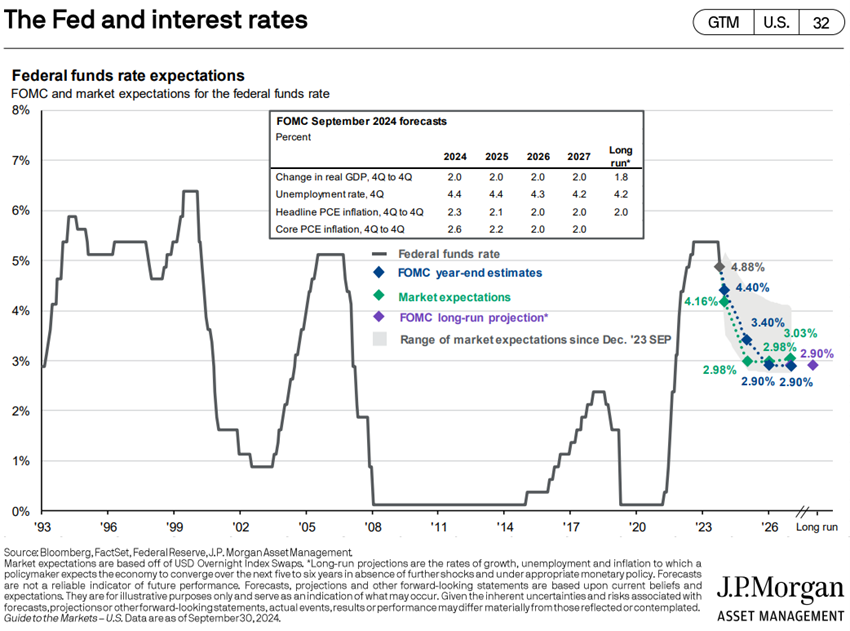

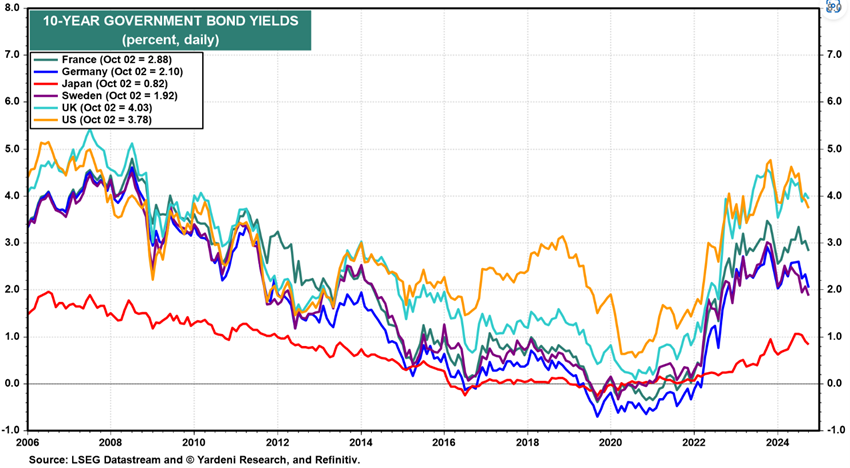

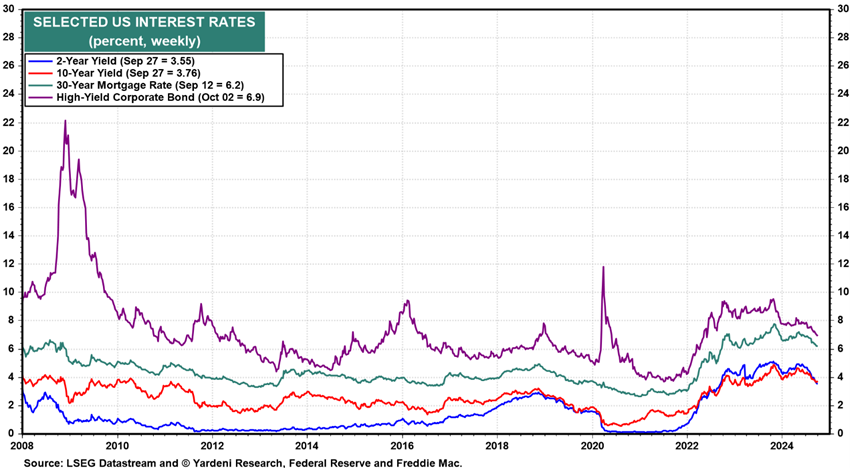

After two years of hiking, the Fed began to lower interest rates, following the ECB.

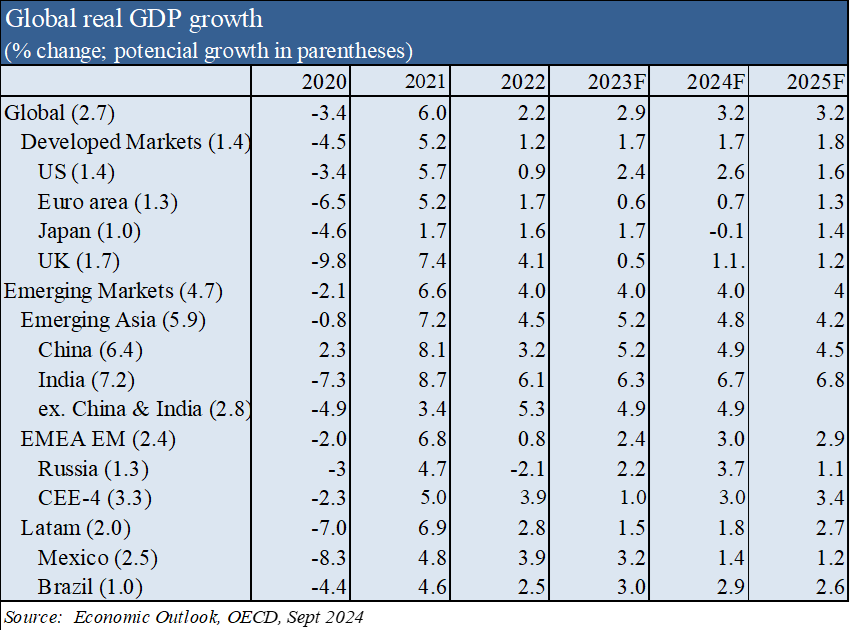

The most recent indicators of US economic growth have shown some decline. Europe remains practically stagnant and China is below the authorities’ forecasts.

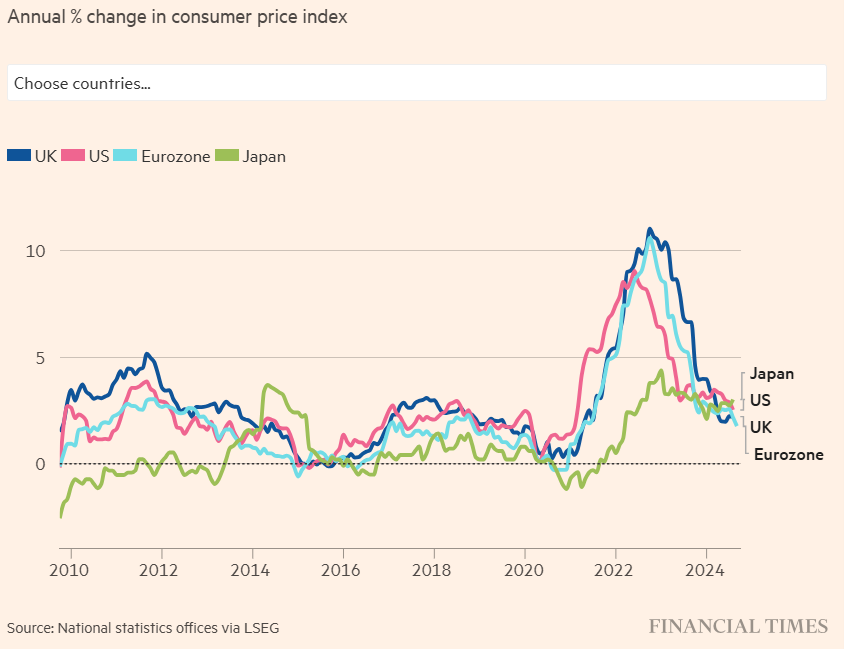

Inflation continues to fall in the US and Eurozone, and is already below 2% in some European countries.

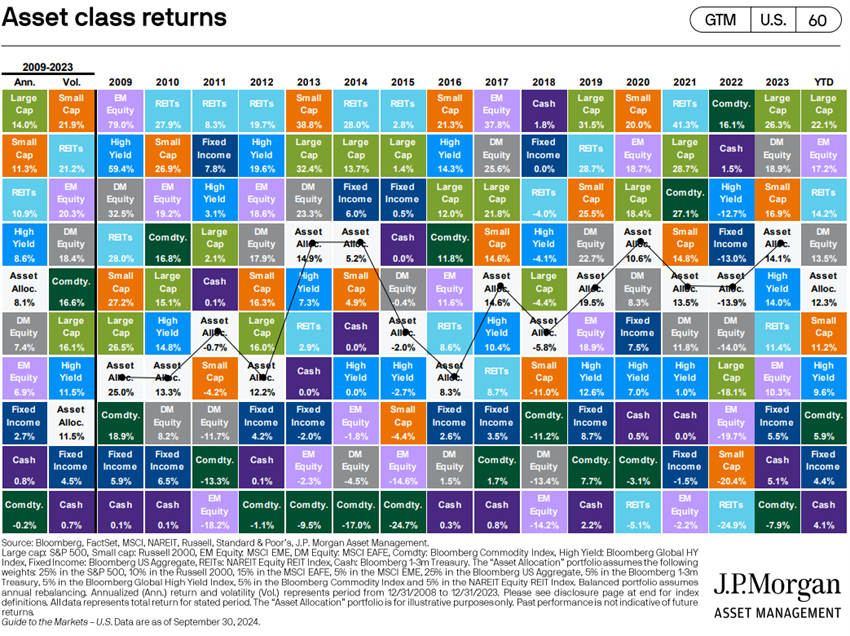

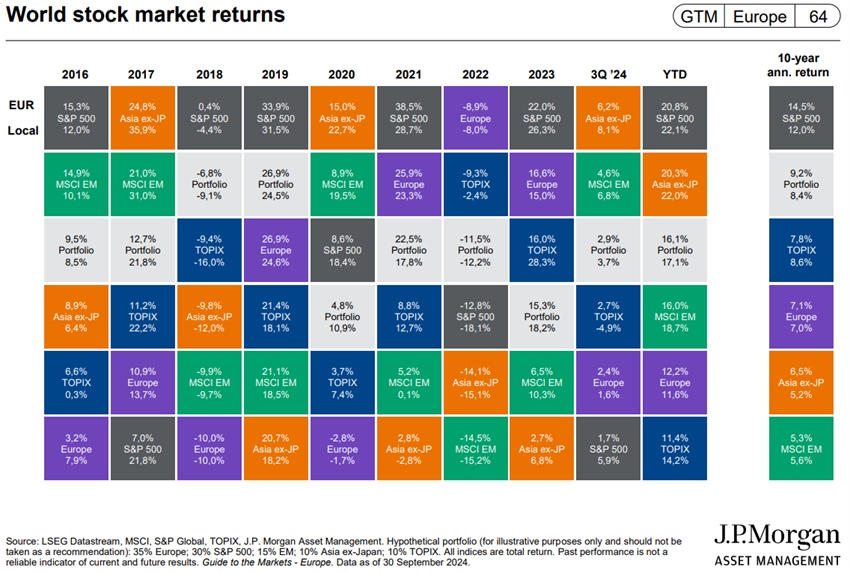

The US, European and Japanese stock indices are at peak levels, with a wide dispersion in performance across sectors and individual securities.

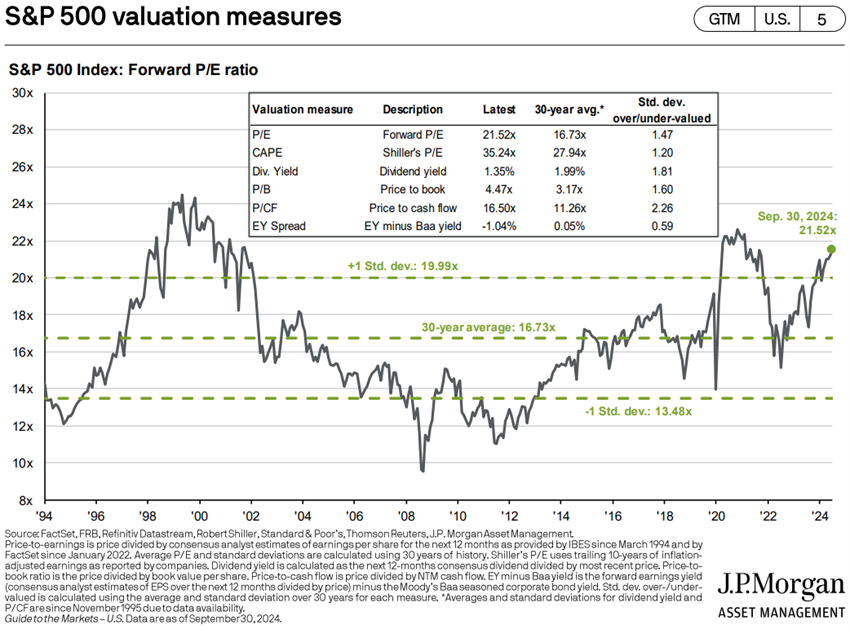

Stock market valuations are above the historical average, especially in the US.

In this context, the focus is on lower interest rates, market valuations, earnings per share growth and fund flows.

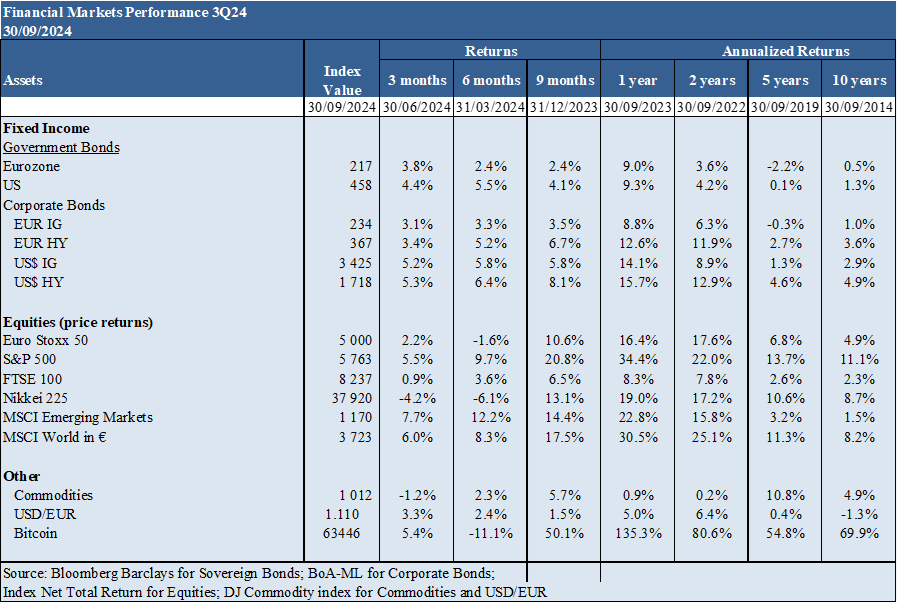

Performance 3Q24 Markets: Overall, equity markets saw a slight uptick in the quarter, with plenty of volatility in early August. Long-term treasury bond interest rates in the US and Europe decrease in line with the fall in inflation, positively influencing bond performance.

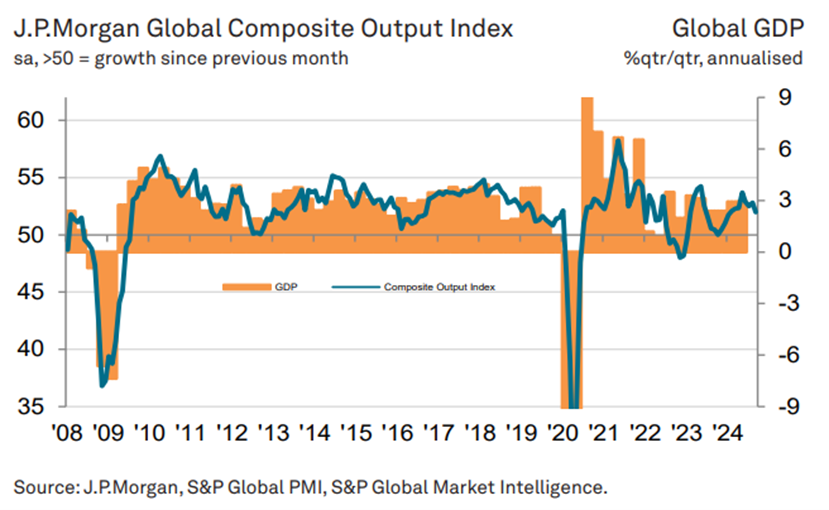

Macro Context: Overall economic growth levels are below average. The U.S. is beginning to show some signs of lower growth, and Europe remains virtually stagnant. The problems in China continue to worsen, which led the authorities to launch a strong stimulus program at the end of September, with a magnitude similar to that of Covid. Inflation in the US and Europe continues to fall.

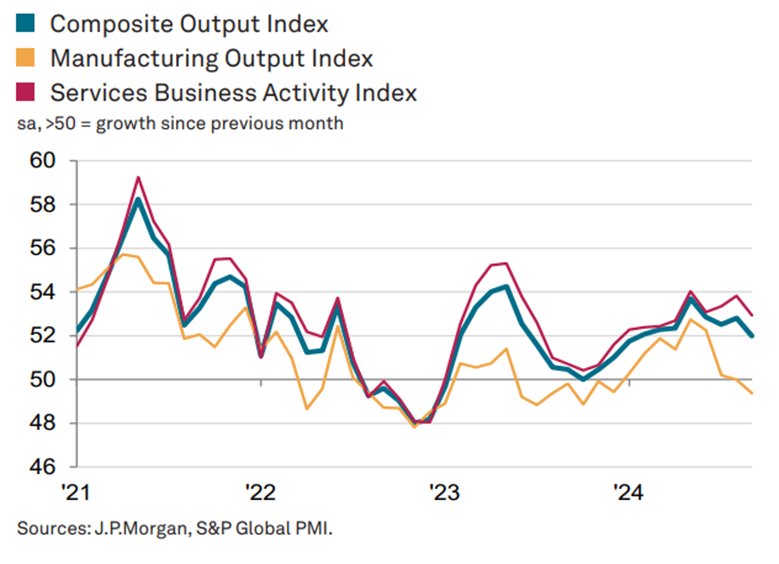

Micro Context: The main instant and advanced economic indicators show a slight decline almost everywhere in the world.

Economic policies: After 2 years of raising official interest rates, the Fed started the cut movement, by 0.5% in September, following the ECB’s decreases of 0.25% each in June and September.

Equity markets: US equity markets at peak levels, having fully recovered from the sharp fall of early August. The Japanese and Eurozone markets also recorded small increases.

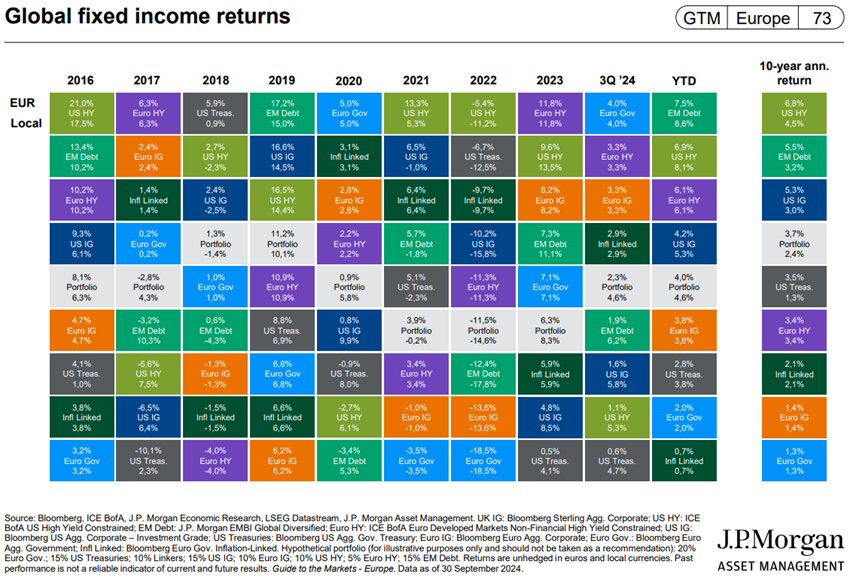

Bond markets: US and European bonds of medium and long-term and good rating appreciated in line with the fall in interest rates. Credit spreads remain at historically low levels.

Key opportunities: Better-than-expected earnings and guidance performance in earnings and inflation decline.

Main risks: Spread of the Israel-Palestine conflict to Lebanon and eventually to Iran, spreading to the Middle East region. Instability caused by the uncertainty of the US elections .

Falling inflation and long-term interest rates in Western countries favor investments in equities, as well as bonds, especially in the US, where growth has been less affected.

4Q24 financial markets performance: Overall, equity markets saw a slight increase in the quarter, with a lot of volatility in early August. Long-term treasury bond interest rates in the US and Europe decrease in line with the fall in inflation, positively influencing bond performance.

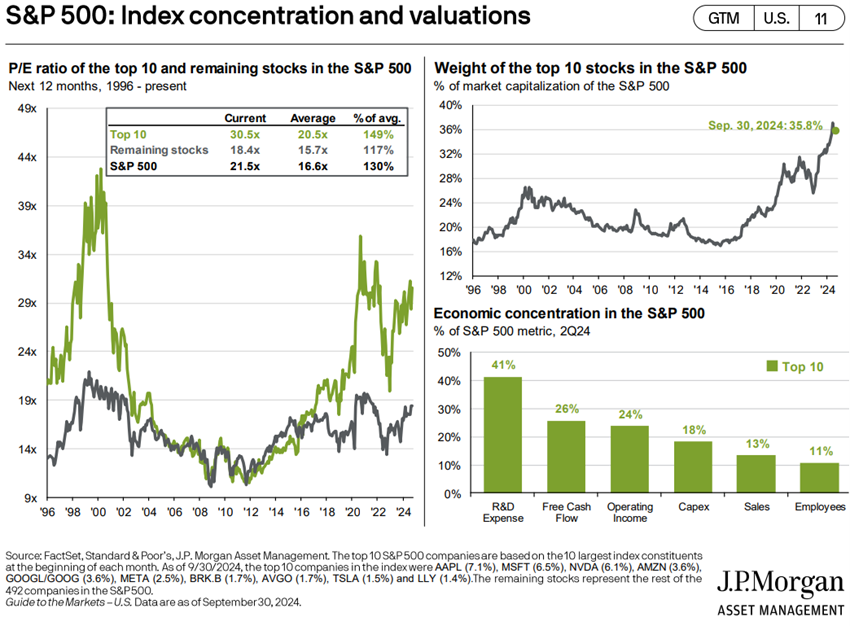

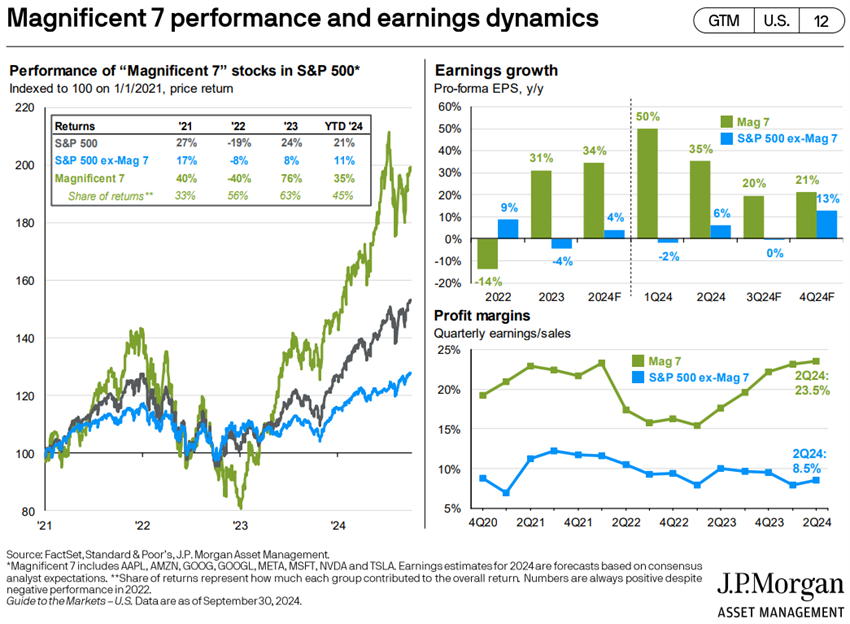

The main North American and European stock indexes reach new highs, with high sectoral and individual concentration.

Western bond markets are performing well, appreciating as a result of falling interest rates.

Bitcoin appreciated to $63,000.

Macroeconomic context: Overall economic growth levels are below average. The U.S. is beginning to show some signs of lower growth, and Europe remains virtually stagnant. The problems in China continue to worsen, which led the authorities to launch a strong stimulus program at the end of September, with a magnitude similar to that of Covid. Inflation in the US and Europe continues to fall.

Stabilization of global economic growth forecasts to 3.2% in 2024 and 2025, with 2.6% and 1.6% in the US, 0.7% and 1.3% in the Eurozone, 4.9% and 4.5% in China, respectively, but below the long-term average.

The US continues to beat economic growth estimates, while Europe maintains weak growth.

Inflation in the US fell again to 2.5% in August.

Eurozone inflation was 1.8% in September.

The economic and financial problems of recent years continue to hamper Chinese economic growth, and the authorities launched a strong stimulus program at the end of September, only comparable to that of Covid.

In essence, global growth remains stable, having slowed down for three consecutive years.

Inflation has been reduced to the lowest level in the last three years.

Financial conditions have improved.

In short, the world economy seems to be in the final stages for a soft landing.

The Draghi report on Europe’s competitiveness vis-à-vis the US and China was published in September, the findings of which show a huge gap due to the loss of innovation. They point out as major challenges greater integration, less regulation, correction of the energy deficit, less dependence on rare metals and greater development of the defense industry.

Microeconomic context: The main instant and advanced economic indicators show a slight decline almost everywhere in the world.

J.P. Morgan’s global composite PMI production index stood at 52.9 in June, versus 53.9 in May, signaling expansion in eight consecutive months, in industry and services, closing the semester with solid levels.

Of the 14 countries with available data from the manufacturing and services PMI, 11 recorded expansions in June.

The unemployment rate in the US is at 4.0%, levels close to the lows.

Economic policies: The ECB cut official rates in June by 0.25%, while the US admits 1-2 cuts only for the end of the year

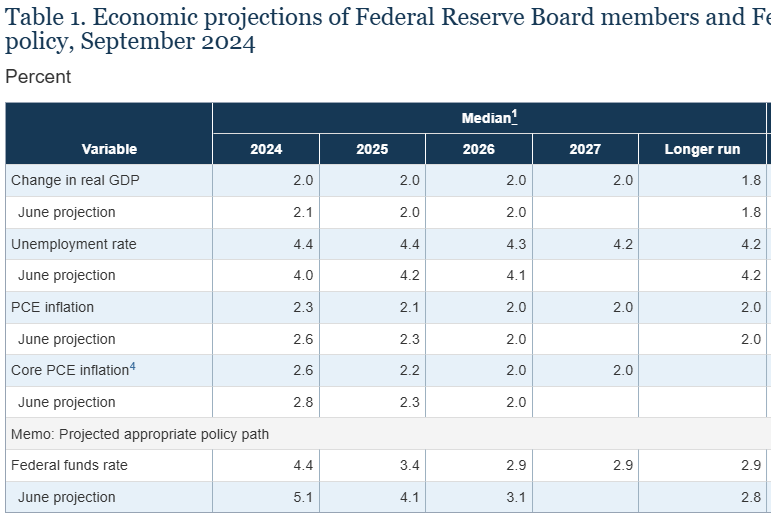

The Fed cut official interest rates by 0.50% to the level of %-5,0% in September, following the ECB’s cuts of 0.25% each in June and September to 3.75-4.0.%-4,0%

The Fed’s projections point to the decision of this rate from the current 4.83% to 4.4% in 2024, 3.4% in 2025, and 2.9% in 2026. The Fed maintained its projections of its preferred measure of inflation – the private consumption price index (PCE) – to 2.6% in 2024, 2.2% in 2025 and 2% in 2026.

The ECB forecasts inflation of 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026.

The Bank of England has reduced the official interest rate to 5.0%.

Assessment of the stock markets: US stock markets at peak levels, having fully recovered the sharp fall of early August. The Japanese and Eurozone markets also recorded small increases.

The US stock market is at peak levels, with the S&P 500 closing the first 9 months with a gain of 21%, driven and very concentrated in mega capitalizations.

The other stock markets also advanced slightly in the quarter.

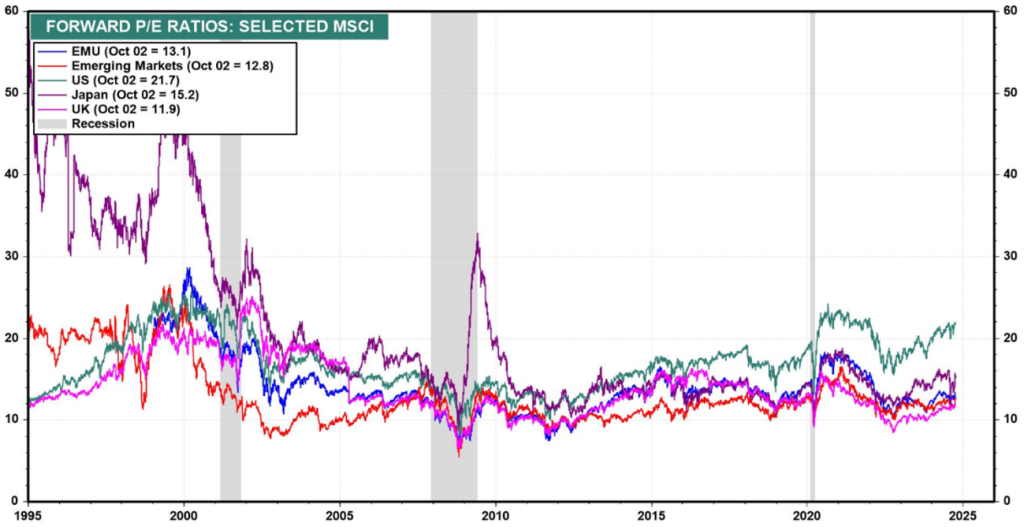

The 21.5x forward PER for the US is above the long-term average, dropping to 18.0x without the 10 Mega Caps.

Japan’s PER of 15.2x is also above average.

The PER of the other regions fell slightly to 13.1x in the Eurozone, 11.9x in the UK and 12.8x in emerging markets, all below the historical average.

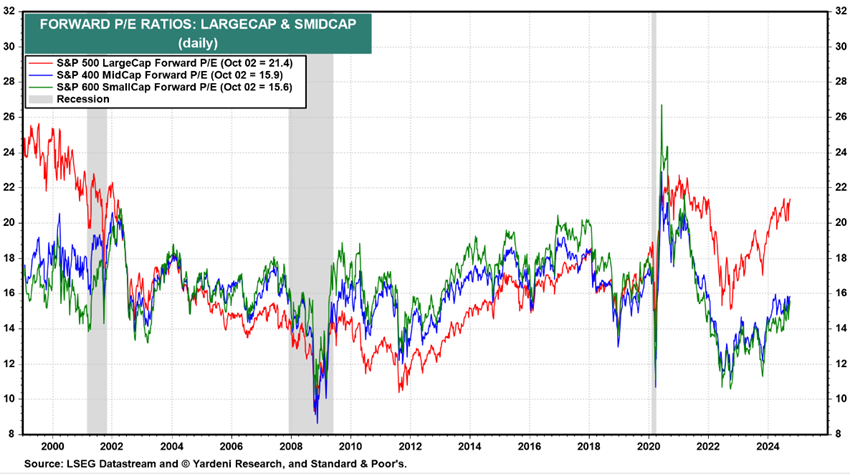

The PER of mid- and small-cap U.S. stocks are both at 15.9x to 15.6x, below the long-term average.

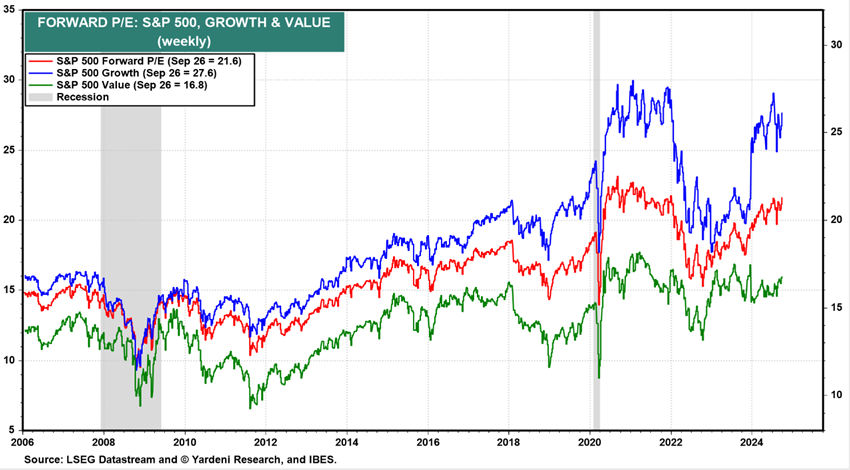

The PER of growth US stocks is at 27.6x and that of value stocks is at 16.8x.

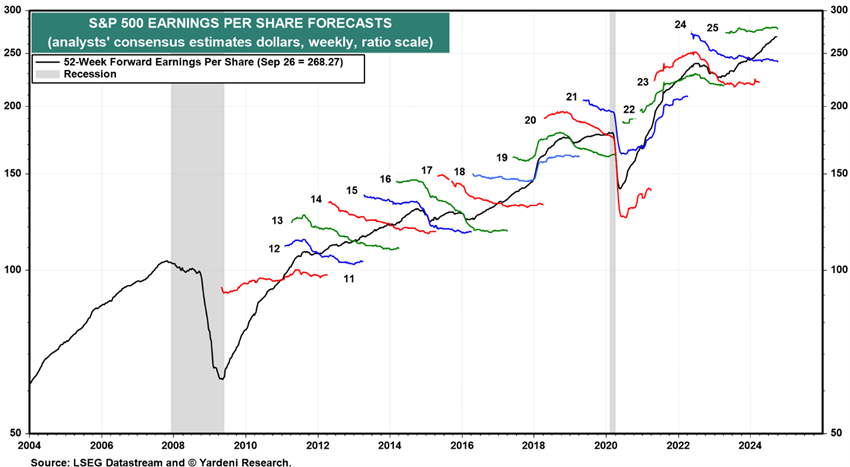

Analysts predict earnings growth for S&P companies of 10.0% in 2024 and 15.2% in 2025.

The North American market continues to be moderately attractive despite high valuation multiples due to the expectation of growth in annual results. The earnings season that starts on October 10 and lasts for 3 weeks will be a good indicator.

Europe has weak growth and greater geopolitical risk, due to the war in Ukraine and the elections in France and England, while China struggles with the exhaustion of the development model, which benefits India as one of the main bets of emerging markets.

https://www.ii.co.uk/investing-with-ii/international-investing/us-earnings-season

Bond market assessment: Medium- and long-term US and European bonds with good ratings appreciated in line with the fall in interest rates. Credit spreads remain at historically low levels

Long-term risk-free interest rates have fallen by 0.5% in the United States and 0.4% in the Eurozone since the beginning of the year, boosting bonds.

Credit spreads in the U.S. and Europe remained stable.

The reduction in official interest rates by the Fed and the ECB, in line with inflation, is having the expected positive impact on bonds.

With long interest rates well above the average of the last 15 years, and the downward trend in these rates, investment quality bonds trade at interesting levels in the medium and long term, especially in the US.

Main opportunities: Better-than-expected performance of the earnings season in the US, in terms of earnings and guidance, and a sharper than anticipated reduction in inflation.

With equity markets trading at historically high levels, the next gains will result from an improved earnings season performance, or a sharper decline in inflation.

Any of these movements will reinforce the movement of asset rotation from liquidity to the stock market.

The fall in interest rates will continue to value long bonds with good credit risk.

Main risks: Spread of the Israel-Palestine conflict to Lebanon and eventually to Iran, spreading to the Middle East region. Instability caused by the uncertainty of the US elections.

The polls of the US elections to be held in November show a technical tie and this uncertainty introduces instability in the markets.