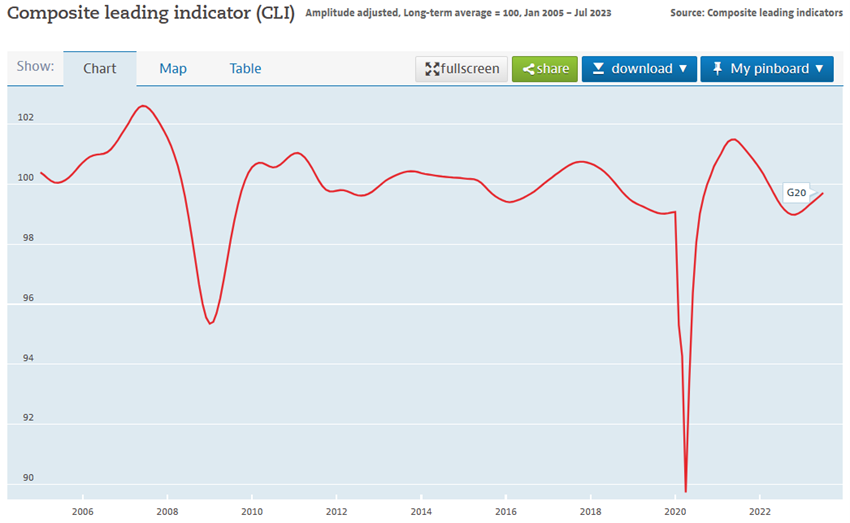

The composite main indicator (CLI) is designed to provide early signals of turning points in business cycles, showing the fluctuation of economic activity around its long-term potential level.

CLIs show short-term economic movements in qualitative and non-quantitative terms.

It can be used to track output growth and anticipate turning points in economic activity.

Values above 100 suggest an increase in confidence in business performance in the near future, while values below 100 indicate pessimism regarding future performance.

The consumer confidence indicator provides an indication of the future evolution of household consumption and savings, based on responses on their expected financial situation, their sentiment on the general economic situation, unemployment and saving capacity.

An indicator above 100 signals an increase in consumer confidence regarding the future economic situation, as a consequence of which they are less likely to save and more inclined to spend money on large purchases in the next 12 months.

Values below 100 indicate a pessimistic attitude towards the future evolution of the economy, which may result in a tendency to save more and consume less.

Access:

https://data.oecd.org/leadind/composite-leading-indicator-cli.htm