Tackling the Covid-19 pandemic causes a major economic standstill, with unprecedent global GDP contractions and unemployment increases, and widespread impact on financial markets, the resolution of which by public health solutions is still very uncertain

Index

Executive summary

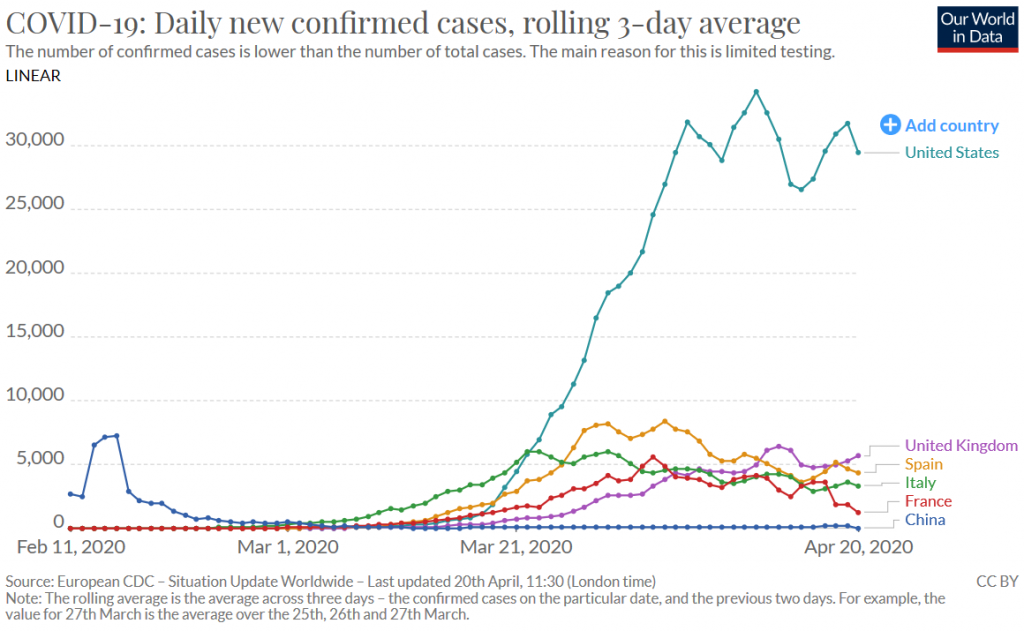

Covid-19: Severe pandemic started in January/February in China, with rapid spread to Southeast Asia and around the world, particularly Europe (Italy, Spain and UK) and US.

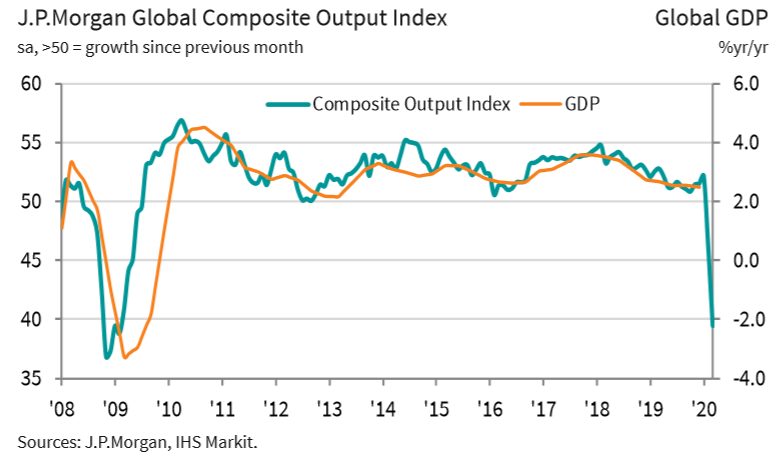

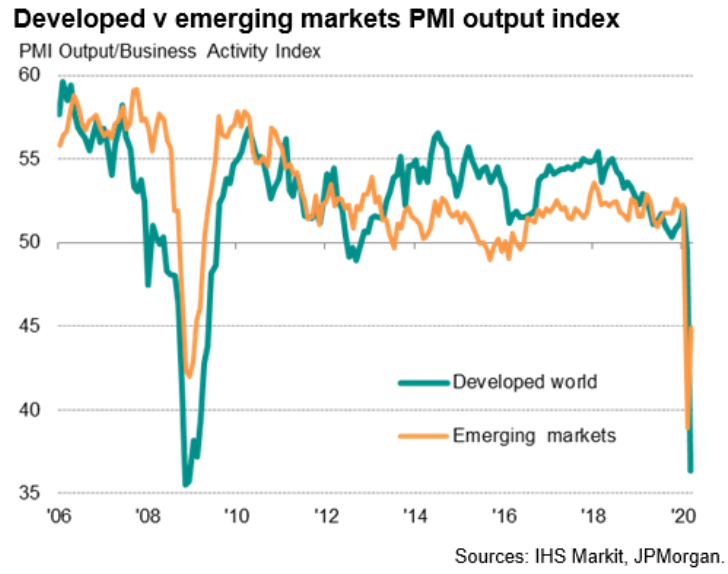

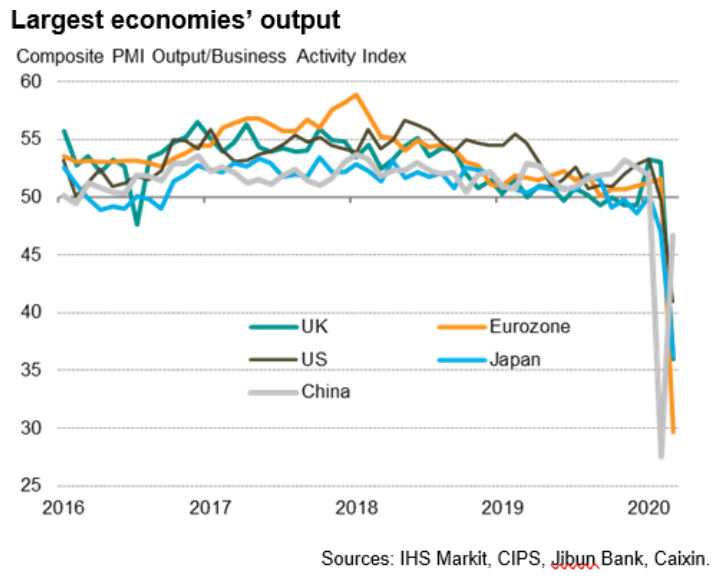

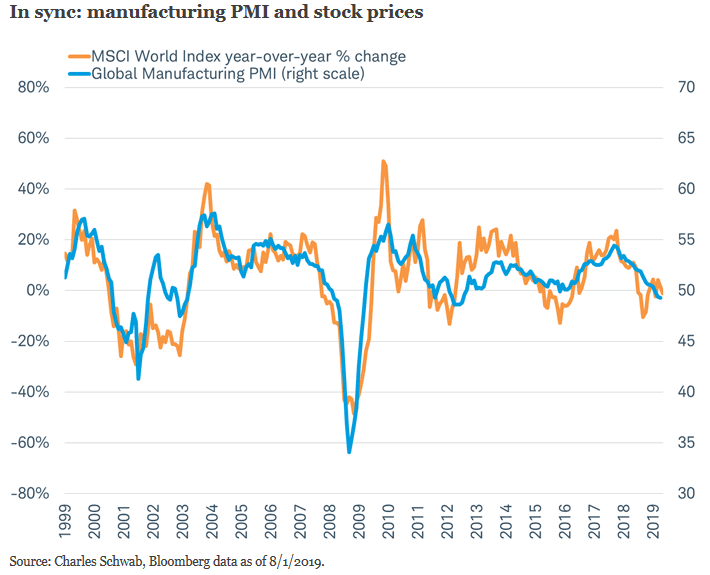

The first current and leading economic indicators indicate a severity of the current economic crisis at the level of the Great Depression, and it will be particularly important the early May publication of those with the greatest historical correlation with the stock markets.

Financial conditions have deteriorated, and major geopolitical risks are suspended by the pandemic.

This scenario favours a more conservative/defensive stance than the central allocation of each investor in relation to the different asset subclasses of the financial markets, via increased liquidity, and a preferential allocation to the US equities versus Rest of the World.

Financial markets performance

A robust and accelerating global economy at the beginning of the year faces a pandemic shock (Covid 19), whose response requires a major shutdown of activity and causes devaluations of credit and stock markets between 10% and 40%.

After an excellent 2019 for almost all segments of the stock and bond markets, the first quarter brought us the reverse of the medal due to the economic and financial impact caused by the emergence and spread of the Covid-19 pandemic that far exceeded the robustness and growth potential of world economic background.

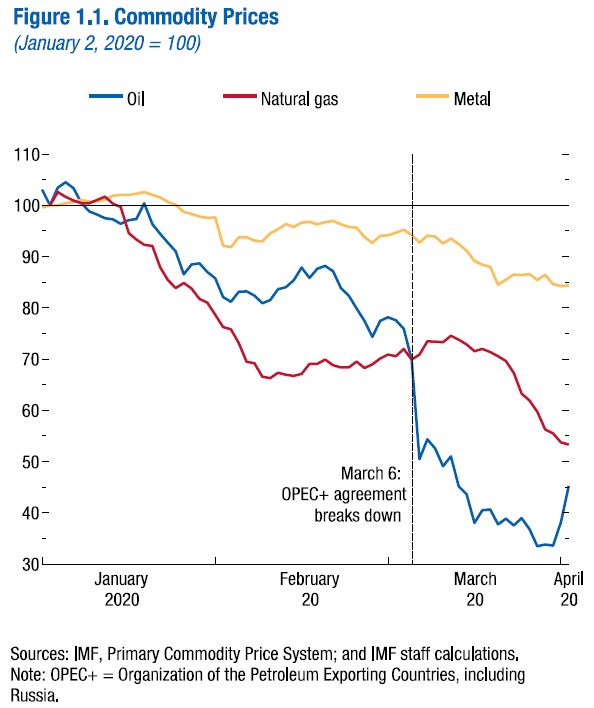

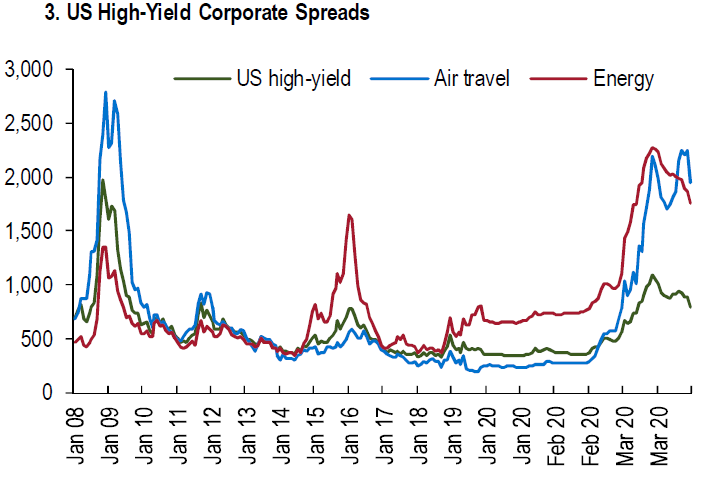

Aggravating the situation, the imbalance in the oil market caused a 50% price drop in the year, even after the OECD+ production cut agreement in mid-April.

Corporate bond and stock markets fell between 10% and 40% from peak levels by March 23 and have recovered half of that value since then with aggressive economic policy response and the most recent positive signs of pandemic restraint and reopening economies.

Source: World Economic Outlook April 2020, IMF

Source: World Economic Outlook April 2020, IMF

Source: World Economic Outlook April 2020, IMF

Source: World Economic Outlook April 2020, IMF

Source: World Economic Outlook April 2020, IMF

Covid-19

The Covid-19 virus starts in China and spreads to Southeast Asia, and to around the world, with greater severity in Western Europe (Italy, Spain, France and the UK) and the US, turning into a pandemic.

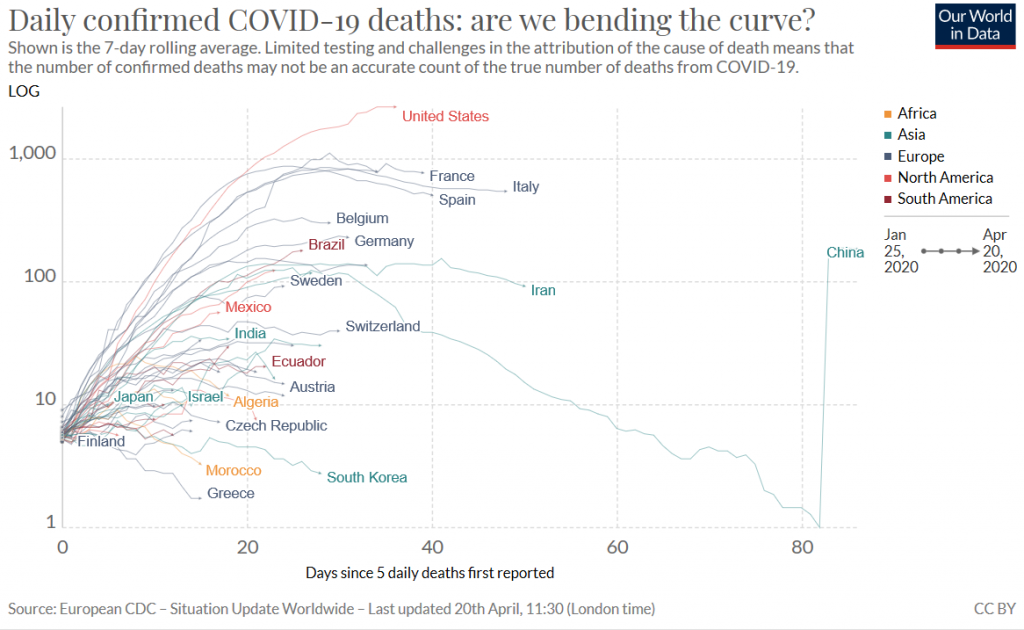

It has high rates of propagation, contagion and lethality and there is no effective treatment or vaccine available (probably only in spring 2021), being fought with lockdown, quarantining, social distancing, prompt detection (tests) and hospitalization of critical cases worldwide.

China is almost case-free and has resumed activity recently at the epicentre in Wuhan, advanced economies are still in the ascending phase with lower slope or plateauing, mostly in confinement and beginning to equate reopening, and Japan has just declared a national State of Emergency (16/04/20).

Large-scale serological immunity tests are being produced worldwide (Abbot in the US and other regional pharmaceutical companies in Europe and Asia).

Several dozen pharmaceutical and research laboratories around the world are testing vaccines on animals and some already in humans, and public health experts believe that vaccine availability is estimated in 12 to 18 months, (best case scenario, spring 2021).

Macroeconomic context

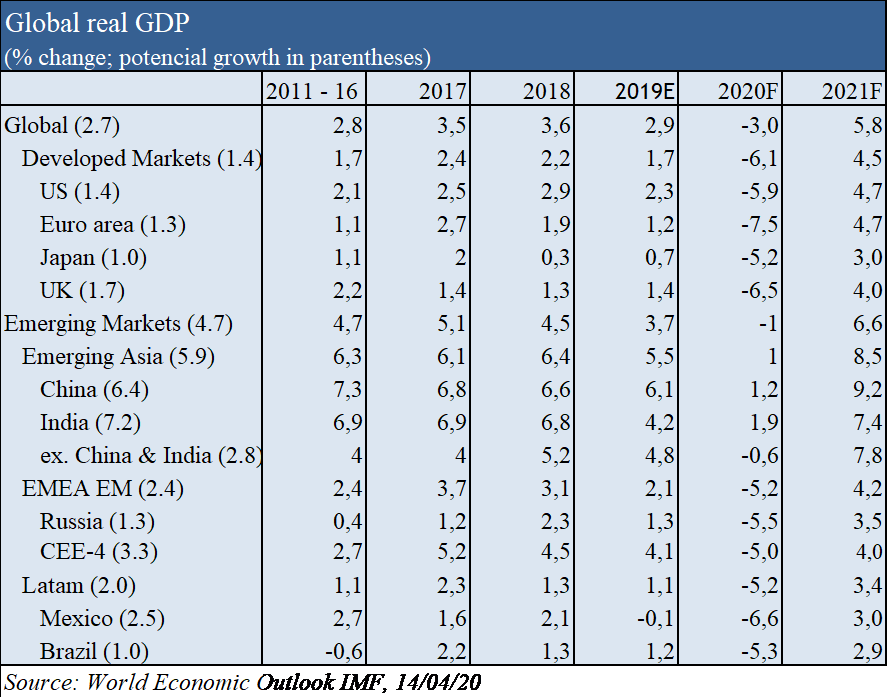

World GDP contraction of -3% in 2020 and growth of +5.8% in 2021, of -6.1% and +4.5% in advanced economies, and -1.0% and +6.6% in emerging economies, respectively, according to the latest IMF forecasts of April 14.

As a result of the brutal increase in the severity of the pandemic, the response of almost every country in the world to prevent the spread and contagion was quarantine and lockdown, which resulted in a “de facto” shutdown of a significant portion of economic activity.

As a result of the pandemic, the global GDP is expected to contract sharply by -3.0% in 2020, much worse than during the 2008/09 financial crisis (GDP contraction is estimated to be 2% to 3% for each month of shutdown).

In the baseline scenario, which assumes that the pandemic will disappear in the second half of 2020 and containment efforts can be largely mitigated, the global economy is expected to grow by +5.8% in 2021 as economic activity normalises, supported by the actions of fiscal and monetary policy authorities.

The stoppage of activity has a cross-cutting economic and financial impact, but very differentiated in sectoral terms, strongly affecting the tourism, leisure, consumer discretionary, and banking sectors, and to a lesser extent consumer staples, utilities, telecommunications, and technology.

Being very difficult to estimate the impact of this economic crisis by the very nature (health), extension (global), size (stoppage) and duration (time) of the crisis, the current forecasts are of a contraction of U.S. and global GDP higher than the Great Depression, but with a faster recovery (from 1 to 2 years instead of 4 to 5 years).

Inflation is under control all over the world.

Microeconomic context

The first leading economic indicators indicate a high severity of the current economic crisis at the level of the Great Depression, and it will be particularly important the early May publication of those with the greatest historical correlation with the stock markets.

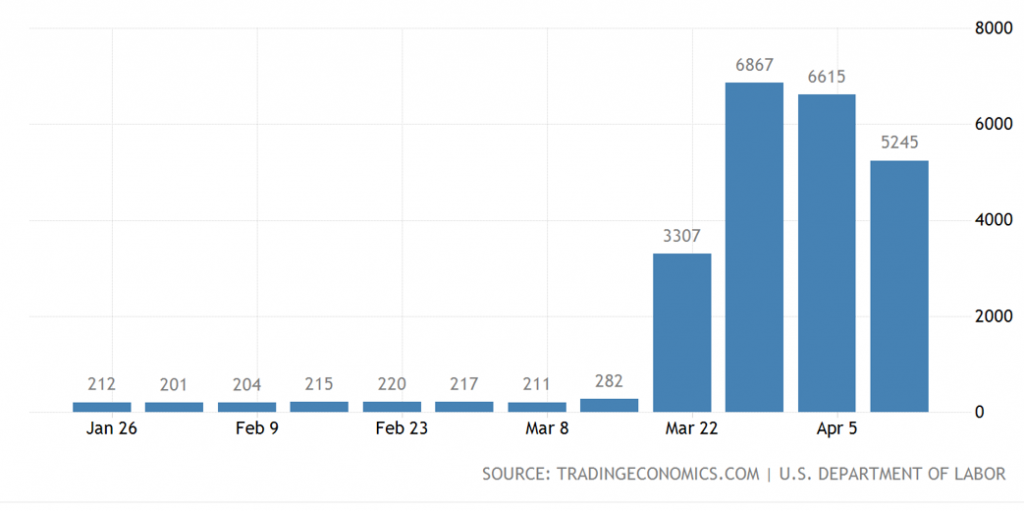

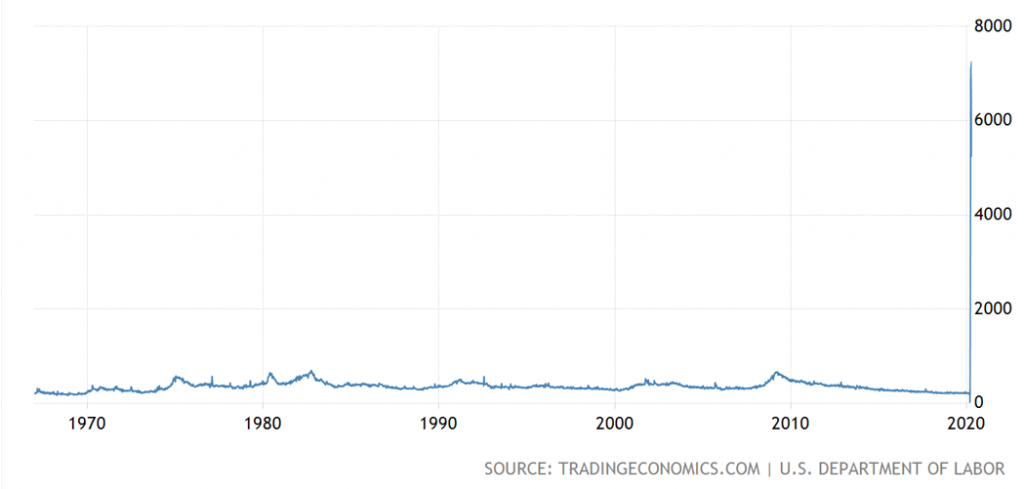

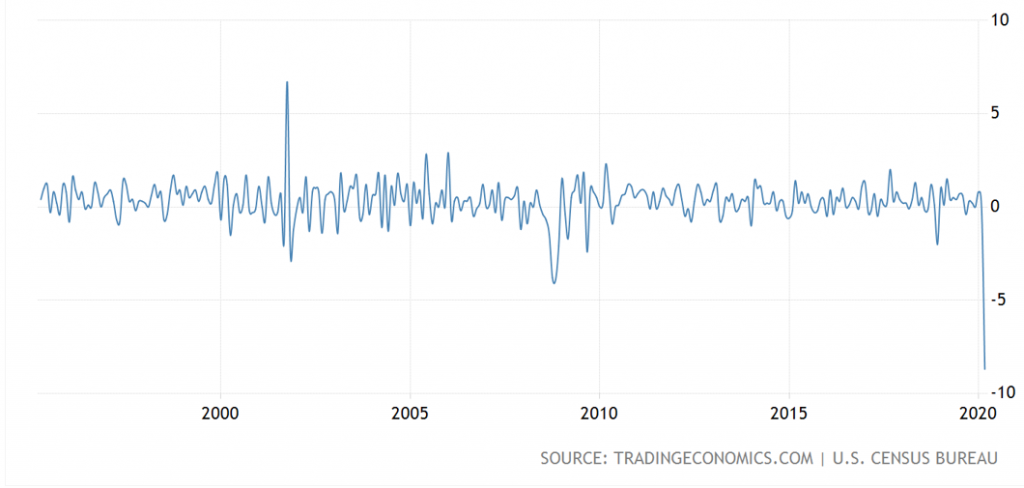

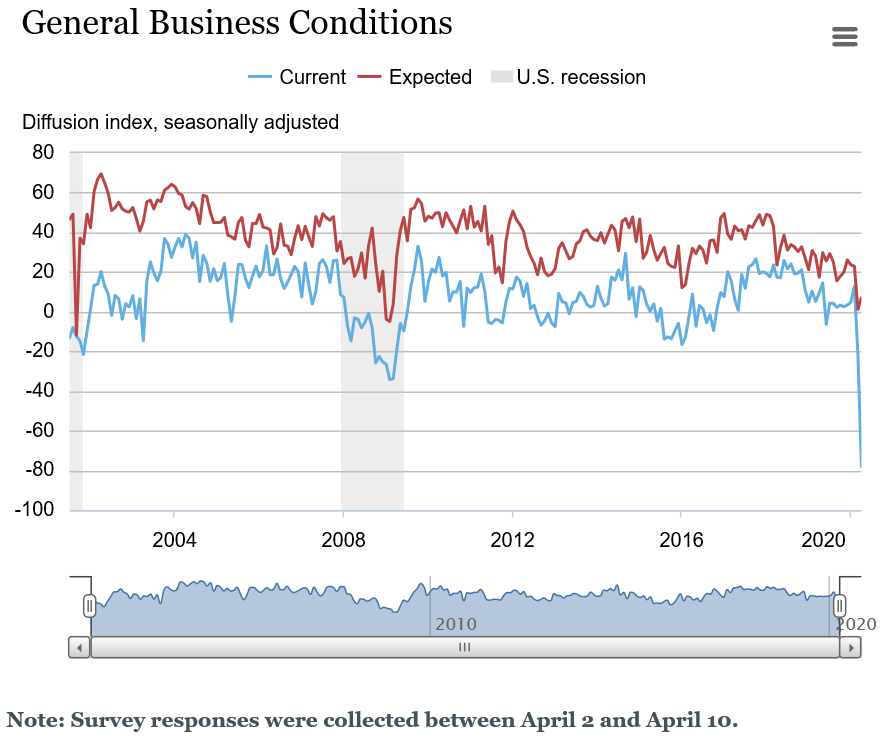

The first leading economic data that were released are very negative: Global Composite PMI for March with a sharp drop from 46.1 to 39.4, close to the minimum value of 36.5 recorded in the GFC; US Jobless Claims (more than 22 million in 4 consecutive weeks, equal to job recovery in the 11 years after the GFC); Retail sales (-8.7%, worst on record); Empire State Manufacturing (-78, lowest ever).

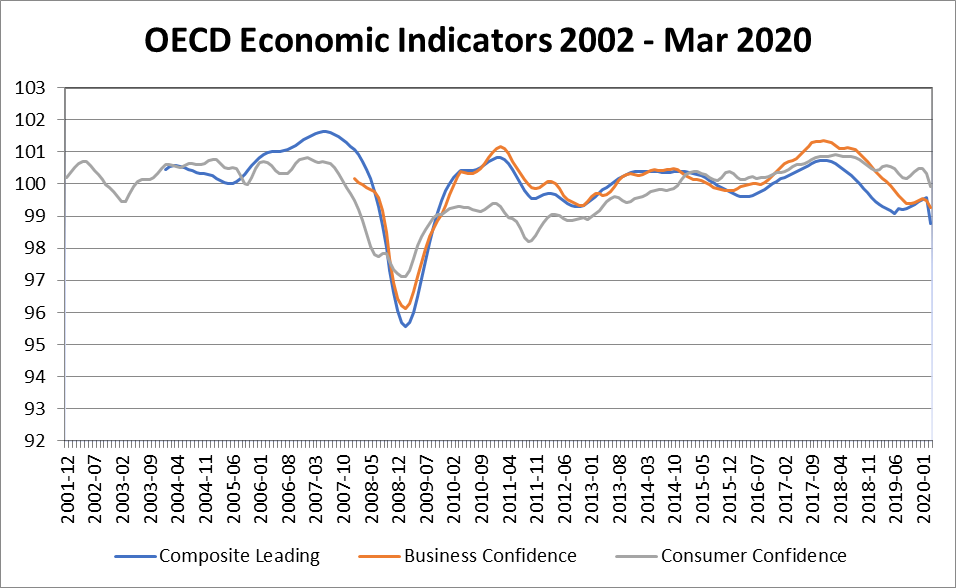

The latest OECD business and consumer confidence indicators do not yet reflect the crisis.

The end of April and early May readings for the ISMs in the US, country-level PMIs and OECD confidence indicators will give better visibility to the depth of the economic impact.

Source: US Jobless Claims 1967-2020, US Department of Labor, 16/04/20

Source: US Retail Sales, US Census Bureau, 15/04/20

Source: US Empire State Manufacturing, 14/04/20

Economic policies

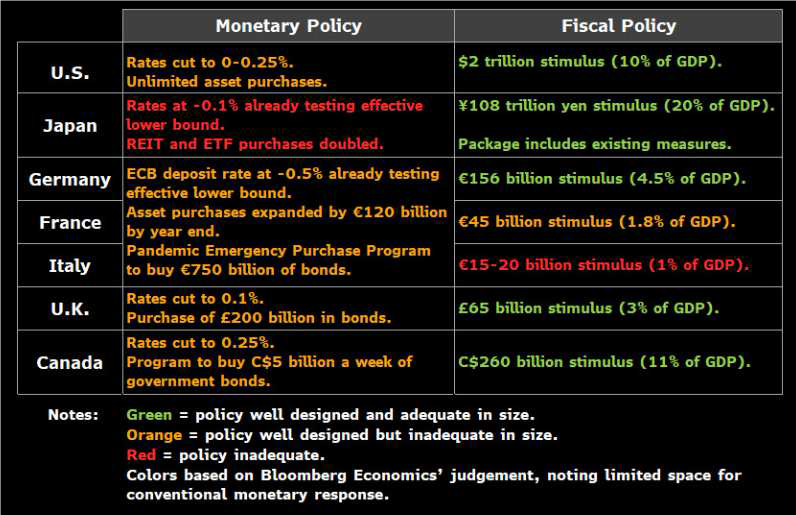

Economic policy makers around the world have implemented substantial fiscal and monetary and financial measures to support affected households and businesses to maintain economic activity during the shutdown and allow activity to gradually normalise until pandemic fighting and containment measures are lifted, with emphasis on:

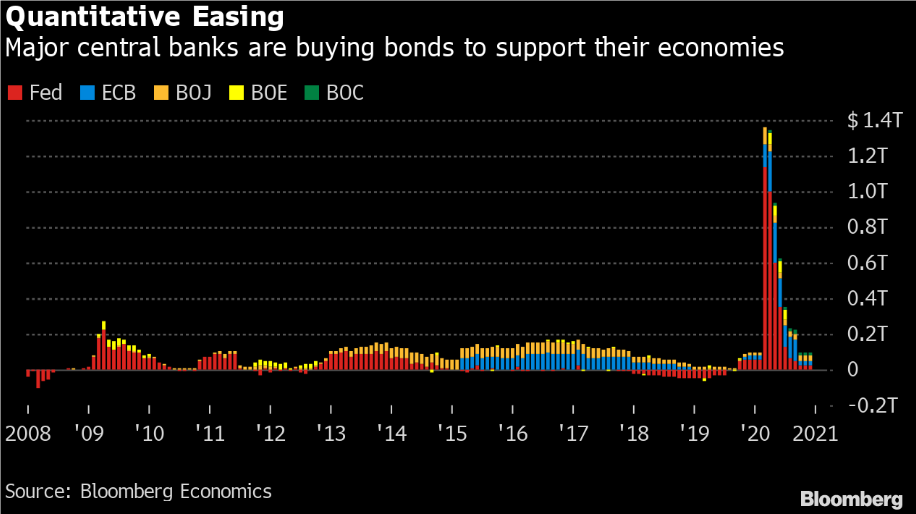

– In the Us, the FED implemented a Quantitative Easing (QE) program initially worth $1.47Tr and potentially unlimited (“whatever it takes”) and which the market estimates at $2.5Tr through June and $4.5Tr in total (higher than $3.7Tr of the total of previous QEs since 2008), covering purchases ranging from treasury bonds to speculative credit quality ETFs, alongside a government fiscal program of $2Tr (10% of GDP);

– In the Euro zone, the ECB has launched a €750Bn QE programme, the EC has implemented a €500Bn country lending programme without conditions and the various national governments developed fiscal programmes of between 1% up to 4.5% of GDP.

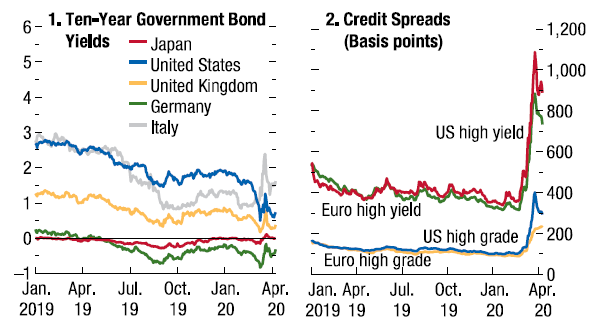

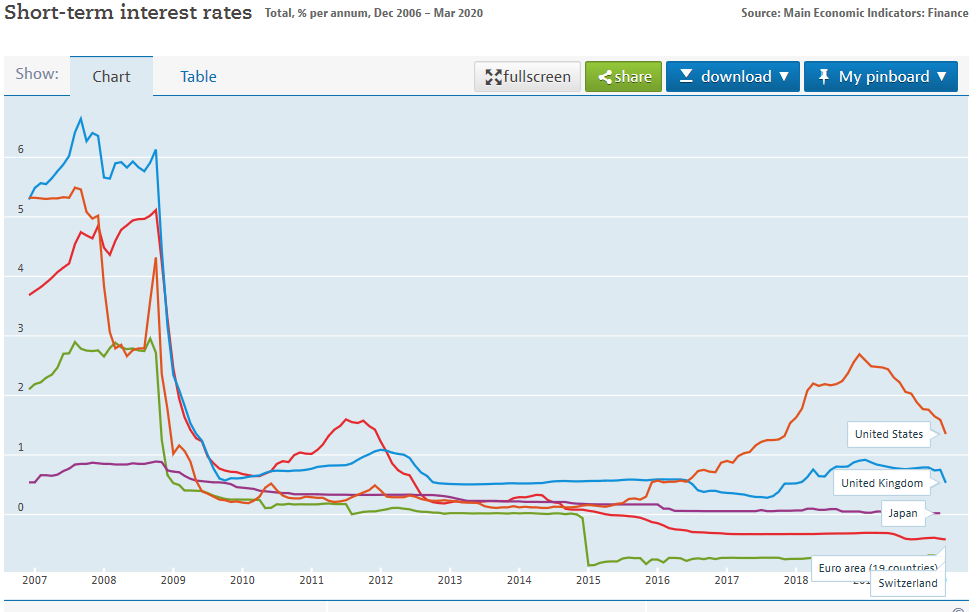

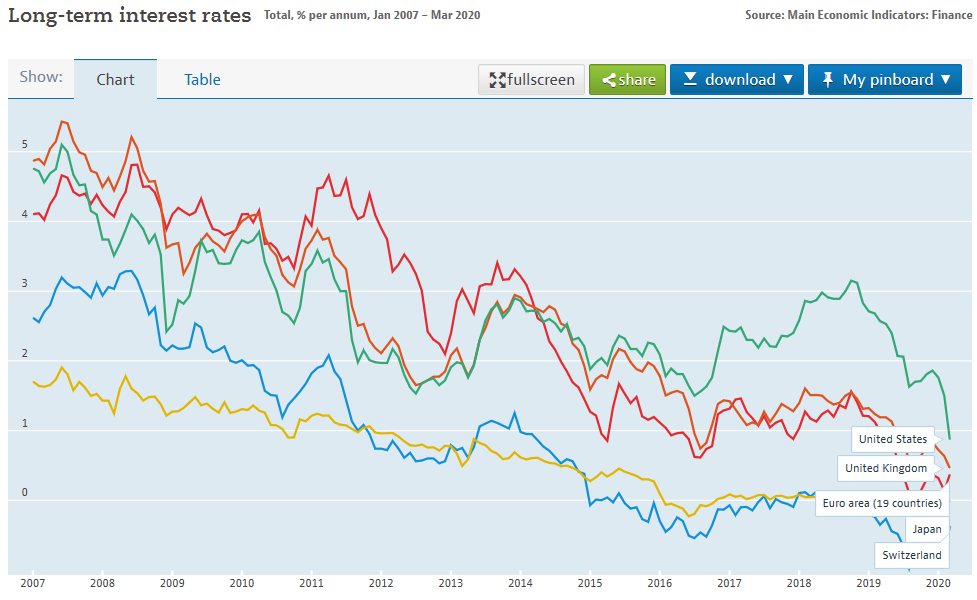

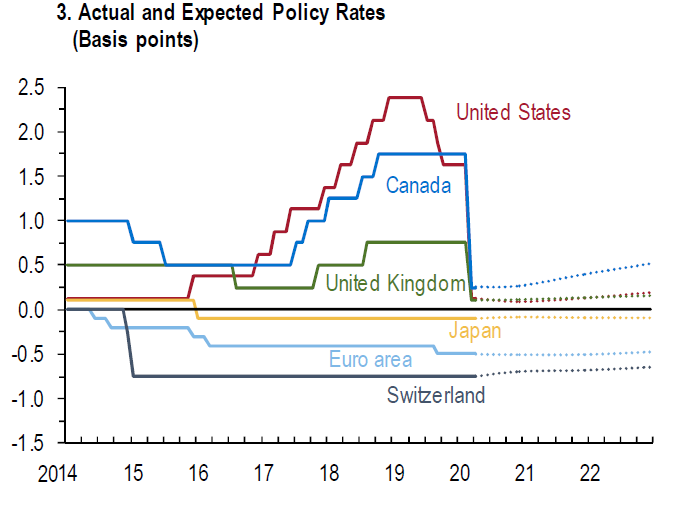

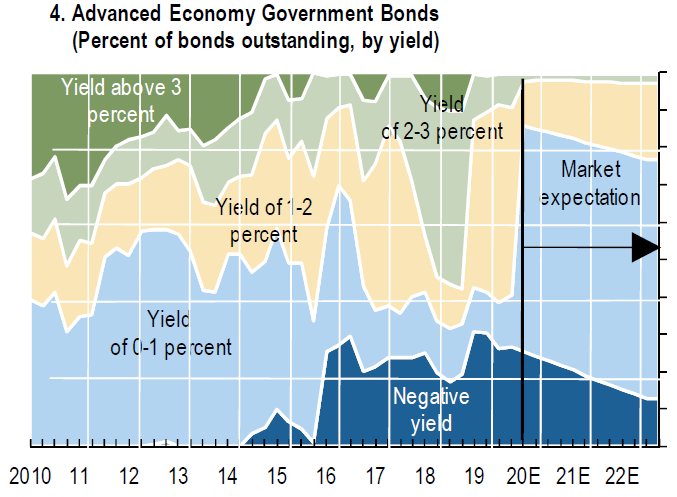

Short-term interest rates are negative in the Eurozone, Japan and Switzerland, and falling in the US.

Interest rates on 10-year treasuries are close to zero in the Eurozone, Japan, and Switzerland, and falling in the US and UK to historic lows.

Central banks’ benchmark interest rates are expected to remain negative in the eurozone for an extended period and could be up to 2024/2025, and those in the US will remain below 2%.

Source: Bloomberg

Source: Global Financial Stability Report, April 2020

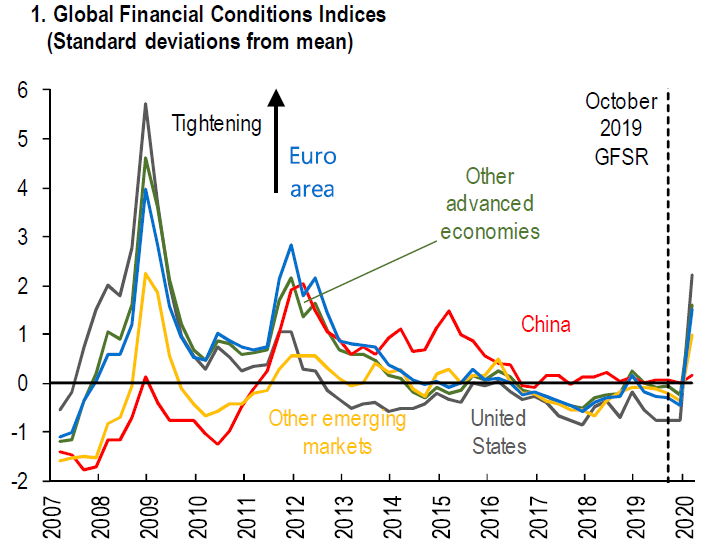

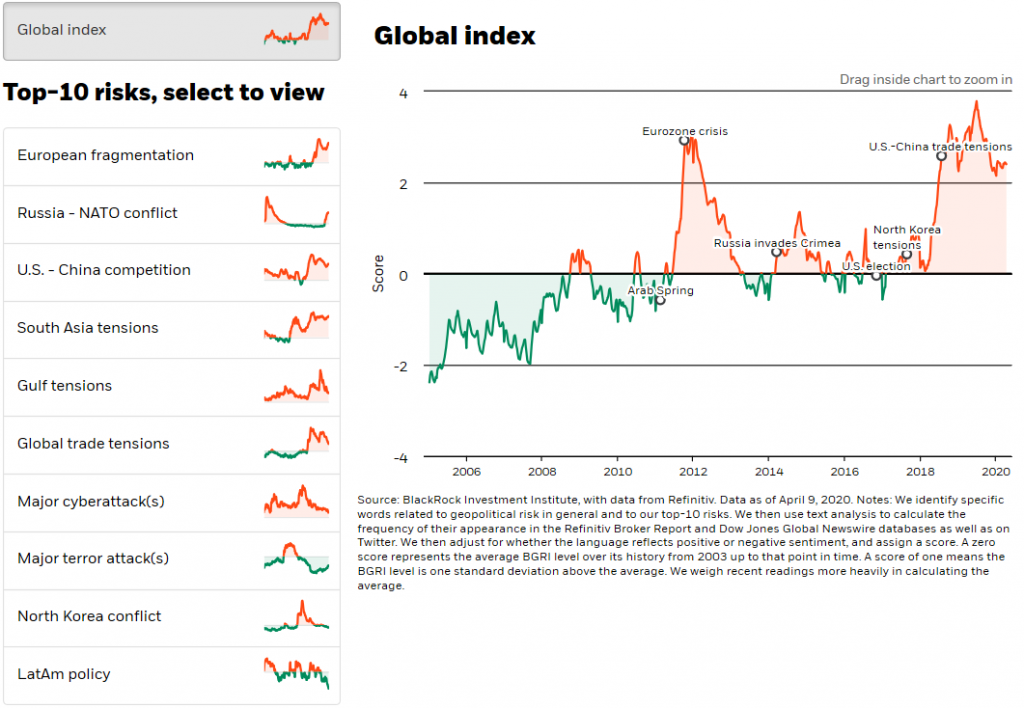

Financial conditions have deteriorated, and major geopolitical risks are suspended by the pandemic.

Globally, despite the strong economic policies, global financial conditions deteriorate by the profound impact of the shutdown of economic activity.

Geopolitical risks have eased at the end of the year and are currently suspended for pandemic risk.

Source: Global Financial Stability Report, April 2020

Market valuation

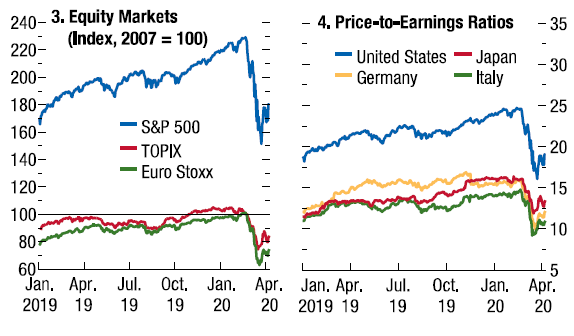

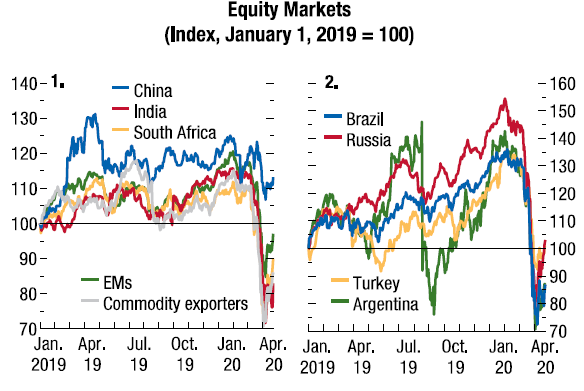

Stock markets fall sharply and recover part in the first quarter, with volatility at the GCF level and lower volume traded, reacting to economic policy actions, intentions to resume activity in the various countries and news of medical solutions for the virus.

Stock markets have fallen 30% or more since the start of the pandemic through March 23, having recovered more than half of this decline in the US and somewhat in Europe, with a lower-than-average transacted volume and based on the prospects of reopening the economic activity by mid-May and the availability of medical solutions to combat the virus (effective immediate treatment and/or vaccine between October and Spring).

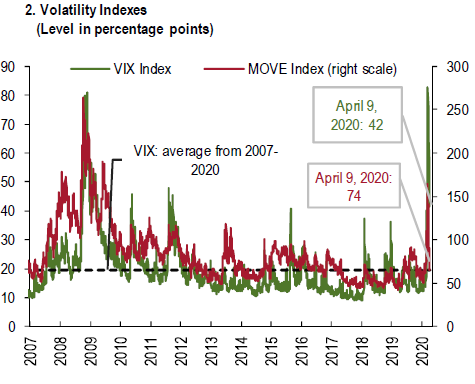

Volatility indicators in the US and Europe have reached GFC levels at the peak of the crisis in the last week of March and have been gradually falling.

The uncertainty of the impact on corporate earnings is extremely high, with the majority abandoning their guidance. The first quarter earnings season that has now begun in the US and will continue in the next 3 weeks (in Europe begins at the end of April), indicated a strong build-up of credit provisions by large banks.

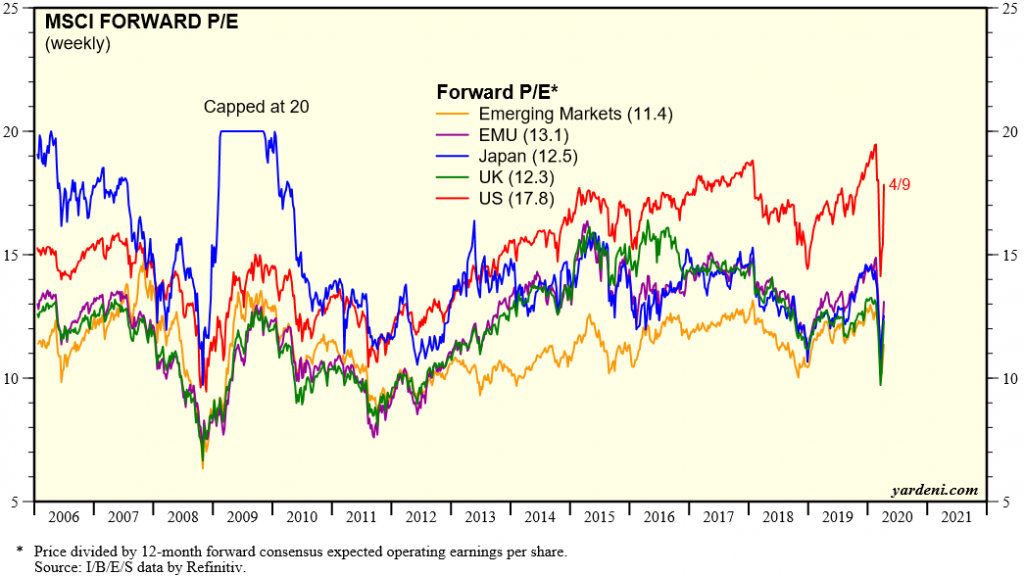

The global stock market valuation is above the long-term average, but with differences across the main markets. The PER of 17.8x for the US is above average and near highs, which is compounded by the fact that the earnings consensus is still high and being constantly revised downwards. The PER of 13.1x in the Eurozone, 12.5x in Japan and 11.5x in emerging markets are below average but have the same bias in consensus earnings estimates.

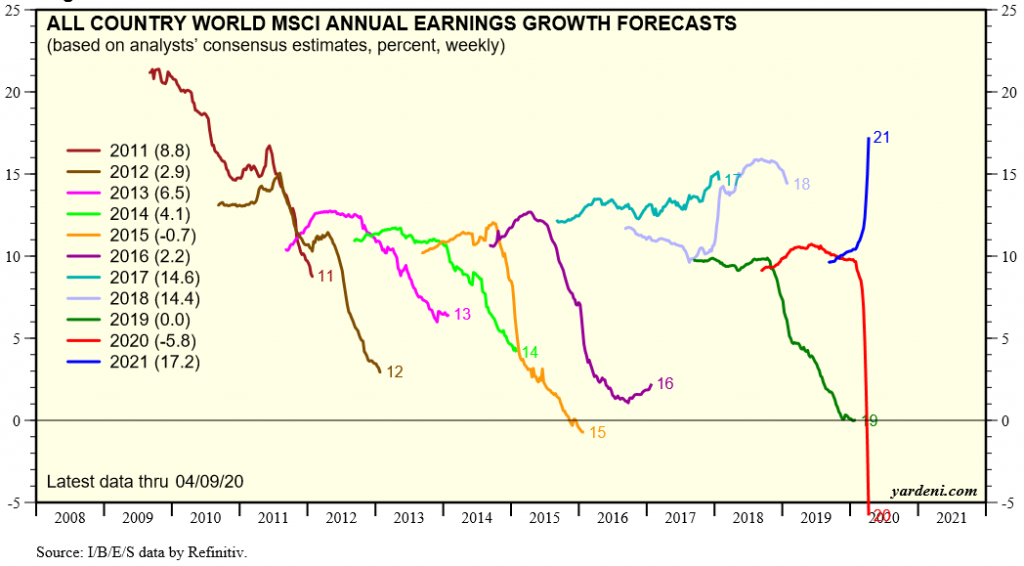

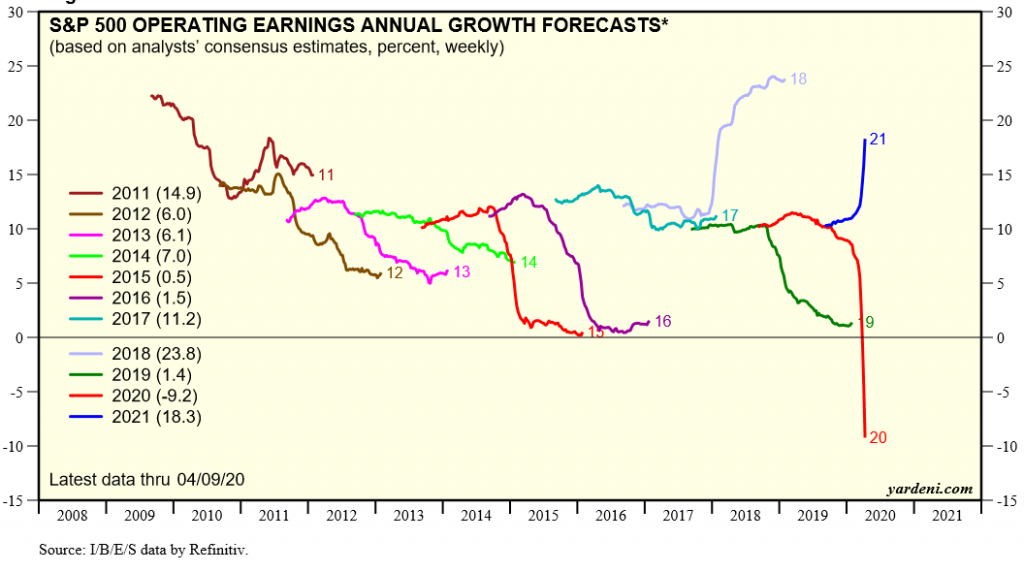

Consensus forecasts growth rates of negative earnings growth of -6.0% for the world stock market in 2020, and +17% for 2021, based on a rapid recovery from the second half of this year.

Source: Global Financial Stability Report, April 2020

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, April, 15, 2020

Source: Global Index Briefing: All Country World MSCI, Yardeni Research, April, 17, 2020

Source: Corporate Finance Briefing: S&P 500 Revenues and Earnings Growth Rate, Yardeni Research, April, 20, 2020

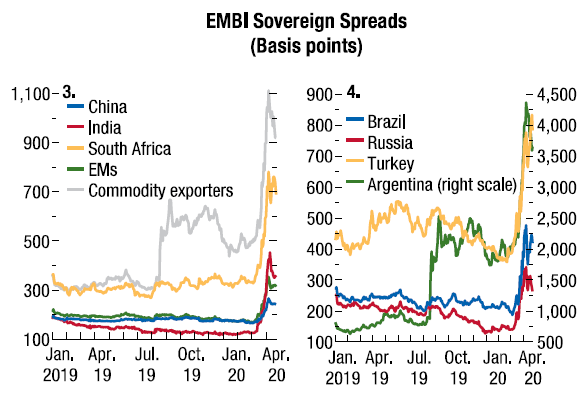

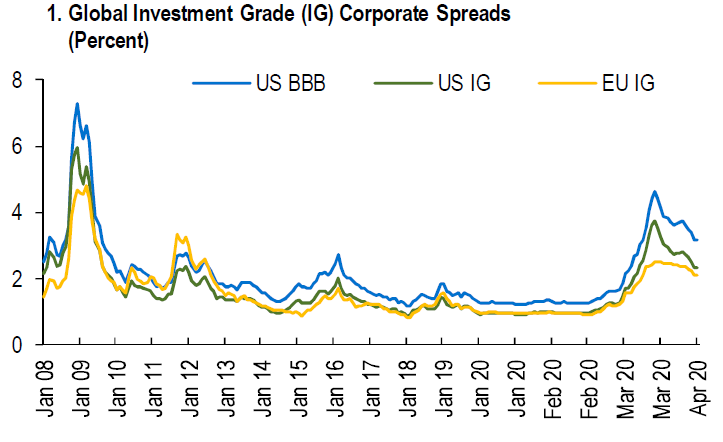

Corporate bond markets had a strong deterioration, with significant increase in risk spreads for investment and especially speculative ratings, and treasury interest rates of the largest economies at historic lows due to increased demand for refuge assets (such as gold).

The pandemic had a huge impact on credit markets with risk spreads more than doubling to values never seen after the GFC in the investment rating segment and with greater preponderance in the speculative rating segment.

The medium and long-term interest rates of US treasury bonds are at historic lows due to the growing demand for refuge assets (such as the rise in the price of gold).

The spread of medium and long-term implied interest rates on sovereign bonds in Europe among the various countries has widened not only to peripheral economies, but also to Spain and Italy, in line with a negative review of the outlook by rating agencies.

Despite this there is still a remarkably high amount of government debt yielding up to 1% in Europe, Japan and the US, as a result of negative official interest rates being set and strong asset purchase programs led by central banks.

Source: Global Financial Stability Report, April 2020

Source: Global Financial Stability Report, April 2020

Source: Global Financial Stability Report, April 2020

Main opportunities

The anticipation of medical health solutions that allow for a faster recovery and normalization in the US and Europe, greater growth in China, and an even greater intensification of monetary policies (“whatever it takes”).

- Anticipation of medical solutions (effective treatment and/or vaccine) that enable a faster economic recovery in developed countries.

- Surprise of higher economic growth in China, keeping up the latest positive signs of a resumption of activity

- Inflationary effect in the price of financial assets caused by the further intensification of the efforts of monetary authorities (unlimited policies or almost “whatever it takes”)

Main risks

- Lower than expected growth in advanced economies in 2020 and/or 2021 due to a prolongation of the pandemic, resulting in a longer or deeper shutdown, lower reactivation rate or adverse household behaviours.

- Rekindled the European sovereign crisis, but now not limited to peripheral countries but also affecting Spain and Italy, with the possible worsening of the risk of European fragmentation.

- Worsening external imbalances and public accounts in large emerging economies such as Brazil Mexico and South Africa, doubly dependent on oil and other natural resources and international trade (increased protectionism).

- Increase in hoarding effect with the consequent brake on the normalization of economic activity.