We also said how investors should choose and select mutual funds.

In a way that this theme is clearer and more useful for investors, we wanted to present some of the main mutual funds, as an example and for reference to their characteristics.

There are tens of thousands of mutual funds worldwide. That’s 8, 000 in the U.S. alone.

Even only for the main categories of funds, such as stocks or bonds, global or developed countries, there are thousands.

The Best Of Mutual Funds is a series that presents some of the main mutual funds marketed in the world, grouped by categories (see information note at the end of the article).

To facilitate the analysis and selection of the investor, in each of these articles we group mutual funds by types or categories, registration countries and currency denomination.

This Best Of is not intended, nor does it constitute a recommendation.

It is a sample of some of the largest funds in each category.

There are other funds that may have similar features and be better than these.

Thus, given the available offer, it is up to each investor to decide which funds will be best suited to their case.

In the Tools folder, a summary form containing a summary description of the main characteristics of the main funds of each category is also presented.

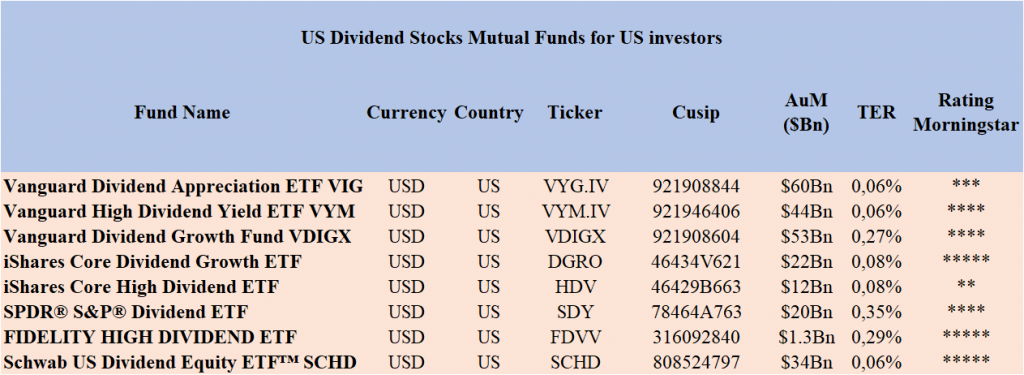

Investment funds covered in this article: Vanguard Dividend Appreciation ETF VIG; Vanguard High Dividend Yield ETF VYM; Vanguard Dividend Growth Fund VDIGX; iShares Core Dividend Growth; iShares Core High Dividend ETF; SPDR® S&P Dividend ETF SDY; Fidelity® High Dividend ETF FDVV; Schwab US Dividend Equity ETF™ SCHD

These are the largest dividend stock mutual funds in terms of assets under management accessible by U.S. investors, attracting more capital and investors.

Considering the importance of this market segment, these funds can be part of the stock investment portfolio of any individual investor.

These are the equity funds that pay good dividends.

We know that there is another way of distributing results to shareholders who are buy-backs, which are more tax-efficient and increasingly used.

What matters to the investor is the distributed overall income, whether by dividends or “buy-backs”.

In upcoming articles we will cover investment funds of “buy-backs”.

Fund: Vanguard Dividend Appreciation ETF VIG

Ticker: VYG.IV

CUSIP: 921908844

Assets under Management (AuM): $60 Bn

TER: 0.06%

Benchmark: S&P U.S. Dividend Growers Index

Currency: USD

Domicile: US

Registered countries: US

Link: https://investor.vanguard.com/investment-products/etfs/profile/vig

Morningstar Rating: ***

Fund: Vanguard High Dividend Yield ETF VYM

Ticker: VYM.IV

CUSIP: 921946906

Assets under Management (AuM): $44Bn

TER: 0.06%

Benchmark: FTSE High Dividend Yield Index

Currency: USD

Domicile: US

Registered countries: US

Link: https://investor.vanguard.com/investment-products/etfs/profile/vym

Morningstar Rating: ****

Fund: Vanguard Dividend Growth Fund VDIGX

Ticker: VDIGX

CUSIP: 921908604

Assets under Management (AuM): $53Bn

TER: 0.27%

Benchmark: Dividend Growth Spliced Index

Currency: USD

Domicile: US

Registered countries: US

Link: https://investor.vanguard.com/investment-products/mutual-funds/profile/vdigx

Morningstar Rating: ****

Fund: iShares Core Dividend Growth

Ticker: DGRO

CUSIP: 46434V621

Assets under Management (AuM): $23Bn

TER: 0.08%

Benchmark: Morningstar US Dividend Growth Index

Currency: USD

Domicile: US

Registered countries: US

Link: https://www.ishares.com/us/products/264623/ishares-core-dividend-growth-etf

Morningstar Rating: *****

Fund: iShares Core High Dividend ETF

Ticker: HDV

CUSIP: 46429B663

Assets under Management (AuM): $13Bn

TER: 0.08%

Benchmark: Morningstar Dividend Yield Focus Index

Currency: USD

Domicile: US

Registered countries: US

Link: https://www.ishares.com/us/products/239563/ishares-high-dividend-etf

Morningstar Rating: **

Fund: SPDR® S&P® Dividend ETF

Ticker: SDY

CUSIP: 78464A763

Assets under Management (AuM): $20Bn

TER: 0.35%

Benchmark: S&P® High Yield Dividend Aristocrats

Currency: USD

Domicile: US

Registered countries: US

Link: https://www.ssga.com/us/en/intermediary/etfs/funds/spdr-sp-dividend-etf-sdy

Morningstar Rating: ****

Fund: FIDELITY HIGH DIVIDEND ETF

Ticker: FDVV

CUSIP: 316092840

Assets under Management (AuM): $1.3Bn

TER: 0.29%

Benchmark: Fidelity High Dividend NR USD

Currency: USD

Domicile: US

Registered countries: US

Link: https://screener.fidelity.com/ftgw/etf/snapshot/snapshot.jhtml?symbols=FDVV

Morningstar Rating: *****

Fund: Schwab US Dividend Equity ETF™ SCHD

Ticker: SCHD

CUSIP: 808524797

Assets under Management (AuM): $34Bn

TER: 0.06%

Benchmark: Dow Jones U.S. Dividend

Currency: USD

Domicile: US

Registered countries: US

Link: https://www.schwabassetmanagement.com/products/schd

Morningstar Rating: *****

The following are links to all the mutual funds mentioned:

https://investor.vanguard.com/investment-products/etfs/profile/vig

https://investor.vanguard.com/investment-products/etfs/profile/vym

https://investor.vanguard.com/investment-products/mutual-funds/profile/vdigx

https://www.ishares.com/us/products/264623/ishares-core-dividend-growth-etf

https://www.ishares.com/us/products/239563/ishares-high-dividend-etf

https://www.ssga.com/us/en/intermediary/etfs/funds/spdr-sp-dividend-etf-sdy

https://screener.fidelity.com/ftgw/etf/snapshot/snapshot.jhtml?symbols=FDVV

https://www.schwabassetmanagement.com/products/schd

Informational/explanatory note:

In this series we will present many of the best mutual funds available in the various geographies for the individual investor, by each category and in a structured way.

There are tens if not even hundreds of thousands of mutual funds available worldwide.

It would be unthinkable to analyze even the vast majority of them. That is why it is necessary to establish criteria to focus the analysis.

The criteria we have taken up are as follows:

- Grouping by categories of funds;

- Superior performance in terms of profitability and risk, whenever possible using the rating;

- Availability and accessibility for the investor;

- Size and reputation of management companies.

The various funds are classified by several multiple categories in terms of their investment object:

- 4 main categories per asset, including stocks, bonds, blend or balanced, and others;

- 7 categories by geography, covering global or global, regional (majorus, Europe, emerging markets, Japan, the UK and Germany);

- 2 categories in relation to the management model, active or passive.

In this sense, at the limit we could have up to about 56 categories (=4x7x2), but we will only cover the most important ones.

We also want to address other important factors such as the availability of mutual funds to the individual investor of the various countries of the world (domicile or origin of the investor) and the currency of denomination.

As we have seen in another article, the investment in stocks must be made in the investments currency (i.e. the securities that constitute its object or destination), while the investment in bonds must be made in the investor’s currency (from the treasury of the funds or from the origin).

We will start with stocks, in the two largest geographies, world and USA, and addressing for each the two management models.

Next we will move on to bonds, to 3 geographies, world, USA and Eurozone, also covering the 2 management models.

Then we’ll cover the following.

For each case, we will consider the availability of funds in the investor’s home or origin market, seeking to serve the American and European markets (giving note of access by other countries whenever possible).

For each fund, we present its main practical characteristics, in order to allow easy identification, knowledge and investment, namely the designation, the value of assets under management, the country of domicile, and a link to the most detailed information.

The ticker or stock symbol is an abbreviation used to uniquely identify the securities publicly traded of a particular company on a given stock market.

The ISIN or International Securities Identification Number is a 12-digit alphanumeric code that identifies a specific security.

CUSIP is a unique identifier representing the Committee on Uniform Securities Identification Procedures and is used to identify securities registered in the U.S. and Canada.

The expense ratio is the rate of management fees associated with the administration of mutual funds.

There are other costs associated with investing in funds, such as trading fees, legal fees, audit fees, and other operating expenses (e.g. deposit and custody of securities).

The sum of all fees associated with investment in funds is called a total expense ratio and, as we have seen in other articles, it is very important in the analysis and selection of funds.