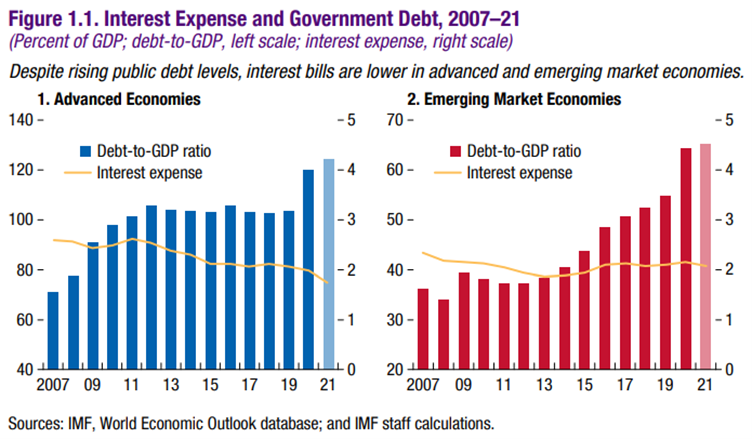

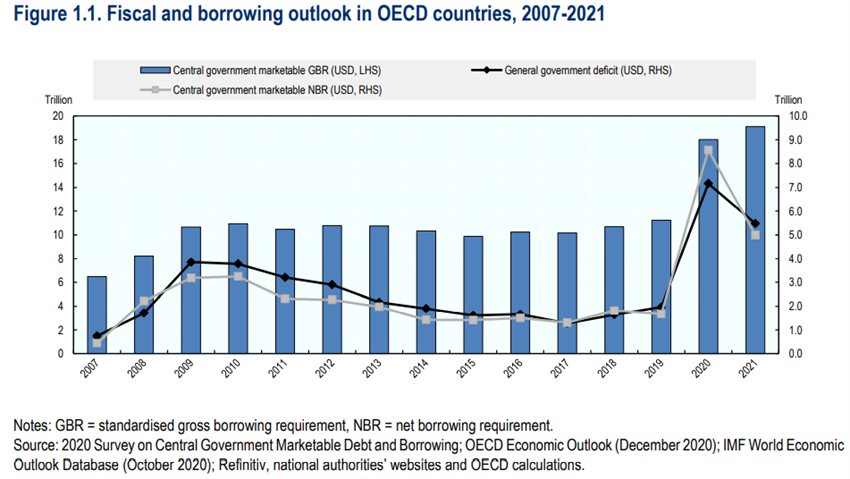

The unprecedented transfer of state and public funds to the private sector has been financed largely by monetary creation, greatly aggravating fiscal and monetary imbalances.

As a result of these programs, net government funding needs increased from $1.7Tr in 2019 to $8.6Tr in 2020, which is more than the cumulative value of the last 5 years, now beginning to discuss more structural financing measures, including, for example, raising taxes in the US.

Source: World Economic Outlook Update, IMF, April, 6, 2021

Source: Major Central Bank Total Assets, Yardeni Research, April, 8, 2021

Source: OECD Sovereign Borrowing, March 2021

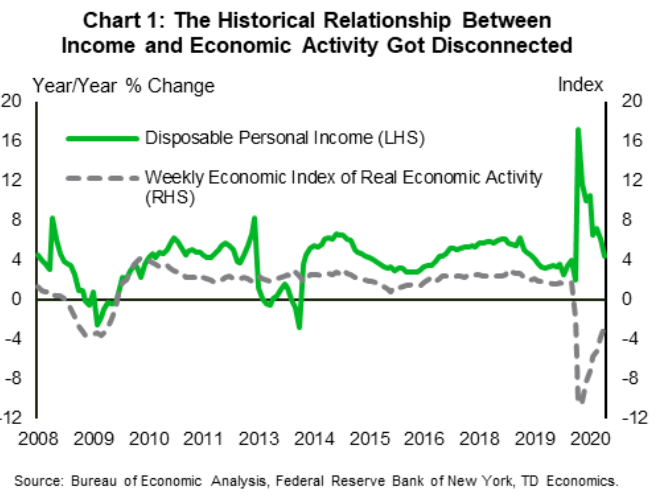

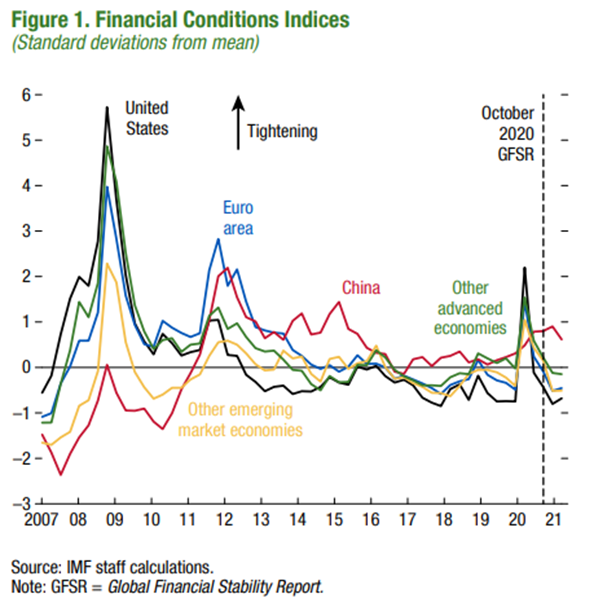

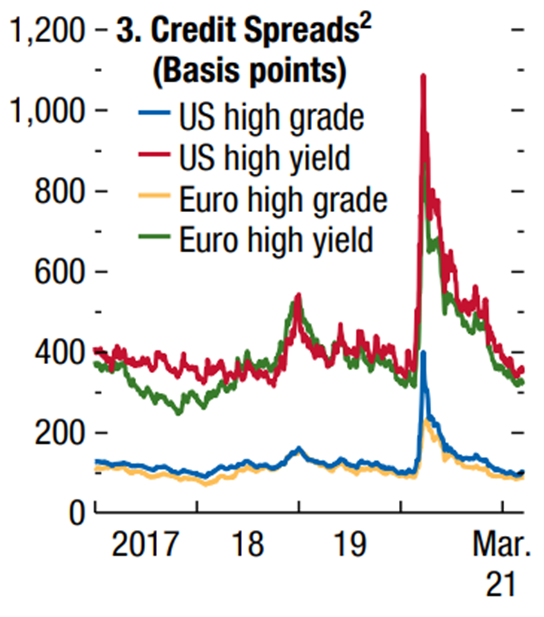

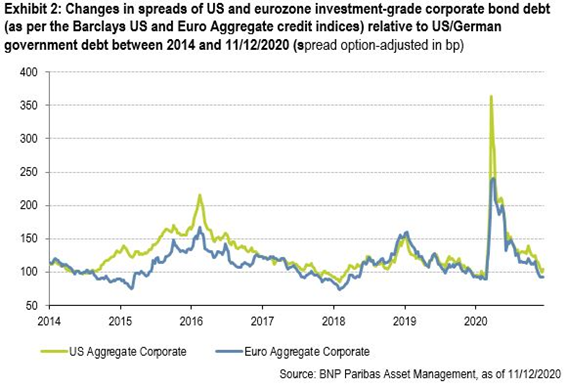

Global financial conditions have improved with the actions of governments and central banks around the world and the good performance of financial markets.

Support from governments and central banks around the world has improved financial conditions, and disposable income and household savings even increased in countries such as the US, UK, Germany, etc.

The recovery in risk asset prices following their sharp initial drop and the fall in benchmark interest rates has also led to an overall improvement in financial conditions.

Source: Global Financial Stability Update, IMF, Apr 2021

Source: Central Banks:Monthly Balance Sheets, Yardeni Research, Apr, 8, 2021

Markets Valuation

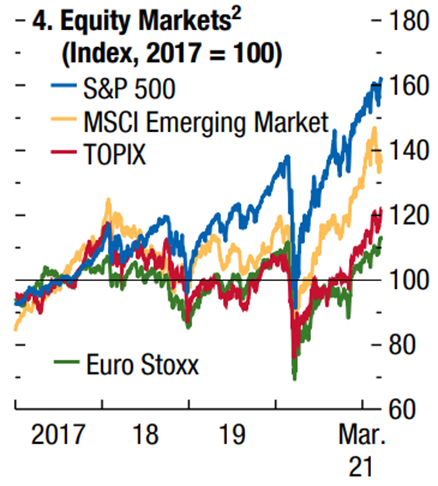

Equity markets: Stock markets continued to record historic highs in the US and years highs in other geographies, also continuing the movements of more universal gains and a rotation of growth stocks to value stocks in line with the normalization of economic activity and the rise in long-term interest rates.

Equity markets around the world maintained positive performances in the first quarter, recording historic highs in the US and a few years highs in major European and Asian countries.

This movement has been supported by economic policies, increased risk premium and asset rotation associated with low interest rates.

Since the last quarter of last year, performance has been more cross-cutting and with a rotation of growth stocks to value stocks, in line with the anticipation of a return to normality, and in reaction to the rise in interest rates in the US.

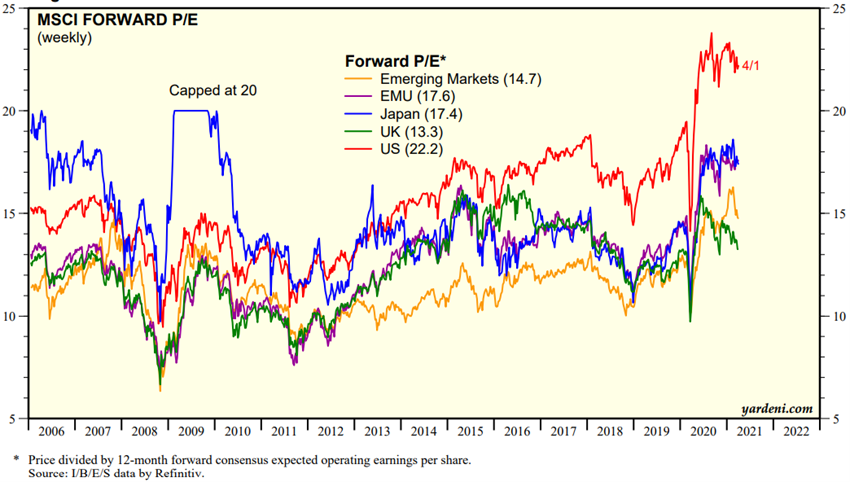

The global and regional equity markets valuation is above the long-term average. The 22.2x PER for the US is well above average and close to highs. The PER of 17.6x in the Eurozone, 17.4x in Japan and 14.7x in emerging markets are also above average.

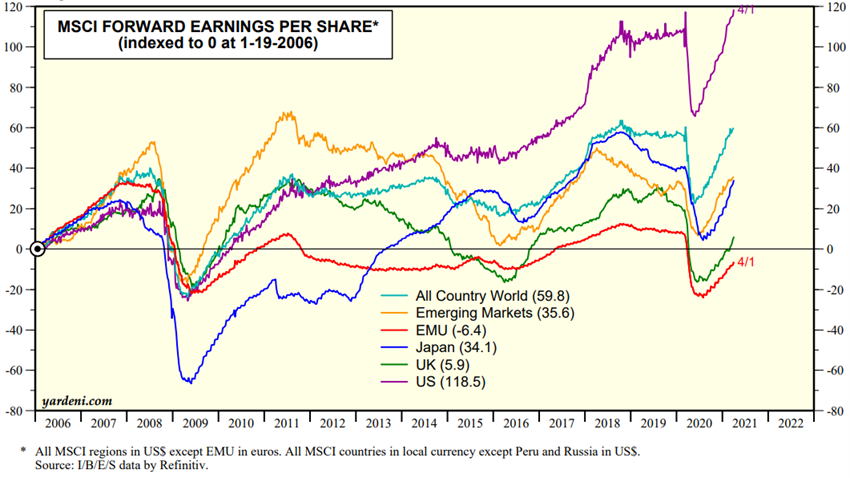

Estimates of earnings per share from the consensus of analysts already exceed pre-pandemic levels in the US and around the world, and are still below in emerging markets, Japan, and especially in the United Kingdom and the European Union.

The first quarter earnings season in the U.S. that begins soon and will last for the next 3 weeks (in Europe starts at the end of the month), will be important to validate and stabilize the projections and evolution of earnings per share.

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, Apr, 7, 2021

Source: Global Index Briefing: MSCI Metrics Comparisons, Yardeni Research, Apr, 7, 2021

Fixed income markets: Fixed income markets performed slightly negatively due to the rise in long-term sovereign interest rates.

The increase in the inflation rate in the US caused a rise in the interest rates of medium and long-term sovereign debt that extended to other bonds, with the consequent loss of their value.

Central banks around the world have taken on keeping benchmark rates at low levels and pursue active monetary injection programs to stimulate economies until normal.

Medium- and long-term interest rates on Treasury bonds are at historic lows in almost the world except for the US.

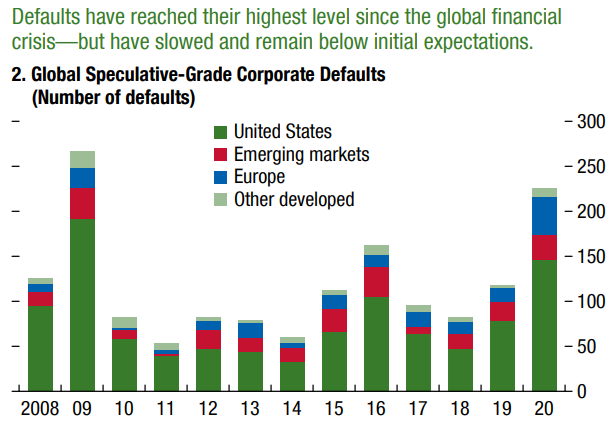

In 2020 there was no significant increase in corporate defaults as it was expected due to government support for sustaining the activity.

Soure: World Economic Outlook, IMF, Apr, 6, 2021

Source: Global Financial Stability Report Update, IMF, Apr 2021

Main opportunities

The authorities’ determination to sustain the recovery is the best guarantee of support for economic activity growth, with a return to pre-pandemic levels in 2021 in the US and 2022 for major European countries.

The huge vaccination process underway, especially in developed countries, could anticipate group immunity in these countries planned to take place until or during the summer, freeing up economic activity.

If there is a higher-than-expected increase in inflation and long-term interest rates in the US, there will be a direct negative impact on the fixed income market, and indirect negative on the equity market due to lower valuation of future cash flows.

There is a risk that vaccines that have been shown to be effective for the various strains of the virus, which are more infectious and lethal, may not be in the face of a new strain that is more difficult to control and fight.

The fight against the pandemic has exacerbated the weaknesses and vulnerabilities of companies in some sectors, as well as countries such as Turkey, South Africa, and Brazil, which will have a more difficult recovery capacity.

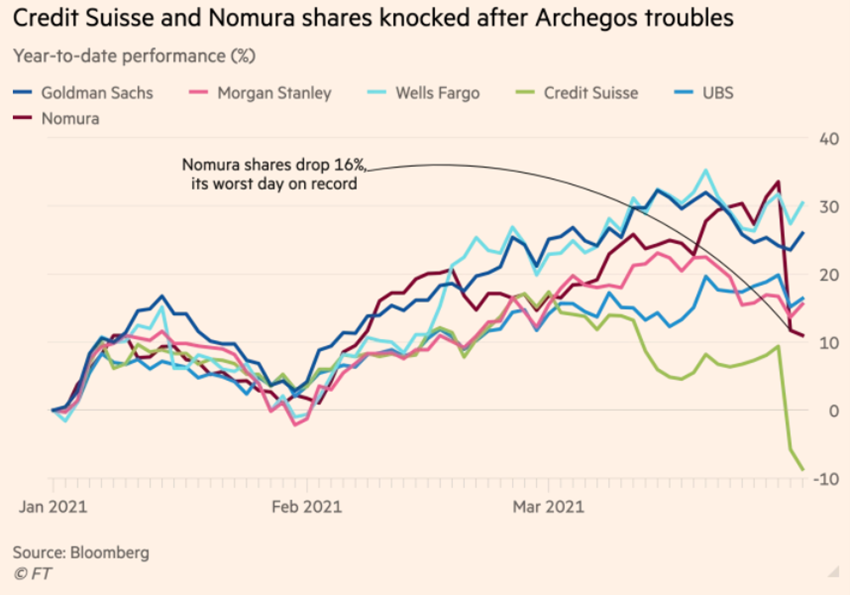

The market excesses we have seen in some valuations of listed companies pulled by highly leveraged retail investors or hedge funds may have harmful and deeper effects than the first recent warnings (e.g. Gamestop and Archegos).