The Nasdaq 100 Index (and the Nasdaq Composite)

Long historical performance and the last years of the Nasdaq 100 index

Comparison of the Nasdaq 100 with the S&P 500 and the DJIA 30

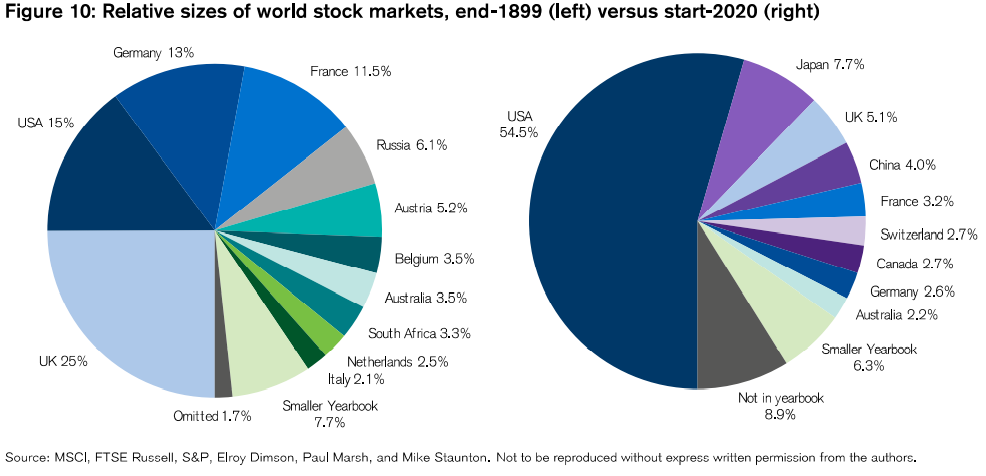

Remember the US accounts for more than 50% of the world’s stock markets:

The Nasdaq 100 is one of the three most relevant indices in the US stock market, a benchmark of the global stock market in terms of the most modern and innovative sectors and companies

The Nasdaq 100 is one of the three most relevant indices in the US stock market, alongside the S&P 500 and DJIA 30, and a global benchmark.

It has a strong pleading of modern economy, innovation, the present and the future, due to its heavy weight of technology companies.

The Nasdaq 100 Index and the Nasdaq Composite)

The Nasdaq 100 index is made up of the 100 largest US companies most actively traded on the Nasdaq stock exchange.

The index includes companies from various industries, with the exception of the financial industry, such as commercial and investment banks. These non-financial sectors include retail, biotechnology, industry, technology, healthcare, among others.

The index is a modified capital methodology. This method uses individual weights of the shares of the companies included according to their market capitalization. A restrictive weighting that limits the influence of the largest companies and balances the index with all members. To do this, Nasdaq reviews the composition of the index each quarter and weights if distribution requirements are not met foremen

The current market capitalization of the Nasdaq 100 is over $10 trillion.

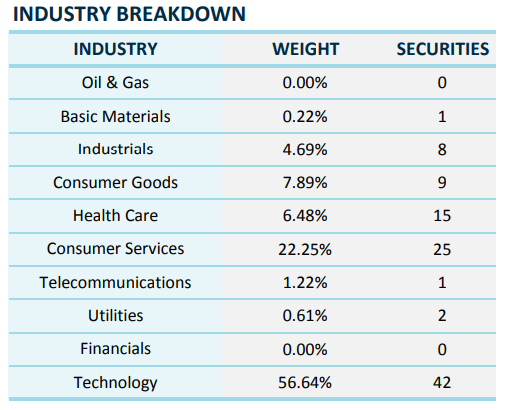

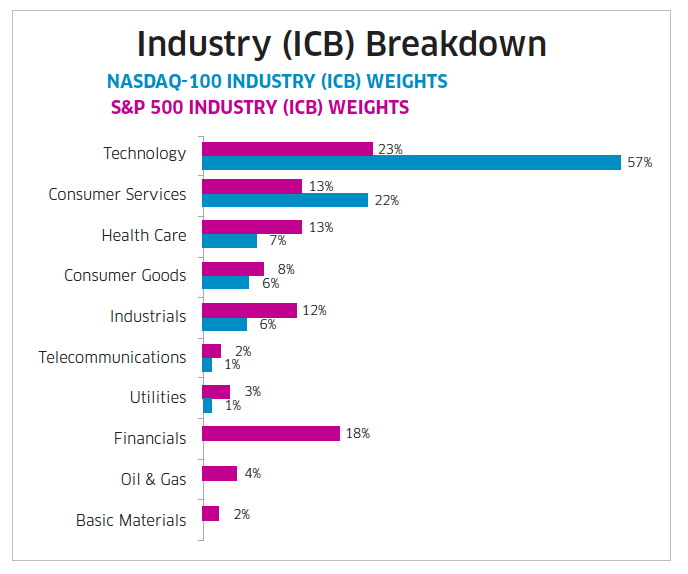

Its sectoral composition is as follows:

The largest sector is technology with 57%, followed by consumer services with 22%, consumer goods with 8%, biotechnology with 7%, and industry with 5%. Note the absence of the financial and energy sectors, with 0% each, and the derisory expression of public goods and raw materials.

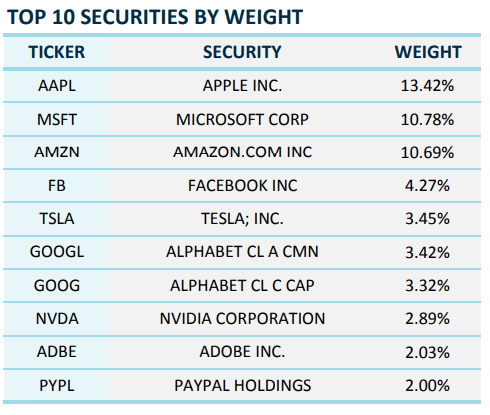

The 10 companies with the most weight in the index are as follows:

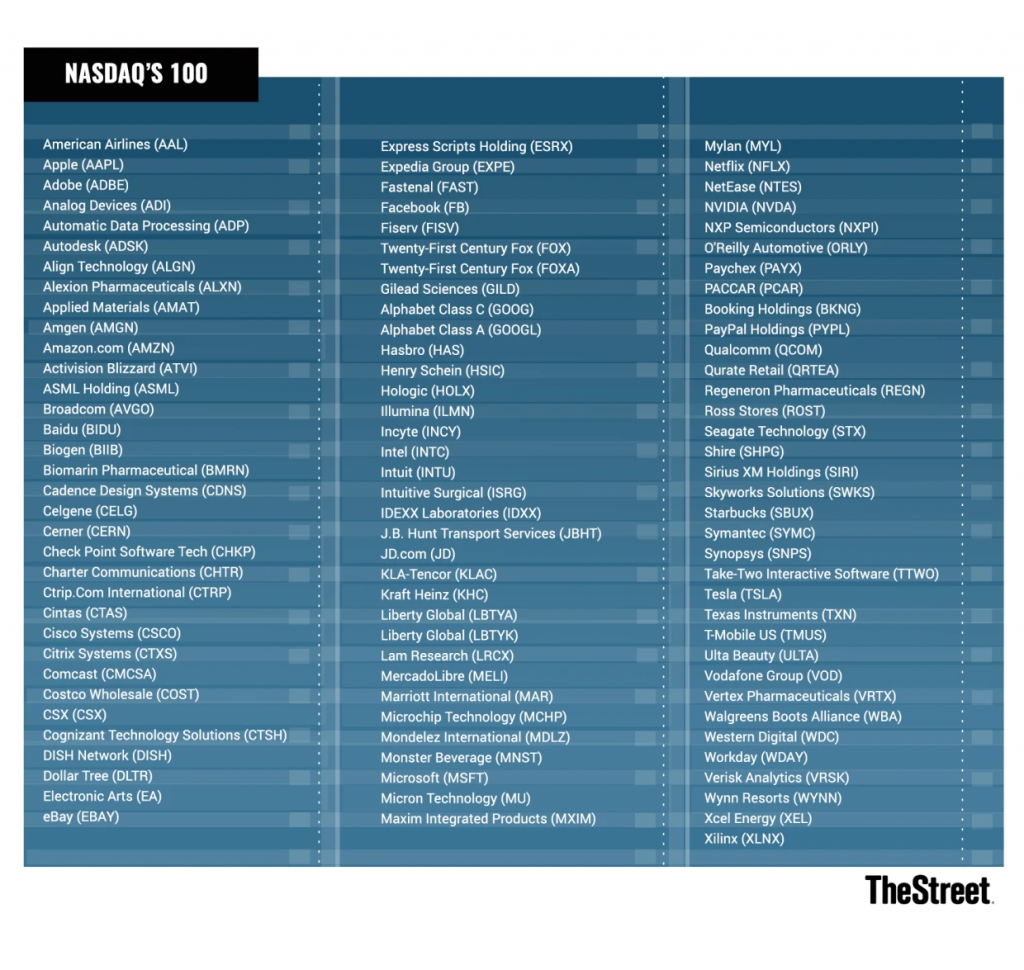

The companies that make up the Nasdaq 100 are as follows:

The identity brand of the Nasdaq 100 is the inclusion of many of the leading companies and pioneers of the modern world, integrating the largest stock market capitalizations in the world, starting with FAAMG, Tesla, Nvidia, Starbucks, large biotech companies, etc., as can be seen in the following 2 charts:

There is another major Nasdaq index, the Nasdaq Composite Index, which is the market capitalization-weighted index of more than 2,500 stocks listed on the Nasdaq stock exchange.

The Nasdaq Composite Index uses a market capitalization weighting methodology. The value of the index is equal to the total value of the weights of the shares of each of the securities constituted, multiplied by the last price of each guarantee.

In the following links we have a brief characteristic of the Nasdaq 100 and Nasdaq Composite indices:

https://indexes.nasdaq.com/docs/FS_XNDX.pdf

https://indexes.nasdaqomx.com/docs/FS_COMP.pdf

Long historical performance and the last years of the Nasdaq 100 index

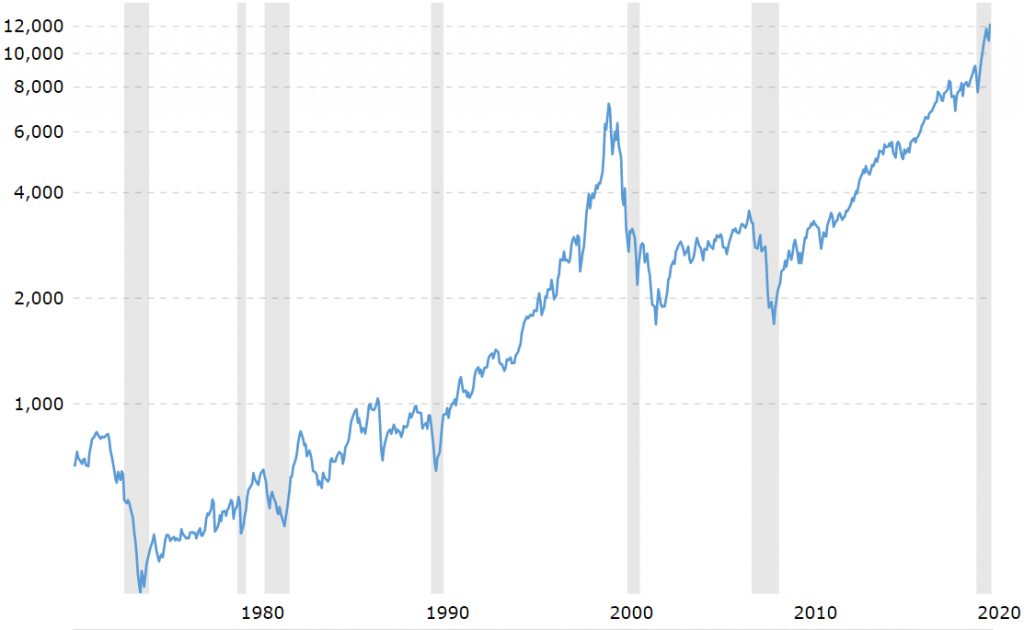

The following chart shows the evolution of the Nasdaq 100 index since its inception in 1972:

The Nasdaq 100 index posted an average annual nominal return above 11% in this period, slightly higher than the S&P 500 in the same period.

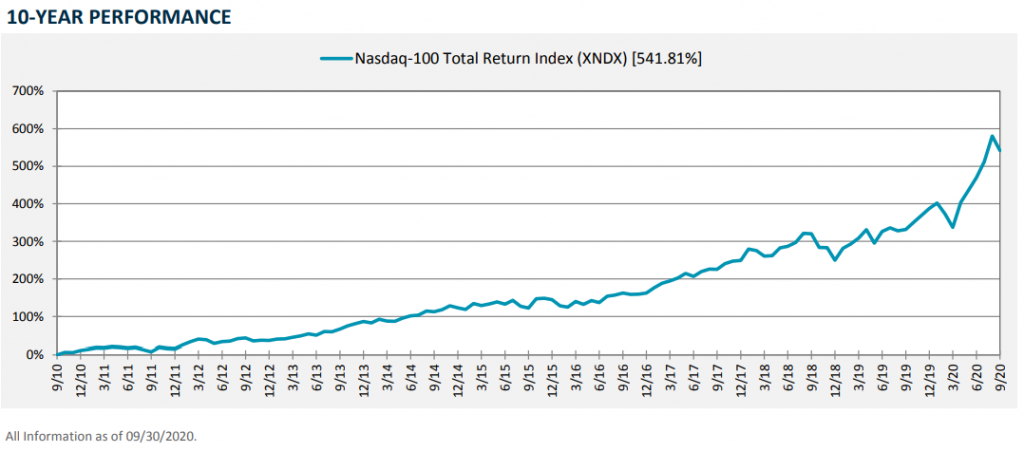

The evolution of the Nasdaq 100 index in the last 10 years to September 2020 was as follows:

Comparison of the Nasdaq 100 with the S&P 500 and the DJIA 30

The Dow contains only 30 stocks of major blue-chip companies listed on the NYSE and Nasdaq, is a stock-weighted index, and represents the largest companies in the various sectors.

The S&P 500 contains 500 stocks of the NYSE’s largest-cap companies, is weighted by stock market capitalization, and represents the US economy.

The Nasdaq 100 contains the top 100 capitalizations listed on this stock exchange, all non-financial, weighted by the market capitalization, and represents the modern, innovative and fundamentally the US technological economy.

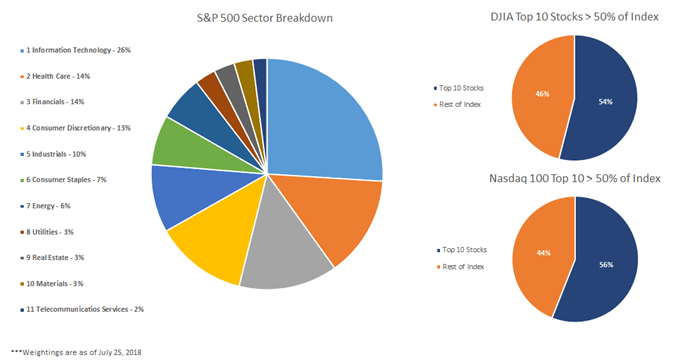

Both the Dow and Nasdaq 100 are impacted by the performance of individual stocks as they derive more than 50% of their value from the top 10 stocks. However, the S&P 500 is more diverse, with the top 10 stocks bearing a total weight of 26 percent (July 2018 data):

Each of the three indexes offers a different exposure. The Dow is the least volatile as it is major blue-chip companies with lower fluctuations, while the Nasdaq 100 is comparatively more volatile due to its considerable exposure to high-growth technology stocks. The S&P 500 is somewhere in the middle, but like most other indexes, it falls faster than rallies.

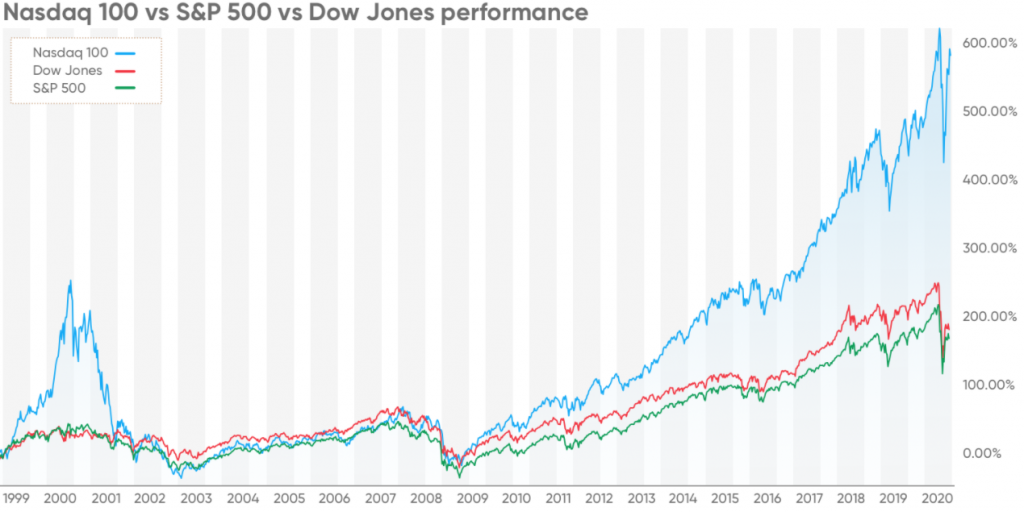

The following chart shows the comparative evolution of the Dow, S&P and Nasdaq 100 between 1999 and 2020:

We see that in this 20-year period, Dow and S&P have had about the same performance, growing 200%, while the Nasdaq 100 performed clearly better, with a 600% appreciation.

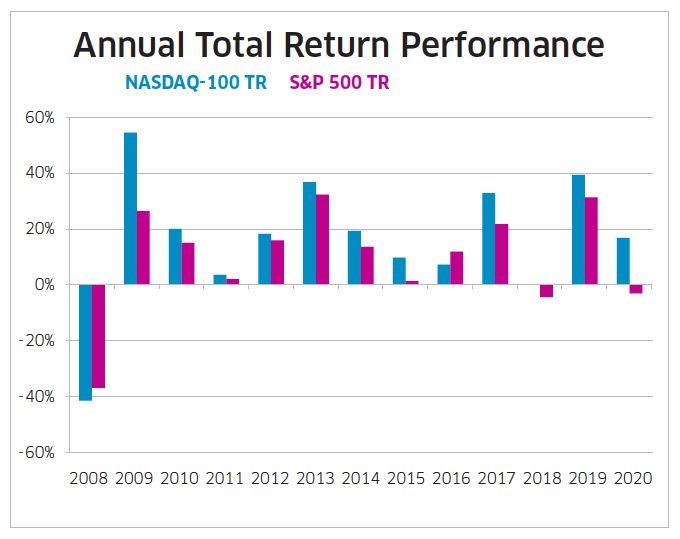

In recent years, especially since the 2007/08 financial crisis, the Nasdaq 100 has outperformed the S&P 500 by far:

Nasdaq beat the S&P 500 every year except one.

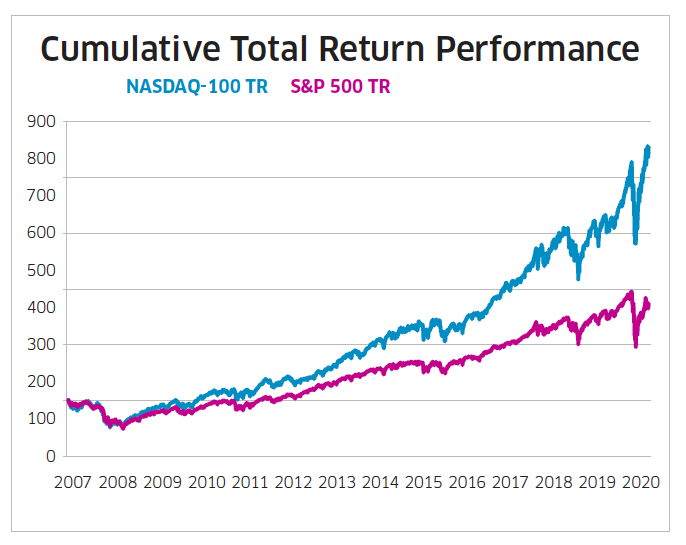

The Nasdaq 100 performance since 2007 was an impressive more than 850%, while the S&P 500 was close to 500%.

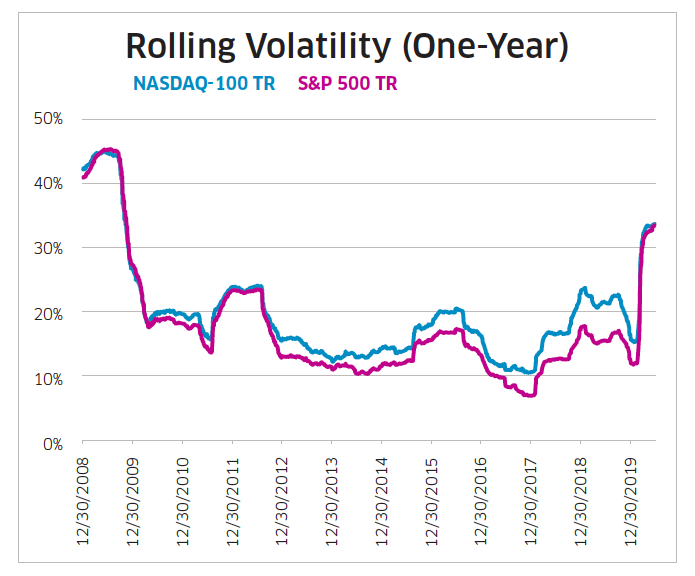

The volatility of the Nasdaq 100 was higher than that of the S&P, but with developments aligned and not far away.

The differences between these indices are fundamentally the result of their sectoral composition:

The weight of technology on the Nasdaq 100 is more than double the S&P 500 at 57%, as is consumer services at 22%, while the financial, energy and raw sectors do not appear on the Nasdaq 100 and account for nearly 25% in the S&P 500.

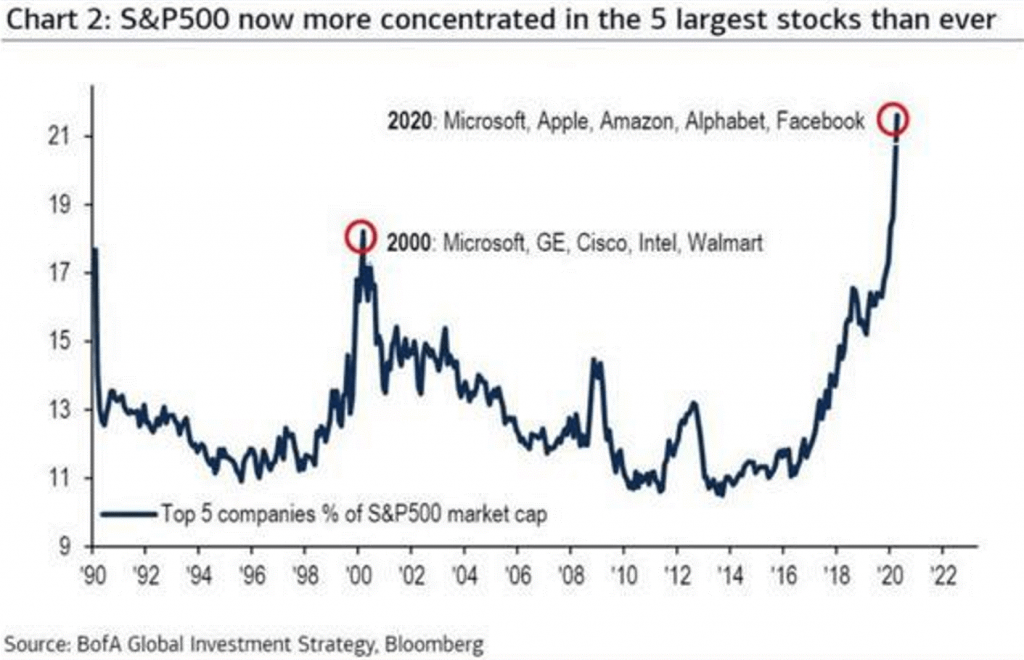

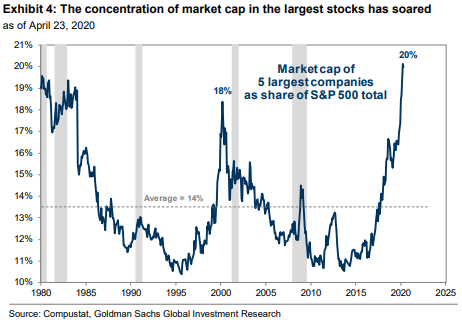

Currently there is a high concentration in the S&P 500, representing the 5 largest companies, the FAAMG, more than 20% of the index, a situation only verified in 1980 and 2000:

In the Nasdaq 100 this weight is much higher, around 43%.