The ING International Survey promotes an understanding of how people around the world spend, save, invest, and feel about money.

This report is the result of one of the most comprehensive and in-depth surveys ever conducted in various geographies around the world.

It covers a total of 15 countries: Austria, Belgium, Czech Republic, France, Germany, Italy, Luxembourg, Netherlands, Poland, Romania, Spain, Turkey, UK, USA, Australia

On average, 1,000 people were surveyed in each country, with the exception of Luxembourg, with 500.

The total sample size of this report 14,695 is of respondents (2,747 retired; 11,948 non-retired).

This online survey was conducted by Ipsos from 17 October to 2 November 2018.

European consumer figures are a weighted average to take into account the population of the countries.

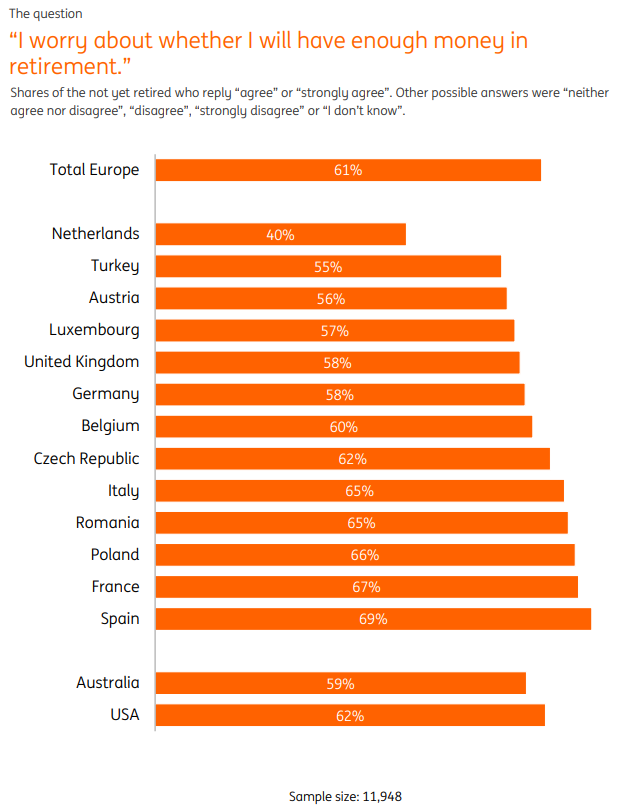

61% of Europeans who have not yet retired are concerned about the lack of money in retirement.

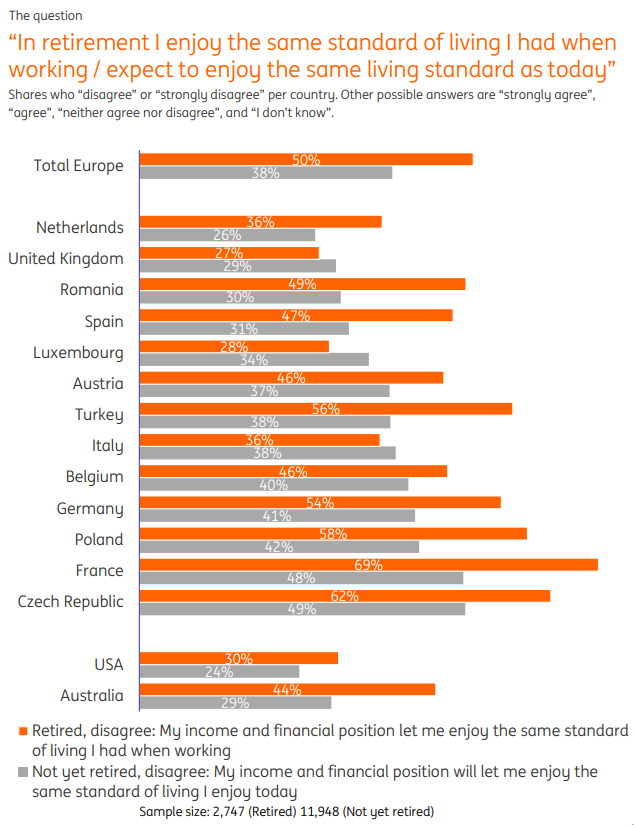

Almost two out of five Europeans who have not yet retired say they do not expect to have the same standard of living when they retire as they do today.

Half of the people who have already retired confirm that they do not have the same standard of living as they had when they worked.

More than one in four (27%) people in Europe tell us that their families do not have funds set aside for retirement.

This is the case of the 13% resident in Luxembourg, which is the lowest percentage in Europe.

Without savings, households and individuals exert less control over their lives – both now and in the future.

Decision-making can be restricted, reducing opportunities throughout life.

For example, people with no savings typically have less choice of where to live, what health care they can afford, and what training or education they or their children can receive.

Access here: