The outlook of the main investment banks for 2024

JP Morgan: U.S. GDP growth slows considerably to 0.7% and earnings per share growth below consensus

Goldman Sachs: S&P 500 at 4,700 points, based on global economic growth of 2.1%, higher than consensus, and low probability of recession in the US (15%)

Morgan Stanley: S&P 500 at 4,500 points, with U.S. economic growth slowing to 1.6% and EPS growth of 7%

Bank of America: S&P 500 at 5,000 in a stable economy, with EPS growth even as economic growth slows

UBS: New world, with valuations of stocks, and especially bonds, allowing gains to balanced portfolios

Large disparity in the degree of slowdown in U.S. economic growth (between 0.7% and 2.1%) leads to a wide range of projections for the S&P 500 of 4,000 to 5,000 points (10%), and with 10-year U.S. interest rates below 4%

The outlook of the main investment banks for 2024

In the past two weeks, reports on the financial market outlook for 2024 from the main US banks began to be published and released: JP Morgan, Goldman Sachs, Morgan Stanley, Bank of America and UBS.

Each year, individual investors must make an assessment of the positioning of their investments and this is the right time to do so, based on a balanced view for the current year and the outlook for the next.

In this article, we begin by presenting the main conclusions of a joint analysis of the various opinions, then move on to some further development on the position of each, and conclude the ideas with recommendations regarding investments.

A year ago, we presented the first annual Outlook of the world’s leading investment banks, which on average pointed to the S&P 500 at 4,000 points and interest rates on 10-year US bonds at 3.5%.

At this date, any of these predictions seem difficult to realise.

The first is flawed and the second is excessive, which is even more paradoxical, given the inverse relationship between the two variables.

As usual, these exercises do not consider any changes in exogenous factors, current or potential, including changes in the geopolitical context, in particular the War of Ukraine.

In our opinion, it is interesting and important to consider and monitor the opinion of the big banks regarding the economy and financial markets in general.

On the contrary, we are very critical of the value of your recommendations for individual securities.

In a subsequent article, we will present our economic and financial markets vision and outlook for 2024.

JP Morgan: Considerable slowdown in US GDP growth to 0.7% and earnings per share growth below consensus

JP Morgan forecasts real GDP growth in the US to slow to +0.7% in 2024 due to the persistence of monetary policy effects and little fiscal policy momentum.

The core inflation rate, or PCE, is expected to rise by 2.4% in 2024. down from 3.4% in 2023.

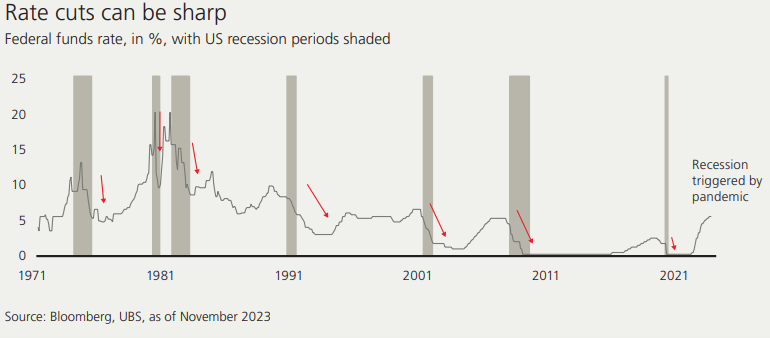

He admits that the Fed should start cutting rates in the 2nd half of 2024, to avoid recession, with inflation close to, but still above target.

It considers that S&P 500 earnings per share (EPS) growth may not meet analysts’ consensus expectations for a rise, ending up flat or down, due to declining producer price indices (PPIs) and slower real U.S. GDP growth next year, even without a recession.

It believes that there is a possibility that EPS revisions could lead to a decrease in price-to-earnings (PER) multiples.

Goldman Sachs: S&P 500 at 4,700 points, based on global economic growth of 2.1%, higher than consensus, and low probability of recession in the US (15%)

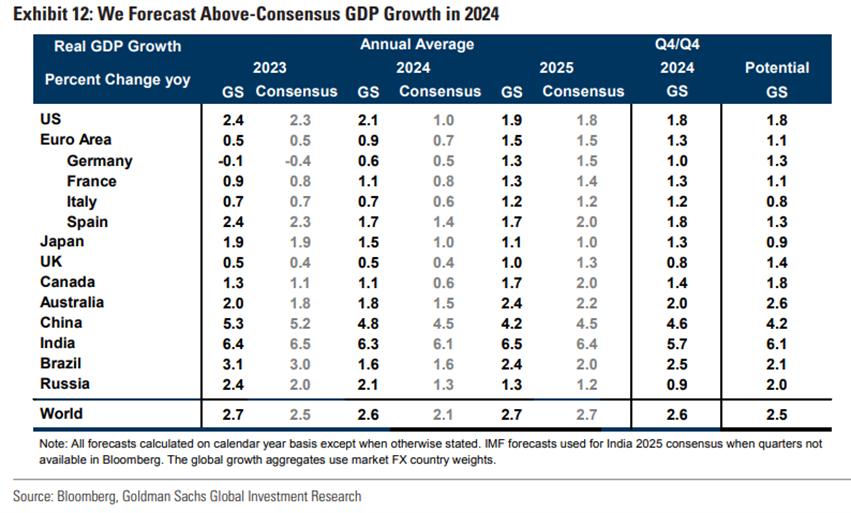

Goldman Sachs expects the global economy to beat expectations in 2024, just as it did in 2023.

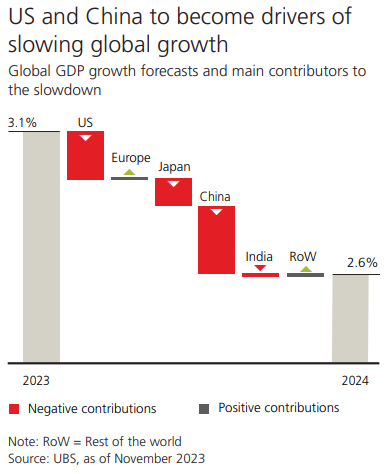

Global GDP is expected to grow 2.6% next year on an average annual basis, compared with the consensus forecast of 2.1%.

This outlook is part of higher growth in the US, which is based on the forecast of a strong increase in disposable income (due to falling inflation and a robust labour market), the expectation that rate hikes have already had their biggest impacts on GDP growth, and the view that manufacturing will recover.

It believes that central banks will have room to cut interest rates if concerns arise about a slowdown in the economy.

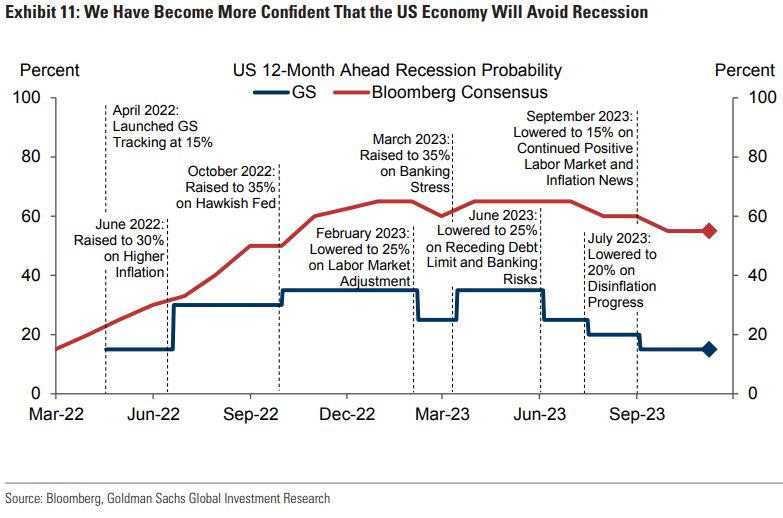

They maintain their view that the probability of a recession in the U.S. is much lower than commonly reported, at just 15% in the next 12 months.

It forecasts that the S&P 500 index is expected to rise to 4,700 points by the end of 2024, representing an appreciation of about 5% and a total return of about 6%, including dividends, with the concentration of gains in the second half of 2024, fueled by the Fed’s interest rate cuts and the resolution of election uncertainty.

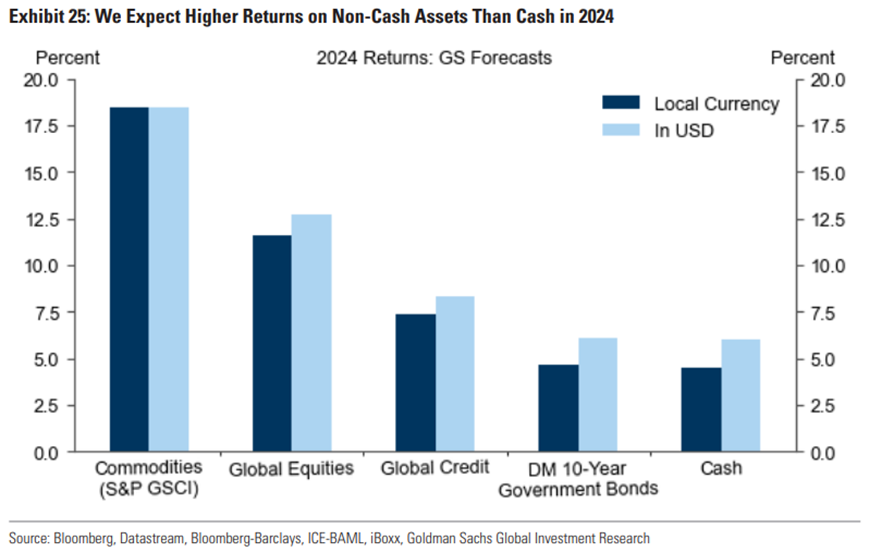

Short-term (“cash”) investments in the U.S., which provide a risk-free return of 5%, will be a competitive alternative to stocks, as three-month treasury bills yield about 5.5%, similar to the earnings growth of the S&P 500 index.

Morgan Stanley: S&P 500 at 4,500 points, with U.S. economic growth slowing to 1.6% and EPS growth of 7%

Morgan Stanley forecasts U.S. GDP growth to slow from an estimated 2.5% this year in Q4 to 1.6% in 2024 and 1.4% in 2025.

This forecast is based on the Fed’s understanding that the Fed’s monetary policy of higher interest rates for longer is increasingly weighing on growth, and especially in 2024, causing growth to be below potential in the coming years.

It also expects US consumption to start decelerating more significantly in 2024 and 2025, as a result of a cooling labour market, lower real disposable income and high interest rates, which puts further pressure on debt servicing costs.

It understands that the official interest rate has peaked at 5.375% for this cycle, remaining until June 2024, when it admits that the Fed will start cutting at a pace of 25 basis points per quarter.

Mike Wilson, the strategist at Morgan Stanley, sees the S&P 500 at 4,500 points at the end of 2024, with U.S. equity earnings growing 7%, mostly through cost reduction.

Meanwhile, earnings will continue to be challenged in the near term due to macroeconomic, geopolitical and cyclical risks.

In the U.S., it favors investments in defensive growth stocks and end-of-cycle cyclicals.

Morgan Stanley expects Japanese equities to continue to perform well in 2024, forecasting TOPIX, Japan’s main stock index, to rise 11% to 2,600 points in 2024 due to a strong forecast for earnings per share growth of 10% in 2024 and 8% in 2025.

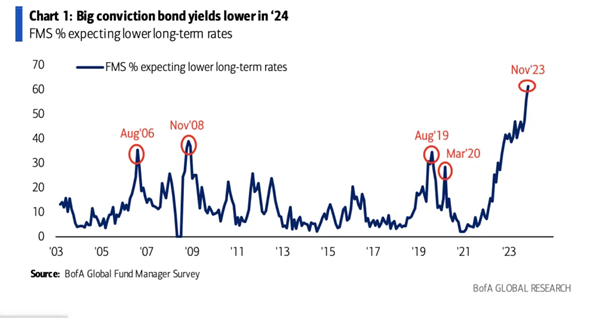

It considers long-term U.S. treasury bonds to be an attractive investment, expecting implied interest rates to reach 3.95% by the end of 2024.

Bank of America: S&P 500 at 5,000 in a stable economy, with EPS growth even as economic growth slows

This more optimistic outlook results from an overall picture of a stable economy, neither hot nor cold, in which profit growth will occur even as economic growth slows.

UBS: New world, with valuations of stocks, and especially bonds, allowing gains to balanced portfolios

He believes that we face a new world – defined by economic uncertainty and geopolitical instability, but also by profound technological changes, leading to three key conclusions for the coming year.

First, it believes that the strength of the US economy in 2023 will give way to slower, though still positive, growth in 2024, while European growth is expected to remain subdued and China enters a “new normal” of lower-quality but potentially higher growth.

Second, it expects central banks to start their rate cutting cycles next year. And finally, politics will play an outsized role in 2024, with the upcoming U.S. elections and ongoing geopolitical tensions and wars.

Third, in the baseline scenario, it expects bonds to appreciate in value over the next year, and that lower bond yields will support equities, as long as they do not coincide with a particularly sharp slowdown in economic growth.

It chooses bonds as the preferred asset class, given the combination of attractive yields and the potential for capital appreciation if interest rate expectations fall.

But it also anticipates a positive performance for stock indices, supported by earnings growth among quality companies.

Overall, he believes that 2024 should be a good year for investors with balanced portfolios, with positive forward-looking returns in equities, bonds and alternative investments.

The conclusions common to the various perspectives of banks are:

Slowing economic growth globally and in all economies, both advanced and emerging, to moderate levels in the U.S., low in Europe, and below average in China and Latin America.

Continued decline in advanced economies towards the 2% target, achievable in 2025 in the US and Europe.

Interest rates on 10-year U.S. treasury bonds will continue to decline and are expected to fall below 4% by the end of 2024, with interest rate cuts by the Fed in the second half of the year, favoring bond and cash investment.

The dollar is expected to remain strong.

The dominant economic theme will be the extent of the impact on economic growth of the monetary policy of high interest rates for a prolonged period in the US, in a context in which Europe is expected to remain anaemic, and China will have to solve the problems with the construction and financial sector and will be able to develop a new model of economic growth.

All banks are positive about investing in government bonds and cash in developed economies, which will benefit from the gradual decline in high interest rates.

Likewise, they all point to the importance of monitoring the evolution of geopolitical risks, fundamentally the war in Ukraine, the elections in the US and the conflict in Gaza.

However, the disparities in opinion are notable in some respects:

In terms of economic growth in the US, JP Morgan and Morgan Stanley consider it to be below 1%, while Goldman Sachs and Bank of America see a level close to 2%, a divergence that focuses on the resilience of household consumption and impact on corporate earnings per share (EPS) growth.

Consequently, the first two banks predict a level of 4,500 for the S&P 500, in line with current quotations, while the second estimate a value close to 5,000 points, an appreciation of up to 10%.

Conclusions and recommendations

These forecasts recommend that investors maintain balanced portfolios by combining investments in well-rated bonds with quality and robust equities.

Considering these forecasts, the recommendations are as follows:

Maintenance of investment allocations in pension plans.

Maintenance of good cash levels, until the central banks foresee the rate cut, rotating to increase exposure to equities, phased, from that time onwards.

Maintaining a higher exposure to long-term US and European government bonds than average, respectively for US and European investors, benefiting from lower high interest rates.

Preference for investments in U.S. and Japanese stocks, combining generalized investments in major indices with the selection of individual securities.