Since then and despite continued regulatory efforts, there are still some major corporate scandals

Every day there are more scandals, and there is a need to strengthen preventive, control and surveillance mechanisms, as well as sanctions

Although the theme of corporate governance comes from a few years ago, the truth is that it gained new impulses, projection and acuity especially with the fraudulent actions by some large listed companies around the world and especially in the USA in the early years of the new millennium, which resulted in scandals and crimes with great visibility not only in the financial community, but also in the media in general.

It was precisely these scandals that triggered to a large extent the regulatory intervention promoted by the government powers.

This was first followed in the United Kingdom with the Canterbury Report in 1999 following the Black Friday of October, 13 1987 and later in the US following the bankruptcies of Worldcom and Enron, among others, which culminated in the Sarbanes-Oxley Act of July, 30 2002.

Two major scandals stand out in particular, those of Enron in 2001 and Wordcom in 2002.

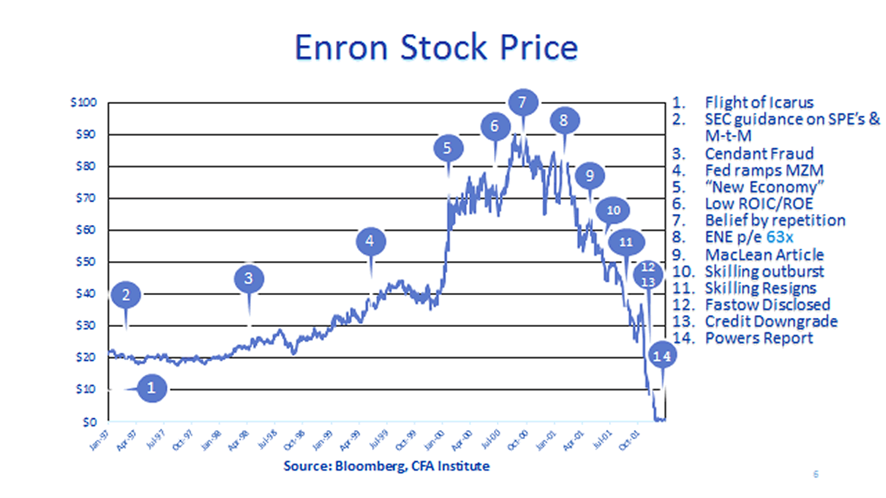

Enron was an energy trading company that perpetrated one of the biggest accounting frauds in history, at a time when it was the seventh largest company in the United States.

Enron executives employed accounting practices that falsely inflated the company’s revenues and managed to hide billions of dollars in failed business debts and projects for some time.

As soon as the fraud came to light, the company quickly dismembered, and filed for Chapter 11 bankruptcy on December 2, 2001.

Enron shares traded up to $90.56 before the fraud was discovered, but fell to about $0.25 after it was revealed. Its accounting firm, Arthur Andersen – then one of the five largest audit and accounting partnerships in the world – was dissolved.

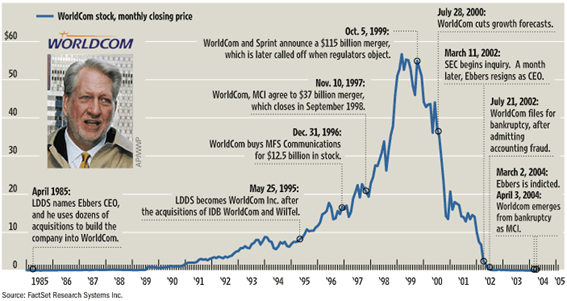

WorldCom was one of the largest telecommunications companies in the world and a high-dividend share that many retirees held in their portfolios.

Its founder and CEO Bernard Ebbers has been acquiring other telecommunications companies, making Worldcom one of America’s leading long-distance phone companies. At the height of the dotcom bubble, its market capitalization had grown to $175 billion.

From 1999 to 2002, some of WorldCom’s top executives led by its CEO orchestrated a scheme to inflate profits to maintain WorldCom’s share price.

In June 2002, more than $3.8 billion of fraudulent balance sheet entries were discovered.

The company was later forced to admit that it had overvalued its assets by more than $11 billion.

The disclosure came at a particularly bad time because even before the scandal broke, its credit had been reduced to junk status, and its shares had lost more than 94% of their value.

At the time, it was the biggest accounting fraud in American history.

Nor could Sarbanes-Oxley’s Act put a brake on the great corporate scandals, because soon after, those of the financial industry multiplied and gave rise to the Great Financial Crisis (among others)

However, the schemes and scandals are far from having stopped there.

In fact, the financial crisis has been fertile in many other cases, focused accurately and specifically on the financial sector.

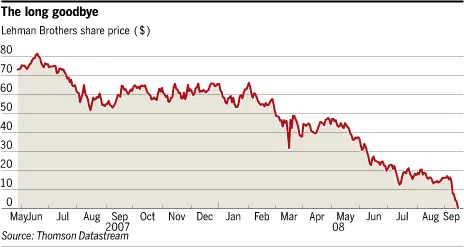

The bankruptcy of Lehman Brothers on September 15, 2008 was the climax of the subprime mortgage crisis. Lehman Brothers was one of the first Wall Street firms to bet in the mortgage business, turning into a real estate fund disguised as an investment bank.

In 2008, it had assets of $680 billion backed by just $22.5 billion of equity.

Its risky commercial real estate holdings were thirty times higher than equity. In such a highly leveraged structure, a 3-5% drop in real estate values would consume all capital.

Lehman Brothers shares quoted $86 per share in February 2007, giving the company a market capitalization of nearly $60 billion.

The company posted a new record for net results, more than $4 billion, in 2007, and was the fourth-largest investment bank in the U.S.

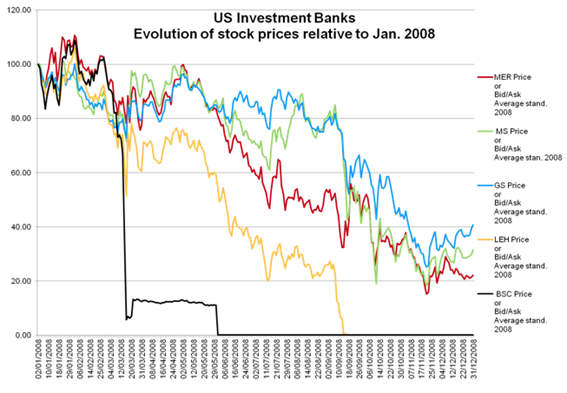

In March 2008, immediately after Bear Stearns (the second largest holder of mortgage securities, just behind Lehman Brothers) nearly collapsed, Lehman’s shares fell nearly 50%. In June, the company reported a quarterly loss of $2.8 billion.

In late 2008, Lehman Brothers Holdings Inc. disappeared with the largest bankruptcy process of the companies worth 619 billion dollars in debt in U.S. history.

While elements of the subprime crisis became more visible in 2007, several major financial institutions collapsed in September 2008, with a significant disruption in the flow of credit to businesses and consumers and the onset of a severe global recession:

The crisis has had serious lasting consequences for the US and European economies.

The U.S. went into deep recession, with nearly 9 million jobs lost during 2008 and 2009, about 6% of the workforce. The number of jobs only returned to the pre-crisis peak from December 2007 until May 2014.

Net worth of US households declined nearly $13 billion (20 percent) from its pre-crisis peak in q2 2007, recovering through Q4 2012.

U.S. house prices fell nearly 30 percent on average, and the U.S. stock market fell about 50 percent in early 2009, with stocks recovering from their December 2007 level during September 2012.

The estimated loss of production and income from the crisis is at least 40% of gross domestic product for 2007.

Europe has also continued to struggle with its own economic crisis, with high unemployment and severe bank ing swipes estimated at €940 billion between 2008 and 2012.

In response to widespread calls for changes to the financial regulation system in June 2009, President Barack Obama presented a proposal for a general overhaul of the United States financial regulation system, a transformation on a scale not seen since the reforms that followed the Great Depression.

The Dodd-Frank Consumer Reform and Defense Act (commonly referred to as Dodd-Frank) is a United States federal law that was enacted on July 21, 2010. The law reviewed financial regulation in the aftermath of the Great Recession, and made changes affecting all federal financial regulatory agencies and almost all matters of the financial services industry

Since then and despite continued regulatory efforts, there are still some major corporate scandals

Despite this, cases in the financial industry have continued to multiply since then. And not only that. The cases of Deepwater from BP, Dieselgate from Volkswagen and other car manufacturers and, more recently, Wirecard, have been famous.

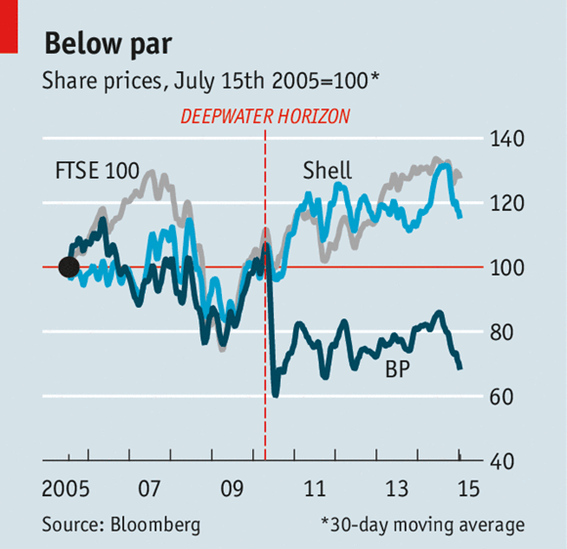

The oil spill in the Gulf of Mexico by collapse and explosion on BP’s Deepwater floating platform due to failures in the risk monitoring, prevention and control system:

BP shares fell 51% in 40 days on the New York Stock Exchange, from $60.57 on April 20, 2010, to $29.20 on June 9, its lowest level since August 1996. On June 25, BP’s market value reached last year’s low. The total amount lost by the company since April 20 was $105 billion.

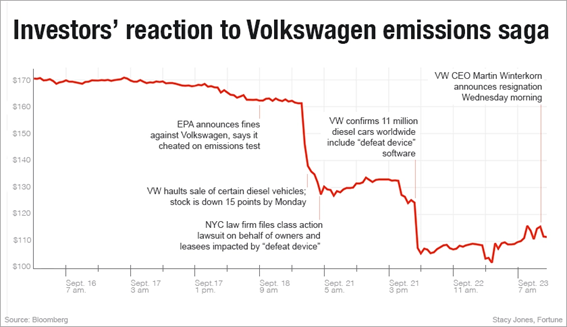

Volkswagen AG has lost nearly a quarter of its market value after it admitted to manipulating U.S. air pollution tests for years, putting pressure on its chief executive, Martin Winterkorn, to repair the reputation of the world’s largest car maker.

Volkswagen shares fell nearly 30 percent in the month of reports of violations of the car maker’s Clean Air Act and were more than 50 percent below the 52-week high reached in March of the same year.

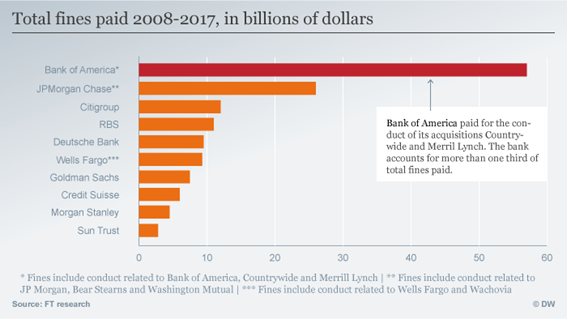

The amount US. authorities have charged in fines from financial institutions for dubious deals with subprime mortgages since the start of the credit crisis in 2007, according to a survey by the British newspaper Financial Times was $150 billion (127.6 billion euros).

While the Financial Times was assessing bank fines at $150 billion, a report by the Boston Consulting Group said the fines had totaled $321 billion.

That latest issue includes sanctions for crimes such as money laundering, terrorist financing, manipulation of benchmark interest rates, and violation of US law. According to this calculation, European banks paid US$118 billion, compared to $204 billion paid by US banks.

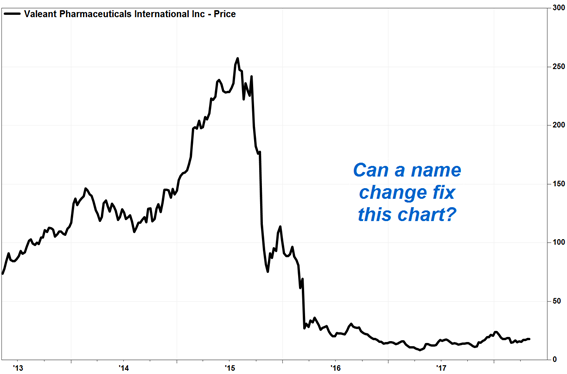

Under the leadership of J. Michael Pearson, Valeant adopted a strategy to buy other pharmaceutical companies that manufactured effective drugs for a variety of medical problems, and then it was the price of these drugs. As a result, the company grew rapidly and in 2015 became Canada’s most valuable company.

In 2015, Valeant was involved in a series of controversies surrounding this rise in drug prices and the use of a network of specialized pharmacies for the distribution of its medicines.

This led to an investigation by the US Securities and Exchange Commission, causing its share price to fall more than 90 percent from its peak, while its debt exceeded $30 billion.

The Wirecard scandal is a series of accounting frauds that have resulted in the insolvency of Wirecard, a German electronic payments service processor and financial services provider that was part of the DAX stock exchange index.

In 2018, Wirecard’s shares peaked, valuing the company at €24 billion.

Allegations of accounting negligence have surfaced since the early days of its inception, peaking in 2019 after the Financial Times published a series of investigations, along with whistleblower complaints and internal documents.

On June 25, 2020, Wirecard filed for insolvency following revelations that €1.9 billion was missing, and the termination and detention of its CEO, Markus Braun.

An assessment of regulatory failure by the Federal Financial Supervisory Authority (BaFin), Germany’s chief financial officer, and possible negligence by its long-time auditor Ernst & Young is underway.

Unfortunately, these are just some of the most visible cases of accounting or economic fraud, audit failures, and deficiencies in internal and external control systems. There are many others, less known and publicised, and smaller.

Thus, much still has to be done in regulatory terms to improve corporate governance, both in preventive terms, control and supervision, and in sanctioning terms.

However, nothing replaces the morals, principles and ethics of the agents themselves, and it is increasingly important to reinforce the mechanisms of diagnosis and evaluation of them.

Just as nothing replaces the right or aligned incentives, efforts and developments should be multiplied to ensure more effective internal supervision, greater weight of independent managers in the composition of corporate governance, a truer independence of managers, a more preponderant role and greater accountability of them.