What are hedge funds, how they have grown and what are their returns

Hedge funds, also known as absolute return funds, are alternative investments, less regulated, accessible to qualified investors and investing in financial markets using proprietary strategies

Hedge funds, also known as absolute return funds, are alternative investments that mobilize investment capital in financial markets and pursue different management strategies to seek independent and market-superior returns for their investors.

Hedge funds can be managed aggressively and/or use derivatives and leverage by investing in national and international markets.

Absolute return funds are generally only accessible to qualified investors as they require less regulation from market supervisors than other funds.

In terms of legal structure, hedge funds are most often created as limited liability private investment companies that are open to a limited number of qualified investors and require a large initial minimum investment.

Investments in hedge funds are illiquid, as they often require investors to keep their money in the fund for at least a year, a period known as the lockout period. Withdrawal of funds can also only occur at certain intervals, for example quarterly or every six months.

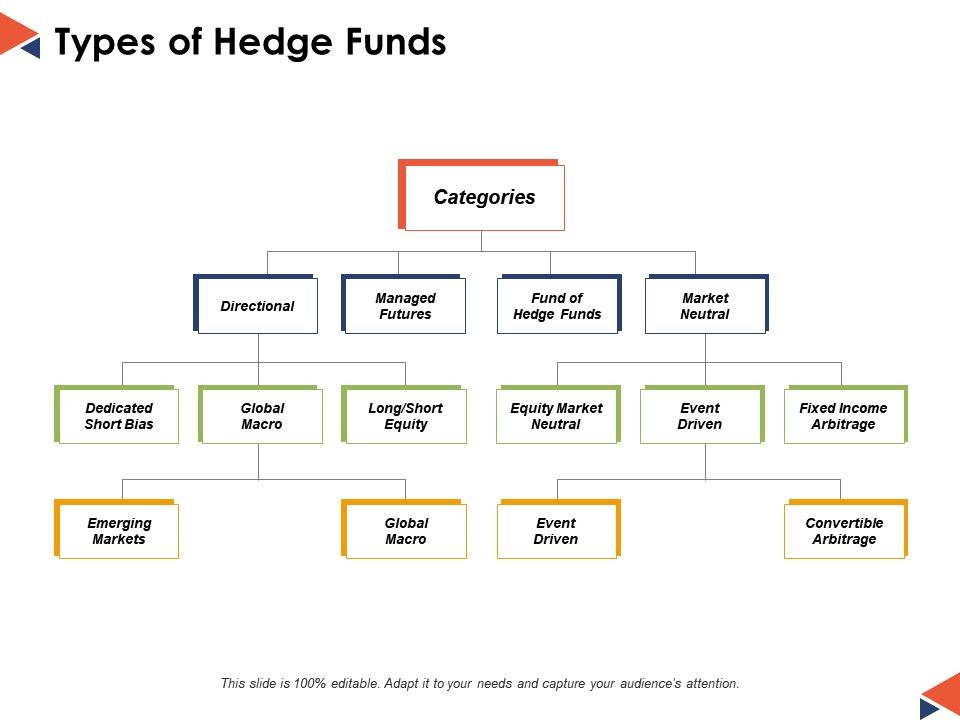

Hedge funds use different investment strategies and are therefore often classified according to the investment style. There is a substantial diversity in risk attributes and investments between styles.

Hedge funds emerged in the 1970s, developed in the 1990s, grew exponentially between 2001 and 2007, fell sharply in the Great Financial Crises, and since 2012 have grown more moderately, evidencing a process of natural selection of the best

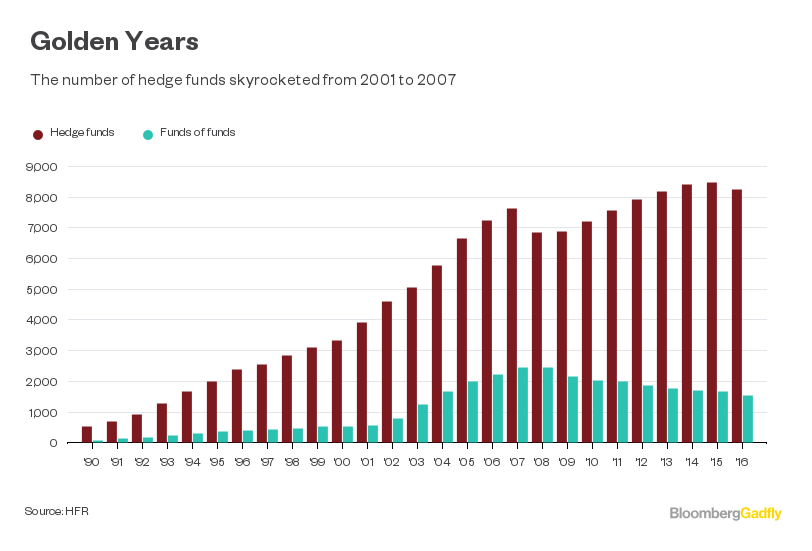

The first hedge funds emerged in the 1970s and had the following evolution between 1990 and 2016:

Hedge funds developed in the 1990s, grew significantly between 2001 and 2007, and have stabilized or regressed since then. The same was true of hedge fund of funds, which are investment funds that invest in hedge funds.

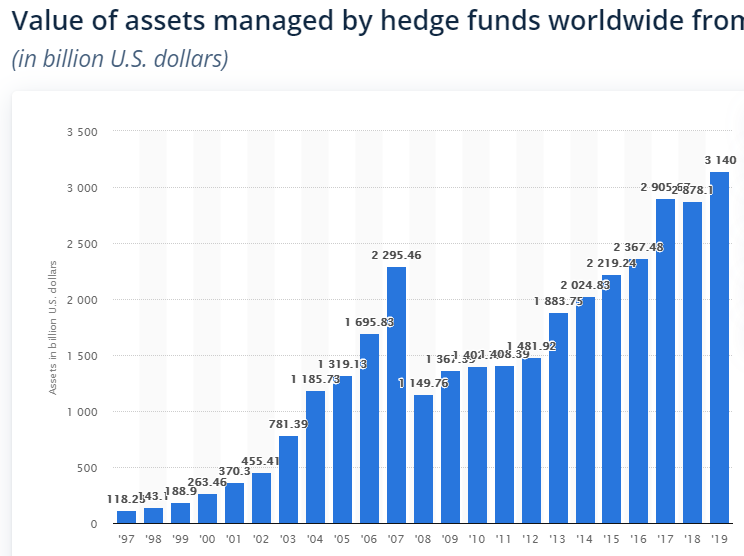

In terms of assets under management, developments were as follows:

The hedge funds industry accounted for more than $3.1 trillion of total assets under management in 2020. The growth of these assets was almost exponential between 1997 and 2007, when it suffered a major setback and the assets halved, starting a more gradual rise from 2012.

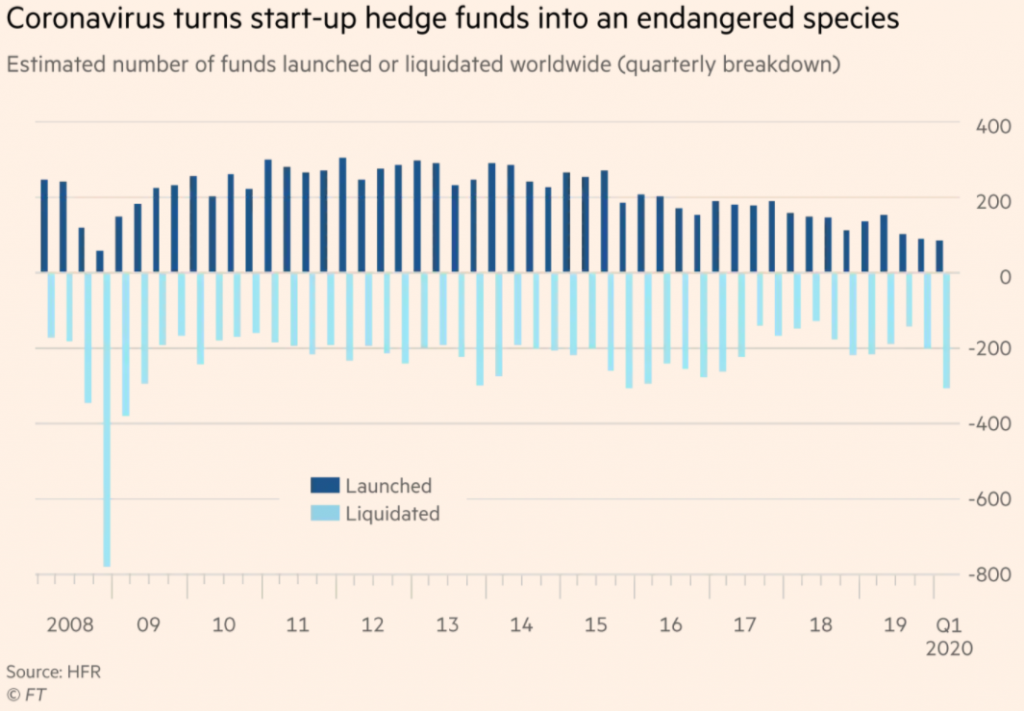

The following graph shows the evolution of new hedge funds created versus those settled between 2008 and 2020:

We see that in the beginning of this period there were more new hedge funds than liquidated ones, but more recently the balance began to become negative.

After showing a better performance in the 1990s and during the major crises of 2000 and 2008, hedge funds have had lower average annual returns than the equity and bond markets, especially since 2009

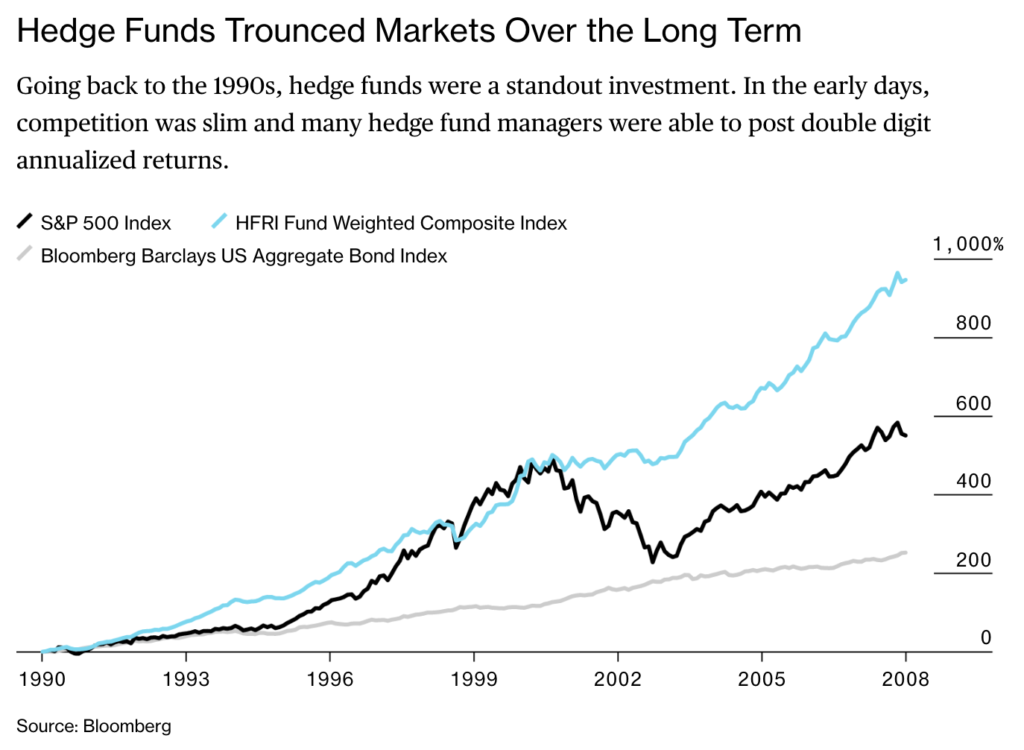

The following graph shows that hedge funds had significantly higher returns than equity markets in the 1990s and during the 2000-2003 crisis:

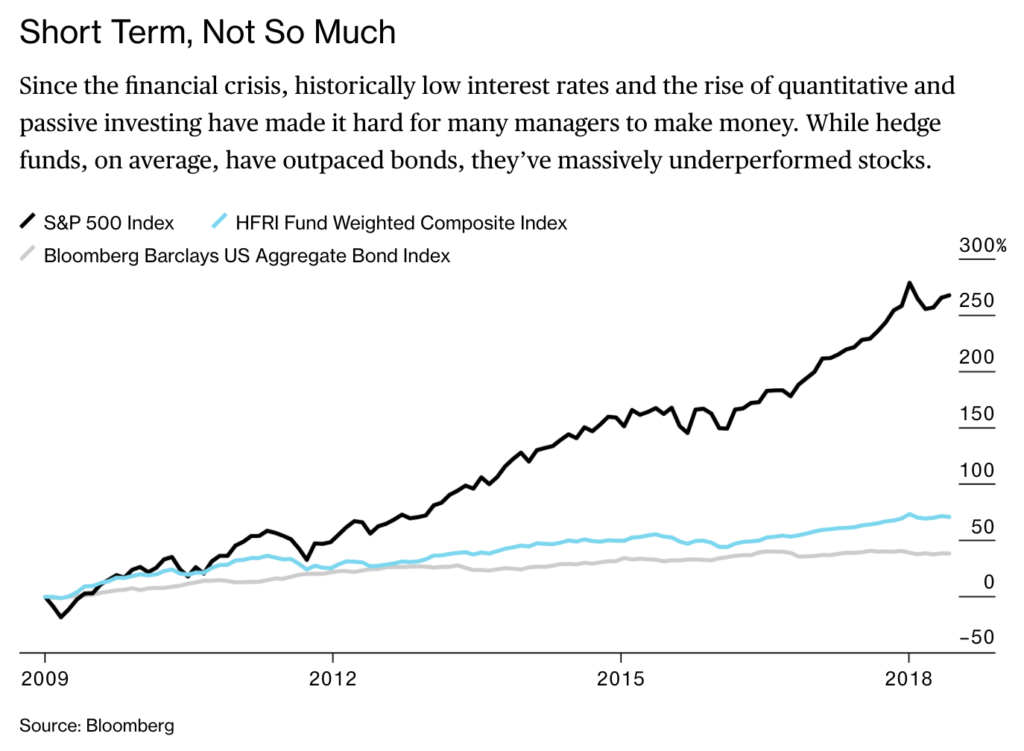

However, since 2009, returns have been much lower than those of the stock market:

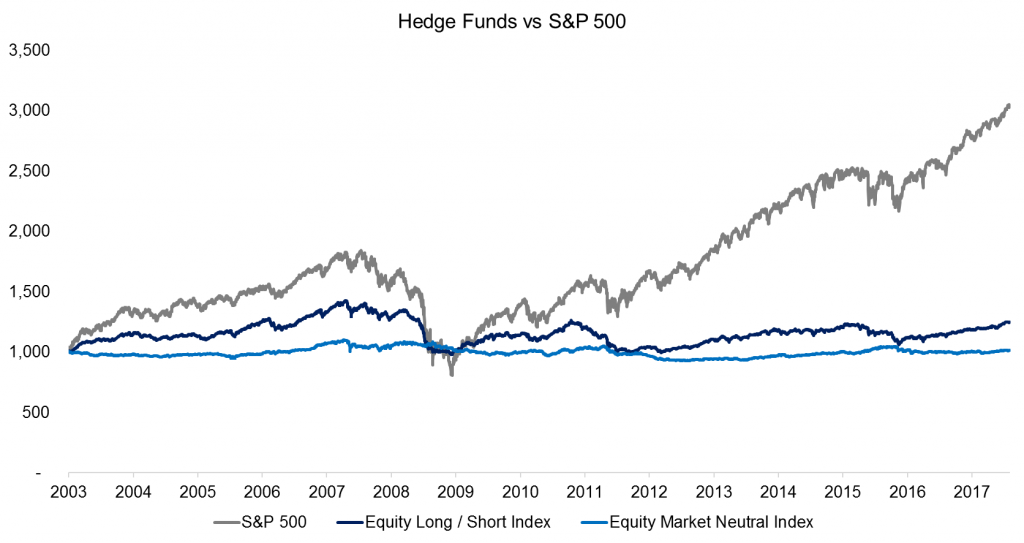

The following chart shows the performance of an investment of 1,000 in two of the most common hedge fund types compared to the S&P 500 between 2003 and 2017:

We see that while investment in the S&P 500 has generated accumulated capital of more than $3,000, investment in both types of hedge funds has little surpassed the capital invested in these 15 years.

The following table shows the annual returns of hedge funds investment (given by its overall index which is a composite of the returns of the various strategies weighted by the respective assets under management), compared with those of other investments, in the period between 1998 and 2016, and in two subperiods, until 2003 and afterwards:

In the 18-year period, the annual return of hedge funds was 4.5%, lower than the returns of any of the investments compared, whether in the equity markets (S&P 500 and MSCI ACWI ex-US), in the bond markets (Bloomberg Aggregate Barclays Bond Bond Index), or a combination of 60% in the equity markets (S&P 500) and 40% in bond markets.

However, the reality is distinct when we analyse the subperiods. Between 1998 and 2003, hedge funds far outperformed the returns of any of the other investments, and in the following 12 years, between 2004 and 2016, they were largely surpassed by the returns of those investments.

The following chart shows yet another comparison of the annual returns of hedge funds with that of the S&P between 1995 and 2019, marking in blue the years when hedge funds had better annual returns, and in orange the years in which the S&P 500 was better:

Just by looking at the colours it is clear that hedge funds have performed better in the past, especially until the year 2000, and that since then the S&P 500 has been the best option. If we look more closely, we see that hedge funds were more useful in times of recessions, particularly in 2000 and 2007.

The graphs above show that hedge funds are more interesting in times of market crisis and less attractive during positive cycles.

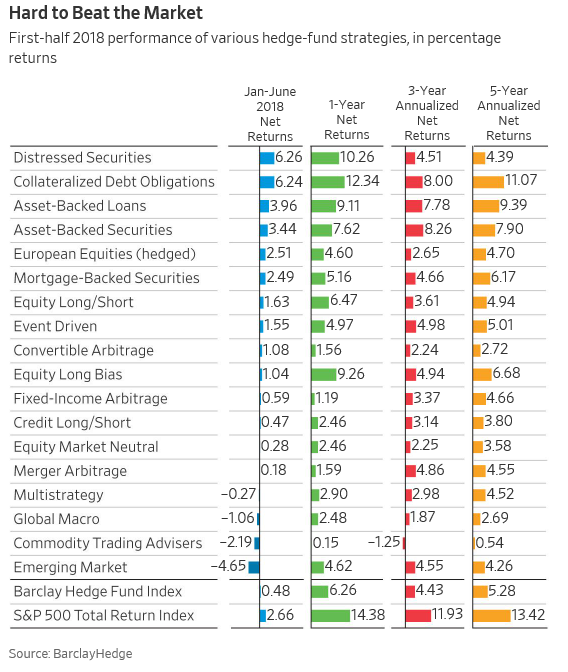

The following chart shows the returns of the various hedge fund strategies in 2018, and in the previous 3 and 5, again compared to investment in the S&P 500:

During these periods, investment in the S&P 500 not only beat the overall Barclays Hedge Fund Index, but also beat any of the investment strategies used.

This evolution of returns had obvious implications for the evolution of assets under management and especially the number of hedge funds in activity.