In developed economies, household’s equities investments are related to the level of wealth, the nature of the socio-economic model and the capitalism weight, and the tradition and culture of return and risk of each country

In the US, about 55% of people invest in the stock market

In Europe, in general, the more developed and richer the country, the more their households invest in the stock market

In Japan, households invest little in the stock market

In the US, about 55% of people invest in the stock market

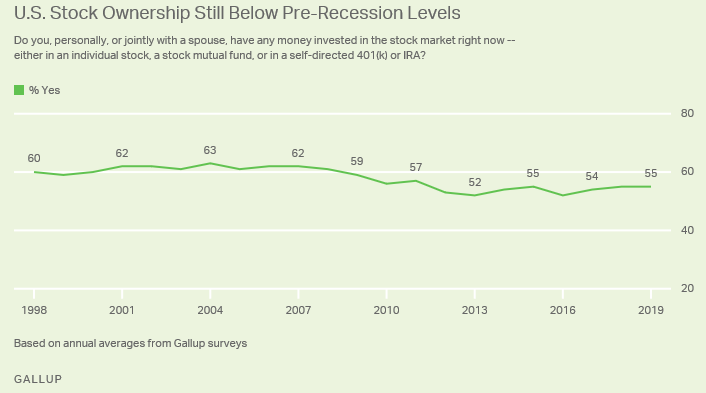

Gallup conducts an annual study on the percentage of US people investing in the stock market with the following results:

Currently 55% of Americans have investments in the stock market, whether in individual stocks, via investment funds or through their individual pension plans.

This percentage has remained stable since the end of the 2007-2008 financial crisis but is below the previous 60% to 63% levels.

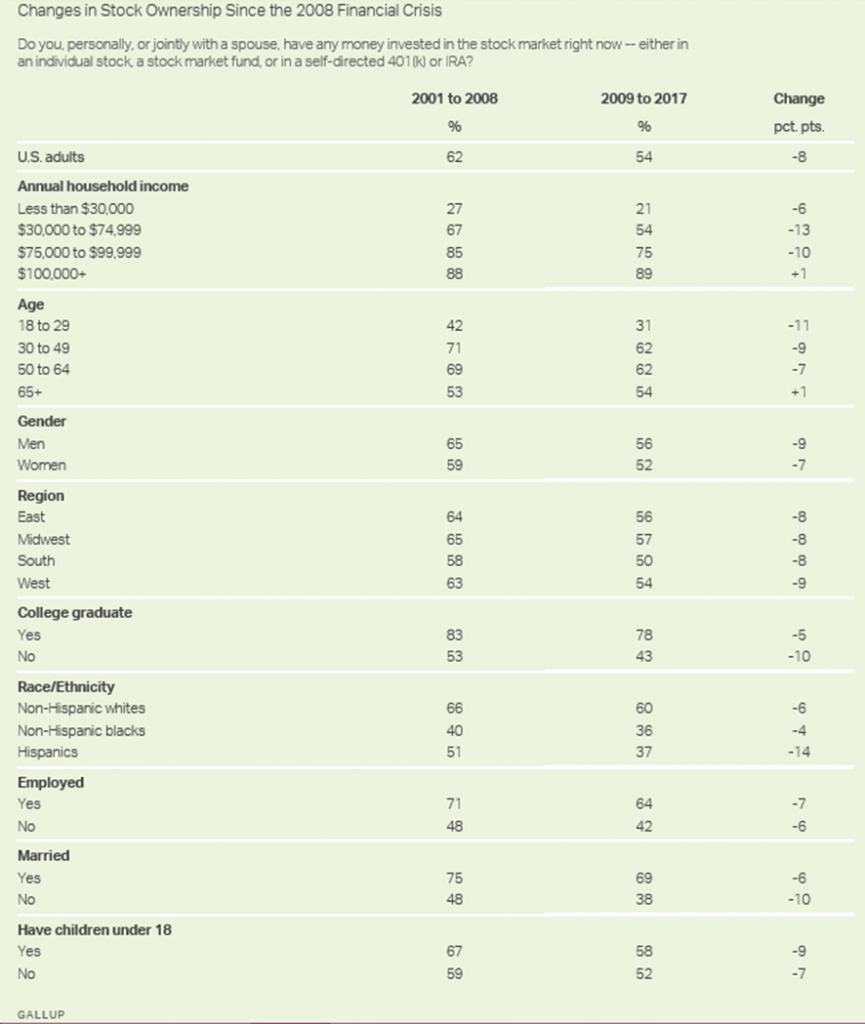

The households that invest the most in the stock markets are the ones with the highest incomes, namely that percentage rises to 89% for households with annual incomes in excess of $100,000, which contrasts with only 21% of households with annual incomes up to $30,000.

In terms of age, households between 30 and 64 years participate in the stock market in 64%, contrasting with only 31% for households up to 29 years of age.

Regarding education, 78% of households with college education invest in the stock market, but only 43% of households without college do so.

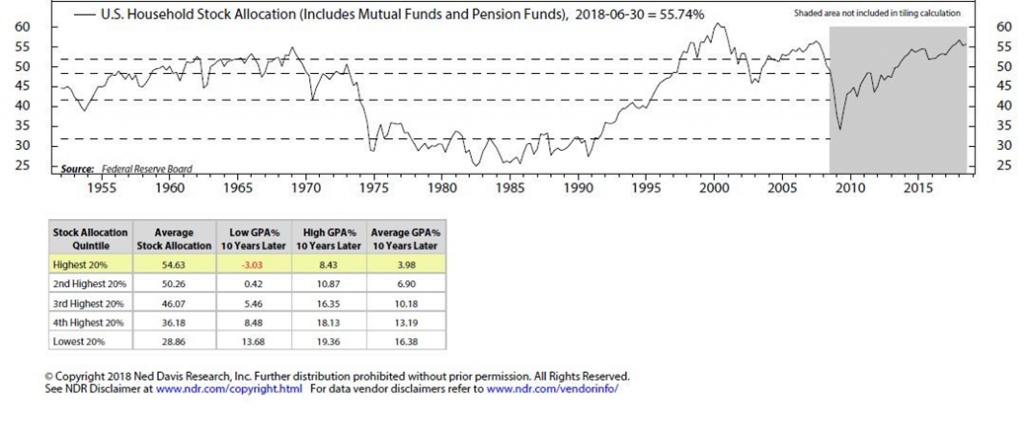

If we go further back, we see greater fluctuations in the participation of US households in the stock markets:

Already in 1950, 45% of households invested in the stock markets, a percentage that rose to more than 50% in 1955 and remained there until the oil shock crisis of 1973-74, in which this figure fell to minimum levels between 25% and 30%.

The boom of the early 1990s caused more households to invest in the market, raising their share up to 60% at the peak of the 2000 tech bubble, falling to 45% in the following years.

This fall was even more pronounced with the sub-prime financial crisis of 2007 in which household participation fell from 55% to 35% and has since risen to the current 55% level.

This data means that most US households have had investments in stock markets for long, a mix of their organization’s tradition and culture and socio-economic structure.

In Europe, in general, the more developed and richer the country, the more their households invest in the stock market

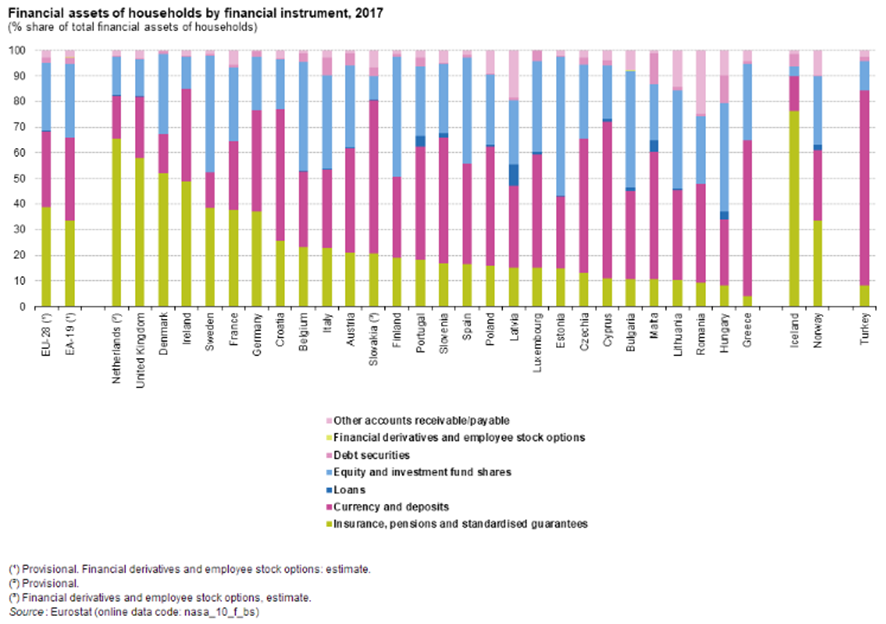

In Europe as a whole, there are no studies of the same kind. The existing data refer to the composition in terms of financial instruments of the total financial assets.

The conclusions are not straight-forward because the component of insurance, pensions and standardised guarantees that are particularly important in some countries are elements that hinder comparability.

Countries where these insurance and pension plans are very advanced, such as the Netherlands, the United Kingdom, Denmark, Ireland, Sweden, France and Germany, naturally have a great deal of weight in the composition of these financial instruments by households.

Typically, these insurance and pensions funds have balance of financial investments, stocks, and bonds.

In addition, we see that the countries where households have the greatest weight in investments in the stock markets are Denmark, Sweden, France, Belgium, Italy, Finland, Spain, and Luxembourg.

Portugal is one of the countries where households have the most cash or monetary placements, as currency and bank deposits, along with Slovakia, Slovenia, Poland, Croatia, Cyprus, Malta, Greece, and Turkey.

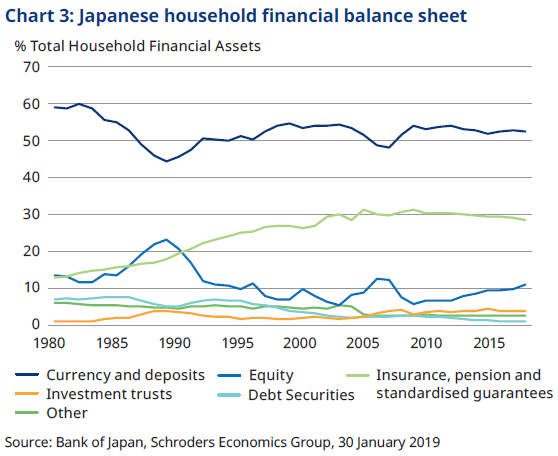

In Japan, households invest little in the stock market

Japan the reality is quite different.

The share of wealth that Japanese households invest in the stock market is extremely low, barely exceeding 10%. It was only higher in the boom period of its stock market between 1985 and 1990, having since fallen in line with the market crisis.