In this blog we have developed a series of articles on mutual funds, since these should be the main investment vehicle of individual investors.

In this space we also showed how investors should choose and select mutual funds.

In a way that this theme is clearer and more useful for investors, we wanted to present some of the main mutual funds, as an example and for reference to their characteristics.

There are tens of thousands of mutual funds worldwide. That’s over 8, 000 in the U.S. alone.

Even only for the main categories of funds, such as stocks or bonds, global or developed countries, there are thousands.

In addition, it is necessary to meet that not all funds are available for distribution in the country of each investor.

The Best Of Mutual Funds is a series that presents some of the main mutual funds marketed in the world, grouped by categories (see information note at the end of the article).

To facilitate the analysis and selection of the investor, in each of these articles we group mutual funds by types or categories, registration countries and currency denomination.

This Best Of is not intended, nor does it constitute a recommendation. It is a sample of some of the largest funds in each category. There are other funds that may have similar features and be better than these.

Thus, given the available offer, it is up to each investor to decide which funds will be best suited to their case.

There are many other funds with the same investment market traded in the Euro Zone of these and other management, passive management and active management companies.

In the selection the investor should consider the commissions, the track-record of the fund in terms of profitability and risk, and the size and reputation of the management company.

In the Tools folder, a summary form containing a summary description of the main characteristics of the main funds of each category is also presented.

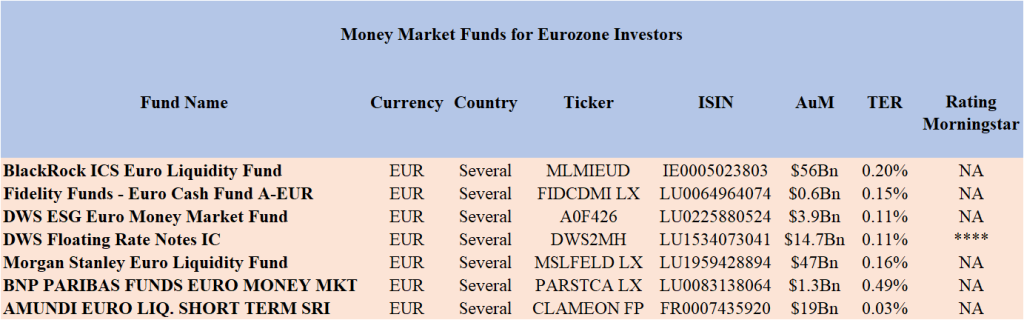

Mutual funds covered in this article: BlackRock ICS Euro Liquidity Fund, Fidelity Funds – Euro Cash Fund A-EUR, DWS ESG Euro Money Market Fund, DWS Floating Rate Notes IC, Morgan Stanley Euro Liquidity Fund, BNP PARIBAS FUNDS EURO MONEY MARKET [CLASSIC, C], AMUNDI EURO LIQUIDITY SHORT TERM SRI – I (C)

Bond funds are part of any individual investor’s investment portfolio because they promote diversification through income stability.

Investors should encourage investment in funds with an investment grade credit rating, which are denominated in their treasury currency in order to avoid foreign exchange risk and their volatility.

These investment funds for Eurozone investors are some of the largest funds that have as their object a diverse set of such bonds and are traded in those countries.

Fund: BlackRock ICS Euro Liquidity Fund

Ticker: IEAA

ISIN: IE0005023803

Assets Under Management (AuM): $56 Bn

TER: 0.20%

Category: Low Volatility NAV

Benchmark: NA

Currency: EUR

Domicile: Ireland

Income: Accumulation

Registered countries: Austria, Germany, Denmark, Spain, Finland, France, Iceland, Ireland, Italy, Luxembourg, Norway, Netherlands, United Kingdom, Singapore, Sweden, Switzerland

Link: https://www.blackrock.com/cash/en-it/products/229226/blackrock-ics-euro-liquidity-core-acc-t0-fund

Morningstar Rating: NA

Fund: Fidelity Funds – Euro Cash Fund A-EUR

Ticker: FIDCDMI LX

ISIN: LU0064964074

Assets Under Management (AuM): $595 Mn

TER: 0.15%

Category: Cash Funds

Benchmark: NA

Currency: EUR

Domicile: Luxembourg

Registered countries: Austria, Germany, Belgium, Chile, Denmark, Spain, Finland, France, Netherlands, Ireland, Italy, Liechtenstein, Luxembourg, Norway, Poland, Portugal, United Kingdom, Czech Republic, Saudi Arabia, Singapore, Slovak Republic, Sweden, Switzerland,

Link: https://www.fidelity.lu/funds/factsheet/LU0064964074

Morningstar Rating: NA

Fund: DWS ESG Euro Money Market Fund

Ticker: A0F426

ISIN: LU0225880524

Assets under Management (AuM): $3.9 Bn

TUE: 0.11%

Category: EUR Money Market

Benchmark: 1M EUR-Euribor

Currency: EUR

Domicile: Luxembourg

Yield: Distribution

Registered countries: Several Germany, Belgium, Chile, Denmark, Spain, Finland, France, Netherlands, Ireland, Italy, Liechtenstein, Luxembourg, Norway, Poland, Portugal, United Kingdom, Czech Republic, Saudi Arabia, Singapore, Slovak Republic, Sweden, Switzerland, Austria

Link: https://funds.dws.com/en-ch/money-market/lu0225880524-dws-esg-euro-money-market-fund/;

Morningstar Rating: NA

Fonds: DWS Floating Rate Notes IC

Ticker: DWS2MH

ISIN: LU1534073041

Assets under Management (AuM): $5.7Bn

TUE: 0.11%

Category: EUR Ultra Short-Term Bond

Benchmark: NA

Currency: EUR

Domicile: Luxembourg

Income: Accumulation

Registered countries: Miscellaneous

Link: https://funds.dws.com/en-ch/bond-funds/lu1534073041-dws-floating-rate-notes-ic/; https://www.morningstar.pt/pt/funds/snapshot/snapshot.aspx?id=F0GBR04NQN

Morningstar Rating: ****

Fund: Morgan Stanley Euro Liquidity Fund

Ticker: MSLFELD LX

ISIN: LU1959428894

Assets Under Management (AuM): $14.7 Bn

TER: 0.16%

Category: Low Volatility Net Asset Value (LVNAV)

Benchmark: NA

Currency: EUR

Domicile: Luxembourg

Yield: Distribution

Registered countries: Miscellaneous

Link: https://www.morganstanley.com/im/en-ie/intermediary-investor/funds-and-performance/morgan-stanley-liquidity-funds/euro-liquidity-fund.html

Morningstar Rating: NA

Fund: BNP PARIBAS FUNDS EURO MONEY MARKET [CLASSIC, C]

Ticker: PARSTCA LX

ISIN: LU0083138064

Assets under Management (AuM): $1.3Bn

TUE: 0.49%

Category: Money Market

Benchmark: Cash Index Euro Short Term Rate (EUR) RI

Currency: EUR

Domicile: Ireland

Yield: Distribution

Registered countries: Austria, Belgium, Chile, Croatia, Cyprus, Czech republic, Denmark, Finland, France, Germany, Greece, Hungary, Ireland rep., Italy, Jersey, Luxembourg, Peru, Portugal, Singapore, Slovakia, Spain, Sweden, Switzerland, Taiwan, United Kingdom

Link: https://www.bnpparibas-am.com/en-be/professional-investor/fundsheet/marche-monetaire/bnp-paribas-funds-euro-money-market-classic-c-lu0083138064/?tab=overview

Morningstar Rating: NA

Fund: AMUNDI EURO LIQUIDITY SHORT TERM SRI – I(C)

Ticker: CLAMEON FP

ISIN: FR0007435920

Assets Under Management (AuM): $19Bn

TER: 0.15%

Category: Money Market

Benchmark: NA

Currency: EUR

Home: France

Income: Accumulation

Registered countries: Austria, Germany, Denmark, Spain, Finland, France, Ireland, Italy, Luxembourg, Norway, Netherlands, United Kingdom, Sweden

Link: https://www.amundi.com/globaldistributor/product/view/FR0007435920

Morningstar Rating: NA

The following are links to all the mutual funds mentioned:

https://www.blackrock.com/cash/en-it/products/229226/blackrock-ics-euro-liquidity-core-acc-t0-fund

https://www.fidelity.lu/funds/factsheet/LU0064964074

https://funds.dws.com/en-ch/money-market/lu0225880524-dws-esg-euro-money-market-fund/

https://funds.dws.com/en-ch/bond-funds/lu1534073041-dws-floating-rate-notes-ic/

https://www.amundi.com/globaldistributor/product/view/FR0007435920

Informational/explanatory note:

In this series we will present many of the best mutual funds available in the various geographies for the individual investor, by each category and in a structured way.

There are tens if not even hundreds of thousands of mutual funds available worldwide.

It would be unthinkable to analyze even the vast majority of them.

That is why it is necessary to establish criteria to focus the analysis.

The criteria we have taken up are as follows:

- Grouping by categories of funds;

- Superior performance in terms of profitability and risk, whenever possible using the rating;

- Availability and accessibility for the investor;

- Size and reputation of management companies.

The various funds are classified by several multiple categories in terms of their investment object:

- 4 main categories per asset, including stocks, bonds, blend or balanced, and others;

- 7 categories by geography, covering global, regional (US, Europe, emerging markets, Japan, the UK and Germany);

- 2 categories in relation to the management model, active or passive.

In this sense, at the limit we could have up to about 56 categories (=4x7x2), but we will only cover the most important ones.

We also want to address other important factors such as the availability of mutual funds to the individual investor of the various countries of the world (domicile or origin of the investor) and the currency of denomination.

As we have seen in another article, the investment in stocks must be made in the investments currency (i.e. the securities that constitute its object or destination), while the investment in bonds must be made in the investor’s currency (from the treasury of the funds or from the origin).

We start with actions, in the two largest geographies, world and USA, and addressing for each the two management models.

Next we move on to the obligations, to 3 geographies, world, USA and Eurozone, also covering the 2 management models.

Then we’ll look at the following.

For each case, we will consider the availability of funds in the investor’s home or origin market, seeking to serve the American and European markets (giving note of access by other countries whenever possible).

For each fund, we present its main practical characteristics, in order to allow easy identification, knowledge and investment, namely the designation, the value of assets under management, the country of domicile, and a link to the most detailed information.

The ticker or stock symbol is an abbreviation used to uniquely identify the publicly traded shares of a particular company on a given stock market.

The ISIN or International Securities Identification Number is a 12-digit alphanumeric code that identifies a specific security.

CUSIP is a unique identifier representing the Committee on Uniform Securities Identification Procedures and is used to identify securities registered in the U.S. and Canada.

The expense ratio is the rate of management fees associated with the administration of mutual funds.

There are other costs associated with investing in funds, such as trading fees, legal fees, audit fees, and other operating expenses (e.g. deposit and custody of securities).

The sum of all fees associated with investment in funds is called a total expense ratio and, as we have seen in other articles, it is very important in the analysis and selection of funds.