Executive summary

Performance 4Q21: Equity marketsat historic highs in developed countries, after 3 consecutive years of returns above 20% in the US, nearly 2 years of pandemic and strong economic measures worldwide

Status Covid-19: Pandemic more controlled by vaccination rates in developed countries, although the outbreak of the omicron variant is spreading around the world and experiencing very high infection rates

Macro Context: High economic growth recovering pre-virus activity levels, with high inflation rates and lasting longer than expected

Micro Context: Key leading economic indicators continue to decline slightly after historical records set in the second quarter

Economic policies: Gradual withdrawal of the pandemic stimulus, with the end of fiscal policies in support of the recovery, the reversal of the asset purchase programme and the announcement of the first interest rate hikes by the FED, while the other central banks maintain monetary stimulus

Equity markets: Stock markets at historic highs in developed countries, with low volatility, as a result of good growth in results per share and low interest rates

Bond markets: Fixed income markets maintained a more volatile performance due to fluctuations in long-term sovereign interest rates associated with inflationary pressures, but with compression of credit spreads due to decreased risks of bankruptcy

Key opportunities: Higher company earnings growth than analysts expect due to increased global pandemic control (passing to endemic stage) and recovery of consumption at pre-pandemic levels

Key risks: Higher interest rate hike in the US, and reduced economic growth in China from the housing crisis

This transition phase of the cycle, with good levels of economic growth and changes in economic policies to a less expansionary register, continues to favour the stock markets over interest and credit markets.

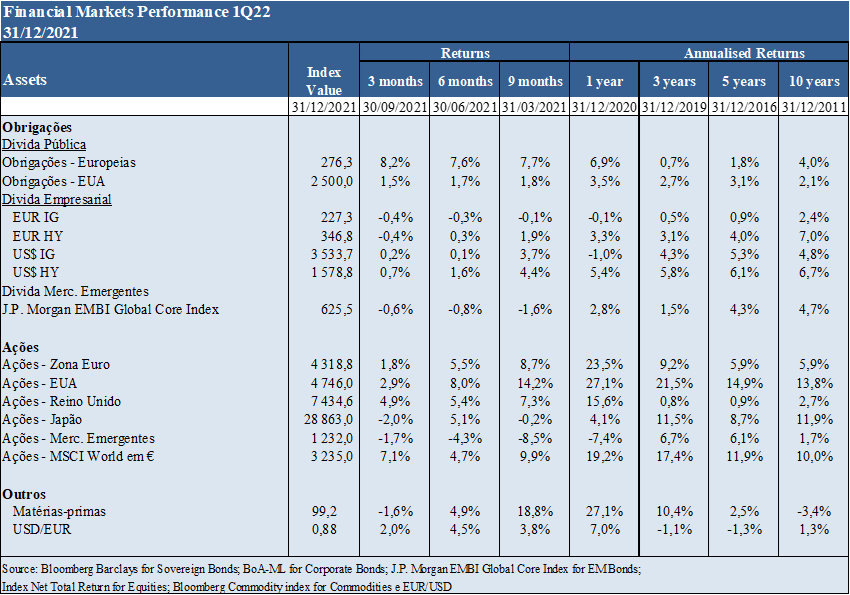

Financial markets performance 4Q21

Equity markets at historicc highs in developed countries after 3 consecutive years of returns above 20% in the US, nearly 2 years of pandemic and strong economic measures around the world

Equity markets at historic highs in developed countries, with returns above 20% in the year, due to good growth in business results and strongly expansionary economic policies, but with negative performance in emerging markets.

Third consecutive year of annual returns above 2 digits in developed countries.

Developed country bond markets performed marginally negatively on treasury bonds, but positive in speculative rating securities, by rising long interest rates and compression of credit spreads.

The total stock market capitalization of cryptocurrencies increased significantly and exceeded the value of 2 billion dollars, with the price of Bitcoin at 20% of the year’s highs.

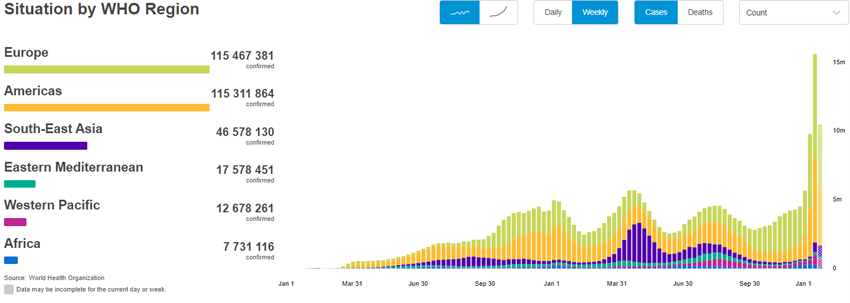

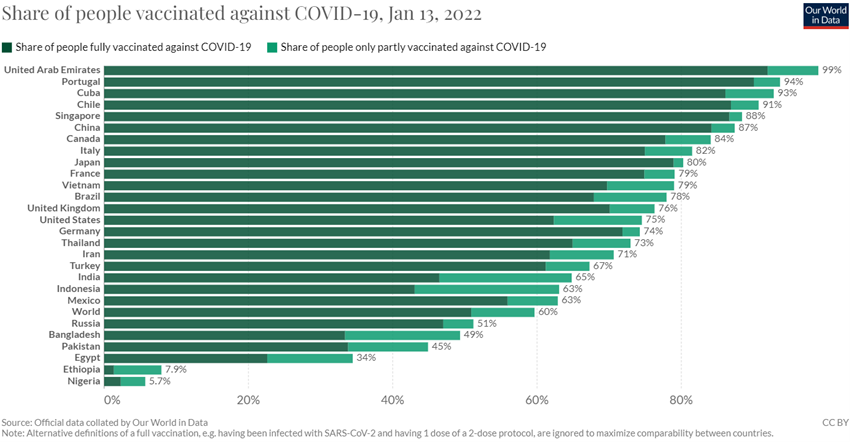

Covid-19

Pandemic more controlled by vaccination rates in developed countries, although the outbreak of the omicron variant is spreading around the world and has very high infection rates

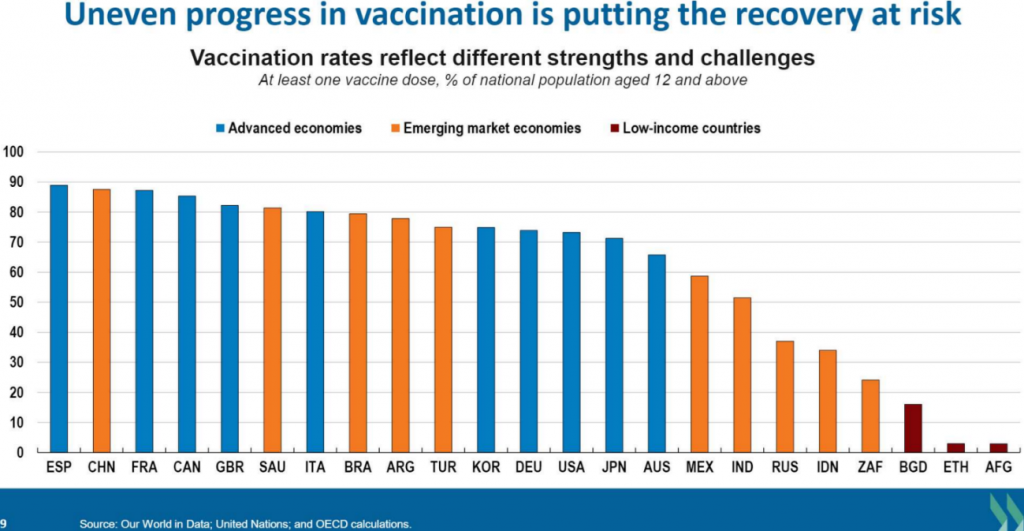

The Covid-19 virus has already surpassed 250 million infected and 5 million dead. 5 billion doses of vaccines have already been administered.

Pandemic more controlled mainly in developed countries, and the outbreak of the strongly contagious omícron variant is fought by vaccination.

High vaccination rates and the most effective new treatments are allowing progress to an endemic stage this year.

Source: WHO, Jan, 14, 2022

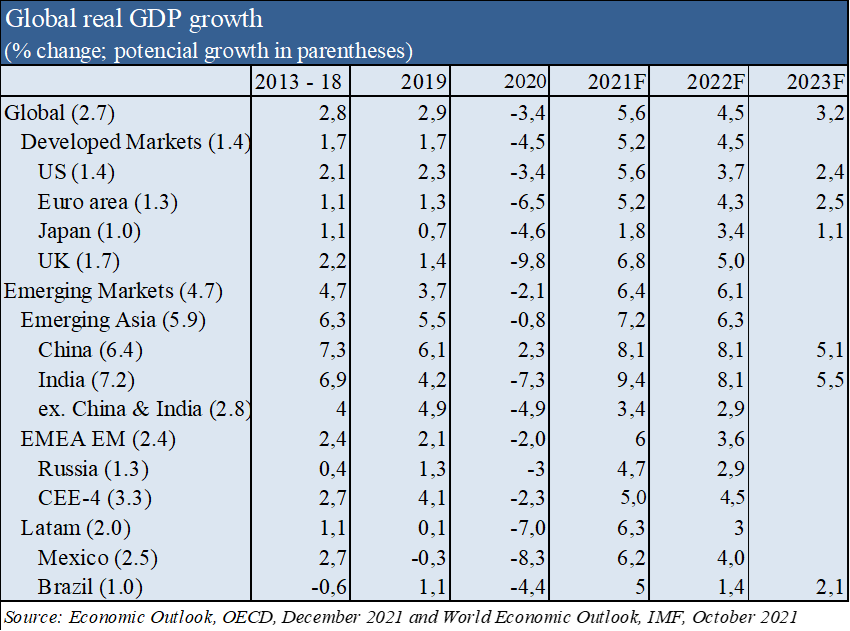

Macroeconomic context

Global economic growth forecasts of +5.6% in 2021, +4.5% in 2022 and 3.2% in 2023, with +5.2%, +4.5% and 3.0%, respectively, in advanced economies, and +6.4%, +6.1% and +5.0, respectively, in emerging economies, respectively, according to the latest December data from the OECD and October from the IMF.

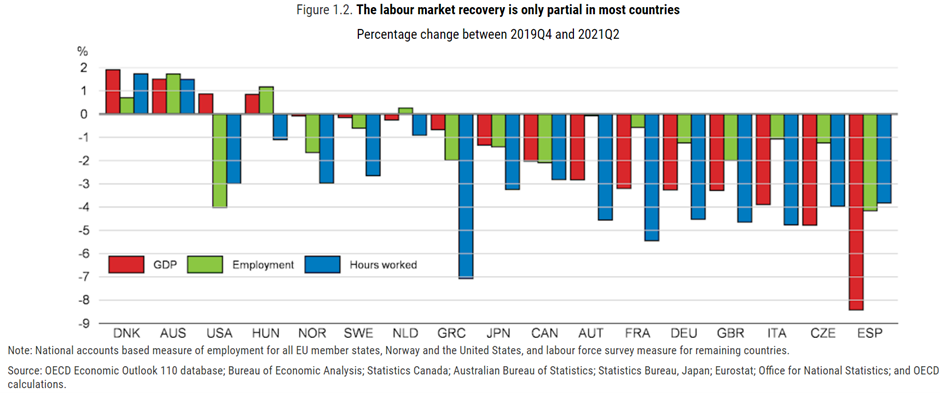

Thus, high and slowing economic growth rates are expected around the world, with the recovery of pre-pandemic activity levels made possible by high vaccination rates in developed countries.

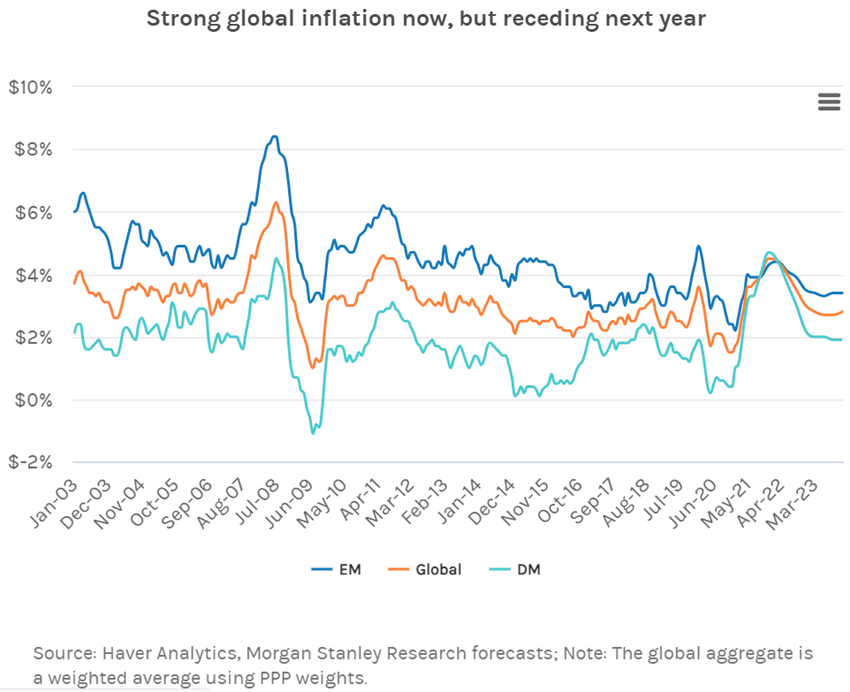

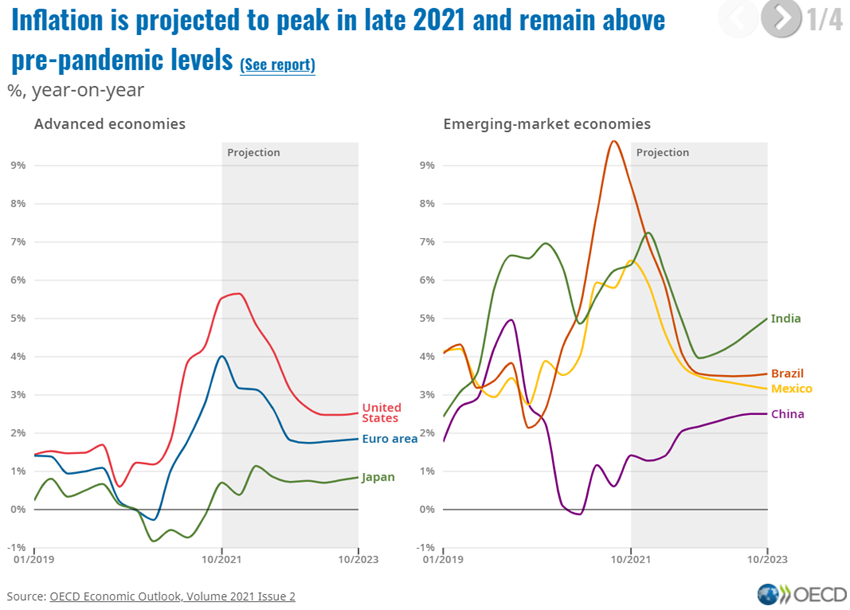

Inflation continues to reach historic highs in recent decades and well above the benchmark levels of US and European Central banks, remaining longer than initially predicted by the authorities, but slowing this year.

Source: OECD, Economic Outlook, December 2021

Micro-economic context

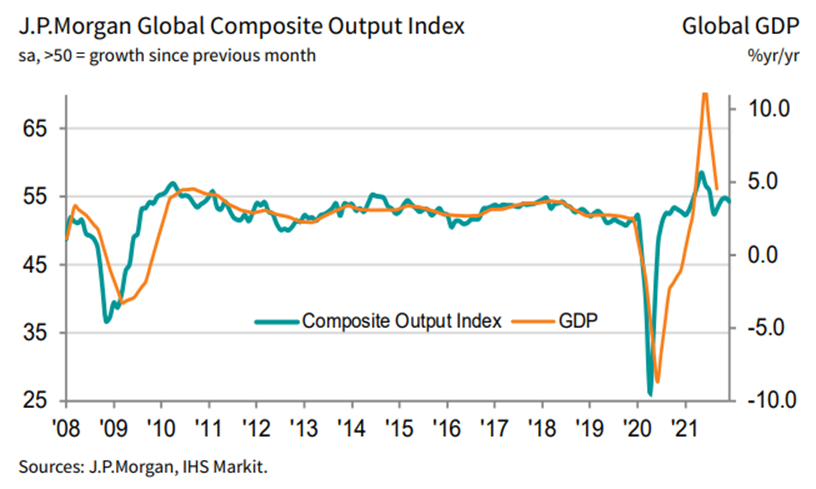

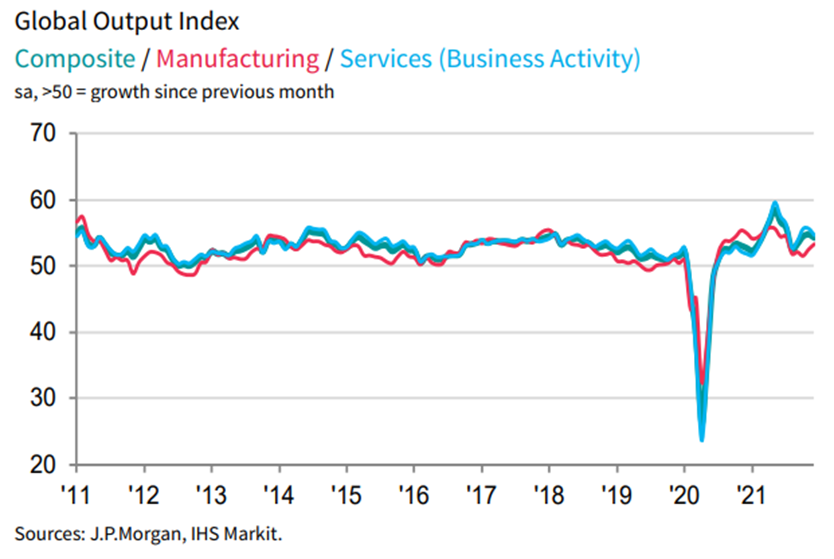

The Global Composite Output index reached 54.8 points in December, recording a slight slowdown in the last 3 months of the year, and increasing to 18 consecutive months the period of expansion of economic activity.

All countries except for Germany have expanded, with the best performance in the US, Ireland and India and the highest growth in China. There have been slight improvements in international trade and some signs of lower inflationary pressures.

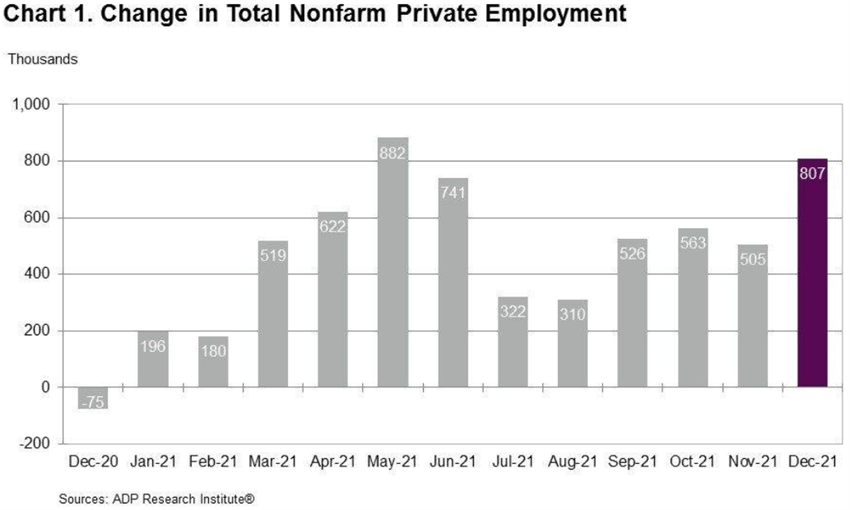

The December rate in the US continues to fall to 3.9%, approaching levels of 3.5% before the pandemic.

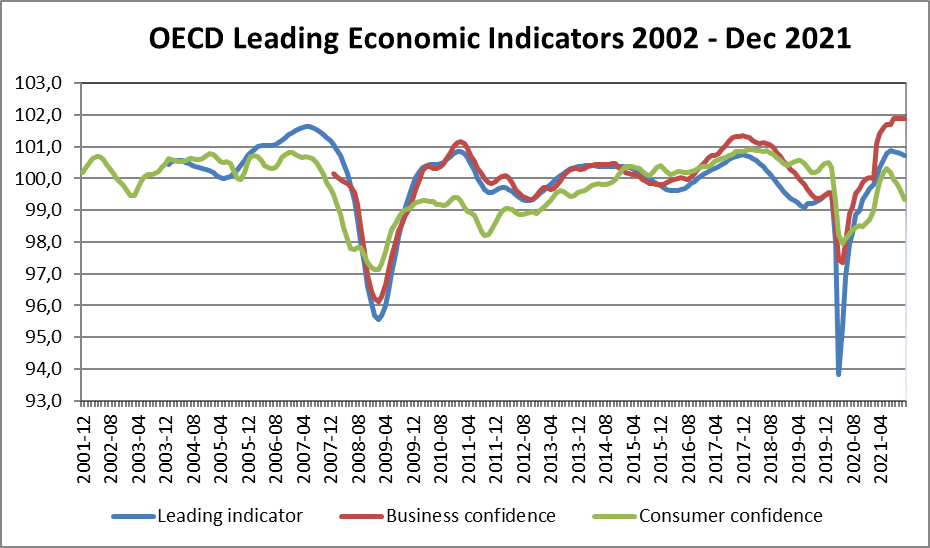

Business and consumer confidence in OECD countries has fallen slightly.

Economic policies

Developed countries have put an end to budgetary stimulus programmes to support extraordinary recovery of activity and employment.

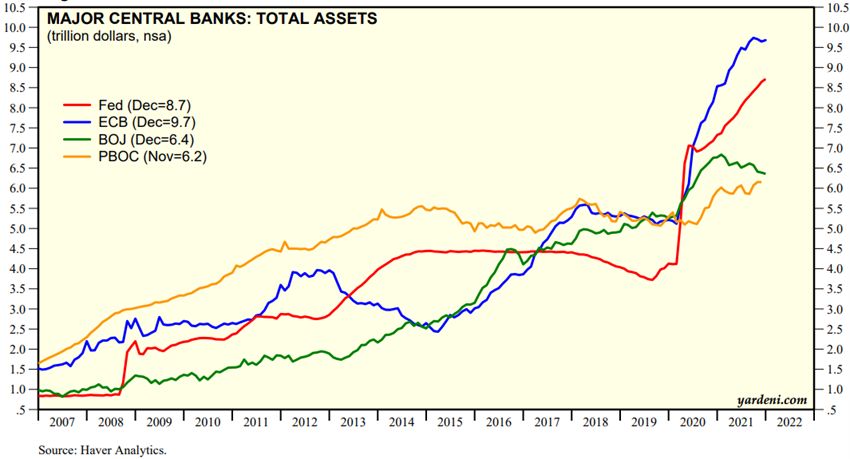

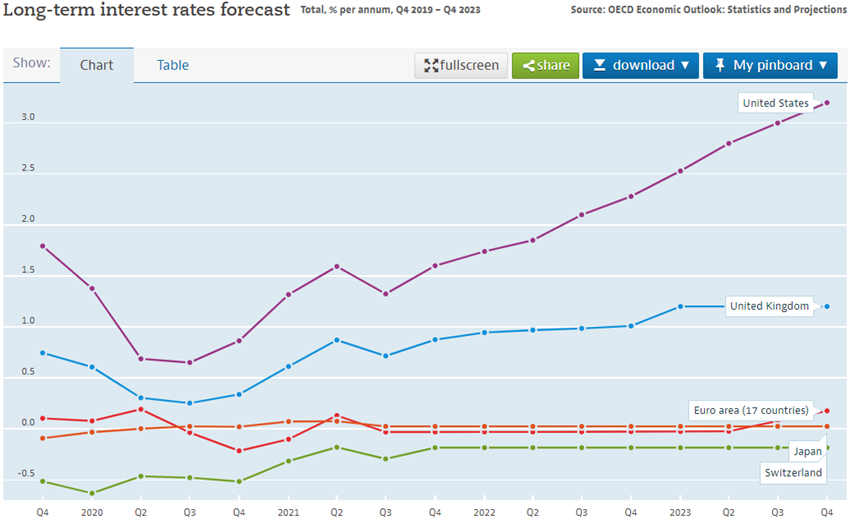

The FED is withdrawing monetary stimulus (a process known as “tapering”), having announced the purpose of raising official interest rates and reducing balance sheet assets to combat inflation currently above 7% (highs since 1982). The remaining central banks, ECB, Bank of Japan and Bank of England, maintain expansionary monetary policy for some more time.

Since March 2020, monetary creation has been more than $4 trillion in the US and $2 trillion in the Eurozone, largely financing the budgetary needs of these economies.

Source: Major Central Bank Total Assets, Yardeni Research, Jan, 13, 2022

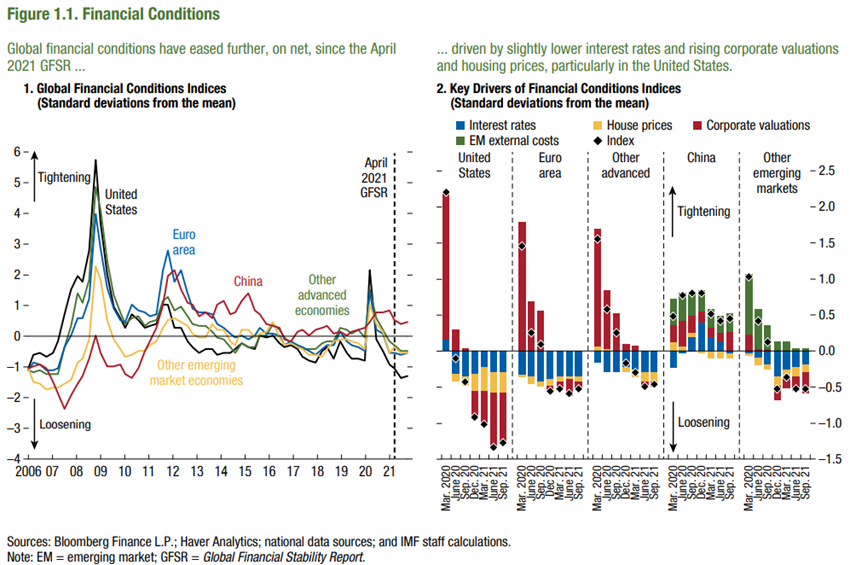

Financial conditions remain positive in developed countries as a result of the actions of governments and central banks around the world and the good performance of financial markets, and negative in China by the degradation of risky assets

In developed countries financial conditions remain favorable due to rising stock prices, low interest rates, compression of credit spreads and rising house prices.

In emerging countries, financial conditions have deteriorated, in particular in China due to the problem of bankruptcies in the real estate sector, and in Brazil due to the slowdown in economic activity.

Source: Global Financial Stability Report, IMF, October, 2021

Equity markets evaluation

The equity market rose more than 20% in 2021 in developed countries, with 27% in the US and 20% in the Euro zone, as opposed to what happened in emerging markets.

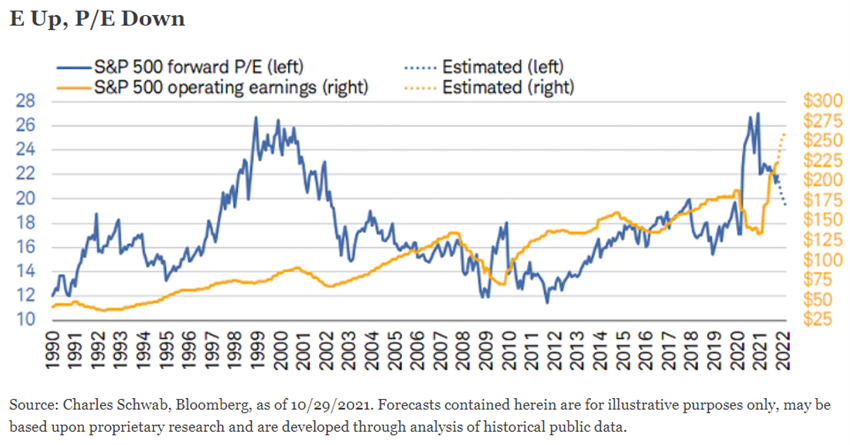

It was the third consecutive year of gains above 20% in the US, with companies continuing to show the best earnings on record.

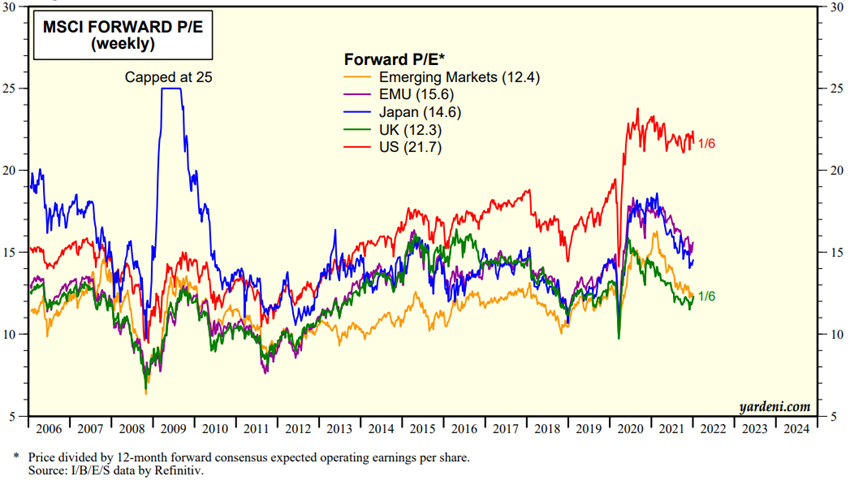

The valuation of the global equity market and in the various regions is above the long-term average. The PER of 21.7 x for the U.S. had a slight drop, but remains well above average. The PER of 15.6 x in the Eurozone, 14.6 x in Japan and 12.4x in emerging markets are also above average, and have fallen more sharply.

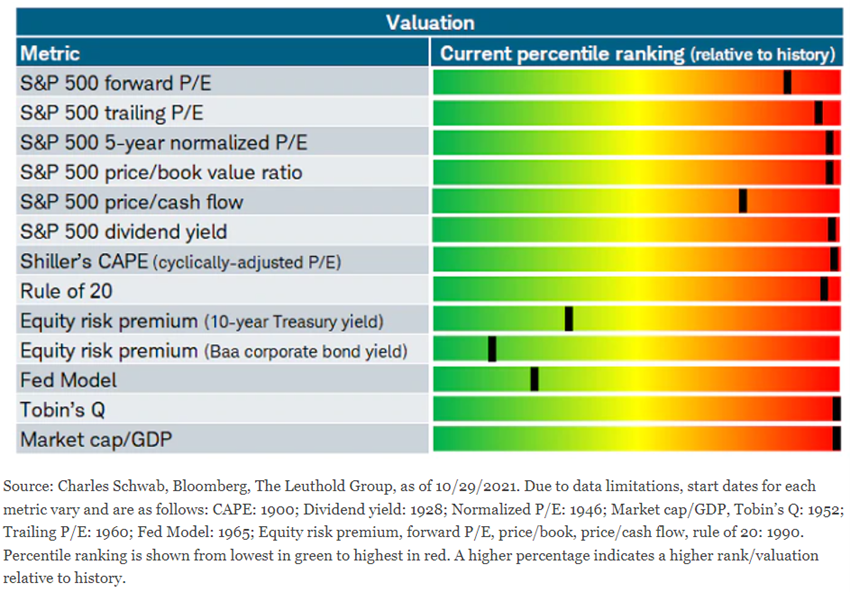

The S&P 500 valuation is excessive in terms of the multiples, but contained in terms of the interest rate methods that compared it to the attractiveness with bonds, which increases its sensitivity to the rise of those.

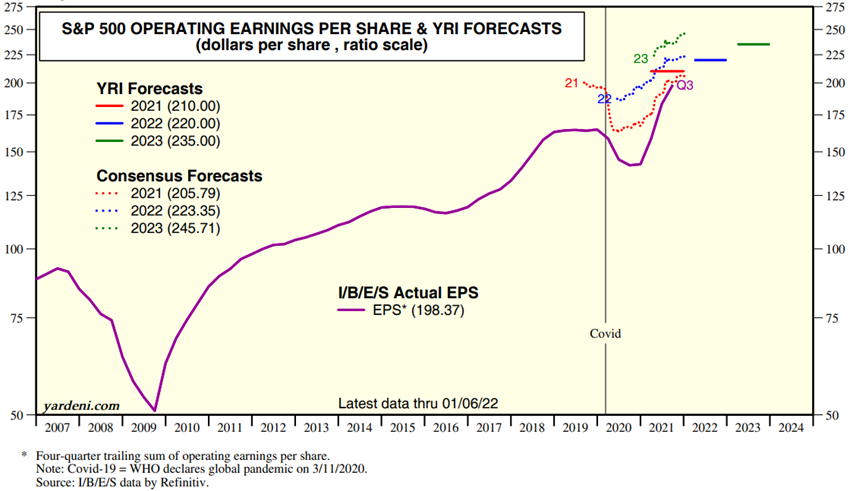

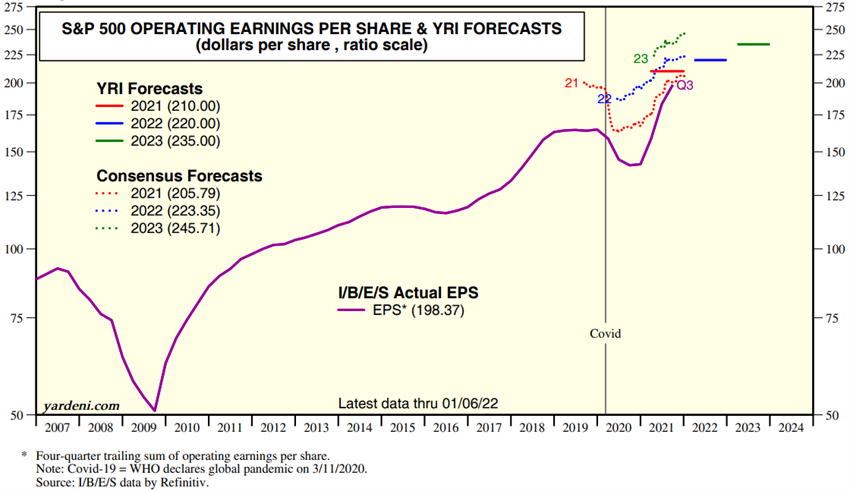

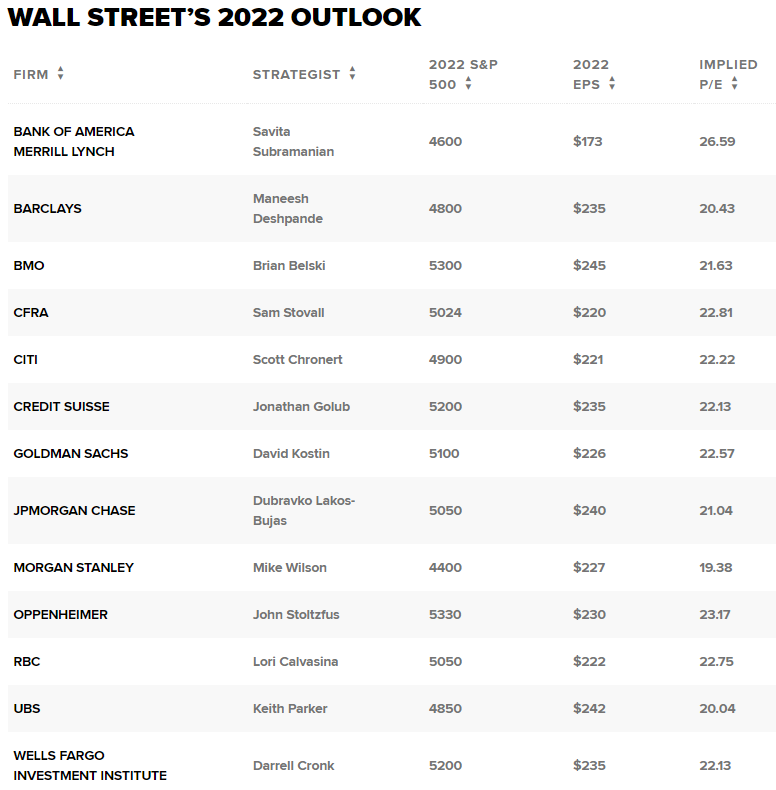

US results per share already far exceed prepandemic levels but estimates for next year have been revised lower, especially as the tapering began.

Analysts’ 2022 targets for the S&P 500 are +5% to +7% from current levels.

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, Jan, 10, 2022

Source: Global Index Briefing: MSCI Forward P/Es, Yardeni Research, Jan, 12, 2022

Source: YRI S&P 500 Earnings Forecast, Yardeni Research, Jan, 10, 2022

Bond markets evaluation

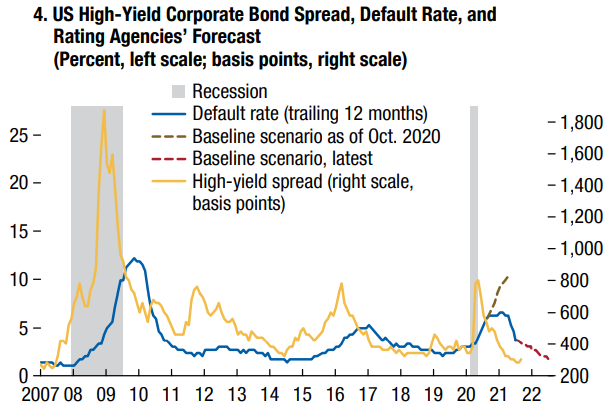

Fixed income markets maintained a more volatile performance due to fluctuations in long-term sovereign interest rates associated with inflationary pressures, but with compression of credit spreads by decreasing bankruptcy risks

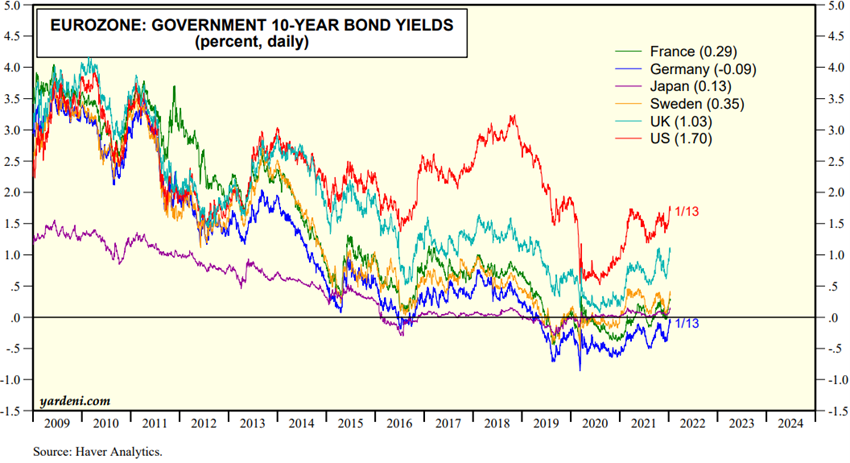

Monetary policy decisions and rising inflation rates in the US and eurozone have led to the evolution of interest rates.

Medium- and long-term interest rates on treasury bonds are at historic levels very low, but they have started the year on the rise, especially in the US.

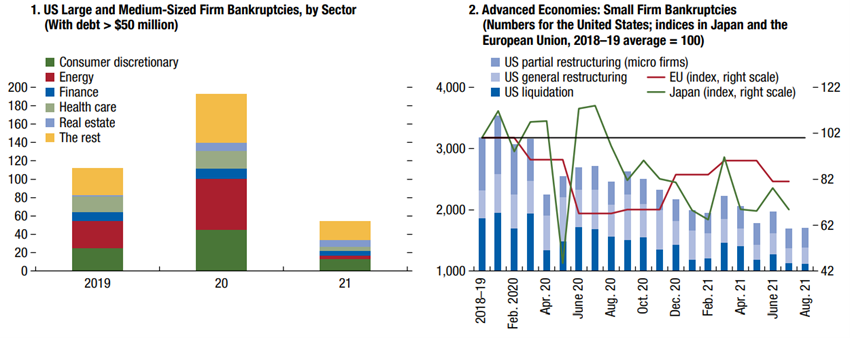

In 2021 there was no increase in bankruptcies as expected as a result of government support.

Source: Market Briefing:Global Interest Rates, Yardeni Research, Jan, 14, 2022

Source: Global Financial Stability Report Update, IMF, Oct 2021

Source: Global Financial Stability Report Update, IMF, Oct 2021

Main opportunities

Increased economic growth worldwide as a result of accelerating the path to endemic

The ongoing rate of vaccination and the high spread of the omicron variant around the world could accelerate the path to endemic, increase international trade, consumption and the global product.

Main risks

Higher US interest rate hikes, and reduced economic growth in China from the housing crisis

A higher and faster rise in official interest rates in the US in response to higher inflationary pressures, resulting from rising energy prices or delays in restoring supply chains, and which could bring 10 year interest rates from the current 1.7% to values above 2%, will have an impact on stock market valuations.

Lower-than-expected economic growth in China from the housing crisis will damage the financial conditions of emerging markets.

Source: OECD Economic Outlook, December 2021

Source: OECD, Long term interest rates forecast, Jan, 14