What are mutual funds?

Publicly traded or variable capital investment funds and closely held or fixed capital

Traditional mutual funds and exchange tradet funds (ETF)

The advantages and benefits of mutual funds for the investor

The program of this series on mutual funds: returns, costs, benchmarks, ratings, active and passive funds, largest management companies, and how to select passive and active mutual funds

This is the first article in the series on mutual funds that aims to help us select the ones that best suit our situation.

This will probably be the most important and most sought-after series of items by investors because it is the one that develops on investments that, in our opinion, should constitute the large part of their financial assets or investment portfolio: mutual funds.

To assist investors in the choices of their investments, this series is accompanied by the publication of articles containing information on the main mutual funds of each category in the Best of Mutual Funds Series in the Wealth and Investments folder and a summary of the fund information in the Tools folder.

In this article we will cover its definition, the main characteristics and the main attributes of investment funds.

It is recalled that in order to arrive at the decision to select mutual funds, and that it is the last step of our financial plan, we have previously made the definition of objectives, the evaluation of our investor profile, and consequently, the establishment of the most appropriate asset allocation for our investment portfolio of our objective in question.

As investors, we have also realized that the best way to realize our investments in a diversified and efficient way is through mutual.

What are mutual funds

Mutual funds are the priviledge investment vehicle of private investors.

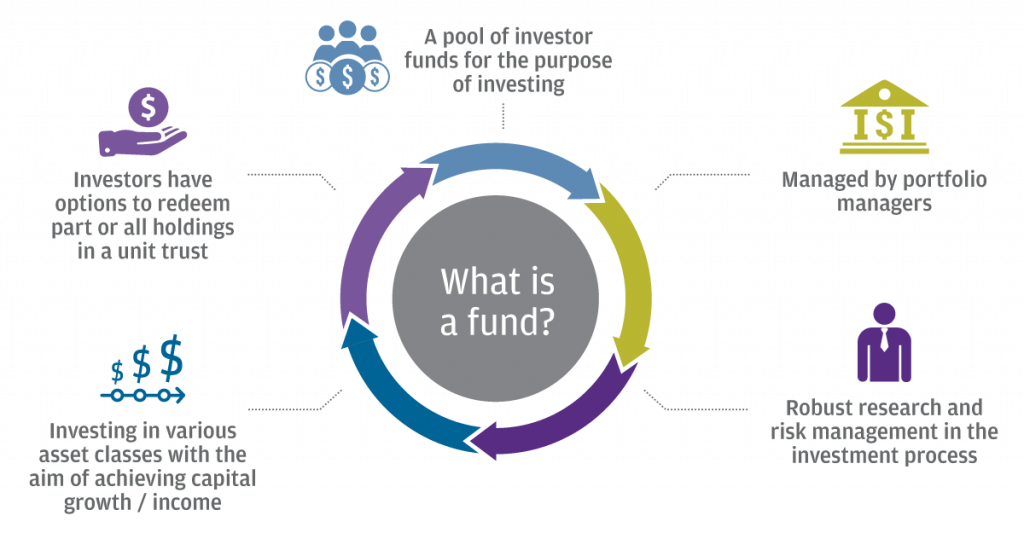

The operation of a mutual fund is very simple.

Investors deliver capital to a fund, the manager of which analyses and decides the securities in which they invest, with the purpose of generating the best return for the permissible risk levels, and these profitability are passed on to investors in the form of capital gains or income.

Thus, mutual funds are collective investment vehicles. They aggregate the savings of several people for investment in the financial markets, which are their investors and are designated by fund participants.

Participants acquire and hold units of the fund, which represent their share of the fund’s assets.

The unit price of each of these units is calculated daily by dividing the value of the assets that integrate the fund by the number of units existing at each time.

The value of the assets is in most cases their market price, and in the absence of this, the market value determined by fair transaction price criteria.

The funds are managed by management companies, duly authorised for this purpose by the regulatory authorities of the markets in which they are domiciled and registered, which are also responsible for their supervision.

Mutual funds are constituted in the form of autonomous assets, which are owned by fund participants, and their investment assets are segregated from other assets held or under management of the management company, which is a security for investors.

The assets are under deposit and custody of a depositary bank, which is jointly and severally responsible for the management alongside the management company, ensuring, in this way, a guarantee of additional monitoring and supervision.

The pooling of savings of several investors allows mutual funds to reach very high amounts of capital under management, enabling them to invest diversified in a broad set of securities, assets or values. On average, a mutual fund invests in more than 50 to 80 securities.

Publicly traded or variable capital investment funds and closely held or fixed capital

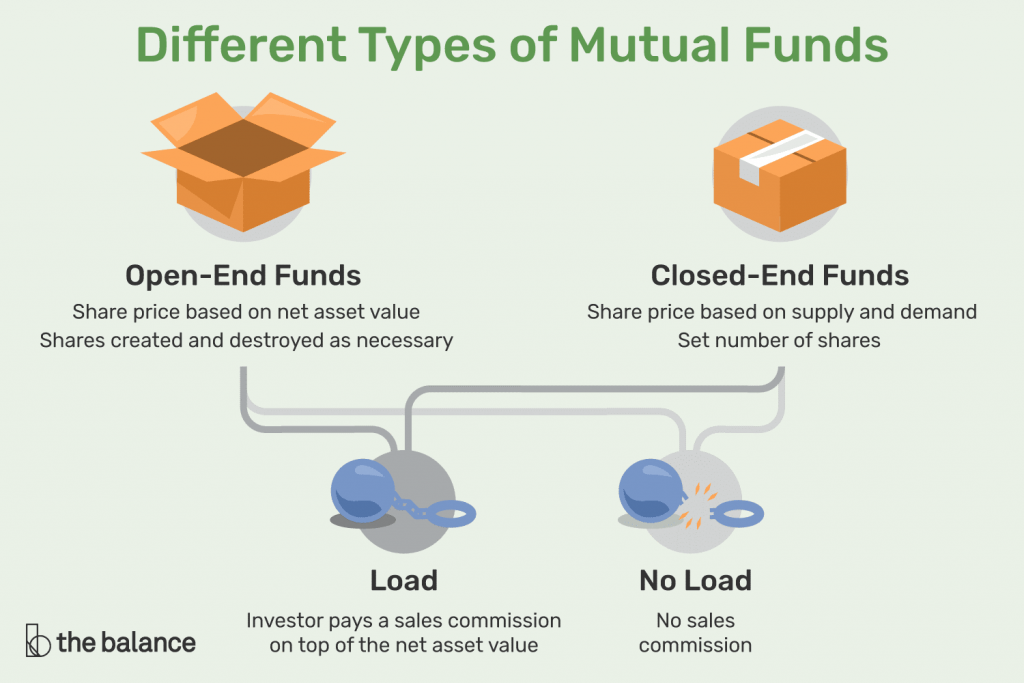

In terms of legal structure, investment funds can be publicly traded or variable, or closely held or fixed-based. The first are the vast majority and the second the exception.

Publicly traded funds have a variable capital represented by a number of variable units and that increases with the inflows of funds or subscriptions made by investors and decreases with their outflows or redemptions.

In this case, net inflows of funds give rise to the issuance of new units at the price in force at the close of that day (and the exits to the settlement or cancellation of the units). Purchases and sales occur between investors and the management company.

On the contrary, closely held mutual funds have a fixed capital, represented by a number of units defined at the time of issue and the offer to subscribe to the fund.

In this case, purchases of units are made to the holders of the existing units, without increasing the number of units in circulation.

Traditional mutual funds and exchange traded funds (ETF)

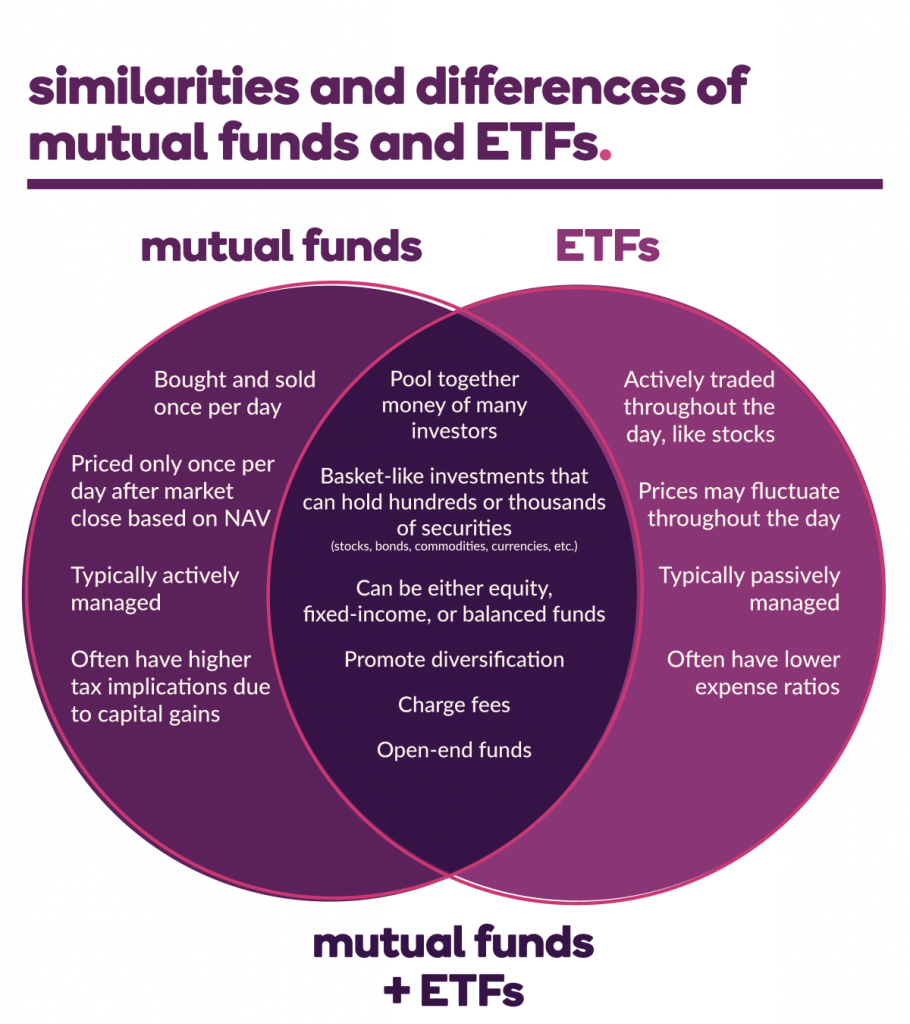

There are two large structures or models of investment funds, traditional mutual funds and exchange traded funds (ETF).

The so-called traditional mutual funds do not quote on the stock exchange, but are traded (subscribed and redeemed) at the price of the units that is calculated at the end of each day.

Exchange Traded Funds are funds that, as their name implies, are traded (bought and sold) on the exchange on the continuous market at the market at the market price at each moment, trading in the same way as a stock.

The advantages and benefits of mutual funds for the investor

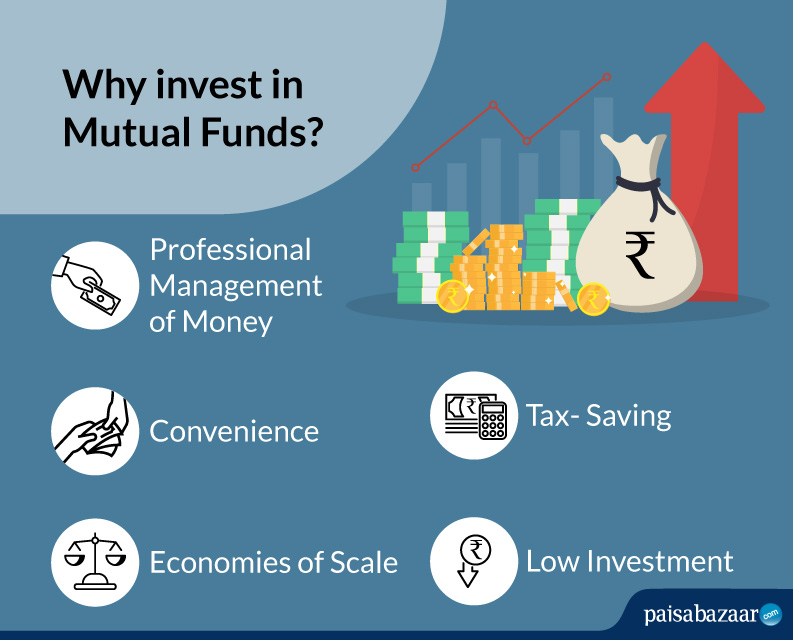

The main advantages and benefits of mutual funds for the investor are professional management, diversification, economies of scale, convenience, low investment amounts and low transaction costs.

Mutual funds are managed by professional asset managers.

Mutual funds pool savings of many people, allowing them to achieve values under management of many millions and in many cases billions of dollars.

This dimension of capital makes it possible to diversify investments more completely than that available to most individual investors.

Typically, mutual funds invest in about 50 to 80 different securities, which would be unaffordable for many individual investors.

This size of capital also enables significant economies of scale, whether in terms of analysis costs or transaction costs. The scale of the funds allows significant savings in the trading of investments compared to the individual investor.

Convenience is an equally important advantage, as the entire process of investing, underwriting and redemption, or buying and selling, of units is very easy and simple.

The fact that units have a unit price accessible to most investors is another benefit to be taken into account.

There are also tax advantages resulting from the size of the fund, since there is a compensation of the gains and losses realised in the various investments, only being taxed the respective difference.

The programme of this series on mutual funds: returns, costs, benchmarks, ratings, active and passive funds, largest management companies; and how to select passive and active mutual funds

In this series, we will address:

The main types of mutual funds

The returns and costs of mutual funds, and the importance of saving on investment expenses or expenses to increase net return for the investor

Index or passive management funds and active management funds

How to measure, evaluate and choose funds: on the use of benchmarks, and their comparison with investments, fund categories and risk level

The rating of the funds: stamp or certificate of quality, or premium, or it is not quite so …

The largest mutual fund management companies

How to select the best index or passive management funds

How to select the best active or active management funds